CAC40 The Week Ahead 24th March '25CAC40 bullish & overbought, the key trading level is at 7900

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FRA40 trade ideas

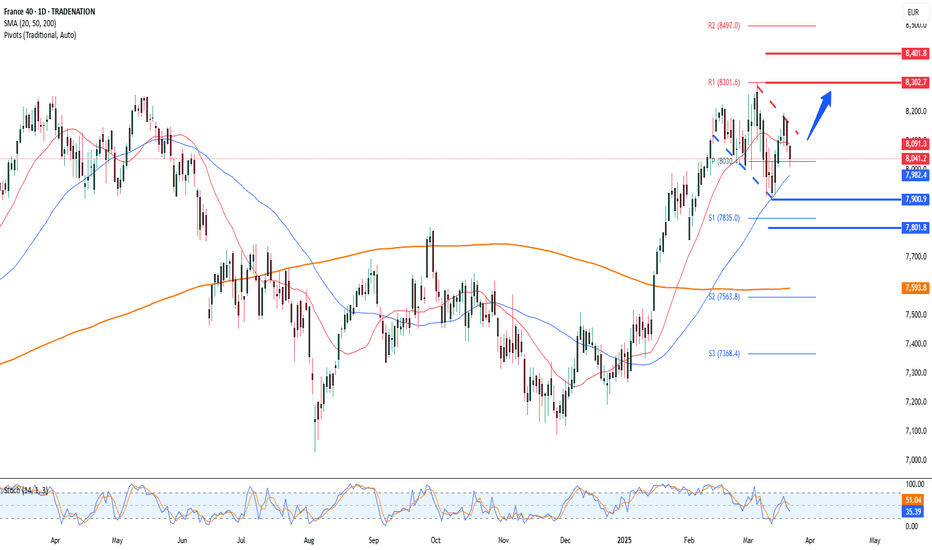

CAC40 INTRADAY Bullish Breakout supported at 8050. The CAC40 equity index remains in a bullish technical structure, underpinned by the prevailing uptrend. Recent intraday price action has shown a breakout above a sideways consolidation pattern, suggesting renewed bullish momentum towards the previous resistance area.

Key Levels:

Support: The critical support level is at 8050, which corresponds to the previous consolidation price range. A corrective pullback to this level, followed by a bullish bounce, could reinforce the uptrend.

Resistance: On the upside, the next resistance levels are positioned at 8190, 8300, and 8400, representing potential profit targets over a longer timeframe.

Bearish Scenario: A decisive break below the 8050 support level and a daily close beneath this mark would invalidate the bullish outlook. Such a move could initiate a deeper retracement, targeting the 7900 support level, followed by 7800 if selling pressure intensifies.

Conclusion: The prevailing sentiment remains bullish as long as the 8050 support holds. Traders should monitor any corrective moves toward this level for potential buying opportunities. A confirmed loss of 8050 would signal caution, as it may trigger further downside pressure.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 (FR40) The Week Ahead 17th March '25CAC40 INTRADAY bullish & oversold, key trading level is at 7917

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FRA40/CAC40 "France40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the FRA40/CAC40 "France40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (8040) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at 8160 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 7900 (or) Escape Before the Target

Secondary Target - 7680 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook, Positioning Analysis:

FRA40/CAC40 "France40" Indices Market is currently experiencing a Bearish trend., driven by several key factors.

✴✴Fundamental Analysis✴✴

Economic Indicators: France's GDP growth rate is expected to continue its upward trend, with the France 40 index increasing by 10.34% since the beginning of 2025.

Earnings Reports: The CAC 40 companies' earnings reports have been showing signs of growth, with some companies experiencing increased revenues and profits.

Dividend Yield: The CAC 40 dividend yield is around 3.5%, which is relatively attractive compared to other major European indices.

✴✴Macro Economics✴✴

Monetary Policy: The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation (latest ECB meeting minutes).

Fiscal Policy: The French government has announced plans to reduce its budget deficit, aiming for a 3.5% deficit-to-GDP ratio by the end of 2025 (latest budget proposal).

Global Trade: The ongoing trade tensions between the US and China have eased, with both countries signing a new trade agreement, which is expected to boost French exports (latest trade data).

✴✴COT Data ✴✴

Speculators (Non-Commercials): The current COT report shows that speculators are holding 50,219 long positions and 25,011 short positions.

Hedgers (Commercials): Hedgers are holding 20,015 long positions and 40,011 short positions.

Asset Managers: Asset managers are holding 30,015 long positions and 15,019 short positions.

✴✴Global Market Analysis✴✴

Trend: The France 40 index is experiencing a bullish trend, with a 2.1% increase in the last week and a 5.6% increase in the last month.

