EIGENUSDT trade ideas

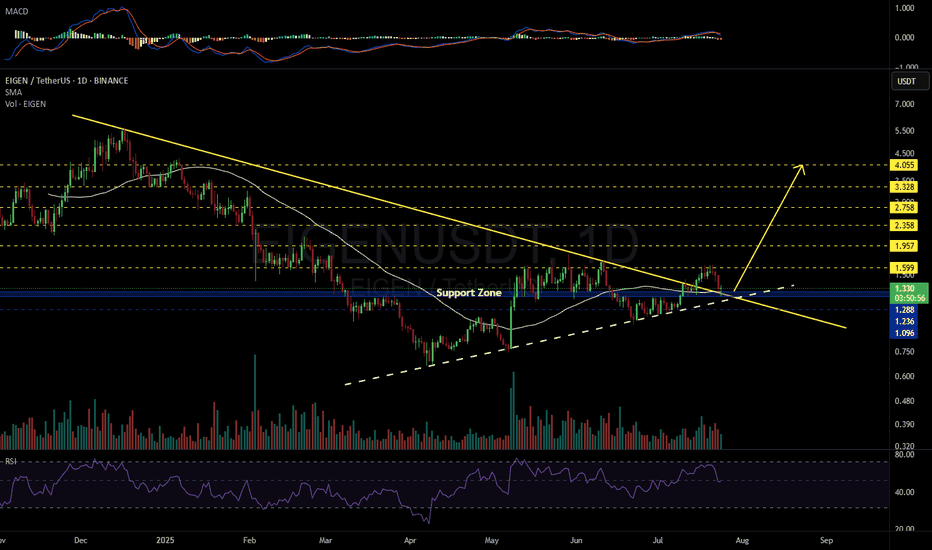

EIGEN/USDT — Symmetrical Triangle: Breakout Imminent?Summary

The daily chart shows a symmetrical triangle pattern (descending resistance from Dec–Aug and ascending support from April). Price is currently around 1.36 USDT, squeezing into the narrow apex zone — this suggests high volatility is likely once a breakout occurs. Statistically, this pattern is neutral, but the formation of higher lows since April gives a slight bullish bias. However, given the prior strong downtrend, we must not ignore the potential for a continuation to the downside.

---

Technical Pattern Details

Pattern: Symmetrical triangle / contracting triangle — two converging trendlines: lower highs vs higher lows.

Meaning: Consolidation between buyers & sellers, representing accumulation/distribution before a sharp move.

Probability: Neutral — the breakout direction defines the medium-term bias. With the prior downtrend, continuation is possible, but persistent higher lows suggest ongoing demand.

Timing: Apex likely reached in Sept; breakouts often occur before or at the apex.

---

Key Levels (from chart)

Current price: 1.3604 USDT

Resistance levels: 1.5788, 1.9671, 2.3877, 2.9906, 3.3557, and major high at 5.52–5.66 USDT.

Key support: ascending trendline & historical low at 0.6590 USDT.

---

Bullish Scenario (Confirmation & Targets)

Confirmation:

1. Daily candle closes above the triangle resistance (~1.58–1.65 USDT, depending on precision).

2. Breakout volume is higher than average.

3. Retest holds as support after breakout.

Targets after bullish breakout:

TP1: 1.5788

TP2: 1.9671

TP3: 2.3877 → 2.9906 → 3.3557 (if strong momentum)

Example aggressive setup:

Entry: 1.62 USDT

Stop-loss: 1.30 USDT

Risk per unit = 0.32 USDT

TP1 (1.97) → ~1.09R

TP2 (2.38) → ~2.37R

---

Bearish Scenario (Confirmation & Targets)

Confirmation:

1. Strong rejection at triangle resistance, followed by daily close below ascending support.

2. Increased volume on breakdown.

3. Failed retest of broken support.

Targets after bearish breakdown:

TP1: Local support zones (~1.10–0.90).

TP2: Historical low 0.6590 USDT.

