EURINR trade ideas

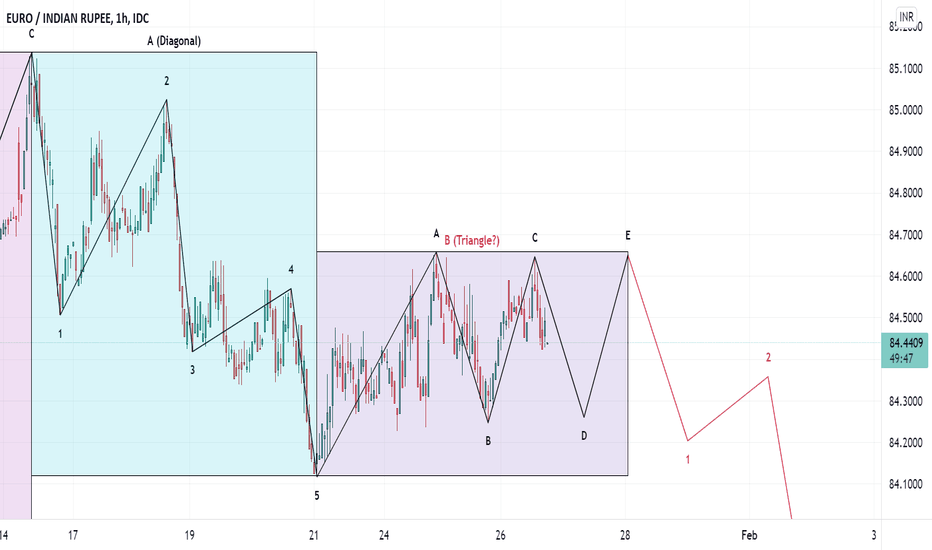

Update 10-EUR/INRAs expected in as stated in UPDATE 9-EUR/INR trade setup the price had hit and reversed at 84.6583. But the reversal to the downside from 84.6583 was not strong enough. Refer Chart 1 for details.

Chart 1

Hence this downward wave is a correction wave to the previous ABC wave and this could turn out to be a regular flat as shown in chart 2

Chart 2: Option 1

Chart 3: Option 3, This move could be a triangle correction to ABC.

Chart 4: Option 4, the whole correction could be a triangle

Time should answer and hence let's give time sometime until this weekend.

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 9-EUR/INRThe pattern mentioned in Chart 11 of Update 8-EUR/INR given below turned into a major correction forming and irregular flat as shown in Chart 1

Chart 11 of Update 8-EUR/INR

Chart 1:

Price action had formed a Diagonal pattern to the downside after this correction. Right now the price is correcting the diagonal pattern which is expected to be over by 25 Jan 2022.

Chart 2

Trade setup:

Position : Short

Entry: Aggressive entry at 84.6 ro 84.65. Conservative entry upon break below 84.10

Entry period: 25 Jan 2022 - 26 Jan 2022

Stop loss: 84.80

Target: 83.6

Target period: 31 Jan 2022 to 03 Feb 2022 (subject to change based on end of correction)

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 8-EUR/INRIt's pretty long since the last update "Update 7-EUR/INR" and all the targets are achieved and lets check how it had happened.

As stated in "Update 7-EUR/INR", the price action broke below 86.8936 on 22 Oct 2021 09:30 (IST) which is before 22 Oct 2021 11:30 (IST) and indicated that the reversal was faster than wave 5 (the ending diagonal). Check out the Chart 1 for details.

Chart 1

Violet ray indicates the price within the "Reversal?" area which broke the red ray (86.8936 the starting point of Wave 5) before 22 Oct 2021 11:30 (IST) faster than wave 5.

What had happened after that?

Price action had resolved itself as shown in chart 2

Chart 2

Just ignore the labels. Without labels price action looks as show in chart 3.

Chart 3

How to label it then?

Firstly, it is important to identify wave reversal with high momentum to confirm reversal in direction of price action. Chart 4 below indicates that the recent wave had taken time greater than the previous wave but yet to break above pervious wave. This indicates that the correction is not yet over and the direction of momentum is yet to the downside.

Chart 4

Now, let’s assess the different possibilities of labelling.

Alternate-1: Is it 12345 as shown in Chart 5?

Chart 5

No, because wave 3 is the smallest as shown in Chart 6

Chart 6

Alternate-2: Is this WXYXZ as shown in Chart 7?

Chart 7

Possibly Yes, but this is a plan for a big drop in EUR upon completion of ongoing correction. So, this alternate-2 cannot be considered until the time answers.

Alternate-3: Is this WXY as indicated in chart 8?

Chart 8

Most possibly yes if the Wave B in Y ends by breaking below 83.5 before March 21, 2022.

Alternate-4: Whether the Wave Y a terminal triangle as shown in Chart 9?

Chart 9

Much possibly Yes and this structure can indicate exhaustion of downward move. This structure might fit into proportionality concept with Wave W.

But all these alternatives-2,3 and 4 are long term views and should be granted to Time for answering.

And what for now?

Wave C in Y indicated in Chart 9 is zoomed into 1H resolution and it seems to be like in Chart 10.

Chart 10

It is an ABC wave and its end was indicated by the price by breaking above wave 4 at 84.74 faster than wave 4.

So what to expect? Expect price to go up now. How?

Chart 11

Chart 11 shows that the price action which broke above wave 4 had formed wave A. This wave A was corrected by a triangle forming wave B. Wave B end is marked by the price breaking above 84.3643 faster than wave e in triangle. Now it is wave C and the trade plan is as follows:

Trade setup:

Position: Long

Entry zone: 84.2 to 84.6 (experts can choose their own entry points other than this)

Stop loss: 83.9

Target zone: 85.0 to 85.2

Target period: Before 14 Jan 2022

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 7-EUR/INRApologies, friends!!! It was pretty premature to conclude in Update 6-EUR/INR (refer the linked idea) that Wave C in 1H chart was over and hence the flat correction in 1D chart was complete. However the trading plan had prevented us from taking short entry as the price action didn't break below 86.8936 yet.

Now I believe that the wave C in 1H chart is over with an ending diagonal as shown below.

Upon completion of ending diagonal, the price had a steep fall which is marked in the rectangle labelled 'Reversal?".

Remaining concepts stand as explained in Update 6-EUR/INR.

Trade opportunities if the current wave is correction to Wave C:

Short upon break below 86.8936 if break down is within 22 Oct 2021 11:30 (IST)

Target range : 86.5983 to 86.3173

Stop loss: above the recent high which is to be confirmed upon price breaking below 86.8936

Trade opportunities if current wave is motive to adjacent flat wave in 1D chart:

Short upon break below 86.8936 if break down is within 22 Oct 2021 11:30 (IST)

Target range : 86.5983 to 86.3173 and 85.2575 (85.2575 is target only when he price does drop below 86.0503 on or before 08/11/2021)

Stop loss: above the recent high which is to be confirmed upon price breaking below 86.8936

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 6-EUR/INRTargets predicted in idea titled "Update 5-EUR/INR" (linked as related ideas) are achieved.

Wave C in 1H chart is over which completes a flat correction in 1D chart.

1H chart showing internals of Wave C and its 5 wave completion

1D chart showing the recent flat correction

And what's next-

1H chart below shows that the momentum of "recent wave" to the downside is low and it has consumed 36 hours which is more than the time taken by wave 5 and yet the "recent wave" had not retrace below wave 5.

Arguments:

As the corrective flat pattern had ended which was validated by "recent wave" retracing wave 5 by more than 78%, there are 2 things which could happen.

1. A correction to Flat corrective wave in 1D chart

2. A motive down wave

Argument 1: Correction to Flat correction wave in 1D chart

If the price does not drop below 86.0503 on or before 27/10/2021, then it confirms that the price action is corrective to the adjacent flat and the correction could end around 27/11/2021.

