ETHUSD.PI trade ideas

ETH/USD Bearish Reversal Setup – Targeting $1,470 After ResistanPair: Ethereum / U.S. Dollar (ETH/USD)

Exchange: Coinbase

Timeframe: 15 minutes

Indicators:

EMA 30 (red line): ~1635.82

EMA 200 (blue line): ~1585.79

🟣 Key Levels & Zones

Resistance Zone (Purple Rectangle Top): Around $1,647 – previously tested and rejected.

Support Zone (Purple Rectangle Bottom): Around $1,470 – marked as the "EATARGET POINT".

Current Price: ~$1,645

📉 Bearish Breakdown Setup

Chart Pattern: There’s a potential double top or distribution zone forming near the resistance.

Projection: The price is expected to break below the smaller support zone and drop to the target zone around $1,470.67, representing an 11.13% drop.

Measured Move Tool: Indicates a bearish price target if the price breaks down from the current consolidation.

✅ Confluence

Price is currently hovering under resistance.

EMAs show short-term bullish momentum but could flatten if breakdown confirms.

Support near $1,635 is being tested – a break below could trigger the expected drop.

⚠️ Trading Implications

Short Setup: A trader might look to enter short around $1,647 if breakdown confirmation occurs.

Stop Loss: Just above the resistance zone (~$1,650+).

Take Profit: Near $1,470 zone.

$ETH update, are we at the bottom?We’re getting close.

If you’re still holding AMEX:ETH , you might just need a bit more patience — in a month, we could be heading back up.

Let’s break down the chart, because this is a fascinating setup:

1️⃣ Two similar patterns with three tops and three MACD resets.

2️⃣ AMEX:ETH is in a consolidation zone between $1950 and $1075, right where past rallies have started.

3️⃣ MACD on the weekly is near reset — a bullish reversal could kick in within 2 weeks and last 6+ months.

4️⃣ RSI is at the bottom, aligning perfectly with the MACD: this often signals a bounce.

📉 Yes, one last dip is possible — maybe $1150–$1250 — but I personally think AMEX:ETH will bounce above the previous low.

🚫 Don’t sell the bottom. Capitulating now could mean missing out on the reversal.

📅 Timeline? January was the time to exit. If you’re still in, just hold tight — things might look very different by May and beyond.

⚠️ Disclaimer: This is a chart-based analysis. Macro factors (👋 tariffs!) can shift everything, so stay alert and manage risk.

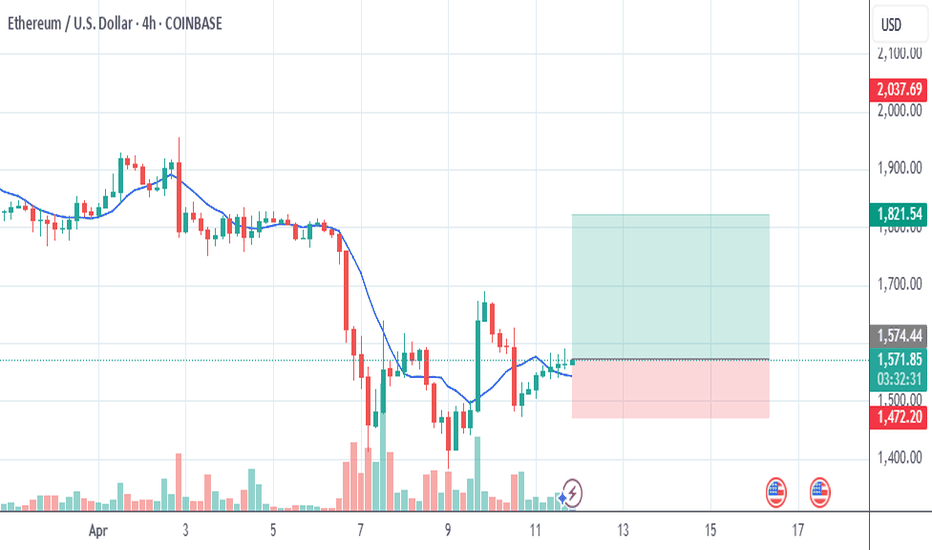

ETH) to U.S. Dollar (USD) A potential bullish reversal is indicaETH/USD (Ethereum vs. US Dollar)

4-hour chart, meaning each candle represents 4 hours of trading activity.

