ETHUST trade ideas

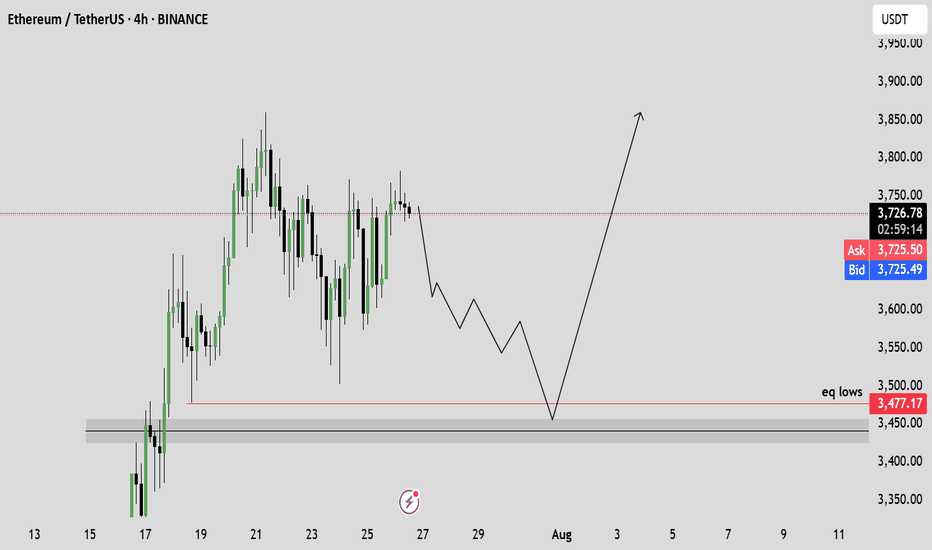

ETH Buy Idea📈 Setup Summary:

Ethereum (ETHUSD) is breaking out of a multi-week consolidation with rising volume and strong bullish momentum. Price has reclaimed key moving averages, and sentiment has shifted favorably across crypto markets.

📊 Entry & Risk:

• Entry Price: $3,860 - 3870

• Stop: $3,470

🧠 Macro Catalyst: Spot ETH ETFs Are Coming

• The SEC is reviewing multiple Ethereum Spot ETF applications from BlackRock, VanEck, ARK/21Shares, and others.

• Market expects approvals Q3–Q4 2025, mirroring the prior surge seen in BTC after IBIT and similar ETFs launched.

• A successful launch could unlock institutional ETH flows, driving significant upside.

🟢 Adding ETF tailwind to technical breakout = high-conviction swing trade.

🚀 Momentum Signals:

• RSI & MACD bullish cross on daily

• Increasing volume on breakout

• ETH outperforming BTC (ETHBTC ratio turning up)

• Crypto market as a whole showing risk-on tone

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Risk Management is Your Shield! Always prioritise risk management. It’s your best defence against losses.

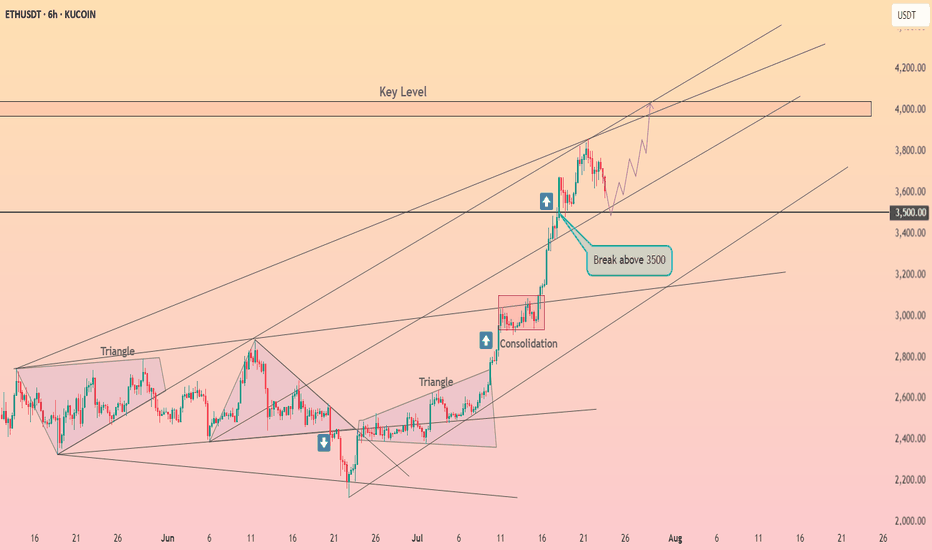

$ETH Mid-TermLooking at Ethereum from a mid-term perspective, it’s currently sitting near its price ceiling, suggesting a potential need for a correction. Of course, it’s also possible that this level could be broken, depending on overall market conditions. However, the primary scenario is that it fails to break through and pulls back, with the potential reversal zone identified based on Fibonacci levels. On the other hand, the 55 EMA is also providing solid support.

If Ethereum manages to break above this resistance, then we'll wait for either a confirmation or a pullback before entering a long position

Ethereum (ETH): Bloody End of Week & Start of Month | We Wait!Well, we were close to breaking out of the $4000 area and now we are back on the lower side of the area, where sellers are showing strong pressure to coin.

As we approached the 100 EMA, we waited. Waiting is the worst part of trading, but that's what we do here. The 200 EMA is one key zone for us for another buying opportunity so if we keep on falling, that's the zone we are aiming for.

The second point of interest is the current 100 EMA, where if we see MSB to form, there might be a smaller scalp opportunity.

And last but not least, the zone above $4000.

Swallow Academy

Ethereum (ETH): Approaching $4000, Targeting Next $4800Ethereum is still below our current target, which is $4000. Soon to approach it, we are looking for a breakout from there and another trade to be opened right after the breakout.

The game plan is simple: 1 trade has been successfully closed, and the second one is almost near the target. Now waiting for the third one to be activated!

Swallow Academy

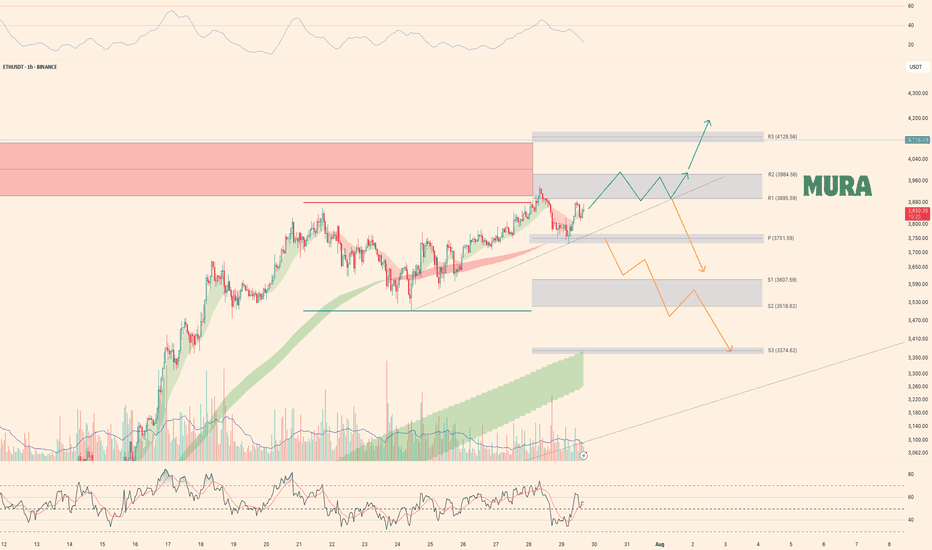

Weekly trading plan for EthereumLast week's BINANCE:ETHUSDT price action performed perfectly according to our scenarios - hitting our first target and establishing a new local high. Currently, price remains above the weekly reversal level at $3,751, maintaining potential for an advance toward Resistance #2.

Key Considerations:

While above $3,751 → Resistance #2 remains in play

Break below reversal level + trendline → Likely retest of last week's low

Such breakdown would likely breach both primary support levels

Trade Plan:

