AAPL at a Pivotal Zone! TA for July 14AAPL at a Pivotal Zone! GEX & Price Action Align for Major Move 📉📈

🧠 GEX Sentiment (Options-Based Insight)

* Current Price: $210.53

* GEX Zone Traps:

* Below Price:

* 🟥 Put Support at $205 (-11.48%)

* 🔻 PUT Wall at $200 (-9.06%) — strong floor

* Above Price:

* 🟩 CALL Walls at:

* $212.5 → 29.79% GEX7

* $215 → 38.62% GEX6 (3rd largest resistance)

* $217.5 → 11.45% GEX9

* $220 → 39.78% GEX2 (heavy resistance zone)

* 🟩 Max GEX Cluster: $215–$220

* 🔺GEX10 spike at $230 → unlikely unless squeeze

* IVR/IVX:

* IVR: 24 (low volatility environment)

* IVX: 34.2 → Soft volatility bounce

* Call/Put Flow:

* Calls: 3.1% favored

* GEX trend: 🌕🌕🌕 (Neutral-to-Bullish if over $212.5)

📦 Interpretation:

Gamma compression is strong near $212.5–$215. If AAPL stays above $210.5 and reclaims $212.5, options market opens up space toward $217.5–$220. Below $207.5 = risk of drop toward $205 then $200 PUT wall.

🕹️ Option Trade Ideas Based on GEX

Bullish Strategy (IF Breaks $212.5):

* Trade: Buy AAPL 215c or 217.5c (Jul 19 or 26 expiry)

* Trigger: Hold above $212.5

* Target: $217.5–$220

* Stop: Break below $209.8

Bearish Strategy (IF Breaks $207.5):

* Trade: Buy AAPL 205p or 200p (Jul 19 or 26 expiry)

* Trigger: Loss of $207.5 with momentum

* Target: $205 → $200

* Stop: Reclaim of $210.5

🔍 1-Hour Chart Analysis (Price Action)

* Structure: Sideways consolidation between $207.5–$213.5

* Key Levels:

* Demand: $205–$207.5 (Buyers defended)

* CHoCH (Change of Character) confirmed near $209.8

* Resistance: $213.48 (rejected multiple times)

* Trendline: Rising wedge forming under liquidity sweep zone

* Liquidity Pools: Resting above $215 and below $205

* FVG/OB Zones: Thin FVG at $209.8–210.5 and mid OB around $207

📈 Scenario 1 (Bullish):

* If price bounces off $210 again and breaks $212.5 with volume, watch for sweep of $215–$217.5

* Watch for re-entry above CHoCH/BOS confluence near $211.5

📉 Scenario 2 (Bearish):

* If we break $207.5 and fail to reclaim $210.5 → liquidity vacuum opens toward $205 and $200

✅ My Thoughts & Suggestions

* Direction Bias: Neutral > Bullish if $212.5 is claimed, otherwise range-bound.

* Best Risk/Reward: Wait for $212.5 breakout confirmation OR $207.5 breakdown.

* Scalpers: Use $210.5–212.5 as chop zone — fade edges.

* Swing Traders: Only enter on clear breakouts with stop discipline.

🔒 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

4AAPL trade ideas

AAPL - Another Possible BreakoutsHello Everyone,

Apple AAPL is the another possible breakouts in my list.

Good entry point could be 205-206 , Re-test point.

228-230 is target price for me , which is approx %10 above from 205-206.

I tried to draw possible price action on Graphs.

Same as I mentioned in GOOG , Apple is Apple and you can get it in every price point for long term.

