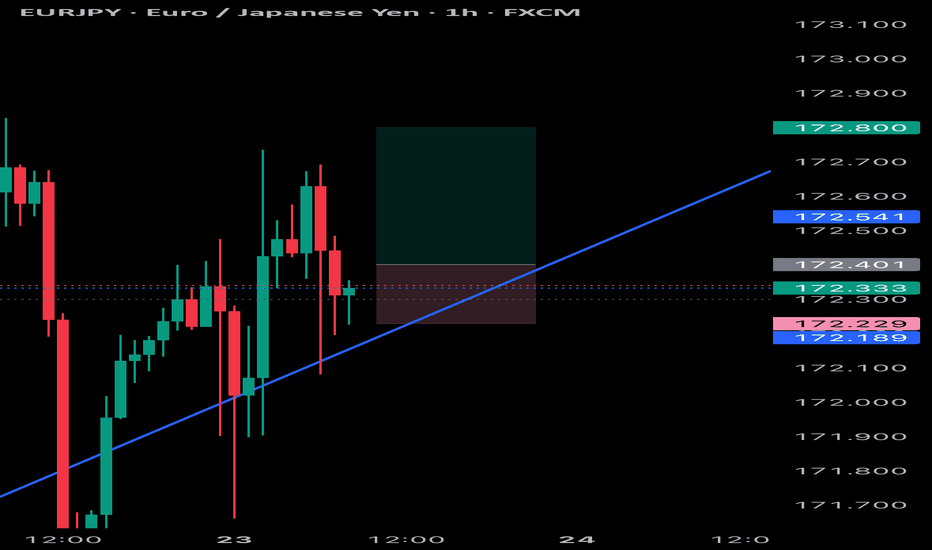

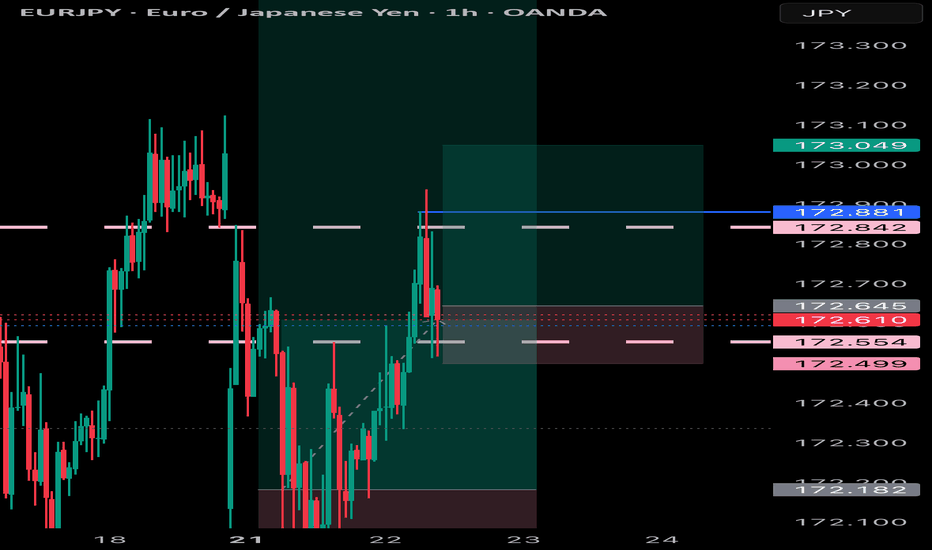

$EJ (EURJPY) 1HEURJPY recently showed a strong bullish rally off a key 1H Order Block (OB) near 171.200. This rally swept sell-side liquidity before shifting short-term structure.

However, current price action shows signs of weakness — multiple rejection wicks near 172.350 and a potential shift in momentum.

The corrective structure forming suggests the bullish move may have been a liquidity run. A clean lower high may confirm bearish intent.

As long as price remains below the recent swing high, we anticipate a short-term retracement toward the OB zone (171.200), which aligns with an area of unfilled orders and possible rebalancing.

