EUR/JPY Bullish Reversal Setup – Entry, Stop Loss & Target StratEMA (30) - Red Line (160.596): Short-term trend.

EMA (200) - Blue Line (161.267): Long-term trend, currently above the 30 EMA indicating a bearish macro trend.

2. Entry Zone:

Marked in purple between 159.751 and 160.161, suggesting a buy (long) opportunity if price retests this demand/support zone.

3. Stop Loss:

Set just below the entry zone at 158.907, protecting against deeper bearish momentum.

4. Target Zone:

163.025 is the profit target, with a purple rectangle showing a resistance/supply zone around that level.

5. Price Action:

The price is currently consolidating near the ent

EURJPY trade ideas

EURJPY Short Opportunity: AI-driven Analysis Suggests Bearish MoEASY Trading AI indicates a strong SELL signal for the EURJPY pair. Current Entry Price stands at 160.204, targeting Take Profit at 159.41466667, with a necessary precautionary Stop Loss set at 161.59466667. This bearish stance is supported by recent momentum shifts and significant resistance rejection near key price levels identified through neural network pattern recognition. Technical indicators integrated into the EASY Trading AI point consistently downward, highlighting potential selling pressure and increased volatility ahead.

EURJPY What Next? BUY!

My dear followers,

I analysed this chart on EURJPY and concluded the following:

The market is trading on 160.85 pivot level.

Bias -Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 161.67

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR/JPY NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

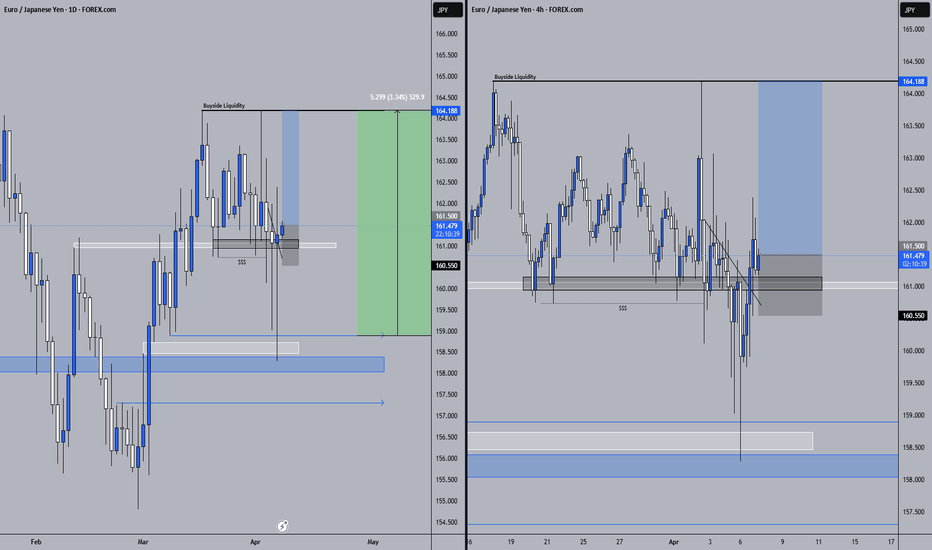

EUR/JPY "The Yuppy" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (164.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (161.000) Day / swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 167.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/JPY "The Yuppy" Forex Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURJPY SellEUR/JPY is showing signs of bearish momentum after a recent retracement into key resistance levels. This analysis will break down the key levels, market structure, and potential trade setups based on the 1-hour chart.

Bearish Market Structure & Resistance Rejection

The chart indicates a clear downtrend, with lower highs and lower lows forming. The recent rally into resistance aligns with Fibonacci retracement levels, suggesting a potential continuation of the bearish trend.

Key Areas of Interest

Resistance Zone at 160.60 - 160.75: This area, marked as an "Area of Interest," aligns with the 0.5 and 0.618 Fibonacci retracement levels, making it a potential turning point for bearish continuation.

Support at 158.44: This level aligns with the Asian session low and could serve as the next bearish target if price resumes its downward movement.

Fibonacci Retracement & Potential Sell Zones

Price is currently retracing within the Fibonacci levels, with the 0.5 and 0.618 zones acting as potential resistance. If price fails to break above 160.75, a strong rejection could signal a sell opportunity targeting lower support levels.

Liquidity

Liquidity is likely sitting below the recent lows near 158.44. A stop-hunt scenario could see price briefly pushing above resistance before reversing downward.

Bearish Scenario: If price rejects the 160.60 - 160.75 zone with bearish confirmation (such as a strong rejection wick or bearish engulfing candle), traders could look for short entries targeting 159.40 and then 158.44.

