ETH - Altseason ??ETH has rallied sharply and is now entering the major resistance zone between $3,725 and $4,081, which has repeatedly acted as a local top during previous cycles.

This red zone represents a high-supply area, and historically ETH has struggled to break and hold above it without a significant catalyst.

Rejection here could lead to a pullback toward the $2,300–$2,000 range.

A clean breakout and weekly close above $4,081 would flip this resistance into support and open the path toward the all-time high (ATH) at $4,868.

If ETH reclaims this red zone and flips it to support, it will act as a major trigger for a broad Altseason.

Historically, such ETH strength is a key confirmation that capital is rotating from BTC into the altcoin market.

Currently, momentum is favoring bulls unless this red supply zone causes a strong rejection.

ETHUSDT trade ideas

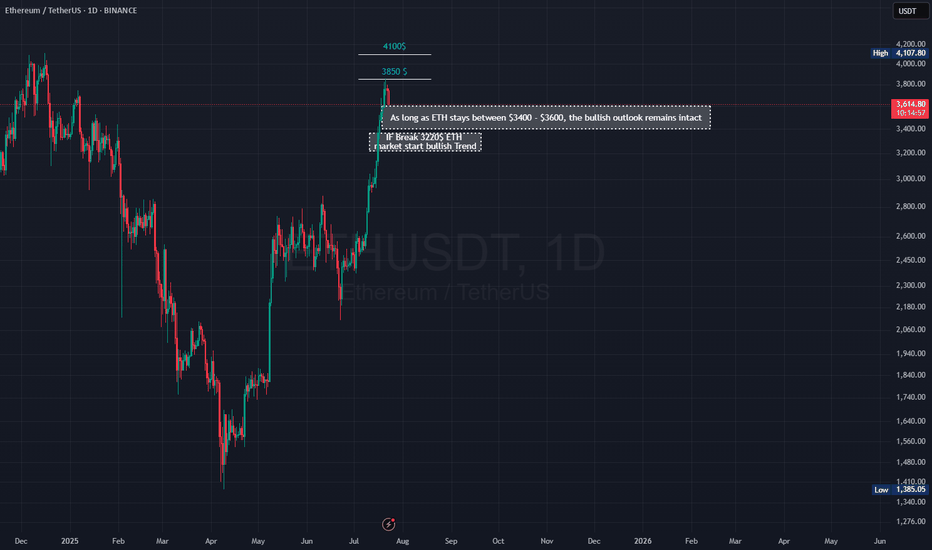

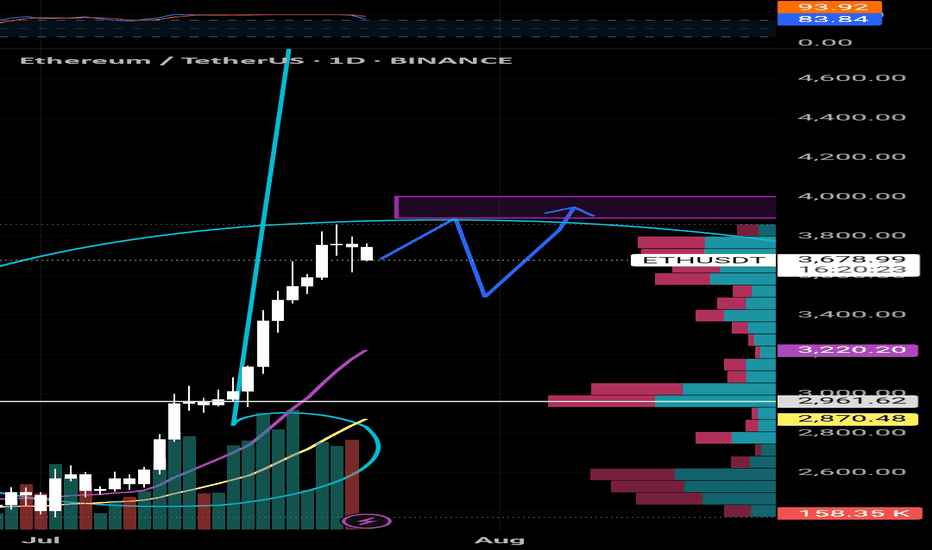

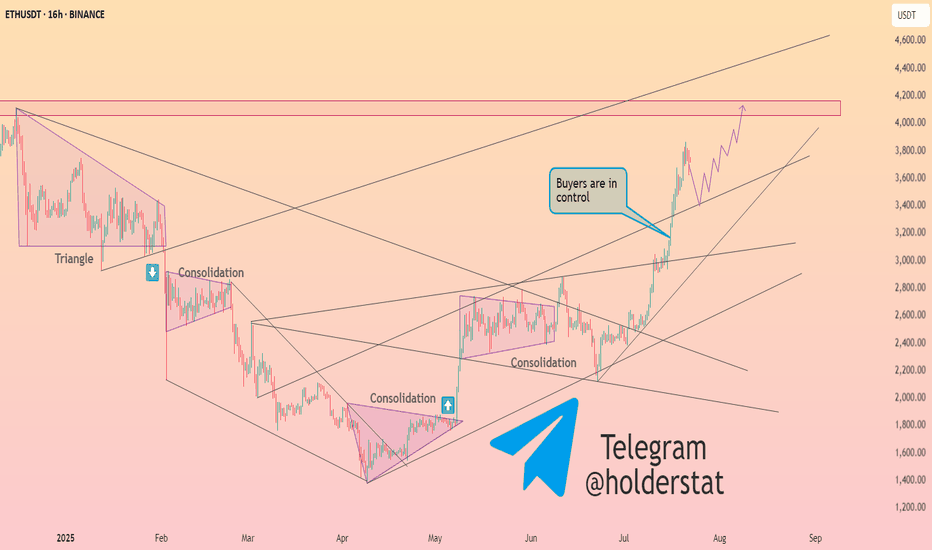

Ethereum Ready for Breakout Above $3850?📊 Ethereum Quick Analysis | Breakout or Breakdown?

