Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

15.15 EUR

5.15 B EUR

68.63 B EUR

233.29 M

About Lockheed Martin Corporation

Sector

Industry

CEO

James D. Taiclet

Website

Headquarters

Bethesda

Founded

1912

FIGI

BBG00KH5K538

Lockheed Martin Corp. is a global security and aerospace company, which engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services. It operates through the following business segments: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. The Aeronautics segment researches, designs, develops, manufactures, integrates, sustains, supports, and upgrades advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles, and related technologies. The MFC segment is involved in air and missile defense systems, tactical missiles and air-to-ground precision strike weapon systems, logistics, fire control systems, mission operations support, readiness, engineering support and integration services, manned and unmanned ground vehicles, and energy management solutions. The RMS segment designs, manufactures, services, and supports various military and commercial helicopters, surface ships, sea and land-based missile defense systems, radar systems, sea and air-based mission and combat systems, command and control mission solutions, cyber solutions, and simulation and training solutions. The Space segment includes the production of satellites, space transportation systems, and strategic, advanced strike, and defensive systems. The company was founded in 1995 and is headquartered in Bethesda, MD.

Related stocks

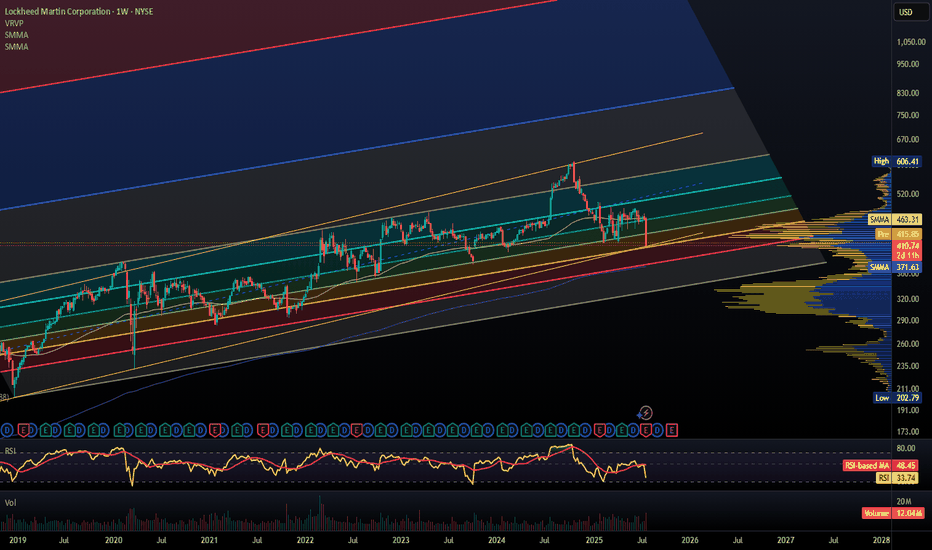

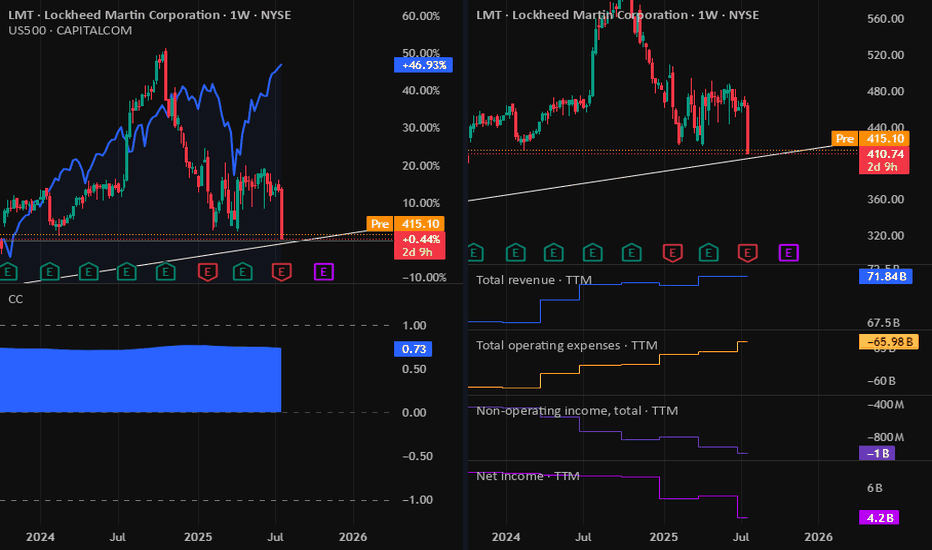

LMT: Lookheed Martin Dropped on Earnings 23-07-2025The dividends now is around 3% which is good for a strong company like Lookheed Martin. But as we are seeing a drop in company profits & Equity, and the stock price is near to a support level, we have to monitor the stock for the next few days or weeks. If all is ok, I will consider buying it.

Discl

LMT – Long Setup IdeaLMT – Long Setup

