EURCAD trade ideas

EURCAD MAY RETEST ALL-TIME-HIGH AGAIN If you look at this very closely, you would see that the monthly candle of June 2025 already closed above June 2020 after 5 years exactly. That was very instructive. However, there may be opportunities for sell as counter trade as we are currently seeing some rejections that can be seen more clearly in lower timeframes.

Nevertheless, I am ultimately bullish and would be looking to buy to that 1.75 zone in the near-future, depending on the price action I am seeing on the daily.

Let us see if daily is in perfect alignment with the monthly.

Trade with caution!!!!

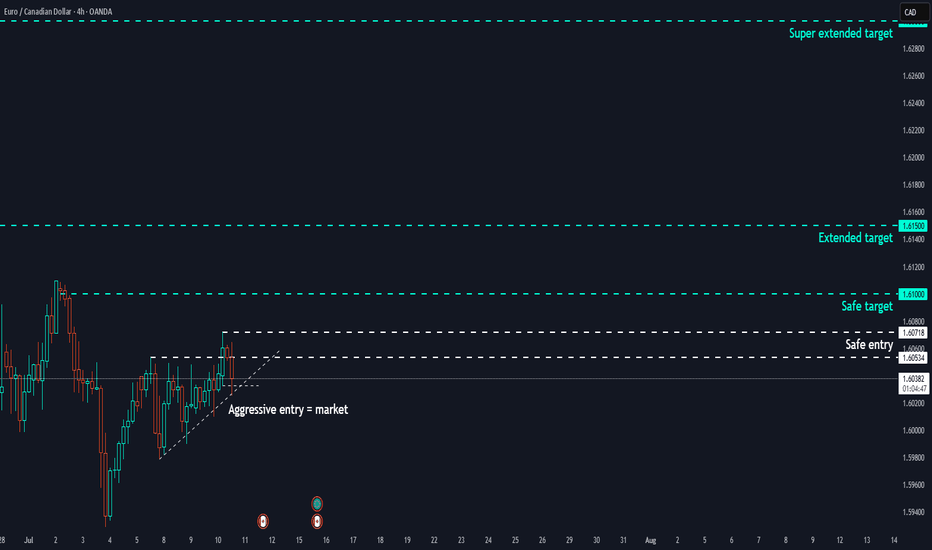

EURCAD - Long Bias explanation and Entry/SL/TP ideasThe main reasons this seems like a very good opportunity to me are :

Trend : EURCAD is in a strong uptrend at the moment

Retail : Majority have a BEARISH sentiment on this pair

Institutions : More holdings in EUR than CAD

Structures : Equal highs up above that MAY act as a magnet

Price action : Recent breakout of a consolidation and resistance shelf

Targets : levels at round numbers

Stops : Many options to place stops below

Entries : Many options in terms of entry aswell

This is primarily for me as a reference in the future.

For educational purposes only

EURCAD BUY TRADE PLAN ✅ EURCAD TRADE PLAN

📅 **Date**: July 10, 2025

🕐 **Pair**: EUR/CAD

---

### 1️⃣ STRUCTURAL ALIGNMENT

| TF | Structure Status | Key Levels | Market Bias |

| -- | ------------------- | ------------------------------ | ----------------- |

| D1 | Bullish Trend | HH: 1.6108 / HL: 1.5910 | ✅ Bullish |

| H4 | Trend Resumption | Range Break > 1.6060 Confirmed | ✅ Bullish |

| H1 | Micro Bullish Shift | Price > 1.6040 key minor HL | ✅ Bullish (Ready) |

🧠 **Comment**: Market holding higher low structure across all TFs. Compression breakout likely underway.

---

### 2️⃣ ENTRY TRIGGER ZONE

| Parameter | Level / Zone |

| --------------- | ---------------------------------- |

| 🎯 ENTRY | **1.6025–1.6038** (retest pocket) |

| ⛔ STOP LOSS | **1.5975** (below H1 invalidation) |

| 🎯 TP1 | **1.6100** (prev swing high) |

| 🎯 TP2 | **1.6170** (measured extension) |

| 🧠 Optional TP3 | **1.6235** (macro fib proj) |

📌 **Only enter on valid wick or LTF confirmation candle inside zone.**

📉 Avoid mid-candle chases or breakout impulse entries. Let it *pull back*.

