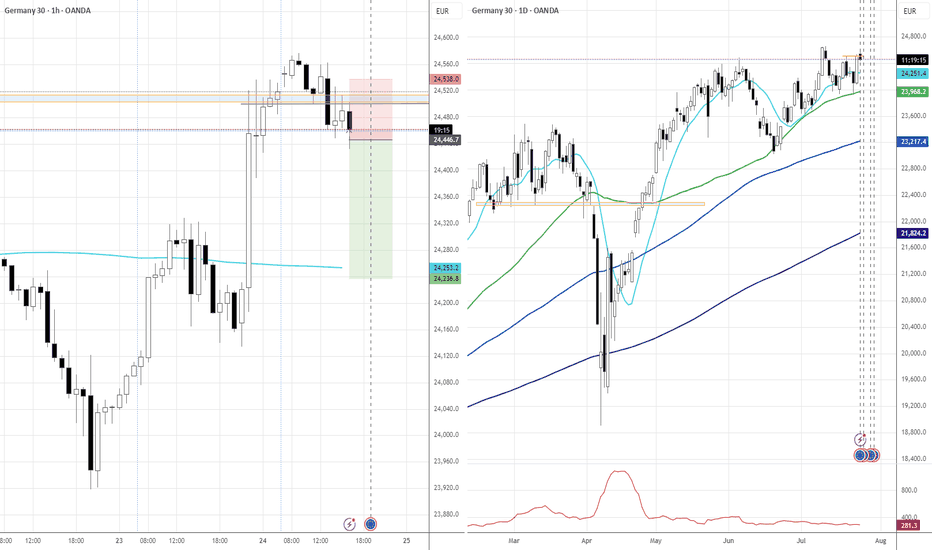

GERM30It's been a long time since I shared my idea.

Here we go; the market has collected enough liquidity to push up. It has bounced on the psychological area on the horizontal trend line where money gets pumped. Now that I missed the entry, I am waiting for a small pullback, then I'm in, taking my 1st TP in the 1st key level, and so on and so on.

GER40 trade ideas

#DAX - AUG Quarterly Levels : 3000 Pts SwingDate: 09-08-2025

#DAX - We are here for the interesting moments of the historical period where the trade tariff wars are at it's peak. The markets are not moving based on any fundamentals rather it's on the fear and sentiments factor. At this point, 3000 points swing will not be surprising!

The pivot levels posted in the previous chart remain intact and new these levels add as an extra support and resistance levels along with the new big targets.

#DAX Current Price: 24162.86

#DAX Pivot Point: 23907 Support: 23264 Resistance: 24556

#DAX Upside Targets:

🎯Target 1: 25284

🎯Target 2: 26012

🎯Target 3: 26801

🎯Target 4: 27591

#DAX Downside Targets:

🎯Target 1: 22533

🎯Target 2: 21802

🎯Target 3: 21013

🎯Target 4: 20224

#TradingView #Nifty #BankNifty #DJI #NDQ #SENSEX #DAX #USOIL #GOLD #SILVER

#BHEL #HUDCO #LT #LTF #ABB #DIXON #SIEMENS #BALKRISIND #MRF #DIVISLAB

#MARUTI #HAL #SHREECEM #JSWSTEEL #MPHASIS #NATIONALUM #BALRAMCHIN #TRIVENI

#USDINR #EURUSD #USDJPY #NIFTY_MID_SELECT #CNXFINANCE

#SOLANA #ETHEREUM #BTCUSD #MATICUSDT #XRPUSDT

#Crypto #Bitcoin #BTC #CryptoTA #TradingView #PivotPoints #SupportResistance

SELL GER30 FOR WIFE BIRTHDAYI am already in the sell, will be entering more entries on neckline of triangle. I need to take my wife out tomorrow and I am betting on this tade. I will close the trade at 22:45 exactly before market closes.

Analysis:

1. Daily bearish

2. 4 hr brearish

3. Entered the early position on 1 min timeframe

DAX WILL GO UP|LONG|

✅DAX is going up now

And the index made a

Breakout of the key horizontal

Level of 24,100 which is

Now a support then

Made a retest and a is now

Making a rebound already so

We are bullish biased and we

Will be expecting a further

Bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

DAX oversold rally resistance at 24540The DAX remains in a bullish trend, with recent price action showing signs of a oversold really within the broader uptrend.

Support Zone: 23790 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 23790 would confirm ongoing upside momentum, with potential targets at:

24540 – initial resistance

24670 – psychological and structural level

24980 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 23790 would weaken the bullish outlook and suggest deeper downside risk toward:

23610 – minor support

23400 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 23790. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GER40CASH (DE40) - potential short - HSThere is a potential head and shoulders continuation pattern.

What I like about this setup is the GER40 is potentially creating a bear flag.

Finding a continuation pattern within the bear flag, like the head and shoulders, is a great entry point for the second part of the downward move.

