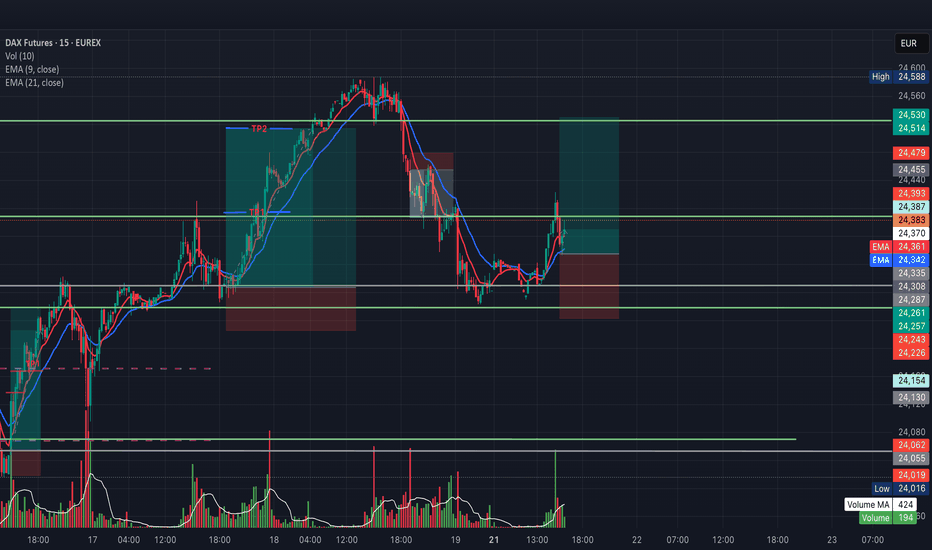

DAX Futures (FDAX1!) – Intraday Long Setup from SupportInstrument: FDAX1! (DAX Futures – EUREX)

Chart: 15 mins

Type: Intraday / Day Trade

DAX Futures is holding support near 24,259 after a recent pullback. Watching for a potential bounce if price remains above this level, with a move toward intraday highs as a possible target.

This setup is valid only for today session.

📌 Not financial advice – for educational purposes only.

FDAX1! trade ideas

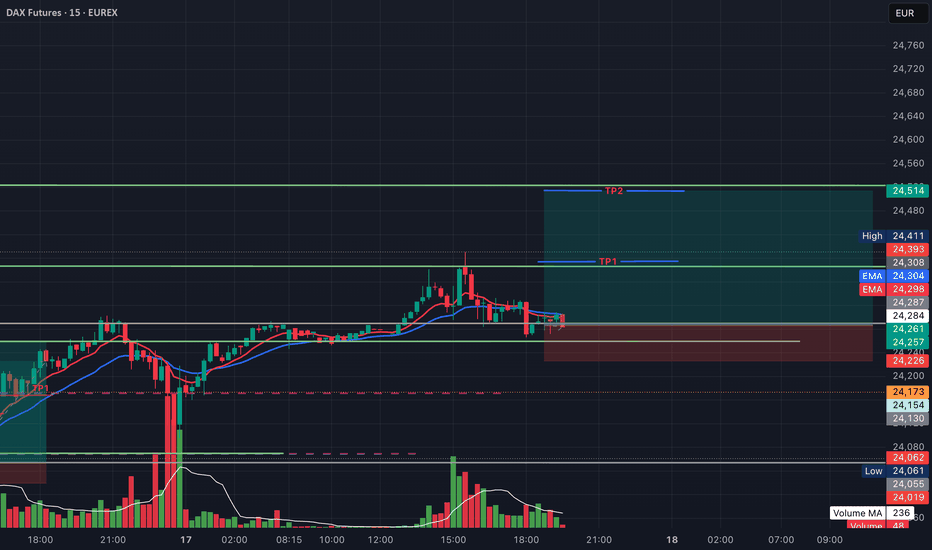

DAX Futures (FDAX1!) – Intraday Long Setup from Support with TP1Instrument: FDAX1! (DAX Futures – EUREX)

Chart: 15 mins

Type: Intraday / Day Trade

DAX Futures is holding support near 24,259 after a recent pullback. Watching for a potential bounce if price remains above this level, with a move toward intraday highs as a possible target.

This setup is valid until tomorrow's session.

📌 Not financial advice – for educational purposes only.

#202528 - priceactiontds - weekly update - daxGood Evening and I hope you are well.

comment: Third leg up is done and now it’s all about how long do we need for a lower low below 23680 again. For now I don’t know since we have another risk-off news but of them were bought the past 3 months, so I remain skeptical. Too early for shorts but I think longs near 24000 are likely good for a bounce to either retest 24749 or print a lower high.

current market cycle: bull wedge

key levels for next week: 23000 - 24800

bull case: Bulls want to continue sideways to up and trap all eager bears again who think that 30% tariffs between the US-EU are bad. Those poor souls. Markets can only go up.

Invalidation is below 23680

bear case: Bears need a lower low below 23680. That’s all there is to it. No idea how fast and if we get there but shorts before are most likely a gamble, since literally every dip since April has been bought and especially every Sunday Globex gap down became a giant trap. I do think 24749 is a perfect double top with the prior ath from June and we can go down from here but until we have a daily close below 23680, I am not eager to run into another bear trap.

Invalidation is above 24749

short term: Neutral. Tariff news are bad but they are not in-effect, so could be that we see another bear trap. I don’t know and I won’t pretend otherwise. Sitting on hands.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000.

DAX Futures FDAX1!) Imbalance Fill Before Bullish Continuation?Analysis Summary:

1. Current pullback after a strong impulse move suggests a short-term retracement.

2. The imbalance zone (highlighted in red) around 23,970–24,010 may act as a magnet.

3. Alternatively, price may continue lower to tap into 4H demand / liquidity zone before reversing upward.

📌 Educational purpose only. Not financial advice.

Let me know your thoughts or if you see it differently — open to feedback!

FDAX Today 1. Wave (3) likely near completion:

Price hit the 1.618 extension of Wave 1, which is textbook for a Wave 3 target.

There’s also confluence with the 23.6% retracement from the previous swing high (24,703), and we're near a Bearish FVG + Order Block zone.

High-probability zone for a short-term rejection or distribution top.

2. Wave (4) could start today

If Wave 3 is topping into OpEx, dealers might unwind long gamma hedges, contributing to volatility + pullback.

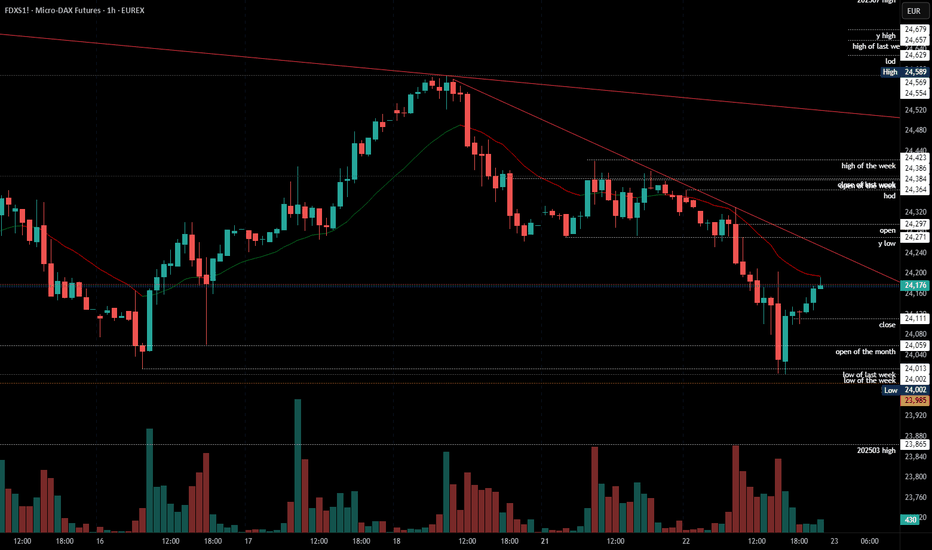

2025-07-22 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Bears had two legs down and the reversal from 24000 was strong enough to doubt this can go below 24000. I do expect some form of re-test of 24000 but the buying since then was insane again. Not a single 1h bar dropped below the prior one.

current market cycle: trading range

key levels: 24000 - 24600

bull case: Bulls next target is the breakout re-test of 24271 and if they can break above, the next target is today’s high at 24364. Above is likely no more resistance until 24450 or 24500. A print above 24271 would confirm the trading range and conclude the selling for now. This looks more like a two-legged move in a bigger trading range than stronger selling.

Invalidation is below 24350.

bear case: Bears need to keep it below the breakout price and re-test 24000. If they can leave an open gap, that would be great. Best would be to go sideways and stay below 24100 then but for now I have no trust in the bears.

Invalidation is above 24271.

short term: Neutral. No trust in bears but it would be great if we would stay below 23271 and test 24000 again. Daily close below 24000 would be a dream for bears. Above 24271 I would probably look for longs and higher prices again.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Selling EU open, no bigger resistance and only red bars on the 1h chart.

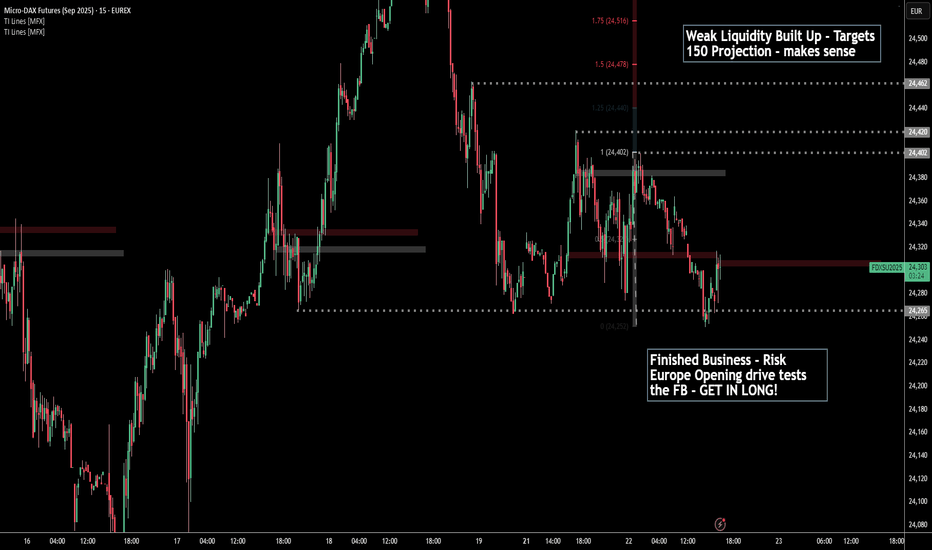

Finished Business TEST - LONGEurope Opening Drive shows a test of Finished Business

Above we have Multiple liquidity levels for Instos to take profits of their LONGS.

Also 150 projection (next distributions POC) marries up where the weak liquidity is.

GET IN and ride risk behind the demand auctions all the way.

2025-07-17 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Selling down from 24400 to 24300 on high volume and the bears just gave up and market showed where it really wants to go. Almost without resistance we just grinded higher for 24500. No more obvious resistance until ath.

current market cycle: bull trend

key levels: 24000 - 25000

bull case: Bulls want to leave the big gap open down to 24350 and go higher from here. 24750 is the obvious target but if bulls want it, there is no reason we can not print 25000. Any pullback should stay above 24350 or this rally is over again. Will be looking for longs against 1h 20ema tomorrow, unless bears clearly took over.

Invalidation is below 24350.

bear case: Bears tried down to 24275 but failed at the 1h 20ema and I doubt many will try to keep this a lower high below 24750. Bears have absolutely nothing once again. Nothing bearish about this on any time frame.

Invalidation is above 25100.

short term: Bullish. What could stop this? Only If they fire Jpow tomorrow but I doubt they will do it before markets close. Can only expect higher prices but I would not hold anything over the weekend. Make no mistake, if orange face fires Jpow, bonds will go apefeces and stonkz as well.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Long 24300 because Globex low was 24242 and market clearly found no acceptance below the 1h 20ema.

2025-07-15 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Very important day tomorrow. If we trade below 24000, this means we saw leg 1 from 24749 down to 24100 and leg 2 could lead us to 23500 or lower. Until we have clearly broken below 24000, I remain neutral but hopeful we can finally go lower again.

current market cycle: trading range

key levels: 23000 - 24750

bull case: Bulls need to stay above 24000 or risk a sell-off down to 23700ish. No matter how you try to draw the bull trend lines, they are all broken now but bears need lower lows below 23690 to confirm it. Daily ema is around 24100 and it has been support for 3 weeks and that is the reason I remain neutral for now.

Invalidation is below 24270.

bear case: Bears need to break below the daily ema and close below. Only then can we go lower. It’s good for the bears that they printed a lower high below 24400 but we are still too high for bulls to give up on BTFD.

Invalidation is above 24400.

short term: Neutral. If we stay below 24400, we have a shot at breaking down but 24000ish is support until proven otherwise. The selling today was not strong and the chart is rather neutral. Bears have only set up a potential structure which could break down but you have to wait for confirmation before betting on it.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Scalping between 24250 - 24300 which was clear support & resistance for 4h after EU open. The bear breakdown was a surprise and not obvious to trade.

2025-07-10 - priceactiontds - daily update - dax

Good Evening and I hope you are well.

comment: 50% retracement of the last bull leg is pretty much exactly 24530 and low of the day was 24531. Could always be a coincidence eh. Bull gap still open to 24383, so do not look for shorts. I doubt we will go red into the weekend unless we get bad news. Technically we could pull back to the bull trend line 24200ish but I can not, for the life of me, see that happening tomorrow.

current market cycle: trading range - bull trend on the 1h tf

key levels: 24300 - 25000

bull case: Bulls want 25000 now. They are correcting sideways, which is as bullish as it gets. Even if bears close the gap to 24383, I would still expect another push for 24700+ with at least a lower high. Bulls remain in full control.

Invalidation is below 24270.

bear case: Bears likely not doing much but rather bulls taking profits. It was a slow grind lower on low volume. I would not expect follow-through selling tomorrow. Bears still have nothing until we see lower lows again.

Invalidation is above 25100.

short term: Neutral. Bulls remain in control but the spike phase is over and we are trading below the 1h ema, which means the trend is getting weaker. We could pull back further or stop at the 50% retracement and leave the gap open. No bigger interest in guessing what it’s gonna be, so I sit on hands.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Tough to short this and hold tbh. Not really obvious today, so no trade of the day from me.

2025-07-08 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Not many times a month where the chart is as clear as this one. Every pattern can fail but you have to take these setups because they work more than they fail. Market is clearly refusing to go down, so don’t try to short it yet.

current market cycle: trading range - bull trend on the 1h tf

key levels: 23600 - 24700

bull case: Bulls want a retest of 24500+ and today they got a clear breakout above the prior high and stayed there. They have all the arguments on their side to test the ath. Only thing they could stop this is a news event.

Invalidation is below 23860.

bear case: Bears kinda gave up. Channel is tight and looking for shorts in these channels is not a good strategy. Above 24400 bears have to cover again since the obvious target is 24500+. Bears basically have nothing here. No matter what you think of we where should trade.

Invalidation is above 24400.

short term: Can only be bullish. Any long has stop 24170

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Buying any pullback was good. Most obvious one was the double bottom on EU open, right at the 1h 20ema.

#202527 - priceactiontds - weekly update - daxGood Day and I hope you are well.

comment: Neutral. Clear triangle on the daily chart and mid point is 23850. Week closed at 23900. Market is in balance and I think it’s completely 50/50 for both sides where the breakout will happen. Given the tariff shit show, I would wait for it to happen and be flat until then. If they apply 10%+ tariffs on EU imports, we go down, if they postpone, we rally further. I trade only technicals but this is one of the few moments per year where news will completely determine where the markets will breakout out next.

Big if. If orange face does another TACO move, momentum is strong enough for markets to keep going and squeeze further. We need a very strong daily bear bar to kill it.

current market cycle: trading range - triangle

key levels for next week: 23500 - 24300 (above 24300, 500 comes into play and also likely 600+)

bull case: Bulls made a higher low but barely. This is a bad looking bull trend from the 23061 low and market is currently in breakout mode to decide where we go next. The 24283 high is a reasonable high to turn lower but as longs as bulls stay above 23600, there is a chance of this doing another try at 23300 and above the ugly bull channel is confirmed and higher prices are likely.

Invalidation is below 23500

bear case: Bears keeping it below 24000 is good but they are not doing enough or we would have made lower lows below 23600. Everything depends on the US-EU tariffs over the next days. Technically all bullish targets are met and the 24283 was high enough to qualify as a re-test. Market is free to go down again, it just needs a catalyst.

Invalidation is above 24300

short term: Neutral. I won’t gamble on the trade talk outcome but I am much more eager to sell this on bad news than to buy it on not-too-bad news.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000.

2025-07-03 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: On my weekly chart I think this W4 was too deep to be part of a strong bull trend. 24000 is a decent spot to go sideways rather than up but above 24100 means I’m likely wrong and bears could give up for 24500+. I would not look for shorts until we see better selling pressure again. The Globex spike from 23681 to 23963 was beyond weird. It’s a bull wedge but will likely break out sideways in Globex session. 50/50 for both sides I think.

current market cycle: unclear. bull trend could continue but trading range is most likely

key levels: 23600 - 24500

bull case: Bulls want a retest of 24500+ but they find no buyers around 24000. They tried so many times to print 24000 and today they finally did it again but they would need to stay above 23900 and go sideways until bears give up. Markets can poke at a price long enough until one sides gives up.

Invalidation is below 23860.

bear case: Bears need lower lows again and if they can get below 23860, many bulls could cover in fear of a bigger pullback down to 23700. As of now bears have zero arguments since we only made higher lows since Globex low but we are also barely making higher highs and if we do, they have tails above.

Invalidation is above 24100.

short term: Completely neutral. Can go both way. US markets are overbought and once the profit taking starts, Dax won’t hold up either. Not much interest in guessing which way we go from 24000. Best to sit on hands and wait for a clear and strong signal.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Longs since the giant Globex bull spike but had to have wide stops and scale in. Not an easy day.

2025-07-01 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: If I had longs for 24400+ I would really doubt my position right now. Problem for the bears is, that it’s not low enough to be definitive. Only below 23600 we are making lower lows again and those can not happen in bull trends. Strong enough selling but I have my doubts that bears get follow-through tomorrow. Especially when other markets are rallying instead of selling. Above 24000 we likely see more upside but if bears are strong, they keep the market below and continue lower.

current market cycle: unclear. bull trend could continue but trading range is most likely

key levels: 23100 - 24500

bull case: Bulls need to stay above 23700 bad and continue higher for 24000. If they manage to break above 24k and the bear trend line, there is no reason why we can’t have another strong leg up. Until the bear channel is broken, they are not favored for anything. This could have been a retest of the daily 20ema, but only if we move strongly higher tomorrow.

Invalidation is below 23600.

bear case: Bears need follow-through below 23600 and close the gap to 23540. Then they have a good argument to trade down to 23100 or lower. Right now I would not short the lows because the risk of trading back up to 24000 is too big. The bear channel is clear and valid until broken.

Invalidation is above 24050ish.

short term: Slightly bullish that we bottom out above 23750 and trade back up to 24000 but I would only do small scalps here. Anything below 23700 would surprise me more than 24000.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Short from EU open.

#202526 - priceactiontds - weekly update - daxGood Evening and I hope you are well.

comment: Monday was neutral and the warning to bears that the markets do not care about the risk at hand. Tuesday’s gap up then was the sign of bull strength and defending the Globex gap was the sure sign we are going higher. Thursday was the bears giving up and since we have a measured move target up to 24700. I have drawn my 5-wave thesis on the chart, which I think is currently the most likely outcome. All depends if the US markets continue the squeeze as well. There is always the possibility that Friday marked the highs but that is very low and in the absence of bear bars, we can only assume higher prices.

current market cycle: trading range

key levels for next week: 23500 - 25000

bull case: Bulls made the bears give up on Thursday and since we have been going only up. The obvious next targets are 24500 and then 25000. As of now, there is absolutely no reason to assume we reverse from here and print lower lows again. Bulls took over control of the market again and we have two clear legs up, with a third one we may do a new ath but as always, every pattern can fail.

Invalidation is below 23500

bear case: Not much. A pullback is expected but so is the third leg up for W5 and everything below 23500 would be a huge bear surprise and cut this short. As of now I don’t think this chart can lead you to looking for shorts. We would need a break of two bull trend lines and prices below 23500 before you should think bearish again.

Invalidation is above 24400

short term: Bearish was the obvious read last weekend and when bears failed on Monday, it set the stage for an explosive move to the upside. That can always happen since we are in a profession where you play odds.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

2025-06-26 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Is this a bigger two-legged pullback to the 4h ema and now we strongly break above 23900 to go for 24200+ again? It’s my most likely case. It’s still not a good trade to buy above 23800 since that trapped you two times this week for 230 and 300 point pullbacks.

current market cycle: broad bull channel on the weekly chart. Daily chart is in a trading range 23000 - 24500

key levels: 23500 - 24500

bull case: Everything aligns for the bulls. They need the breakout above Tuesday’s high and then we go for the obvious big round number 24000 but I doubt we will stop here. Once the bears who sold above 23800 this week give up, I doubt there will be much resistance until maybe 24300 or higher. Anything below 23600 would be a huge bear surprise tomorrow and my bullish bias is likely wrong.

Invalidation is below 23000.

bear case: Bears don’t have much until they print below 23600 again. Can they hold the market below 24000 and keep this trading range alive? I doubt it. Bears tried 3 times this week and the bull gap to 23550 stayed open.

Invalidation is above 24100.

short term: Bullish. Still expecting 24000 and no print below 23600 tomorrow. Everything else would be a big bear surprise and we could go much lower than 23500 but this is the most unlikely scenario.

medium-long term from 2025-06-22: New bear trend has likely started on 2025-06-05 and we saw W2 conclude on Friday. Daily close below 23000 will be the confirmation for the bears and I have drawn 2 potential final W5 targets. I have written that we will see 20000/21000 again over the summer for many weeks/months now, this even is just another excuse for “analysts” to justify the move down.

trade of the day: Longs close to 23600 were the obvious trade today. The selling for 198 was at least 100 points stronger than I expected and stopped me out but I immediately went long again on the very strong buying below 23650 and closed the day with profits.

2025-06-24 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Market stalled exactly at the 50% retracement from the bear leg 24627 down to 23061. I highly doubt we top out here but 24000 is a possible target for the high. Issue for the bears is that this is as bullish as it get’s right now. All markets printing big green candles and bears gave up. US markets are heading for new ath and they will likely print new ones this week. So thinking about topping out is dumb as of now. Will only look for longs closer to the 1h ema until we see much much bigger selling pressure and prices below 23500.

current market cycle: broad bull channel on the weekly chart. Daily chart is in a trading range 23000 - 24500

key levels: 23500 - 24000

bull case: Big Globex gap up, retest and go. Market is leaving gaps below and until they close, we are in a max bullish market. 24000 is the obvious target but we can do more. Any pullback now has to stay above 23700 or bears might come around again.

Invalidation is below 23000.

bear case: There is a tiny chance for the bears that this is just a retest of 24000 and the breakout price area and also the daily 20ema. Tiny. Don’t bet on it. You can not look for shorts until we close the next gap down to 23550ish.

Invalidation is above 24100.

short term: Bullish af. 24000 I see as given unless a newsbomb hits. Market should not drop below 23690 if bulls want to continue higher.

medium-long term from 2025-06-22: New bear trend has likely started on 2025-06-05 and we saw W2 conclude on Friday. Daily close below 23000 will be the confirmation for the bears and I have drawn 2 potential final W5 targets. I have written that we will see 20000/21000 again over the summer for many weeks/months now, this even is just another excuse for “analysts” to justify the move down.

trade of the day: Long on Globex or buying pullbacks near the 15m or 60m ema. All were profitable at least for scalps. When you see this much buying during Globex session and a perfect double bottom above a big bull gap, chances that this day is bearish are abysmally low so don’t look for shorts.

#202525 - priceactiontds - weekly update - dax futuresGood Day and I hope you are well.

comment: Full bear mode. Bulls tried 3 times to get some pullback going but only huge rejections on every try and since we have crossed the daily ema, we have not touched it or came close to it. Maybe we see some sideways movement around 23000 but given my uber bearish expectation due to US bombs on Iran, I can see a giant move down to 22000 and some stalling around it. Any price above 23700 means I am wrong and markets continue to ignore every risk under the sun.

1500 points down by the bears in two weeks is decent enough for a first leg. I market two potential W5 targets for the next weeks.

current market cycle: most likely new bear trend which can bring us to 21k or 20k over the next weeks

key levels for next week: 22000 - 23700

bull case: Can they try another “ignore the risk” move after the weekend news? I doubt it but anything can happen, so my invalidation for the bears is 23700. If they print it, we move sideways but I can not, for the life of me, see this printing new highs. If you are still holding long term longs on anything, I think you are late on running for the exit.

Invalidation is below 22900

bear case: Bears have been given another gift by orange face. The selling started two weeks ago, so it has nothing to do with Iran but it will likely help in confirming the trend and maybe accelerate it. The drawn channel is a rough guess for now. We have seen slow and steady liquidation the past 2 weeks and now we could see a shift to a huge “run for the exits” and type of “liberation-day” markets. 22000 is the big next target for bears since I expect 23000 or lower to get hit immediately on futures open.

Invalidation is above 23700

short term: Full bear mode. 23000 is almost a given and we could move quickly to 22000 over the next days. If we produce an island gap with the previous bull gap 22800-23100 (don’t take those numbers per tick value, this is not an exact science, many algos see the gap differently) it’s a huge confirmation and it could not be closed for months. If we do a big gap down and bulls close it, much less chance for the bears to continue down faster.

medium-long term from 2025-06-22: New bear trend has likely started on 2025-06-05 and we saw W2 conclude on Friday. Daily close below 23000 will be the confirmation for the bears and I have drawn 2 potential final W5 targets. I have written that we will see 20000/21000 again over the summer for many weeks/months now, this even is just another excuse for “analysts” to justify the move down.

2025-06-18 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Market has not traded above prior day’s high for 9 sessions. Can we do 10 and accelerate down? I would love it but it’s getting a bit unlikely without a better pullback. I can not see bulls coming back from this tbh but I have been wrong about this before. Bears need a big breakout below and accelerate down. Bulls some higher highs to continue sideways between 23000/24000.

current market cycle: broad bull channel on the weekly chart. Daily chart is in a trading range 23000 - 24500

key levels: 23000 - 24000

bull case: Any higher high will do and could lead to couple of legs up for 24000. Whole story because right now they don’t have any arguments besides having support around 23300 and bears unable to make meaningful lower lows. Time-wise we have been going down for 9 sessions and at some point bulls will give up hope and we flush down if they don’t reverse strongly over the next 1-2 sessions.

Invalidation is below 23000.

bear case: Clear target for bears is 23000 and leaving behind a decent gap 23700-24000. They are favored since we are only printing lower highs. Bears have to keep it below 23400 or risk hopeful bulls buying for 23505 which was last week’s close and if we close this week above it, it will be a weekly bull bar and likely a doji. That’s neutral and good for bulls. For this to go down, bears have to print a weekly bar closing on it’s low and below prior support.

Invalidation is above 23500.

short term: Neutral around 23300 but I think we can do 23000 this week. Don’t bet on the breakout before it happens. Shorts closer to 23500 are likely good, unless strong bulls overwhelm the bears tomorrow.

medium-long term from 2025-06-15: Bull trend has most likely concluded. Long term shorts are fine. Stop has to be at least 24508. I see it 70% or more that we will see 22000 before end of August.

trade of the day: Selling anything close to 23400 and buying anything at 23300. The early pump before EU open was a nasty bull trap but shorts with stop above yesterday’s high 23567 were the obvious trade.

2025-06-16 - priceactiontds - daily update - dax Good Evening and I hope you are well.

comment: Market is much weaker than sp500 and nq, which is always unusual. We are staying below 23724, which is good for the bears but we are in a weak bull channel and making higher highs and higher lows since the Friday sell spike. Both sides make money and market is currently in balance around 23560ish. Clear invalidation prices for both sides and until then it’s buy low, sell high and scalp.

current market cycle: broad bull channel

key levels: 23300 - 24000

bull case: Bulls want to accelerate upwards, close the Globex gap to 23800 and retest 24000. End of story. They are currently a bit favored since we are in a bull channel but only slightly. Market has to stay above 23500 if they want to continue higher. If broader bullishness on markets continues, dax won’t stay below 23800 tomorrow.

Invalidation is below 23500.

bear case: Given that US markets pumped again, dax lags big time. Bears need to keep the gap to 23800 open and print something below 23500 again. If they continue sideways, their chances of another leg down to 23000 become better. My weekly outlook was that we correct sideways for a couple of days before we get another leg down, So far I think this is unfolding.

Invalidation is above 23800.

short term: Neutral around 23650. Bullish really only above 23800 or closer to 23500. If we stay above 23560 tomorrow, I expect another try at 23700 and above 23742 bears will give up for at least 23800.

medium-long term from 2025-06-15: Bull trend has most likely concluded. Long term shorts are fine. Stop has to be at least 24508. I see it 70% or more that we will see 22000 before end of August.

trade of the day: Long around 23500 on EU open since Globex breakout from 23400 was bullish enough to expect a second leg up or at least a re-test of the high 23620 which would have been good for 100 points but was actually good for 220 if you held. The short around 23700 was tough. bears should signs of wanting a trading range with the structure after EU open and the sell-off from 23724 was unexpected in it’s strength since US markets pumped that hard.

#202524 - priceactiontds - weekly update - daxGood Day and I hope you are well.

comment: Bears leaving no doubt who is in control of the market now. Volume is picking up on the move down and bear bars are getting bigger. I expect a bit more fighting around 23500 but once we break below, 23000 is the next target and also likely a gap close down to 22600. I have drawn my least bearish wave thesis on the chart where the 50% retracement gets hit over the next weeks. Much more bearish would be the 20000 target. If this selling continues without a pullback, I will adjust the legs.

current market cycle: trading range until we close below 23200 - then we are in the new bear trend. As of now the continuation inside the range is more likely.

key levels for next week: 22600 - 24000

bull case: Got nothing for the bulls but in case we trade back above 23580, we have to assume sideways for longer. I don’t think we can try another new ath after this selling. Bulls found support at the sell-spike from the 50% tariff announcement. If overall markets won’t sell off early on Monday, we can expect some sideways movement before market gets the next impulse up or down. Anything above 24100 would surprise me big time.

Invalidation is below 23280

bear case: 23280 is the price to break for more downside and 23580 is the most important price for bears to prevent the bulls from getting. If 23580 holds, we can do another strong leg down to close the gap 22600. If we go above, the next bear trend line would be around 23950ish and if we get there we will likely test 24000 again. After 5 consecutive bear bars, bulls can not hold longs in hope for another run at the highs. The bear bars are getting bigger and market tested above 24000 enough to know there are not enough buyers. Bulls tried 4 times to 3 times to continue the trend. Selling this top with long term shorts is as good as it gets. On lower time frames I expect a bit more sideways before another leg down.

Invalidation is above 23280

short term: Neutral but only on time frames lower than 4h. W1 has likely concluded but I expect at least a big second leg down to 22600ish. Bears have to keep it below 23580 or we could test back up to 24000.

medium-long term from 2025-06-15: Bull trend has most likely concluded. Long term shorts are fine. Stop has to be at least 24508. I see it 70% or more that we will see 22000 before end of August.

2025-06-11 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Much more reasons to buy below 23900 than to sell. I do think bulls showed strength today by printing 24193 and this could become a lower low, major trend reversal. Long stops have to be 23750 but there is decent chance could get there as well. I still think they will fail at the gap again and market will close the week closer to 24000 than to 23800. Anything above 24200 tomorrow would be a huge bull surprise and could lead to 24500 again.

current market cycle: broad bull channel

key levels: 23700 - 24500

bull case: Bulls need to keep this a higher low if they want 24500 again. Bulls see the 4 legs down and with today’s huge bull spike, they are likely confident that buying down here is great value. R:R is on their side since the upside is 700 points but they maybe have to risk 200. They reason that what bears wants to sell down here at huge prior support, the bull trend line and the open gap to 23750. Don’t be too early and wait for strong momentum to join.

Invalidation is below 23700.

bear case: Bears outdid themselves for 3 days now, compared to the price action the weeks before. But what now? Big support below us and who wants to sell this? If they see a strong 15m or 1h bar tomorrow, they just have to give up. If they don’t it likely means opex forces institutions to keep the market below 23900 because options need to expire worthless. I would never sell down here. If it goes to 23500, so be it.

Invalidation is above 24550.

short term: Neutral but waiting only for bulls to come around. I think 24200 is much more likely than 23500.

medium-long term from 2025-05-25: My rough guess from early May was down over the summer and up into year end. POTUS certainly helped with the 50% tariffs. I need to see market reaction next week and if there is no 180° reversal until Friday, they will become reality the week after and dax should do 20-30% down over the next months. Markets were not positioned for any risk what so ever. Now we got the atomic trade bomb.

trade of the day: Buying the strong 1hm bull bar 2 hours before EU opened or selling the news spike up to 24193. Both were easy to spot and went for many points without testing above the signal bar.

2025-06-09 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Wedge bull flag, I expect 24000 and 24500 to get hit this week, everything above and below those prices would be a surprise to me. We are also forming a triangle with the bull trend line and I expect bulls to get the breakout above.

current market cycle: broad bull channel

key levels: 23700 - 24500

bull case: Bulls making sure the correction is sideways and shallow. They likely want to buy closer to the trend line around 24000 for more value. They want another retest of 24500 and another higher high. Since the trend line is valid and we are comfortably above the daily 20ema, they remain in full control.

Invalidation is below 23700.

bear case: Bears printed a lower low for the past 4 trading days but does the 1h chart look bearish to you? The move down to 24112 has mostly overlapping bars and bulls even printed 5 consecutive 1h bull bars. Those things do not happen in strong bear trends. I expect bears to give up tomorrow. 1h close below 23800 would certainly change everything. This would open the possibility to test down to 23746 and the bigger trend line.

Invalidation is above 24550.

short term: Neutral but expecting bulls to come around strongly closer to 24000 for a re-test of 24500. Only below 23800 I would become bearish and even if we get there, I doubt we would go further down.

medium-long term from 2025-05-25: My rough guess from early May was down over the summer and up into year end. POTUS certainly helped with the 50% tariffs. I need to see market reaction next week and if there is no 180° reversal until Friday, they will become reality the week after and dax should do 20-30% down over the next months. Markets were not positioned for any risk what so ever. Now we got the atomic trade bomb.

trade of the day: Selling 24200 was good for many scalps today but I think the most obvious trade was the long on the EU open sell spike from 24168 up to open price 24272.