Trade opportunities:

Short upon break below 86.8936

Target range : 86.5983 to 86.3173

Stop loss: above the recent high which is to be confirmed upon price breaking below 86.8936

Argument 2: A motive down wave in 1D chart

If the price does drop below 86.0503 on or before 27/10/2021, then it confirms that the price action is motive to the adjacent flat wave as it retraces the price range of the flat within the period of wave C in flat. The Motive wave could end around 27/11/2021 as shown in blue path

Trade opportunities:

Short upon break below 86.8936

Target range : 86.5983 to 86.3173 and 85.2575 (85.2575 is target only when he price does drop below 86.0503 on or before 27/10/2021)

Stop loss: above the recent high which is to be confirmed upon price breaking below 86.8936

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 5-EUR/INRI have entered long on 08/10/2021 10:02 in contrary to the idea "Update 4-EUR/INR". Here I shall explain the reason for entering the trade and what is expected next.

Firstly the reason for taking long trade in contrary to the idea "Update 4-EUR/INR" is explained below:

Black bold box indicates the price band and period equivalent to wave C of wave Z and the bold red box indicates the price band and period equivalent to the whole wave Z.

Reversal wave would have failed to retrace the price band of wave C of wave Z within the period equivalent to wave C of Z but it had ensured to retrace the price band of whole wave Z within the period equivalent to wave Z hence I entered long.

And What's next:

This daily chart shows that the current wave is corrective to the downtrend but should relook on labelling these waves.

This hourly chart shows the internal waves in the above stated corrective wave in daily chart. Wave A and B are over and this is wave C. Waves A, B and C are indicated in bold boxes. Wave C is expected to travel the distance equivalent to wave A up to 87.1374 or it retraces the whole of wave B upto 87.3698. These are the predictions for now.

Internals of Wave C:

Wave 1 and 2 are over. Wave 3 is slower than wave 1 so the probability for wave 3 to hit 87.2909 (price band equivalent to wave 1) is low. Completion of wave 3 can be identified based on corrective price action in future. But for now wait and see for the behavior of price action at following levels:

87.1374

87.3698

For those who have entered long, the current stop loss shall be below the wave 2 @ 86.3128

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 4-EUR/INRFormation of Wave Z was confirmed by price action with its break below the wave X on 27/09/2021 13:30 as expected and shared in Update 3-EUR/INR (view linked idea), however Wave Z was not an ending diagonal nor a triangle as expected in Update 3-EUR/INR but it was a flat.

In the above chart, Wave W, Y and Z form the motive waves and wave X(s) form correction waves of Wave B. None of these correction Wave X(s) had retraced the motive Wave W and Y completely which confirms bearishness. However as shown in below chart motive Wave Z is about to be completely retraced.

Wave C of Z was retraced more than 78% and hence validating the completion of wave Z. If Wave Z is completely retraced before 06/10/2021 11:30 (time period equal to wave C in Z) then it marks the end of downward move or Wave B (with WXYXZ) and start of bullish reversal to form Major wave C.

Now the trade plan:

If the wave marked as "Reversal?" breaks above wave Z (86.8016) before 06/10/2021 11:30 (Indian Standard Time) then the trade plan is as below:

Position: Long

Target 1: 87.1374

Target 2: 87.5015

Target 3: 87.9647

Stop loss: 85.7988 (trail as the higher lows are formed)

I am excited to wait an watch the price action validating my entry signal by breaking above 86.8016 before 06/10/2021 11:30 (Indian Standard Time) to take my long position.

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 3-EUR/INRAs expected in Update 2-EUR/INR , Wave X was formed and it has not resolved itself to a regular flat.

The C wave of flat in this Wave X was retraced more than 78% which validates completion of wave C and thereby completion of Wave X. In addition this Wave X had not retraced more than 68% of previous wave Y, hence this is a correction to Wave Y and not to the whole of the previous WXY.

Now expect a 5 wave move to the downside to form the terminal Wave Z. Wave Z could be an ending diagonal or a triangle. The formation of wave Z shall be confirmed by price action breaking below Wave X before 29/09/2021 11:30 (Indian Standard Time).

Wave Z shall end the correction wave B in the box with bold black borders.

I am excited to watch the confirmation of Wave Z and recognize its pattern (expecting either the black path forming a triangle or blue path forming an ending diagonal displayed on screen) to put an end correction Wave B. Waiting for the price to break above Wave Z with high momentum to the upside to trade long with the wave C of major trend.

Keep watching this space for further updates on trading.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 2-EUR/INRAs expected on 16/09/2021, wave X (in blue box) was formed and failed to have upward momentum.

Wave X was followed by a zigzag the downside (now labelled Y in red). Wave which was labelled as Y on 16/09/2021 had resolved it self as wave W. This WXY wave formation together formed a double zigzag and finally forming the major wave Y. Refer the idea Update 1-EUR/INR dated 16/09/2021 for comparing this wave with then analysis.

Now the price action is forming a major wave X with low momentum to the upside. It is a correction wave to the major wave Y because in this period inside the box labelled as "Recent wave X" the momentum to the downside is slower than the upward momentum and the upward momentum is slower than the Y wave in box labelled as "Wave Y (7 wave move forming WXY)".

Expectation from the "Recent Wave X" and further price movement is projected in screen.

I am yet awaiting for a high momentum to the upside to trade wave C of major trend. Hence I shall be watching the market.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Update 1-EUR/INRI have planned to start a series of regular updates for EURINR and hence started to label the ideas in a serially. This idea is starts the series as Update 1-EUR/INR. Now lets get into the subject.

Refer the linked idea on how momentum helps in identifying waves.

This chart shows how the momentum had its critical role in identification of waves.

Red boxes are motive waves with strong momentum and the blue ones are corrective waves with weak momentum.

Notice that in Waves W and Y the motive waves have strong momentum in the direction of downtrend and the same down (directional) waves have weak momentum in Wave X.

Price action in box labelled as Wave X/Reversal had completely retraced wave 5 of wave Y with stronger momentum than wave 5. This could be correction wave X to wave Y or it could be a reversal. If this is a reversal then it shall retrace the whole of wave Y within the period of this box before 17/09/2021 22:30 (Indian standard time). If not then it confirms wave X formation. Expect wave Z to the downside upon completion of wave X. I am neutral for now.

Your comments are welcome.

Trends-Waves-Momentum-Patterns "Key concepts of trading"I am writing this idea to document my learnings in wave analysis. Your thoughts and comments on this document are welcomed for discussion.

Identification of waves and wave patterns is critical in wave analysis. I have seen that MOMENTUM is a key indicator in wave analysis.

There are four main concepts I use in my analysis:

1. Trend – It is defined as the direction in which the price is moving. Trend can be a downtrend or an uptrend. Downtrend shall be marked by a series of lower highs and lower lows. Uptrend shall be marked by a series of higher highs and higher lows.

2. Momentum – It can be defined as the pace at which the price moves i.e distance / time or the rate of change in price. Momentum is a relative measurement. it is measured with reference to the previous move and accordingly the momentum can be strong or weak compared to the previous move.

3. Wave – It is defined as a price move through time in a specific direction either up or down. Period should cover at least 2 candles or bars in a timeframe to form a wave.

4. Pattern is defined as a group of up and down waves formed in a specific manner. Patterns can be motive or corrective.

EURINR chart which I am following shall be used to explain the concepts. Price action in daily chart within the box shown in Chart 1 shall be in scope of analysis.

Chart 1:

The direction of price action within the box is downwards and hence the trend is down trend. Marking highs and lows within the trend is too early right now without applying the concept of wave moves. Accordingly, the following chart is marked with waves lines based on direction of price move.

Chart 2:

In the above chart there is a blue box marked with a purpose to explain why the price action in the box is marked as 1 single wave. Box is zoomed into and alternate possibility of marking waves within the box is represented below.

Chart 3

It could be seen above that the last candle in the box makes both the new low and high of the wave and there is no other possibility to mark it. However according to the definition of wave it cannot be formed with 1 period (candle) in a time frame. Hence the whole move is marked as a single move.

Now that the highs and lows in the trend are clearly visible, chart 2 shall be taken for further analysis. Based on clarity of waves movements the price action can be ripped apart as directional and corrective periods and represented in chart 4

Chart 4

Now getting into the logic behind identification of directional and corrective periods. Let’s analyse directional period-1 given in chart 4. Chart 5 is incorporated with momentum to analyse directional period-1.

Chart 5

Momentum of upward movement of price is marked in blue and downward movement in red. It can be seen from the above chart that the price movement to the downside (in red boxes) retraces the upward moves faster i.e. on the left hand side, price moved up by 0.8540 in 1 bar but at the same time it retraced the whole price and moved down by 0.8970 in 1 bar the next day and continued downwards. Similar momentum correlation can be found on the right-hand side of chart 5. Accordingly, the momentum is towards the downside and the price movement is directional during this period.

Now let’s analyse the momentum of price moves in correction period marked in chart 4. Chart 6 shows the analysis.

Chart 6

In chart 6 the momentum of downward price move is weaker than the upward price move. Momentum in chart 6 is in contrast with momentum in chart 5. This means the momentum of directional (downward and trending) move is weaker than the counter trend moves (upward move) hence this period contains corrective price action to the directional period-1.

Now let’s find the end of correction period-1 and resumption of directional moves in directional period-2. See chart 7.

Chart 7

Box marked with bold black border in chart 7 is the area where correction period ended. Change in momentum getting stronger towards the downside can be seen in bold black bordered box. 0.9414 up move which happened in 4 bars was engulphed by 1 bar to the downside marking the end of correction period and start of directional period-2.

Concepts of waves, momentum and trend being applied, now let’s get into marking the waves with Elliot wave counts. Chart 8 shows the Elliot wave counts and the patterns.

Chart 8

Chart 8 without minor waves

Now the query is how the move in box with bold black bordered box became wave 4 in Directional wave -2. Lets see it in Chart 9.

Chart 9

This is again due to the bias in momentum of up and down moves. The up move on the left-hand side(blue area) is with strong momentum than the down (directional) move (red area). The pattern within the box forms a C-failure flat pattern which upon completion resumes directional down move with strong momentum.

And finally the directional and corrective periods can be labelled with higher degree Elliot waves and the chart gets represented in Chart 10

Chart 10

Yes, it’s a ABC zigzag correction. Its labelled ABC instead of 123 because the momentum of Wave C is weaker than Wave A. In contrast if it is wave 3 it is expected to have strong momentum than wave 1. Conclusion: It’s an ABC correction.

Use momentum to identify the nature of future moves and enjoy trading.

This is how the messy chart 1 was simplified as chart 10 to identify the direction of price action, wave counts, patterns. There is no trade plan shared in this document but identification of directional and correction moves, identification of end of directional and correction periods, identification, counting and labelling wave patterns with this approach shall provide an objective insight in taking trades.

Once again HAPPY TRADING😊!!!!!!!!

Might continue down or continue to correctIf price breaks below the yellow box (87.0325) within the period of yellow box (before 28/08/2021 2:30 UTC+5:30) then it is continuation to downtrend (blue path) or it is continuation to the upward correction (black path).

However the entry is

short for now

Stop loss 87.4256

Target: 85.86

Wait until target or stop loss is hit.

EURUSD - Multi-year breakoutMulti-year breakout above 86 handle has created room for upside till 92.30 (All time high) and beyond. As far as 86.00 is intact uptrend will continue. At current levels we can observe bullish divergence in RSI along with rising trend line making a case for fresh long with favorable risk reward.