But short term you can watch the these price points that i mentioned to get some gain.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday and good start a Week

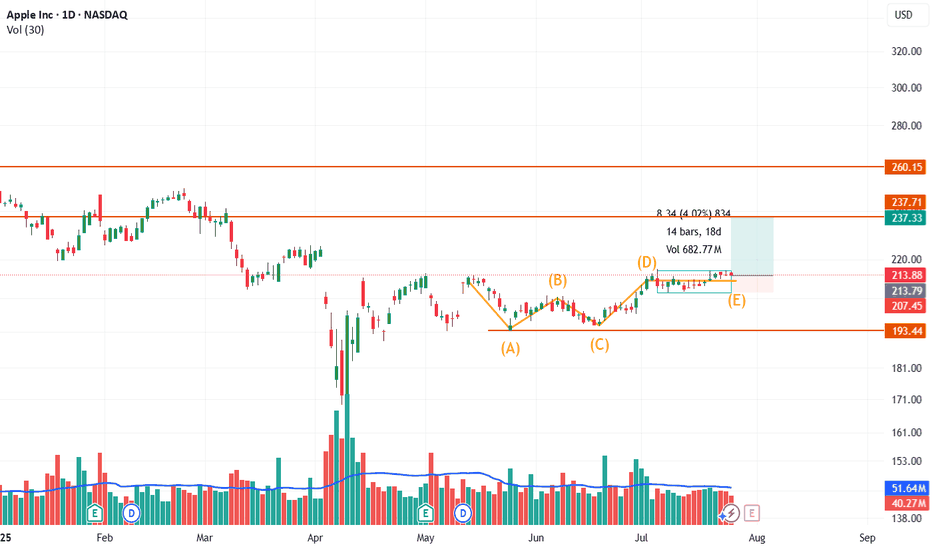

Apple Inc. (NASDAQ: AAPL) – Potential Breakout from Bullish ABCDApple has recently formed a well-structured ABCDE corrective pattern inside a broader sideways range, suggesting accumulation and possible trend continuation on breakout.

Technical Breakdown:

🔸 ABCDE Formation: The structure resembles a contracting triangle or bullish consolidation, marked by higher lows (A, C, E) and lower highs (B, D), signaling price compression.

🔼 Breakout Zone: Price has moved above point (D) briefly and is now consolidating around the $214 zone. A strong close above this could lead to continuation toward the $237 and $260 resistance levels.

🔻 Support Levels:

Minor support at $207.45

Strong base support near $193.44 (ABC low)

📈 Volume Spike: The most recent leg from E to D showed a significant volume surge, indicating possible institutional interest or breakout anticipation.

🔍 Trade Outlook:

A sustained move above $217–$218 with volume could trigger a bullish breakout.

Targets:

First: $237.33 (recent horizontal resistance)

Next: $260.15 (gap-fill or prior high zone)

Risk Management: A drop below $207 would invalidate the structure and suggest further range-bound behavior or downside.

⚠️ Disclaimer: This chart is for educational purposes only. We are sharing a trade setup based on technical signals generated by our private invite-only indicator. This is not financial advice or a recommendation to buy or sell any financial instrument.

📊 The indicator highlights potential buy/sell zones based on a custom strategy developed by our team. In this chart, we are demonstrating how the signal aligned with market structure and trend conditions.

🛑 Regulatory Note: We are an independent development team. Our private indicator and services are not registered or licensed by any regulatory body in India, the U.S., the U.K., or any global financial authority. Please consult a licensed advisor before making trading decisions.