2. Key Chart Features

Support and Resistance Zones:

Resistance: A rectangular box near the $2,600 to $2,800 price zone. This area previously acted as a ceiling where price was rejected.

Support: A box near the $1,700–$1,750 region. Price has bounced off this area, suggesting a strong demand zone.

Fibonacci Circles:

These concentric circles are used to project potential support/resistance levels and timing based on Fibonacci ratios.

The price seems to be reacting near some of these circle lines, which are drawn from a major swing high to swing low.

Price Action:

There was a strong downward movement (highlighted in blue) followed by a consolidation.

A potential bullish reversal is indicated on the right, with a possible breakout to the upside shown by the green arrow and price projection box.

Risk/Reward Setup:

A long trade setup is illustrated:

Entry around $1,800

Stop loss near $1,417.5

Target around $2,100 or higher

This reflects a bullish outlook with an upward price trajectory.

3. Indicators and Tools Used

Fibonacci Retracement and Fibonacci Circles

Price Action Zones (Support/Resistance)

Projection arrows and rectangular zone for trade visualization

3k before august, is it real?Looking at history, ETH corrections of 65–75% have often been followed by sharp rallies. I believe we’re in a similar situation right now. With the upcoming Pectra upgrade on the horizon, there’s a strong chance we could see this pattern repeat.

At the same time, ETH is currently undervalued — not just against BTC, but also compared to many altcoins.

In my opinion, ETH is the most undervalued asset in the market right now.

Nice squeeze ETHWe're still in a negative trend from December, but as you can see the situation is becoming a squeeze, what happens often after this is, if the green indicator breaks this line, there is a good chance that the next consolidation will be around 2000

Normally when that happens, people react and buy because they think its going to continue, and this brings more liquidity to the market

its is what is called FOMO - fear of losing out, and it can affect the actual trajectory big time

causing it to continue its climb until no one has any more funds to put in

but looking at the previous years of Eth and whats been happening this year, its the lowest eth has been in three years at this time of year

its an indicator too that anyone who is actually interested in eth will get on board, because of these trend signs.

So what ever your ideas or choices, know that Eth has a very strong buying price point right now. It can't really get much better.

Bullish break or bearish breakTo me its bullish and quite tike the bears trying to find the way to reject it. If still in a buy becareful; be sure buy it at the right time..

So look if it breaks above 1,800 then it can go up to 2000 but it keeps the momentum to go higher then 3200 and lastly 4000. Baby steps; but if the rejects hits time after time and after time then possible will drop to 1250 or a little lower.

Lets see what happens

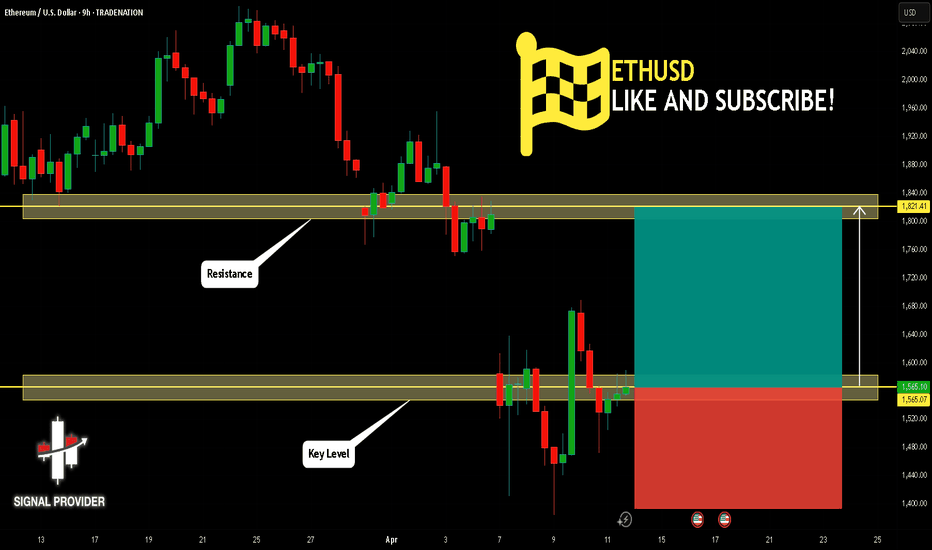

ETHUSD Will Go Higher! Buy!

