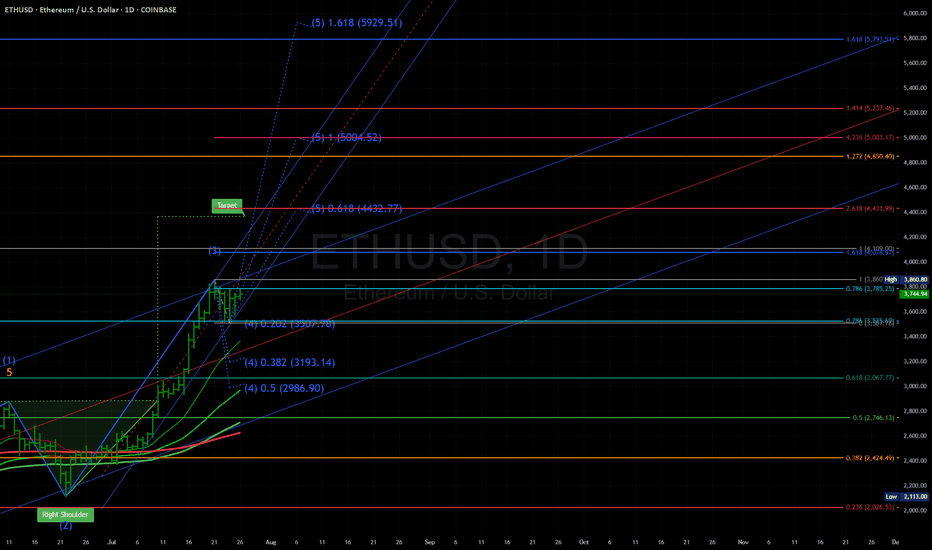

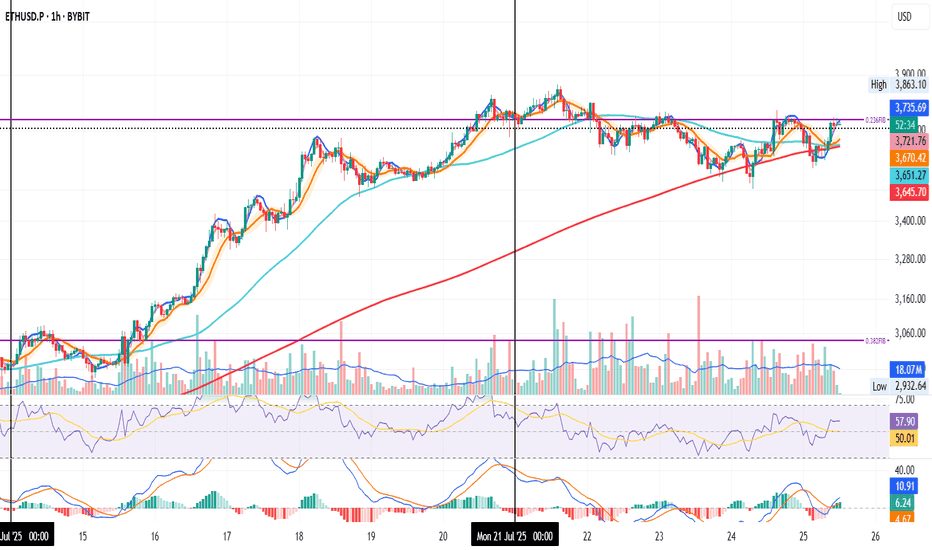

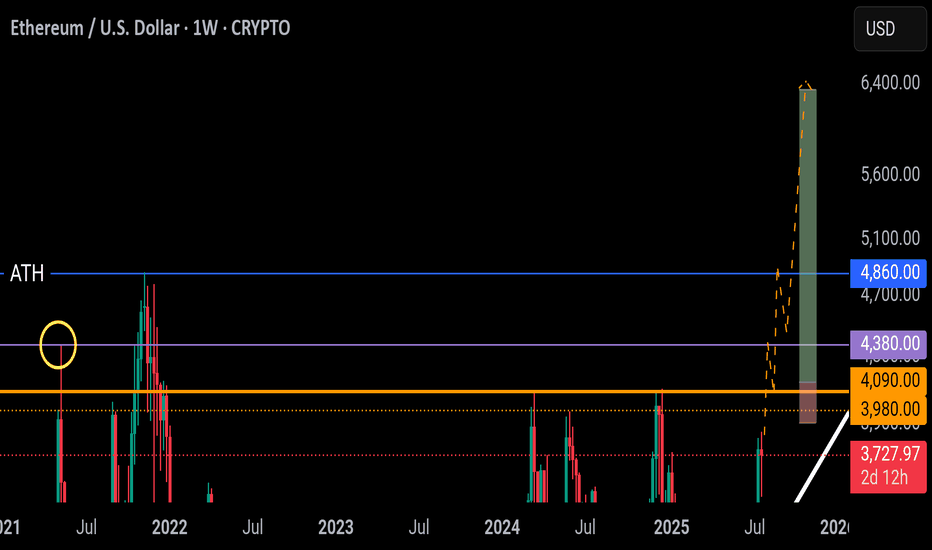

Why hello there ETH, can we be friends?barring any black swan events - now that we have the new ETH release forthcoming, the bitcoin halving in the future, and the bear market behind us (fingers crossed?), this is the trend - we'll see some stops and volatility at the major support/resistances for trading.

I'll just be holding for the next year or two. Less stress!

