EURCHF trade ideas

EUR/CHF Daily Chart📊 EUR/CHF Daily Chart

🛠 Tools Used:🔹 Horizontal Support & Resistance – key resistance at 0.95866 and intermediate resistance at 0.94541.🔹 Range Zone Highlight – marked in purple to visualize consolidation area.🔹 Price Action Analysis – identifying breakout/rejection potential.

📊 Market Snapshot:EUR/CHF is trading at 0.94077, recovering strongly from the lower end of the consolidation range. The pair has been stuck in a sideways market between 0.92200 (support) and 0.94541 (resistance) for several months.

⚠️ Key Zones to Watch:

Immediate Resistance: 0.94541 🛪

Major Resistance: 0.95866 🛪

Support: 0.92200 🕺

💡 Trade Idea:👉 Bullish scenario: A breakout above 0.94541 could open the door for a rally towards 0.95866.👉 Bearish scenario: Failure to break 0.94541 may push the price back towards 0.93000 and possibly retest 0.92200.

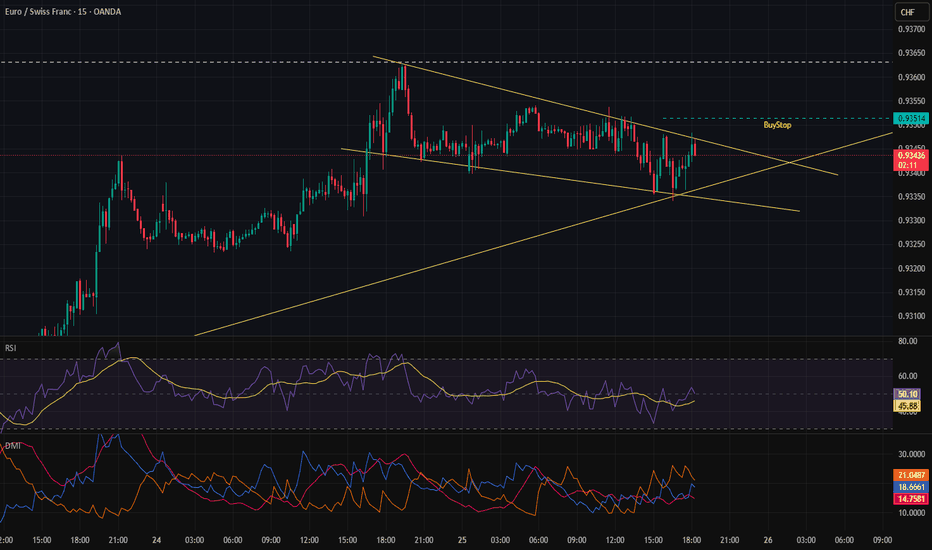

EURCHF – Pullback & New SetupIn my previous analysis (tagged below), I entered a short position. Price reached Reward 2, then pulled back and took me out at breakeven.

This is where you see the power of partial exit — it protects you from losses and keeps your risk low.

With this approach, I rarely see a 5% drawdown, but of course, nothing is guaranteed in trading.

The market broke my level strongly, and that’s okay. We don’t fight the market — we follow it.

Now I’m waiting for a pullback to the broken level, and I’ve also identified another nearby key zone.

If I get a valid signal at either level, I’ll enter a buy trade.

🧠 Remember: Trade with the market, not against it.

Drop the ego, drop the bias — let price lead.

