Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.61 B EUR

77.50 B EUR

219.15 M

About FedEx Corporation

Sector

Industry

CEO

Rajesh Subramaniam

Website

Headquarters

Memphis

Founded

1971

FIGI

BBG00LXXLBN1

FedEx Corp. is a holding company, which engages in the provision of transportation, e-commerce, business services, and business solutions. It operates through the following segments: FedEx Express, FedEx Ground, FedEx Freight, FedEx Services, and Corporate, Other and Eliminations. The FedEx Express segment offers transportation and delivery services. The FedEx Ground segment provides small-package ground delivery services. The FedEx Freight segment refers to freight transportation services to business and residences. The FedEx Services segment includes sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and certain back-office functions that support the company's operating segments. The Corporate, Other, and Eliminations segment is involved in the corporate headquarters costs for executive officers and certain legal and finance functions, as well as certain other costs and credits not attributed to the firm's core business. The company was founded by Frederick Wallace Smith on June 18, 1971, and is headquartered in Memphis, TN.

Related stocks

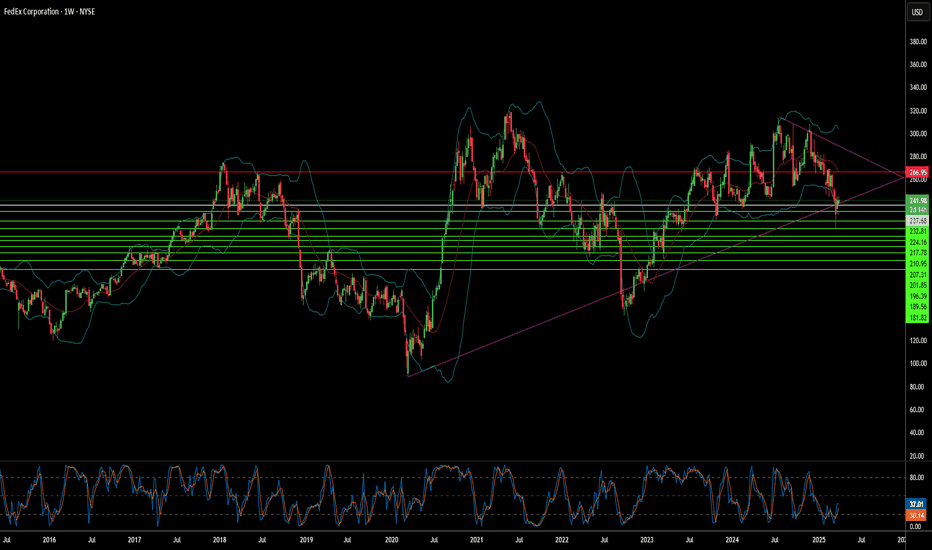

FedEx (FDX) – Cautious Bullish SetupNYSE:FDX Price is testing the upper Bollinger Band, while Stochastic shows overbought conditions (78–82), which may trigger a pullback or sideways move.

✅ RSI remains strong above 50, showing momentum is still positive.

🎯 Idea: Wait for earnings or a breakout above $230–$231 zone for confirmation

Will FedEx See a Big Swing Following Next Week’s Earnings?Shares of FedEx NYSE:FDX have often swung quite violently following release of the delivery-service giant's quarterly earnings. What does FDX’s chart and fundamental analysis say might happen after the firm reports results next Tuesday (June 24)?

Let’s check:

A History of Big Swings

Looking a

FedEx: Balancing Act or Precarious Gamble?Recent market activity highlights significant pressure on FedEx, as the logistics giant grapples with prevailing economic uncertainty. A notable drop in its stock price followed the company's decision to lower its revenue and profit outlook for fiscal year 2025. Management attributes this revision t

FDX watch $244.36: SemiMajor Covid fib giving furious resistanceFDX dumped upon last earnings but has been trying to recover.

Currently struggling against a semi-major covid fib at $244.26

It seems likely it will reject to green support zone $231 -233

======================================================

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximate

The #1 Power Of A Chart Patterns Analysis Am feeling low on courage and energy because of this i decided to do some yard maintenance work 😊

Just to remove my negative thoughts even as we trade mental health is very important.

Am following this awesome newsletter watchlist recommend to me by Tim Sykes.

This i where I got the idea of how

FDX 267.5 PUT Exp 2/21/25 (Win)Saw multiple confluences on higher timeframes. Broke a weekly uptrend to the downside, came back to retest the consolidation box it made, retested the weekly trend line break, Hit the 61.8% fibonacci retracement level, and formed a gap on a smaller timeframe.

Broke a structure level and broke a mi

Major Price Movement Incoming for FDXSignalist has detected a precise pattern in NYSE:FDX trading activity, signaling that a substantial price movement is imminent. This isn’t a random fluctuation—it’s a carefully analyzed precursor to a significant market event.

📅 What to Expect:

⌛ Timeline: Anticipate a major move within the next

Long because of my algo and not this sh!tsh0w of a chartDo not adjust your eyes or screen. There are no parts of this chart missing. Either FDX management is horrifyingly poor at guidance or the analysts that follow this one are really poor at their jobs. No matter, this hopefully won't last long enough for me to worry about whoever is incompetent at

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US31428XBD7

FEDEX CORP. 2065Yield to maturity

8.37%

Maturity date

Feb 1, 2065

US31428XBQ8

FEDEX CORP. 2048Yield to maturity

7.83%

Maturity date

Feb 15, 2048

US31428XCE4

FEDEX 21/41Yield to maturity

7.70%

Maturity date

May 15, 2041

FDXD

FEDEX CORP. 2045Yield to maturity

7.57%

Maturity date

Feb 1, 2045

US31428XBN5

FEDEX CORP. 2047Yield to maturity

7.48%

Maturity date

Jan 15, 2047

FDX3881474

FedEx Corporation 3.875% 01-AUG-2042Yield to maturity

7.46%

Maturity date

Aug 1, 2042

US31428XBG0

FEDEX CORP. 2046Yield to maturity

7.35%

Maturity date

Apr 1, 2046

USU31520AX4

FEDEX 25/48 REGSYield to maturity

7.09%

Maturity date

Feb 15, 2048

USU31520AP1

FEDEX 25/41 REGSYield to maturity

7.08%

Maturity date

May 15, 2041

FDX6059381

FedEx Corporation 3.875% 01-AUG-2042Yield to maturity

7.05%

Maturity date

Aug 1, 2042

USU31520AT3

FEDEX 25/45 REGSYield to maturity

7.05%

Maturity date

Feb 1, 2045

See all 4FDX bonds

Curated watchlists where 4FDX is featured.

Frequently Asked Questions

The current price of 4FDX is 201.65 EUR — it has decreased by −1.56% in the past 24 hours. Watch FEDEX stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange FEDEX stocks are traded under the ticker 4FDX.

4FDX stock has fallen by −0.79% compared to the previous week, the month change is a 2.44% rise, over the last year FEDEX has showed a −26.94% decrease.

We've gathered analysts' opinions on FEDEX future price: according to them, 4FDX price has a max estimate of 273.04 EUR and a min estimate of 170.65 EUR. Watch 4FDX chart and read a more detailed FEDEX stock forecast: see what analysts think of FEDEX and suggest that you do with its stocks.

4FDX reached its all-time high on Nov 25, 2024 with the price of 293.55 EUR, and its all-time low was 83.40 EUR and was reached on Mar 17, 2020. View more price dynamics on 4FDX chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4FDX stock is 1.59% volatile and has beta coefficient of 0.84. Track FEDEX stock price on the chart and check out the list of the most volatile stocks — is FEDEX there?

Today FEDEX has the market capitalization of 48.33 B, it has increased by 0.43% over the last week.

Yes, you can track FEDEX financials in yearly and quarterly reports right on TradingView.

FEDEX is going to release the next earnings report on Sep 18, 2025. Keep track of upcoming events with our Earnings Calendar.

4FDX earnings for the last quarter are 5.35 EUR per share, whereas the estimation was 5.13 EUR resulting in a 4.24% surprise. The estimated earnings for the next quarter are 3.18 EUR per share. See more details about FEDEX earnings.

FEDEX revenue for the last quarter amounts to 19.57 B EUR, despite the estimated figure of 19.16 B EUR. In the next quarter, revenue is expected to reach 18.58 B EUR.

4FDX net income for the last quarter is 1.45 B EUR, while the quarter before that showed 875.31 M EUR of net income which accounts for 65.96% change. Track more FEDEX financial stats to get the full picture.

Yes, 4FDX dividends are paid quarterly. The last dividend per share was 1.25 EUR. As of today, Dividend Yield (TTM)% is 2.37%. Tracking FEDEX dividends might help you take more informed decisions.

FEDEX dividend yield was 2.53% in 2024, and payout ratio reached 32.78%. The year before the numbers were 1.98% and 29.25% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FEDEX EBITDA is 9.09 B EUR, and current EBITDA margin is 11.77%. See more stats in FEDEX financial statements.

Like other stocks, 4FDX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FEDEX stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FEDEX technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FEDEX stock shows the sell signal. See more of FEDEX technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.