Example short setup:

Entry: 1.30 USDT

Stop-loss: 1.60 USDT

Target: 0.659 USDT → ~2.14R

---

Trading & Risk Management Notes

1. Wait for confirmation — avoid early intraday breakouts.

2. Retest entries for conservative trades.

3. Stop-loss placement beyond structural levels.

4. Risk per trade: 1–3% of total capital.

5. Partial scale-in if breakout shows strong momentum.

6. Beware of fakeouts — common in tightening triangles.

---

Confirmation Checklist

Daily close outside trendline.

Breakout volume above accumulation average.

RSI/Stoch supports breakout direction.

Multi-timeframe alignment (e.g., 4H, 12H).

Liquidity/spread checks on exchange.

---

Risk Notes

Triangles after a downtrend can be continuation patterns — don’t pre-bias without confirmation.

Use horizontal resistance levels for realistic profit-taking instead of overly optimistic measured moves.

Watch for correlated market moves (BTC/ETH).

---

EIGEN/USDT (1D) forming a symmetrical triangle — volatility spike likely as breakout nears. Wait for daily close + volume above 1.58–1.65 for bullish targets (1.97 → 2.38 → 2.99), or breakdown below ascending support for bearish targets (down to 0.659). Manage risk and watch for retests.

#EIGEN #EIGENUSDT #CryptoTA #SymmetricalTriangle #BreakoutSetup #SupportResistance #TechnicalAnalysis #CryptoTrading #AltcoinAnalysis #RiskManagement

EIGEN/USDT TestingDemand Zone – Rebound or Breakdown Ahead?🧠 Technical Analysis:

🔸 Market Structure:

The price is currently sitting around 1.15 USDT, right above a key demand zone (highlighted in yellow) that has been tested multiple times since March 2025.

This area between 1.00 – 1.20 USDT acts as a major support zone.

🔸 Key Resistance Levels:

1.430 USDT → short-term resistance

1.604 USDT → significant resistance (previous support turned resistance)

Higher resistance targets: 1.980, 2.341, 2.982, 4.018, and 5.480 USDT

🔸 Key Support Levels:

1.154 USDT → current price level

Main demand zone: 1.00 – 1.20 USDT

If broken, the next major support lies around 0.80 USDT

---

📈 Bullish Scenario:

If the 1.00 – 1.20 USDT demand zone holds and the price prints a higher low, a bullish reversal is possible.

Short-term target: 1.43 and 1.60 USDT

If 1.60 is broken with strong momentum, the next targets are: 1.98 – 2.34 USDT

Bullish confirmation will be stronger if the price breaks and closes above 1.60 USDT on the daily chart

✅ Bullish Confirmation:

Bullish engulfing candle near support

Rising volume on upward moves

Breaking above previous lower highs

---

📉 Bearish Scenario:

If the price breaks down below the 1.00 – 1.15 USDT support zone, downside targets shift toward 0.80 – 0.66 USDT

A descending triangle pattern may be forming if the price continues making lower highs while testing the same support

⚠️ Bearish Confirmation:

Strong bearish candle closing below support

High sell volume

New lower low after a failed bounce

---

🔺 Pattern Analysis:

The price has been forming a range-bound pattern between 1.00 – 1.60 USDT

A potential double bottom could form if this support holds and price bounces up again

Otherwise, it may evolve into a descending triangle, signaling bearish pressure

---

🔖 Conclusion:

EIGEN is at a critical support zone that could define its next major move. A strong reaction here could signal a bullish reversal, while a breakdown could open the door to deeper declines. This is a key level to watch.

#EIGEN #EIGENUSDT #CryptoAnalysis #Altcoin #TechnicalAnalysis #SupportResistance #BullishScenario #BearishScenario #CryptoTrading #ChartAnalysis

EIGENUSDT 1D#EIGEN is pulling back to retest both the broken descending trendline and the daily SMA50, which are converging with a key support zone. So far, this level is showing signs of strength.

📌 We're entering a position here, and will add more near the $1.096 support level if price dips further.

