4000$ is last resistance left Ready for breakout and pump?market is still bullish and i am looking for breakout here to the upside for sure But we should consider this factor that major resistance now is touching and we may have first short-term fall.

so for now we may have correction and dump to the targets like 3300$ which is first support of 0.23 Fibonacci level.

and after this healthy correction or without it we can expect more pump and breakout of 4K$ and heavy pump to the targets like 7K$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

ETHUSDT trade ideas

ETH at Critical Resistance + Liquidation Zone | Time to Short?Today I want to analyze Ethereum ( BINANCE:ETHUSDT ) on the 1-hour time frame . Is there a short position opportunity?

Please stay with me.

Ethereum is currently trading near a Heavy Resistance zone($4,390-$3,950) , Cumulative Short Liquidation Leverage($3,983-$3,878) and the $4,000 ( round number ). $4,000 could be a psychological number to sell .

In terms of Elliott Wave theory , Ethereum appears to have completed the main wave 3 at $3,860 and is currently completing the main wave 4 . The main wave 4 could have a Double Three Correction(WXY) or Expanding Flat(ABC/3-3-5) , with the Expanding Flat structure being more likely .

One of the reasons why shorting Ethereum could be better than shorting Bitcoin right now is that ETHBTC ( BINANCE:ETHBTC ) is currently trading above the ascending channel and is likely to correct to Fibonacci levels .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Ethereum to drop to at least the Potential Reversal Zone(PRZ) and attack the Support lines ( Second target ) .

Cumulative Long Liquidation Leverage: $3,591-$3,543

CME Gap: $3,461-$3,417

Note: Stop Loss: $4,023

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Lingrid | ETHUSDT Short-Term Move: Buying Opportunity at SupportThe price perfectly fulfilled my last idea . BINANCE:ETHUSDT is attempting a bounce after dipping into the lower boundary of its channel near the $3,400 support level. Price action has followed a descending structure with lower highs inside a broad downward channel. As long as the $3,400 zone holds, a rebound toward the mid-range resistance at $3,630 remains viable. Current positioning inside the "BUYING area" suggests momentum may flip bullish if a reversal structure forms.

📉 Key Levels

Buy trigger: Break above $3,630

Buy zone: $3,250 – $3,400

Target: $3,630 – $3,720

Invalidation: Break below $3,250

💡 Risks

Momentum still favors sellers from the recent sell-off

Failure to reclaim mid-range resistance could cap upside

Broader trend remains within a bearish channel structure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

#ETHUSDT: Price is going as expected in previous ideas on eth!!ETHUSDT is performing well as expected in our previous analysis, as the price has reached the $4000 area. There are two potential areas where the price could reverse. The first is a small correction, which could cause a sharp price reversal without a significant price correction. The second area is a void price, which may be filled before any further strong bullish movement.

Please use strict risk management while trading.

Team Setupsfx_

Ethereum: Bullish Momentum Recharging for the Next Leg UpEthereum: Bullish Momentum Recharging for the Next Leg Up

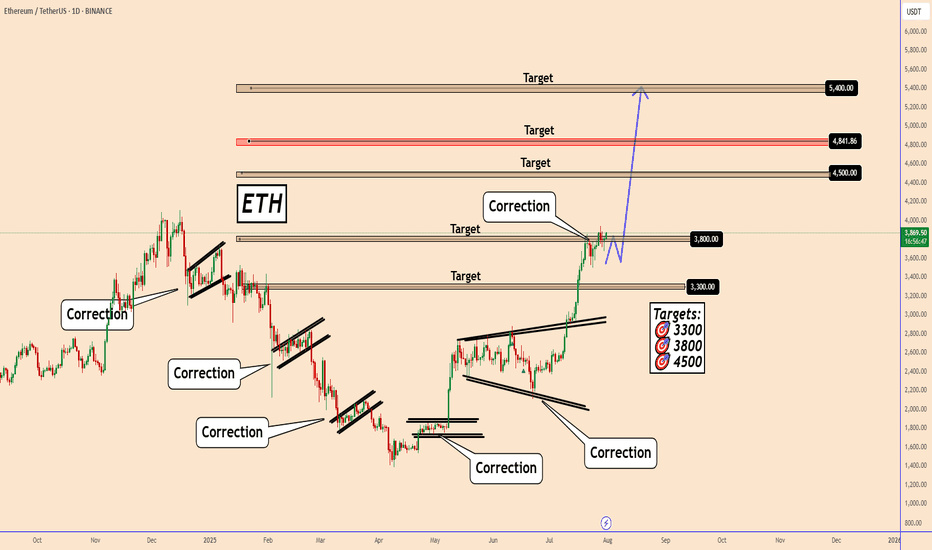

Daily Perspective on ETH Ethereum remains in a clear bullish trend on the daily chart. The long and consistent green waves reflect strong upward momentum over the past several days and weeks.