EURJPY trade ideas

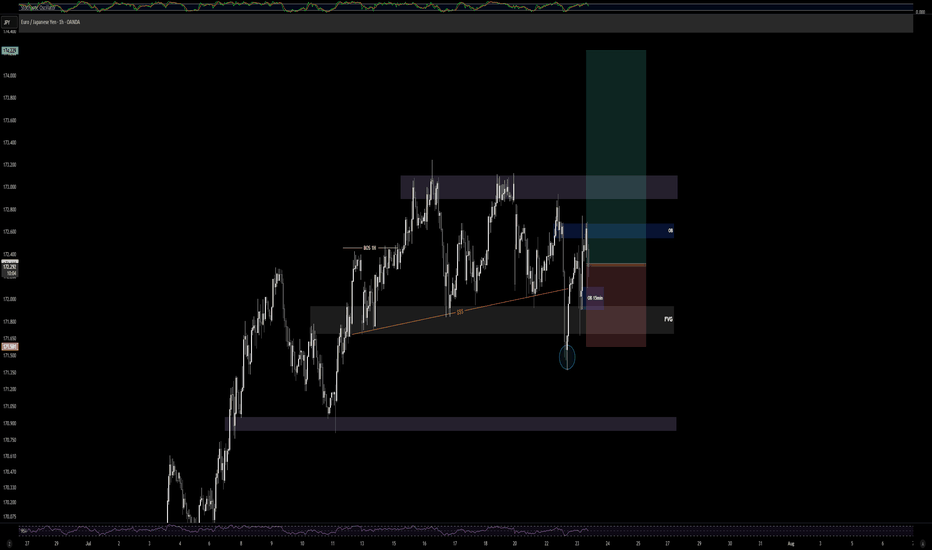

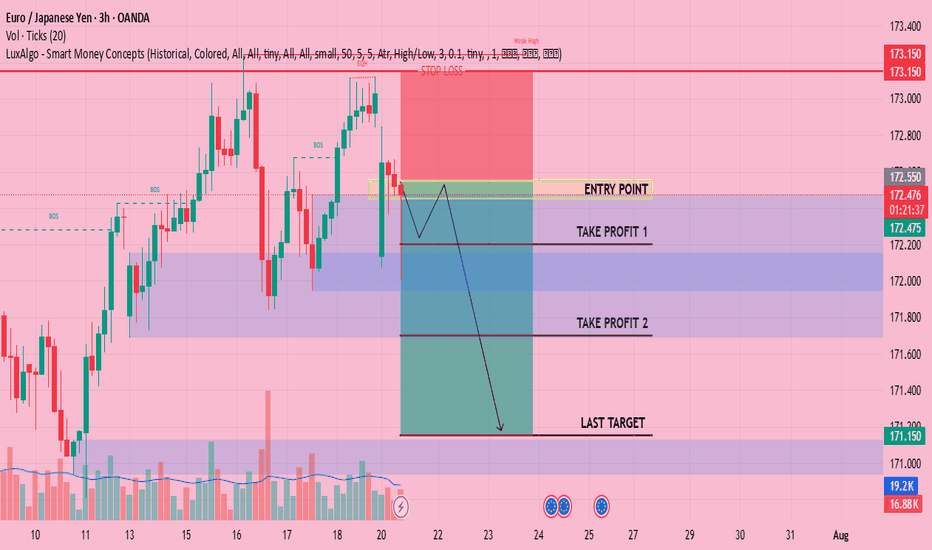

EURJPY SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 EURJPY SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURJPY is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Strong reaction and early signs of distribution.

Previous bullish momentum is losing steam; structure is flattening with rejection wicks forming.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

1H structure shift bearish

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

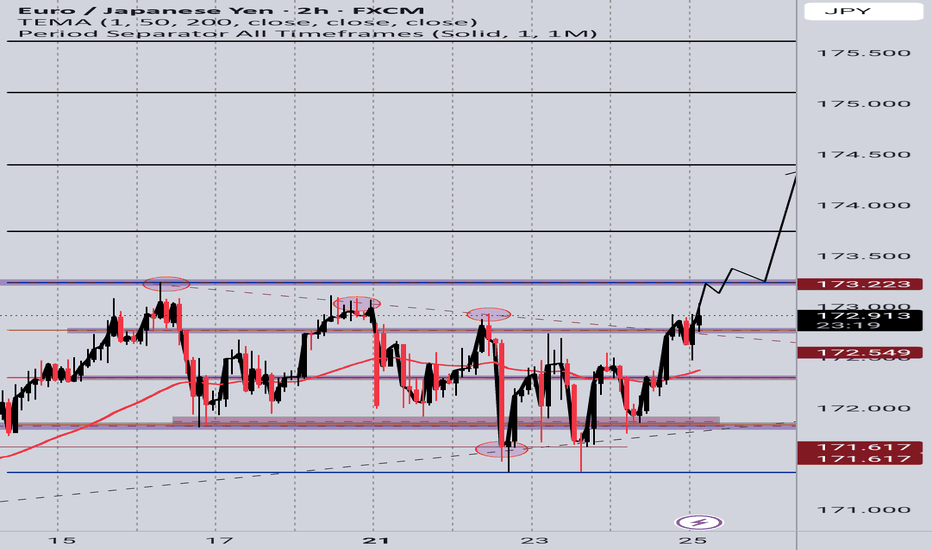

EURJPY Hits Supply | Pullback Is ComingPrice has entered the daily supply zone (red area) between 170.80 and 171.80, showing immediate rejection with a long upper wick — a signal of potential short-term bearish reaction.

The RSI is turning lower, indicating loss of momentum, although it hasn’t reached extreme levels yet.

The current map suggests a technical pullback toward the 169.40–168.50 zone (FVG + dynamic support) before any potential bullish continuation toward 174+.

The overall structure remains bullish, but a correction looks likely due to technical exhaustion and retail positioning.

📊 2. COT Report (JPY Futures – as of 2025-07-01)

Non-Commercials (speculators) reduced long positions on the JPY by -7,779 contracts, and also slightly trimmed shorts → clear sign of position reduction.

Net positioning remains strongly negative (JPY weakness), but it's starting to recover slightly.

Commercials added both longs (+2,830) and shorts (+5,977), indicating indecision but growing interest.

Open interest slightly decreased (–516), though it remains elevated.

👉 The market has not yet reversed, but the JPY downtrend may be approaching exhaustion.

🧠 3. Retail Sentiment

86% of retail traders are short EUR/JPY — a strong contrarian bullish signal.

Average retail short entry: 166.27, while current price is 171.55 → retail traders are trapped and under pressure.

A short squeeze is likely underway or already completed, increasing the risk of a technical correction after distribution.

📅 4. Seasonality

July is historically weak for EUR/JPY:

20Y: -0.35

15Y: -0.49

10Y: -0.18

August tends to be even worse from a seasonal perspective.

This supports the idea of a potential pullback in the coming days or weeks.

Trading Conclusion

Current Bias: Short-term Neutral–Bearish, Medium-term Bullish.

✳️ Potential pullback from 172.30 toward 169.40–168.50

🎯 If price holds and builds clean bullish structure, expect continuation toward 174.00–175.00

❌ Invalidation on daily close below 167.80

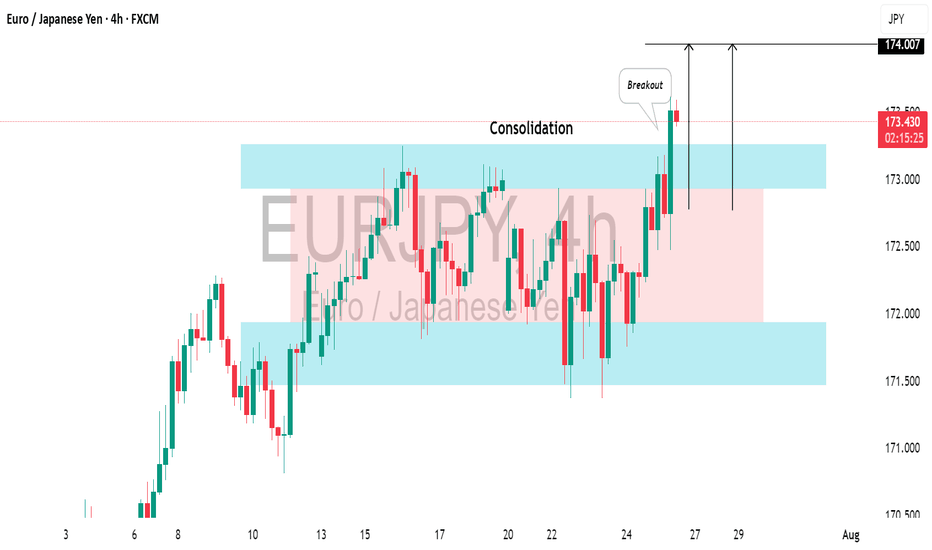

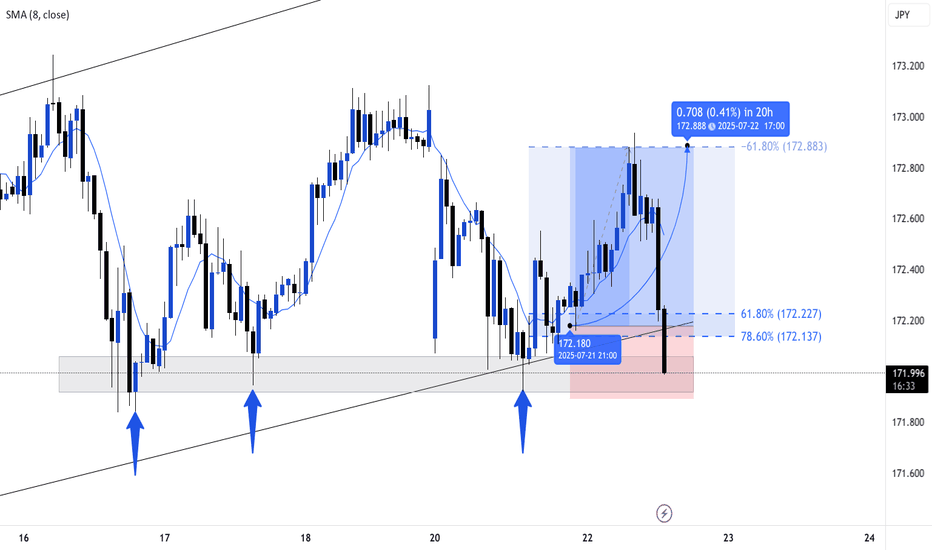

EURJPY: Correction is Over?!It seems like 📈EURJPY has finished consolidating within a broad horizontal channel on the 4H chart.

The formation of a new higher high today suggests potential upward movement.

Since it's Friday, I recommend considering trend-following buys starting Monday.

We should wait for the market to close above the highlighted resistance to establish a Higher Close on the daily chart.

Look to buy after a pullback, targeting 174.00 as the initial goal.

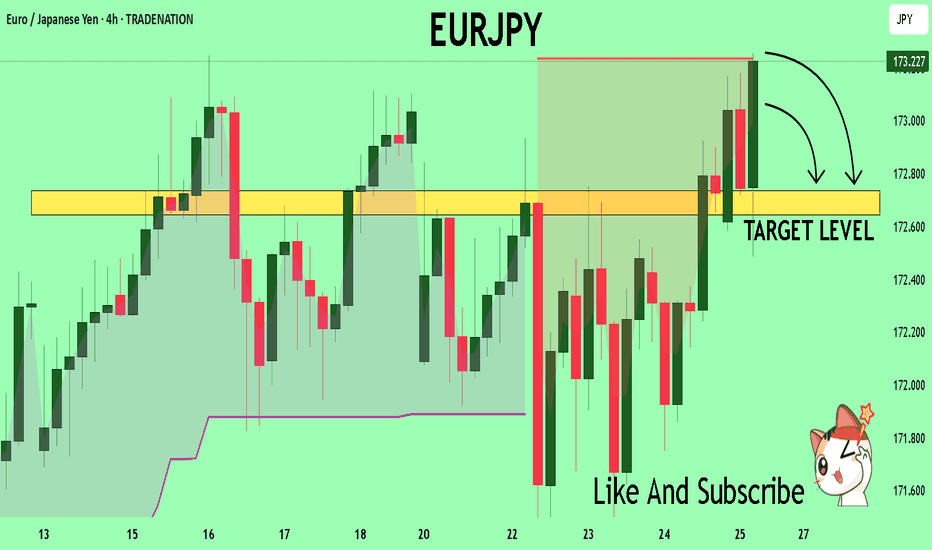

EURJPY Technical Analysis! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 173.19 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 172.73

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

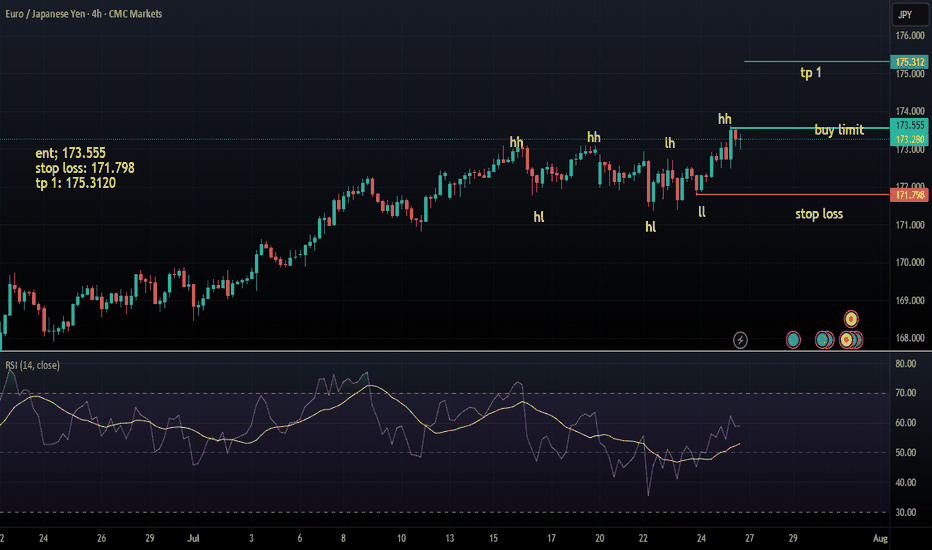

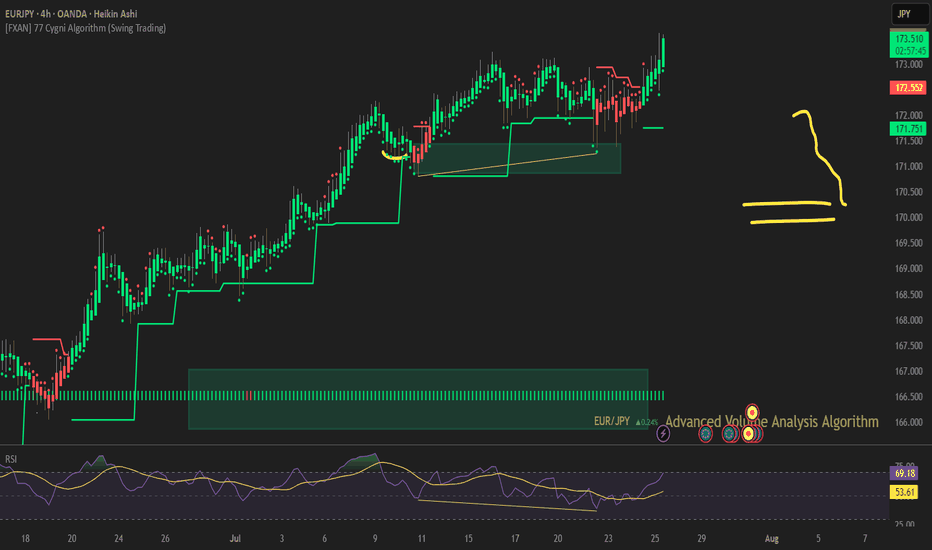

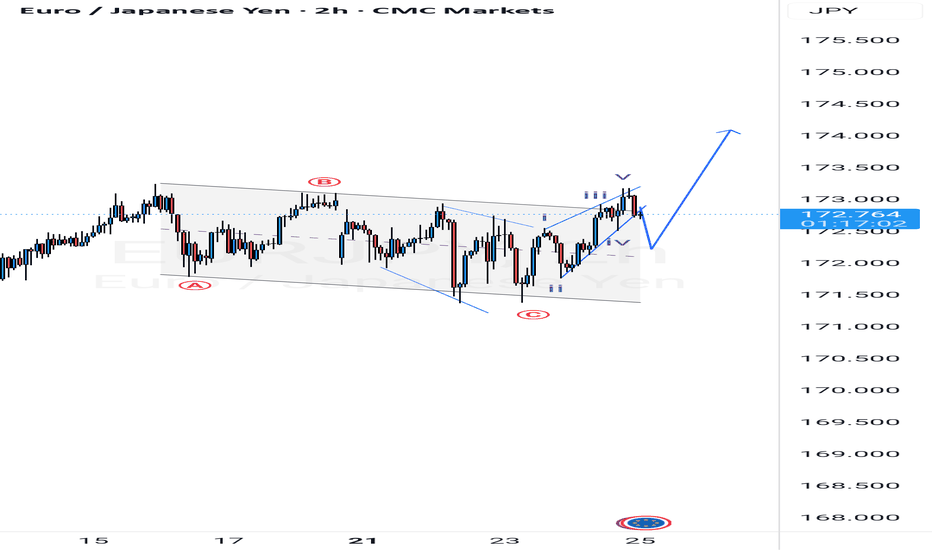

BULLISH SCENARIO EURJPY has been on a consolidation for some few days almost a week, and it looks like the asset has been printing out a flat correction for W4 before it breaks it the upside. The print out of the breakout looks like a LEADING diagonal, which leads to a new Impulse constructing W5. If all goes well we should be looking upstairs before a fall.

Don't forget to apply your trading tactics.

