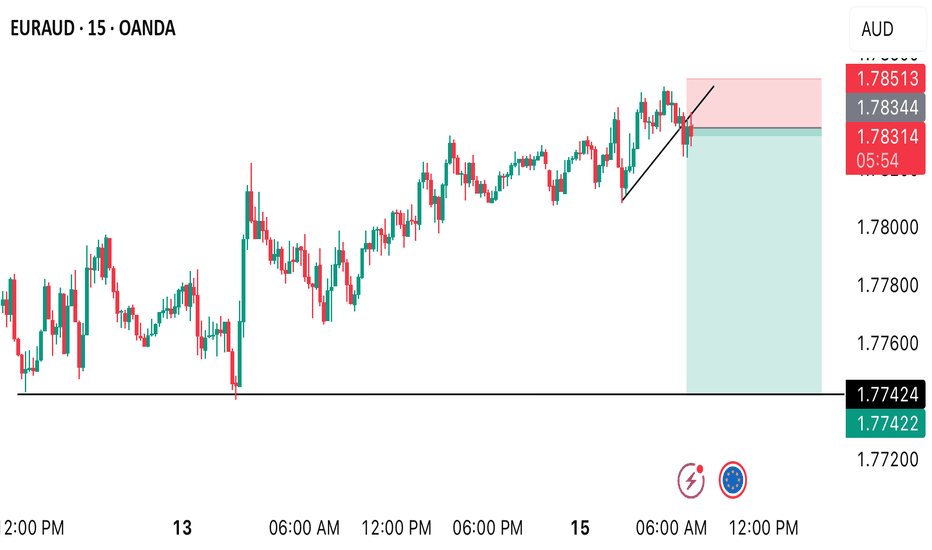

If confirmed, this could be a strong trigger to enter shortIf the euro is indeed set to weaken — as we anticipate based on the current signs of trend exhaustion — this could be a solid trigger for a short position.

However, if the breakout fails to confirm, it may turn out to be a fakeout, potentially leading to a bullish reversal instead

EURAUD trade ideas

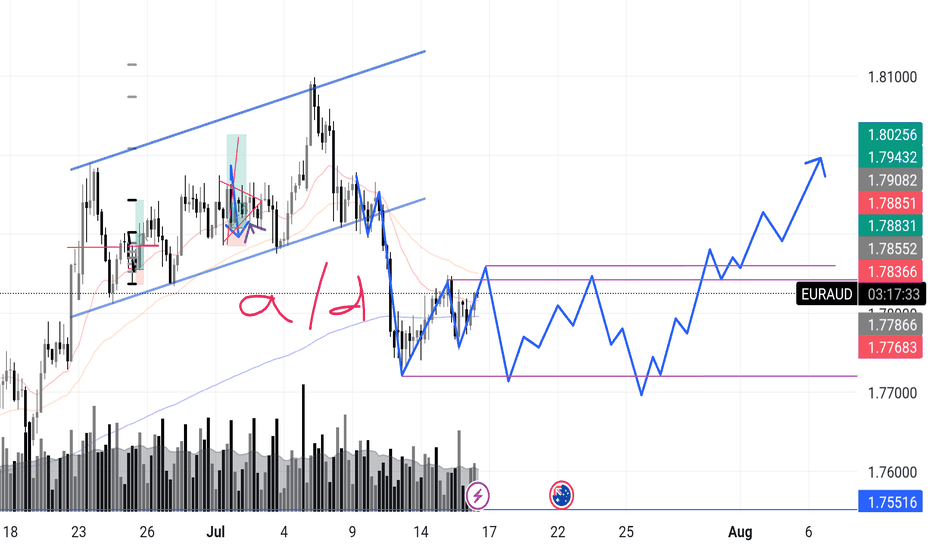

EURAUD – Incoming Upthrust? Accumulation or Distribution? Chart Context:

EURAUD recently completed a sharp markdown after a textbook rising channel break. What’s interesting now is that price has entered what looks like a potential box range between 1.7768 and 1.7885.