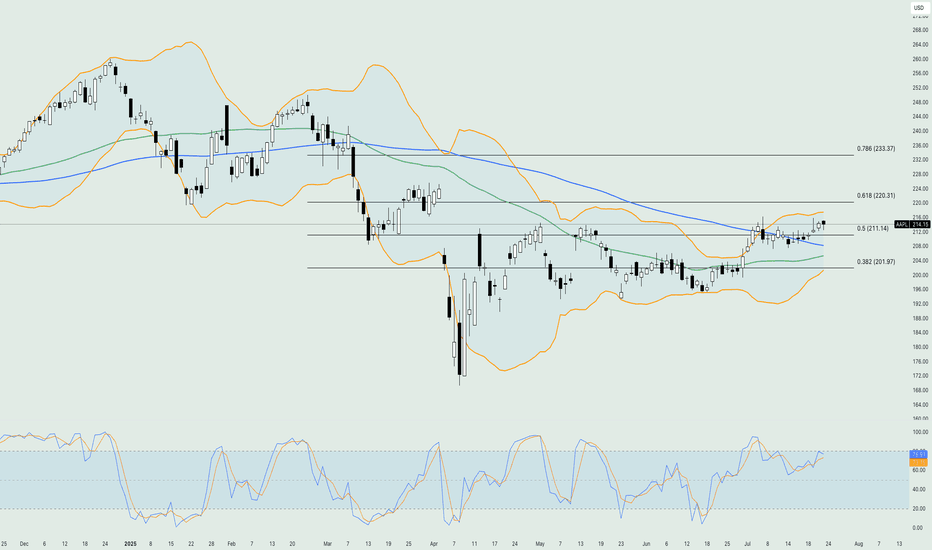

Apple battles resistance area – Can Earnings Turn It Around?Shares in Apple Inc. (symbol ‘AAPL’) gained back a large percentage of the losses incurred at the beginning of the second quarter. The company’s earnings report for the fiscal quarter ending June 2025 is set to be released on Thursday, 31st of July, after market close. The consensus EPS is $1,42 compared to $1,40 of the same quarter last year.

2025 is a hard year for the company so far since it lost more than 17% of its share value. The recent minor bullish rally might give some hope for a positive overall result at the end of the year, but the price needs to rise above $260 to be considered a positive year, and the company is still far from this number. Also, the financial image of the company is not looking great with the current ratio at 0.82 as of 31 March 2025. This means that the company is not liquid enough to cover the short-term liabilities with the current assets at hand. The payout ratio (percentage of the total earnings of the company paid out as dividends) is at 15,74% indicating that the company is looking forward to keeping most of its earnings for economic growth/strength, which is a good sign for the overall performance of the company.

On the technical side, the price is testing the resistance area between the upper band of the Bollinger bands and the 50% of the weekly Fibonacci retracement level. The level of $212 is also an inside resistance area of price reaction in early May and early July, making it a strong technical resistance level. The Bollinger bands are quite expande,d showing that there is volatility to support big moves. The Stochastic oscillator is near the extreme overbought level, but it's not in there just yet. On the other hand, the moving averages are still validating an overall bearish trend in the market.

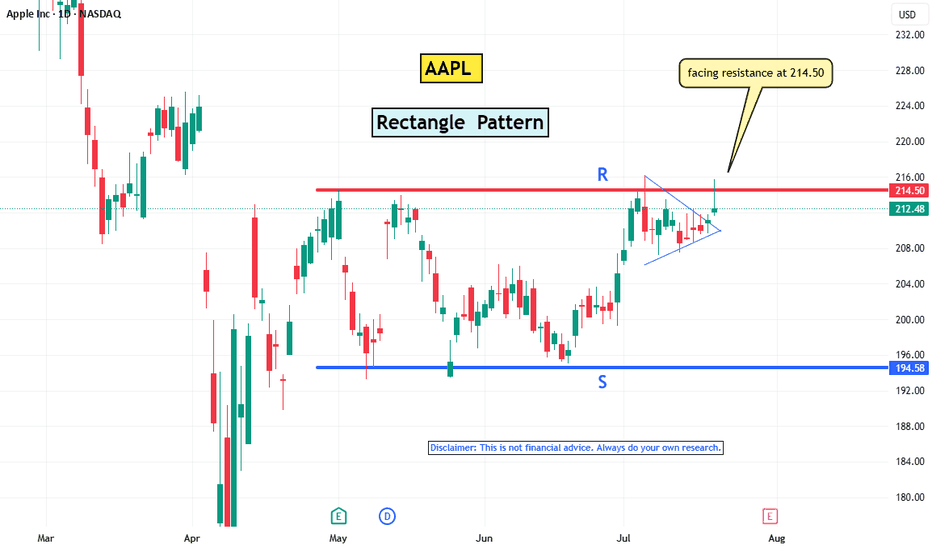

AAPL’s Pennant Breakout: Is $214.5 the Final Hurdle?Apple Inc. (AAPL) has been moving sideways since May, stuck in a tight trading range. It’s been following a classic rectangle pattern — showing that the market hasn’t quite made up its mind.

