EURNZD Update: This short trigger could spark a waterfall dropYo traders, Skeptic from Skeptic Lab! 🩵 EURNZD just broke its daily upward trendline, setting up a sharp drop. Weekly shows a fading uptrend. Daily’s got a strong bearish candle, full body, no buyer fight. 4H trendline broke and... more on this video:)

👀Beware of fakeouts this week—volatility’s high! Trade smart, keep risk tight, and don’t FOMO. Share your thoughts in the comments, boost if it helps <3

EURNZD trade ideas

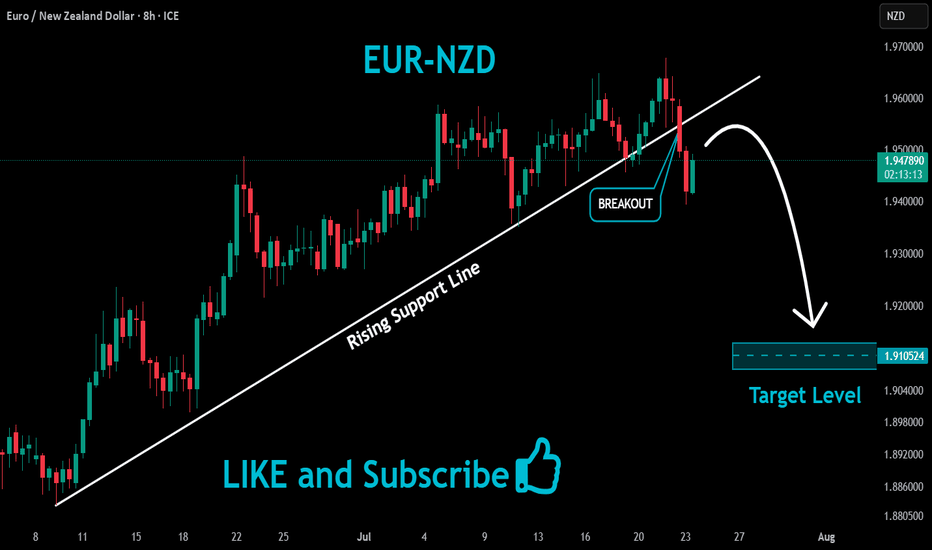

EUR/NZD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR/NZD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 12H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.929 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURNZD – Buy the Dip at Marabuzo SupportTrade Idea

Type: Buy Limit

Entry: 1.9485

Target: 1.9655

Stop Loss: 1.9428

Duration: Intraday

Expires: 05/08/2025 06:00

Technical Overview

Yesterday’s Marabuzo support level is at 1.9475, offering a strong potential reversal point.

Short-term bias has turned positive following a reaction from the recent low at 1.9284.

The 20-period 4H EMA is aligning at 1.9471, supporting the idea of dip-buying.

A temporary pullback is anticipated, providing a tactical entry for continuation higher.

Key Technical Levels

Resistance: 1.9625 / 1.9650 / 1.9679

Support: 1.9535 / 1.9500 / 1.9400

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/NZD Made H&S Pattern , Short Setup Valid After Confirmation Here is my 1H Chart On EUR/NZD , The price created a very clear reversal pattern ( head and shoulders pattern ) But the price Still not close below the neckline so the pattern still not confirmed and we can sell after we have a clear closure below our neckline and targeting from 50 : 150 pips , if we have not a closure below the neckline then we can`t sell and this idea will not be valid anymore .

August 3, Forex Outlook: High-Reward Setups You Need to See Now!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

EURUSD

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

Potential bearish drop?EUR/NZD has rejected off the pivot and could drop to the overlap support.

Pivot: 1.94200

1st Support: 1.92361

1st Resistance: 1.95499

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURNZD Will Go Down From Resistance! Short!

Here is our detailed technical review for EURNZD.

Time Frame: 6h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.941.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.927 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Dynamic Entry Alert – EUR/NZD Bearish Heist Execution!💣 EUR/NZD Robbery Blueprint: The Kiwi Vault Bearish Heist Plan 💰🕵️♂️

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

This ain't your usual trading tip — it’s a Thief Trading Masterstroke 🎯. We're gearing up for a high-stakes heist on the EUR/NZD forex market. Time to crack open the Kiwi vault and rob those bullish bandits blind! 😼💣

🧠 Strategic Mindset:

🔍 We're targeting the oversold consolidation zone. Bullish traders think they’re safe? Think again. This area is a trap — the perfect bait for our bearish ambush. Expect trend reversal vibes, layered with juicy liquidity grabs.

🕵️♂️ Entry Plan:

🎯 Sell Entry: The vault is wide open! Swipe the Bearish loot at any price - the heist is on!.

💣 Setup:

Sell Limit Orders at nearest swing highs (15m or 30m timeframe)

Use DCA / Layering Method for multiple entries (scalp or swing tactics)

📌 Set your Alert 🚨 — no breakout, no entry. Patience pays.

🛑 Stop Loss Strategy (SL):

No premature moves! Don’t place that SL till we get the confirmed break.

🔥 SL Recommendation:

Just above 1.95400 (4H candle wick swing high)

Adjust based on lot size and number of layers

📍 Remember, the market’s a jungle — stay sharp or get sliced.

🎯 Take Profit (TP):

💵 Target Zone: 1.92500

(But hey, escape early if the vault starts shaking. Protect your gains like a pro.)

📊 Macro Intel – Why This Works:

This isn’t random — it's backed by our 🔥 combo of:

COT Reports

Sentiment Analysis

Quant/Algo Bias

Intermarket Correlation

Fundamental + Technical Confirmation

📌 You can dig deeper — but trust me, this setup’s been scouted like a pro job.

⚠️ Risk Protocols:

Avoid entries during high-impact news

Use Trailing SLs to lock in the loot

Adjust position size to suit your personal bankroll & risk appetite

🔥 Final Word from the Thief:

Smash that 💥Boost Button💥 if you're vibing with the heist plan!

Support the squad, stay profitable, and rob the market — legally, of course.

We don’t trade, we infiltrate.

We don’t predict, we execute.

📡 Stay tuned… More robbery blueprints coming soon!

🤑🐱👤🚨💸💪 #ThiefTrader #ForexHeist #EURNZDShortPlan

EURNZD Short Day TradeOANDA:EURNZD Short Day Trade - Low Risk, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

EURNZD shows signs for a continuation long.Price did finish the initial selloff into the start of the HTF 3-touch structure with a 1-2-3 move and started to aggressively reverse. We saw price turning bullish again and is now trading through an AoI and starting to form a consolidation. Price left a small Liq.P, which could act as a base, and if we see price stalling in this area and forming some kind of bull flag, that would be deliberate PA for a continuation to the upside, with the previous high as initial target.

*** **** *****

The pairs I publish here are usually discussed in detail in my Weekly Forex Forecast (WFF) and are now showing further developments worth mentioning.

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

*** **** *****

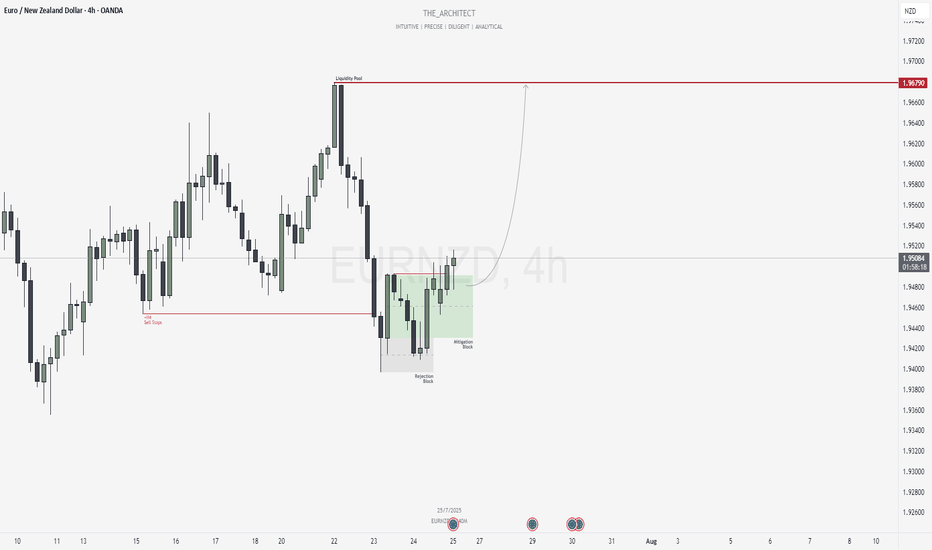

EURNZD: Bullish Shift and Institutional Re-Entry from SupportGreetings Traders,

In today’s analysis of EURNZD, we observe that institutional order flow on the H4 timeframe has recently shifted bullish. This alignment now provides us with a clear bias to seek buying opportunities in line with the predominant higher timeframe trend.

Higher Timeframe Context:

The weekly timeframe is currently delivering bullish order flow. With the recent bullish market structure shift (MSS) on the H4, we now have confluence across both timeframes, which strengthens our confidence in seeking long setups on lower timeframes.

Key Observations on H4:

Sell Stop Raid & Structural Rejection: Price action recently swept sell-side liquidity, a typical behavior indicating institutional order pairing. Following this, price attempted to move lower but failed to break the previous low, instead being supported by a Rejection Block. This led to a bullish market structure shift—our key signal of trend continuation.

Mitigation Block Entry Zone: Price has since retraced into a Mitigation Block—an area where previous institutional selling occurred. The purpose of this pullback is to mitigate earlier positions and initiate fresh buying orders. This now becomes our zone of interest for potential confirmation entries towards the upside.

Trading Plan:

Entry Strategy: Look for lower timeframe confirmation entries within the H4 Mitigation Block.

Target: The objective is to target the H4 liquidity pool residing at premium prices, aligning with the discount-to-premium delivery model.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:https://www.tradingview.com/chart/EURNZD/BZC9xW1L-July-21-Forex-Outlook-Don-t-Miss-These-High-Reward-Setups/

As always, remain patient and disciplined. Wait for confirmation before executing, and manage your risk accordingly.

Kind Regards,

The Architect 🏛️📈

Bullish bounce off pullback support?EUR/NZD has bounced off the support level, which is a pullback support and could rise from this level to our take profit.

Entry: 1.93030

Why we like it:

There is a pullback support.

Stop loss: 1.92255

Why we like it:

There is an overlap support

Take profit: 1.95377

Why we like it:

There is a swing high resistance that lines up with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Euro vs Kiwi Bull Raid: High Reward Target Strategy🏴☠️EUR/NZD Heist Plan: "Robbing the Kiwi Vault with Thief Trading Style" 💰🔥

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Dear Money Makers, Chart Bandits & Market Strategists! 🤑💸✈️

Here’s the EUR/NZD (Euro vs Kiwi) blueprint crafted using the signature 🔥Thief Trading Style🔥 — a blend of bold technicals, insightful fundamentals, and pure tactical precision. We’re setting our sights on a potential bullish breakout — targeting the high-security resistance zone where big money hides.

💡The Robbery Plan (Thief Entry Setup):

🟢 Entry Point:

"The vault is wide open — time to extract the bullish loot!"

⚔️ Entry can be taken at market price, but the smarter thieves use a layered Buy Limit strategy at pullback zones (near swing lows/highs on the 15-30 min TF) to snipe the best entries with reduced exposure.

🔁 Scaling in = DCA-style Thief Method: split entries for efficiency, just like robbing in waves.

🔻 Stop Loss Plan (Escape Route):

🔒 Place SL below the recent swing low using 3H timeframe (1.94000 for scalpers/day traders).

🛡️ Adjust based on risk appetite, lot size, and number of entries in play.

🎯 Take Profit Target:

🏁 Exit the heist near 1.97700, where strong resistance awaits. That’s the Danger Zone — the edge of our mission.

🔍EUR/NZD Outlook Snapshot:

This pair is flashing bullish vibes due to:

🏛️ Macro & Fundamental tailwinds

📊 COT positioning & Sentiment readings

🔗 Intermarket influences

📈 Price structure & liquidity zones

For more depth: dive into external analysis tools, COT reports, and sentiment dashboards to fine-tune your view. The direction is clear — the bulls are assembling.

⚠️ Trading Alerts & Risk Management Reminders:

🚨 News releases = volatility mines.

Before entering, make sure to:

Avoid new positions near red-flag economic events

Protect your open trades with trailing SLs or partial exits

Stay alert — the market shifts fast, adapt faster

💬 Final Word from the Vault Boss:

📢 Smashing likes = boosting the crew. 💥

Support the Thief Trading Style by hitting the BOOST button and keep the robbery crew rolling strong 💪💸

We're here to outsmart the market — one clean chart raid at a time.

Stay tuned for the next master plan. Until then, rob smart, rob safe. 🧠🔐💥

Weekly Trade Outlook | Lessons in Discipline, Risk & PerspectiveGreetings Traders,

In today’s video, I’ll be walking you through my end-of-week trade outlook, breaking down every setup I took throughout the week. This session is designed to offer insight into how I apply risk management, trading rules, and maintain psychological discipline in real-time market conditions.

Whether you're struggling with emotional trading, inconsistency, or overtrading, this video will give you a fresh perspective on how structure, faith, and discipline can shape a sustainable trading approach.

Remember: respect your trading rules, pray over them daily, and ask God for the strength to remain disciplined—so you don’t become your own worst enemy in the market.

Let’s grow together,

The Architect 🏛️📈

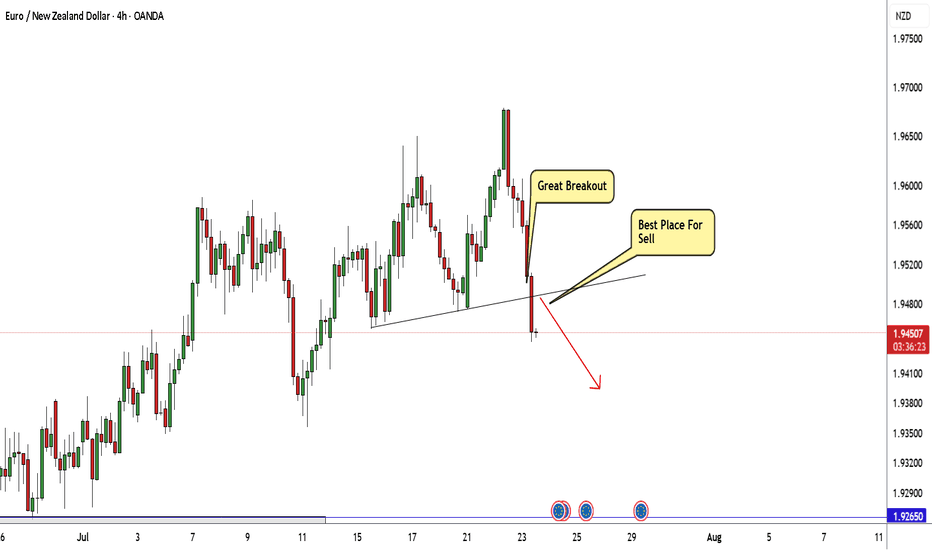

EUR/NZD Breakout Done , Short Setup Valid To Get 150 Pips !This Pair moved to upside very hard last 2 weeks and now the time to go down again , we have a very good closure below my C.T.L , And we have a confirmation with a very good 4h Candle so we can wait the price to go up a little to retest the broken area and we can enter a sell trade .

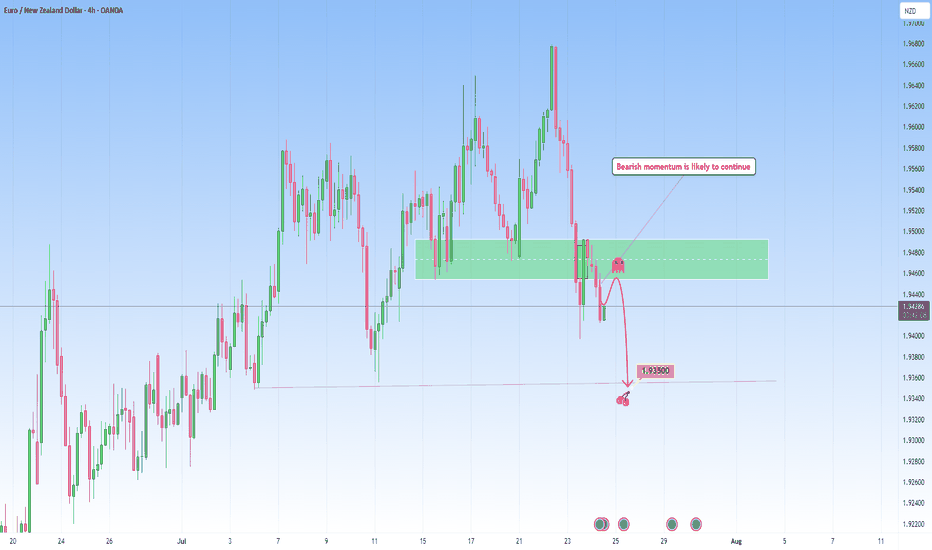

EURNZD Continuation setup following recent bearish momentumThe market has recently pushed down with momentum.

Price attempted a timid "echo bounce" back into the broken support but was rejected, confirming this area now serves as area for bearish re-entries.

From what I can tell, we're entering the next leg of what I call the “Gravity Spiral Phase”, where sellers take over after taking a clear zone. Each wave down is not just a move, but a continuation of momentum migration into new bearish move.

Target: 1.93500

This level marks the next gravity anchor, a zone where price memory may attempt to stabilize, but only temporarily.

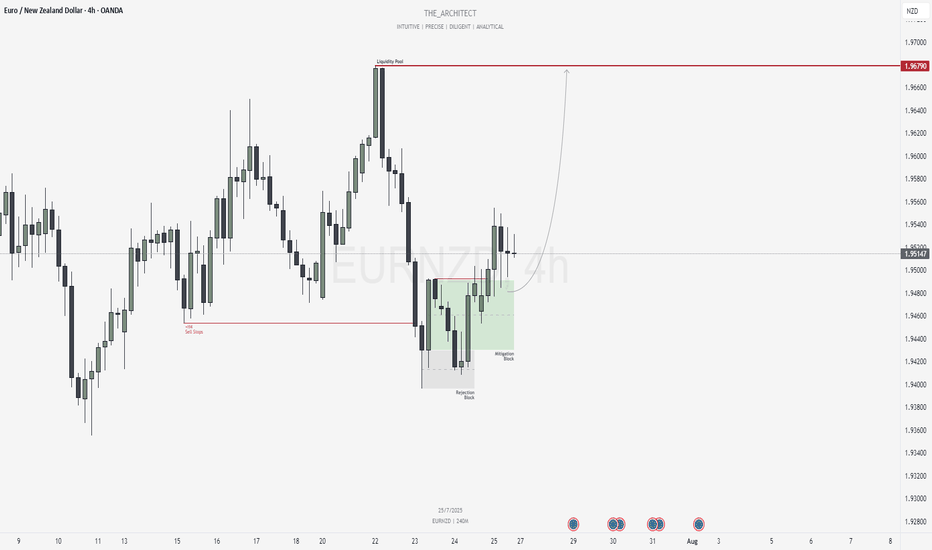

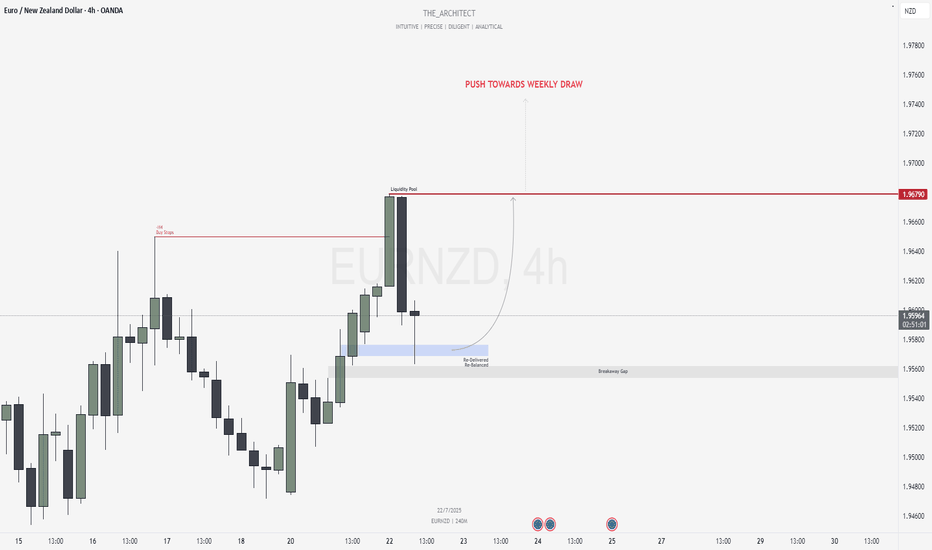

EURNZD: Bullish Confluence Aligns for Buy Setups at Key ArraysGreetings Traders,

In today’s analysis of EURNZD, we identify that the current institutional order flow is bullish. With this bias in mind, we aim to capitalize on high-probability buying opportunities from key points of interest aligned with institutional behavior.

Higher Timeframe Context:

The weekly timeframe is showing a clear bullish narrative. This bullish order flow is confirmed by the H4 timeframe, which is also delivering higher highs and higher lows—providing confluence between both the macro and intermediate timeframes. This alignment increases our confidence in seeking long setups.

Key Observations on H4:

Buy-Side Liquidity Sweep: Price recently took out H4 buy stops, which triggered a retracement into internal range price action.

Re-Delivered Re-Balanced Zone (RDRB): Price has now pulled back into a re-delivered, re-balanced array—a significant institutional level that typically offers low-risk buy setups. Given the nature of this zone, we do not anticipate a deeper pullback into the fair value gap (FVG), thereby treating it as a potential breakaway gap.

Draw on Liquidity: The next probable target is the external liquidity pool resting in premium prices. The market appears poised to gravitate towards that area.

Trading Plan:

Entry Strategy: Monitor the lower timeframes for bullish confirmations within the RDRB array.

Targets: The primary target is the engineered liquidity pool in premium prices.

For a detailed analysis, please watch this weeks Forex Outlook:https://www.tradingview.com/chart/EURNZD/BZC9xW1L-July-21-Forex-Outlook-Don-t-Miss-These-High-Reward-Setups/

Remain patient, trust the structure, and execute with precision as the bullish narrative unfolds.

Kind Regards,

The Architect 🏛️📈