Looking left on the chart, ETH previously made several corrective moves during bearish phases. The current correction looks similar to those on the left side of the chart, but this time it is taking place within an uptrend.

The price is currently in a consolidation phase, likely preparing for another push higher. I’m watching three key upside targets: 4500, 4840, and 5400.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Take profit is more important than a stop lossAre you actually in profit, or just delaying your next loss?

How many times have you watched your gains vanish because you wanted more?

Maybe it's time to stop fearing losses and start planning exits.

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

💸 Why Most Traders Lose Profits They Already Had

Most traders obsess over stop losses but never define where they'll take profits. Imagine entering a great trade, watching the price go up, then suddenly it pulls back and you're out with nothing. That happens because you didn’t define your win.

A well-placed take profit acts like a contract with your future self. It secures your gain before the market decides otherwise.

📉 No Take Profit? Say Hello to Unnecessary Losses

Failing to set a take profit is basically handing the market a free ticket to reverse your gains. Especially in the highly volatile crypto space, a missed exit often turns into a regretful stop out. So while everyone is talking about stop losses, you should focus on where the money is actually made.

🧮 A Clear Profit Target Creates a Clear Mind

Having a defined profit target gives your mind a place to rest. It brings structure and removes hesitation. This peace of mind is something new traders lack, which often leads them to close early or hold too long.

🧠 Greed Is the Real Enemy of Your Gains

Greed whispers "Wait, it might go higher"

But when you don't have a take profit plan, that whisper becomes your worst advisor. Pro traders map their exits before entering, while amateurs dream of riding forever.

🛡 True Capital Protection Begins with Profit Protection

If you're aiming for safe capital in crypto, it's not just about minimizing losses. It's about securing wins. Beginners often build their whole plan around stop loss. But advanced traders fear losing profits more than they fear taking a hit.

🎯 Take Profit Is Your Emergency Exit Plan

Setting a profit target is like having an escape route during a fire. Without it, you’ll panic when things turn. Crypto markets are full of pump traps. Your profit is only real when you actually take it.

🚪 Exit Strategy Matters More Than Entry

Everyone talks about entries, but it's your exit that defines whether your trade ends in green or red. Many traders nail the perfect entry but without a clear exit plan, they hand back their profits. Prioritizing your take profit is not optional. It’s essential.

🔁 Managing Gains Is Managing Emotions

Without a defined exit, every candle can shake your decision-making. But when your take profit is set in advance, emotions can’t hijack your strategy. You’re following a plan, not a feeling.

📊 TradingView Tools to Manage Take Profits Effectively

In the world of trading, the right tool means the right decision. TradingView offers powerful tools that help you manage not just your stop loss but more importantly, your take profit targets. With tools like Price Range and Long/Short Position, you can easily visualize where you entered and where you need to exit before greed pulls you deeper.

The Fibonacci Extension tool is especially valuable during bullish runs. It allows you to map out realistic and strategic profit levels like TP1, TP2, and TP3. These targets can then be paired with horizontal lines or alerts within TradingView’s chart system.

Even if you're using a free TradingView account, a simple custom Pine Script can help set alerts when your percentage targets are hit so you can scale out or lock in profits instead of emotionally reacting to price movement.

Using these tools practically empowers traders to build real-world strategies and take control of their exits, not just their entries. That’s the real edge.

📌 Final Takeaway

A clear, well-placed take profit protects both your money and your mind. Don’t let your wins dissolve into losses. With the right tools and the right mindset, you don’t just survive the market, you beat it. Start managing your profits today, not just your losses.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

Ethereum (ETH/USDT) – Bearish Channel Structure Developing

⸻

🔍 Technical Overview

Ethereum has broken down from its ascending channel, invalidating the earlier bullish projection toward $4,000. After failing to hold the channel midline around $3,577, price dropped sharply to $3,360, forming a new bearish descending channel.

Currently, ETH is trading near the midline of this bearish channel, which typically acts as a decision point — not a buying zone — in smart money models.

⸻

🧠 NEoWave Interpretation

We may be inside a Complex Corrective Wave, possibly a Running or Contracting Flat evolving after the March top. The current structure resembles a B-wave trap, where price fakes out the upside before shifting momentum sharply downward. The break below the ascending channel midline confirms this bearish shift.