ETHUSD.P trade ideas

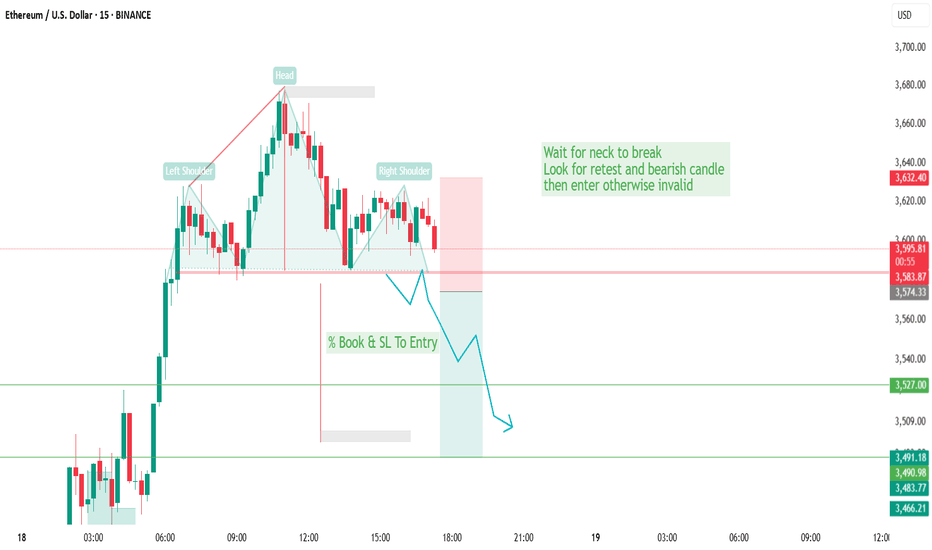

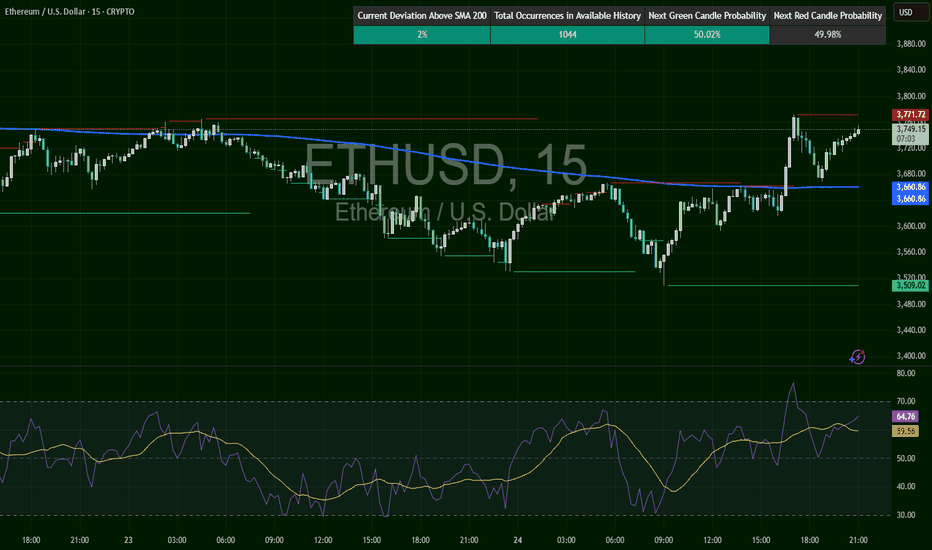

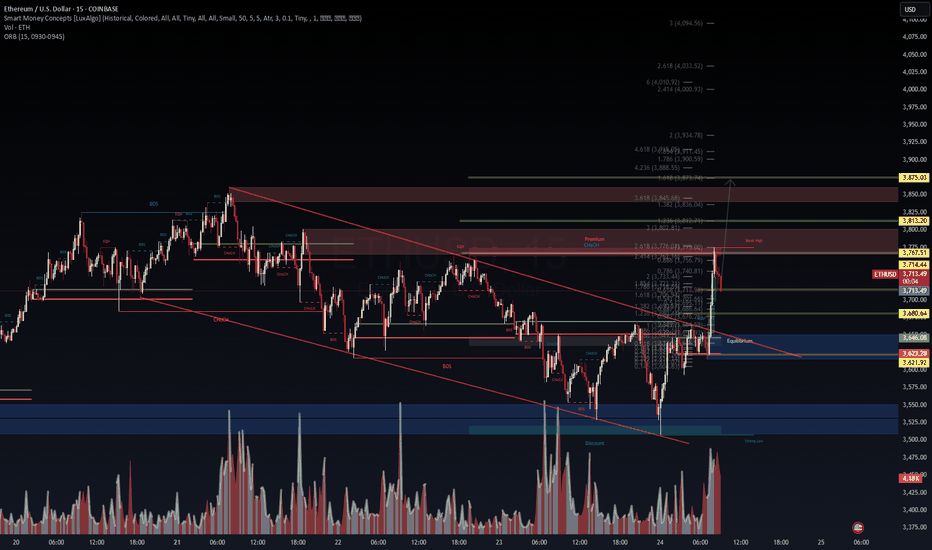

ETH/USD Forecast — GANN DAILY PIPP STRATEGYTimeframe: 15min | Dynamic Time Structure

Using a fractal time-based model, the working period is divided systematically to isolate potential time-pressure points.

Every price move is evaluated only when it aligns with a defined time interval.

---

🎯 Key Price Levels

Pivot Price: 3582

↳ Price below this level favors selling

Point of Interest This Week: 3825

↳ Price above this level opens the door for buy setups

Critical Resistance: 3879

↳ If broken, the target is 3960, expected before the next time interval at Tuesday 12:00 noon.

---

🕓 Nearest Time Interval

→ Today at 16:00 — a potential turning point. Watch price reaction closely.

---

🧠 Strategy Mindset

This is not guesswork — it’s reactive trading based on precise time intervals and structured price behavior.

I don’t chase the market. I wait for it to align with time.

---

🖼️ Open the Chart and Explore the Structure

This is not just analysis — this is geometry of time and price.

Click and witness the art behind the numbers.

Sharplink Bets Big on ETH as It Breaks $3,900Ethereum has surged past the $3,900 mark, propelled in part by news that Sharplink has acquired 77,200 ETH — a transaction worth over $300 million at current market value. For BBDelta, this move is not just market noise — it’s a concrete example of how institutional-grade Ethereum strategies can drive both asset growth and consistent income.

Sharplink, originally focused on gaming and Web3 infrastructure, has recently pivoted toward an asset-heavy Ethereum strategy. This latest acquisition positions the firm among the top ETH holders globally — and, more importantly, signals a clear roadmap to profit generation within the Ethereum ecosystem.