✅ As long as ETH stays between $3400 - $3600, the bullish outlook remains intact.

🚨 A confirmed close below $3200 could mark the end of the bull market.

🚀 A clean, shadowless candle close above $3850 may push price toward $4100.

⚠️ However:

📉 Expect retail sell-offs around those highs

💸 But heavy institutional buying could send ETH to $6230 in the short term.

🔥 Altseason is officially here — get ready for explosive moves!

🎯 I'm here to track and update all major targets in real-time 💥

#BullRun#altseason#ETH

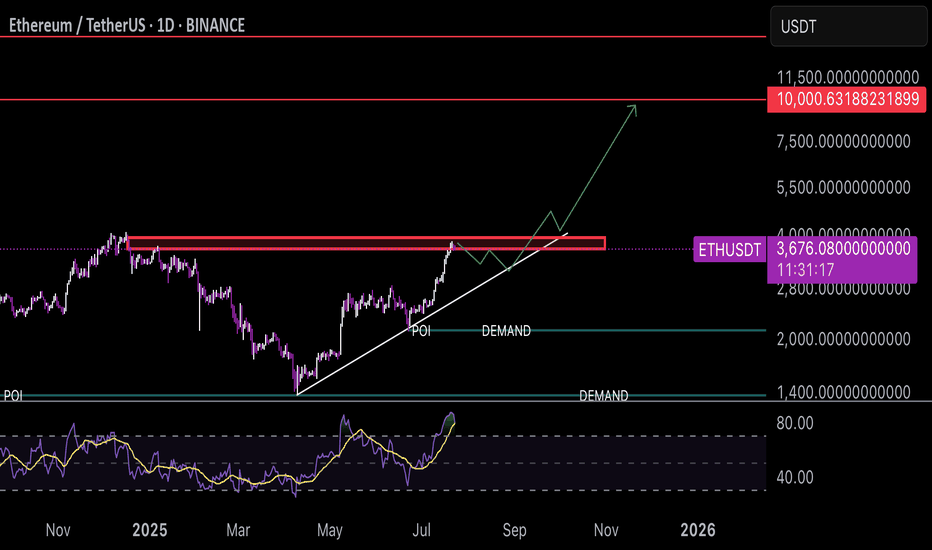

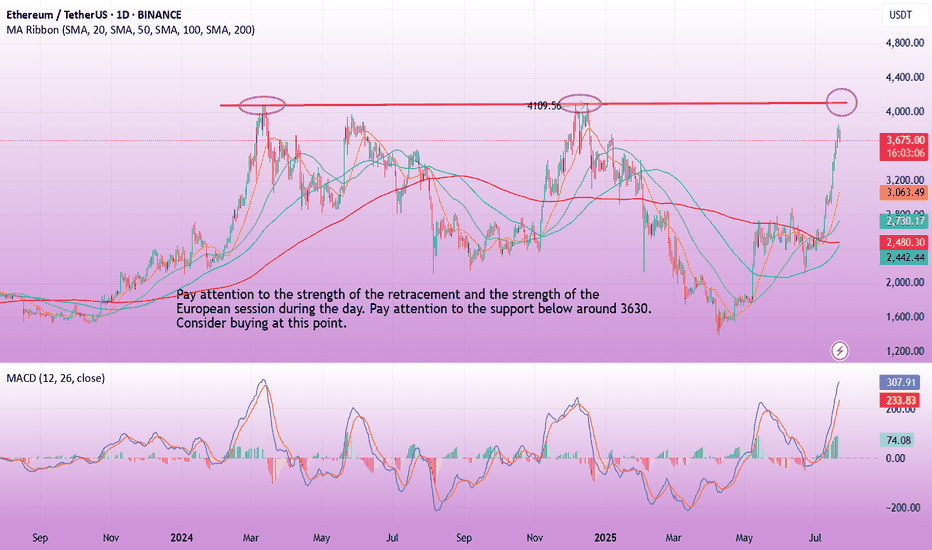

EthFor a technical analysis of the provided ETH/USDT 1D chart, here are the key points:

1. **Current Price and Changes**: The current price is around 3,672.23 USD, down 1.99% (74.54 USD) from the previous day.

2. **Support and Resistance Levels**:

- **Resistance**: Near 3,672.24 USD (current SELL level), marked by the red line.

- **Supports**: Demand levels around 1,800 and 40 USD indicate potential support zones if the price drops significantly.

3. **Trend and Direction**: An upward trend line from the chart's bottom to the current point suggests an overall bullish trend, though the recent break below the resistance line may indicate weakness.

4. **Indicators**:

- The POI (Point of Interest) line near 3,672 USD highlights a key level where price is fluctuating.

- The lower indicator (likely RSI or similar) shows price oscillations, currently in a neutral zone with no clear buy or sell signal.

5. **Short-Term Outlook**: If the price fails to stabilize above 3,672 USD, it may move toward lower demand levels (e.g., 1,800 USD). A breakout and stabilization above resistance could target 10,000 USD (based on the upward trend line).