In case of a successful bounce, the upside targets are:

🎯 $1.599

🎯 $1.957

🎯 $2.358

🎯 $2.758

🎯 $3.328

🎯 $4.055

⚠️ As always, use a tight stop-loss and follow proper risk management.

EIIGEN 1D – wave 4 dip loading zone (1.30 → 1.20) before a push idea TL;DR

• structure: HH/HL since June low (\~1.05). I’m labeling current move as wave (4) inside an ascending channel.

• plan: buy/scale in on the red box 1.30–1.20 (0.5–0.618 retrace of the June leg).

• targets: 1.62 / 1.97 / 2.13–2.43 (midline + 0.786 fib) for wave (5).

• invalidation: daily close < 1.18 (breaks HL) → next shelf 1.05 then 0.93.

details

Price rejected at \~1.55 and rolled under the orange median line. Momentum (RSI) is cooling but not oversold, so a controlled bleed into the lower channel (pink trendline) makes sense. Confluence stack in the box: fib 0.5–0.618, prior demand from early July, and channel support.

entries

1.32–1.24: starter

1.24–1.20: full size if RSI < 45 and volume tapers (no capitulation yet)

exits / targets

T1 1.62 (recent pivot + fib 0.618 of the whole drop)

T2 1.97 (measured move from wave 2→3)

T3 2.13–2.43 (channel top + 0.786 retrace of Nov dump)

Leave a moon bag in case extension blows through 2.4 toward 3.0.

risk

Cut if daily candle closes < 1.18. If 1.18 cracks fast, expect a vacuum to 1.05/0.93. BTC nukes = plan invalid fast.

notes

• keep an eye on funding/points narratives—macro sentiment can override TA.

• ladder orders, don’t chase green candles.

• not financial advice, just how I’m playing it.

EIGEN/USDT Breakout Countdown: Descending Triangle Retest

EIGEN/USDT is currently at a critical technical juncture. After months of downward pressure, the pair is now showing signs of a major bullish breakout from a descending triangle pattern, which is often a strong reversal signal. Are we about to witness an explosive upside move? Let’s dive into the setup.

🧠 Key Technical Structure

📌 Pattern: Descending Triangle (Bullish Reversal Potential)

Formed since December 2024

Strong horizontal support between $1.05–$1.28 (yellow box), tested multiple times

Series of lower highs forming a descending trendline, now being challenged by price action

This structure hints at heavy accumulation beneath resistance

📌 Volume: Gradually increasing near breakout zone — a sign of accumulation by smart money

📌 Breakout Confirmation: A daily close above $1.30 with strong volume will validate the breakout, potentially triggering a powerful move.

🟢 Bullish Scenario (Confirmed Breakout)

If EIGEN breaks and successfully retests the descending trendline, a major rally could follow, with these targets in sight:

🎯 Upside Price Targets:

1. $1.60 – Minor resistance and previous support flip

2. $1.98 – Previous distribution zone

3. $2.34 – Horizontal resistance from past structure

4. $2.98 – Mid-Fibonacci extension target

5. $4.01 – Full height target from triangle breakout

6. $5.48–$5.65 – Long-term target from historical resistance

✅ This structure aligns with a classic impulsive wave pattern following a major technical breakout.

🔴 Bearish Scenario (Failed Breakout / Fakeout)

Not all breakouts are successful. Here's what to watch out for:

🔻 If price fails to hold above $1.28, and breaks below $1.05, the structure turns bearish:

Opens the door for a trend continuation downward

Next supports lie at $0.90–$0.80, and possibly $0.65–$0.60

Indicates that sellers are still in control and accumulation has failed

🚫 This would invalidate the bullish setup and signal caution for long positions.

📌 Suggested Trading Plan

Entry Strategy:

Conservative: Wait for a confirmed breakout and successful retest above $1.30

Aggressive: Enter on intraday breakout with strong volume above trendline

Stop Loss: Below triangle support (~$1.02–$1.05)

Take Profits (TP): Scale out at $1.60 / $1.98 / $2.34 / $2.98 / $4.01 / $5.48

💬 Conclusion

EIGEN is on the verge of a major technical move. A clean breakout from the descending triangle could mark the transition from bearish consolidation to bullish expansion — a structure often seen before explosive rallies in altcoins.