Still waiting for my system to confirm some variables before I take the trade.

Risk/reward = 4.3

Entry price = 23 905.3

Stop loss price = 23 955.4

Take profit level 1 (50%) = 23 733

Take profit level 2 (50%) = 23 628

GER40 (DE40) SHORT - Double top 15minPotential short on GER40 with a double top on the 15min.

There is negative rsi divergence which is one of the indicators I use to look for double tops.

Still waiting on further confirmation before I take the trade.

Risk/reward = 3.2

Entry price = 23 905

Stop loss price = 23 965

Take profit level 1 (50%) = 23745

Take profit level 2 (50%) = 23684

What do you guys and girls think the GER40 is going to do from here?

Technical Analysis WeeklyGermany 40 is now in a range-bound environment, currently trading at 23,630, below its VWAP of 24,150 and close to StdDev #2 Lower. RSI at 43 reflects weakening momentum. Support lies at 23,630 and resistance is seen at 24,740

UK 100 continues its bullish trend, undergoing a small pullback. Price is at 9,102, just above its VWAP at 9059. RSI at 61 indicates steady bullish interest. Support is at 8,906 and resistance is at 9,212

Wall Street remains bullish but is now in a corrective phase. Price has dropped to 43,786, below its VWAP of 44,407. The RSI of 43 highlights growing downside pressure. Support is at 43,580, and resistance is at 45,253.

Brent Crude continues in a choppy range, albeit with lower volatility, trading at 6,932, right at its VWAP. The RSI at 50 confirms the lack of directional bias. Support sits at 6,631 and resistance at 7,198.

Gold continues to consolidate in a broad triangle pattern - keeping it in a neutral range, with price at 3,357, nearly equal to its VWAP. The RSI at 53 shows a balanced outlook. Support is at 3,280 and resistance at 3,416.

EUR/USD holds a bullish trend but is correcting. The pair trades at 1.1565, slightly below the VWAP of 1.1635. RSI at 45 reflects subdued buying pressure. Support is at 1.1435 and resistance at 1.1834.

GBP/USD has potentially entered a new bearish trend in a quick reversal from the prior uptrend. It trades at 1.3275, below the VWAP of 1.3404. The RSI of 36 signals fresh bearish momentum. Support is at 1.3204 and resistance at 1.3604.

USD/JPY remains neutral and in a range phase but is possibly building a new uptrend with its recent drop back from range resistance. Price is 147.95, aligned with the VWAP. RSI at 53 suggests a balanced tone. Support is near 145.95 and resistance stands at 149.88.

DAX: Next Move Is Up! Long!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 23,502.95 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

DAX - potential buyPotential buy on the German index as we are coming out of the 30min correction that followed a first small impulse to the upside. Conservative target is a move equivalent to the first 30 min setup. Optimal target are the break of the top and even better the 24.85 area. Levels on the chart. Trade with care.

DAX: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 24,252.78 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

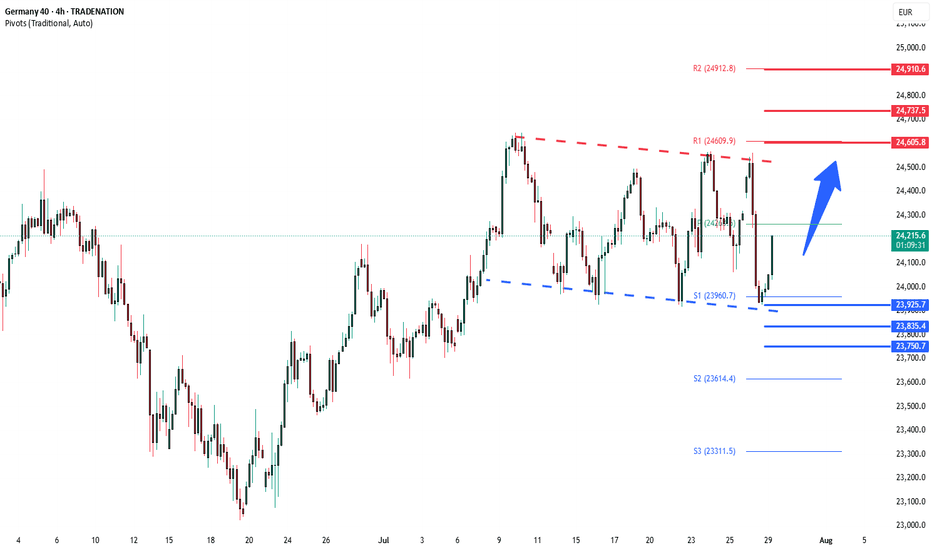

DAX oversold rally support at 23925The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 23925 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 23925 would confirm ongoing upside momentum, with potential targets at:

24605 – initial resistance

24740 – psychological and structural level

24910 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 23925 would weaken the bullish outlook and suggest deeper downside risk toward:

23835 – minor support

23750 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX holds above 23925. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.