Current: \$463.01 | Premarket: \$464.01 (+0.22%)

---

📊 Why I’m Eyeing the Long:

✅ Strong base at \$450–460 – buyers defending this level hard for months. Solid floor.

✅ Premarket green after red day = possible bounce play incoming.

✅ Deutsche Bank PT \$472 – not huge, but con

Buy Idea: LMT @ around $480This war is really happening right now between Israel, Iran, and the United States.

Because of this, countries are spending more money on weapons, defense systems and military gear.

The U.S. and its friends are about to increase their defense budgets and Lockheed Martin is one of the biggest co

U.S. – Iran Tensions: How Geopolitics Could Rattle the MarketsRising tensions between the United States and Iran are once again casting a shadow over global markets. From oil prices to defense contractors and transport stocks, this situation has the potential to ignite volatility across several key sectors.

🔍 What Traders Should Watch:

Oil & Energy Stocks – I

What happens when war whispers... and Wall Street listens? 🦅🔥

"🌍 📉📈

Lockheed Martin ( NYSE:LMT ) just pierced through a tightening triangle 🔺— like a fighter jet breaking the sound barrier ✈️💥

Coincidence? 🤔 Or is this price action a signal of something brewing behind the scenes? 🕵️♂️

⚔️ Global tension is rising.

💰 Defense budgets are booming.

And NY

How will Israel-Iran war affect Lockheed Martin?Why LMT Could Go Up

Defense Stocks Rally on Tensions

-LMT surged ~3–4% recently after Israel’s major strike on Iran’s nuclear facilities, similar to gains seen in other defense names like RTX and Northrop Grumman.

F-35 & Advanced Weapons in Spotlight

-Israel deployed its F‑35I Adir (built b

Lockheed Martin (LMT): Defense Supercycle + Trend ContinuationOverview Summary

Lockheed Martin ( NYSE:LMT ), one of the largest defense contractors globally, is entering a critical inflection point, both technically and geopolitically. With rising global conflict risk and structural shifts in defense spending, Green Zone Capital is re-accumulating long-term