---

### 3️⃣ RISK MODEL INTEGRITY

| Metric | Value |

| ------------------- | -------------------------------- |

| SL Distance | ≈ 50-60 pips max |

| Minimum RRR | **1:2.5 to 1:3.5** |

| Break-even Protocol | Lock BE after 1H close > 1.6080 |

| Trade Invalidation | 1H Close < 1.5975 |

⚠️ Risk size calibrated to avoid breach of core portfolio risk ceiling.

---

### 4️⃣ MACRO–FUNDAMENTAL ALIGNMENT

| Macro Driver | Current Stance | Effect |

| ----------------------- | ------------------------------------------------ | ------------------- |

| 🇨🇦 CAD | Weak (Oil pressure + BOC dovish bias) | ✅ CAD Soft |

| 🇪🇺 EUR | Strong (Post-NFP euro demand + ECB hawkish tone) | ✅ EUR Strong |

| Intermarket Correlation | Oil ↓ → CAD ↓ | ✅ Pro-EURCAD |

| Macro Bias | **EUR Strength > CAD Weakness** | ✅ Bullish Alignment |

🧠 No conflict with structural plan = ✅ Macro Confirmed

---

### 5️⃣ EXECUTION PROTOCOL

* 💎 *Type*: **Limit Order** ONLY — no market chasing

* 🎯 Wait for rejection or bullish engulfing on 15M or 30M inside entry zone

* 🔒 Trail after price > 1.6080 with hourly close

* ❌ Do not trade this setup if **1.5980 is breached intraday**

---

🚫 NOT INVESTMENT ADVICE – For institutional execution only under your risk model.

EURCAD Wave Analysis – 4 July 2025- EURCAD reversed from support level 1.5950

- Likely to rise to resistance level 1.6100

EURCAD currency pair recently reversed up from the strong support level 1.5950 (former double top from April, acting as the support after it was broken).

The upward reversal from the support level 1.5950 continues the active short-term impulse wave 5 of the intermediate impulse wave (3) from last November.

Given the strong daily uptrend and the strongly bullish euro sentiment seen today, EURCAD currency pair can be expected to rise to the next resistance level 1.6100.

EUR/CAD: Wave 5 Trade SetupEUR/CAD is presenting a compelling long setup as what appears to be a five-wave impulse from the June lows looks ready for its final leg higher. The structure shows a classic wave 4 correction that has found support right where Elliott Wave theory suggests it should—setting up a potential wave 5 that could deliver solid risk-to-reward for patient traders.

What the Current Structure Shows (Primary Scenario)

Clean Five-Wave Impulse in Progress: The move up from the June 2025 lows has unfolded in a textbook impulsive pattern, with waves 1, 2, and 3 clearly defined and wave 4 appearing to have completed its correction.

Wave 4 Finds Support: The correction has retraced to a level that respects the typical boundaries for a fourth wave—not too deep to overlap with wave 1, but enough to provide a healthy pullback before the final push.

Wave 5 Setup: With wave 4 likely complete, the structure points to wave 5 beginning, targeting the equality relationship with wave 1 at 1.6170.

Why the Count Is Labeled This Way

The initial surge from the lows shows strong, impulsive characteristics with clear five-wave subdivisions.

Wave 3 extended beyond the typical 1.618 relationship with wave 1, which is common in strong trends.

The current level, at around 1.5927, represents a logical support zone where wave 4 should find its footing.

Trade Setup: Riding the Final Wave

Entry: Current levels, with wave 4 appearing to have bottomed.

Stop Loss: Below 1.5952—if price breaks this level, the wave count is invalidated and suggests wave 4 may be more complex or the entire structure needs reassessment.

Target: 1.6170, where wave 5 achieves equality with wave 1. This is a classic Elliott Wave projection when wave 3 has been the extended wave in the sequence.

What to Watch Next (Confirmation or Invalidation)

Confirmation: A break of the B wave termination point at 160.50 would be confirmation that wave 5 may have started.

Invalidation: A break below 1.5928 would suggest wave 4 is not complete and may be forming a more complex correction.

After Wave 5: Once the target is reached, expect a significant correction as the entire five-wave sequence from the June lows completes.

Alternate Count

If the current support fails, wave 4 could extend into a more complex correction—possibly a triangle or double zigzag—before wave 5 begins. This would delay but not necessarily invalidate the bullish scenario.

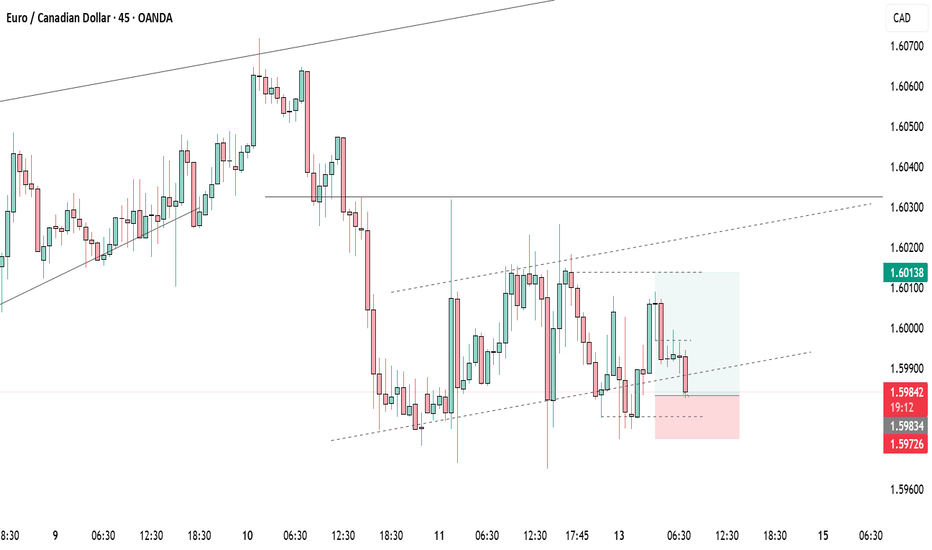

EURCAD Potential Short SetupsEURCAD dropped below 1.59988 with bears driving it towards 1.59292. If EURCAD holds below our resistance zone it would be ideal to have a bearish bias.

Sell Zone: 1.59988 - 1.60120

Target Levels: 1.59615 - 1.59292

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

EURCAD Wave Analysis – 3 July 2025- EURCAD reversed from resistance zone

- Likely to fall to support level 1.5800

EURCAD currency pair recently reversed down from the major resistance zone located between the strong resistance level 1.6150 (former yearly high from 2018) and the resistance level 1.5965 (former Double Top from 2020).

The downward reversal from this resistance zone stopped the previous impulse waves 5 and (3).

Given the strength of the resistance level 1.6150 and the bearish divergence on the weekly Stochastic indicator, EURCAD currency pair can be expected to fall further to the next support level 1.5800.

EUR/CAD 4H Technical Analysis – Trend Continuation Signal ForminIn today’s 4-hour analysis of the EUR/CAD currency pair, we uncover a classic trend continuation setup supported by both price structure and oscillator signals. This kind of setup is a favorite among professional traders because it combines momentum, market psychology, and technical precision.

If you’re a trader looking for clarity during pullbacks, this strategy offers a high-probability entry based on simple but effective tools: EMA crossover, Stochastic RSI, and clean candlestick behavior.

---

Market Structure: A Textbook Uptrend

The EUR/CAD pair has shown exceptional strength over the last few weeks. The current 4-hour chart reveals a clear higher high, higher low structure, with price comfortably trading above both the 50 EMA and 200 EMA.

This isn’t just noise. It’s a strong institutional trend fueled by euro strength and CAD weakness — possibly linked to recent oil weakness or shifts in eurozone inflation sentiment.

The market is currently undergoing a natural pullback — and this pullback may be offering savvy traders a prime entry opportunity.

---

Indicator Confirmation: Stochastic RSI Resetting

Let’s dig into the Stochastic RSI, set at (3, 3, 14, 14), a powerful tool to detect momentum reversals within trends.

* The oscillator has dipped into oversold territory, with values at 0.44 and 0.29.

* In the context of a strong uptrend, this suggests a healthy pause, not a reversal — meaning the market is likely reloading before its next upward move.

* Traders often refer to this behavior as a “reset within a trend” — a critical moment when fear shakes out weak hands and invites disciplined entries.

---

Dynamic Support Holding Firm

The 50 EMA, currently near 1.59792, is acting as dynamic support, catching price dips and rejecting strong bearish moves. Below that, the 200 EMA sits at 1.57965, further confirming a deep support zone.

This kind of dual-EMA structure is a hallmark of trend strength. Price sitting above both with clean spacing means the trend is still maturing and has more room to go.

---

Trade Setup: Buying the Pullback

If you’re planning an entry, here’s a simple, structured idea:

Entry Zone: Between 1.59800 and 1.60000, once a bullish candlestick confirms support (look for pin bars or engulfing candles).

Stop Loss: Below 1.59500 (under swing low and below the 50 EMA to allow breathing space).

Take Profit Levels:

* TP1: 1.61000 (recent swing high)

* TP2: 1.61800 (next Fibonacci extension and psychological round number)

This trade idea supports a 1:2 or 1:3 reward-to-risk ratio, depending on your exit management — ideal for both intraday and short-swing traders.

---

Why This Trade Matters

Many traders struggle with knowing when to enter a trend after they “miss the move.” This is where understanding pullbacks becomes a skill edge.

Instead of chasing highs, this strategy teaches patience — wait for the crowd to panic on a dip, then ride the institutional wave.

This setup works not because of magic indicators, but because it respects market rhythm and trend psychology.

You’re not fighting the market. You’re listening to it.

---

Educational Takeaway

If you’re learning how to trade trends, study this EUR/CAD 4H chart. Here’s what to take away:

* Let price lead, not indicators.

* Look for alignment between EMAs and oscillator resets.

* Enter at key zones — not at the top, not too early.

* Be patient. The best setups are the ones that make sense even to the eye.

Trading is not about being perfect. It’s about consistency, discipline, and only acting when the odds are in your favor.

---

Risk Disclaimer

This analysis is shared for educational purposes only and does not constitute financial advice. Always use risk management, protect your capital, and never trade with money you cannot afford to lose.

Past performance does not guarantee future results.

---

Final Thoughts

The EUR/CAD chart is offering more than a setup — it’s offering a lesson in trading discipline.

With the right entry signal near support and the current structure holding, this pair has the potential to deliver a clean continuation toward 1.6100 and possibly beyond.

Watch for confirmation. Respect your plan. Trade smart.

---

Have you traded EUR/CAD recently? Do you see the same opportunity forming?

Drop your thoughts in the comments — let’s learn together.

EURCAD: Expecting Bearish Continuation! Here is Why:

The recent price action on the EURCAD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

The Top 3 Candlestick Patterns In Buying This Forex PairThis will be the first time of me trading a breakout strategy.

This breakout pattern happened on the week.

Looking back within this 4 hour time frame.What do you see?

-Doji

-Hanging Man

-Bullish Engulfing

These 3 patterns are working together..How?? let me explain:

The bullish engulfing is showing the surpport level of this price action.Then comes in the hanging man.

The hanging man shows you the resistance level.

Its very clear to see on this chart that the price

has broken resistance and this is a very clear breakout.

That is what my mentor Tim Sykes usually says.Because he loves clear breakouts.

This 4 hour time frame is the key to entry

positions in short term trading.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please learn risk management

and profit taking strategies.Also feel free to use a simulation trading account before you trade with real money.

Also do not use margin.

EUR/CAD Raid Alert: Last Chance to Loot This Bullish Breakout!🏴☠️ EUR/CAD LOOT ALERT: Can We Steal 100 Pips Before the Trap Springs? (Thief Trading Blueprint)

🌟 Hola! Bonjour! Ciao! Hallo! Marhaba! 🌟

Attention Forex Bandits & Loonie Raiders! 💶🦫💰

🔥 Thief Trading Intel: We're targeting EUR/CAD for a MA breakout heist! Long entry only - eyeing that 1.57200 breakout level. High-risk MA Zone ahead: overbought, consolidating, perfect for our ambush.

"Take your pips and vanish - this steal's on the house!" 💨💵

🚪 ENTRY: The Trap is Set!

📈 "Wait for MA breakout at 1.57200 - then STRIKE!"

Option 1: Buy Stop above MA (breakout confirmation)

Option 2: Buy Limit at swing levels (15-30 min TF)

📌 Pro Thief Move: SET THOSE ALERTS!

🛑 STOP LOSS: Escape Plan

🔊 "Listen up, rookies!" 🗣️

Breakout trades? NO SL until after confirmation!

Rebels: Place wherever... but sleep with one eye open! 👁️

📍 Smart Crew SL: Nearest swing low (1H TF)

🎯 TARGET: Loot & Scoot!

🎯 1.58200 (100 pips of pure profit!)

⚡ SCALPERS' QUICK HIT

👀 Long only!

Deep pockets? Raid now

Light wallet? Join swing heist

Trailing SL = Your Getaway Car! 🚗💨

📢 WHY THIS HEIST?

"Euro vs Loonie" showing strength! Watch for:

COT data & Macro trends

Intermarket analysis

Sentiment shifts

🔗 Full dossier? Bio0 links below! 👉🏻☝🏻👉🏻☝🏻

⚠️ WARNING: News = Police Raid! 📰🚨

CAD news moves fast! Protect your stash:

❌ No new trades during news

🔒 Trailing stops = Handcuff-proof profits

💖 SUPPORT THE CREW!

💥 SMASH THAT BOOST BUTTON! 💥

More boosts = bigger future scores!

Stronger crew = more pips for all!

Next currency heist coming soon... 💶🔫

EUR/CAD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

We are now examining the EUR/CAD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 1.588 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD My Opinion! SELL!

My dear friends,

Please, find my technical outlook for EURCAD below:

The instrument tests an important psychological level 1.6006

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.5978

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

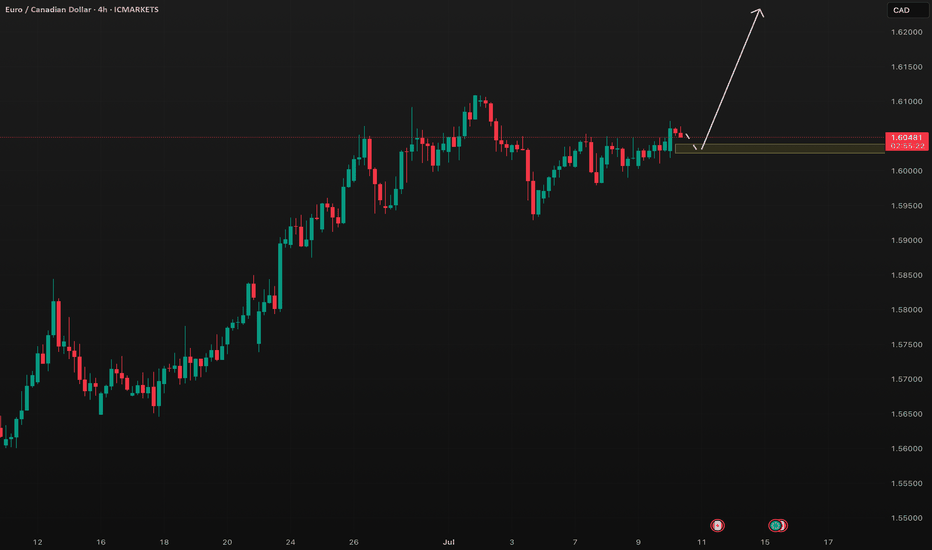

EURCAD: The Buy Might Be Hidden in the GapEURCAD just cleared out some liquidity at the highs and is now pulling back into an interesting zone. The bullish structure is still intact, and price has left behind a clean fair value gap right above the previous day’s low.

This zone is where I’m watching closely.

If price taps into that FVG and gives a strong reaction, we could see another leg to the upside. But no need to jump in blindly. Let the 15-minute timeframe show a change of character first.

If that shift happens, I’ll be looking for entries back toward the highs.

Let price come to you. Let structure guide you.

EURCAD: Pullback Trade From Support 🇪🇺🇨🇦

EURCAD is going to bounce from a recently broken

key daily horizontal resistance that turned into support after a violation.

The price violated a neckline of a double bottom pattern with

a bullish imbalance candle on an hourly time frame as a confirmation.

Goal - 1.5998

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CAD Local Long! Buy!

Hello,Traders!

EUR-CAD is trading in an

Uptrend and the pair is

About to retest a horizontal

Support of 1.5933 and as

We are locally bullish biased

We will be expecting a

Local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.