Support and Resistance: Key support levels are at 8000 and 7950, while resistance levels are at 8250 and 8300.

✴✴Positioning✴✴

Long/Short Ratio: The long/short ratio for the France 40 (CAC 40) index is 2.05, indicating a slightly bullish sentiment.

Open Interest: The open interest for the France 40 (CAC 40) index is approximately €12.5 billion.

✴✴Next Trend Move✴✴

Bullish Prediction: Some analysts suggest a potential bullish move, targeting 8300 and 8400, due to the ongoing economic growth and attractive valuations.

Bearish Prediction: Others predict a potential bearish move, targeting 7900 and 7800, due to the ongoing trade tensions and potential economic slowdown.

Long-Term Bearish Target: A potential long-term bearish target is 7200, due to the ongoing global economic uncertainty and potential recession risks.

✴✴Future Prediction✴✴

Short-Term:

Bullish: 8200-8300

Bearish: 7900-7800

Medium-Term:

Bullish: 8500-8600

Bearish: 7500-7400

Long-Term:

Bullish: 9000-9200

Bearish: 6800-6600

✴✴Overall Summary Outlook✴✴

Bullish or Bearish: The overall outlook for the France 40 (CAC 40) index is neutral, with a mix of bullish and bearish predictions.

Real-Time Market Feed: As of the current time, the France 40 (CAC 40) index is trading at 8100, with a 0.5% increase in the last 24 hours.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Can France’s Economy Defy Gravity?The CAC 40, France’s flagship stock index, showcases the nation’s economic strength, driven by global giants like LVMH and TotalEnergies. With their vast international presence, these multinational corporations provide the index with notable resilience, allowing it to endure domestic challenges. However, this apparent stability masks a deeper, more intricate reality. Beneath the surface, the French economy grapples with significant structural issues that could undermine its long-term success, making the CAC 40’s performance both a symbol of hope and a point of vulnerability.

France confronts multiple internal pressures that threaten its economic stability. An aging population, with a median age of 40—among the highest in developed nations—shrinks the workforce, increasing the burden of healthcare and pension costs. Public debt, projected to hit 112% of GDP by 2027, restricts fiscal flexibility, while political instability, such as a recent government collapse, hampers essential reforms. Compounding these issues is the challenge of immigration. France’s immigrant population, particularly from Africa and the Middle East, faces difficulties integrating into a rigid labor market shaped by strict regulations and strong unions. This struggle limits the nation’s ability to leverage immigrant labor to offset workforce shortages while straining social unity, adding further complexity to France’s economic challenges.

Looking forward, France’s economic future hangs in the balance. The CAC 40’s resilience offers a buffer, but lasting prosperity depends on tackling these entrenched problems—demographic decline, fiscal constraints, political gridlock, and the effective integration of immigrants. To maintain its global standing, France must pursue bold reforms and innovative solutions, a daunting task requiring determination and foresight. As the nation strives to reconcile its rich traditions with the demands of a modern economy, a critical question looms: can France overcome these obstacles to secure a thriving future? The outcome will resonate well beyond its borders, offering lessons for a watching world.

CAC (F40) INRADAY continuation pattern in play supported at 7900The CAC 40 (FR40) equity index price action remains bullish, supported by the prevailing longer-term uptrend. Recent intraday movements indicate sideways consolidation near the breakout level, which previously acted as resistance and has now become a new support zone.

Key Levels and Price Action

The critical trading level to watch is the 7900 level, representing the previous consolidation price range. A corrective pullback to this level, followed by a bullish bounce, could signal a continuation of the upward trend. In this scenario, the index may target the next upside resistance levels at 8160, 8300, and 8400 over the longer timeframe.

However, if the 7900 support level is decisively broken, confirmed by a daily close below this level, the bullish outlook would be invalidated. This breakdown could lead to a deeper retracement, with potential downside targets at the 7866 support level, followed by 7800 and 7733.

Conclusion

The overall sentiment remains bullish as long as the 7900 support level holds. A successful bounce from this zone could pave the way for continued upside momentum. Conversely, a confirmed break below 7900 would shift the outlook to bearish, suggesting a more significant corrective move. Traders should closely monitor daily closes around the critical support to gauge sentiment shifts.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 (Fr40) The Week Ahead 10th March '25Sentiment: Bullish INTRADAY, Price action consolidates in a tight trading range.

Resistance: Key Resistance is at 8265, followed by 8309 and 8354 - 8400 levels.