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LMT4988881

Lockheed Martin Corporation 2.8% 15-JUN-2050Yield to maturity

7.09%

Maturity date

Jun 15, 2050

LMT5402220

Lockheed Martin Corporation 4.3% 15-JUN-2062Yield to maturity

6.36%

Maturity date

Jun 15, 2062

LOMA

LOCKHEED MARTIN 2045Yield to maturity

6.36%

Maturity date

Mar 1, 2045

LMT4549067

Lockheed Martin Corporation 4.09% 15-SEP-2052Yield to maturity

6.33%

Maturity date

Sep 15, 2052

LMT5402219

Lockheed Martin Corporation 4.15% 15-JUN-2053Yield to maturity

6.29%

Maturity date

Jun 15, 2053

LMT4002344

Lockheed Martin Corporation 4.07% 15-DEC-2042Yield to maturity

6.07%

Maturity date

Dec 15, 2042

US539830BL2

LOCKHEED MARTIN 15/46Yield to maturity

6.05%

Maturity date

May 15, 2046

LMT5741406

Lockheed Martin Corporation 5.2% 15-FEB-2064Yield to maturity

6.02%

Maturity date

Feb 15, 2064

LMT5592253

Lockheed Martin Corporation 5.2% 15-FEB-2055Yield to maturity

5.87%

Maturity date

Feb 15, 2055

LMT.HN

Lockheed Martin Corporation 4.85% 15-SEP-2041Yield to maturity

5.79%

Maturity date

Sep 15, 2041

LMT5492512

Lockheed Martin Corporation 5.9% 15-NOV-2063Yield to maturity

5.75%

Maturity date

Nov 15, 2063

See all 4LMT bonds

Curated watchlists where 4LMT is featured.

Frequently Asked Questions

The current price of 4LMT is 361.35 EUR — it has increased by 0.35% in the past 24 hours. Watch LOCKHEED MARTIN stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange LOCKHEED MARTIN stocks are traded under the ticker 4LMT.

4LMT stock has fallen by −9.65% compared to the previous week, the month change is a −8.81% fall, over the last year LOCKHEED MARTIN has showed a −24.59% decrease.

We've gathered analysts' opinions on LOCKHEED MARTIN future price: according to them, 4LMT price has a max estimate of 569.35 EUR and a min estimate of 338.21 EUR. Watch 4LMT chart and read a more detailed LOCKHEED MARTIN stock forecast: see what analysts think of LOCKHEED MARTIN and suggest that you do with its stocks.

4LMT reached its all-time high on Oct 21, 2024 with the price of 565.30 EUR, and its all-time low was 221.00 EUR and was reached on Dec 27, 2018. View more price dynamics on 4LMT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4LMT stock is 0.35% volatile and has beta coefficient of 0.34. Track LOCKHEED MARTIN stock price on the chart and check out the list of the most volatile stocks — is LOCKHEED MARTIN there?

Today LOCKHEED MARTIN has the market capitalization of 83.71 B, it has increased by 2.14% over the last week.

Yes, you can track LOCKHEED MARTIN financials in yearly and quarterly reports right on TradingView.

LOCKHEED MARTIN is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

4LMT earnings for the last quarter are 1.24 EUR per share, whereas the estimation was 5.53 EUR resulting in a −77.60% surprise. The estimated earnings for the next quarter are 5.49 EUR per share. See more details about LOCKHEED MARTIN earnings.

LOCKHEED MARTIN revenue for the last quarter amounts to 15.41 B EUR, despite the estimated figure of 15.76 B EUR. In the next quarter, revenue is expected to reach 15.73 B EUR.

4LMT net income for the last quarter is 290.33 M EUR, while the quarter before that showed 1.58 B EUR of net income which accounts for −81.65% change. Track more LOCKHEED MARTIN financial stats to get the full picture.

Yes, 4LMT dividends are paid quarterly. The last dividend per share was 2.88 EUR. As of today, Dividend Yield (TTM)% is 3.10%. Tracking LOCKHEED MARTIN dividends might help you take more informed decisions.

LOCKHEED MARTIN dividend yield was 2.62% in 2024, and payout ratio reached 57.16%. The year before the numbers were 2.68% and 44.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 121 K employees. See our rating of the largest employees — is LOCKHEED MARTIN on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LOCKHEED MARTIN EBITDA is 6.38 B EUR, and current EBITDA margin is 11.83%. See more stats in LOCKHEED MARTIN financial statements.

Like other stocks, 4LMT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LOCKHEED MARTIN stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LOCKHEED MARTIN technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LOCKHEED MARTIN stock shows the strong sell signal. See more of LOCKHEED MARTIN technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.