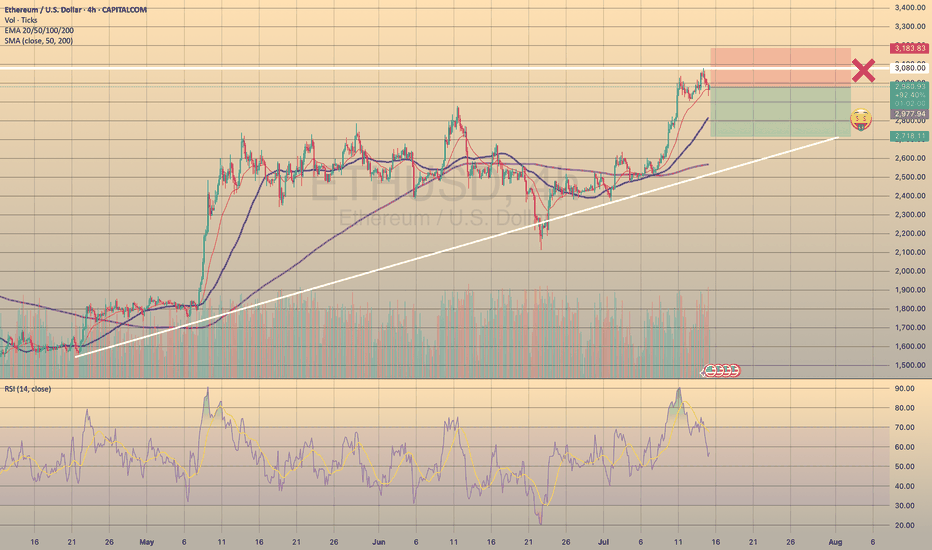

ETHUSD REACHED NEW HIGH - SHORT OPPORTUNITY

TRADING IDEA - ETHUSD REACHED NEW HIGH - SHORT OPPORTUNITY📉

The same as BTCUSD, ETHUSD has reached a new maximum at 3.083.52. After that the asset went sideways, waiting for some impulse. I see strong divergence on 4h timeframe on RSI and expect a decline within next 24-48 hours. Basically, it is the same story here as with the bitcoin, cause the nature of the recent hike is also the same. So, I put a

🔽 a market sell order at 2977.94 with

❌a stop loss at 3183.83 and

🤑a take profit at 2718.11

It is a counter-trend trade, so it's a bit more risky than usual.

Trade cautiously! Preserve your deposits!

ETHUSD.P trade ideas

Ethereum Price Rejects $3K: Is A Deeper Correction Ahead?Ethereum's Precarious Perch: Price Stumbles at $3K as Long-Term Conviction and Quantum Threats Collide

The cryptocurrency community is intently watching Ethereum as the premier smart contract platform engages in a fierce battle around the psychologically crucial $3,000 mark. Following a promising surge that breached this barrier for the first time in several months, the upward momentum has stalled, giving way to a tense period of consolidation. This raises a pivotal question for investors and market observers alike: is a more significant correction on the horizon, or is this merely a strategic pause before the next major advance toward $3,200 and potentially higher valuations?

The recent price action has been a whirlwind for traders. Ethereum climbed with bullish determination, reaching heights near $3,080 before encountering substantial selling pressure that forced a retreat. This downturn has left the price hovering near the $2,940 level, trading precariously near its 100-hourly Simple Moving Average (SMA). Exacerbating the bearish sentiment, the price has broken below a key bullish trend line that had previously offered support at the $2,980 mark, a technical development that often signals the potential for further declines.

This short-term market turbulence, however, unfolds within a much broader and more intricate narrative. While hourly charts may be flashing warning signs, an analysis of long-term on-chain data reveals a story of strengthening fundamentals, underscored by a record amount of Ethereum being locked away by confident, long-term holders. In parallel, the Ethereum developer community, with co-founder Vitalik Buterin at the forefront, is proactively strategizing for a distant yet potentially existential threat: the "Quantum Apocalypse." This unique convergence of immediate bearish technical indicators, profound long-term bullish sentiment, and forward-thinking security planning creates a fascinating and unpredictable landscape for the pioneering blockchain platform.

The Short-Term Tug-of-War: A Correction Towards $2,900 or a Rally to $3,200?

In the immediate term, the market is a battlefield of competing forces. The inability to sustain a position above the $3,000 level has emboldened sellers, and key technical indicators are suggesting a cautious approach. The hourly MACD (Moving Average Convergence Divergence) is indicating a loss of momentum within the bullish zone, while the RSI (Relative Strength Index) has fallen below the 50 mark, suggesting that selling pressure could be gaining the upper hand.

Market analysts are now laser-focused on the $2,900 zone, viewing it as the primary line of defense for the bulls. If this support level can withstand the selling pressure, it could provide the necessary foundation for a fresh increase, enabling Ethereum to reclaim its lost ground and launch another attempt to conquer the $3,000 resistance. Conversely, a decisive break below this critical support could initiate a more substantial correction. In such a scenario, subsequent support targets would likely be found near $2,800, with the potential for further drops to the $2,720 or even $2,650 price points.

A particularly compelling theory circulating among analysts involves the concept of a "liquidity sweep." On-chain data indicates a significant concentration of liquidity—essentially, a large cluster of buy orders and stop-loss orders—residing just below the $2,900 level. Market dynamics frequently see price action gravitate toward these zones to trigger liquidations, effectively shaking out over-leveraged traders before a more sustained move in the opposite direction. Consequently, a brief dip below $2,900 to "grab" this liquidity would not be an unexpected development. Paradoxically, such a move could be the very catalyst required to fuel a durable rally toward the next major target: the $3,200 supply zone. This level is widely regarded as the next significant hurdle, a price ceiling where a large volume of sell orders is anticipated to be waiting.

The volatility surrounding key psychological levels like $3,000 is notoriously difficult to predict, as human emotions of fear and greed often drive exaggerated market reactions. For the time being, the short-term outlook remains uncertain, heavily contingent on whether the crucial $2,900 support can absorb the selling pressure or if a flush-out of liquidity is needed before the bulls can confidently reassert control.

The Bullish Undercurrent: Smart Money's Long Game and a Shrinking Supply

Looking beyond the volatile daily price charts reveals a powerful undercurrent of bullish conviction. A key metric that speaks volumes about long-term investor sentiment is the quantity of Ethereum locked in staking contracts, which has recently soared to a new all-time high.

Recent on-chain data indicates that nearly 30% of Ethereum's total supply is now staked on the network. As of mid-2025, more than 35 million ETH have been committed to validator nodes, a process that helps secure the network while allowing stakers to earn passive income. This trend, which has seen a notable acceleration in recent months, serves as a powerful indicator of long-term confidence. When investors, particularly large holders often referred to as "whales," stake their ETH, they are effectively removing it from the liquid, tradable supply. This reduction in available supply, frequently described as a "supply shock," means that any future increase in demand can have a more pronounced positive effect on the asset's price.

This staking activity is widely interpreted as "smart money" placing a long-term bet on Ethereum's continued growth and success. These are not day traders reacting to minor price swings but rather institutional investors and seasoned crypto participants who are focused on the bigger picture. Their actions signal a deep-seated belief that the intrinsic value of the Ethereum network—as the foundational layer for decentralized finance (DeFi), non-fungible tokens (NFTs), and a vast ecosystem of other applications—will continue to appreciate over time. This accumulation is not limited to staking; the number of wallets with no history of selling has also reached a record high, collectively holding over 22.8 million ETH.

This expanding pool of illiquid supply, driven by a firm belief in Ethereum's fundamental value proposition and its future roadmap, provides a strong counter-narrative to the short-term bearish technicals. It suggests that while the price may experience turbulence in the near term, a substantial and growing cohort of investors is prepared to hold through the volatility, thereby creating a solid foundation for future price appreciation.

The Existential Question: Can Ethereum Outsmart a Quantum Apocalypse?

While traders and short-term investors grapple with hourly charts and staking metrics, Ethereum's core developers are concentrating on a threat that is far more distant but infinitely more profound: the advent of quantum computing. The "Quantum Apocalypse" is a term used to describe the hypothetical future event—often called "Q-Day"—when a quantum computer becomes powerful enough to break the cryptographic algorithms that secure virtually all of our modern digital infrastructure. This includes blockchain networks like Ethereum and Bitcoin.

Such a powerful machine could, in theory, reverse-engineer a user's private key from their public key, which would grant an attacker complete and unfettered control over their digital assets. For a multi-billion dollar ecosystem built on the unwavering promise of cryptographic security, this represents an existential threat of the highest order.

However, the leadership within the Ethereum ecosystem, including co-founder Vitalik Buterin and the Ethereum Foundation, is not idly waiting for this threat to materialize. They are actively and transparently working to make the network quantum-resistant. Buterin has publicly addressed the issue, noting that prediction markets currently forecast the arrival of a cryptographically relevant quantum computer sometime between 2030 and 2035. This timeline provides a crucial window for the network to transition its security protocols to a more robust standard.

The strategy to neutralize this threat is multifaceted and is a core component of Ethereum's long-term development roadmap. Key initiatives include:

• Post-Quantum Cryptography: Researchers are diligently developing and testing new types of signature schemes that are designed to be resistant to attacks from both classical and quantum computers. Two of the most promising approaches are STARKs (Scalable Transparent Arguments of Knowledge) and lattice-based cryptography. STARKs, for instance, would allow users to prove ownership of their assets without ever exposing their private keys.

• The "Lean Ethereum" Roadmap: Buterin and fellow researcher Justin Drake have put forth a vision for a "Lean Ethereum" that aims to simplify the blockchain's base layer. This simplification would not only make the protocol easier to audit and secure but would also facilitate the integration of post-quantum-ready signatures and other advanced defensive measures.

• Emergency Hard Forks: In a worst-case scenario where a quantum threat emerges much sooner than anticipated, Buterin has suggested that an emergency hard fork could be deployed as a final line of defense. This would involve a network-wide upgrade where all users would be required to migrate their funds to new, quantum-resistant "smart" wallets, thereby rendering the old, vulnerable accounts obsolete.

Buterin remains cautiously optimistic about the network's ability to navigate this challenge. The proactive stance, the commitment to public and transparent research, and the multi-layered defense strategy all demonstrate a deep commitment to ensuring Ethereum's security for decades to come. This effort aims to transform a potential apocalypse into a manageable, albeit complex, technological evolution.

Conclusion: A Market at a Crossroads

Ethereum currently stands at a fascinating crossroads, a point where short-term technical uncertainty is juxtaposed with immense long-term fundamental strength and remarkable foresight. The immediate price action is a toss-up, delicately balanced on the crucial $2,900 support level. A sustained dip below this line could send prices into a corrective wave toward $2,800 or lower, possibly to sweep liquidity before a stronger and more convincing rebound. Conversely, if this support holds firm, it could empower the bulls to decisively conquer the $3,000 barrier and set their sights on the formidable $3,200 resistance zone.

When one zooms out from the daily noise, the picture becomes clearer and decidedly more bullish. The record-breaking amount of ETH locked in staking contracts paints a portrait of unwavering long-term conviction from sophisticated investors who are systematically reducing the available supply while simultaneously strengthening the network's security. This patient accumulation provides a powerful buffer against short-term market panic.

Looking even further into the future, Ethereum's leadership is already waging a quiet war against the quantum threat, meticulously laying the groundwork for a post-quantum world. This long-range planning, while not a direct factor in today's price movements, underpins the network's potential for longevity and resilience.

For the investor, the current dilemma—a rally to $3,200 or a pullback first?—is largely a matter of time horizon. The path of least resistance in the coming days and weeks remains ambiguous, clouded by liquidation levels and psychological barriers. But for those with a longer view, the on-chain data and the forward-thinking roadmap strongly suggest that Ethereum is not just building for the next bull run, but for the next generation of the internet. The current price turbulence, while unsettling, may ultimately be remembered as a minor tremor before a much more significant structural shift in value.

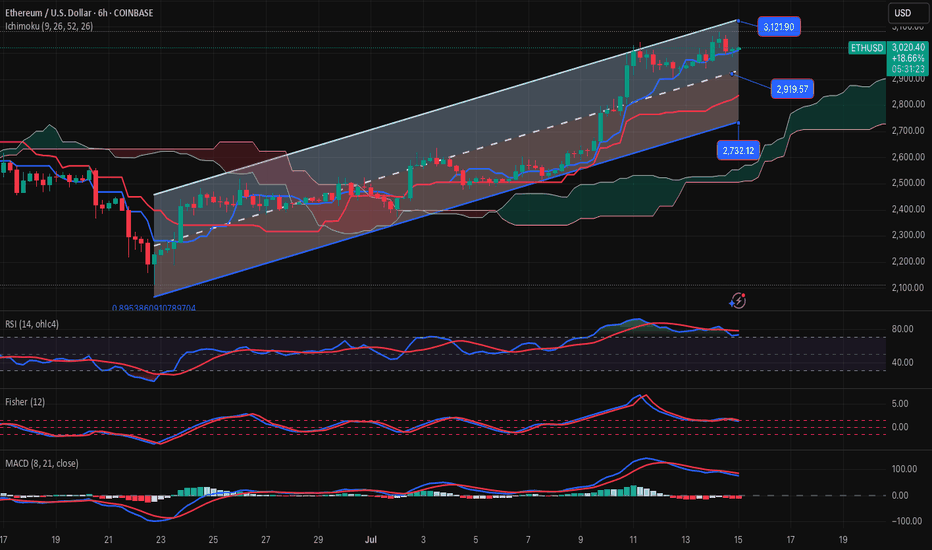

Bullish continuation?The Ethereum (ETH?USD) is falling towards the pivot which is a pullback support and could bounce to the 1st resistance.

Pivot: 2,821.91

1st Support: 2,649.43

1st Resistance: 3,077.96

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

(ETH/USD) Bullish Setup: Entry at $2,422 with Target at $2,521 a1. Entry Point: ~2,422.2

This is the suggested buy area based on a recent bounce from the support zone

2. Support Zone (Purple Box):

Bottom boundary: ~2,392.4

Top boundary: ~2,408.4

Price has bounced multiple times here, showing strong buying interest.

3. Resistance Point: ~2,463.9

A clear horizontal resistance line, previously tested.

4. EA Target Point: ~2,522.1

A bullish target if the price breaks above the resistance level.

🔶 Highlighted Patterns / Markers

Orange Circles: Indicate key swing highs and lows — possibly used to identify double tops/bottoms or rejection/wick zones.

Blue Arrows: Illustrate the anticipated move from:

Entry (2,408.1) → Resistance (2,463.9) → Target (2,521.2)

Target gain = +111.7 USD (+4.64%)

🔻 Stop Loss Level

Set just below the support box at ~2,392.4

Protects from false breakouts or deeper pullbacks.

📈 Strategy Outlook

Bullish Bias: The setup expects a breakout from the current price range.

Risk-Reward Ratio: Appears favorable — tight stop and wide target.

Confirmation Needed: A solid breakout and hold above 2,423–2,425 may be the early confirmation signal.

📌 Summary

Element Value

Entry Point ~2,422.2

Stop Loss ~2,392.4

Resistance ~2,463.9

Target (TP) ~2,521.2

R:R Ratio Approx. 3:1

Bias Bullish

ETH reclaiming yearly support and going to the moon !The march bottom was a total reset of Ethereum price cycle and the beginning of a new one.

Now altcoin season is confirmed, ETH nicely reclaimed the yearly support.

And can now go to price discovery again !

Target around end of the year around 10k to 15k.

Ethereum Set for a Major Move — Watch $2,700–$2,800Epic Base Forming:

Ethereum is building a powerful base, and the fundamental dynamics have shifted significantly in recent weeks. With ETF fund flows hitting new highs, institutional interest is clearly growing.

Tight Setup for a Short Squeeze:

Meanwhile, the futures market shows a near-record short position, creating a high-potential setup for a massive short squeeze. Even without the chart, this kind of positioning mismatch is rare—and explosive.