For a more detailed analysis, consider adding indicators like MACD or Bollinger Bands. Would you like me to create a visual chart in a separate panel?

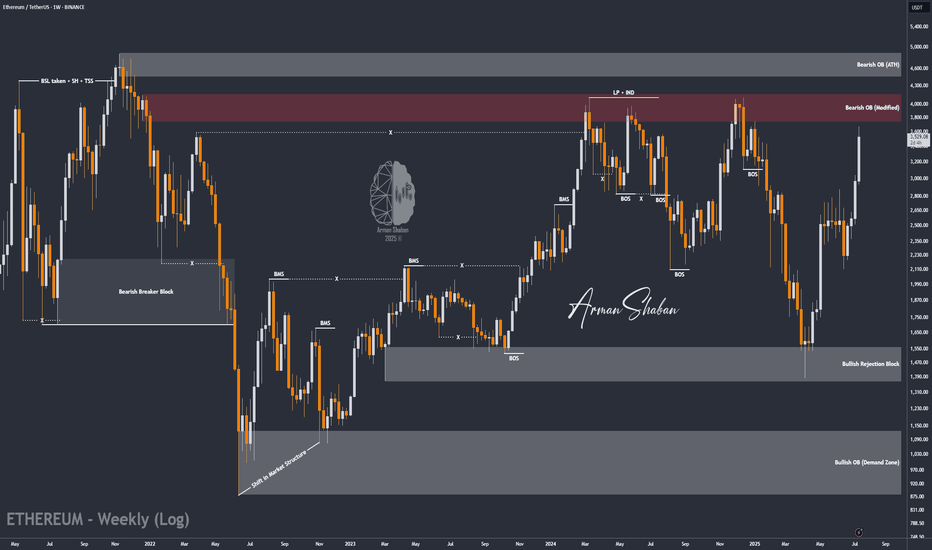

ETH/USDT | The Next Target is $4000 and it's Close! (READ)By analyzing the Ethereum chart on the weekly timeframe, we can see that this cryptocurrency remains one of the strongest major cryptos in the market, continuing its bullish rally despite the overall market correction. It has already hit the next target at $3500, and I believe we might see Ethereum reaching $4000 sooner than expected! Based on previous analyses, if this bullish momentum continues, the next targets will be $3740, $4100, and $4470.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

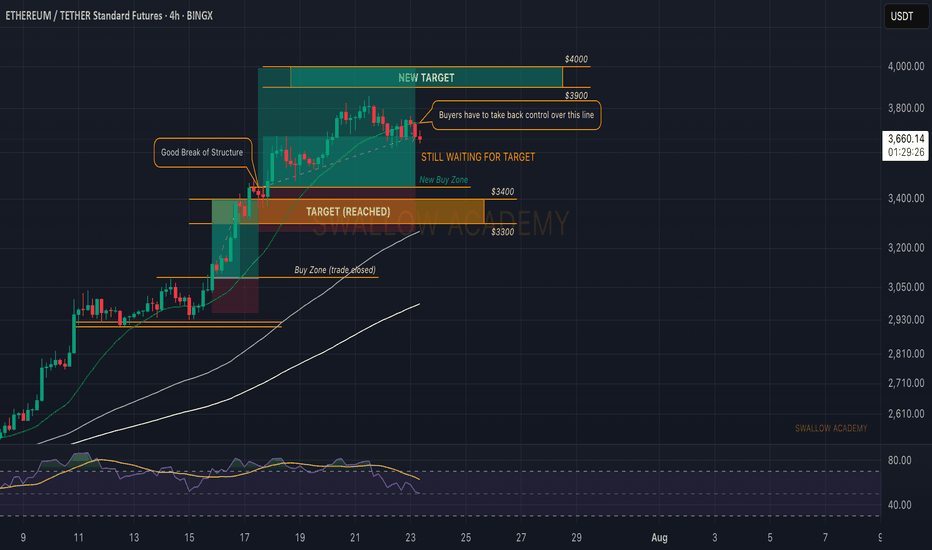

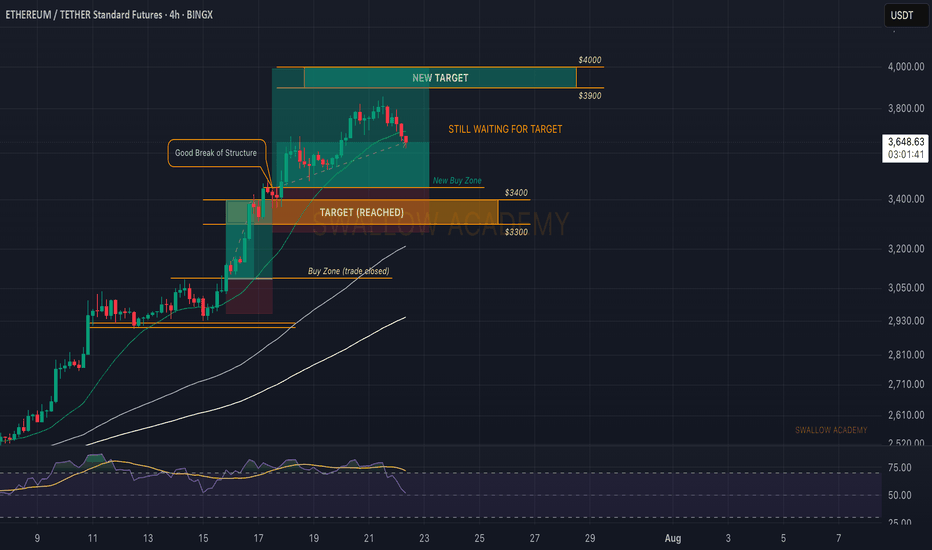

Ethereum (ETH): Bollinger Bands Middle Line Has Been Broken!Well, buyers have to take back the control over the middle line of BB in order to see further movement to upper zones from the current market price.

This is one crucial zone, as upon sellers taking dominance here, we will most likely fall back closer to our entry point here.

But even after that, we still will be expecting the $400 area as our major target (psychological target) will be reached with time so we wait patiently!

Swallow Academy

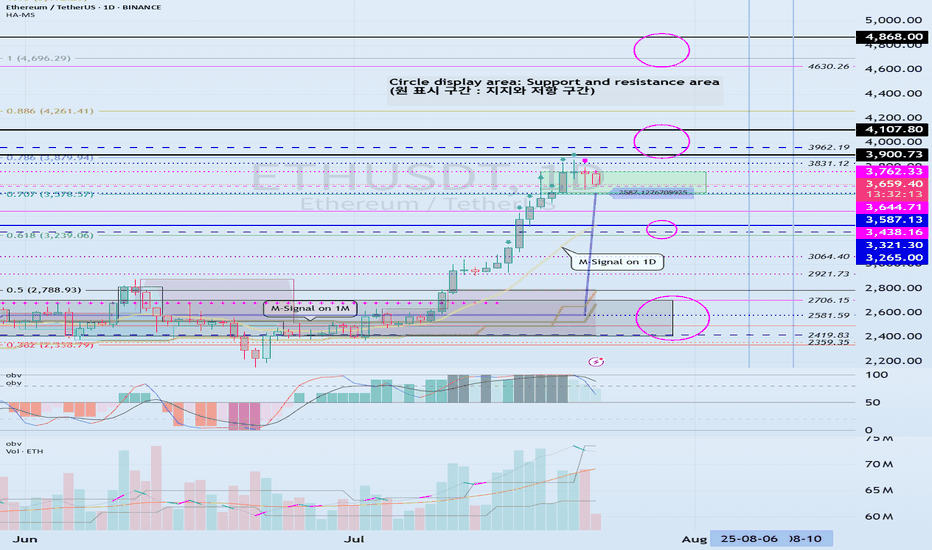

Check if HA-High indicator is forming at 3587.13

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

HA-High indicator is showing that it is about to form at 3587.13.

Accordingly, if the HA-High indicator is newly created, the support in the 3587.13-3762.33 section is an important issue.

If it falls below 3587.13, it is likely to touch the M-Signal indicator on the 1D chart.

Therefore, we should check whether it touches the area around 3265.0-3321.30 and rises.

-

This can be seen as a time to test whether it will continue the first step-up trend while rising in the important section of 2419.83-2706.15.

ETH's volatility period is around August 6-10, but we should check what kind of movement it shows after passing the volatility period of BTC.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

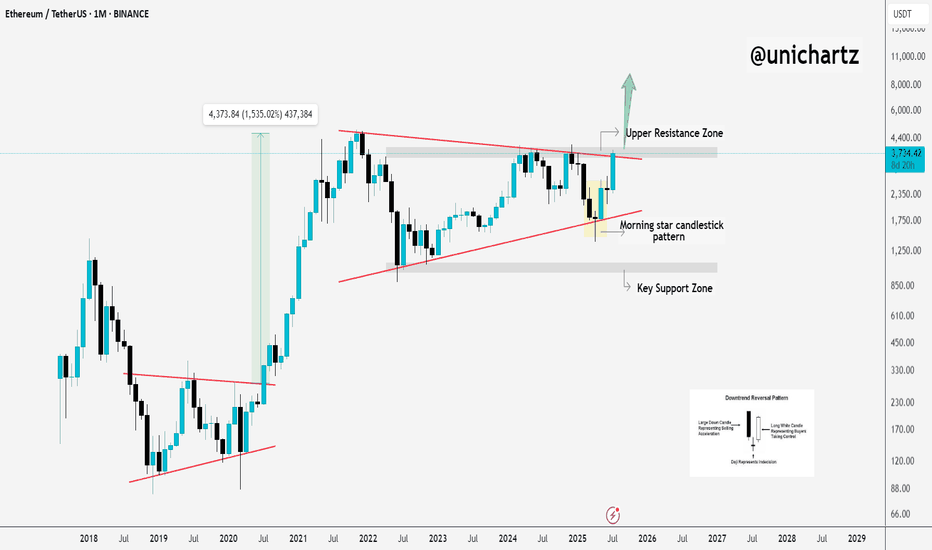

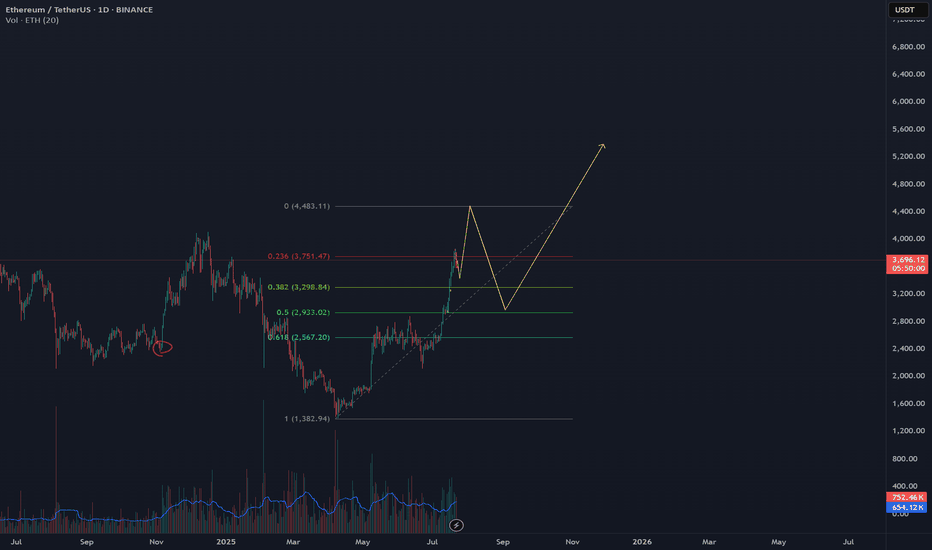

Ethereum Breakout Could Spark the Next Altseason!A Massive Altseason Is Brewing… 🚀

Ethereum just flashed a major monthly breakout after printing a clean Morning Star reversal right at key support.

Now it's pushing against the upper resistance zone, a structure that held it back for over two years.

If CRYPTOCAP:ETH breaks and closes above this level, it won’t just be bullish for Ethereum — it could ignite the biggest altcoin season since 2021.

Why it matters:

📌 ETH is the heart of the altcoin ecosystem.

📌Historical breakouts like this led to 1500%+ moves.

📌The pattern and price action are lining up perfectly again.

Once Ethereum breaks cleanly above $4,000, expect altcoins to explode across the board — Layer 2s, DeFi, AI tokens, and even the meme coins could all start flying.

Keep your eyes on ETH. Its breakout is the spark… the altseason fire is coming.

DYOR | Not Financial Advice

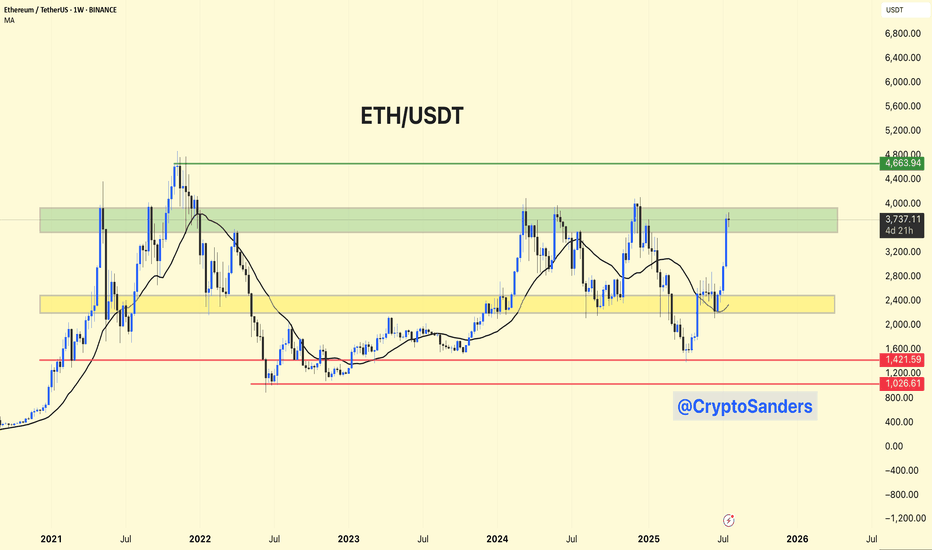

ETH/USDT – Weekly Chart Analysis !! ETH/USDT – Weekly Chart Analysis

ETH is testing a major historical resistance between $3,700 – $4,000 (highlighted green zone).

A clean breakout above this level could push price toward the next key resistance at ~$4,660.

Previous accumulation zone around $2,400 – $2,800 (yellow box) now acts as strong support.

Long-term floor at $1,420 and $1,025, though currently far below.

Bullish Breakout Potential: If ETH sustains above the green resistance, it may retest $4,660+.

A failure to break above $4K could lead to a healthy pullback toward the yellow zone (~$2,800).

Stay updated and manage your risk accordingly.

DYOR | NFA

ETHS Swing long to $4100Just now opened a swing long position on eth...though looking at it from the 4hr kinda looks like it might get hit today or tomorrow....that be awesome

Playing it conservative.

Stop is below prior week low at $3580

The prior week closed with little top wick rejection with big strong body. Daily also close similar . 4hr and 1hr tend is also aligned so basically all trends align from weekly to 1hr which stacks the odds significantly in our favor.

And fundamentally there has been a lot of talks about Etereum.. Lets see how it goes.

Roughly 2.42 RR. I did size up to like 4 times my usual risk.

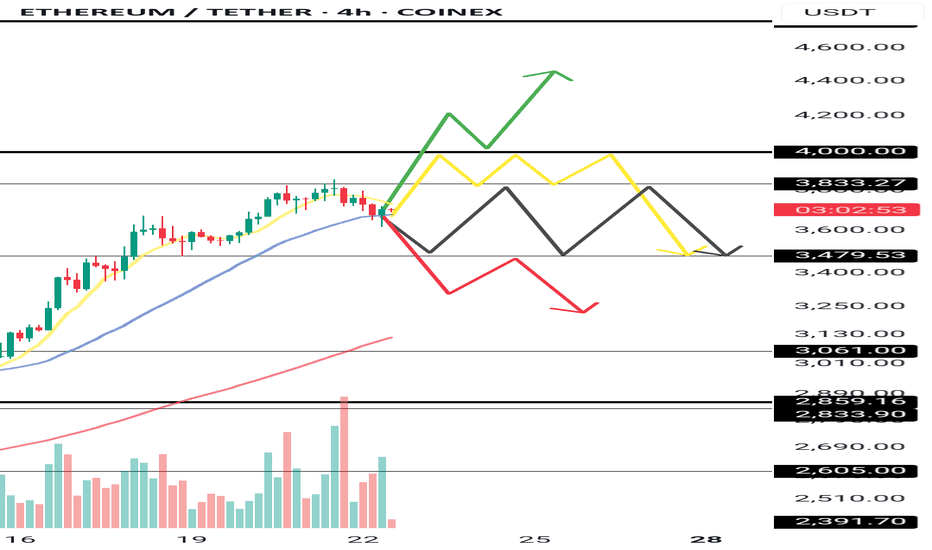

Weekly plan for EthereumLast week, ETH followed our green scenario, breaking through resistance to reach $3,860. Currently, a critical level at $4,116 (higher timeframe) will determine the next major move.

Key Scenarios

If $4,116 holds as resistance:

Expect a Wave E correction within the long-term ABCDE triangle pattern.

Initial downside target: $3,500

Breakdown below $3,500 opens the door to $3,100–$2,900

If $4,116 breaks:

The ABCDE triangle scenario is invalidated

Next major resistance levels open for a potential continuation rally

Current Market Structure

Price remains above the weekly pivot point

However, early signs suggest a correction may have begun

Confirmation of a deeper pullback requires a close below $3,500

As always, manage risk according to key level breaks

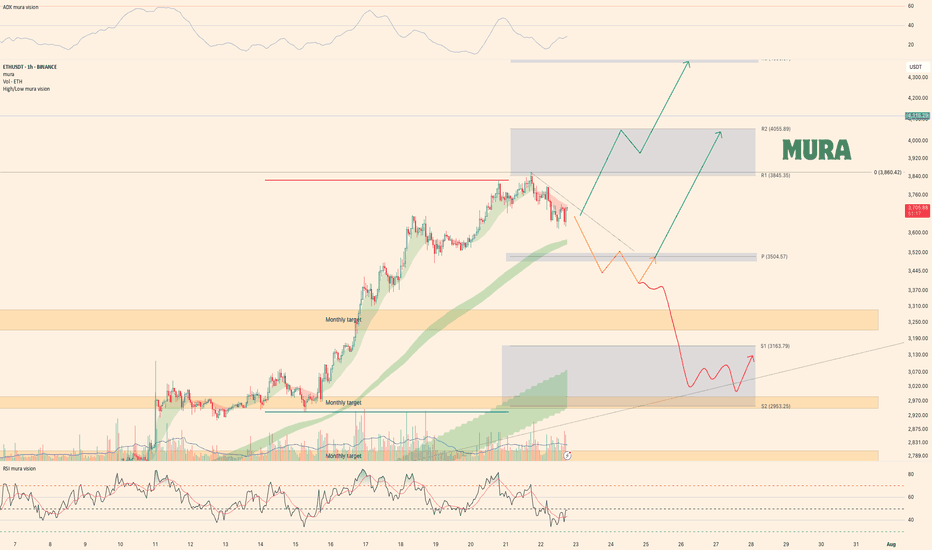

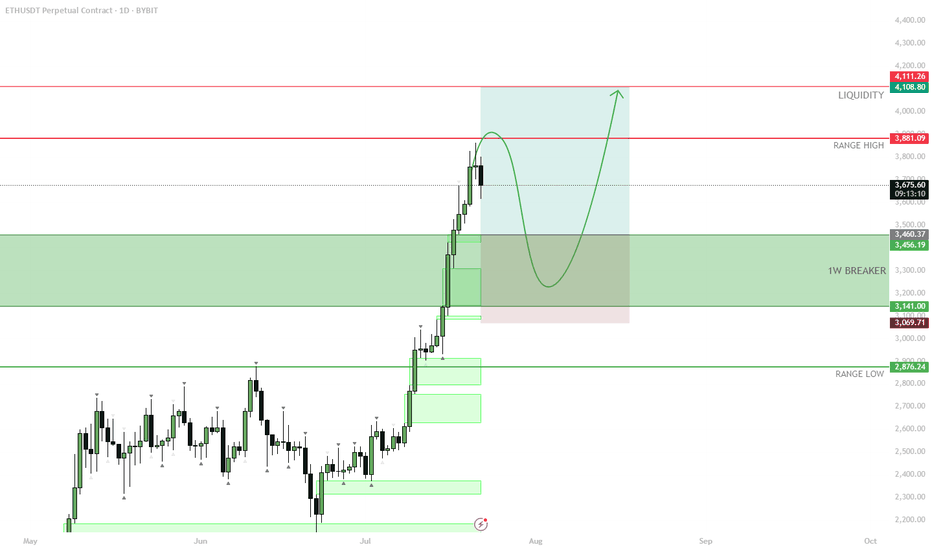

ETH — Perfect Long Play: Pullback & 1W Breaker Reclaim

After the strong move, price is likely to retrace as longs get trapped and late buyers take profit.

Best scenario: ETH pulls back to the 1W breaker zone ($3,141–$3,456), which previously acted as resistance and could now flip into support.

Watch for bullish reaction and confirmation in the 1W breaker zone.

If support holds, enter long — targeting a return to the range high and then the liquidity zone ($4,108+).

Invalidation if ETH closes below the 1W breaker or loses range low ($2,876) support.

ETH has rallied hard. After such a move, it’s normal for price to pull back and test old resistance as new support. The ideal long is on confirmation of a bounce from the 1W breaker zone, which keeps risk controlled and sets up for a continuation move higher. This approach avoids FOMO and protects against reversal if the breakout fails.

Ethereum (ETH) Analysis – July 22, 2025🚨 Ethereum (ETH) Analysis – July 22, 2025

👉 Please read the previous post first. That one explains the fundamental background and market behavior that led to today’s setup.

Now let’s zoom in on ETH with some fresh analysis 👇

---

✅ ETH/BTC – Trend Structure

📈 The overall trend is still bullish, even though today's candles are red and corrective.

🔹 Resistance: 0.03242

→ A breakout here = confirmation to enter or continue long.

🔹 Support: 0.03072

→ Price reacted here, showing it’s a valid level.

🔹 Key Support: 0.02975

→ If broken, the bullish structure breaks, and a deeper correction may begin.

---

📊 ETH Dominance (ETH.D)

🔹 Resistance: 11.90%

→ Staying above this = support for keeping or adding to longs.

🔸 Support Zones:

11.45%

11.22%

→ Strong zones if market pulls back.

---

🌐 TOTAL2 (Altcoin Market Cap Without BTC)

🔹 Key Resistance: $1.55 Trillion

→ Breaking above this = more upside for altcoins, including ETH.

---

🔎 ETH/USDT – 4H Timeframe

✅ Mid-term trend is still up, but we are entering a correction phase.

📉 Price is testing the key 3,480 level.

📊 Volume is high, and momentum is fading, which shows buyers are getting weaker.

📈 20 EMA and 50 EMA are still rising, but flattening.

---

📌 Key Confluences

🧩 USDT.D at 4.14%

🧩 BTC Dominance at 61.31% and 60.42%

These levels + ETH chart = critical for making accurate decisions.

---

📈 Main Scenarios

🟡 Scenario 1 – Sideways Range

→ Price moves between 3,480–3,850

→ If confirmed, smart entries from edges with tight SLs make sense.

🔻 Scenario 2 – Breakdown of 3,480

→ Bullish 4H structure breaks

→ Possible drop to 3,200 or even 3,060

⚫ Scenario 3 – Breakout of 3,850

→ Likely moves to range between 3,850–4,000

→ Market enters a “macro decision zone”

🟢 Scenario 4 – Sharp Break Above 4,000

→ Strong bullish signal

→ Daily uptrend may continue toward 4,400 or even a new ATH

---

🚀 If this analysis helped:

🔁 Tap the rocket to boost

🔔 Follow for more clear updates

💬 Comment your thoughts or chart ideas!

ETH (5 year of accumulation!)ETH / USDT

📌 Background: i shared an analysis about ETH/BTC chart and i predicted the ultimate bottom, from which ETH/BTC pumped 52% and ETH/USDT pumped 97% in few days !

you can check previous analysis: click here

📌 Today we have different chart against stable coin … Ethereum is being accumulated since 5 years in mega accumulation range with 2 major stop-loss hunt (long and short)

📌 What IF ?

What if ETH made a breakout throughout this accumulation ? i think we can see scenario like that in the green candles in my chart

DO YOU AGREE ?

ETH-----Sell around 3680, target 3650-3630 areaTechnical analysis of ETH contract on July 22:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern continued to rise, the price was above the moving average, and the attached indicator was running in a golden cross. The overall upward trend was still very obvious, and yesterday's decline can be regarded as a correction based on the current trend. The price just returned to the support of the moving average, and the strong support position was near the 3630 area; the short-cycle hourly chart currently has a continuous negative K-line pattern, the price is below the moving average, and the attached indicator is running in a dead cross, so let's look at the retracement trend during the day, and pay attention to the 3630 area below the support.

Today's ETH short-term contract trading strategy:

The current price is 3680, short, stop loss in the 3745 area, and the target is the 3650-3630 area;

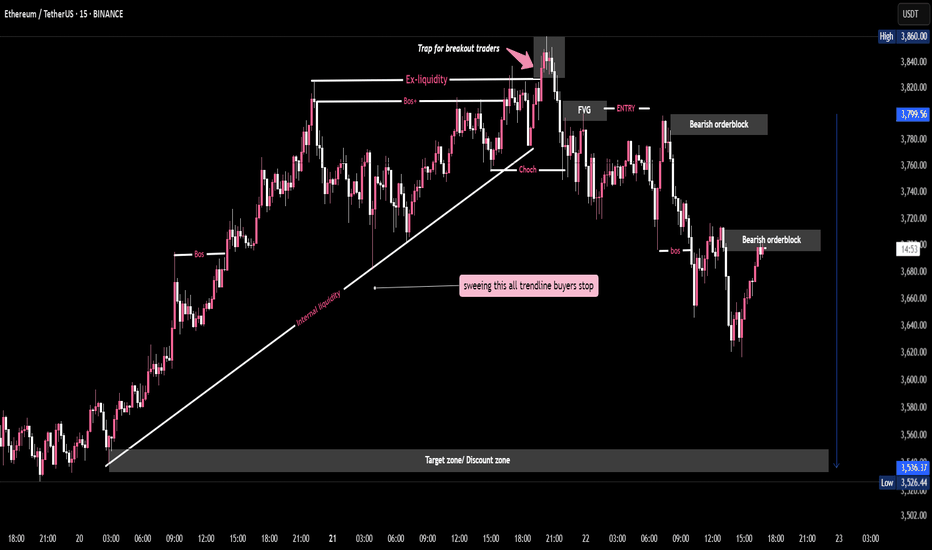

Liquidity Hunt Complete - ETH/USDT 15M BreakdownThis 15-minute ETH/USDT chart outlines a classic Smart Money Concept (SMC) short setup. Price action formed a bullish trendline, building internal liquidity and inducing breakout traders above previous highs (Ex-liquidity).

