EUR/NZD - Triangle Breakdown In PlayThe EUR/NZD pair has formed a classic Triangle Pattern on the 1H timeframe, indicating a period of consolidation before a potential breakout.

🔎 Key Technical Insights:

Price is compressing within the triangle, showing lower highs and higher lows.

Bearish bias is anticipated as price approaches the apex, suggesting a potential breakout to the downside.

Break below the triangle support opens the door for a move toward the target zone near 1.9425.

Resistance remains firm at 1.9619, capping bullish attempts.

🎯 Target Point: 1.9425

This aligns with previous structure and projected move size from the triangle’s base.

📌 Watch For:

Clear bearish breakout candle below triangle

Volume confirmation or follow-through momentum

This setup offers a solid opportunity for traders watching for continuation patterns and breakout plays.

EURNZD trade ideas

Lingrid | EURNZD Major Resistance. Possible ShortFX:EURNZD is approaching the resistance zone after an impulse leg formed from a price rebound off the support level. The triangle pattern near the top suggests market indecision, with the current price testing key resistance near 1.96300. If the pair fails to break and hold above this resistance, a sharp reversal is likely toward the 1.9500 level. Structure favors a bearish reaction unless a confirmed breakout occurs.

📉 Key Levels

Sell trigger: Below 1.9570

Sell zone: 1.96300-1.96450

Target: 1.94985

Invalidation: Above 1.96500

💡 Risks

Bullish breakout above 1.96500 invalidates the short setup

Triangle breakout to the upside may reverse bias

External fundamentals (NZD data/news) could disrupt pattern completion

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

EURNZD – Buy the Dip at Marabuzo SupportTrade Idea

Type: Buy Limit

Entry: 1.9485

Target: 1.9655

Stop Loss: 1.9428

Duration: Intraday

Expires: 05/08/2025 06:00

Technical Overview

Yesterday’s Marabuzo support level is at 1.9475, offering a strong potential reversal point.

Short-term bias has turned positive following a reaction from the recent low at 1.9284.

The 20-period 4H EMA is aligning at 1.9471, supporting the idea of dip-buying.

A temporary pullback is anticipated, providing a tactical entry for continuation higher.

Key Technical Levels

Resistance: 1.9625 / 1.9650 / 1.9679

Support: 1.9535 / 1.9500 / 1.9400

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Local Long! Buy!

Hello,Traders!

EUR-NZD made a retest

Of the horizontal support

Level of 1.9540 from where

We are already seeing a

Local bullish rebound so

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/NZD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR/NZD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 12H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.929 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/NZD Made H&S Pattern , Short Setup Valid After Confirmation Here is my 1H Chart On EUR/NZD , The price created a very clear reversal pattern ( head and shoulders pattern ) But the price Still not close below the neckline so the pattern still not confirmed and we can sell after we have a clear closure below our neckline and targeting from 50 : 150 pips , if we have not a closure below the neckline then we can`t sell and this idea will not be valid anymore .

August 3, Forex Outlook: High-Reward Setups You Need to See Now!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

EURUSD

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

EUR-NZD Short From Resistance! Sell!

Hello,Traders!

EUR-NZD keeps growing

But the pair is locally overbought

So after the pair hits a horizontal

Resistance of 1.9680 we will

Be expecting a local correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD – A Short at the Edge: Counter-Trend Setup BrewingEURNZD – A Short at the Edge: Counter-Trend Setup Brewing ⚠️

When the crowd rushes one way, sometimes the edge is found in going the other. EURNZD has been marching higher, but momentum is stalling — and we’re now seeing cracks at resistance. It’s a counter-trend idea, no doubt, but the setup is clean, the risk is tight, and the timing may be right.

📉 I’m bearish on EURNZD — looking to short from overbought levels at resistance.

Here’s why I’m watching this:

🔹 Price is extended and showing signs of exhaustion on the 4H chart

🔹 Both EUR and NZD are fundamentally weak — this rally is not supported by strong divergence

🔹 Sell signals are emerging from price action near key resistance ⚒️

🔹 Sentiment on NZD has recently turned bullish 📈

🔹 The EUR remains inflated after a 17% run since February — overbought conditions ripe for mean reversion 🔄

Let’s zoom in 🔍

The Euro’s strength is largely speculative and now front-loaded — boosted by the confirmation of a US-EU trade deal 🤝 and hopes that the ECB may pause further cuts 🧊. But the underlying data tells another story: sluggish growth 📉, weak consumption 🛒, and a fragile macro backdrop ⚠️.

Meanwhile, the Kiwi is quietly gaining ground 🥝. Business confidence just hit an 11-year high 🚀, inflation is stabilizing, and the RBNZ is signaling a pause 🧭 after aggressive easing — suggesting the worst may be behind.

Yes, the long-term trend is up 📊 — but this is a short-term idea. Markets are overstretched, price action confirms hesitation ⚖️, and there’s room to fade this move before the next leg is decided.

🤔 Would you take this short? Or do you think momentum carries it higher still? Let’s hear it.

Bullish bounce off pullback support?EUR/NZD has bounced off the support level, which is a pullback support and could rise from this level to our take profit.

Entry: 1.93030

Why we like it:

There is a pullback support.

Stop loss: 1.92255

Why we like it:

There is an overlap support

Take profit: 1.95377

Why we like it:

There is a swing high resistance that lines up with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURNZD shows signs for a continuation long.Price did finish the initial selloff into the start of the HTF 3-touch structure with a 1-2-3 move and started to aggressively reverse. We saw price turning bullish again and is now trading through an AoI and starting to form a consolidation. Price left a small Liq.P, which could act as a base, and if we see price stalling in this area and forming some kind of bull flag, that would be deliberate PA for a continuation to the upside, with the previous high as initial target.

*** **** *****

The pairs I publish here are usually discussed in detail in my Weekly Forex Forecast (WFF) and are now showing further developments worth mentioning.

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

*** **** *****

EURNZD – Double Top + 200 EMA Break… Is the Fall Coming?I think this pair has more chance to go down because a clear Double Top pattern has been formed exactly at a supply zone. After that, price has broken below the 200 EMA, showing weakness in the recent bullish move.

From here, I’m looking at the possibility of a bearish continuation. My expectation is for price to drop towards the 1.94600 area, which aligns with the Fibonacci extension target.

This is just my personal view based on the pattern and 200 EMA break — let’s see how the market reacts in the coming sessions.

Potential bearish drop?EUR/NZD has rejected off the pivot and could drop to the overlap support.

Pivot: 1.94200

1st Support: 1.92361

1st Resistance: 1.95499

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

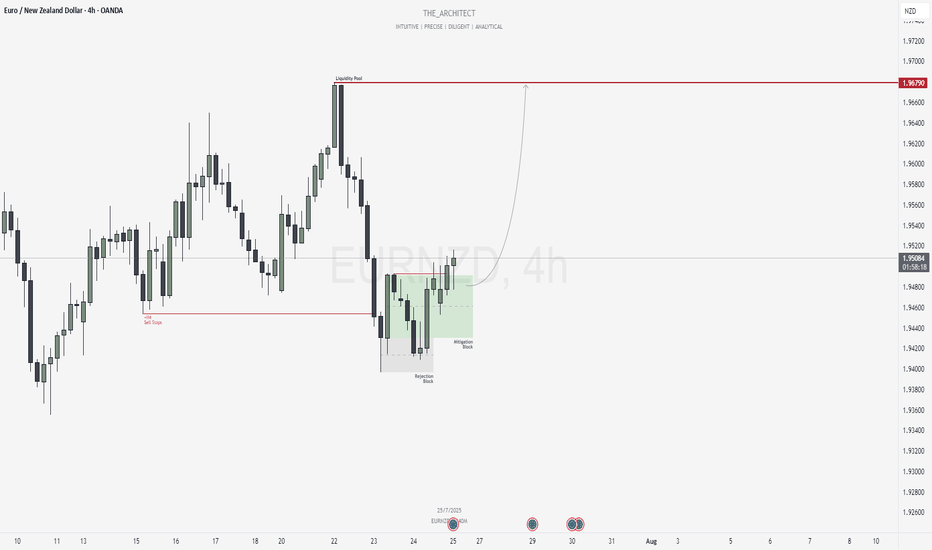

EURNZD: Bullish Shift and Institutional Re-Entry from SupportGreetings Traders,

In today’s analysis of EURNZD, we observe that institutional order flow on the H4 timeframe has recently shifted bullish. This alignment now provides us with a clear bias to seek buying opportunities in line with the predominant higher timeframe trend.

Higher Timeframe Context:

The weekly timeframe is currently delivering bullish order flow. With the recent bullish market structure shift (MSS) on the H4, we now have confluence across both timeframes, which strengthens our confidence in seeking long setups on lower timeframes.

Key Observations on H4:

Sell Stop Raid & Structural Rejection: Price action recently swept sell-side liquidity, a typical behavior indicating institutional order pairing. Following this, price attempted to move lower but failed to break the previous low, instead being supported by a Rejection Block. This led to a bullish market structure shift—our key signal of trend continuation.

Mitigation Block Entry Zone: Price has since retraced into a Mitigation Block—an area where previous institutional selling occurred. The purpose of this pullback is to mitigate earlier positions and initiate fresh buying orders. This now becomes our zone of interest for potential confirmation entries towards the upside.

Trading Plan:

Entry Strategy: Look for lower timeframe confirmation entries within the H4 Mitigation Block.

Target: The objective is to target the H4 liquidity pool residing at premium prices, aligning with the discount-to-premium delivery model.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:https://www.tradingview.com/chart/EURNZD/BZC9xW1L-July-21-Forex-Outlook-Don-t-Miss-These-High-Reward-Setups/

As always, remain patient and disciplined. Wait for confirmation before executing, and manage your risk accordingly.

Kind Regards,

The Architect 🏛️📈

EURNZD Short Day TradeOANDA:EURNZD Short Day Trade - Low Risk, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

EURNZD Update: This short trigger could spark a waterfall dropYo traders, Skeptic from Skeptic Lab! 🩵 EURNZD just broke its daily upward trendline, setting up a sharp drop. Weekly shows a fading uptrend. Daily’s got a strong bearish candle, full body, no buyer fight. 4H trendline broke and... more on this video:)

👀Beware of fakeouts this week—volatility’s high! Trade smart, keep risk tight, and don’t FOMO. Share your thoughts in the comments, boost if it helps <3