EURJPY trade ideas

EURJPY - Expecting The Price To Bounce Higher FurtherH4 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Expecting retraces and further continuation higher until the two key Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TRADE THE BREAKOUTOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will rise to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

EUR/JPYSell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

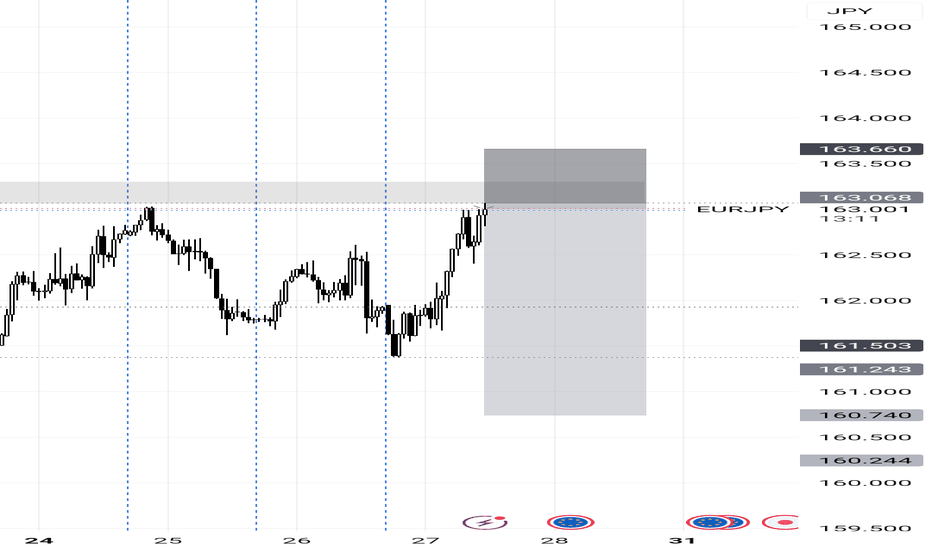

EURJPY Setup IdeaLooking for a long entry, limit order set....

Here is my logic from left to right: we have an short term "double top" forming inside a higher time frame up trend, I'm looking for a run on the stops of traders going short.

We found support at a bullish liquidity pocket (bottom red spot) = Bullish sign

Price completed a bullish harmonic (that grey double top structure is a harmonic) = Bullish sign

Price gave me entry signal with H1 break of structure (blue zone) = Bullish sign

We have equal lows sitting just above the blue line (X's) = Bullish sign

My target is the next red zone even though im projecting this pair to go much higher.

Earlier this week in my newsletter, I gave two zones to look for buy reactions in for EURJPY.

(the huge purple zone on the left, and the bottom red zone within it which currently has a +75 pip reaction.)

Feel free to check it out, the link is in my post signature, and profile bio.

Cheers 🍻

EUR/JPY Triple Bottom Breakout – Bullish SetupThis chart represents the EUR/JPY currency pair on the daily timeframe. It highlights a Triple Bottom pattern, a bullish reversal formation that signals a potential upward trend after testing strong support multiple times.

1. Chart Pattern Analysis – Triple Bottom Formation

The Triple Bottom is a classic reversal pattern that forms after a downtrend and consists of three distinct lows at nearly the same level. This indicates that sellers attempted to push the price lower but failed three times, suggesting that buying pressure is increasing.

Bottom 1 (August 2024): The price reached a low near 150.344, forming the first support zone.

Bottom 2 (September 2024): The price dropped again to the same support level but bounced back, indicating strong demand.

Bottom 3 (March 2025): The price retested the support for the third time and rebounded, confirming the pattern.

💡 Key Takeaway: The repeated failure to break below the support level suggests that sellers are losing control, and buyers are preparing for a strong move up.

2. Support & Resistance Levels

Understanding support and resistance levels is crucial for identifying entry and exit points:

Support Level (150.344 - 150.125): This zone has acted as a strong demand area where price consistently bounced back.

Resistance Level (167.500 - 170.000): This is the neckline of the Triple Bottom pattern. A breakout above this level confirms the bullish trend.

