ETHUSD previous resistance new support The ETHSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 3,667 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3,667 would confirm ongoing upside momentum, with potential targets at:

4,020 – initial resistance

4,105 – psychological and structural level

4,190 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3,667 would weaken the bullish outlook and suggest deeper downside risk toward:

3,584 – minor support

3,482 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the ETHUSD holds above 3,667. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ETHUSD trade ideas

Is Eth still in a downward channel?On 7/23 I wrote:

"Eth will hit my red T1 target, bounce to the top of the current range (green T1)

then drop..."

So far these 2 targets were hit and target 3 (bearish T2) was off by 1%

7/24 Bearish T1 hit

7/28 Bullish T1 hit

8/3 Eth drops toward Bearish T2 (within 1%)

8/7 (Today) I will soon determine if this is a fakeout and my lower target gets hit, or if the bearish scenario will get invalidated and I will enter the remainder of my positions upon confirmation. Either way trading the initial range proved to be a success and I have a strategy moving forward.

I keep these stats for myself to track my accuracy. I also used to track influencer's predictions (when I first started many years ago). I would write notes on my charts, documenting each influencers predicitons and see how often they were correct. If not how do we really know if we should be following them?

ETH/USD – Critical Reversal Zone?

### 🚀 ETH/USD – Critical Reversal Zone?

**🔍 ETH Futures Multi-Model Signal | Consensus: LONG | Confidence: 77%**

---

**🧠 Key Highlights (DS + OA Model Consensus):**

* **Price:** \$3,375 → Trading *below* EMA9/SMA20 = short-term bearish, but hitting strong **support zone**

* **Support:** \$3,248 (Bollinger Lower) & \$2,987 (SMA50)

* **Resistance:** \$3,487 (EMA21), \$3,620 (SMA20)

* **Volume:** -10.3% (5D) → Selling **weakening**

* **RSI:** 49.5 → Neutral but oversold on short-term

* **MACD:** Bearish crossover, but showing **divergence**

* **Volatility:** Bollinger width 9.18% = **Breakout Setup**

---

### 📈 Trade Setup – Conditional LONG

| Entry | Stop Loss | Target | R/R | Confidence |

| ------- | --------- | ------- | ------ | ---------- |

| \$3,375 | \$3,229 | \$3,690 | 1:3.24 | 77% ✅ |

🪙 **Trade Type:** Scale-in (50% @ \$3,375, 50% @ \$3,275)

📊 **Take Profits:**

* TP1: \$3,485 (EMA21)

* TP2: \$3,590 (SMA20)

* TP3: \$3,690 (Weekly VWAP Anchor)

---

### ⚠️ Risk Dashboard

* 🚨 BTC < \$58K → Setup invalid

* 📉 No Open Interest Data – monitor liquidation triggers

* 🧠 Max Position Risk: **1.25%** | Use hard stop-loss

* ⏰ Entry Timing: **London Open (8:00 GMT)**

---

### 💬 TL;DR

ETH is sitting in a **high-confluence reversal zone**. Weak sell volume, macro bullish trend, and volatility contraction signal a potential bounce. 📊 **Risk-defined long** setup favored by both models.

🧠 “Smart money doesn’t chase — it positions early.”

---

📌 **#ETH #CryptoTrading #ETHUSDT #Futures #BreakoutSetup #BollingerBands #MACD #RSI #DeFi #Ethereum #CryptoSignals #TradingView**

Ethereum (ETH/USD) Technical InsightsEthereum (ETH/USD) Technical Insights

**Chart Overview**

* **Current Price**: \~\$3,631

* **EMA 7 (Red Line)**: \$3,720.80

* **EMA 21 (Blue Line)**: \$3,522.96

* **Key Support Zone (Pink area)**: \~\$3,600–\$3,650

* **Support 1 (S1)**: \~\$2,950

* **Support 2 (S2)**: \~\$2,500

* **Uptrend Line**: Still intact, but under pressure

**Technical Insights**

* **Price Breakdown**: ETH has dropped below the **EMA 7**, and is now testing a **critical horizontal support zone** around **\$3,600–\$3,650**.

* **Trendline**: Still holds, but ETH is **hovering just above it**, signaling a potential bounce or breakdown.

* **EMA 21** near \$3,522 is the next short-term support if \$3,600 fails.

* **Momentum**: Recent candles show **strong selling**, indicating weakness, but no full breakdown yet.

**Bullish Scenario**

*Conditions**:

* Price **holds above** \$3,600–\$3,620 zone and the **trendline**

* **Bounce** with bullish daily candle from current zone or above \$3,650

**Buy Setup**:

* **Entry**: \$3,620–\$3,650 on confirmation

* **Stop-loss**: Below \$3,520 (just under EMA 21)

* **Targets**:

* TP1: \$3,720 (reclaim EMA 7)

* TP2: \$3,850–\$3,940

* TP3: \$4,100+

**Bearish Scenario**

**Conditions**:

* Price **breaks below** \$3,600 and **the trendline**

* EMA 21 is lost with strong bearish candle

**Sell Setup**:

* **Entry**: Below \$3,580 on breakdown

* **Stop-loss**: Above \$3,650

* **Targets**:

* TP1: \$3,520 (EMA 21)

* TP2: \$2,950 (S1)

* TP3: \$2,500 (S2)

**Bias: Neutral with Bearish Lean**

* **Decision Zone**: ETH is at a key inflection point

* Wait for **confirmation**: bounce or breakdown before entering

ETH PERPETUAL TRADE ,Short from $3490ETH PERPETUAL TRADE

SELL SETUP

Short from $3490

Currently $3490

Stoploss $3700

Targeting $3425 or Down

(Trading plan ETH go up to $3550

will add more shorts)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Its not a Financial advice

#ETH July Monthly Close: The Chart Everyone Should Watch#Ethereum just printed a very strong July candle.

We’re now flirting with the upper resistance of this multi-year triangle, and a monthly close above $3,800 would confirm the breakout.

That would unlock a measured move target > $8,000.

Momentum is already shifting, and the RSI broke out of its downtrend.

The setup is here.

Now let’s see the confirmation.

#crypto #trading #bitcoin

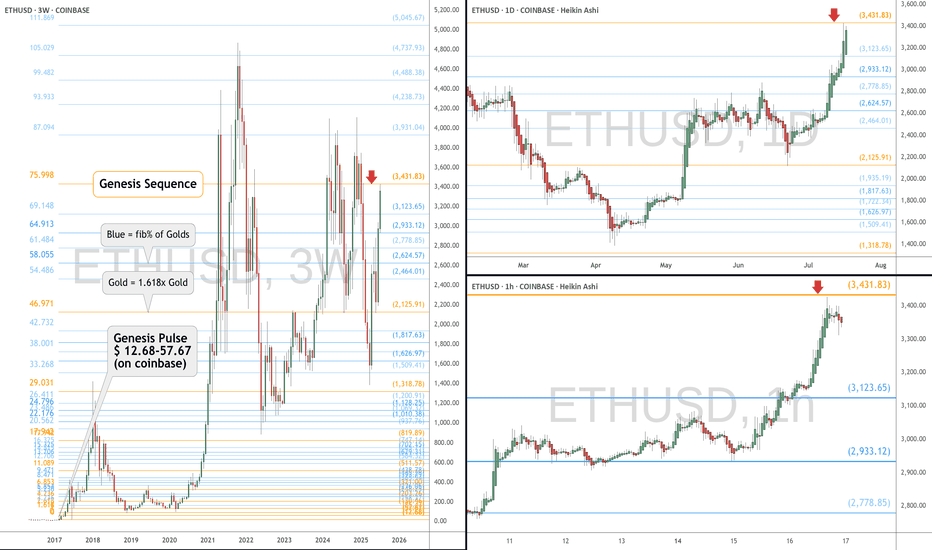

ETH eyes on $3431.83: Golden Genesis fib may END this SurgeETH finally got a surge after a long consolidation.

But has just hit a Golden Genesis fib at $3431.83

Like hitting a brick wall, it is now staggering back.

It is PROBABLE that we orbit this fib a few times.

It is POSSIBLE that we reject here to end the surge.

It is PLAUSIBLE that we Break-n-Retest to continue.

We were here at this EXACT spot 8 months ago:

=============================================

.

ETHEREUM ELLIOTT WAVE: BULLISH MEGAPHONE BREAKOUT TO $10K? ETHUSD Analysis | Daily Timeframe

Current Price: $3,866

Bias: BULLISH 🟢 CONFIRMED

Pattern: Elliott Wave 5 + Bullish Megaphone

Status: 🔥 MOMENTUM BUILDING 🔥

THE SETUP - BULLISH CONFIRMATION

Elliott Wave Count:

✅ Wave 1: Completed at $4,100 (March 2024)

✅ Wave 2: Corrected to $1,600 (August 2024)

🔄 Wave 3: IN PROGRESS → Target $6,000-$6,200

⏳ Wave 4: Expected pullback to $2,800-$3,200

🎯 Wave 5: ULTIMATE TARGET $10,000+

Bullish Megaphone Pattern:

Expanding triangle since June 2022 low

Key breakout level: $4,100-$4,200 (APPROACHING)

Pattern height: $2,50

Measuring objective: $6,600

🎯 UPDATED PRICE TARGETS

T1: $4,700 (+21.6% gain) - 95% probability

T2: $5,290 (+36.8% gain) - 95% probability

T3: $6,245 (+61.5% gain) - 83.5% probability

🥈 SECONDARY TARGETS

T4: $7,200 (+86.2% gain) - 68% probability

T5: $8,745 (+126.2% gain) - 53% probability

🏆 MOONSHOT TARGET

T6: $10,000+ (+158.7% gain) - 16.8% probability

⚠️ UPDATED RISK MANAGEMENT

🛡️ SUPPORT LEVELS (Bull Market Invalidation)

S1: $3,737 (-3.3% from current) - 1st warning

S2: $3,648 (-5.6% from current) - 2nd warning

S3: $3,546 (-8.3% from current) - 3rd warning

S4: $3,356 (-13.2% from current) - MAJOR SUPPORT

🔴 STOP LOSS OPTIONS

Conservative: Below $3,356 (-13.2% risk)

Aggressive: Below $3,546 (-8.3% risk)

Tight: Below $3,737 (-3.3% risk)

🔥 UPDATED ENTRY STRATEGY

🟢 CURRENT ENTRY (RECOMMENDED)

Entry: $3,866 (current levels)

Stop: $3,356

Risk: -13.2%

R:R to T3: 1:4.7 (Excellent!)

🟡 BREAKOUT ENTRY

Entry: Above $4,200 (confirmation)

Stop: $3,737

Risk: -11.0%

R:R to T3: 1:4.4

🔵 PULLBACK ENTRY (If Available )

Entry: $3,450-$3,555 range

Stop: $3,356

Risk: -2.7%

R:R to T3: 1:18+ (Exceptional!)

🧠 ELLIOTT WAVE PSYCHOLOGY - ACCELERATION PHASE

Current Phase: Early Wave 3 🚀

Status: Momentum building toward breakout

Psychology: Growing recognition

Volume: Should expand on breakout

Participation: Institutional interest increasing

What's Happening NOW:

📈 Price approaching key resistance

📊 Volume building

🌊 Wave 3 characteristics emerging

💰 Smart money accumulating

🎪 MEGAPHONE PATTERN - BREAKOUT IMMINENT

Current Status:

📐 Price at 94% of breakout level

🔊 Volatility expanding as expected

⚡ Breakout catalyst building

🎯 $6,600 target on deck

Breakout Levels:

Resistance: $4,100-$4,200 (6.1-8.6% away)

Volume: Need 2x average on breakout

Target: $6,600 minimum (+70.7% gain)

🎲 UPDATED $10K PROBABILITY ANALYSIS

📊 SCENARIO BREAKDOWN (From $3,866)

🟢 Optimistic (40% probability)

Gain Required: +158.7%

Timeframe: 6-18 months

Catalyst: Parabolic Wave 5 + Major news

🟡 Moderate (25% probability)

Gain Required: +158.7%

Timeframe: 1-2 years

Catalyst: Institutional adoption wave

🔴 Conservative (15% probability)

Gain Required: +158.7%

Timeframe: 2-3 years

Catalyst: Extended crypto bull market

📈 WEIGHTED AVERAGE: 24%

🎯 RISK-ADJUSTED: 16.8%

🔍 IMMEDIATE CATALYSTS TO WATCH

🟢 BULLISH MOMENTUM DRIVERS

✅ Price approaching breakout zone

✅ Elliott Wave 3 acceleration

✅ Institutional accumulation

✅ DeFi TVL growth

✅ Layer 2 adoption

⚠️ NEAR-TERM RISKS

🔴 Rejection at $4,100-$4,200

🔴 Bitcoin correlation breakdown

🔴 Macro headwinds

🔴 Profit-taking pressure

📅 UPDATED TIMELINE EXPECTATIONS

📍 Next 2-4 weeks: Test $4,100-$4,200 breakout

📍 Q4 2025: Rally to $6,000-$6,200 (if breakout)

📍 Q1 2026: Potential Wave 4 correction

📍 Q2-Q4 2026: Wave 5 extension → $10,000+ potential

💡 UPDATED TRADING PLAN

🎯 POSITION SIZING (From $3,866)

Core Position: 60% at current levels (PRIORITY)

Breakout Add: 25% above $4,200

Pullback Add: 15% on any dip to $3,450-$3,555

💰 PROFIT TAKING STRATEGY

20% at $4,700 (lock in +21.6%)

25% at $5,290 (secure +36.8%)

25% at $6,245 (major target +61.5%)

30% HODL for $10K+ (moonshot +158.7%)

⏰ TIME MANAGEMENT

Immediate: Watch for $4,200 breakout

Short-term: Reassess if below $3,737

Long-term: Major review if below $3,356

🚨 URGENT UPDATE SUMMARY

🔥 WHAT CHANGED:

Price up +5.2% to $3,866 (bullish confirmation)

Now only 6.1% from key breakout at $4,100

Risk/reward ratios improved significantly

Momentum building toward critical resistance

⚡ IMMEDIATE ACTION:

BUY SIGNAL ACTIVE at current levels

Stop loss: $3,356 (-13.2% risk)

First target: $4,700 (+21.6% gain)

R:R = 1:4.7 (Excellent setup!)

🎯 KEY LEVEL TO WATCH:

$4,100-$4,200 = Make or break zone

Break above = Explosive move to $6,600+

Rejection = Pullback to $3,450-$3,555

🔮 BOTTOM LINE - UPDATED

The Setup: Even stronger! Price action confirming Elliott Wave count with momentum building toward the critical $4,100-$4,200 breakout zone.

The Opportunity: Now at $3,866, we're positioned perfectly for the next leg up. Risk/reward of 1:4.7 to major target is exceptional.

The Risk: Manageable at -13.2% to major support at $3,356.

The Play: BUY NOW - This is the sweet spot before the breakout. Scale in aggressively at current levels.

📊 UPDATED CHART FOCUS

🎯 CURRENT PRICE: $3,866 (+5.2% momentum)

📈 IMMEDIATE TARGET: $4,200 breakout (+8.6%)

🚀 HIGH PROBABILITY: $6,245 (+61.5%)

🌙 MOONSHOT: $10,000+ (+158.7%)

🛡️ STOP LOSS: $3,356 (-13.2%)

⚡ PATTERN: Bullish Megaphone + Elliott Wave 3

🚨 TRADE ALERT: BUY SIGNAL ACTIVE 🚨

Entry: $3,866 (NOW)

Stop: $3,356

Target 1: $4,700

Target 2: $6,245

Moonshot: $10,000+

⚠️ DISCLAIMER: This analysis is for educational purposes only. Cryptocurrency trading involves substantial risk. Always do your own research and never risk more than you can afford to lose.

ETH (just a perspective): Potential Liquidity Grab Before DeeperPrice has engulfed the DP and is now pushing higher. Based on the current structure, it looks like ETH wants to hunt the liquidity resting above the $4,080 level.

After grabbing that liquidity, we might see a sharp reversal back down toward the MPL, which sits in the $2,100–$2,500 zone. This area is a strong demand zone and also where the most pain would be felt for late buyers, making it a key level to watch.

⚠️ This is not a prediction, just a perspective based on price behavior and structure.

Bullish potential detected for EthereumEntry conditions:

(i) higher share price for COINBASE:ETHUSD along with MACD crossover on the 4 hour chart at the low end of the scale with histogram crossover zero,

(ii) bounce off potential support zones of 15 min / 1 hour and 4 hour intraday timeframes, and

(iii) observation of market reaction at these support zones.

Stop loss for the trade would be below the ultimate support level from the open of 22nd January (i.e.: below $3327.56).

Ethereum Not Dead- i know some peoples think ETH will go to 250$ or 500$, so wait for it...

- I've always maintained that I'm not a fan of ETH because of its scalability limitations and centralization, for that reason ETH needs some messy L1...L2...etc..

- That said, my opinion doesn’t matter much, ETH is here to stay. The Ethereum ecosystem hosts thousands of projects; I’d say it’s too big to fail.

- i used Bitstamp exchange to look further back in the chart's history.

- i simplified this monthly chart so much that even a 10 year old kid could understand it, just check the RSI low levels and compare it with previous years. Again, check the max RSI level for the previous ATHs.

- i won't discuss where to buy because, whether you get ETH at $1,800 or $1,500, the bull run for ETH and Altcoins hasn't started yet.

Happy Tr4Ding !

ETH is knocking like Walter White on that $4K levelOnce we break past this point, there’s little to no resistance-we should all be expecting an all-time high. Altcoins are going to melt people’s faces off when we break past $4K. With rate cuts anticipated, don’t miss out on this move.

ETH is holding extremely strong right now in relation to BTC, while other altcoins are still seeking their lows for this cycle. With rate cuts expected in September, ETF flows, and growing institutional interest, I believe ETH will have a crazy rally.