I'm anticipating a possible upthrust move into the 1.788x zone — and what follows will reveal the true intent.

Here’s the internal debate:

Are we looking at reaccumulation — smart money trapping shorts before driving higher in line with broader money flow?

Or is this a distribution — where the market builds a false sense of support before deeper downside?

🔍 What tips the scale for now is this:

>The overall money flow direction (via volume patterns + structure) has leaned bullish, so I’m favoring accumulation with a shakeout scenario.

Signs I’m watching:

✅ Absorption volume near the bottom of the range

✅ Higher lows inside the zone

✅ Fake breakout / upthrust into prior structure

❌ Failure to hold above 1.7855 could flip the bias short-term

📉 Expecting one more dip to test demand, followed by range tightening, and if buyers show up strong — the breakout can get explosive.

What’s your take?

Are we prepping for a markup or will this fakeout and roll over?

"I go long or short as close as I can to the danger point, and if the danger becomes real, I close out and take a small loss"

Idea on a charthe June consumer price inflation report shows a 0.3% month-on-month reading for headline inflation (0.287% to three decimal places) and a 0.2% MoM outcome for core (0.228%) versus the consensus forecast of 0.3% for both. The details show that there was some scattered evidence of early tariff impacts on some goods components – mainly fresh fruit & vegetables, household appliance, toys, clothing and sporting goods, but this was offset to a large extent by softness in the all-important shelter component, which has an approximately 40% weighting within the core CPI basket. It rose only 0.2% MoM while new vehicle

7.15 EUR/AUD LIVE TRADEHere is another Eur market that looks to be heading down. We have a 123 leg down with pullbacks creating swing highs and lows. The 4th leg has made a pullback with a strong engulfing candle rejection at support and resistance. Price action is at the 50 EMA and not above it. Volume is good, not great. Momentum is great. Price will have to take out the recent swing high for us to be wrong but watch out for those equity grabs...I hate that. We use the top/bottom of the recent swing high/low and add/deduct the current ATR to help reduce the stop loss hunters. I would have liked price action to be a bit higher into the S/R but determining S/R level is very subjective...i might see one area and you might see something different. I think it is important to use support and resistance zones, this trade might be a Head and Shoulder pattern? What do you guys think?

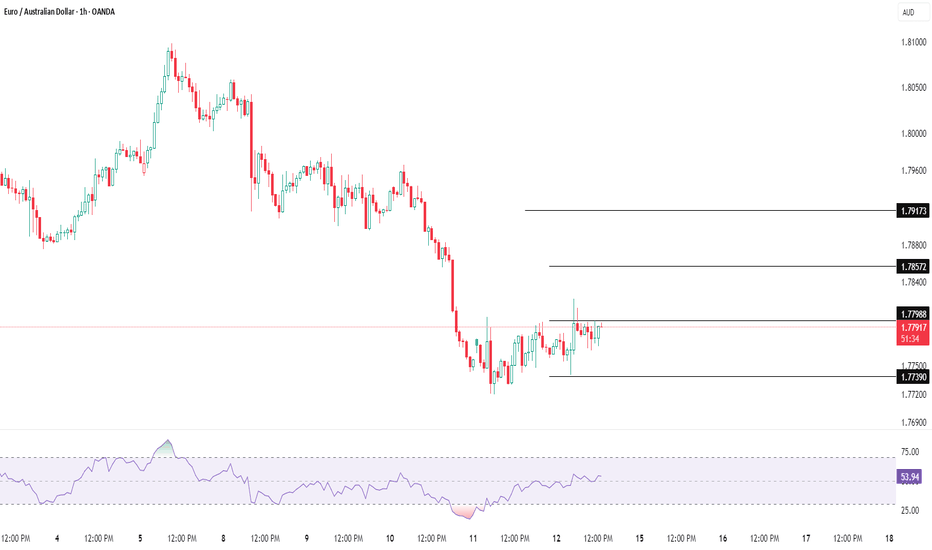

EURAUD Bullish support at 1.7720The EURAUD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 1.7720 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.7720 would confirm ongoing upside momentum, with potential targets at:

1.7920 – initial resistance

1.7970 – psychological and structural level

1.8000 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.7720 would weaken the bullish outlook and suggest deeper downside risk toward:

1.7680 – minor support

1.7630 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURAUD holds above 1.7720. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURAUDLet’s focus on the EURAUD forex pair with a more tight and cautious approach compared to other setups. ⚠️📉

If price breaks our stop-loss, I won’t be interested in looking for buy entries at lower levels anymore. It’s important to respect the trade plan and avoid chasing the market. 🚫🔄

The week ended on a bullish note and the momentum has continued upward, but I will only consider entering if I see a proper price correction that offers a better risk-to-reward opportunity. 📈⏳

Patience is key here — waiting for the right pullback to optimize the entry and manage risk effectively will increase the chances of a successful trade. 🎯💡

Remember, disciplined trading always wins in the long run! 💪📊

euraud trendline longsSeeing as euraud has well respected the trendlines recently I decided to long eur back into the upper end of previously broken trendline. I am european living in australia, I know first hand how weak aud is agains eur as my salary in australia took a massive hit against euro...

I decided to go all in on this trade with a 2% risk. RR is 1:4 for the final TP, but I do see how trade management is the key for longevity, so I still plan on taking partial profits and moving my stop back to BE as soon as price is hitting 1:1 for BE and 1:2 RR for 50% profit taking.

Let's goo

EUR/AUD BULLISH BIAS RIGHT NOW| LONG

EUR/AUD SIGNAL

Trade Direction: long

Entry Level: 1.778

Target Level: 1.804

Stop Loss: 1.760

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURUAD is in the Buy direction from the Third TouchHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURAUD MARKET OVERVIEW - WEEKLY CHART Price’s direction from the weekly perspective looks quite bullish. Technically, we saw how price broke out of the symmetrical triangle pattern and also above the upper resistance of the channel. Therefore, we’re likely to see more bullish growth developments as the upper resistance is currently being retested.

EURAUD Breakdown Incoming? Price + COT + Seasonality🧠 MACRO & INSTITUTIONAL FLOWS (COT)

EURO (EUR)

Strong increase in net long positions by non-commercials: +16,146

Commercials also added long exposure: +25,799

Bias: moderately bullish

AUSTRALIAN DOLLAR (AUD)

Non-commercials remain heavily net short (long/short ratio: 15% vs 63.6%)

Slight increase in commercial longs: +2,629

Bias: still bearish, but showing early signs of positioning exhaustion

COT Conclusion: EUR remains strong, AUD remains weak — but the recent extension calls for caution on fresh EURAUD longs.

📊 SEASONALITY (JULY)

EUR shows historically positive July performance across 2Y, 5Y, and 10Y averages

AUD also shows mild strength, but less consistent

🔎 Net differential: No strong seasonal edge on EURAUD in July

📈 RETAIL SENTIMENT

54% of retail traders are short EURAUD, 46% long

Slight contrarian bullish bias, but not extreme yet → neutral to slightly long

📉 TECHNICAL STRUCTURE – MULTI-TIMEFRAME

1. Weekly Chart

Strong bearish engulfing candle after 4 weeks of upside

RSI dropped below 50 → clear momentum shift

1.7960–1.8100 is now a liquidity zone that’s been tapped

2. Daily Chart

Confirmed break of the ascending channel formed since May

Price reacted from demand zone around 1.7460–1.7720, signaling potential pullback

Watch for rejection around 1.7910 (50% body of the weekly engulfing candle)

3. Entry Setup

Key area for short entries: 1.7910–1.7940

This zone aligns with:

✅ Former support now turned resistance

✅ Inside a valid bearish order block

✅ Ideal retracement level (50% engulfing body)

🎯 OPERATIONAL CONCLUSION

While the macro context still favors a stronger EUR against AUD, price action tells another story.

The weekly engulfing candle is a strong technical reversal signal, and the daily structure confirms the break.

→ Shorting the pullback into 1.7910–1.7940 could offer an excellent R/R trade setup.

Bias: Short-term bearish – Targeting 1.7700, 1.7550, and potentially 1.7315

Invalidation: Daily close above 1.8040

EURAUD The current head of the European Central Bank (ECB) is Christine Lagarde. She has been serving as ECB President since November 2019, Lagarde has emphasized her commitment to steering the ECB through complex economic challenges, including inflation control and adapting monetary policy to evolving global conditions.

the current key interest rates set by the European Central Bank (ECB) are as follows:

Deposit Facility Rate: 2.00%

Main Refinancing Operations Rate: 2.15%

Marginal Lending Facility Rate: 2.40%

These rates were last adjusted on June 11, 2025, when the ECB lowered the key interest rates by 25 basis points (0.25%) to reflect the updated inflation outlook and economic conditions.

Additional Context:

Inflation in the Eurozone is currently around the ECB’s medium-term target of 2%.

The ECB’s Governing Council decided on the rate cut based on a downward revision of inflation projections for 2025 and 2026, partly due to lower energy prices and a stronger euro.

The next ECB interest rate decision is scheduled for July 24, 2025.

ECB Executive Board member Isabel Schnabel recently indicated that the bar for further rate cuts remains “very high” as the economy is holding up well.

Summary Table of ECB Key Rates (as of June 11, 2025)

Rate Type Interest Rate (%)

Deposit Facility Rate 2.00

Main Refinancing Rate 2.15

Marginal Lending Rate 2.40

the Reserve Bank of Australia (RBA) cash rate remains at 3.85%. This decision was made at the RBA’s July 8, 2025 meeting, where the board chose to hold rates steady despite widespread market expectations of a cut to 3.6%

Key Points:

The RBA has signaled that an easing cycle is likely coming, but it wants to wait for the release of the full quarterly inflation data at the end of July to confirm that inflation is on track to decline sustainably toward the target range (2–3%).

Inflation has moderated, with trimmed mean inflation at 2.4% in May, within the target band.

The board was divided: six members voted to hold rates, while three favored a cut.

Market expectations now price in about an 85% chance of a 25 basis point cut to 3.60% at the next meeting on August 12, 2025.

RBA Governor Michele Bullock emphasized that the bank is reacting to domestic inflation and employment data and is prepared to adjust policy as needed, but is not holding rates high “just in case.”

Summary Table

Date Cash Rate (%) Board Decision Next Meeting Expectation

July 8, 2025 3.85 Hold rates steady Likely 0.25% cut at August 12, 2025

Additional Context

The RBA’s cautious approach reflects the need to confirm inflation trends before easing.

The decision surprised markets that had anticipated an immediate cut due to slowing consumer spending and inflation within the target range.

Governor Bullock acknowledged the challenges for borrowers but noted that housing prices, not just interest rates, affect affordability.

EURAUD TRADE MATHE

EU10Y=2.686%

ECB RATE =2.0%

AU10Y= 4.362%

RBA RATE =3.85%

INTEREST RATE DIFFERENTIAL= EUR-AUD=2.0-3.85=-1.85% EURO BASE CURRENCY AND AUD QUOTE. FAVOUR AUD CARRY TRADE.THE TARRIF HAMMER ,AUDSTRALIA AND CHINA TRADE REMAINS A KEY TOOL FOR AUD STRENGTH.

BOND YIELD DIFFERENTIAL= EURO-AUD =2.686%-4.362%=-1.676 FAVOUR AUD .

BUT EURO ZONE ECONOMIC OUTLOOK WILL OFFSET YIELD AND BOND ADVANTAGE AS CHINA AUSTRALIA COMMODITIES MARKET IS DEPENDING MORE ON CHINA ,SO GLOBAL RESTRICTION ON EXPORT WILL GIVE EURAUD LONG POSITION.

#EURAUD

EURAUD: Expecting Bullish Movement! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current EURAUD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️