If the price breaks above the resistance level, it will trigger buying momentum and open the doors for further upside.

3. Trading Strategy & Price Targets

✅ Entry Criteria

The ideal buy entry is after the price breaks above the resistance level (~167.500 - 170.000) with strong bullish momentum and increased volume.

Wait for a daily candle close above the resistance level to confirm the breakout.

🎯 Target Levels (Take Profit - TP)

TP1 (173.001) – First profit-taking level, as the price may encounter some resistance.

TP2 (179.266) – Final bullish target if the breakout holds strong.

📉 Stop Loss (Risk Management)

Stop Loss (SL): Below 150.125, just below the previous support level. This minimizes losses if the price fails to break out.

Risk-to-Reward Ratio: This setup offers a high risk-reward ratio, making it a favorable trade.

4. Market Psychology & Confirmation Signals

The Triple Bottom indicates a strong shift in market sentiment from bearish to bullish.

Confirmation signals to watch for:

✅ Bullish breakout above resistance

✅ Increase in trading volume

✅ Formation of bullish candlesticks (e.g., Engulfing, Marubozu, or Breakout Retest Confirmation)

5. Summary & Final Thoughts

🔹 The Triple Bottom pattern signals a strong reversal with clear upside potential.

🔹 The breakout above resistance (~167.500 - 170.000) will confirm a bullish trend.

🔹 Entry: Buy after breakout confirmation with volume support.

🔹 TP1: 173.001, TP2: 179.266

🔹 SL: Below 150.125 to protect capital.

🚀 Conclusion : This setup presents an excellent long opportunity with a well-defined risk-reward strategy. If the breakout holds, EUR/JPY could see a strong uptrend in the coming weeks.

eurjpy analysis ellio. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

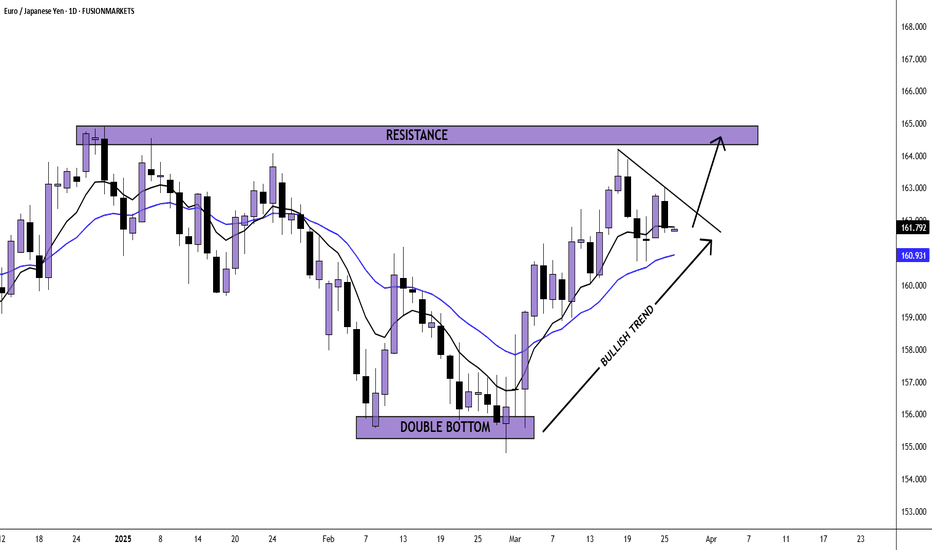

EUR/JPY H4 | Falling to a multi-swing-low supportEUR/JPY is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 160.93 which is a multi-swing-low support.

Stop loss is at 159.90 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement.

Take profit is at 164.00 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

eurjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

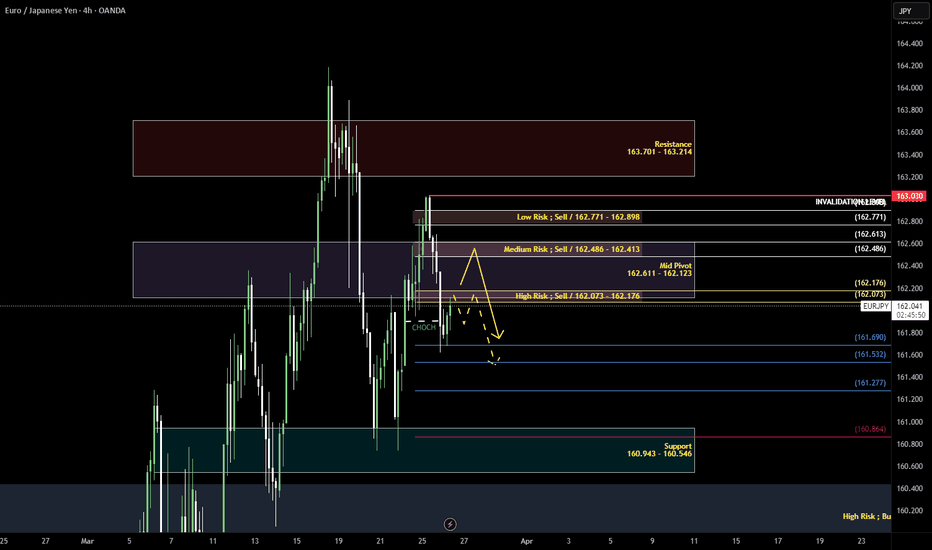

EURJPY Look For ThisOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will rise to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

Short - EUR/JPYGiven the structure that has been formed in the 4 hour timeframe. We can see that there is CHOCH within the structure. This could indicate us that there is potential for the price to move downwards. Currently the price has just touched the first reversal point of the fibonacci retracement it has yet to touch the 2nd reversal point. I would not rush my entry as there are still potential for the price to climb up to the medium risk and low risk zone.

EURJPY - Buy Trade SetupIf risk-on sentiment prevails, I expect to see further upside with EURJPY towards the 165 handle. Should technicals breaks back below the most recent bullish breakout, I most likely will lose confidence confidence and trim my lose. For now, I'm bullish ~ Know thy self

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

EUR/JPY Daily AnalysisAfter printing a double bottom circa 155.50 in February, price has seen a steady move to the upside.

Price appears to be currently correcting.

Look for a break to the upside and a potential long trade (if it meets your strategy rules) into 164.50 which was resistance in December 2024.

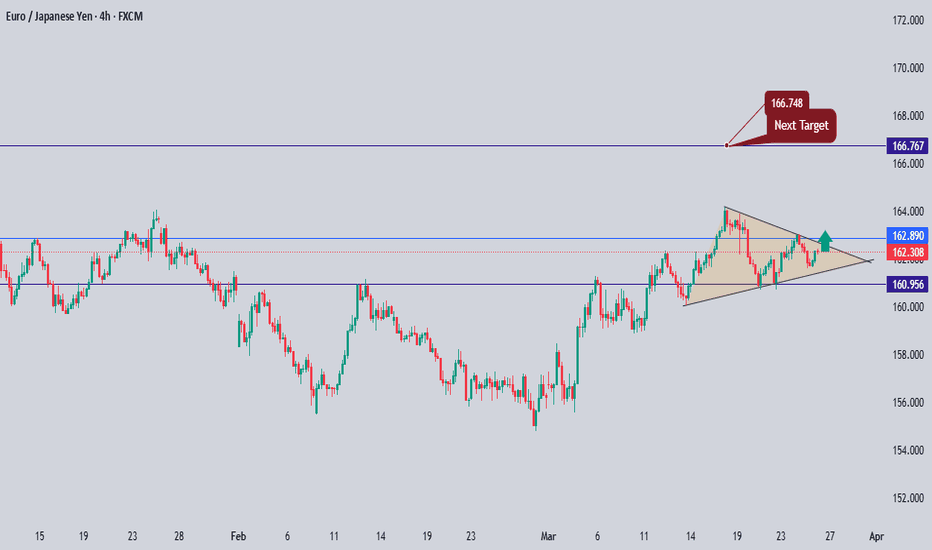

EUR/JPY Breakdown: Falling Wedge Breakout & Bullish SetupThe EUR/JPY 4-hour chart is presenting a well-structured price action setup, featuring a falling wedge breakout, a strong bullish trendline, and key resistance and support levels. This detailed analysis will walk through each aspect of the chart to provide a professional trading perspective.

1. Market Context & Price Action Overview

At the beginning of the chart, EUR/JPY was experiencing a downtrend, characterized by a series of lower highs and lower lows, forming a falling wedge pattern. This pattern is typically a bullish reversal signal, indicating that sellers are losing strength and buyers may take control.

Once the price reached a key support zone near 156.08, it bounced, leading to a breakout of the falling wedge. Since the breakout, the price has been moving in a bullish trend, forming higher highs and higher lows, respecting an ascending trendline.

2. Technical Patterns & Key Levels

🔹 Falling Wedge Pattern – Bullish Breakout

The falling wedge is identified by two converging trendlines sloping downward.

It indicates that bearish momentum is weakening as price compresses.

A breakout above the upper wedge line confirmed the shift in trend direction.

The breakout candle had strong bullish momentum, suggesting increased buyer interest.

🔹 Support and Resistance Levels

📉 Major Support Level (~156.08):

This level acted as a demand zone, where buyers aggressively stepped in.

The price formed multiple rejections at this level before breaking upwards.

A stop-loss placement below this level is ideal for bullish trades.

📈 Resistance Level (~163.50 - 164.00):

This zone has been tested multiple times as price approaches from below.

A break and retest of this resistance would confirm further bullish momentum.

If price faces strong rejection, a short-term pullback to the trendline may occur.

🎯 Final Target (~166.79):

This is the next major resistance level, aligning with previous swing highs.

It serves as a strong take-profit (TP) level for long positions.

If price reaches this level, we may see a consolidation phase or possible reversal.

3. Trend Analysis & Market Structure

📈 Bullish Trendline:

The price has been respecting an ascending trendline, acting as dynamic support.

This trendline connects higher lows, confirming a strong bullish trend.

As long as price stays above this line, buyers remain in control.

📊 Market Structure:

Since breaking out from the falling wedge, the price is forming a classic bullish structure of higher highs and higher lows.

This indicates sustained buyer pressure and a potential continuation toward resistance levels.

4. Trading Setup & Risk Management

📌 Entry Strategy:

Aggressive Entry: After the wedge breakout with a tight stop-loss.

Conservative Entry: Wait for a pullback to the trendline support or a break and retest of resistance at 163.50 - 164.00.

🔻 Stop Loss Placement:

Below 156.08 (previous support zone) to protect against trend invalidation.

Alternatively, below the rising trendline for a dynamic SL approach.

🎯 Take Profit Targets:

TP1: 163.50 - 164.00 resistance zone (Partial profits).

TP2: 166.79 final target, aligning with historical resistance.

5. Market Outlook & Potential Scenarios

✅ Bullish Scenario (High Probability)

If price holds above the trendline and breaks 163.50 - 164.00, we expect a continuation towards 166.79.

The structure remains intact as long as higher highs and higher lows persist.

❌ Bearish Scenario (Low Probability, but Possible)

If price fails at resistance and breaks below the trendline, it could signal a deeper retracement.

A break below 156.08 would completely invalidate the bullish setup, leading to a potential downtrend.

6. Summary & Key Takeaways

Trend Bias: Bullish, supported by a falling wedge breakout and higher highs.

Key Levels: Support at 156.08, resistance at 163.50 - 164.00, final target at 166.79.

Trading Strategy: Buy on retests of trendline or resistance breakouts.

Risk Management: Use dynamic stop-loss levels to minimize downside exposure.

🔹 Final Verdict:

If price remains above support and successfully breaks 163.50 - 164.00, a strong move toward 166.79 is expected. However, traders should remain cautious of trendline breakdowns and manage risk accordingly.

📊 Stay disciplined, follow your trading plan, and always use stop-loss protection! 🚀 #EURJPY #Forex #TradingStrategy #PriceAction