Technical Watch Zone:

Ethereum is pressing into key resistance from a rounding bottom. The critical level to watch is $2,700–$2,800. A clean breakout here could ignite a sharp rally, with $4,000+ back on the table in short order.

This is a textbook setup—fundamentals, sentiment, and technicals are aligning.

#Ethereum #ETH #Crypto #TechnicalAnalysis #ShortSqueeze #ETFFlows #MarketSetup #Bullish #Altcoins #CryptoTrading #WatchList

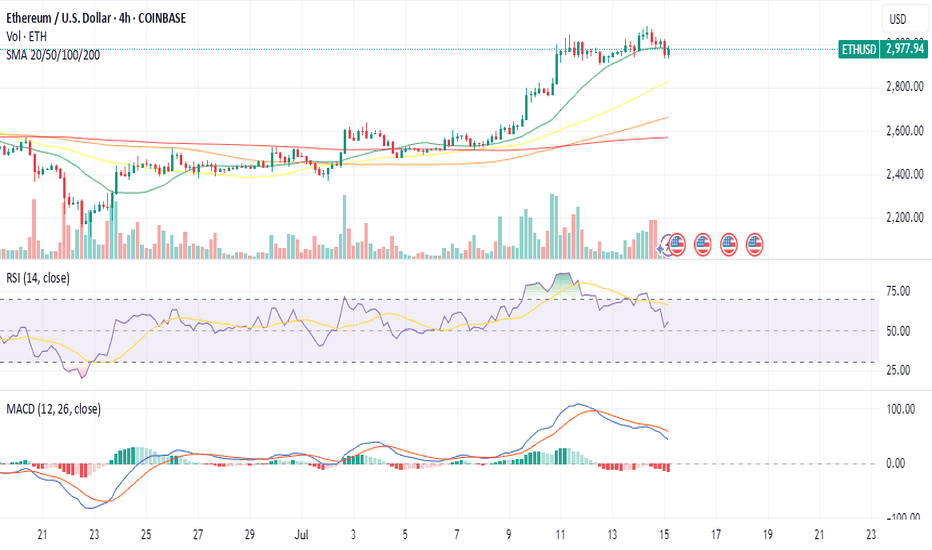

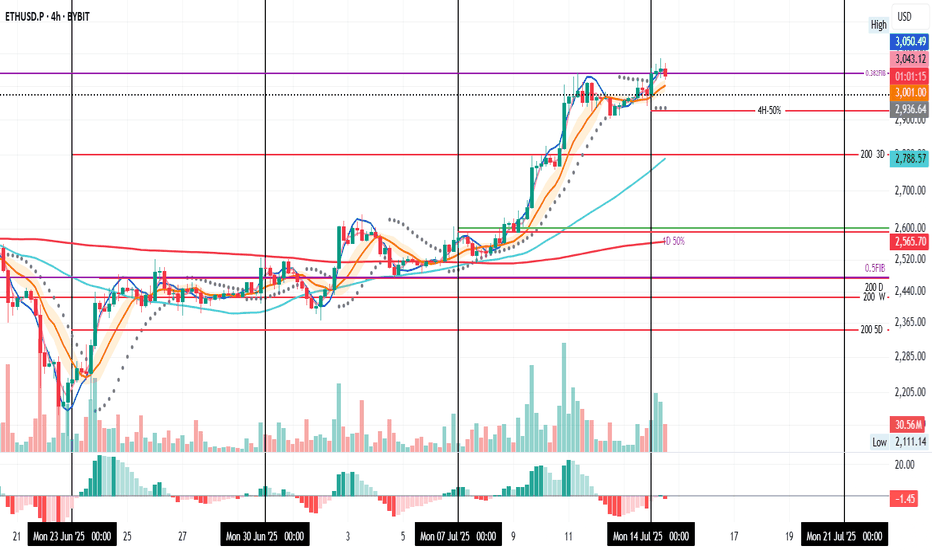

ETH 4H: Retest in Progress

ETH on the 4H starts the week strong, currently retesting support at the 0.382 Fib, a level that acted as resistance last week.