⸻

📊 Smart Money Summary

• 🟥 BOS confirmed on 1H and 4H (lower highs and lower lows)

• 🔻 Midline failure acted as a smart money trap, followed by a liquidity sweep below $3,490

• 📦 Bullish Order Block around $3,490–$3,520 has been tapped, prompting a minor reaction

• 🟡 Current resistance sits near the channel top ~ $3,715

⸻

🎯 Trade Scenarios

📌 Bearish Continuation:

If price fails to reclaim above $3,715, a retest and rejection from the channel top could trigger continuation toward $3,300–$3,250.

📌 Bullish Reversal (less likely for now):

Only a clean break and hold above $3,720 would suggest that bulls are regaining control, opening path toward $3,900–$4,000 — though this scenario is weakened after structural damage.

⸻

⚠️ Trader Tip:

Avoid buying into midline reactions in weak channels. Better long setups form after stop-hunts, ideally near bullish OBs + internal BOS confirmations.

⸻

✅ Conclusion

Ethereum remains under bearish pressure after losing its ascending structure. Unless price reclaims the $3,715 resistance zone with momentum, downside continuation remains likely.

⸻

📌 Save this analysis

💬 Share your thoughts or alt wave counts in the comments.

ETH | Ethereum - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Traders are currently anticipating a potential 0.25% rate cut at the September FOMC meeting, which continues to support the broader bullish outlook.

While the market pulled back following weaker-than-expected Non-Farm Payroll data, overall sentiment remains optimistic.

Greed has cooled off into a more neutral stance. Historically, August often brings some consolidation or pullbacks — but the structural bias for crypto market remains bullish.

🧾 Weekly Recap:

ETH started the retracement movement after building a bullish trend over the past couple of weeks.

It’s mainly being affected by Bitcoin's bearishness, so we’re closely following BTC’s price action.

ETH has tapped into the Weekly Fair Value Gap, which is a key level for me.

We may see a bounce from here.

📌 Technical Outlook & Game Plan:

I expect to see another low on ETH before we go up — as I’m also anticipating one more leg down on Bitcoin.

So I’ll wait for a final bearish expansion and a trap for late sellers before positioning for longs.

After that, I want to see price closing above the purple line at $3500.

🎯 Setup Trigger:

A candle close above the $3500 level will be my signal to look for long setups.

📋 Trade Management:

Stoploss: Below the swing low that breaks above $3500

Take Profit: Targeting $3870, but will trail and lock in aggressively in case of deeper downside expansion.

💬 Like, follow, and comment if this breakdown supports your trading! More setups and market insights coming soon — stay connected!

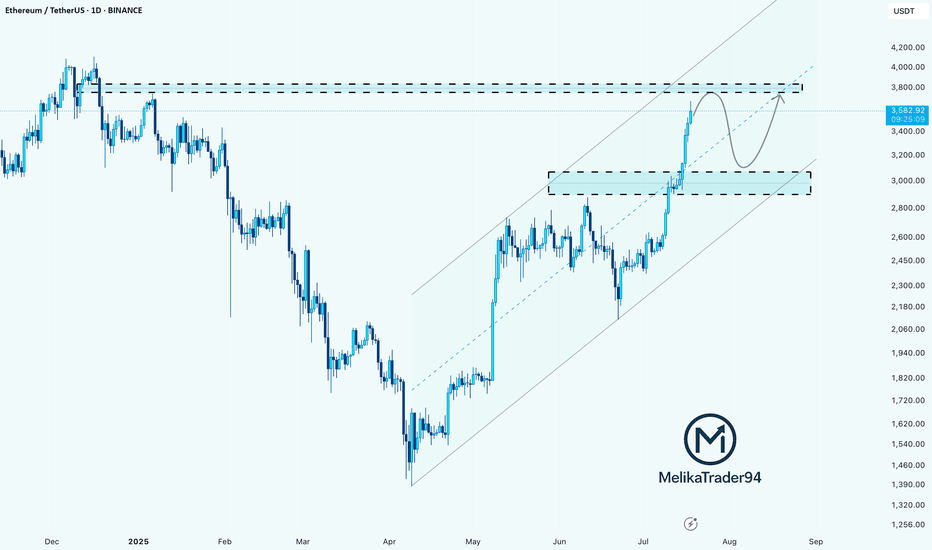

ETH Approaching Major Resistance – Expecting Pullback Hello guys!

Ethereum has been rallying strongly within a well-respected ascending channel, pushing past key levels and now approaching a major resistance zone around $3,900–$4,000.

According to the chart structure, it looks like price could soon react from this resistance, leading to a pullback into the $3,000–$3,200 demand zone, which aligns with the midline of the channel.

This would be a healthy correction before potentially continuing the bullish trend and attempting a clean breakout toward new highs.

ETH is still bullish, but it may need to retest support before continuation.

Watch for a bounce from the $3,000–$3,200 zone for a high-probability long opportunity.

Ethereum Above $4,000 Bullish Signal RevealsNo major drops and low volatility is a major bullish signal. Ether is bullish now with all sellers gone. Look at the down wave from December 2024 and see what three days red would do to Ethereum's price. Today we are on the third red day and ETH is hardly a few dollars below the most recent peak. A signal of strength. This strength also means that we are likely to see a continuation of the bullish move soon, Ether will continue growing.

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Everything seems calm now, a small pause... Sell at resistance, buy at support; right?

Well, not always. It depends on the context.

Here we have a rising trend and Ethereum has been advancing nicely. Now we reach resistance, is this the time to go SHORT? It is possible to SHORT at resistance and do good but here we have a very clear uptrend. When ETHUSDT peaked 28-July there wasn't much selling. This is telling us that the bullish move is not over, not complete.

Ethereum will produce additional growth. Seeing this, it would be unwise to sell SHORT. If prices drop, it is better to wait for support and go LONG. Trade with the trend, it reduces risk and increases your chances for success.

Namaste.

The bull market here will continue if the price break 4K$ As we can see on chart two major resistances which are reason of killing BINANCE:ETHUSDT each time are the red trendline and also the 4K$ resistance zone and soon i believe ETH now has the power to break this resistances and start new high volume pump the targets like 5000$ and new ATH.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Possibility of Ethereum moving toward the \$3,330 price range.Considering the breakout of the 4-hour channel and confirmation of the downtrend, reaching the \$3,330 level is not out of the question.

This target was derived using a pattern-based projection from the channel breakout.

I’ve personally taken this position, but I’m not recommending it — just sharing for informational purposes.

Important Trend Determination Area: 3708.87-3762.33

Hello, traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(ETHUSDT 1D Chart)

The price began to rise after breaking above the important 2419.83-2706.15 area.

This can be interpreted as the beginning of a step-up trend, with an upward breakout of the HA-High ~ DOM(60) range.

The HA-High ~ DOM(60) range corresponds to the 2581.59-2681.60 range.

This suggests that the price is currently testing whether a second step-up trend will continue or whether it will simply end as the first step-up trend.

The HA-High ~ DOM(60) range is currently 3708.87-3762.33.

Therefore, if the price rises above 3708.87-3762.33 and maintains this level through the upcoming volatility period, a second step-up trend is expected.

The conditions for this are as follows:

- The K value of the StochRSI indicator must rise from the oversold zone and show an upward trend with K > D. - The OBV indicator must rise above the High Line and maintain an upward trend.

- The TC (Trend Check) indicator must continue its upward trend. (If possible, it's best to stay above 0.)

The next volatility period for ETH is expected to last from around August 6th to 10th.

However, it's worth keeping an eye on the movements during the BTC volatility period.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

ETH Looks Bearish (3D)Ethereum approached the weekly trendline and experienced a correction. It seems likely that we may see one more push upward to create a false bullish sentiment on this coin. There is even a possibility of a fake breakout above the descending trendline. However, before any major move, a significant correction toward the green zone appears likely | after which the main bullish move is expected to occur.

On higher timeframes, this is currently our outlook on Ethereum.

A daily candle closing above or below the invalidation levels would negate the current buy or sell bias.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ETH/USDT | ETH Under Pressure – Watch $3500 Support!By analyzing the Ethereum chart on the weekly timeframe, we can see that after reaching the $3940 zone, ETH faced selling pressure and is now trading around $3540. If the price fails to hold the key $3500 support, a deeper decline is likely, with potential targets at $3040 first and possibly $2680 as the second bearish target.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ETHUSD Long to 3700 BITSTAMP:ETHUSD Long trade, with my back testing of this strategy, ETHUSD need to touch 3700

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Ethereum Market Flush, Retrace & Support ZoneEthereum is now on its third consecutive red day and bearish action is fully confirmed. The market is preparing for a strong drop.

As I've been mentioning, this move looked up from a broader perspective is part of a small correction for the last major advance. Ethereum moved up from $2,500 to almost $4,000. Now we get a retrace that ends in a higher low followed by additional growth.