Today, AAPL finally broke out of a pennant pattern, giving traders a reason to look up. But the real test is still ahead: the stock is once again bumping into the $214.5 resistance level — the same spot where recent rallies have lost steam.

Apple’s P/E ratio is sitting at 33.2, which feels a bit stretched. That could explain why some investors are hesitating, waiting for stronger earnings or a new catalyst to justify higher prices.

If Apple can break above $214.5 with strong volume, it might kick off a new leg higher. Until then, the stock could keep drifting in this range. The breakout is promising — but not convincing just yet.

(Disclaimer : This is not financial advice. Always do your own research)

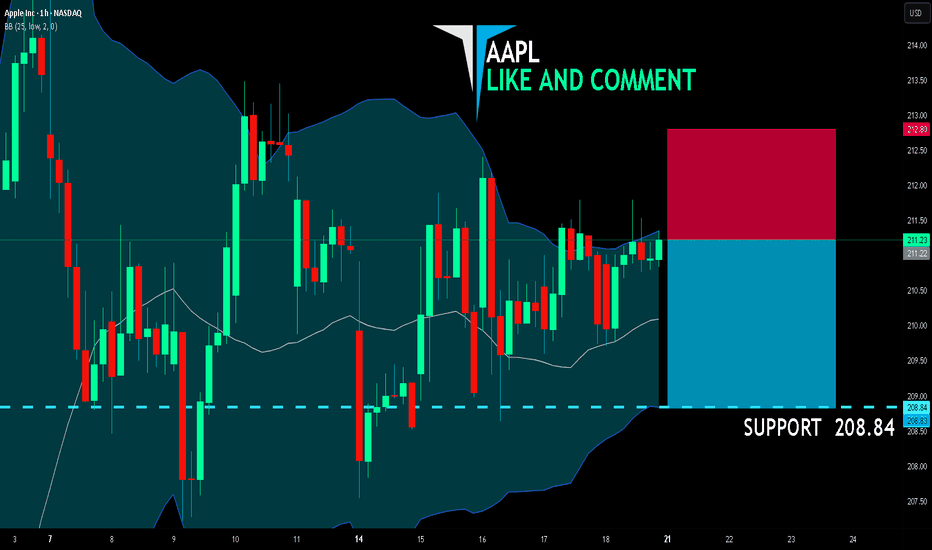

AAPL BEARS WILL DOMINATE THE MARKET|SHORT

AAPL SIGNAL

Trade Direction: short

Entry Level: 211.22

Target Level: 208.84

Stop Loss: 212.80

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

The Crypto Market Shaken by USDe Collapse – What’s Next for BtcIn early July 2025, the crypto market was rocked by the sudden destabilization of one of the fastest-growing stablecoins — USDe by Ethena. In just a few days, the token lost over 10% of its value, dropping to $0.88. This triggered a wave of liquidations across DeFi protocols and a sharp decline in major crypto assets like Bitcoin and Ethereum.

Why USDe Collapsed

The main cause of the collapse was a weak collateral model. Unlike USDT and USDC, USDe lacked full fiat backing. Its reserves were partially based on derivatives and complex hedging strategies. When a few large wallets began withdrawing liquidity, panic spread quickly. The rush to exit USDe overwhelmed the system, breaking the $1 peg.

This led to an accelerated loss of trust and triggered cascading liquidations across multiple DeFi platforms.

Impact on DeFi and the Broader Market

DeFi was hit hard. The total value locked (TVL) across major protocols like Aave, Curve, and MakerDAO dropped by 17% in one week. Some platforms halted USDe-related activity to contain losses.

Bitcoin fell below $58,000, and Ethereum dropped under $3,000, driven not only by lower liquidity but also by renewed skepticism from institutional investors. The volatility in what was perceived as a “safe” asset reignited debates around the future of algorithmic stablecoins.

What Happens Next?

The fallout from USDe is a major stress test for the entire DeFi ecosystem. If the team behind Ethena fails to restore trust, other algorithmic stablecoins could come under pressure. There are already growing calls for greater transparency, independent audits, and stricter collateralization rules.

On the flip side, many see this as a healthy correction — a purge of undercollateralized, risky experiments. The long-term winners could be robust, transparent protocols, and Bitcoin, with its capped supply and increasing institutional demand, may once again be seen as a flight-to-safety asset.

AAPL PREPARING FOR A LARGER MOVEAAPL clearly shows a descending channel pattern, marked by two parallel downward-sloping yellow trendlines. Within that broader structure, the price is currently consolidating in a narrow range between two horizontal yellow lines:

Resistance around $210.98

Support around $207.46

🔍 Current Technical Setup

Consolidation Range

AAPL is moving sideways in a tight range between $207.46 and $210.98. This narrow trading zone within a broader descending channel is typical of compression before a breakout.

Descending Channel Context

The channel suggests a longer-term downtrend bias, but the compression at these levels can lead to a breakout in either direction, especially when volume starts to increase.

Support Zone ($207.46)

This level has been tested and held, making it a key line to watch. A breakdown below this support would likely trigger a sharper selloff toward the lower channel boundary, near $203–$204.

Resistance Zone ($210.98)

This level lines up with the upper boundary of the current consolidation and the midline of the descending channel. A breakout above would invalidate the local downtrend and could send price to test the top of the channel (~$214+).

Volume Clues

Volume is relatively low during this sideways movement, which often precedes a high-volume breakout as indecision resolves.

📈 Scenarios to Watch

Bullish Breakout

Above $210.98 and the descending trendline.

Likely target: $214–$216

Confirmation: Volume spike + strong bullish candle

Bearish Breakdown

Below $207.46 support.

Target: $203 or lower, testing channel support.

Confirmation: Increasing red volume + bearish momentum

🧠 Summary

AAPL is in a compressed state, with a tight horizontal range forming inside a broader downward-sloping channel. This often sets the stage for a powerful directional move. Traders should closely monitor breaks of $210.98 or $207.46 to catch the next leg — either a reversal toward higher levels or continuation of the downtrend.

APPLE Set To Fall! SELL!

My dear friends,

APPLE looks like it will make a good move, and here are the details:

The market is trading on 211.08 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 206.69

Recommended Stop Loss - 213.91

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Crypto in July 2025: A Financial Reset from Macromics GroupThe world of cryptocurrencies in July 2025 is experiencing more than just another growth cycle — it’s undergoing a fundamental transformation of the global financial system. Amid geopolitical instability, tighter control over digital assets, and growing interest from institutional investors, digital currencies are once again in the spotlight. Macromics Group shares its latest analytical insights on the key events and trends.

A New Bull Run: Ethereum 3.0 and Bitcoin Network Upgrade

Since the start of summer 2025, Ethereum has shown strong growth, largely due to the launch of Ethereum 3.0, which reduced transaction fees and made the network more scalable. Bitcoin, in turn, has undergone another major security upgrade, attracting new institutional investors, including funds from Japan and Saudi Arabia.

CBDCs and Regulation: Governments Shift Approach

Central banks are actively rolling out central bank digital currencies (CBDCs). China, India, Brazil, and the EU have expanded pilot programs for their national digital currencies. This has led to increased interest in stablecoins backed by fiat currencies and greater demands for transparency on DeFi platforms.

Macromics Group helps clients navigate these new dynamics, offering up-to-date analytical resources and capital protection strategies across both regulated and unregulated sectors of the crypto market.