Bulls: Watch for continuation above $3,751

Bears: Require confirmed break of trendline + reversal level

As always, confirmation is key - trade the breaks, not the anticipations

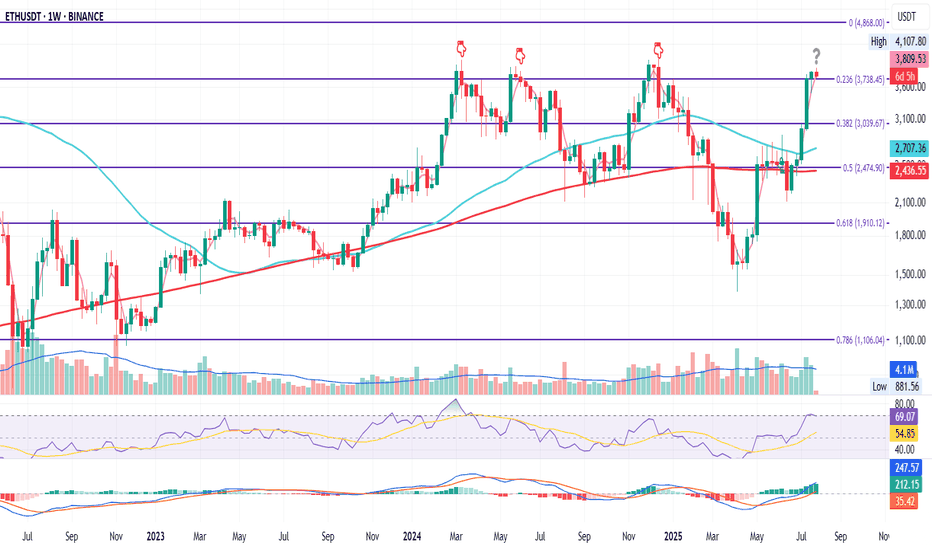

ETH Weekly Flip ZoneETH on the Weekly

ETH just closed the week above the 0.236 Fib level at $3738.45.

It’s the fourth attempt to conquer this zone since the June 2022 bottom.

If price holds above this level, the odds of continuation increase.

If it fails, we could see downside.

It may also just consolidate here for a while.

RSI just touched overbought, and MACD remains green — still some room for upside.

I remain bullish long term, but this looks like a smart area to manage risk if you’re late to the move, or take partial profits.

Always take profits and manage risk.

Interaction is welcome.

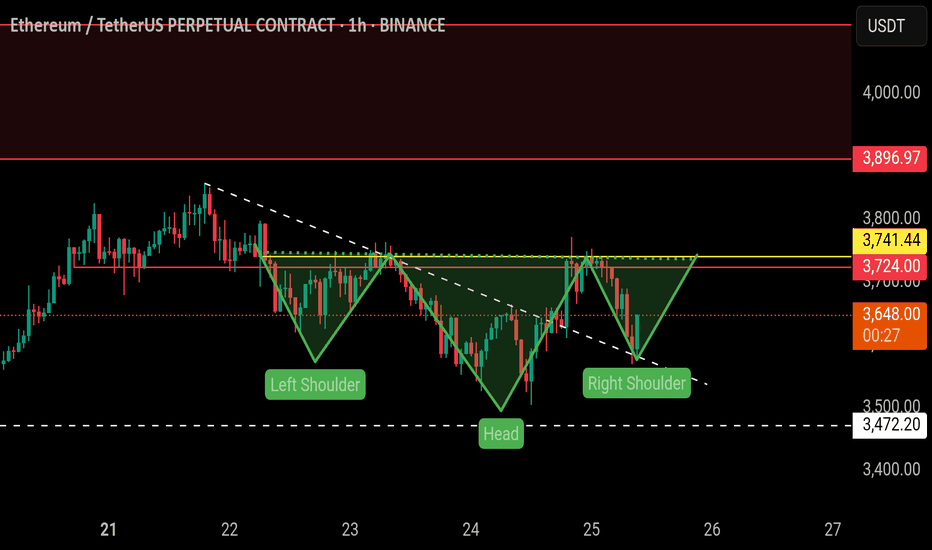

"ETH Warning Signal: Is a Bearish Breakdown Imminent?"📊 Pattern Overview: Head and Shoulders

Left Shoulder: Formed around July 24th, marked by a high near $3,800 followed by a retracement.

Head: A higher peak on July 27th, topping out near $3,888, then pulling back again.

Right Shoulder: Currently anticipated, projected to form around the same height as the left shoulder, with a potential completion near $3,800 before another decline.

Neckline: Flat support line around $3,544, acting as the crucial level that, if broken, confirms the pattern.

🧠 Interpretation

The Head and Shoulders is generally interpreted as a trend reversal pattern. In this context, Ethereum has been in a strong uptrend, but the pattern signals a potential topping out and shift toward a bearish phase.