Support: Key support is at 8099 followed by 7983 and 7928.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 (FR40) Index outlookBullish Scenario:

The CAC (F40) index maintains a bullish outlook, supported by the prevailing longer-term uptrend. The recent intraday price action indicates a bullish breakout above a period of sideways consolidation. The key level to watch is 8100, which marks the breakout zone and aligns with the rising support trendline. A corrective pullback that finds support at 8100, followed by a bullish rebound, could trigger further upside movement towards 8265, with extended targets at 8308 and 8354 over a longer timeframe.

Bearish Scenario:

A confirmed breakdown below the 8100 level, particularly with a daily close beneath this support, would negate the bullish outlook. This would expose the index to a deeper retracement, with immediate support at 8017, followed by 7983 and 7928, indicating a potential shift towards a corrective phase.

Conclusion:

The broader trend remains bullish, but 8100 is a pivotal level. Holding above this zone reinforces upside potential, while a decisive break below it could lead to increased selling pressure. Traders should monitor price action around this key level to confirm the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC and the WORLD WIDE EVENT NEARING The chart is that of the FRENCH CAC 40 And The MATH pointing to a Major TOP soon . we have now entered the final 5th wave in wave 5 The Math is been circled for you To understand the target and how tight it is . after this top you should exit anything and Move all funds into US$ in 20 and 90 day T bill . Europe markets and The E.U. To start the Collapse and will fragment! WAVETIMER

CAC40 Bullish Flag, The week ahead 03rd March ’25 The CAC 40 (F40) index maintains a bullish outlook, supported by its long-term uptrend. However, recent sideways consolidation near the rising support trendline suggests a potential corrective pullback before the next directional move unfolds.

Bullish Scenario:

The 8060 level is a key support zone, aligning with the previous consolidation range, 20-day moving average, and the rising trendline.

A pullback to this level, followed by a bullish rebound, would indicate continued strength in the uptrend.

Upside targets include:

8180 (initial resistance)

8230 (next resistance level)

8268 (longer-term target)

A successful hold above 8060 would reinforce bullish sentiment and could signal a continuation of the prevailing trend.

Bearish Scenario:

A confirmed break below 8060, with a daily close beneath this level, would weaken the bullish structure.

This could trigger a deeper retracement, exposing the following downside levels:

8038 (immediate support)

7980, if selling pressure accelerates

A sustained move below 8060 would invalidate the bullish outlook, signaling potential downside continuation and a broader pullback.

Market Outlook:

The 8060 level remains the key pivot—holding above it could sustain bullish momentum, while a decisive break below would confirm increased downside risks. Traders should watch price action around this critical level to assess the next market move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC INTRADAY Uptrend continuation pattern breakout? The CAC (F40) equity index price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a sideways consolidation towards the rising support trendline zone.

The key trading level is at 8060 level, the previous consolidation price range and also the rising support trendline zone. A corrective pullback from the current levels and a bullish bounce back from the 8060 level could target the upside resistance at 81960 followed by the 8220 and 8277 levels over the longer timeframe.

Alternatively, a confirmed loss of the 8060 support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 8038 support level followed by 7980.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 testing support at 50DMAThe CAC (F40) equity index price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a sideways consolidation towards the rising support trendline zone.

The key trading level is at 8090 level, the previous consolidation price range, 50 Day Moving Average and also the rising support trendline zone. A corrective pullback from the current levels and a bullish bounce back from the 8090 level could target the upside resistance at 160 (20 DMA)0 followed by the 8220 and 8268 levels over the longer timeframe.

Alternatively, a confirmed loss of the 8090 support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 8024 support level followed by 7980.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40The CAC 40, or Cotation Assistée en Continu, is a benchmark French stock market index that tracks the performance of the 40 largest publicly traded companies on the Euronext Paris. As of February 2025, the CAC 40 index comprises the following companies:

Accor,Air Liquide,Airbus,ArcelorMittal,AXA,BNP Paribas,Bouygues,Bureau Veritas,Capgemini,Carrefour,Credit Agricole,Danone,Dassault Systemes,Edenred,Engie,EssilorLuxottica,Eurofins Scientific,Hermes International,Kering,L’Oréal,Legrand,LVMH Moët Hennessy Louis Vuitton,Michelin,Orange,Pernod Ricard,Publicis Groupe,Renault,Safran,Saint-Gobain,Sanofi,Schneider Electric,Société Générale,Stellantis,STMicroelectronics,Teleperformance,Thales,TotalEnergies,Unibail-Rodamco-Westfield,Veolia Environnement and VINCI.This list reflects the most significant companies listed on Euronext Paris and is subject to quarterly reviews and adjustments based on market capitalization and trading volume.

The index consists of the 40 most significant stocks from the top 100 companies by market capitalization listed on Euronext Paris. It is a price return index, meaning it does not account for dividends.

The index is calculated based on a capitalization-weighted methodology, which means larger companies have a greater impact on the index's value.

The CAC 40 operates from Monday to Friday, 9:00 AM to 5:30 PM CET (8:00 AM to 4:30 PM GMT) and The CAC 40 was launched on December 31, 1987, with a base value set at 1,000.

As of February 20, 2025, the CAC 40 index is reported to be around 8,206.56, having experienced a recent increase of approximately 0.21%.

Current Trends on Technical indicates that CAC 40 is bullish

The performance of the CAC 40 is closely tied to the overall health of the French economy and can be influenced by various factors, such as the Economic data releases (e.g., GDP growth, employment figures),Changes in monetary policy by the European Central Bank (ECB) and Global market trends and investors sentiment,

Conclusion

The CAC 40 serves as an important indicator of market performance in France and reflects investor sentiment towards major French corporations. Its movements can provide insights into economic trends and potential investment opportunities.

Moustafa! 18.02.25 CAC index analysis with two targets!The index already broke a falling wedge before which helped the index to reach to the current level!

There is a bullish pennant which will help the price to reach to TP1 easily!

On the medium term, the index will reach to my TP2 indeed

Note:

My ideas are exclusive to myself only and is not regarded as an advice for traders or investors and are not more than personal thoughts which I just wanted to share with you all and I do hope they could help.

I am not selling any signals and I do not take money favour any trades recommendations. They are free of charge all lifelong but I keep the copy rights of them though to not be copied or shared or sold.

CAC rising trendline retest? The CAC (F40) equity index price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a sideways consolidation towards the rising support trendline zone.

The key trading level is at 8066 level, the previous consolidation price range and also the rising support trendline zone. A corrective pullback from the current levels and a bullish bounce back from the 8066 level could target the upside resistance at 8220 followed by the 8268 and 8363 levels over the longer timeframe.

Alternatively, a confirmed loss of the 8066 support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 8024 support level followed by 7980.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC (France40) key trading level at 7946The CAC (F40) index price action sentiment appears bullish, supported by the longer-term prevailing uptrend.

The key trading level is at 7946, which is 25th Feb swing low. A corrective pullback from the current levels and a bullish bounce back from the 7946 level could target the upside resistance at 8066 followed by the 8100 and 8180 levels over the longer timeframe.

Alternatively, a confirmed loss of 7946 support and a daily close below that level could trigger a further retracement and a retest of 7900 support level followed by 7858 and 7800.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

French 40-This invesment will help Europe get on the map with AIHi Guys, we are looking into the French 40 - with the recent great news we would consider a potential buy - Fundamentals below :

France’s ambitious investment of €109 billion in artificial intelligence (AI) marks a major step toward positioning the country as a global leader in the AI revolution. This significant commitment demonstrates France’s dedication to fostering innovation, driving economic growth, and securing technological sovereignty in an increasingly AI-driven world.

Boosting Innovation and Research

With this funding, France is set to enhance its AI research ecosystem by supporting universities, research institutions, and startups. This will help attract top-tier talent and encourage groundbreaking advancements in AI technologies.

Strengthening Economic Competitiveness

By investing heavily in AI, France aims to reinforce its global competitiveness, particularly in key sectors such as healthcare, finance, transportation, and cybersecurity. The funding will enable companies—both startups and established enterprises—to develop cutting-edge AI applications that can drive efficiency and productivity.

Creating Jobs and Opportunities

This investment is expected to generate thousands of high-skilled jobs, fostering a new wave of AI professionals, engineers, and researchers. It also ensures that French businesses remain at the forefront of AI adoption, enhancing their ability to compete on the global stage.

Promoting Ethical and Responsible AI

France has been a strong advocate for ethical AI development. With this funding, the country can lead the way in creating AI systems that are transparent, fair, and aligned with European values of privacy and human rights.

Positioning France as a Global AI Hub

This investment aligns with France’s broader strategy to become a major AI hub in Europe and beyond. By collaborating with international partners and fostering public-private partnerships, France is set to play a pivotal role in shaping the future of AI.

Overall, this bold move underscores France’s commitment to technological excellence and economic resilience. By investing in AI today, France is laying the foundation for a smarter, more innovative, and prosperous future.

Entry: 7,990

Target: 8,350

SL: 7,650

A possible bearish outcomeThe CAC is currently attempting to surpass the 7800 mark, in an attempt to retest an all-time high. If it does pass, it may retest with an opportunity to continue further up.

However, failing to do so may lead the French benchmark to retest established lows. This is due to a double-top being formed due to where price action is as of now.

If the points remain under 7800, falling and settling below 7100, the indice may be bearish searching for support on the respective lower barriers