BBDelta analysts believe Sharplink isn’t buying ETH for speculative purposes. Rather, the company is likely deploying a multifaceted revenue model using its holdings. That includes high-yield staking via Ethereum’s proof-of-stake protocol, engagement with DeFi lending platforms, and participation in liquidity pools. These strategies, when executed correctly, can yield between 4% and 8% annually — paid directly in ETH or stablecoins.

In addition to yield generation, Sharplink could be utilizing ETH to collateralize derivatives positions, fund tokenized infrastructure, or support its presence in NFT ecosystems. Ethereum, as a platform, offers an incredibly diverse set of use cases — making it more than just a crypto asset, but a cornerstone of digital finance.

The breakout past $3,900 further strengthens this strategy. BBDelta’s technical analysis shows increased open interest in ETH futures and options, indicating rising institutional demand and the likelihood of continued volatility — a prime environment for experienced players to profit from both price movement and structure-based yields.

Sharplink’s timing also reflects sound macroeconomic thinking. As fiat currencies continue to face inflationary pressure and traditional interest rates plateau, ETH-based strategies offer both protection and performance. BBDelta believes this dual value proposition — yield + appreciation — is driving renewed interest in Ethereum as a strategic reserve asset.

At BBDelta, we empower clients to capitalize on these same dynamics. Whether it’s through ETH staking, DeFi revenue models, or structured derivatives, we offer the tools and advisory frameworks that allow investors to turn ETH holdings into active profit centers — with proper risk management in place.

Ethereum’s $3,900 milestone is not a peak — it’s a gateway to next-level opportunity. For those with the infrastructure, insights, and risk controls in place, the digital economy is not just a bet — it’s a business.

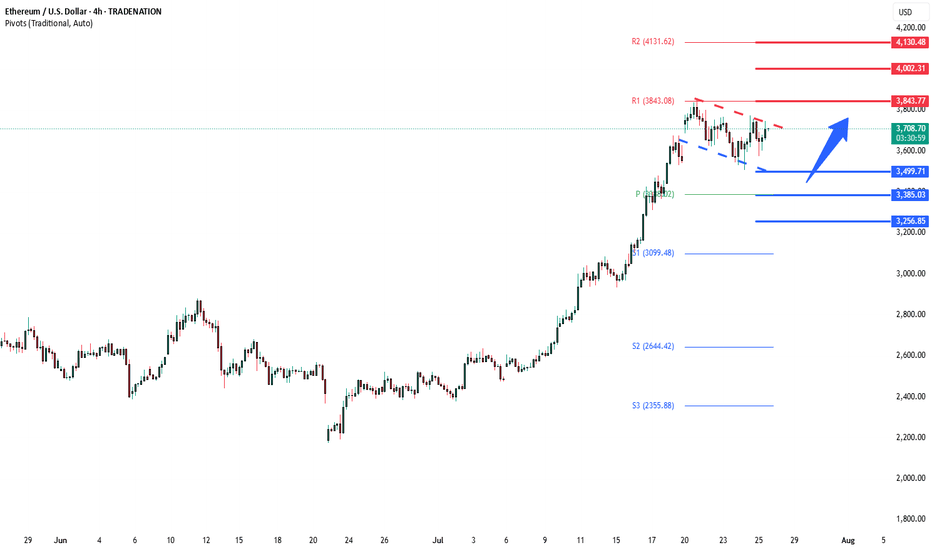

ETHUSD HEADS TOWARDS WEEKLY RESISTANCEETHUSD HEADS TOWARDS WEEKLY RESISTANCE

ETHUSD has broken local resistance of 3,850.00 and is currently heading towards weekly resistance of 4,100.00, the level, established in 2021. Last time the asset came close to this level at the end of last year and reversed from it afterwards. Same situation is expected here.

Price may retest the level of 3,850.00 and then head towards 4,100.00 level. No reversal signs on RSI or MACD. Vice a versa, RSI shows local strength of the asset, MACD is in the green zone. Buying volume highlights current bullish impulse.

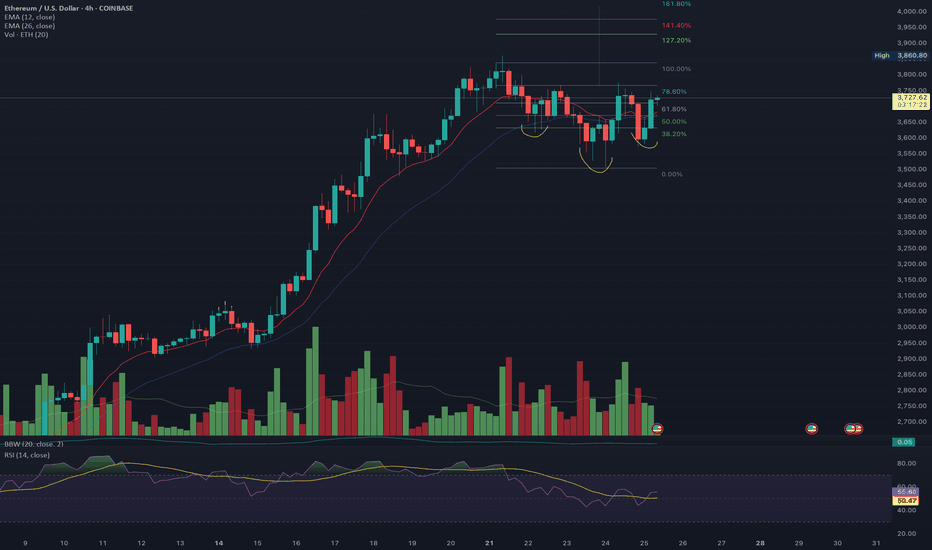

TradingView Post – ETH/USD: Ethereum Pushing Toward $4,000 TradingView Post – ETH/USD: Ethereum Pushing Toward $4,000 🚀

Market Snapshot

Ethereum (ETH/USD) is currently trading near $3,821, after a slight pullback of 2.09% from its recent highs, consolidating just below the $4,000 psychological barrier. Institutional demand and network upgrades are pushing Ethereum into a strong bullish structure, with multiple indicators aligning for an upside breakout (Crowdfund Insider, 2025).

Technical Overview

Structure: ETH has broken above the $3,700–$3,800 resistance range, entering a premium supply zone (Cryptopotato, 2025).

Ichimoku Cloud: Price action remains above the Kumo with bullish Tenkan and Kijun lines, indicating strong medium-term momentum.

Volume Dynamics: Institutional flows have absorbed previous resistance, with nearly 2.8M ETH (~$10B) bought by ETFs and large holders since May (Crowdfund Insider, 2025).

Momentum: RSI hovers around 76–78, suggesting short-term overbought conditions, but MACD remains bullish (TipRanks, 2025).

Key Levels

Resistance: $3,820–$3,830 (breakout zone), followed by $4,000 and $4,100–$4,200 (extension zone).

Support: $3,650–$3,700 (former resistance flipped support), with invalidation below $3,550.

Targets: Short-term: $4,000–$4,200. Medium-term: $4,500–$5,000 if momentum sustains (Coinpedia, 2025).

Catalysts Driving ETH

Network Upgrade: Ethereum's Pectra upgrade improved scalability and reduced fees, increasing staking yields and network efficiency (Wikipedia, 2025).

Institutional Demand: ETFs and funds continue accumulating ETH, creating a potential supply squeeze (Crowdfund Insider, 2025).

Macro Trend: July saw ETH gain over 48%, echoing BTC’s 2020 consolidation-to-breakout pattern (Tickeron, 2025).

Strategy & Risk Management

Entry Zones: Add on dips near $3,650–$3,700 or on breakout confirmation above $3,830.

Stops: Tight stops below $3,550 to protect against sudden corrections.

Profit Zones: Take partial profits at $4,000 and $4,200, trailing the remainder toward $4,500+.

Outlook

Ethereum’s path to $4,000 is supported by both on-chain metrics and institutional activity, aligning with long-term forecasts projecting ETH between $5,000 and $10,000 by 2026 (TokenMetrics, 2025).

Disclaimer: For informational and educational purposes only. Not financial advice.

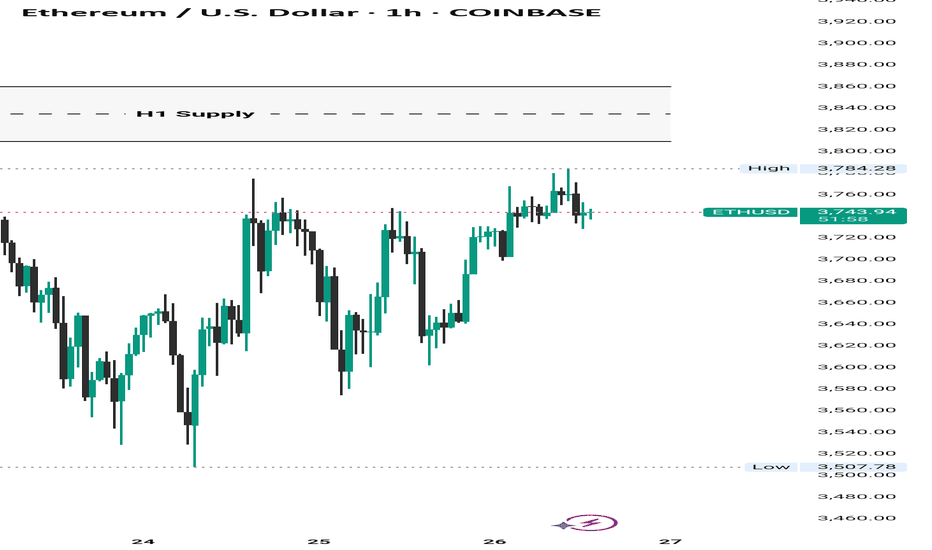

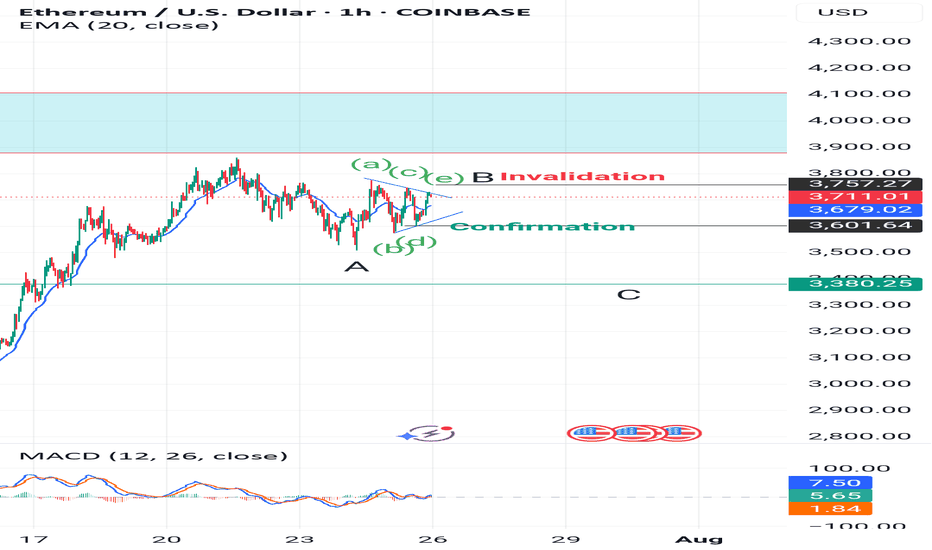

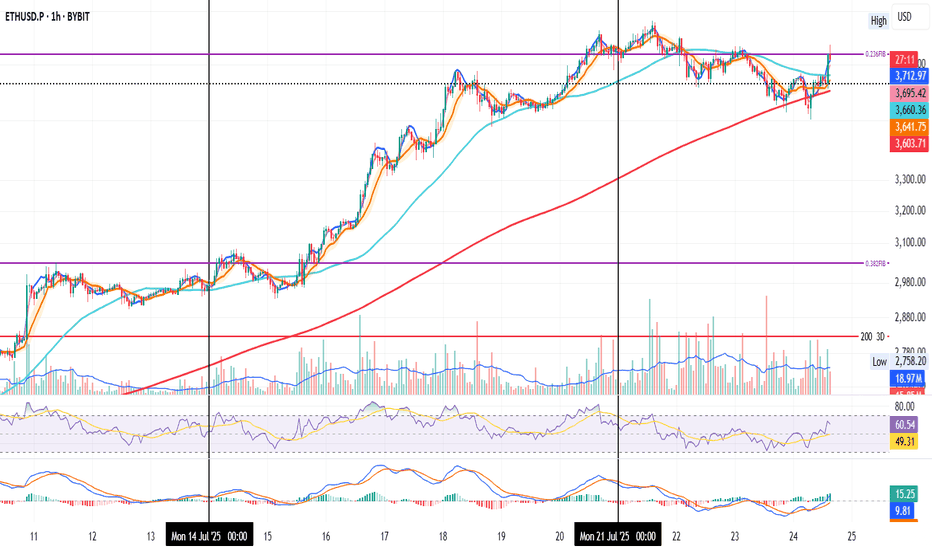

Closing the Week on ETH 1H

ETH is about to close the week just above the 0.236 Fib level.

The 50MA is crossing this key level, and the 200MA is close behind — showing alignment across moving averages.

MLR > SMA > BB Center confirms the current uptrend.

Volume is picking up slightly, though it’s Sunday — so expectations remain tempered.

RSI is nearing overbought but still has room to push higher.

MACD supports the bullish momentum.

Taken together, these signs lean bullish for the weekly close.

But this is crypto — and anything can happen in the final hours.

We’ll be here to watch it unfold.

Always take profits and manage risk.

Interaction is welcome.

Ethereum heading towards $4000Ethereum heading towards $4000

Resistance lines across $4150 and $4200.

Due the growth of bitcoin we think ethereum could be next.

Based on the growing interest of defi.

Could also be a catalyst for mid and small cap altcoins.

Rsi = avg bullish

Stoch Rsi = avg bullish

Macd = avg bullish

ETH/USDT – Daily Chart | Bearish Harmonic Setup (Butterfly Patte@ Eth/USDT Daily time frame A potential Bearish Butterfly harmonic pattern is unfolding on the daily timeframe. Price is currently approaching the D point completion zone, projecting a reversal area near 4896.

📌 Trade Setup:

Buy Limit: 3450

Stop Loss: 2870

TP1: 3894

TP2: 4896

RSI is approaching overbought levels (currently 79.57), suggesting caution as price nears the harmonic resistance zone. If price completes the pattern near TP2, traders can watch for a potential bearish reversal opportunity.

Pattern aligns with historical RSI divergences and prior structure. Monitor price action closely as we approach the D point.

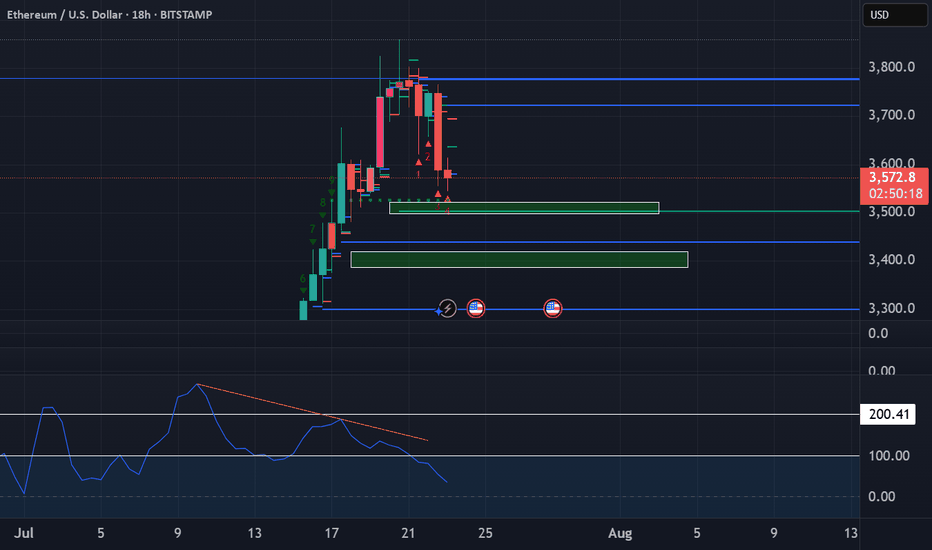

ETHUSD support at 3500The ETHUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 3500 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3500 would confirm ongoing upside momentum, with potential targets at:

3842 – initial resistance

4000 – psychological and structural level

4130 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3500 would weaken the bullish outlook and suggest deeper downside risk toward:

3385 – minor support

3256 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the ETHUSD holds above 3500. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ETH on the 1H

After rejecting the 0.236 Fib level, price found support at the 200MA.

RSI cooled off slightly, giving room for another move before hitting overbought.

MACD just flipped bullish, pushing price higher.

MLR > SMA > BB Center — structure confirms upward momentum.

Now price is back at the Fib level.

It looks fresher than yesterday, but needs clean closes above to build traction for a real breakout.

We’ll be here watching.

Always take profits and manage risk.

Interaction is welcome.

ETH key levels / fligh pathResistance zone @ 4,000 - 4,100

If Ethereum is able to break above this level the next price level likely to slow momentum / see a rejection is @ 4,400. A rejection from this price point could present a good long entry at the same Resistance zone @ 4k (flipping into support).

The ATH is likely to briefly act as resistance - saw a similar pattern with XRP/SOL/BNB/BTC - price does not naturally just "bust through" first time. Rejection/consolidation likely followed by a continued move into price/discovery.

Anticipate a new ATH to be printed toward the back end of Q4 📈

ETHUSD – From Breakdown to BreakoutETH reversed off a major demand near $3,510 and exploded past the 200 SMA into $3,747. Currently, price is resting just under resistance at $3,771, with RSI at 64.49 — strong and trending. If this resistance breaks, next leg up begins. If rejected, expect retest of $3,680–$3,700 range.

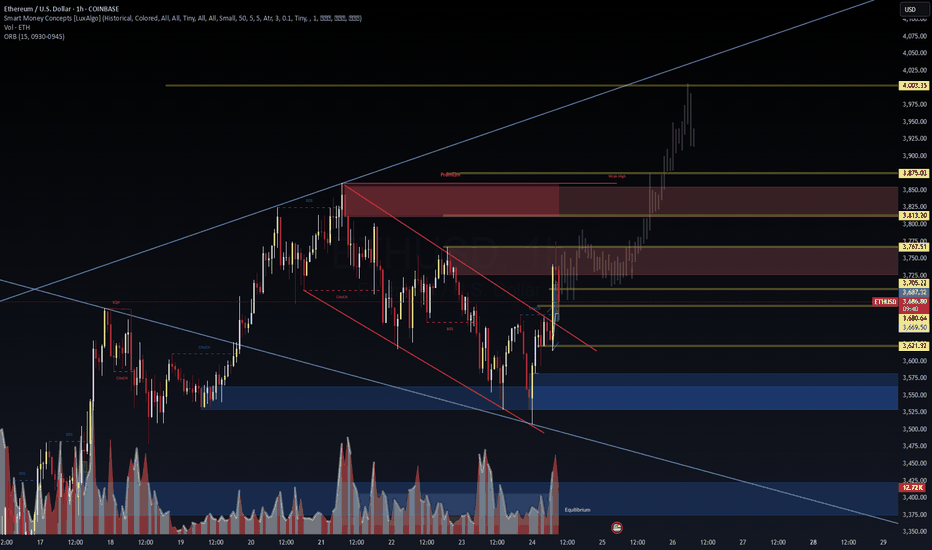

ETHUSD – Breakout Confirmation & Premium Targeting🚀 ETHUSD – Breakout Confirmation & Premium Targeting (VolanX Protocol)

ETHUSD has broken out of its descending channel with a clean BOS (Break of Structure) and aggressive volume spike from the 3,620–3,650 demand zone. This breakout suggests a shift in order flow, with liquidity now being targeted toward premium levels.

Key Observations (1H SMC):

BOS: Clear bullish structure shift above 3,669 and 3,705 levels.

Volume Surge: Buyers stepped in aggressively near the equilibrium zone.

Liquidity Pools: Weak highs around 3,767 and 3,813 are prime targets.

Premium Zone: Between 3,767 – 3,875, marked as the next magnet zone.

Ultimate Target: 4,003 key level if momentum sustains.

VolanX Playbook:

Long Bias:

Entry Zone: 3,669–3,705 (retest of BOS level)

Targets:

3,767 (first liquidity grab)

3,813–3,875 (premium zone)

4,003+ if breakout trend extends

Invalidation:

Close below 3,621 = bullish scenario voided, revert to discount pricing.

VolanX Signal:

This breakout suggests institutional order flow absorption and rotation toward high-value zones. Monitor retests for long entries and manage risk under 3,621.

#ETH #ETHUSD #VolanX #SMC #CryptoTrading #Liquidity #OrderFlow #PriceAction #TradingView #AlphaSignals

ETH 1H — Decision Point Ahead

ETH just confirmed a bullish RSI divergence, with price finding support at the 200MA.

MACD supports the move, and the trend structure is clean: MLR > SMA > BB Center.

Now, price is hovering at the 0.236 Fib level.

A few strong closes above it could open the door for more upside.

If rejected, we might revisit the 200MA for another test.

Either way — we’ll find out soon.

Always take profits and manage risk.

Interaction is welcome.

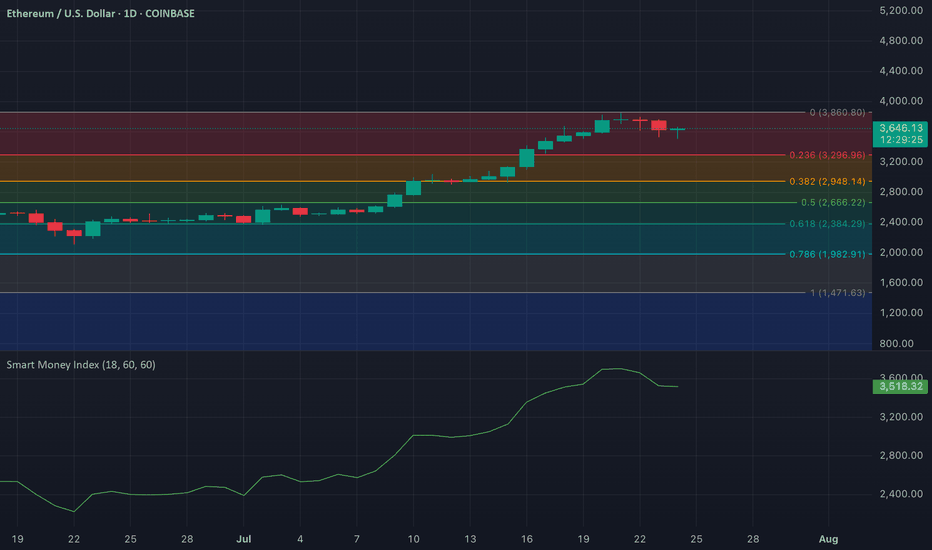

ETH/USD: Smart Money Index Signals Distribution Post-RallyOn the ETH/USD daily chart, a notable drop in the Smart Money Index (SMI) is confirming bearish sentiment among key market players. Since July 20, the SMI has declined by 7%, signaling increased selling activity from institutional investors and seasoned traders—often referred to as "smart money."

The SMI works by contrasting intraday trading behavior: it gauges retail-driven morning trades against institutional-dominated afternoon moves. A falling SMI, like the one seen on Ethereum, suggests that smart money is quietly exiting positions. In this case, it points to profit-taking after ETH’s recent price rally, reinforcing the idea that the current pullback may be more than just noise. Traders should monitor further declines in the SMI as a sign of continued distribution.