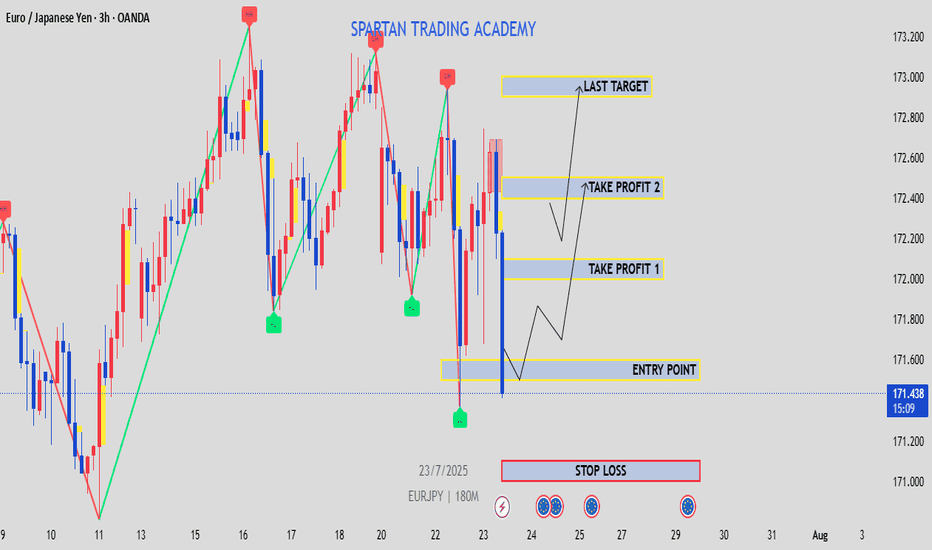

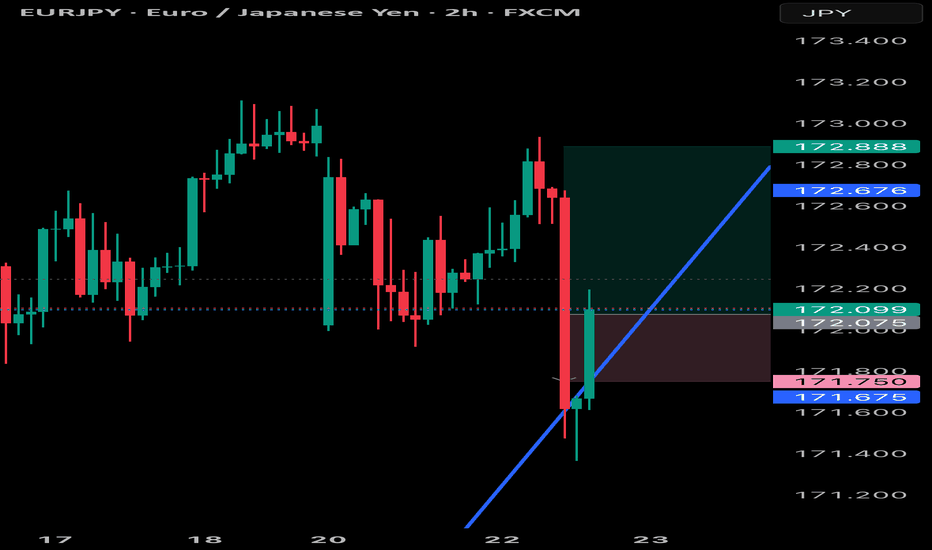

EURJPY will retest yesterday's lowest priceBased on Asian session price action, price broke the 172.00 mark.

due to this, i believed it will continue downtrend at least to test yesterday's lowest price (around 171.37).

I'm instant sell from current market price.

calculate your own risk & reward.

Good Luck.

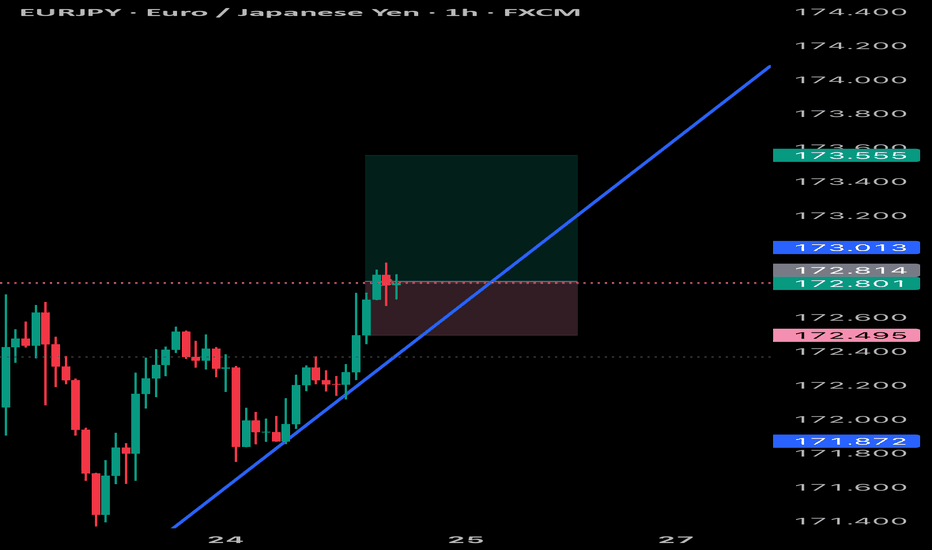

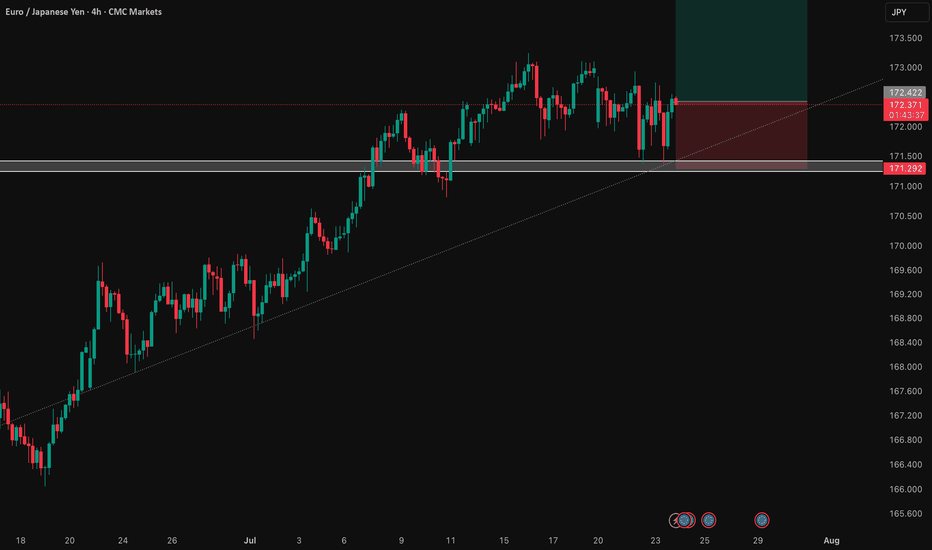

EUR/JPY: Bullish Thesis on Policy DivergenceOur primary thesis is built on a powerful confluence of compelling fundamental drivers and a clear technical structure. We are taking a long position in EUR/JPY with high conviction, anticipating significant upside fueled by a stark monetary policy divergence confirmed by a constructive chart formation.

📰 Fundamental Analysis: The core of this trade is the widening policy gap between the European Central Bank (ECB) and the Bank of Japan (BoJ). While the BoJ is only just beginning to exit its ultra-loose monetary policy, the global environment points toward continued JPY weakness. The upcoming high-impact US news will act as a major catalyst. A "risk-on" reaction to the data would significantly weaken the JPY, providing a strong tailwind for this trade.

📊 Technical Analysis: The chart structure for EUR/JPY is decidedly bullish. The pair has established a clear uptrend, and recent price action indicates a period of healthy consolidation above key support levels. This presents a strategic entry point, as the market appears to be gathering momentum for the next leg higher. The current setup suggests a low-risk entry into a well-defined upward trend.

🧠 The Trade Plan: Based on this synthesis, we are executing a precise trade with a favorable risk profile.

👉 Entry: 172.422

⛔️ Stop Loss: 171.292

🎯 Take Profit: 174.684

⚖️ Risk/Reward: 1:2

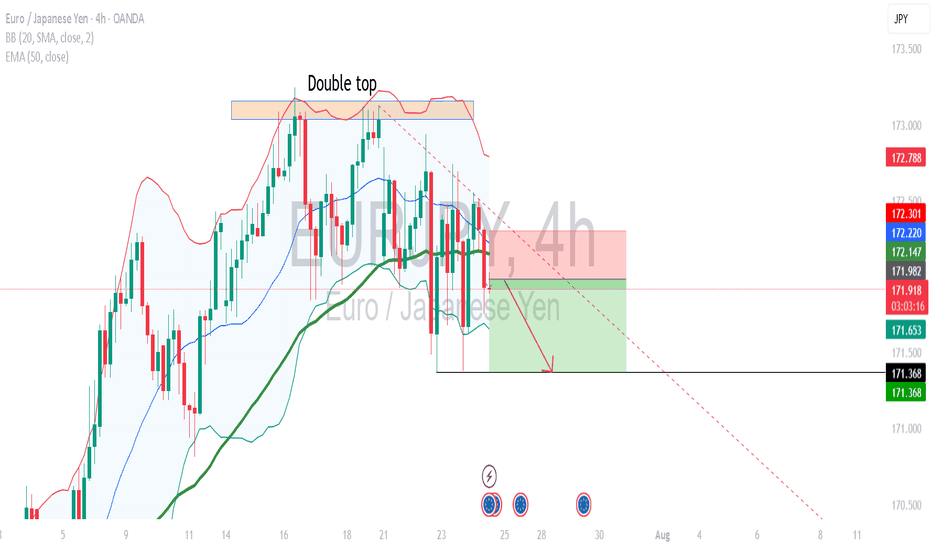

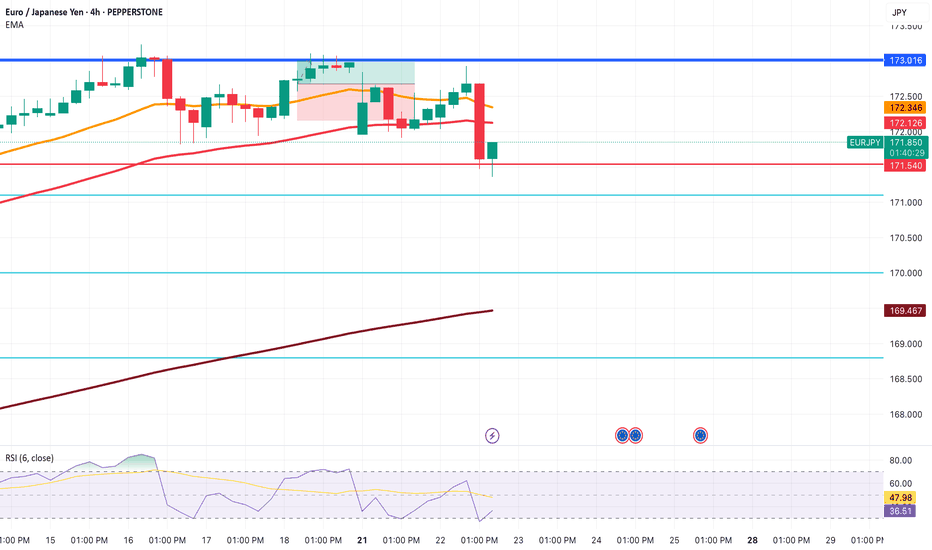

EURJPY about to enter into a DowntrendRecently EURJPY reached high points in the chart at 173.016

From there it fell and continued downwards.

I took a quick demo trade with an inverse risk to reward. Not the ideal thing to do, but I didn't want to keep my TP higher than 173.016 since we know it's a strong resistance level.

Got a quick win there.

Now, on the 4H, we can see that one huge red candle look out the previous five green candles.

It indicates that selling pressure is incoming.

This would be a good time to sell now. But I do want to see price go below 171.540 just to get that extra confirmation. Just in case, price decides to consolidate or go high for a while.

Have to stay vigilant with this market now.

TP1 will be 171.100.

TP2 will be 170.000

TP3 will be 168.800

Lets see how this trade plays out.

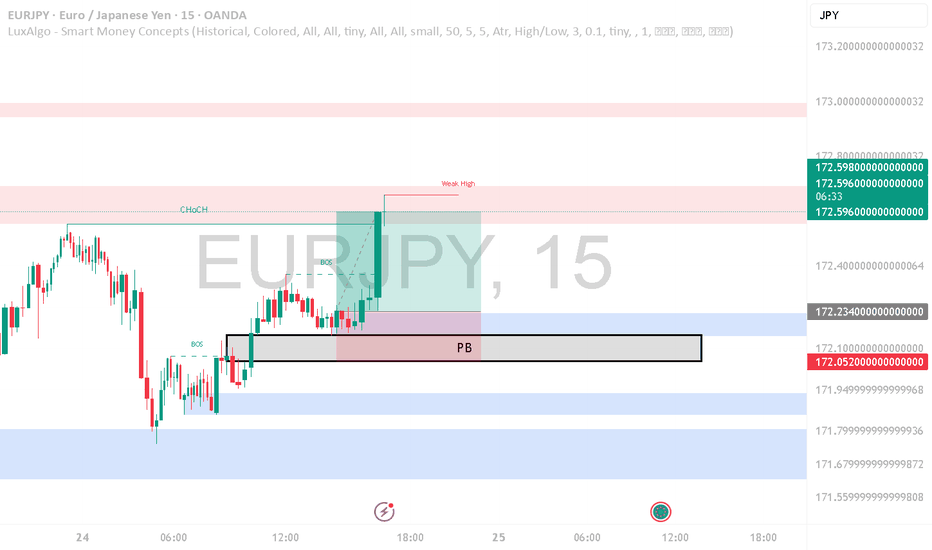

EURJPY

📍 Strategy: BoS + Retest Sniper Entry

🔍 Market Context:

Break of Structure (BoS) confirmed

Price returned to retest broken structure zone

RSI showing overbought divergence (above 70)

Perfect rejection from AREA OF INTEREST near 172.90–173.00

🔻 TRADE DETAILS

🟣 Sell Entry: 172.349

🔺 Stop Loss: 172.948 (Above structure high)

🎯 Take Profit: 169.146

🧮 Risk/Reward: ~1:5.6

🧠 Confidence: 75% setup based on structure + RSI + fakeout wick