Bullish Scenario: If price breaks and holds above 160.75, it could invalidate the bearish setup, opening the door for a potential push toward 161.20.

TRADE

Entry: 160.649

Stop Loss: 161.095

Take Profit: 159.242

EURJPY: Top formation, sell opportunity.EURJPY is neutral on its 1D technical outlook (RSI = 53.515, MACD = 0.340, ADX = 26.005) as it ranges between its 1D MA50 and 1D MA200. This is a peak formation on the LH trendline of the 5 month Channel Down identical to January. At least a -6.20% bearish wave is to be expected. Today's spike gives an even better sell entry for a TP = 154.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

EUR/JPY Bullish Breakout Setup with 2.02% Target PotentialEMA 30 (red): 160.813

EMA 200 (blue): 161.441

---

Highlighted Zones & Points:

1. Entry Point:

Marked around 160.719 (just below EMA 30)

Positioned in a demand/support zone (highlighted purple box)

2. Resistance Point:

Marked at 161.799

Serves as a minor resistance level before the major target

3. EA Target Point:

Final target is 163.880

This represents a potential move of 3.253 units or 2.02%

---

Interpretation:

Bullish Bias: The chart suggests a bullish setup, anticipating a breakout above EMA 200 and the resistance point toward the target of 163…

Is EURJPY trying to break the resistance move again to 176 area?OUT OF BOX THOUGHTS -Risky : Last week, EURJPY experienced a false breakout and has been spending a considerable amount of time consolidating near the resistance zone. Is it trying to break through the resistance and reach 176 again? Let's find out.

EUR JPY #0002 Short Position Trading - The Weekly chart indicating a downtrend

- There was a presence of a false breakout price action named Inverted hammers on weekly charts

- The Daily Charts reflecting a presence of order blocks signified a accumulation of short position is undergoing.

- I decided to place entry at the last weekly candle's HIGH as my liquidity area.

- The rest are as labelled

- This is meant for Swing/position trading - might take some time

- less headache

- I am a revert position-trader, from the sin of Scalping.

EJ, Massive correction is in order - and thats an understatementEURJPY has been resilient last year, goin parabolic and hitting highs at 175.0 levels. As with any parabolic behavior -- weighty trim downs has followed thereafter. Slashing as much as 1500 pips from its last years price peak.

Based on recent long term metrics -- more trim downs is expected that may linger for quite a bit. Color of the year will likely stay red for the next few seasons ahead.

Our diagram depicts a major long term shift -- with a ultra wide time spectrum double top resistance that spans 17 years from July 2008 to April 2025. This solid head bump zone is historically a hard roof to crack and its already showing rejection based on latest price behavior.

As economic uncertainty lingers, with all markets in red recently -- JPY status as a safe haven pair is currently manifesting hence the recent surge in strength (and weakness on all paired).

The resurfaced black bar on the last monthly closing represents the first of many incoming series of descending price levels.

Expect more price decay from this top zone.

Spotted at 161.0

Mid/Long term target 150, 140 areas.

TAYOR

Trade safely.

EUR/JPY Breakouot trendline @162.077 H4 chart analysisFrom the chart, here are the key details for your EUR/JPY trade setup along with support and resistance levels:

Trade Setup:

Entry Point: ~162.077

Stop Loss (SL): ~164.369

Take Profit (TP): ~156.037

Support & Resistance Levels:

Major Resistance: ~164.451

Minor Resistance: ~162.194

Major Support: ~156.154

Minor Support: ~160.000 (psychological level)

This trade setup shows a Risk/Reward Ratio of 2.6, aligning with solid risk management principles. If you’d like a polished message to send to your client, let me know.

EURJPY detailed pingpong tradeEURJPY Forecast – Market Structure Shift (15-Minute Timeframe)

The EURJPY pair has recently shown a Market Structure Shift (MSS) on the 15-minute timeframe, suggesting a potentially strong bullish move is imminent. This shift follows last week's aggressive bearish momentum, which likely left a trail of liquidity pools above the current price.

However, before the market begins this bullish run, it is expected to mitigate the Order Block (OB) below the current structure. This will likely trigger retail traders to enter short positions, creating more liquidity for smart money to capitalize on.

Once this mitigation is complete, I anticipate a rapid upside movement, targeting and sweeping liquidity up to the 163.50 area.

After reaching this level, the market is expected to reverse and head downward, targeting liquidity resting below, potentially reaching the 158.50 zone.

From this level, I expect EURJPY to gain strong bullish momentum once again, aiming for an extended move towards the 165.00 area.