The retrace is now confirmed as Ether needs to test EMA55 and EMA89 as support. If these levels hold, you can count on a reversal right away. If these levels are compromised strongly, then prices can linger lower before a recovery shows up. It should be fast and strong. It should all happen within a few days, the crash and bottom, and the reversal a long-term process; sustained long-term growth, the market will be removing some of the weak hands.

We are going to be experiencing a bull run, are you sure you want to stay?

Protect your positions at all cost. We've seen nothing yet. $8,000 or more by the end of the bull run phase.

Namaste.

Ethereum at a Critical Crossroad: Will $4,000 Finally Break ?Ethereum is once again approaching the psychologically significant $4,000 resistance level, a high-timeframe barrier that has rejected price on multiple occasions. As the second-largest cryptocurrency by market cap pushes higher, traders are closely watching for signs of a breakout—or another range-bound rejection.

Ethereum has entered a decisive phase, with price action now testing the upper boundary of a long-standing trading range. After multiple failed attempts to breach the $4,000 mark, ETH is consolidating just below this level, creating an environment filled with both opportunity and risk. Whether Ethereum can break through or gets rejected again will shape its mid- to long-term outlook.

Key Technical Points:

- Major Resistance at $4,000: A psychologically important level and long-time price cap on high timeframes

- Defined Trading Range: ETH has remained range-bound between $1,300 and $4,000 for an extended period

- Critical Candle Closes Needed: Breakout requires strong daily or weekly closes above $4,000 to confirm

Ethereum’s price is hovering just under the $4,000 resistance zone, which has acted as a ceiling for price action since early 2022. From a high time frame perspective, ETH has been range-bound, trading between $1,300 as the range low and $4,000 as the range high. Each visit to this upper boundary has led to a rejection and a subsequent rotation back toward mid-range or lower levels.

Now, with momentum building and bullish sentiment returning across the crypto market, Ethereum finds itself at another pivotal moment. The key technical requirement for a confirmed breakout will be a decisive daily or weekly close above the $4,000 level. Without this confirmation, any temporary push above the resistance could result in a fakeout and trap late long entries.

Volume behavior around this zone remains mixed. While there is some bullish buildup in recent sessions, there has not yet been a significant influx in volume to confirm conviction from buyers. This aligns with the historical pattern of Ethereum trading at resistance before eventually pulling back, suggesting caution is still warranted.

However, should ETH close decisively above $4,000 and turn this level into support, it would mark the first major break of this range since its inception. This would likely trigger a wave of bullish momentum, possibly sending Ethereum to new yearly highs, with $4,500–$5,000 being the next logical resistance zones based on historical price pivots and Fibonacci extensions.

What to Expect in the Coming Price Action

Ethereum’s price action is currently neutral-bullish but hinges entirely on its interaction with the $4,000 resistance. A confirmed breakout could usher in a powerful rally toward new highs, while another rejection would likely continue the long-standing range between $1,300 and $4,000. Until a decisive move occurs, traders should remain cautious and reactive rather than overly anticipatory.

Ethereum Quick Outlook – Potential Trap Before Drop?ETH is moving within a rising channel, but momentum is fading. Price failed to break above the midline and is now testing lower support.

A fakeout to the upside toward the $4,015–$4,050 supply zone is possible before a deeper drop. The projected path suggests a short-term bounce, final liquidity sweep, then potential reversal.

🟡 Key Resistance: $4,015

🔻 Breakdown trigger: Below $3,620

🎯 Bearish Targets: $3,250 → $3,100

Structure hints at a possible Ending Diagonal (Neowave), or a Trap-Wave E inside a Complex Correction.

⚠️ Watch for manipulation near highs – confirmation needed for short entry.

Ethereum Analysis – July 30, 2025📊 Ethereum Analysis – July 30, 2025

Ethereum is currently testing a key descending trendline (blue line).

If the price breaks above this resistance and confirms with strong candlestick closures, there's a high probability that ETH will rally toward the ascending red trendline, acting as the next dynamic resistance.

🚀 A confirmed breakout could trigger a bullish continuation, opening the door for higher targets in the short term.

However, failure to hold above this level may result in a pullback or range-bound movement.

📌 Keep both the blue and red trendlines on your chart — they’re currently the most critical zones to watch for potential entries or exits.

ETHEREUM ETHUSDTTHE structure and strategy will never lie. Watch demand and supply roof .

from the top layers ,we have seen the 3touch supply roof sending Ethereum tanking again expect the retest of the broken supply from the bottom to provide buy opportunity

trading is 100% probability, please lower your expectations and know that any key level can fail.

#ethusdt #ethereum #bitcoin #btc #crypto