A clear CHoCH (Change of Character) and subsequent BOS (Break of Structure) confirmed bearish intent. Entry was taken at the Fair Value Gap (FVG), aligned with a bearish order block. Price is projected to sweep trendline buyers’ stops and target the discount zone below.

This analysis showcases liquidity engineering, stop hunts, and institutional footprints, providing a high-probability short scenario with well-defined entries, stops, and targets based on SMC principles.

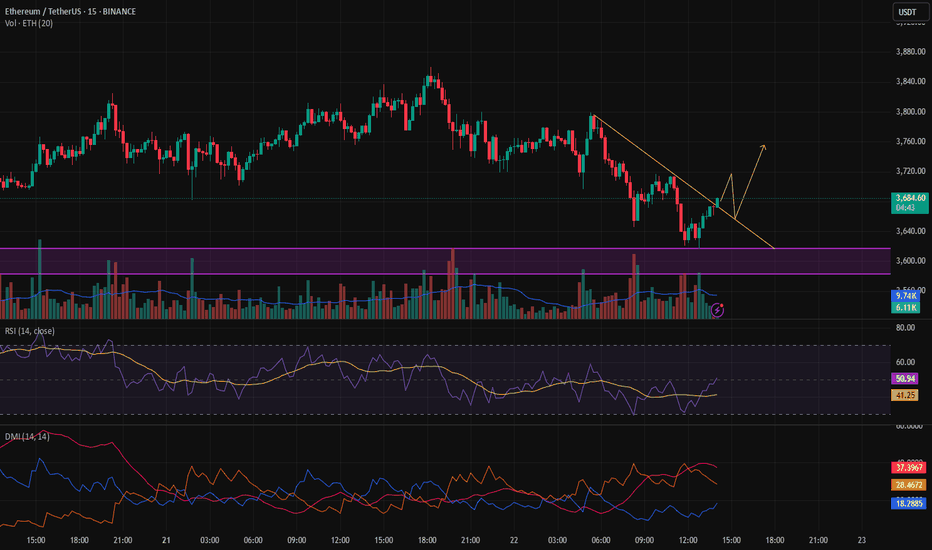

Ethereum 15m Analysis – Waiting for Bullish ConfirmationAfter a step up, Ethereum made a pullback, and a news event released today caused the correction to deepen.

So far, we haven’t received any bullish confirmation.

If the price pulls back to the marked level and gives confirmation on the 15-minute timeframe, we can look for a buy opportunity.

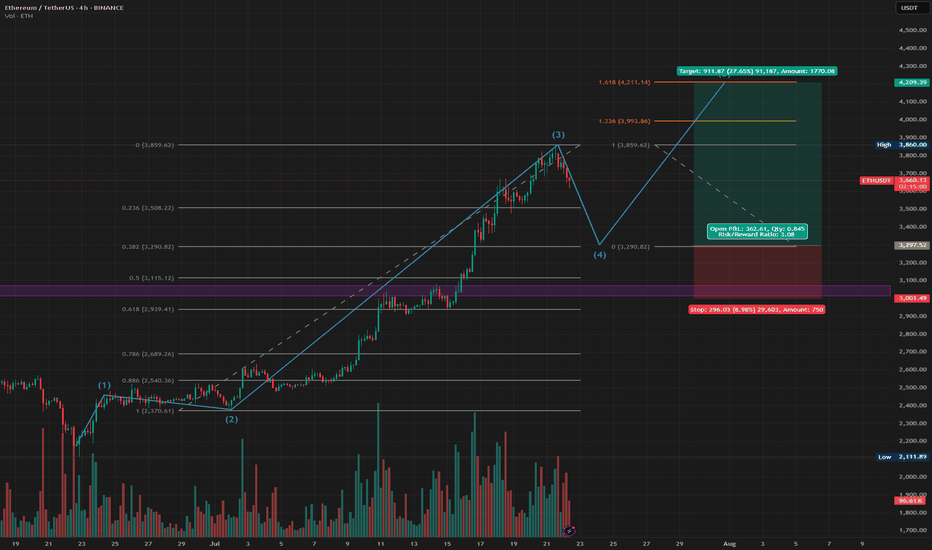

ETH Long Closing July 2025 - Elliot Waves 4-5Elliot Wave setup on the ETH 4h chart. We're now in wave 4, which should be steep since wave 2 was shallow. so targeting the .382 fib for a long entry at $3290 (most likely) - but could go down to the .5 fib for a lower entry ($3115). SL just lower than the DOL on the weekly HTF (end of Nov). Wave 5 should run to $3993 or $4211 (TP at both).

If you're feeling brave, you could also short the rest of wave 4, but be aware this is going against the market upwards momentum and BOS in BTC dominance.

Ethereum (ETH): RSI Restarted, Going For $4000 Now?We were very close to our target of $4000,, where we had an early overtake by sellers, correcting the coin properly and stabilizing most of the the indicators like Bollinger Bands and RSI that we both use.

Monday was full of manipulations and now today we started with some strong downside movement, but we are bullish as long as we are above $3400

Swallow Academy