If ETH breaks below the neckline at $3,544 with volume confirmation, it would signal that bulls are losing control, and sellers may take over.

📉 Bearish Breakdown Target

The theoretical downside target can be calculated by measuring the distance from the Head to the Neckline and projecting it downward from the neckline:

Head peak: ~$3,888

Neckline: ~$3,544

Height: ~$344

📌 Target after breakdown:

$3,544 - $344 = $3,200 (approx.), with interim support levels around:

$3,332 (horizontal support)

$3,112

$2,917

These levels might act as pause points or bounce zones if the breakdown unfolds.

🟢 Invalidation Scenario

If Ethereum invalidates the pattern by:

Breaking above the Head level ($3,888) and holding

Sustaining higher highs with strong volume

Then the bearish thesis would be invalidated, and bulls may aim for continuation toward $4,000+ levels.

🧩 Strategic Takeaways

Aggressive traders might short the neckline break at $3,544, with stops just above the right shoulder (~$3,800).

Conservative traders may wait for a retest of the neckline post-breakdown.

Risk management is key, especially in crypto markets, which are known for head fakes and false breakouts.

⏳ Final Thought

This setup doesn't guarantee a drop—it merely increases the probability of a reversal. Watch for volume on the neckline break and monitor how price reacts at key support levels.

DYOR before taking a trade

Ethereum Rejected from Supply - Bearish Shift in ProgressHello everybody!

Price has been rejected from a supply area.

The bullish trend has slowed down, and the market structure is slightly shifting bearish.

A polished upward trendline has been broken on the 1H timeframe.

We’re aiming for a target around the first untouched demand zone: 3437.

Manage your risk and trade safe!

Ethereum Tests Key Long Term ResistanceEthereum continues to push higher, but a key resistance zone is causing a pause in the upward movement. Every day brings new positive developments for the crypto market, from ETF to tokenization news. This pattern reflects the typical progression of a crypto bull cycle. The latest SEC decision regarding a crypto-based ETF adds to the bullish backdrop.

However, a rising dollar index and a slowing momentum of U.S. stock market are having a short-term negative impact. Another reason for the current slowdown is the presence of massive resistance. The long-term trendline from the 2021 top, combined with the horizontal 4100 level, has formed a major resistance zone for Ether.

In the short term, ETHUSD may have formed another flag pattern. If it breaks to the upside, a retest of the 4100 resistance is possible. Today, dovishness level of Powell and the number of dissents in the rate-hold decision could significantly influence the price action.

ETHUSD 8H — Strategy Nailed the Breakout, But Is $4K Next?This Ethereum 8H chart captures a powerful trend reversal, triggered by the **Enhanced Ichimoku Cloud Strategy V1**. After months of chop, the system delivered a clean entry and held the full breakout — now nearing key resistance around \$4K.

---

**📊 Setup Breakdown:**

* Entry triggered after **three major confirmations**:

* Breakout above long-term trendline

* Flip above the **171 EMA**

* Bullish **Ichimoku Cloud alignment**

* Strategy entered long near **\$2,530**, and has held the move for over 80 days

* Current price: \~\$3,988 — a **+57% trend** captured without exit signal

---

**⚙️ Strategy Logic:**

The strategy uses:

* Custom Ichimoku inputs: *(7 / 255 / 120 / 41)*

* A 171 EMA trend filter for signal clarity

* Optional “Cloud Mode” to confirm direction

* A memory-based system that reduces false chop signals

On this trade, the system **ignored mid-trend noise**, stayed in position, and let the move fully play out — exactly what it’s designed for.

---

**🔍 What to Watch Next:**

* Price structure remains bullish as ETH nears the psychological **\$4K resistance**

* Cloud support rising beneath — confirming healthy structure

* A clean break above \$4K could trigger another leg, while rejection may form a range

---

This is a prime example of how **low-frequency, high-conviction signals** can lead to massive upside when paired with disciplined exits. Backtest this strategy on your favorite altcoin pairs and compare.

Let me know when you’re ready to move to the next chart brother — this one’s ready for the spotlight 🔥

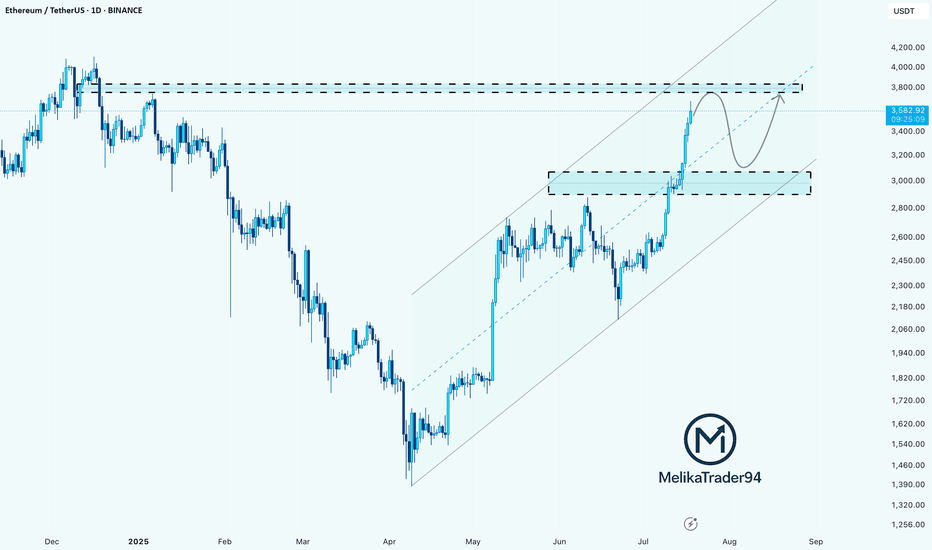

ETHUSDT - Multi-year Symmetrical Triangle ETH has formed a massive symmetrical triangle since the 2021 top (~$4,800).

This triangle has been tightening since 2022 with:

- Lower highs from $4,800 → ~$4,000

- Higher lows from ~$850 → $1,370 → $1,850+

We now close to the apex, meaning a major breakout or breakdown is imminent in the coming weeks/months.

Price Action

ETH is pressing against the upper resistance of the triangle (~$3,850–3,950).

A monthly close above $4,000 would be the first breakout in over 2 years.

Volume

Volume has decreased over time, typical for a symmetrical triangle.

We are looking for volume increase on breakout to confirm it’s on the right track.

Momentum (Laguerre RSI: 0.67)

Momentum is rising, supportive of a bullish breakout.

RSI is not yet overbought, so there’s room for continuation.

Scenarios

Bullish Breakout Scenario:

Trigger: Monthly close above $4,000–4,200

Target: ~$7,000–7,500

Timeline: Could play out over 3–6 months

Bearish Breakdown Scenario

Trigger: Monthly close below $2,500

Target Zone: $1,850 → $1,300 (last major supports)

Would invalidate the higher low structure

I am bullish but it is hard to not to be cautious given its crypto and this is a pretty tough resistance.

Do your own research and make responsible decisions all.

Peace out.

BUY ETH 28.7.2025Confluence order: BUY at M15

Type of order: Limit order

Reason:

- The current top is not touching anything, expected to rise to the H1 above.

- M15~FIBO 0,5-0,618 (same position)

Note:

- Management of money carefully at the last bottom (3,815)

Set up entry:

- Entry buy at 3,798

- SL at 3,783 (below OB NOT USED of M5)

- TP1: 3,815 (~1R)

- TP2: 3,860

Trading Method: Price action (No indicator, only trend and candles)

ETH/USDT 4H Chart📊 General Context

Ethereum is rising in a strong short-term uptrend, supported by a rising trendline (orange).

Current price: 3831 USDT

We are approaching a significant resistance level around 3842–3850 USDT (green line).

Technical support is located around 3760 USDT (previous consolidation level and 50/200 SMA).

🔍 Technical Levels

Resistance:

3842–3850 USDT – local high, currently being tested.

4006 USDT – key psychological level and the last local high on the chart.

Support:

3762 USDT – previous resistance, currently turned into support (may be tested in a correction).

3650 USDT – strong technical support, confirmed several times in the past.

SMA50 and SMA200 – currently just below the price, also acting as dynamic support.

📈 Technical Indicators

MACD:

The histogram is rising and positive → bullish momentum.

The MACD line crosses the signal line from below → a buy signal.

RSI (14):

Currently: around 64 → not yet overbought, but close to the overbought zone.

Slightly rising trend, but may suggest impending market overheating with further gains.