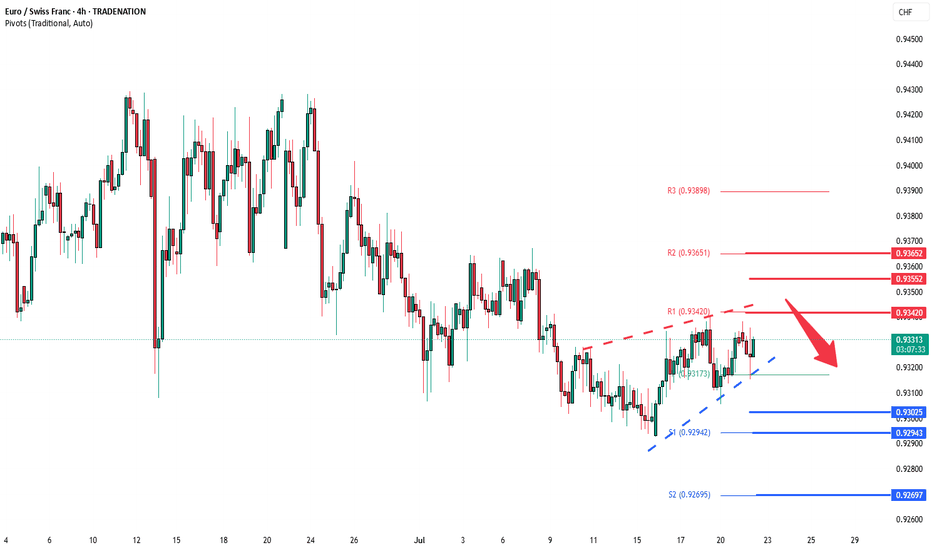

EURCHF oversold bounce backs capped at 0.9364The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 0.9364, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 0.9364 could confirm the resumption of the downtrend, targeting the next support levels at 0.9315, followed by 0.9300 and 0.9270 over a longer timeframe.

Conversely, a decisive breakout and daily close above 0.9364 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 0.9380, then 0.9390.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 0.9364. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURCHF: Short Signal Explained

EURCHF

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell EURCHF

Entry Level - 0.9350

Sl - 0.9361

Tp - 0.9328

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

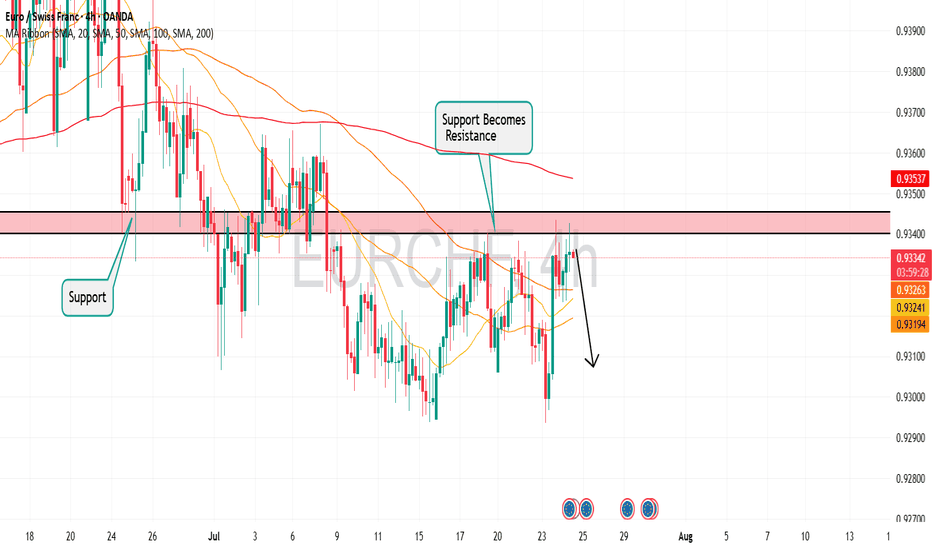

EURCHF bearish continuation The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 0.9340, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 0.9340 could confirm the resumption of the downtrend, targeting the next support levels at 0.9300, followed by 0.9290 and 0.9270 over a longer timeframe.

Conversely, a decisive breakout and daily close above 0.9340 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 0.9355, then 0.9365.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 0.9340. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURCHF Is in The Selling Direction Hello Traders

In This Chart EURCHF HOURLY Forex Forecast By FOREX PLANET

today EURCHF analysis 👆

🟢This Chart includes_ (EURCHF market update)

🟢What is The Next Opportunity on EURCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

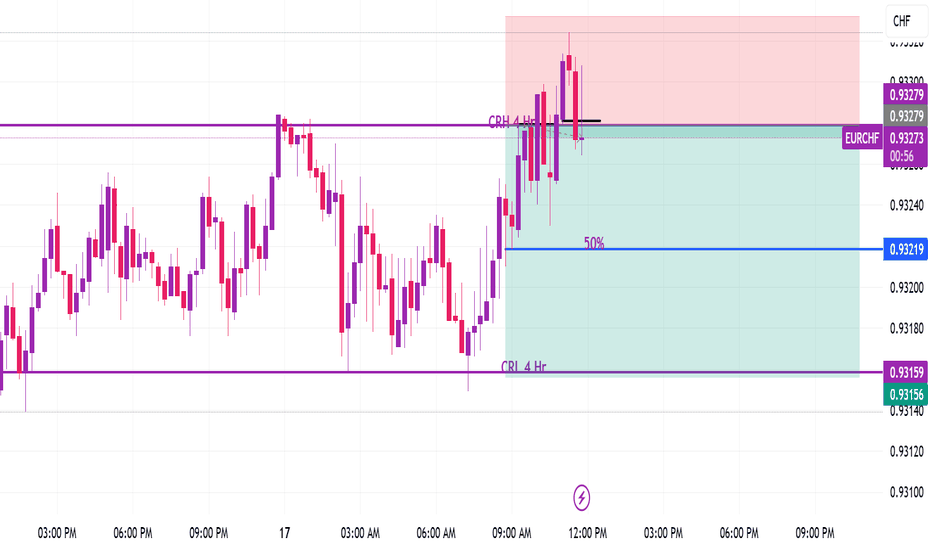

EURCHF Trading Opportunity! SELL!

My dear subscribers,

EURCHF looks like it will make a good move, and here are the details:

The market is trading on 0.9335 pivot level.

Bias - Bearish

My Stop Loss - 0.9341

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.9324

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

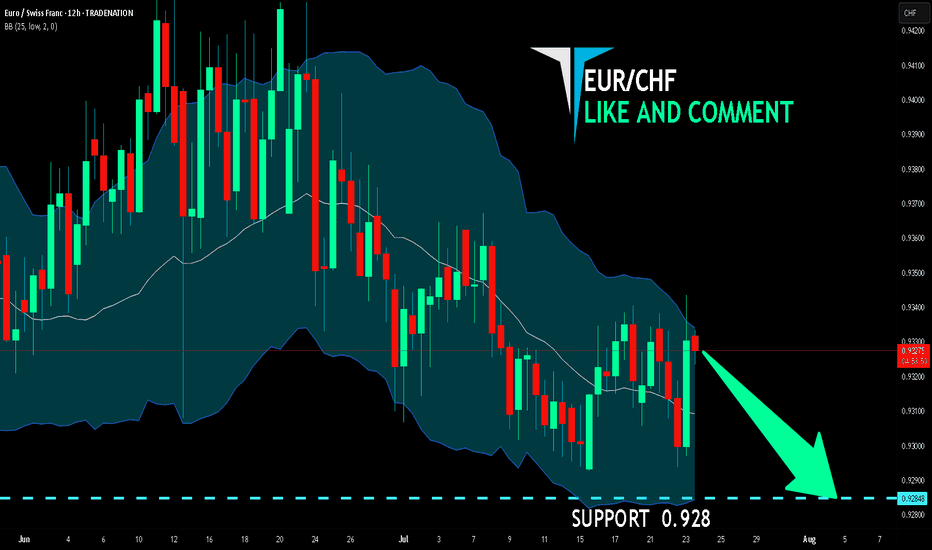

EUR/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR/CHF is making a bullish rebound on the 12H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.928 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

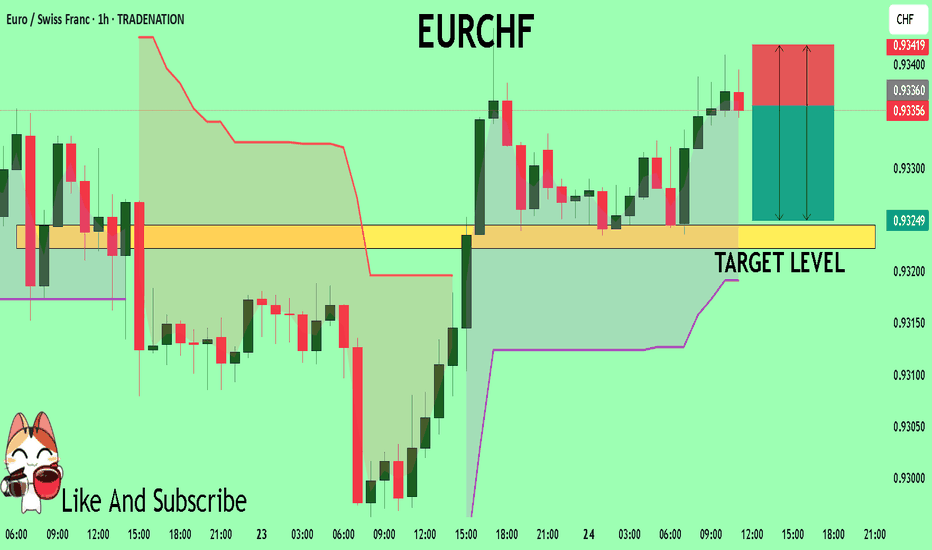

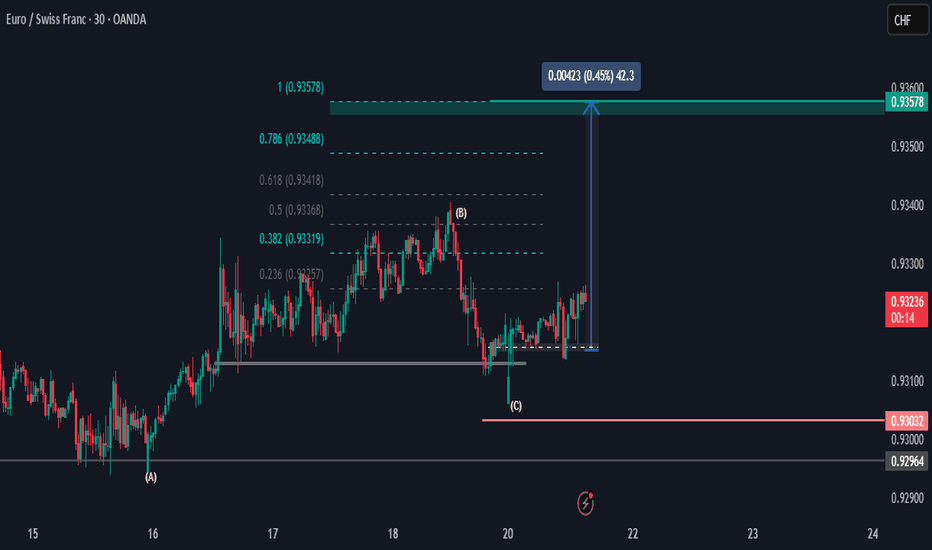

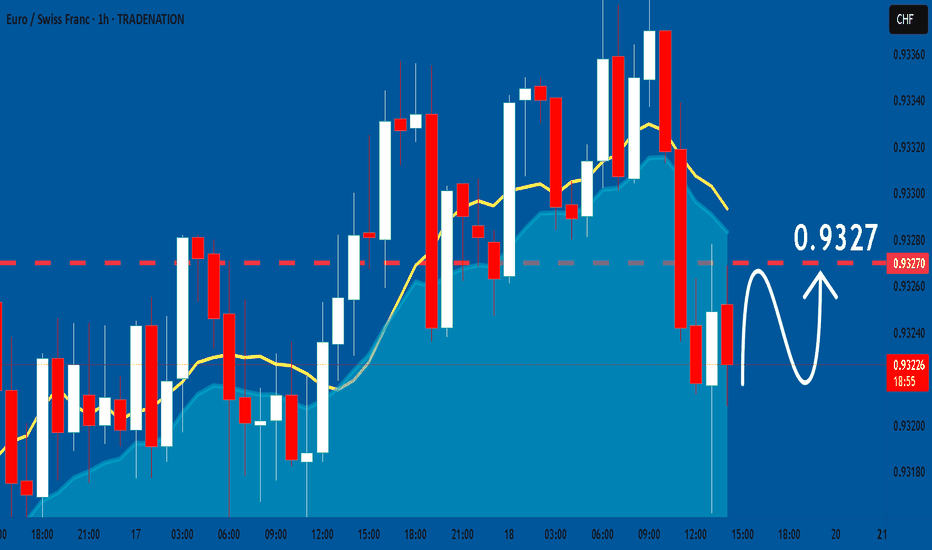

EURCHF Price Is looking UpHi there,

The EURCHF looks bearish at the M30, with the first resistance target potentially being 0.93319. I anticipate for the price to reach above area (B) into the 0.93419 price area for a potential push up to the 0.93488 area, and if momentum is strong in the higher time frames, then the bias is set for 0.93578.

Happy Trading,

K.

Not trading advice.

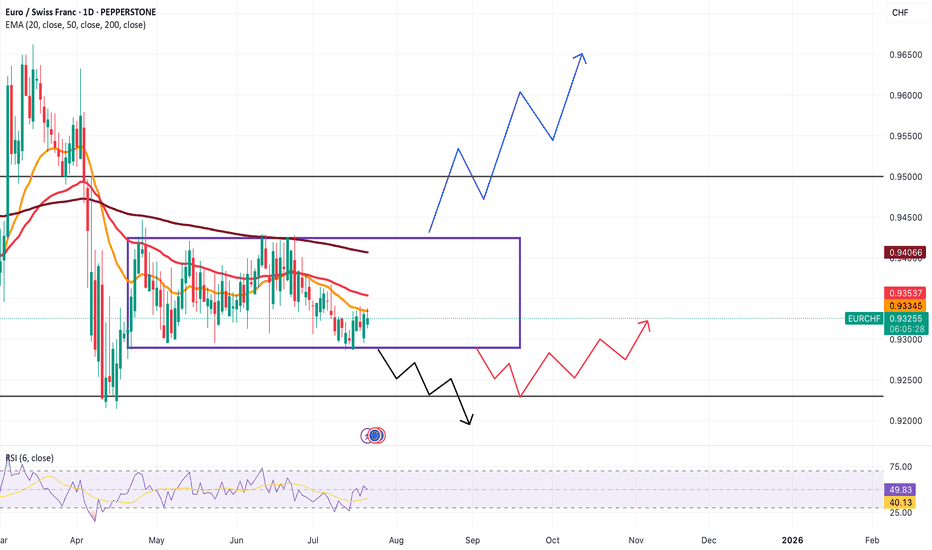

EURCHF has been a Terrible Market to Trade inEURCHF on the 1D has been consolidating for a few months now. Box has been drawn to indicate that.

It's been all noise and I dont think it would be wise to trade in a choppy market.

I'm wondering if anyone is trading EURCHF and has found a profitable way to trade it in this choppy market. Open to hearing any strategies being used in this market.

Key level of support is present at 0.92300. If price breaks the consolidation zone, I'll look to sell till 0.92300.

If the price moves up and above the consolidation zone, we could push till 0.95000

Would be setting alerts for these key levels but may not look to trade at the moment.

Open to hearing any profitable strategies being used in these market conditions.

EURCHF oversold bounce backs capped at 0.9340The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 0.9340, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 0.9340 could confirm the resumption of the downtrend, targeting the next support levels at 0.9300, followed by 0.9290 and 0.9270 over a longer timeframe.

Conversely, a decisive breakout and daily close above 0.9340 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 0.9355, then 0.9365.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 0.9340. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

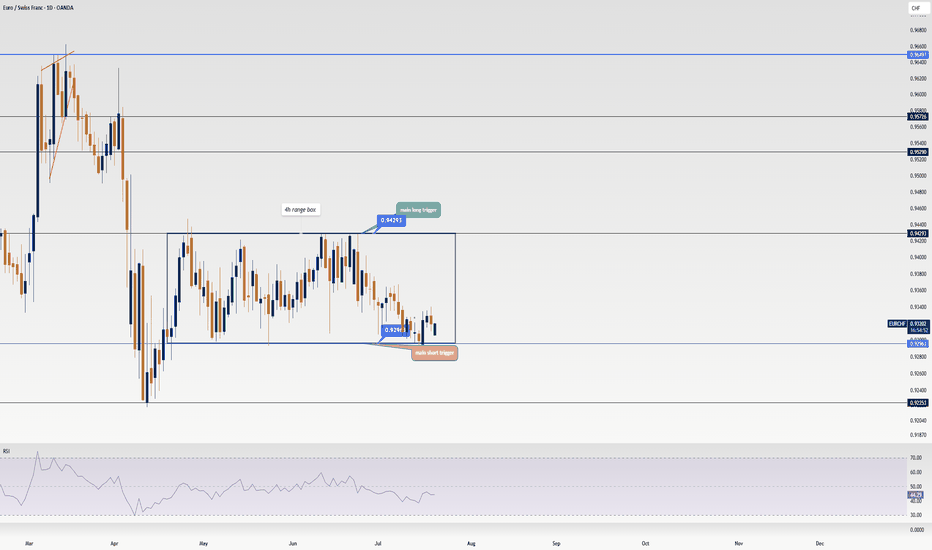

EUR/CHF Update: I just found out the next big triggerHey friends 🩵, hope you’re kicking off the week with a great vibe! It’s Skeptic from Skeptic Lab . In this video, I’m diving into EUR/CHF .

We’re stuck in a range box right now, and knowing this setup will help you miss fewer opportunities. Don’t forget money management, dodge FOMO, and have a plan for different scenarios. I also explained in the video why I personally prefer opening a short position. So, let’s get started!

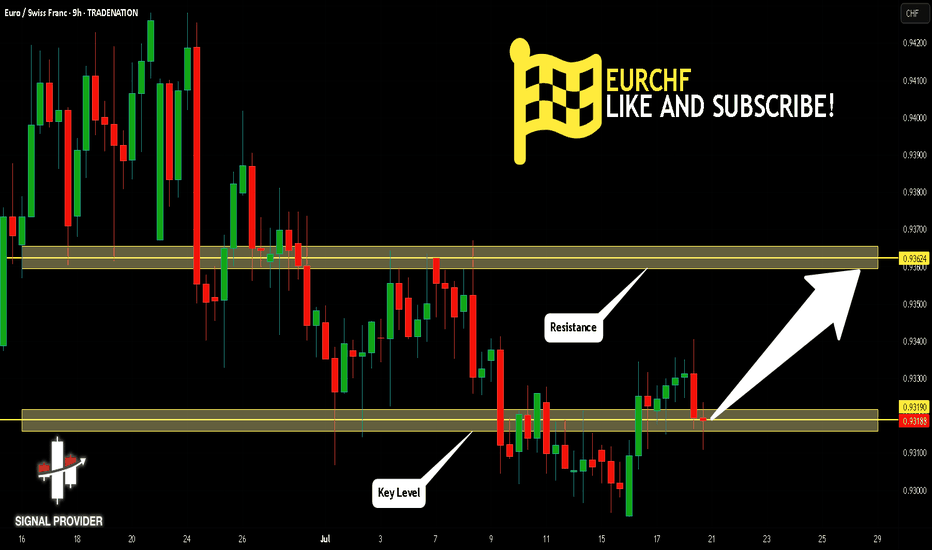

EURCHF Is Going Up! Buy!

Here is our detailed technical review for EURCHF.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.931.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.936 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURCHF: Bullish Continuation is Highly Probable! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURCHF pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/CHF LOSSBoy, sometimes you think the market is targeting you.....I get it. this is not the first time we have been taken out of a trade that just "barely" touched our stop. Keep a solid money management plan in place, no revenge trading....this one didn't work out but in my opinion it was a solid trade. Onto the next one.

EUR/CHF (2H). | Elliott Wave Structure📊 Technical Structure (2H)

✅ Channel structure remains intact

✅ Wave (4) nearing completion within resistance

✅ Strong sell zone between 0.9345–0.9363

📌 Downside Targets

First: 0.93129

Final: 0.92721

🔻 Invalidation Zone

Above: 0.93634 (Break above would invalidate current wave count)

---

📈 Market Outlook

EUR Weakness: Dragged by soft PMIs and ECB's dovish stance.

CHF Strength: Risk-off flows favoring Swiss Franc demand.

Structure: Elliott Wave alignment supports further downside.

---

⚠️ Risks to Watch

Breakout above 0.9364 invalidates bearish count

Sudden shift in SNB or ECB policy stance

Broader EUR strength spilling into crosses

---

🧭 Summary: Bias and Watchpoints

EUR/CHF is likely to resume its downtrend from the current resistance zone, with a Wave (5) extension aiming toward 0.9272. While the setup offers a clean R:R, tight risk control is crucial above 0.9364. Watch for confirmation candles and bearish reaction from the red zone.

---