NFTs Make a Comeback — In the Corporate World

A new wave of interest in NFTs is emerging, not from artists, but from the corporate sector. Companies are using tokens for intellectual property, document verification, and digital rights management. Macromics Group is investing in startups building infrastructure for business-focused NFTs — a clear sign of the technology’s long-term potential.

AI + Blockchain: A Union of Future Technologies

In 2025, two mega-trends are converging: artificial intelligence and blockchain. AI-powered protocols are automating trading, cybersecurity, and even smart contract audits. Macromics Group is already implementing these technologies into its analytical tools and services.

What’s Next? Macromics Group Forecast

According to our data, the crypto market has entered a phase of "conscious growth" — where technology, regulation, and real-world utility are evolving in harmony. In the coming months, we anticipate increased attention toward:

DePIN projects (decentralized physical infrastructure)

Tokenized real-world assets (real estate, gold)

ESG-focused cryptocurrencies

Conclusion: Don’t Just Invest — Understand

Macromics Group urges investors to go beyond participation — to become informed decision-makers. We provide deep analytics, access to unique tools, and expert support at every stage of crypto investing. July 2025 is the perfect time to rethink your strategy and take a step into the future.

Macromics Group — your expert in the world of digital assets.

AAPL - Weekly HV/IV PerspectiveGood evening —

I wanted to do one more write up with that being on NASDAQ:AAPL as we enter the week with futures just opening.

HV10 (16.58%) is trending -11.56% below IV (28.14%) showing a weekly price gap differential of -$2.89 on the stated implied move to what trending markets are doing. This current IV value entering the week sits 69% within the sliding year spectrum.

Now, with Apple consolidating in range for almost eight weeks after selling off when it reached its 4T milestone in December of 2024, has now begun advancing back upwards in price. The strength here is obvious and the quality of company is well, Apple.

My price targets on the week is first the upper band of stated IV ($220.58) then moving on towards the upper implied range of HV63 ($225.87). I believe the markets are going to push apple higher while balancing the indices out selling off in other areas. This would start to accelerate HV10, as it is now 91.23% coiled to its yearly lows and needs to unwind. Hopefully with a few short-term trending days increasing we find our regression.

Please come back next week and see how our position and volatility progressed forward.

AAPL BUY 1st target $223AAPL is forming a wedge and been lagging for 2 years. I was expecting $182 but we never saw that level, after weeks of $200 range consolidation it's clear this is basing, first target of resistance is $223 then we could be off to the races. I would expect to see this as soon as next week provided #donthecon can stop bullying American companies long enough to focus on important things

Ethereum Empowers Its Future Zero-Knowledge TechnologyThe Ethereum $2,969 Foundation has unveiled a new roadmap that aims to expand zero-knowledge (ZK) technologies across the network shortly after the ETH price surpassed the $3,000 threshold. This announcement aims to enhance scalability while concurrently reducing transaction fees and bolstering both security and privacy. The foundation has emphasized integrating ZK-based solutions into the primary layer to accelerate the user experience. This development marks a critical period that may prompt Layer 2 projects and entrepreneurs within the ecosystem to reconsider their competitive strategies.

Key Objectives of the Announced Zero-Knowledge Roadmap

Today, the Ethereum Foundation announced through its official channels that the primary goal is to institutionalize the “ZK-based verification” model at every network point. The plan envisions directing energy from intensive smart contracts towards more efficient cryptographic proofs to reduce transaction congestion. This approach aims to make the network accessible to larger audiences with lower-cost and faster approval processes.

The second focal point is to deepen the security layer. A foundation executive stated, “By integrating ZK technology into our network, we are not only enhancing privacy and security but also achieving significant improvements in transaction efficiency.” The objective is to establish a privacy standard rather than just performance. Within this framework, new technical collaborations and developer grants will be highlighted, with the priority being to develop toolsets and training programs that accelerate integration.