🧭 Trend

Short-term: strong uptrend (trend line, green candles, breakout from consolidation).

Medium-term: higher lows and higher highs – the uptrend is maintained.

The price is holding above the 50 and 200 SMAs – confirming bullish sentiment.

⚠️ What to watch next?

A 4-hour candle close above 3842 USDT → confirmation of a breakout, a potential attack on 4000–4010 USDT.

A break of the trend line (orange) → a possible correction to 3760 or even 3650 USDT is possible.

An RSI rise above 70 → an overbought signal, a possible pullback or consolidation.

Bitcoin, Ethereum & Market Indexes

🔻 🚀 Bitcoin, Ethereum & Market Indexes 🔍

💎 HWC (1D) – MWC (4H) – LWC (1H) Cycle Analysis

⭕️ Structural Review: TOTAL, TOTAL2, TOTAL3, BTC.D, USDT.D

🔥 analysis Coins: BTC, ETH

📉 Strategy: Dow Theory + Fundamentals + Market Sentiment

🔥 Daily Market Analysis – July 31st 🔥

💎 Summary of Key News & Strategy:

✔️ Interest rates were officially held steady at 4.5% – as widely expected. However, Powell’s comments added slight bearish pressure to the market in the short term ❗️

✔️ It’s important to note: recent market growth happened with the same rate in place. So any positive economic news from the U.S. from now until September could trigger a Bitcoin pump 🚀

✔️ One major bullish catalyst: MicroStrategy purchased 21,000 BTC – a strong institutional support signal 💎

✔️ With the BTC monthly candle closing in a few hours, keep risk low and proceed with caution ❗️

✔️ if Volume is picking up in BTC and altcoin momentum is building. This opens up a strategic opportunity to enter long positions even before key breakouts in TOTAL, TOTAL2, and TOTAL3 🔥

♦️ BTC/USDT

Support 1: 115,000

Support 2: 111,000

Resistance: 120,000

Despite 2 days of bearish pressure, the overall BTC structure remains bullish

If the 120,000 level breaks with strong volume, we can use a stop-buy strategy to enter a long. Sellers managed to push down to 115,700, but buyers defended the level well.

⭕️ This volume near support can serve as early confirmation to enter altcoins.

🔥 Break of 120,000 is critical for sustained altcoin rallies.

♦️ BTC Dominance (BTC.D)

Watch for a breakout above 60.44 – if that happens, you should already be in altcoin positions 🔥

It still hasn’t broken the 62–62.36 zone, which remains supportive for altcoin strength ✅

♦️ TOTAL Market Cap

If we see signs of breaking 3.92, we should already be positioned 🔥

Key support: 3.71 – as long as the market holds above it, the long scenario remains valid 💎

♦️ TOTAL2

Open position should happen before a confirmed break of 1.54 ❗️

Waiting until after could lead to late and risky entries. Stay alert and responsive ✅

♦️ TOTAL3

Same logic – position before the 1.08 breakout. Entry afterward will be harder due to sharp candle and volatility ⭕️

♦️ USDT Dominance (USDT.D)

Currently attempting to break 4.40 but has not succeeded ❌ – this is good for buyers.

We should have long positions before any potential drop below 4.13 🔥

♦️ ETH / USDT

Buyers successfully defended the 3,750 support zone 💎

Given strong institutional interest, ETH has high bullish potential.

A break above 4,000 with powerful candles could kickstart the next bull run 🚀

✅ Early Entry Trigger: 3,858 – but only if ETH dips below this level first and returns back to it.

This gives us a tighter stop-loss and better risk/reward setup.

❌ If ETH blasts through 3,858 with a sharp candle, avoid chasing the move.

⭕️ Additional confirmations:

• ETH/BTC should break 0.3277 to confirm ETH strength

• ETH.D should break 12.16 for final validation

Most likely, ETH.D and ETH/BTC will give early confirmation before ETH/USDT breaks 3,858 ✔️

💥 If you found this helpful, don’t forget to FOLLOW and smash that 🚀 button for more daily insights! 💎

