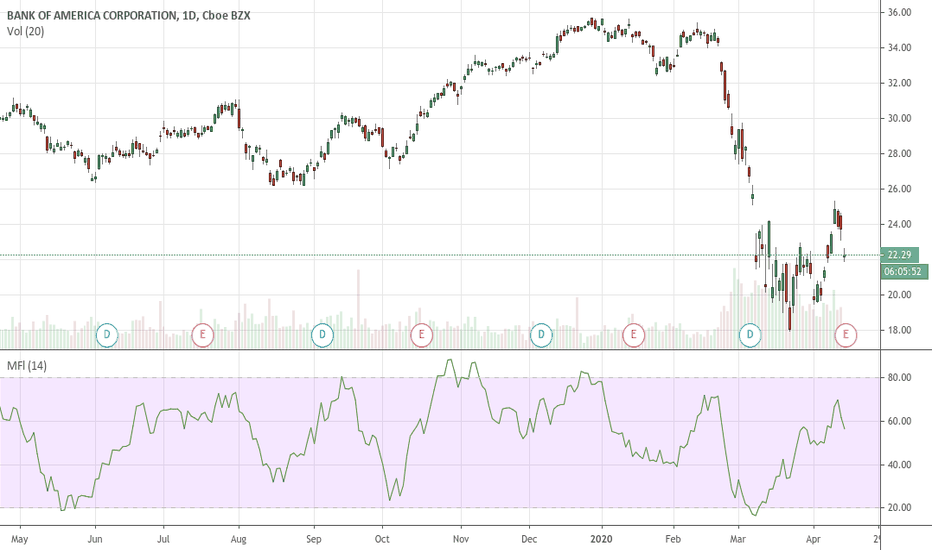

Elliott Wave View: Bank of America (BAC) Resumes LowerElliott Wave view in Bank of America (BAC) suggests the decline from January 15, 2020 high is unfolding as a 5 waves impulse. Down from January 15 high, wave (1) ended at 32.47 and bounce in wave (2) ended at 35.45. Stock has resumed lower in wave (3) which ended at 17.95. Bounce in wave (4) is proposed complete at 25.35 as a zigzag.

Short term 45 minutes chart below shows the stock ended wave (4) bounce at 25.35. This level is now the short term invalidation level for more downside. Internal of wave (4) unfolded as a zigzag where wave A ended at 23, wave B ended at 19.51, and wave C of (4) ended at 25.35. While below 25.35, wave (5) lower is currently in progress as an impulse, but BAC still needs to break below wave (3) at 17.95 to avoid a double correction.

Down from 25.35, wave 1 ended at 21.09 and wave 2 bounce ended at 23.40. Near term, while rally fails below 25.35, expect Bank of America to extend lower within wave (5). Potential target lower is 123.6 – 161.8% external extension of wave (4) which comes at 13.3 – 16.1.

4BAC trade ideas

The banks took a hit. What's next?After a fairly disappointing day across the indices, the dust seems to have settled. BAC is resting on the 100 hr MA and has failed to push past the 22.44 fib on the daily. However, BAC is currently above the Ichimoku Cloud representing an uptrend and has a %K value that has dipped below 25 indicating a potentially ideal long entry opportunity.

BAC A GREAT Deep Value Play In The Making But Not Yet This name BAC is a great deep value long term hold in the making keep your eye on the MFI - for "Oversold" on the one year chart - at that point you can sell puts and get the premium or hope you get the stock put to you or simply buy the stock - this name can reach depths no one thinks it can in these time s- Not advice - Do yor own DD

May be a bullish or correction? alternate wave counts for both .Market Commentary:

First have an look for the positional trend i shared here previous....if you are a follower of me...and sometimes i will share the counter trend trade also in 15 mins and 1hr...but that is risky ones...so if the trend is bearish or bullish, if i am expecting the correction...book the profit there and wait the correction to end and again go with the trend....DONT TRADE THE COUNTER TRADE SETUP...you will took loss too...try to identify the sort term pull back and the long term pull back after that took small lots in the short term PB with strict stop and go with big lots in the trend side that is long term.

Read the market commentary inside the chart what i shared here carefully and try to learn Elliott waves...otherwise its tough to understand the market commentary and my analysis. I wont give a entry, stop loss and take profit in my chart...it is only for EDUCATIONAL PURPOSE and i am sharing how i am analysing the pair and labelling them according to the Elliott wave theory...I AM JUST SHOWING THE TREND HOW IT MAY GO AND MY VIEW(it may wrong too)..so DON'T FOLLOW BLINDLY MY CHART..take this as a reference and if it correlate to you strategy took the trade as per your strategy...DON'T ASK ABOUT YOUR RUNNING TRADES i wont comment on them and I WONT SUGGEST TO TAKE MY TRADE SETUP.

BAC from weak trader to strong trader, I am weakBig pictrue of fundamental analysis and technical analysis. there is an epic time and everything is falling

Write sometning about your psyhology thinking before trade? I am little afraid to trade at all, but I shall still trying with the defferent ideas

Describe the trade. What you see? there is stop at around 20 euro, bears are geting weker, will bulls be able to overcome bears

Write why you want to enter the trade in this point? fibo line, three time tested level and bounce

What have I done well for this trade? getting in

What can I take away to help with later trades? a little bit more space for stock, because market makers see your stop

I also make a second bet but I was bustted again, so I stop betting on BAC, maybe I shall make a rule that never try to second guess

BAC coming close to where we can open a long position?Bank of America with its decent yield of about nearly 4% and a decent balance sheet maybe a good bye during this down turn. The trend drawn above show that approx $18.10 might be a key point for the stock. I would wait for it to reach there and show us a bounce to confirm my idea before opening a long position. As always I am a long term investor looking to buy and hold equities. Please like and comment.

Thanks everyone!

"Be Fearful When Others Are Greedy and Greedy When Others Are Fearful" - Warren Buffet