We’ve had two 4H candle closes above it, but now a close below seems likely.

I’ve set a TP at the 4H-50% line, just under the PSAR dots, to take 50% profit if price dips further.

Always take profits and manage risk.

Interaction is welcome.

"Ethereum Is The New Bitcoin" - Tom Lee ETH / Stablecoins Are the ChatGPT of Crypto

Stablecoins are exploding in adoption — just like ChatGPT took over AI and Ethereum is the engine driving that revolution. In this post, we break down 10 reasons why Tom Lee is extremely bullish on Ethereum and why it could be the single most important digital asset in the future of finance . If you're sleeping on ETH, this might be your wake-up call.

Top 10 Bullish Points from Tom Lee on Ethereum:

• Ethereum is the backbone of stablecoins , which Tom Lee compares to the “ChatGPT of crypto” due to their viral adoption and massive utility.

• Over 51% of all stablecoins operate on Ethereum , contributing to around 30% of the network’s total fees.

• Ethereum network fees could 10x as stablecoin usage grows from $250 billion to $2 trillion.

• Ethereum is positioned to lead the tokenization of real-world assets , including stocks and real estate.

• ETH could reach $10,000 if asset tokenization becomes a mainstream financial practice.

• Ethereum has a regulatory edge in the U.S. , making it the preferred platform for compliant financial innovation.

• A $250 million ETH treasury strategy is underway , aiming to use Ethereum as a long-term reserve asset.

• Institutions will buy and stake ETH to secure stablecoin networks, making ETH the “next Bitcoin.”

• Ethereum dominates the crypto ecosystem , with nearly 60% of activity including DeFi, NFTs, and dApps built on its chain.

• HODL ETH for long-term growth , as its utility, demand, and institutional support continue to rise.

Conclusion:

Ethereum isn’t just a Layer 1 blockchain — it’s becoming the core financial infrastructure for the digital age . As stablecoins expand and institutions enter, ETH could be the most asymmetric opportunity in crypto right now.

📢 Drop a like, leave your thoughts in the comments, and don’t forget to follow for more powerful macro + crypto insights. 👍👍

Ethereum Breaks $3,000: Hype Meets UtilityEthereum (ETH) has surged above $3,000, driven by a wave of retail and institutional momentum following the presale success of Little Pepe (LILPEPE), a meme coin built on a new Ethereum-compatible Layer 2 network. With over $5 million raised during the presale, the appetite for meme-coin ecosystems continues to fuel Ethereum’s utility narrative, giving it both technical and psychological strength.

Key Levels to Watch:

• Short-term Structure (H4 Chart): ETH is currently forming a bullish flag pattern, a continuation structure that often precedes further upside.

• Upside Scenario: A confirmed breakout above $3,100 could extend the rally to $3,200, and potentially test $3,300, a level of major historical resistance.

• Downside Risk: Failure to hold current levels may see ETH retrace back toward $2,900, with the 50% Fibonacci retracement at $2,600 acting as the next support zone.

If sentiment in the broader crypto market remains elevated and Bitcoin holds firm near all-time highs, Ethereum’s bullish setup may have further room to run.

ETH way to test ATHEthereum is making its way toward testing its all-time high, but there are some strong resistance levels in the way—most notably around the $3.5K mark. Still, the technicals are showing promise: RSI has broken out of its trendline, and the monthly Stochastic RSI looks bullish, signaling strong upward momentum.

How ETH reacts to these resistance zones will be key. Historically, Ethereum has led the altcoin market, so if it breaks its ATH, we could see a rapid surge across altcoins. Until then, we’re likely in the middle of a "mini altseason"—some coins running, but the real breakout comes once ETH confirms the move.

Ethereum: Bullish Momentum Signals Broader Rally Beyond $3000Current Price: $3002.13

Direction: LONG

Targets:

- T1 = $3120.00

- T2 = $3203.00

Stop Levels:

- S1 = $2934.00

- S2 = $2842.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom-of-crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Ethereum.

**Key Insights:**

Ethereum shows robust uptrend momentum, underpinned by significant institutional demand and strengthening market sentiment. As the primary cryptocurrency supporting decentralized finance (DeFi) and non-fungible tokens (NFTs), Ethereum has positioned itself at the forefront of blockchain advancements. The growing adoption by institutions and favorable macroeconomic conditions further consolidate its growth prospects, especially with the increasing recognition of Ethereum as a digital inflation hedge.

Positive developments in regulatory frameworks around cryptocurrencies have also been instrumental in improving market sentiment. Ethereum continues to showcase strong transactional activity on its network, bolstering demand for ETH tokens as a utility. Heightened activity ahead of protocol upgrades is another catalyst that traders are closely monitoring.

**Recent Performance:**

Ethereum has maintained a steady price appreciation trend in alignment with broader cryptocurrency market gains. From its previous trading range below $3000, Ethereum has breached psychological resistance, marking $3002.13 as a pivotal level. Increased trading volume and positive sentiment have allowed Ethereum to test higher resistance levels, making it well-positioned for potential upside continuation.

**Expert Analysis:**

Market experts remain bullish on Ethereum, citing fundamental strengths such as its adaptability, technological utility, and yield-generating capabilities through staking. With investor demand continuing to grow, Ethereum is expected to outperform many altcoins and maintain leadership alongside Bitcoin. Analysts project an intermediate target of $3200, while the longer-term objectives extend beyond $3500 given its current trajectory.

Technical metrics also signal bullish momentum, including sustained moving average support and increasing RSI levels. Investors may find attractive reward-to-risk setups at current levels, supported by favorable macro and crypto-specific factors.

**News Impact:**

Ethereum has benefited from an improving regulatory environment in key crypto jurisdictions, which has alleviated some uncertainty. Simultaneously, positive macroeconomic trends, such as declining inflation expectations and risk-on sentiment across equity markets, have boosted overall investor confidence. Ethereum’s role in various decentralized applications (dApps) and strategic partnerships with enterprises further solidify its potential for sustained growth.

**Trading Recommendation:**

Traders should consider taking a long position on Ethereum, targeting $3120 and $3203 as near-term objectives while maintaining disciplined risk management with stops at $2934 and $2842. The combination of fundamental strength, technical indicators, and favorable news impacts positions Ethereum as an attractive investment opportunity amidst current market dynamics.

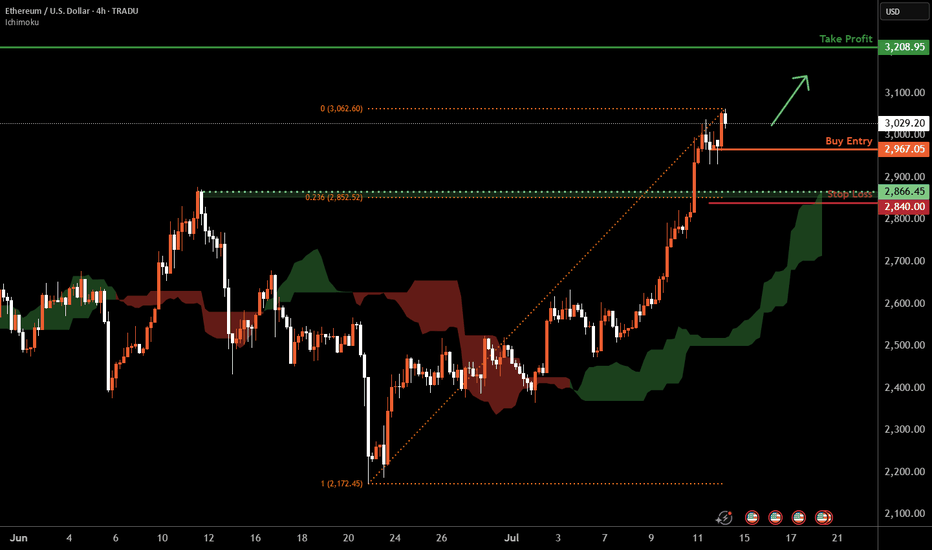

Ethereum H4 | Bullish uptrend to extend higher?Ethereum (ETH/USD) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,967.05 which is a swing-low support.

Stop loss is at 2,840.00 which is a level that lies underneath a pullback support and the 23.6% Fibonacci retracement.

Take profit is at 3,208.95 which is an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

People Don't Eth Enough Most people aren't aware of the opportunities taking place. Here I am soaked with more insight than I can carry. It runs off of me continuously like a waterfall. In all honesty I am truly alone...always in my own thoughts because the world seems impossible to hold a conversation with...a conversation that actually matters...but here, at tradingview, there is a sense of relief. To me, it is important to know where to place money, that it may grow with interest. People don't believe me. They never did and I never cared. I only cared to warn them but who am I?

Bullish bounce?Ethereum (ETH/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 2,810.19

1st Support: 2,361.23

1st Resistance: 3,481.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

ETH/USD Setup | Thief Trading Blueprint for Profit.🔥🚨THE ETHEREUM HEIST PLAN: Thief-Style Trading Blueprint for Maximum Gains🚨🔥

💰Thief Mode: Activated | Time to Rob the Bulls 💰

📢🌍 Hello Money Makers, Crypto Crooks & Chart-Breaking Bandits! 🐱👤🤑💸

Welcome to the “Thief Trading Style” breakdown — a high-stakes, high-reward crypto market blueprint built on deep technical & fundamental intel. This isn’t your average strategy… it’s a full-blown heist on the ETH/USD market!

🧠 THE MASTER PLAN (ETH/USD – Day & Swing Trade)

🔎 Based on our Thief Mode analysis — blending market sentiment, trend psychology, and price action — Ethereum is ripe for a bullish robbery. We’re setting up shop at high-risk liquidity traps and targeting bearish overconfidence.

💥ENTRY STRATEGY – "The Vault Is Open, Time to Strike!" 💥

🟢 Go Long:

Swipe in on bullish momentum.

🕒 Set Buy Limit Orders at key pullback zones (swing highs/lows from 15m or 30m timeframes).

💼 Use DCA (Layered Orders) for multiple precision entries. The more layers, the stronger the loot stack.

🛑STOP LOSS – "Thief Rule: Don’t Get Caught"

📍Place SLs at logical swing highs/lows using the 1H timeframe

💡 Adjust according to lot size & how many entries you're stacking

Risk smart, steal smarter!

🎯TARGET – "Make the Escape at 2850.0 or Jump Early if Cops Close In!"

📌Set TP at 2960.0, or

📌Exit early if the market starts turning shady (exit before reversal signs appear)

⚔️SCALPER'S CODE – "Fast Hands Only!"

🧲Only scalp Long-side plays

🧠Use trailing SLs to protect stolen profits

💼Big wallets? Front-run the move

🪙Smaller bags? Team up with swing traders and follow the blueprint.

🚨MARKET CONTEXT – Why This Heist is Bulletproof

💥ETH/USD is showing bullish energy due to:

Macro & Fundamental Drivers

On-Chain Metrics showing accumulation

Sentiment Analysis leaning toward over-leveraged bears

Intermarket Correlation signaling rotation into altcoins

🔗Stay sharp, keep updated with: COT Reports, Macro Calendar, Crypto News Feeds

⚠️NEWS RELEASE WARNING – "Robbers Hate Surprises"

📛Avoid new entries during major news releases

📈Use Trailing Stop Losses to lock in profits

⛔Don’t leave positions unmanaged during volatility spikes

💖LOVE THE PLAN? THEN BOOST THE GANG!

🎯Tap the 🔥 Boost Button 🔥 and show support for the Thief Trading Style!

The more boosts, the more plans drop — let’s build a community of smart traders robbing the market legally (😉).

✍️DISCLAIMERS

📌This analysis is for educational purposes only — not financial advice.

📌Always trade within your own risk management rules.

📌Market conditions change fast — adapt, evolve, and don’t trade blindfolded.

🚀Stick around for more blueprints — the next heist is always just around the corner.

Until then… Lock. Load. Loot. 🐱👤🤑💰

ETHUSD: Bulls Are Winning! Long!

My dear friends,

Today we will analyse ETHUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 2,980.5 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3,001.1.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️