Potential Impacts of the Roadmap on the Layer-2 Ecosystem

The new roadmap closely concerns Layer 2 projects, which have long provided scalability with ZK Rollup solutions. Experts emphasize that local ZK integration could narrow the competition advantage of these projects but also lay the groundwork for stronger collaborations. Initiatives may need to update their architectural plans to reinforce compatibility with the main network.

As relevant actors seek different models to cover compliance costs, an environment is emerging that will open doors to new partnerships and grants. This process, paralleling Ethereum’s scalability goal, may direct the developer community within the network towards ZK-centered innovation. On the market side, the interest in ETH seems to be supported by expectations of increased security and privacy.

AAPL: The Rally Might Not Be OverWhile many tech giants have already reached new all-time highs, Apple is still lagging behind — NASDAQ:AAPL hasn’t yet broken out. This may represent both a risk and an opportunity for latecomers.

Investor caution remains due to potential tariffs on Apple products from China, with the decision now postponed until August.

This uncertainty may be holding the price back, but could also lead to a strong accumulation phase if no negative headlines emerge in the near term.

Technicals:

• A breakout above $215 could open the way toward $249 (previous high).

• Support at $197 remains strong.

• Stochastic is in overbought, but MACD confirms bullish momentum.

NASDAQ:AAPL may start catching up with the broader market — especially if tariff fears subside. Watch closely for a confirmed breakout above $215.

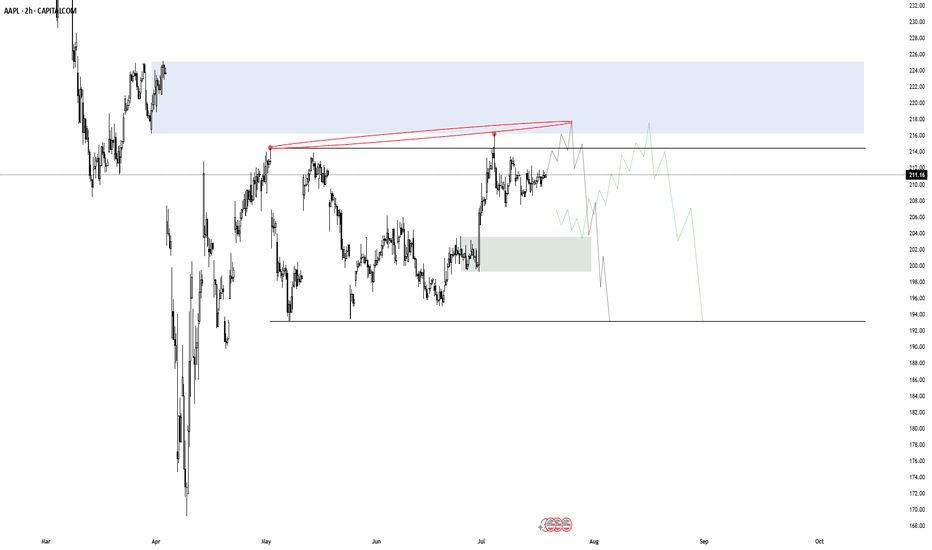

Apple in 2025: Why the Bulls Are Losing SteamApple’s stock has clearly lost its bullish momentum this year, and the chart you shared sums it up perfectly.

Let’s break down what’s happening and why investors are shifting focus to companies like Nvidia and Microsoft.

Chart Says :

Weak Rebounds (green), Bearish Pressure (blue channels are now more agresive)

Downtrend Channels: The chart shows Apple forming lower highs and lower lows, bouncing inside downward channels (not real channels, but are very ilustrative of how the price is moving trendy or not in each direction).

Each recovery (green) is weaker than the last, and the most recent upward move is still capped by resistance.

Bearish Patterns : The price action is dominated by failed breakouts and new descending channels, signaling that sellers are in control.

Volume & Participation: There’s no strong buying volume to support a real reversal. This makes any rally fragile and prone to quick pullbacks.

Why Is the Market Doubting Apple?

Slowing Growth : Apple’s revenue growth has stalled, especially in China, where sales dropped 13% year-over-year. The latest iPhone launch was underwhelming, and services aren't growing fast enough to offset weak hardware sales.

Falling Behind in AI: While Nvidia and Microsoft are leading the AI revolution, Apple is seen as late to the party. Their recent AI announcements disappointed investors looking for bold innovation.

External Pressures: New tariffs and global tensions are hitting Apple harder than its peers, since more than 60% of its sales are international.

Analyst Downgrades: Several analysts have lowered their price targets and ratings, reflecting concerns about Apple’s future growth. We've recently seen someanalyst showing prices under $200.

Key Takeaway

Apple is struggling to regain its former strength. The chart shows persistent bearishness, and the fundamentals back it up: slow growth, weak innovation, and external risks. Meanwhile, Nvidia and Microsoft are capturing investor attention with explosive growth and leadership in AI.

Until Apple delivers a real catalyst, the path of least resistance remains down or sideways, not up.

Do you think apple can surprise with some new AI innovation unexpected for all of us?

Apple Stock Is Surging! Here’s What Most People MissWhen it comes to trading, we don’t care about the latest news headlines or whether some analyst has upgraded or downgraded Apple stock. We focus on one thing and one thing only: the undeniable forces of supply and demand imbalances on higher timeframes.

Right now, Apple’s monthly chart is a textbook example of how waiting for a strong demand imbalance pays off. That $178 monthly level is no random number. It’s the exact origin of a massive bullish impulse that happened in June 2024 — the kind of move that only happens when smart money and big institutions step in, creating an imbalance that pushes the price away rapidly.

📈 It’s Not About Fundamentals. It’s About Imbalances.

Most retail traders waste time chasing news, earnings, or rumours about iPhone sales. But if you think about it, all those factors are already priced in once a strong imbalance is formed. Institutions don’t wait for tomorrow’s news — they plan their positions weeks or months ahead, and those footprints are visible right on your chart.

The $178 level indicates a significant drop in supply and a surge in demand large enough to propel Apple higher, marked by consecutive large bullish candlesticks. That’s our signal — nothing more, nothing less.

AAPL – Long Bias SetupWhy I’m Watching the Long Side:

✅ Clean Bounce from $190 Zone

That \$190–195 level has held multiple times since April. Last two dips got scooped with solid demand = solid base forming.

✅ Break of Recent Lower Highs

Stock finally pushed through prior resistance around $205–208. Structure shift. Possible start of a trend reversal.

✅ Buy Signal Triggered (Green "4")

Chart printed a buy signal near lows with follow-through = momentum may be shifting.

✅ Holding Above Short-Term Moving Level

Price is now holding above the short-term EMA (teal line), showing trend momentum flipping bullish.

✅ Vol Picking Up

Volume on the green days has increased, signaling interest from bigger players.

---

Trade Plan:

• Entry Zone: \$208–211

• TP1: $220 (near previous supply)

• TP2: $230 (gap fill zone)

• TP3: $250

• SL: Just below $204 = exit

---

⚠️ Caution:

Still under red resistance band ($220). Needs real strength to reclaim it.

Watch how price reacts there – could stall or squeeze.

📅 Next earnings 3 weeks out. Could build up into it.

---

💬 Setup looks constructive. Playing the reversal with tight risk. Not chasing, just reacting. Trade your plan.

AAPL needs to break above 213 to start an upward moveAAPL needs to break above 213 to start an upward move

From our previous analysis, the price increased by almost +8% from 200 to 216.

The resistance zone, which was also our first target, stopped the price near 213.50, but again the bullish volume seems to be high and there is a good chance that AAPL will continue to rise further.

A clear move above 212.5 should push AAPL higher to 224.50; 240 and 257.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Previous analysis: