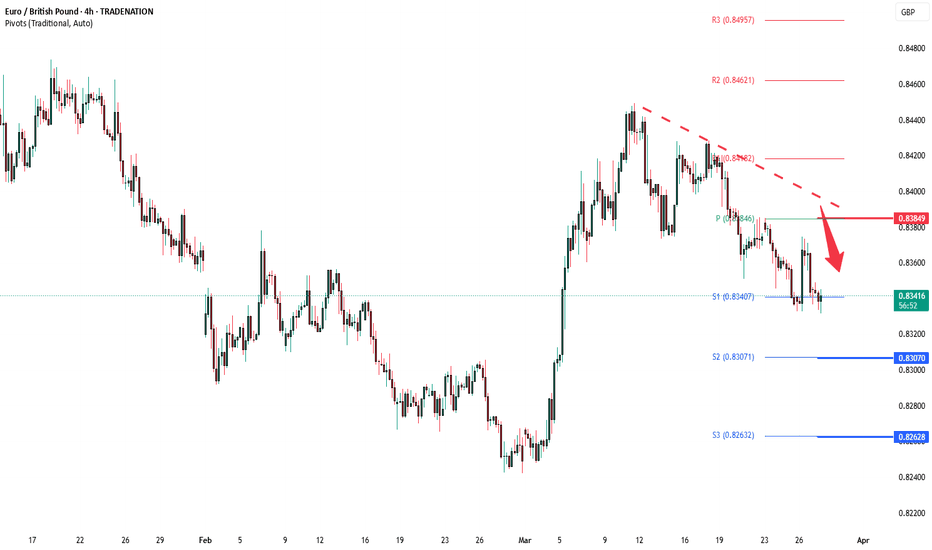

EUR/GBP Bullish Breakout from Falling Wedge – Buy Setup!Introduction

This EUR/GBP 4-hour chart analysis presents a high-probability bullish trading setup based on a falling wedge breakout. A falling wedge is a reliable bullish reversal pattern, signaling that selling pressure is fading, and buyers are regaining control. The price has now broken out of the wedge, confirming potential upside momentum.

This setup provides a well-defined entry, stop-loss, and target level, allowing traders to capitalize on the bullish breakout while maintaining a proper risk management strategy.

1. Chart Pattern: Falling Wedge (Bullish Reversal)

The primary pattern on the chart is a falling wedge, which is a bullish reversal pattern that forms after a downtrend. It is characterized by converging downward-sloping trendlines, indicating that sellers are gradually losing momentum.

🔹 Key Characteristics of the Falling Wedge Pattern:

Lower highs & lower lows within a narrowing price range.

Decreasing selling pressure, indicating a potential shift in trend.

A bullish breakout above the upper trendline confirms a reversal.

Typically followed by a strong price surge, aiming for previous resistance levels.

The price action confirms this pattern as it broke above the wedge's upper boundary, signaling the start of a bullish trend.

2. Key Technical Levels & Market Structure

🔹 Resistance Level (Target) – 0.84183

This level marks a previous strong resistance zone, where the price faced rejection multiple times.

It serves as the primary profit-taking area for this setup.

A successful breakout and close above this level could lead to further upside movement.

🔹 Support Level – 0.83154

This is the major demand zone where price previously bounced.

Strong buying pressure emerged at this level, leading to the recent breakout.

It serves as an important level to define risk and set stop-loss orders.

🔹 Stop-Loss Placement – Below 0.83154

A stop-loss is placed slightly below the support zone, ensuring a logical exit if the market reverses.

This prevents unnecessary losses while allowing room for normal price fluctuations.

🔹 Entry Point Consideration

Ideal entry: Around 0.83700, just after the breakout confirmation.

Confirmation: A strong bullish candle closing above the wedge.

3. Trade Execution Plan: Long Setup

📌 Trade Idea – Bullish Setup

📈 Buy Entry: 0.83600 – 0.83700 (After wedge breakout)

🎯 Target: 0.84183 (Major resistance level)

❌ Stop-Loss: 0.83154 (Below support level)

🔄 Risk-to-Reward Ratio (RRR): ~1:1

📊 Risk Management Strategy

Trade with discipline: Never risk more than 1-2% of your capital per trade.

Adjust position size: Based on risk tolerance and account balance.

Use trailing stops: To secure profits if price continues upward.

4. Market Sentiment & Price Action Analysis

Prior Uptrend: The price previously had a strong bullish rally, indicating overall bullish strength.

Corrective Move: The market entered a falling wedge correction, allowing for a healthy pullback before resuming the trend.

Breakout Confirmation: The breakout above the wedge's upper trendline confirms bullish momentum.

📊 Factors Supporting a Bullish Move:

✅ Breakout confirmation above the wedge pattern.

✅ Higher buying volume supporting the move.

✅ Support level holds strong, preventing further downside.

5. Trading Psychology & Risk Considerations

⚠️ Key Considerations Before Entering the Trade:

✔ Wait for confirmation – Ensure a strong breakout candle before entering.

✔ Avoid chasing the price – Enter at a reasonable pullback level post-breakout.

✔ Monitor economic events – Watch for news that could impact EUR/GBP volatility.

✔ Follow a strict risk-reward ratio – Stick to your predefined stop-loss and target.

6. Conclusion – Bullish Outlook

This falling wedge breakout on EUR/GBP suggests a bullish reversal, offering a high-probability long trade setup. The price is expected to move towards the 0.84183 resistance level, with 0.83154 as the key stop-loss level.

✅ Bias: Bullish

🎯 Target: 0.84183

❌ Stop Loss: 0.83154

📊 Risk-to-Reward: ~1:1

📌 TradingView Idea Title & Description

Title:

🚀 EUR/GBP Falling Wedge Breakout – Bullish Move Incoming!

Description:

📈 Bullish breakout confirmed! EUR/GBP has broken out of a falling wedge, signaling a trend reversal. A long position above 0.83600 targets the 0.84183 resistance level with a stop-loss at 0.83154. Watch for strong bullish momentum! 📊💹

💡 Risk Management: Stick to your stop-loss, and don’t chase price action. Manage your trade wisely! 🔥

EURGBP trade ideas

EUR/GBP: Caught Between Key Support and Resistance LevelsEUR/GBP is currently consolidating between critical technical levels, with price action centered around 0.8360-0.8361. The pair recently bounced from support at 0.8346 but appears to be facing resistance at the 0.8367 level.

The multiple EMA crossover zone (0.8346-0.8359) is creating a decision point for this pair. Recent price history shows a clear downtrend from the March highs above 0.8400, suggesting bearish momentum remains in play.

Volume readings indicate moderate market interest at current levels.

Trade Scenario

Bearish Case:

Failure to break above 0.8367 resistance could trigger another downward move

Initial target: 0.8346 support

If broken: Watch for extension to 0.8320 horizontal support

Bullish Case:

Decisive break above 0.8367 with increased volume would signal potential trend reversal

Initial target: 0.8400 psychological level

Key Levels to Watch:

Resistance: 0.8367, 0.8400

Support: 0.8346, 0.8320

#EURGBP

EUR/GBP SHORT FROM RESISTANCE

Hello, Friends!

We are now examining the EUR/GBP pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 0.831 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR_GBP RESISTANCE AHEAD|SHORT|

✅EUR_GBP is going up now

But a strong resistance level is ahead at 0.8385

Thus I am expecting a pullback

And a move down towards the target at 0.8353

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP LONGHi traders, watch as I closely monitor and forecast the overall structure

-Tap into D FVG

-Expect one more pullback

break of high towards 0.85000

-If price extends below, greater

chance of longs

Please drop a like, comment and follow my channel if you want to see more of this exceptional analysis!

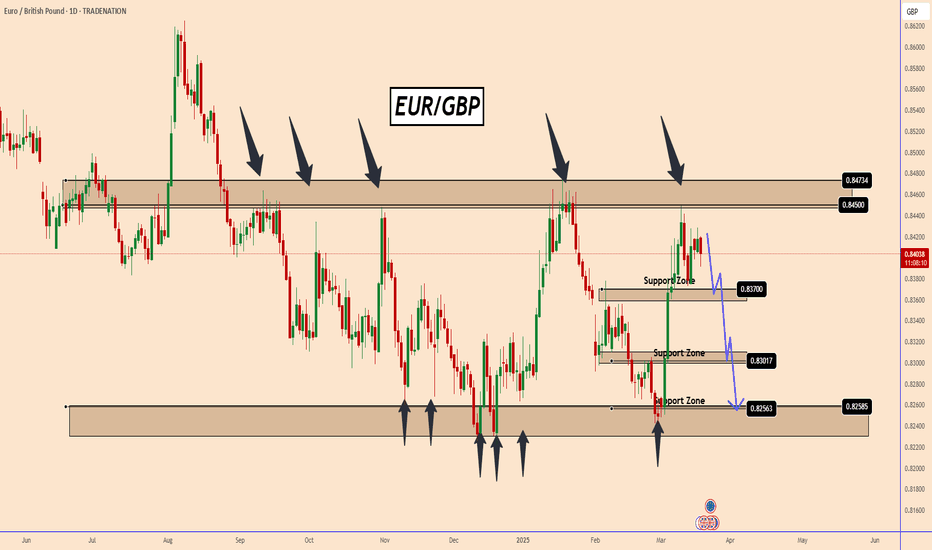

EUR/GBP Weekly Forecast: Double Bottom Pattern, Bullish ReversalOverview of the Chart

This is a EUR/GBP daily chart, showcasing a Double Bottom Pattern, which is a classic bullish reversal formation in technical analysis. The pair has been in a downtrend for several months, but recent price action indicates a potential shift in momentum.

The double bottom pattern consists of two distinct lows (Bottom 1 & Bottom 2) at nearly the same level, forming a W-shaped structure. This suggests that sellers attempted to push the price lower twice but failed both times due to strong buying pressure at the support zone.

As the price starts to rise from the second bottom, the neckline resistance becomes a crucial level to watch. A confirmed breakout above this neckline would validate the pattern and signal a potential bullish rally.

Chart Breakdown & Key Components

1. Double Bottom Pattern Explanation

The first bottom formed in December 2024, marking the lowest price point where buyers stepped in.

The second bottom formed in March 2025, confirming strong demand in the support zone.

The pattern suggests bearish exhaustion, as sellers were unable to push the price lower.

The neckline at ~0.84778 acts as a key breakout level. Once price moves above it, the bullish reversal is confirmed.

🔹 Why is this pattern important?

It signals a trend reversal from bearish to bullish.

It attracts buying interest as traders recognize the formation.

The measured move suggests a potential target of 0.87307, aligning with previous resistance levels.

2. Key Support & Resistance Zones

✅ Support Zone (0.82249 - 0.82458)

This level has been tested twice, making it a strong demand area.

Buyers aggressively defended this zone, preventing further downside.

A break below this level would invalidate the bullish setup.

✅ Neckline Resistance (~0.84778)

This is the breakout level that confirms the double bottom pattern.

A strong bullish daily candle closing above 0.84778 would indicate a trend shift.

The price may retest this level after breaking out, offering a second entry opportunity.

✅ Major Resistance & Target Areas

0.86251 → The first major resistance zone, where price may face some selling pressure.

0.87307 → The final target based on the pattern projection, aligning with historical resistance.

3. Trading Setup & Execution Plan

🔹 Entry Strategy (Breakout Confirmation)

Enter a buy position after the price breaks and closes above the neckline (~0.84778).

A retest of the neckline provides a second chance to enter at a better price.

Look for high volume confirmation on the breakout for additional confidence.

🔹 Stop Loss Placement (Risk Management)

Place the stop-loss below 0.82249, just under the support zone.

This ensures protection against false breakouts.

Avoid placing the stop too tight, as price fluctuations can trigger early exits.

🔹 Take Profit Levels (Reward Calculation)

First Target: 0.86251 (Intermediate Resistance Level)

Final Target: 0.87307 (Measured Move Projection)

Partial profits can be taken at 0.86251, while runners target 0.87307.

🔹 Risk-Reward Analysis

Entry near 0.84778, stop loss below 0.82249, target at 0.87307.

This setup offers a risk-to-reward ratio (R:R) of over 3:1, making it a highly favorable trade.

4. Market Sentiment & Potential Scenarios

Bullish Scenario (High Probability) ✅

Price successfully breaks above the neckline at 0.84778.

Retests the neckline and holds as new support, leading to strong bullish momentum.

Moves toward 0.86251 first, then extends to 0.87307.

This scenario aligns with technical confirmation & volume breakout strategy.

Bearish Scenario (Low Probability) ❌

Price fails to break the neckline and faces rejection.

The pair revisits the support zone (0.82249 - 0.82458) for a third test.

If the support breaks, it could invalidate the bullish setup, leading to continued downtrend.

5. Final Thoughts & Summary 🎯

✅ Pattern Identified → Double Bottom, signaling bullish reversal.

✅ Breakout Level → Watch for confirmation above 0.84778.

✅ Risk Management → Stop loss below 0.82249.

✅ Profit Target → 0.86251 (Partial Profit), 0.87307 (Final Target).

✅ Trade Plan → Buy on breakout, retest entry for better positioning.

🔥 This is a high-probability bullish setup! Watch for breakout confirmation before entering a trade.

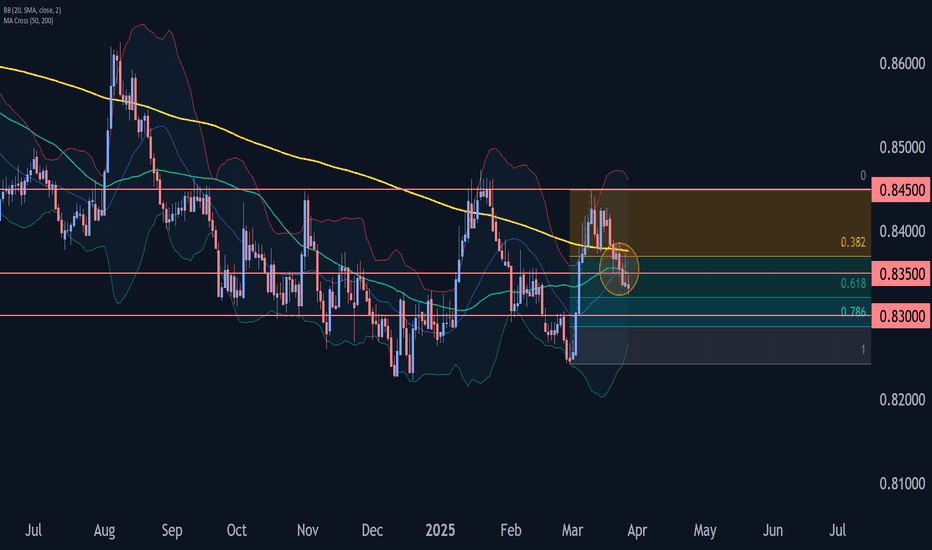

EURGBP Bullish OutlookHere is my Analysis for the EURGBP Outlook for the coming weeks.

Price is already reacted from the Buy Zone or the 0.618-0.500 area or Golden Zone, we may need to see a lower time frame corrective structure before safely Buy to the upside.

Once the price reach a significant level or around 0.844 area, we may need to wait and see how will price reacts to determine the next direction of the trend.

EURGBP: Long Signal with Entry/SL/TP

EURGBP

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURGBP

Entry - 0.8353

Stop - 0.8326

Take - 0.8395

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURGBP - Follow The Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been bearish trading within the falling channel in blue.

Currently, EURGBP is approaching the upper bound of the channel.

Moreover, it is retesting the upper bound of its range marked in blue.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the range and upper blue trendline.

📚 As per my trading style:

As #EURGBP is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP: A Multi-Time Frame AnalysisEURGBP: A Multi-Time Frame Analysis

EUR/GBP recently tested a strong resistance zone near 0.8440, prompting a notable price reaction. Based on historical price behavior, there is potential for the pair to move downward again.

The bearish momentum could gain further support from tomorrow's Bank of England (BoE) decision, which may influence market sentiment and drive additional movement in this currency pair.

You may watch the analysis for further details!

Thank you!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP: Bullish Harmonic Pattern in a Strong ZoneEURGBP: Bullish Harmonic Pattern in a Strong Zone

EURGBP has completed a bullish harmonic pattern within a robust zone.

Despite this, the likelihood of the price testing the entire red zone remains high.

It's crucial to be careful and closely monitor the price's reaction.

Key resistance zones for the harmonic pattern are 0.8307, 0.8335, and 0.8370.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BEARISH MARKETThe overall Market looks Bearish on the D TF, where we can see an M structure with double top rejection and market looking to close the last half of the leg of the M (Blue brush). On the 4hrs TF the market is doing HL and LL confirming the Bearish structure. Highlighted in the yellow rectangle we have 2 big Bullish candles that show MARKET IMBALANCE.

Thank you.

Bullish bounce?EUR/GBP is reacting off the pivot and could bounce to the 1st resistance.

Pivot: 0.8337

1st Support: 0.8310

1st Resistance: 0.8377

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURGBP Wave Analysis – 27 March 2025

- EURGBP broke support area

- Likely to fall to support level 0.8300

EURGBP currency pair recently broke the support area between the key support level 0.8350 (which has been reversing the price from the start of March) and the 38.2% Fibonacci correction of the upward wave 2 from the end of February.

The breakout of this support area accelerated the active impulse wave iii of the higher impulse waves 3 and (3).

Given the strongly bullish sterling sentiment, EURGBP currency pair can be expected to fall to the next support level 0.8300.

EURGBP BREAKOUT SELL *EUR/GBP: Breakout Sell

*Trade Details:*

- *Sell Entry:* Breakout below 0.83500

- *Target Price:* 0.82200 (130 pips)

- *Stop-Loss:* 0.84415 (90 pips)

*Market Analysis:*

The EUR/GBP pair is experiencing a bearish trend, driven by Brexit uncertainty, ECB's dovish stance, and UK economic resilience.

*Key Events:*

- UK PMI data

- ECB meeting minutes

*Trading Strategy:*

Sell EUR/GBP on breakout below 0.83500, with a stop-loss at 0.84415. Use target level to take profits or adjust stop-loss to break even.

*Risk Management:*

- Risk-Reward Ratio: 1:1.5

- Position Sizing: 2-3% of trading capital

Remember the Travis with best wishes if you got it profitable 💯

EURGBP: Bearish Outlook Explained 🇪🇺🇬🇧

A recent breakout of a minor daily support on EURGBP

is a reliable bearish signal.

It shows a mid-term dominance of the sellers.

I think that the price can drop at least to 0.831 support soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP Set To Fall! SELL!

My dear friends,

EURGBP looks like it will make a good move, and here are the details:

The market is trading on 0.8359 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 0.8344

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURGBP INTRADAY corrective pullback capped at 0.8385The EUR/GBP pair continues to exhibit bearish sentiment, reinforced by the prevailing downtrend. The key intraday resistance level is at 0.8385, marking the current swing high.

Bearish Scenario:

An oversold rally from current levels, followed by a bearish rejection at 0.8385, would likely target downside support at 0.8340. A break below this level would open the door for further declines toward 0.8307 and 0.8260 in the longer timeframe.

Bullish Scenario:

Alternatively, a confirmed breakout above the 0.8385 resistance, accompanied by a daily close above this level, would invalidate the bearish outlook. This would pave the way for further rallies, with the next resistance levels at 0.8420 and 0.8460.

Conclusion:

The prevailing sentiment remains bearish as long as 0.8385 holds as resistance. Traders should watch for rejection at this level to confirm downside momentum. Conversely, a decisive breakout above 0.8420 would signal a potential shift to a bullish bias, targeting higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.