Always manage risk wisely, stay alert for retests, and never chase entries without confirmation. This is a setup worth watching closely in the coming days!

#EIGEN #EIGENUSDT #CryptoBreakout #DescendingTriangle #AltcoinSeason #BullishSetup #ChartPattern #BreakoutAlert #SmartMoneyMoves #CryptoTechnicalAnalysis

EIGEN/USDT — Ready to Explode from Accumulation?🔍 Detailed Technical Analysis (1D Timeframe):

After months of bearish pressure, $EIGEN is now showing early signs of a trend reversal. The chart is painting a compelling picture of a breakout setup backed by a strong accumulation base and a long-term descending trendline.

🟨 Solid Accumulation Zone:

Price has been consolidating tightly within the $0.90 – $1.10 range, forming a clear accumulation zone. This zone has acted as a reliable support area multiple times, rejecting bearish attempts and indicating smart money accumulation.

This type of sideways base is often the foundation for explosive upside moves.

📉 Descending Trendline Breakout Setup:

A clear descending resistance line has been holding since the highs in December 2024.

Price is now approaching a critical breakout point. A confirmed breakout above this trendline could mark the beginning of a new bullish trend.

📈 Bullish Scenario (Momentum Breakout):

If price breaks out above the descending trendline and clears the key resistance at $1.227, the path toward higher targets opens up quickly:

Bullish Target Levels Description

🎯 $1.603 Minor psychological resistance

🎯 $1.980 Structural resistance

🎯 $2.341 Fibonacci confluence & supply zone

🎯 $2.982 Medium-term target

🎯 $3.993 Breakout continuation level

🎯 $5.480 – $5.659 Previous all-time high (ATH) region

📌 Note: For a valid breakout, look for a strong daily candle close above $1.227, ideally with high volume to confirm momentum.

🔻 Bearish Scenario (Rejection Play):

If price gets rejected at the trendline and fails to break $1.227:

A pullback to the $1.00 – $0.90 accumulation zone is likely.

If that support fails, price may drop toward:

🔻 $0.85

🔻 $0.78

🔻 $0.68 (key psychological & historical volume zone)

📊 Conclusion: Make or Break Moment Ahead

EIGEN is at a critical decision point. A successful breakout could kick off a major bullish phase, while a failure may extend the sideways or bearish action.

With a strong base formed and pressure building near the trendline, this setup deserves a spot on every trader’s radar.

#EIGENUSDT #CryptoBreakout #AltcoinSetup #TechnicalAnalysis #BullishScenario #BearishScenario #AccumulationZone #PriceAction #CryptoTrading #CryptoAnalysis

EIGEN Eyes Key Demand — Watching $1 for a Potential BounceScenario 1 (Reversal from Demand):

Wait for lower timeframe (M15/H1) reversal signal in $0.98–$1.16 zone

If confirmed, consider long entries with tight risk below $0.98

First target: $1.40–$1.55 (local supply); next: $2.15

Scenario 2 (Breakdown):

If price loses $0.98 with no reaction, step aside — next strong support much lower

No interest in longs if green zone fails

EIGEN/USDT – Falling Wedge Breakout Setup | 4H ChartEIGEN is currently showing a bullish falling wedge pattern near a strong horizontal demand zone, indicating a potential reversal move.

Technical Breakdown:

Entry Zone: $1.17 – $1.18 (current market price)

Stop-Loss: Below $1.14 (last wick low/invalidation of wedge)

Target Price: $1.74, $2.51 (+118%) from CMP

Resistance 1 (Minor): $1.33

Resistance 2 (Major Target): $1.74

Support Levels:

• $1.17 (Immediate support)

• $0.749 (Major demand zone if breakdown)

Target & Risk-Reward

Target Price: $1.74, $2.51 (+118%) from CMP

Stop-Loss: $1.14

Risk per token: ~$0.03

Potential Profit per token: ~$0.56

Risk:Reward Ratio: ~1:6.5

Potential Gain: +118% from entry

Indicators:

Falling wedge breakout looks imminent

RSI (14) at 39.5 — recovering from oversold zone

Demand zone previously triggered rallies — the probability of a bounce is high

Strategy:

Wait for a 4H candle close above the wedge trendline + volume confirmation to validate the breakout. Scaling in near support with a tight stop-loss can offer a strong risk-reward play.

Not Financial Advice – This is a technical view for educational purposes. Always DYOR & manage risk accordingly.

Like & follow if you found this useful!

#EIGEN #Altcoins #Breakout

Eigenlayer EIGEN price analysisLooking at the OKX:EIGENUSDT chart, we can see that the growth amplitude is “choking” and trading volumes are decreasing.

Therefore, at the current price, we would not risk buying #EIGEN

But at $0.90, it's safer! Or at $1.80-1.90, but only after the price breaks through and consolidates above the trend line.

#Eigenlayer is based on the #Ethereum ecosystem and has “come alive” following the price of CRYPTOCAP:ETH

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

EIGEN – Chasing Strength Over PerfectionDoubt I’ll see BINANCE:EIGENUSDT back below $1—so here’s my take:

Risk/reward isn’t ideal at this level, but there’s a clear chance of continuation, and this isn’t one I want to miss.

Buying a small bag now, with plans to add in the green zone if it dips. While a revisit to the Monthly Open is unlikely, that area could be tested if the market cools off.

Leaning more toward higher prices than a retrace—for now.

EigenLayer (EIGEN) – Overview and Technical Analysis

🔎 What is EigenLayer ?

EigenLayer is a restaking protocol built on Ethereum that aims to enhance network security and scalability by allowing validators to reuse their staked ETH or other liquid staking tokens (LSTs) to secure additional decentralized applications (dApps) and services.

This innovative approach provides a way for Ethereum's existing security to be "recycled", making it easier for new projects to launch with a high level of security without building their own validator networks.

Key Features :

Restaking : Allows ETH stakers to earn additional yield by securing multiple services.

Security Scaling : Strengthens the overall security of Ethereum's ecosystem by reusing existing validator resources.

Flexible Staking : Supports a wide range of tokens and assets, increasing the capital efficiency of the Ethereum network.

📈 Technical Analysis (4H Chart)

Looking at the 4H chart, we can see a classic bullish structure forming :

Strong Bounce from Bull OTE – The recent rally came after a clear divergence and a tap into the Bull OTE, suggesting a high-confidence reversal.

Next Key Levels – Immediate resistance sits around $1.40 (local swing high), with the next major level around $2.20 and potentially $3.40 if the momentum continues.

Support to Watch – The Bull OTE and FVG 1D around $0.90 - $1.05 should act as a solid support zone if the market pulls back.

📊 Short-Term Outlook

With this kind of momentum, the short-term outlook for EIGEN remains bullish, but a healthy retracement to the $1.00 - $1.10 area could provide a solid reloading zone before the next leg up.

EigenLayer Easy Targets, Broken Downtrend —500%Now we are looking at EigenLayer, a new project.

Notice the very strong downtrend that started in mid-December 2024. It is hard to believe that it has been already more than five months.

Notice this huge downtrend and how EIGENUSDT broke out without breaking bullish. This is ok if you are looking for good options to buy and trade.

This pair trades at a low price, early, and has huge potential for growth in weeks, months and days.

I will give you some targets, the bottom is in. But a full blown bullish confirmation happens when the action moves above 'main resistance'. The action is happening now within a strong buy-zone.

This zone is the last chance and opportunity to buy when prices are low. It will start growing next and this growth will go for months.

The first target can hit short-term while the second is set for the mid-term. Long-term, you can expect even more.

A perfect strategy for spot traders is simply to buy and hold. When prices are high, say 200%-300%, collect profits and move on to the next trade.

Repeat this process over and over, again and again, and watch your portfolio grow faster than the bull market.

Buy ten pairs and each time one matures, sell and find one trading near support and repeat the process. This is a simple strategy but it pays.

If you miss the selling point, wait.

Never buy when prices are high.

Never sell when prices are low.

Do it the other way around... Buy now, sell later when the masses start to buy at the top. When they are buying, you are selling.

Now that everybody is selling, you have to buy, buy everything up.

Namaste.

their original 32$32.45M is worth only $10.03M (-69%)Remember that whale (or institution) who made a big move buying EIGEN last year? They’re not doing so well 😂

They started with 32.45MinUSDC,bought8.917MEIGEN at an average price of 3$3.64, and lost 17.19M.ThentheyswitchedpartoftheirpositiontoHYPE at the peak, only to lose another $5.21M. Now, after just 5 months, their original 32$32.45M is worth only $10.03M (-69%).

Ouch! 🐬

Trade $EIGEN , come to Gate – no need to think of reasons, just a pure recommendation! 😄

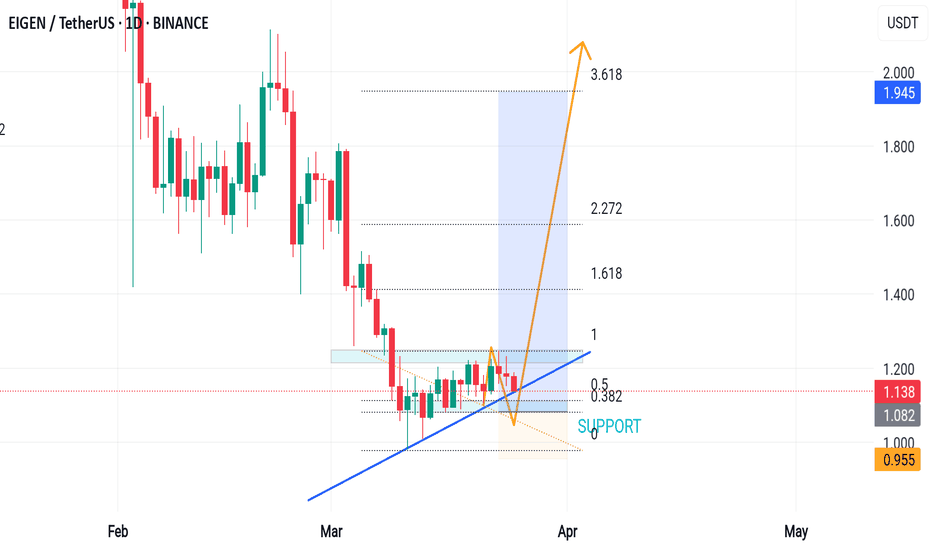

EIGEN/USDTEIGEN/USDT Analysis

Time frame (1D)

Buy Setup:

Entry Zone: $1.08 - $1.14 (strong support area & Fibonacci 0.382).

Target Levels:

TP1: $1.94 (Fibonacci 1.618).

TP2: $2.27 (Fibonacci 2.272).

TP3: $3.61 (Fibonacci 3.618).

Stop Loss: Below $0.95 (support breakdown).

Key Insights:

1. Price continues to respect the ascending trendline, confirming bullish momentum.

2. Pullback to Fibonacci 0.382 signals a potential buying opportunity.

3. Additional confirmation: Monitor for increased volume during a breakout of minor resistance.

$EIGEN 4HTF🚀 $EIGEN Analysis

📊 4H Timeframe:

🔺 Ascending Triangle Formation – Price consolidating within structure.

📍 Resistance: $1.20 - $1.23

📍 Support: $1.08 - $1.12

📊 Daily Timeframe:

📉 Descending Parallel Channel – Price moving under trendline resistance.

📍 Key Resistance: $1.30

👀 Breakout or Rejection? Watch key levels for confirmation!

#EIGEN/USDT#EIGEN

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.56

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.71

First target 1.83

Second target 1.90

Third target 1.98