EURCAD: Short Trade Explained

EURCAD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short EURCAD

Entry - 1.5807

Sl - 1.5889

Tp - 1.5626

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD trade ideas

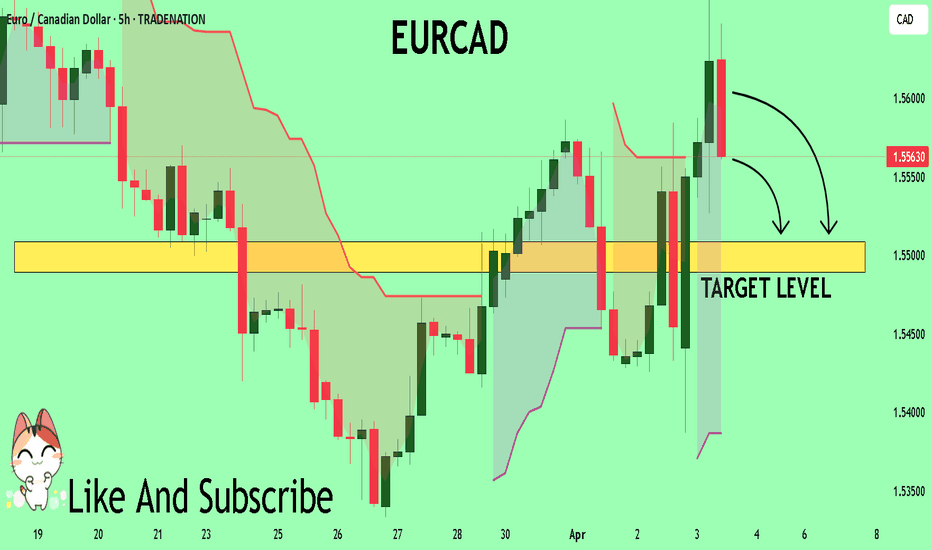

EUR/CAD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR-CAD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 1.562 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the EUR/CAD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

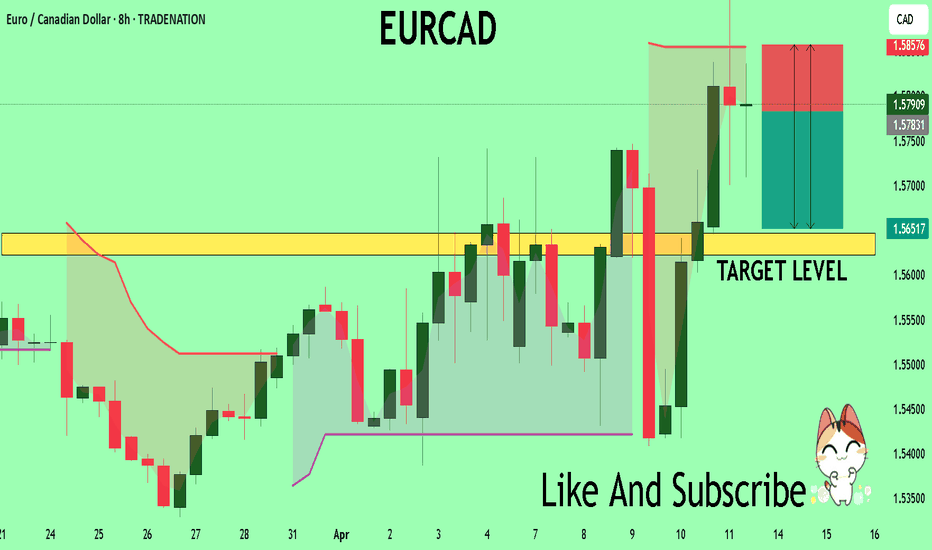

EURCAD Short 4/15/2025EUR/CAD Short Setup (Midweek Reversal Play)

Currently holding a short position on EUR/CAD for the past two days. Price has been hovering around the entry point, showing signs of accumulation and low momentum — likely building volume for a directional move.

Daily Chart: Price is rejecting a significant resistance level, with today’s candle potentially forming a doji. If this confirms, we could see an evening star setup into tomorrow, signaling a strong midweek reversal.

4H Chart: Multiple upper wicks — at least 7 or 8 — show repeated rejection and failure to break higher, indicating strong selling pressure just above our level.

1H Chart: Less conclusive, but not contradicting the higher timeframe bias.

No major EUR news expected this week, which leaves room for technicals to take the lead. Targeting a 1:4 to 1:5 risk-to-reward move, aiming for a sharp drop into recent lows or the next significant demand zone.

EURCAD The Target Is DOWN! SELL!

My dear followers,

I analysed this chart on EURCAD and concluded the following:

The market is trading on 1.5780 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.5647

Safe Stop Loss - 1.5857

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR-CAD Local Long! Buy!

Hello,Traders!