Please, check our technical outlook for ETHUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1,565.07.

Considering the today's price action, probabilities will be high to see a movement to 1,821.41.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Ethereum - The Perfect Crypto Trade!Ethereum ( CRYPTO:ETHUSD ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

For the past four years, Ethereum has overall been trading sideways with significant swings towards the upside and downside. As we are speaking, Ethereum is retesting a significant confluence of support and if the bullrun actually continues, Ethereum will rally parabolically.

Levels to watch: $2.000, $4.000

Keep your long term vision,

Philip (BasicTrading)

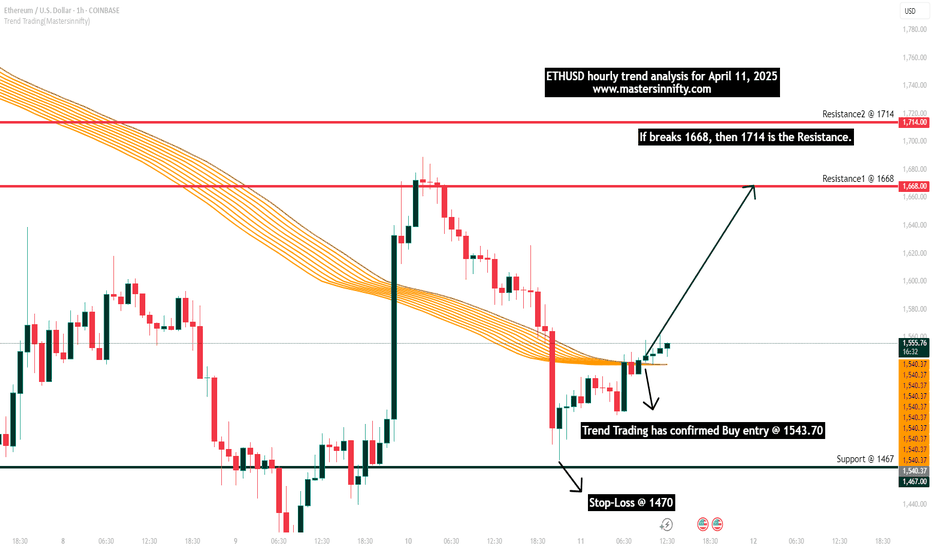

ETHUSD INTRADAY capped by resistance at 1,724 The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 1,724, which represents the current intraday swing high and the falling resistance trendline level.

In the short term, an oversold rally from current levels, followed by a bearish rejection at the 1,724 resistance, could lead to a downside move targeting support at 1,409, with further potential declines to 1,350 and 1,265 over a longer timeframe.

On the other hand, a confirmed breakout above the 1,724 resistance level and a daily close above that mark would invalidate the bearish outlook. This scenario could pave the way for a continuation of the rally, aiming to retest the 1,840 resistance, with a potential extension to 1,926 levels.

Conclusion:

Currently, the ETH/USD sentiment remains bearish, with the 1,724 level acting as a pivotal resistance. Traders should watch for either a bearish rejection at this level or a breakout and daily close above it to determine the next directional move. Caution is advised until the price action confirms a clear break or rejection.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Ethereum H4 | Pullback resistance at 50% Fibonacci retracementEthereum (ETH/USD) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 1,746.35 which is a pullback resistance that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 1,980.00 which is a level that sits above the 78.6% Fibonacci retracement and an overlap resistance.

Take profit is at 1,436.95 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.