Once we break past this resistance from the trendline dating back to the 2021 high and close above $4K, I think we’ll start to see ETH blow past Bitcoin-and altcoins will follow.

I still believe ETH will outperform others for now, but once we get those rate cuts, I feel the bleeding will stop-and by then, the ship will have sailed.

ETHUSD Is Going Up! Buy!

Here is our detailed technical review for ETHUSD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 3,601.00.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 3,751.96 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

ETH Derivatives Indicate Bearish Sentiment

A closer look at Ethereum's derivatives landscape reveals growing caution in the market. The 25-delta risk reversals on ETH options for August and September are trading between -2% and -7%, signaling a rising demand for downside protection. In comparison, BTC's risk reversals sit at a milder -1% to -2.5%.

Futures data adds to the picture: ETH open interest is at $47.5B, but key exchanges like Bitget and Hyperliquid show significant drops in long/short ratios (-9.08% and -9.35%). Meanwhile, Binance maintains a relatively low long/short ratio at 0.39, reflecting increasing short interest.

Despite ETH’s impressive 48% rally in July, recent price action has weakened, down 6% in 24h. This divergence between spot price behavior and derivatives sentiment may point to an upcoming correction.

⚠️ Worth watching closely: A break below $3,500 could trigger a sharper unwind of bullish positioning.

Eth - The descent confirmed. Next target is lower.Recap

-------

On my July 23rd chart I wrote:

"In a bull market the average retrace is between .2 -.4 Fib from the bottom of that run.

Several factors of confluence lead me to believe Eth will hit my red T1 target, bounce to the top of current range (green T1) then drop to a minimum of .35 Fib = $2990".

On July 28th I wrote:

"As anticipated, my bearish T1 target (red) was hit soon after I first posted this chart on July 23rd 2025.

As the arrow indicated, Eth would bounce from my bearish T1 (red) to my bullish T1 (green). This has been confirmed in both price and in the timeframe indicated by my boxes.

There was also a downward arrow from my green T1 pointing towards my bearish T2 (red). Eth is already retracing from my top target, and I belive it will now continue down the red channel towards T2 and possibly T3 (between $2990 - $3200)".

On July 29th on the chart titled "Has Eth begun it's descent?", I wrote:

"On July 23rd, I anticipated that Eth would dump once it took out the range high.

Now that we have witnessed that, along with a bearish retest (as indicated on chart),

I believe the descent has begun. I hope I'm wrong.

But if I'm right, it will provide me with an amazing entry point around $2900-3200"

Aug 2nd:

Eth has crashed 15%. The descent has begun.

ETHUSDT BUYING SETUP !Ethereum (ETHUSDT) is showing a bullish setup as price holds above key support. The market is indicating buyer interest, and a push upward could be expected if momentum continues.

Look for confirmation like bullish candlesticks or a breakout from consolidation before entering. This setup offers a good risk-to-reward opportunity for buyers.

Stay focused, trade with confirmation, and manage your risk properly! 📈🔥

ETH/USD Analysis – Smart Money Breakdown ETH/USD Analysis – Smart Money Breakdown & Rejection from Premium Zone

🔍 Key Breakdown:

✅ BOS (Break of Structure): The initial BOS on July 15 signaled a strong bullish shift in market structure, triggering a sustained upside rally.

💪 Strong Bullish Rebound: After the BOS, ETH experienced impulsive buying, confirming institutional order flow and liquidity injection.

🔺 Resistance Zone (Premium Area): The price formed a clear TOP at the resistance (near $3,950–$4,000), a common zone where smart money distributes positions.

📉 Reaction from Resistance: As ETH tapped into the resistance, price sharply rejected — a potential mitigation move or distribution phase.

⚠️ Current Price Structure: After the correction, ETH is retracing back into the resistance zone. The projected arrow indicates a possible lower high formation, followed by a continuation to the support zone ($3,300–$3,400).

🧠 Educational Takeaways:

Structure Is King: Market structure (HHs, HLs, BOS) is the foundation of SMC-based trading.

Premium vs. Discount Zones: Smart money sells in premium (resistance) and buys in discount (support).

Liquidity Reversal: Tops often trap late buyers before a reversal — watch for liquidity grabs at key zones.

Wait for Confirmation: Always wait for confirmation (candlestick or structure shift) before entering trades.

🎯 Potential Scenarios:

✅ Bearish Case: ETH forms a lower high and drops to support (~$3,350).

❌ Invalidation: Clean breakout and hold above $4,000 could open doors for further bullish continuation.