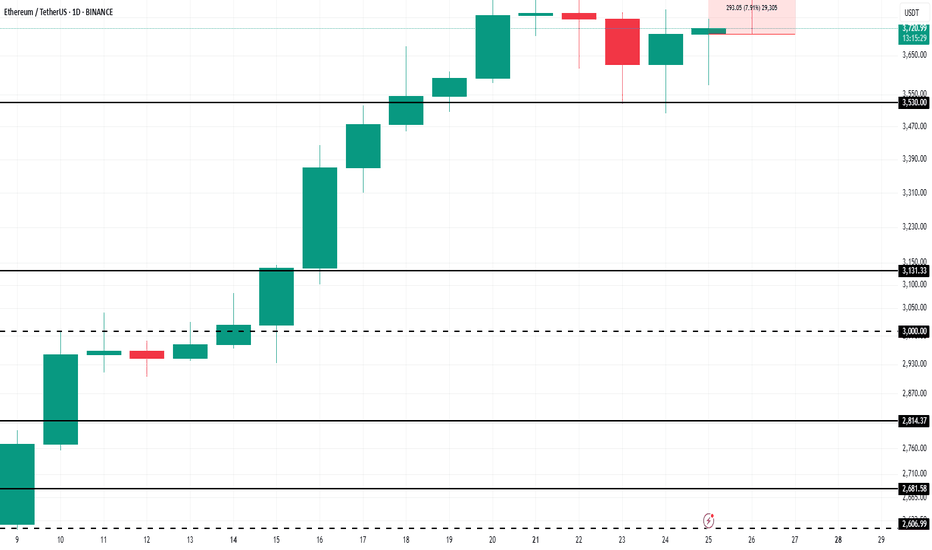

Ethereum’s $4,000 Target Alive as Historic Rally Signs EmergeBINANCE:ETHUSDT is currently trading at $3,680, just 9% away from the critical $4,000 resistance that many investors have been waiting for over the past seven months. The altcoin is expected to continue its upward momentum despite the recent consolidation, with the potential to breach the $4,000 mark soon.

Looking at broader technical indicators, the NUPL (Net Unrealized Profit/Loss) suggests that BINANCE:ETHUSDT is poised for a significant rally . The NUPL indicator, when reaching a threshold of 0.5, traditionally signals a pause in the uptrend, followed by a sharp rally.

$ BINANCE:ETHUSDT is currently nearing this threshold , which, in the past, has marked the beginning of powerful upward price action.

As long as BINANCE:ETHUSDT remains above its key support levels, the price is likely to surge toward $4,000 . If Ethereum can maintain its momentum, a breach of $4,000 could act as a catalyst for further gains.

However, should unforeseen selling pressure arise, $BINANCE:ETHUSDTprice could slip below the $3,530 support level. In such a scenario, Ethereum may fall to $3,131, invalidating the current bullish outlook. The key will be maintaining support and capitalizing on the retail-driven surge.

$ETH | Ready to fly (Inverted head and shoulders)BINANCE:ETHUSDT.P

On 1H TF, the price is forming inverted head and shoulders pattern, which is a strong bullish pattern.

The price has retested the trendline support and bounced back.

Expecting it to breakout above yellow line soon.

A breakout above the yellow line will be a bullish and pattern confirmation.

We can initiate a long entry from here.

Please do proper risk management and must use stop loss.

NFA, DYOR

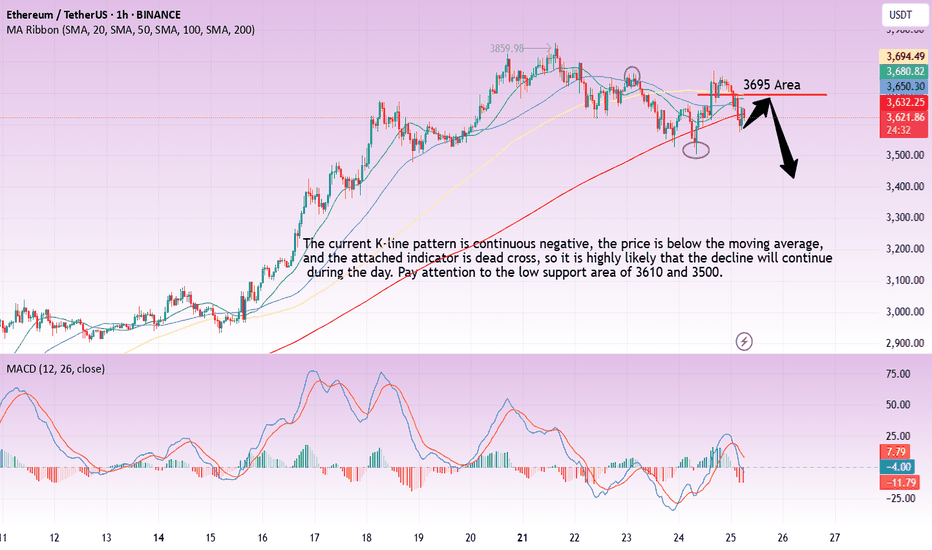

ETH-----Sell around 3690, target 3615 areaTechnical analysis of ETH contract on July 25:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern was single negative and single positive, the price was at a high level, and the attached indicator was golden cross and running with shrinking volume. From the big trend, the current trend is in a weak trend, the price rebound is not strong and has not continued, the trend is prone to fall under pressure and test the low point downward, so the trend has changed; the short-cycle hourly chart yesterday hit a high in the US market and fell under pressure in the Asian morning. The current K-line pattern is continuous negative, the price is at a low level, and the attached indicator is dead cross running. It is highly likely that the decline will continue during the day. Yesterday's low point of 3500 is the position that needs to be paid attention to today. The current hourly chart resistance is near the 3695 area.

Today's ETH short-term contract trading strategy:

Sell in the 3690 area after the rebound, stop loss in the 3720 area, and target the 3615 area;

ETH Approaching Major Resistance – Expecting Pullback Hello guys!

Ethereum has been rallying strongly within a well-respected ascending channel, pushing past key levels and now approaching a major resistance zone around $3,900–$4,000.

According to the chart structure, it looks like price could soon react from this resistance, leading to a pullback into the $3,000–$3,200 demand zone, which aligns with the midline of the channel.

This would be a healthy correction before potentially continuing the bullish trend and attempting a clean breakout toward new highs.

ETH is still bullish, but it may need to retest support before continuation.

Watch for a bounce from the $3,000–$3,200 zone for a high-probability long opportunity.

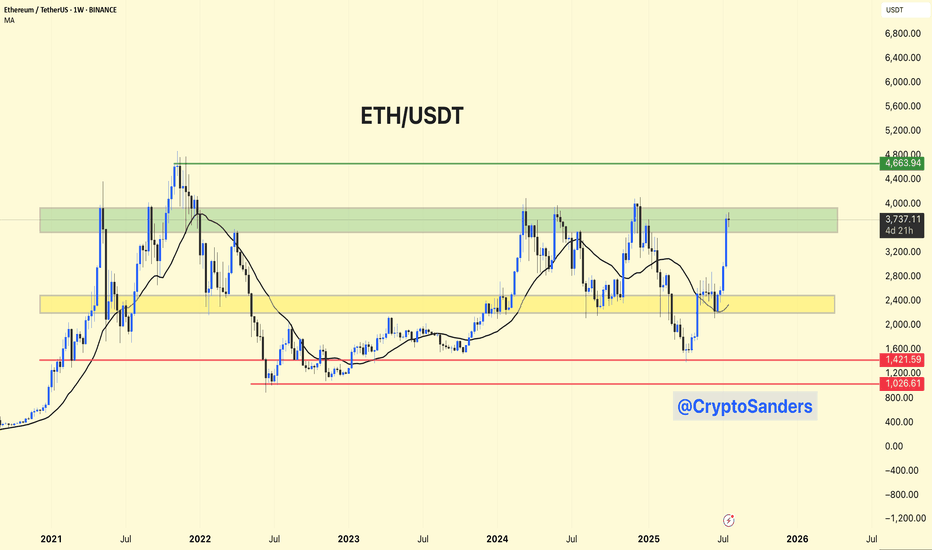

ETH/USDT – Weekly Chart Analysis !! ETH/USDT – Weekly Chart Analysis

ETH is testing a major historical resistance between $3,700 – $4,000 (highlighted green zone).

A clean breakout above this level could push price toward the next key resistance at ~$4,660.

Previous accumulation zone around $2,400 – $2,800 (yellow box) now acts as strong support.

Long-term floor at $1,420 and $1,025, though currently far below.

Bullish Breakout Potential: If ETH sustains above the green resistance, it may retest $4,660+.

A failure to break above $4K could lead to a healthy pullback toward the yellow zone (~$2,800).

Stay updated and manage your risk accordingly.

DYOR | NFA