EUR-CAD has made a retest

Of the horizontal support

Level of 1.5720 and we are

Already seeing a bullish rebound

Which combined with the fact

That the pair is trading in a strong

Uptrend makes us locally

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD: Short Signal Explained

EURCAD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell EURCAD

Entry Level - 1.5767

Sl - 1.5868

Tp - 1.5567

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD GONNA BE UP This week or it takes a few weeks the Eurcad gonna fly to hit the green line IF the blue line had been broken by 4H breaking candle because the market first is in BOS structure and second the blue is the 512 astronomic line cycle which is so strong reversal line as we see the market hit it before and reversed .

EUR/CAD 1H Analysis – April 14, 2025📊 Current Price: 1.57582

🕐 Timeframe: 1 Hour

⚖️ Bias: Bearish (Short Setup Active)

🔍 Technical Breakdown:

Resistance Zone: 1.5783 - 1.5800

Price has tested this zone multiple times but failed to break above convincingly—forming a liquidity grab and now rejecting.

Entry: ~1.5758 (current market price)

Trade seems to have already triggered near this level.

Stop Loss: ~1.5840

Well above the supply zone, protecting against stop hunts.

Take Profit Targets:

TP1: 1.5570 (key support area / FVG close)

TP2: 1.5475 (strong demand zone)

Risk-Reward Ratio (RRR): Approx. 3:1 (visually based on RR box)

EUR_CAD LOCAL REBOUND COMING|LONG|

✅EUR_CAD is trading in

A strong uptrend and the pair

Made a local correction on Friday

To retest the local horizontal

Support level of 1.5700 so

A bullish continuation is to

Be expected but a small

Lot size use is advised

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

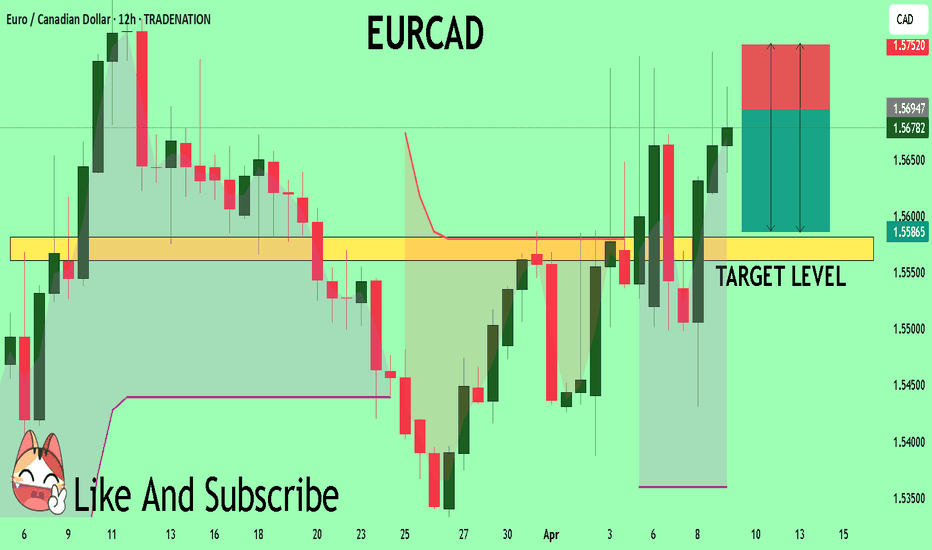

EUR/CAD Daily AnalysisFriday saw price attempt to break the 1.5800 zone for a second since March.

However with a failure to break and close above, a break below the days low of 1.5640 could see price continue lower towards the most recent support at 1.5400.

This is just an idea of what may happen. You should always trade with a well tested and profitable trading strategy using good risk management.

EURCAD: Short Trading Opportunity

EURCAD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURCAD

Entry Point - 1.5748

Stop Loss - 1.5828

Take Profit - 1.5595

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD A Fall Expected! SELL!

My dear subscribers,

This is my opinion on the EURCAD next move:

The instrument tests an important psychological level 1.5572

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.5508

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD Breakdown Watch–Bearish Divergence + Fundamental WeaknessEURCAD rallied into a key turncoat zone (former resistance → support)

Currently consolidating within this zone and showing clear RSI bearish divergence on both 1H and 4H timeframes.

Price is losing momentum while macro and seasonal factors align for a short bias.

🔍 Macro & Seasonality Confluence:

EUR Fundamentals: Worsening LEI, Endogenous & Exogenous scores

CAD Stability: Mildly bearish, but stronger than EUR

Seasonal Bias: EURCAD turns bearish after April 15

EURCAD A Fall Expected! SELL!

My dear subscribers,

EURCAD looks like it will make a good move, and here are the details:

The market is trading on 1.5694 pivot level.

Bias - Bearish

My Stop Loss - 1.5752

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.5581

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD: Bullish Move From Support Confirmed 🇪🇺🇨🇦

EURCAD may continue growing after a strong bullish

reaction to a key daily support.

The market was accumulating for some time on that

within the intraday horizontal range.

Its resistance was broken with both 4H/1H candles.

Next goal - 1.5592

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD Resistance , All eyes on SellingHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts