Check my idea: Idea: EURGBP 1st Buy Entry

Euro / British Pound forum

Check my idea: Idea: EURGBP 1st Buy Entry

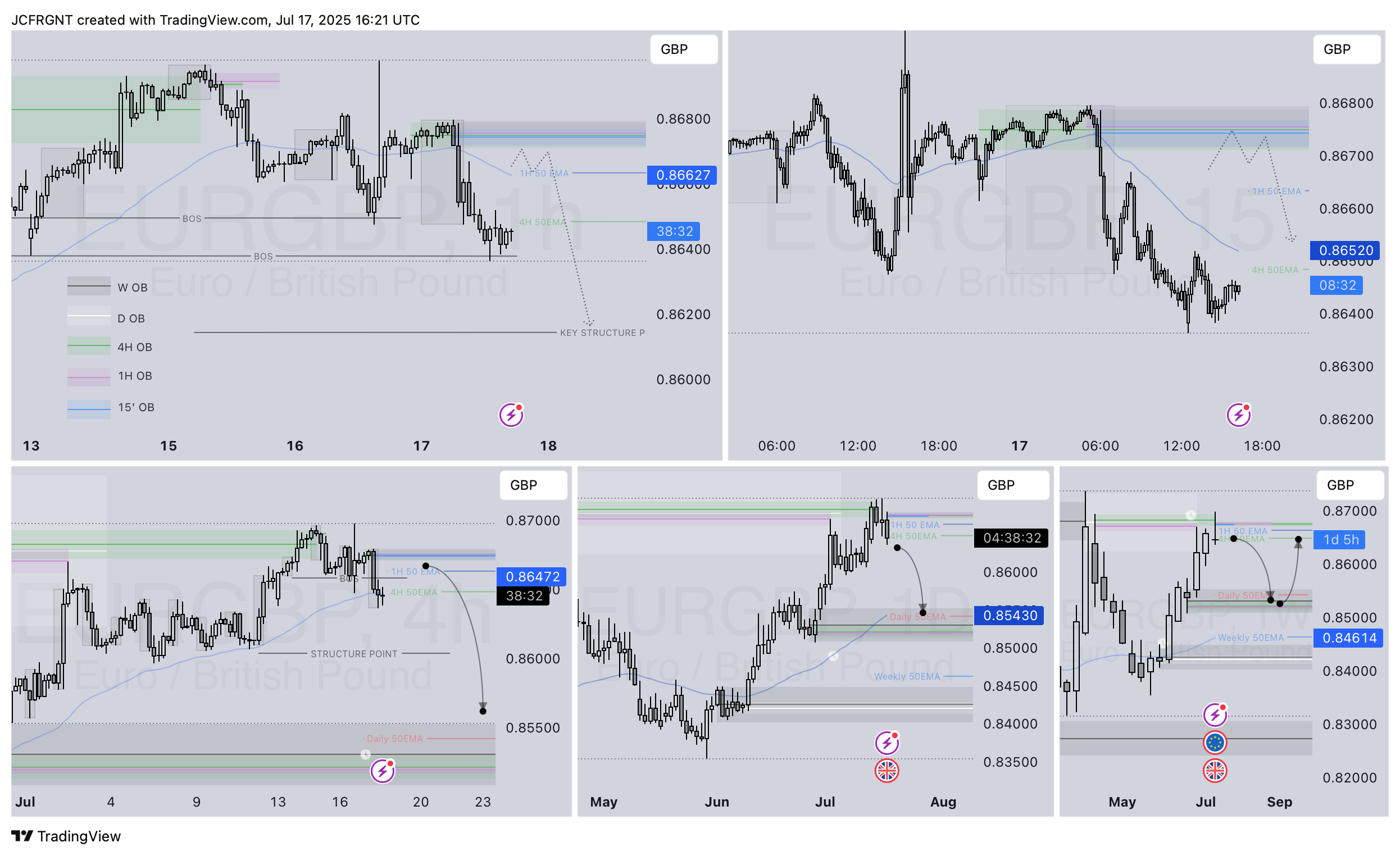

📊 EURGBP – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

Check my idea: Idea: EURGBP Long Project

💼 EURGBP SHORT – DAILY FORECAST

Q3 | D17/18 | W29 | Y25

FUN COUPON FRIDAY INCOMING !

📊 MARKET STRUCTURE SNAPSHOT

EURGBP is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Momentum has slowed, and early signs of distribution are appearing. With structure aligning bearishly across multiple timeframes, the pair presents a short bias opportunity.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Price reacted from a high-probability bearish OB.

Rejection wicks and a shift in candle body control point to supply dominance.

Momentum is fading, confirming the presence of smart money sellers.

✅ 4H Order Block

Clear mitigation of 4H OB followed by an internal break of structure (iBoS).

Price is respecting the OB zone, printing lower highs beneath key supply.

Perfect mid-timeframe confirmation of trend transition.

✅ 1H Order Block

1H structure shifted bearish, validating LTF trend alignment.

Price building supply chain with continued lower highs and bearish engulfing patterns.

Ideal zone for entry on pullback or liquidity sweep.

📈 Risk Management Protocols

🔑 Core Principles:

💰 Max 1% risk per trade

📍 Only execute at pre-identified zones

⏰ Set alerts — avoid impulsive trades

📉 Respect RR — minimum 1:2 per position

🧠 You're not paid for frequency. You're paid for discipline and execution quality.

🧠 Weekly FRGNT Insight

“Trade what the market gives, not what your ego wants.”

Stay mechanical, stay focused, and allow the probabilities to play out. Your job is to control risk — not the outcome.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

📌 The confluences are stacked.

📌 The bias is confirmed.

Let your execution reflect your discipline, not your emotions.

❤️ Good luck this week, and as always – I’ll see you at the very top.

Idea: Beauty Series #11 | EURGBP

EURGBP moves a bit wild, giving room for sl/stop hunts

EURGBP moves a bit wild, giving room for sl/stop hunts

💼 EURGBP SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURGBP is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Momentum has slowed, and early signs of distribution are appearing. With structure aligning bearishly across multiple timeframes, the pair presents a short bias opportunity.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Price reacted from a high-probability bearish OB.

Rejection wicks and a shift in candle body control point to supply dominance.

Momentum is fading, confirming the presence of smart money sellers.

✅ 4H Order Block

Clear mitigation of 4H OB followed by an internal break of structure (iBoS).

Price is respecting the OB zone, printing lower highs beneath key supply.

Perfect mid-timeframe confirmation of trend transition.

✅ 1H Order Block

1H structure shifted bearish, validating LTF trend alignment.

Price building supply chain with continued lower highs and bearish engulfing patterns.

Ideal zone for entry on pullback or liquidity sweep.

📈 Risk Management Protocols

🔑 Core Principles:

💰 Max 1% risk per trade

📍 Only execute at pre-identified zones

⏰ Set alerts — avoid impulsive trades

📉 Respect RR — minimum 1:2 per position

🧠 You're not paid for frequency. You're paid for discipline and execution quality.

🧠 Weekly FRGNT Insight

“Trade what the market gives, not what your ego wants.”

Stay mechanical, stay focused, and allow the probabilities to play out. Your job is to control risk — not the outcome.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

📌 The confluences are stacked.

📌 The bias is confirmed.

Let your execution reflect your discipline, not your emotions.

❤️ Good luck this week, and as always – I’ll see you at the very top.