4NFLX trade ideas

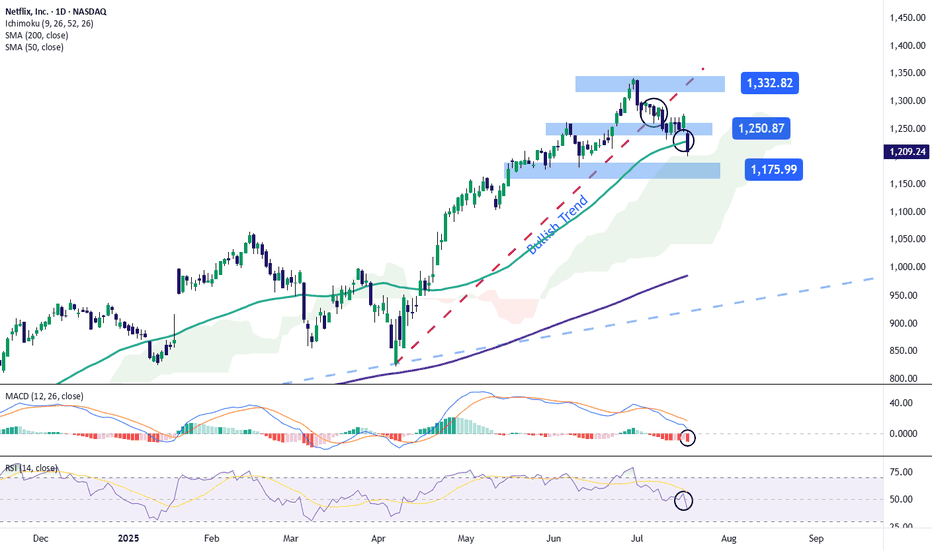

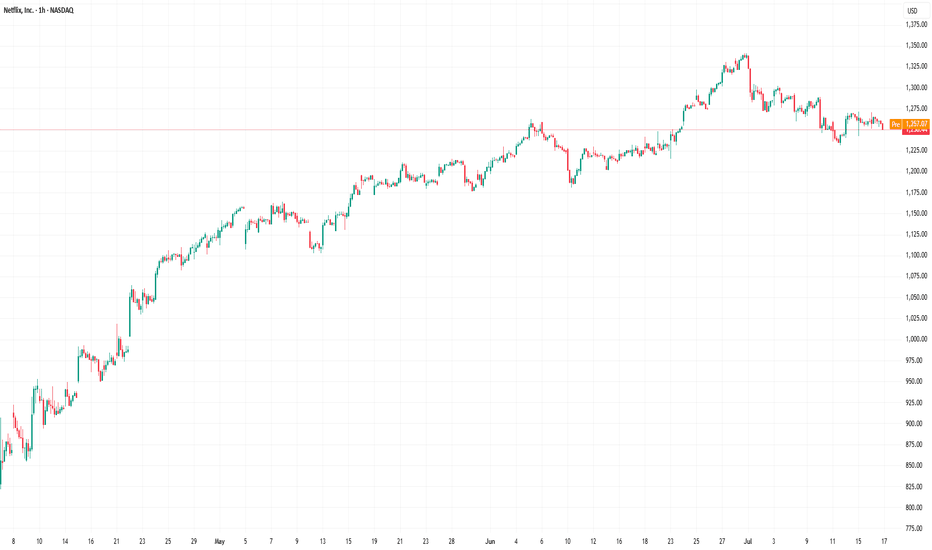

Netflix Wave Analysis – 21 July 2025

- Netflix reversed from support zone

- Likely to rise to resistance level 1275.00

Netflix recently reversed up from the support zone between the support level 1200.00 (which stopped wave 4 at the start of June), lower daily Bollinger Band and the upper trendline of the daily up channel from October.

The upward reversal from this support zone stopped the earlier downward impulse wave C from the middle of July.

Given the strong daily uptrend, Netflix can be expected to rise further to the next resistance level 1275.00 (top of the minor correction B).

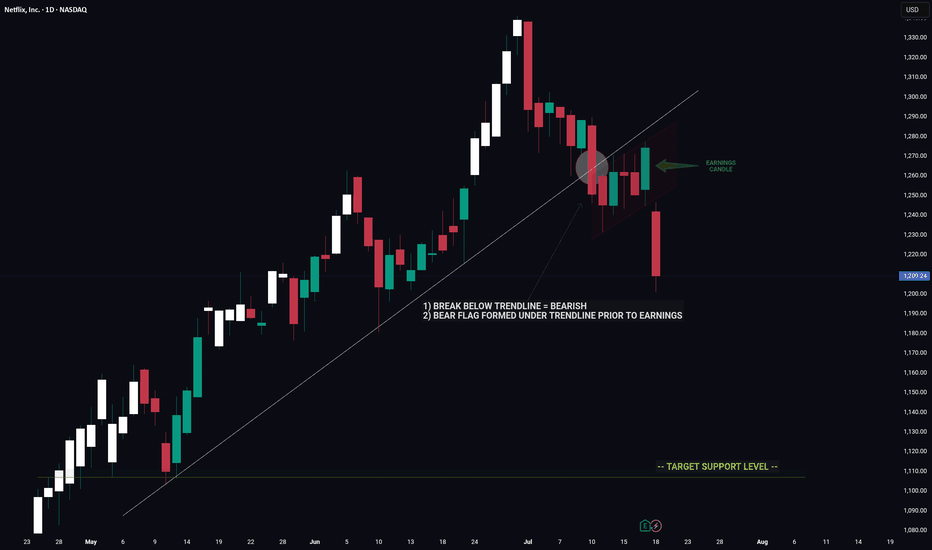

NETFLIX -- Price Signaled A Move Lower Prior To EarningsHello Traders!

The chart of NFLX is a great example of using clues to decipher a future move.

Prior to earnings we had major bearish indicators on the chart that hinted towards a move down on earnings.

1) Break below major trendline

2) Bear flag

These two signals by themselves are very bearish however the fact that these signals appeared coming into earnings was an even strong indicator of a potential for negative move.

Now that the upward trend is broken NFLX has a long way to fall before reaching the next key support level.

Thanks everyone and best of luck on your trading journey!

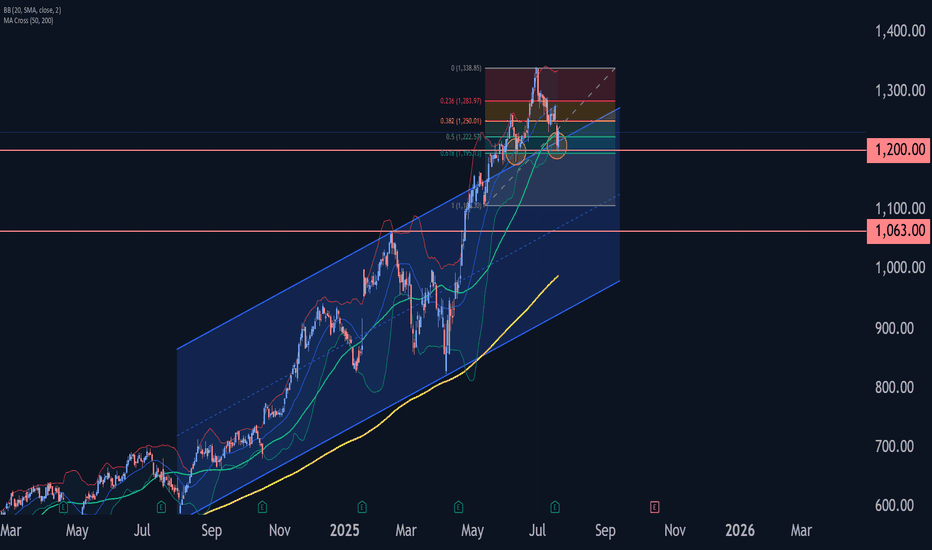

Netflix Stock Drops After Earnings ReleaseShortly after publishing its financial results, Netflix posted a decline of over 5% toward the end of the week and continues to show a strong bearish bias. This comes despite reporting a positive earnings per share (EPS) figure of $7.19, beating the expected $7.08, and revenue of $11.08 billion, slightly above the forecast of $11.07 billion.

However, in its post-earnings communications, the company stated that it expects very moderate growth for the remainder of the year. It also warned that the positive indicators could begin to compress due to increased spending on marketing and content, which has ultimately weakened the impact of the solid financial results. As a result, the stock faced persistent selling pressure heading into the weekly close.

Uptrend Breaks

Over the past few weeks, starting in early April, the stock had followed a steady uptrend, pushing the price above $1,300. However, continued bearish corrections have now brought the price down to the $1,200 area, causing a clear break in the previous uptrend. This breakdown could further strengthen the bearish pressure in the coming sessions if the negative sentiment persists.

MACD

The MACD histogram continues to move below the zero line, and as it drifts further from this level, it signals a steady bearish momentum that could remain dominant in the near term if the trend continues.

RSI

The RSI line has broken sharply below the neutral 50 level, indicating a clear dominance of bearish momentum in the market. As long as it does not reach oversold territory, this move may suggest a continued increase in short-term selling pressure.

Key Levels:

1,332 – Recent High: This is the most important resistance level. If price action returns to this area, it could reactivate the previous uptrend, which had been weakening on the chart.

1,250 – Nearby Resistance: A barrier defined by the most recent neutral zone. It may act as a temporary ceiling against short-term bullish corrections.

1,175 – Key Support: A critical level located below the 50-period simple moving average. If the price breaks below this level, it could strengthen a bearish bias and trigger a more consistent downtrend.

Written by Julian Pineda, CFA – Market Analyst

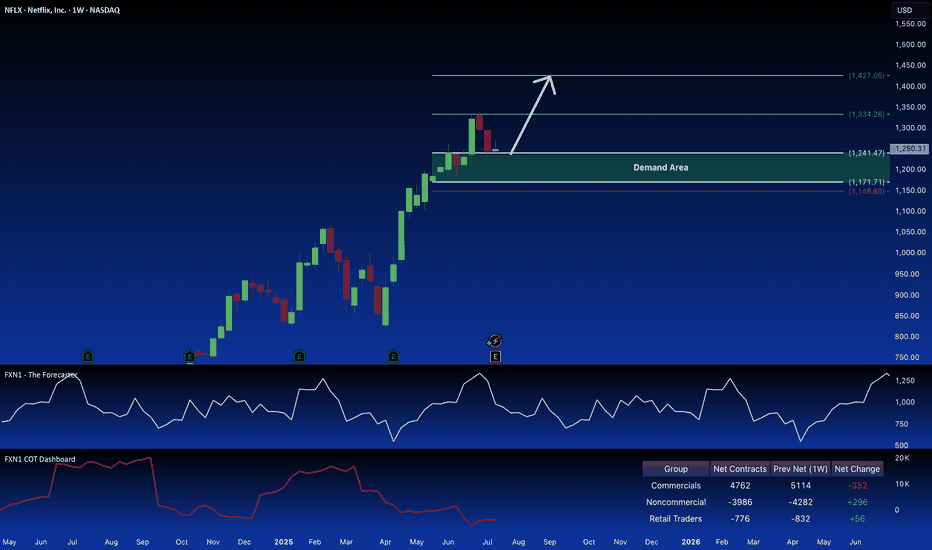

NFLX: Bullish Signal in Demand ZoneNetflix (NFLX) recently retraced within a key weekly demand zone, potentially presenting a long opportunity. Non-commercial traders are also accumulating long positions in the stock. This suggests a possible bullish setup. Your thoughts?

✅ Please share your thoughts about NFLX in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

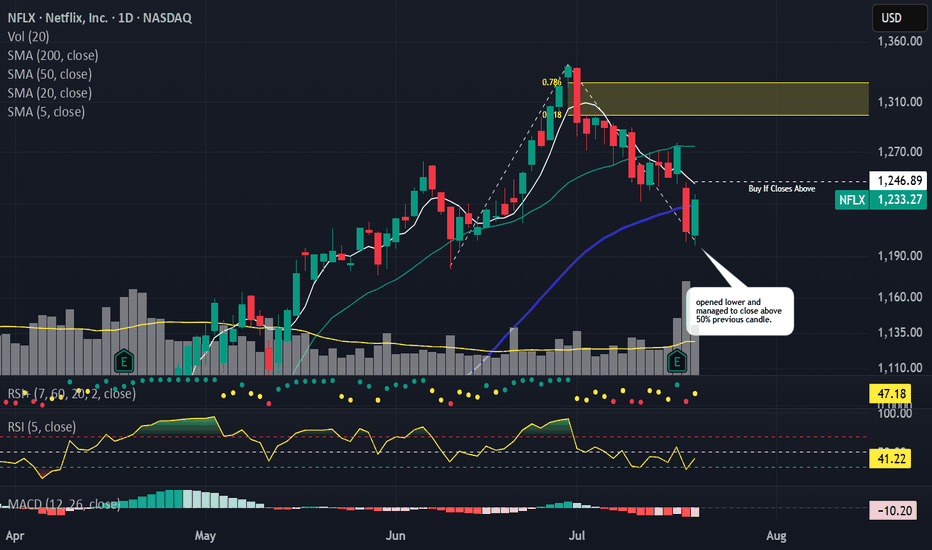

NFLX eyes on $1215-1232: poised for next leg UP with earningsNFLX broke and retested a key resistance zone.

Loud PING's on two major fibs announced support.

It is perfectly set to LAUNCH if earnings are good.

Positive earnings may push to mid $1500's above.

Negative may drop to $1061 Golden Genesis below.

Neutral report should continue uptrend from here.

.

See "Related Publications" for previous charts such as this BOTTOM CALL:

============================================

.

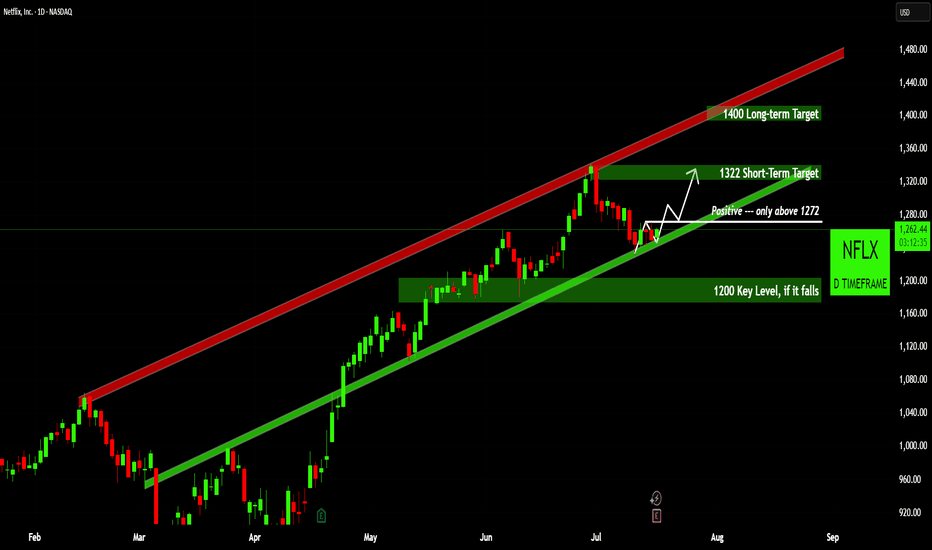

NFLX: Bullish Consolidation - Is a Move to $1322 Imminent?Overall Trend: Netflix is currently demonstrating a strong uptrend, effectively trading within a well-defined ascending channel since late February. This indicates robust buying interest and consistent higher highs and higher lows.

Key Support & Resistance: The $1200 level is acting as a crucial support zone, marked by a green shaded area where price previously found buyers. The stock is currently consolidating around the trendline support of the ascending channel.

Breakout Potential: A decisive breakout above $1272 (white horizontal line) would signal a continuation of the upward momentum, potentially leading to a retest of higher levels.

Price Targets: Should the breakout occur, the immediate short-term target is $1322. For a more extended outlook, the long-term target is $1400, residing at the upper boundary of the established ascending channel.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

How Earnings Reporting Could Impact Netflix (NFLX) Share PriceHow Earnings Reporting Could Impact Netflix (NFLX) Share Price

Earnings season is gaining momentum. Today, after the close of the main trading session, Netflix (NFLX) is set to release its quarterly financial results.

Analysts are optimistic, forecasting earnings per share (EPS) of $7.08, up from $4.88 a year earlier, and revenue growth to $11.1 billion.

The upbeat sentiment is driven by:

→ the fact that Netflix’s business model is relatively resilient to tariff-related pressures;

→ the company’s success in curbing password sharing and promoting a more affordable ad-supported subscription tier.

Netflix has reported revenue growth for six consecutive quarters, outperforming competitors such as Disney, Amazon, and Apple. Its market share has climbed to 8.3%, with YouTube remaining its only serious rival—YouTube's share increased from 9.9% a year ago to 12.8% in June, according to Nielsen. If current trends hold, this reporting quarter could mark another strong performance for Netflix.

However, is the outlook truly that bullish?

Technical analysis of NFLX stock chart

The NFLX stock price is currently moving within an ascending channel (marked in blue), and it is now testing the lower boundary of this formation. Of concern is the recent pronounced bearish movement (B), which has dragged the stock from the channel’s upper boundary to its lower edge—erasing the bullish momentum (A) that followed the breakout above the $1,250 resistance level.

What’s next?

→ On the one hand, bulls may attempt to resume the upward trend within the channel.

→ On the other hand, bears could build on their recent momentum (highlighted in red) and break the ascending trend that has been in place since May.

It appears the fate of the current uptrend hinges on the market’s reaction to today’s earnings release.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Netflix Faces Rising Volatility and Bearish Technicals Ahead of Netflix (NASDAQ: NFLX) will announce its results after the close of trading in New York on Thursday, 17 July. Analysts forecast the NASDAQ-listed streaming media company to report second-quarter earnings growth of 45%, reaching $7.08 per share, while revenue is expected to increase by 15.6%, amounting to $11.1 billion. Net subscriber additions are predicted to decrease by 42.9%, falling to 4.6 million.

For the third quarter, analysts forecast guidance for revenue of $11.3 billion, up 14.7%, and earnings of $6.68 per share, reflecting growth of 23.6%. The options market is pricing in a 6.4% move, either up or down, in Netflix shares following the earnings report.

The significant expected move in the stock is driven by implied volatility levels for options expiring on 18 July, which were high at nearly 70% as of the 13 July close and are likely to increase further as results approach. Options positioning in Netflix also appears notably bullish, with call delta values surpassing put delta values. This indicates that once the company reports its results and options begin to decrease in value due to the decay of implied volatility, market makers might find themselves overly hedged on the long side, potentially forcing them to sell shares. This scenario could exert downward pressure on the stock if it fails to breach the $1,300 level, which acts as the gamma call wall.

Additionally, technical analysis shows a downside risk for the shares both before and after the results. The Relative Strength Index (RSI) for Netflix has been trending lower and recently dropped below 50, signalling a shift in momentum from bullish to bearish. Furthermore, the stock has broken down from a rising broadening wedge pattern, which is traditionally seen as a bearish reversal signal, indicating a possible decline back towards the pattern’s origin, around $1,100.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Netflix is going to fall sharply soonNetflix is in the huge 5th wave extension. I expect it to complete wave (v) of 5 very soon, probably within the next week.

RSI divergence on 3-days, weekly frames is quite visible and supports the upcoming trend reversal.

When wave 5 is extended, retracement typically goes to the bottom of wave (ii) of this 5th wave. This would mean 1180-1195 USD to end the wave 5. Also, at this price wave 5 will be 2.168 times bigger than waves 1 and 3 together.

NETFLIX 1D MA50 test is a new buy opportunity.Netflix (NFLX) has been rising non-stop since the April 07 bottom on the 1D MA200 (orange trend-line). This bottom has been the latest Higher Low of the 3-year Channel Up that started on the June 14 2022 bottom.

This kickstarted its third long-term Bullish Leg. The previous two have been fairly similar (+210% and +195.93%) so we can assume a minimum total rise of +195.93% until the next top (Higher High of the Channel Up).

We can also see that on each Bullish Leg, after the initial rebound, the stock always tested the 1D MA50 (blue trend-line) around the 0.236 Time Fibonacci level. That has always been the best buy opportunity of that stage.

As a result, we believe that the recent short-term correction is a buy opportunity in disguise, targeting a Higher High at $2200.

Check out our previous analysis on Netflix:

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

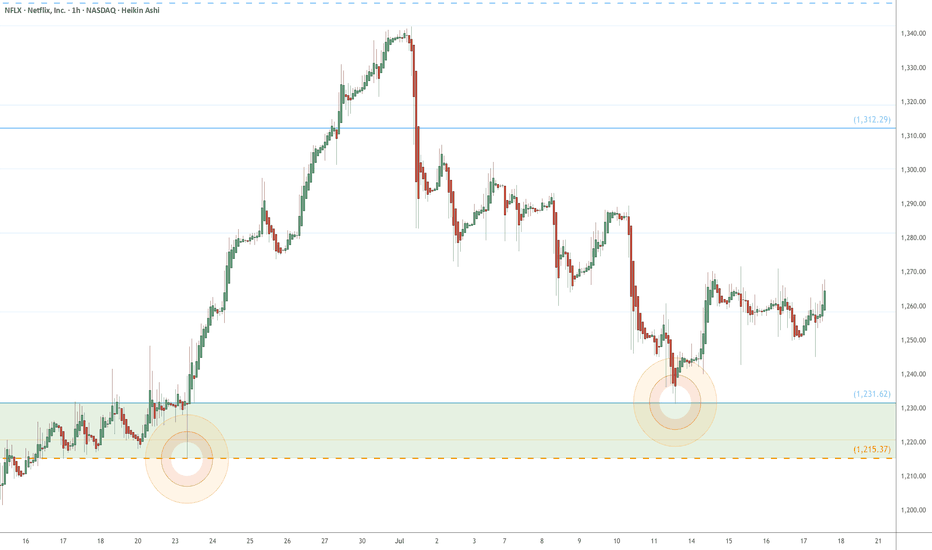

NFLX Bear Call Spread Near Max Profit – Watching 61.8% Fib Zone📉 I'm currently holding a Bear Call Spread 1300/1280 expiring on Jul 18. After multiple Breaks of Structure (BOS) and strong rejection from 1300, price is trending toward a key 1H demand zone near the 61.8% Fibonacci retracement (1242).

📊 Technical Context:

Bearish CHoCH + BOS confirms short-term trend reversal

Clear rejection from 1280–1300 supply

1242 = strong confluence: Fib + demand zone

🎯 Plan:

Hold the spread close to expiration for max profit

Close before earnings on Jul 17 to avoid volatility

If price shows strength at 1242, I may flip bias and look for a bull call spread post-earnings

🔔 TradingView Alerts:

1242: “Watch for bullish reaction at demand zone”

1278: “Rebound in progress – reassess post-earnings”

📌 This is a two-stage plan: secure gains on the short side, then prepare for potential upside.

➡️ Follow me for more structured trade ideas based on price action, options, and macro timing.

NFLX: pullback is an opportunity for bulls into its earning.Buy an At-the-Money (ATM) Call with an expiration at least 60-90 days out to give the trade time to work. For an entry around $1,280, you could buy the $1,280 strike call.

Sell an Out-of-the-Money (OTM) Call with the same expiration to reduce your cost, for instance, the $1,340 strike call.

Price Target: The initial profit target is a retest of the high near $1,340, where the spread would reach its maximum value.

Stop Loss Level: A decisive daily close below the current support shelf at $1,240 would signal that this pullback is something more sinister. We would exit gracefully and preserve our capital.

NFLX (Netflix Inc.) on the 1-hour chart (NASDAQ)NFLX (Netflix Inc.) on the 1-hour chart (NASDAQ) using price action, trendlines, and Ichimoku Cloud.

Observations:

There's a strong uptrend with higher highs and higher lows.

Price recently pulled back and is currently testing the Ichimoku cloud support, possibly forming a bullish continuation pattern.

A trendline from June is acting as dynamic support.

I have a yellow resistance zone drawn at the top, signaling the next potential bullish target.

---

🎯 Target (Short-Term):

Primary Target Zone: $1,335 – $1,340

(This is the previous swing high and resistance area you've marked.)

Secondary Target (if breakout succeeds): $1,350+

---

🛑 Suggested Stop Loss:

Below $1,270, or below the trendline/Ichimoku cloud for safer risk management.

---

📝 Summary:

Bias: Bullish continuation.

Buy zone: Near current price (~$1,290–$1,295) or on confirmation candle.

Target: $1,335–$1,340

Invalidation: Break and close below $1,270 trendline.

Let me know if you'd like a breakdown for a swing or intraday trade.

NFLX chop & dropI had a whole video that I created but couldn't manage to post. Nonetheless... I figured it out and will just share my points in this picture.

*below the 21 ema (1220), I believe we can target 1200 down to 1180. I'll be on the lookout for this trade until it happens.

That's it... that's the post. Enjoy Juneteenth.

Can Netflix Reach One Trillion Dollars? Can Netflix Reach One Trillion Dollars? The Market Already Bets on It

By Ion Jauregui – Analyst at ActivTrades

Netflix, the giant of digital entertainment, continues to cement its position as the global benchmark in streaming. With a market capitalization exceeding $515 billion, the platform is halfway to the trillion-dollar milestone, but more and more analysts and fund managers see this target as achievable in the medium term.

Strategies That Make the Difference

After the boom during the pandemic, Netflix faced fierce competition in its quest to gain and retain subscribers. The company responded with key measures: cracking down on password sharing, raising prices across its plans, and introducing an ad-supported subscription tier, an initiative that has significantly boosted performance metrics.

Thanks to this hybrid strategy, the company now boasts over 94 million monthly active users, many of whom fall within the highly desirable 18–34 age demographic, a segment with high long-term retention potential and strong appeal to advertisers.

Moreover, the platform has enhanced its advertising segmentation tools, enabling brands to reach their target audiences more precisely. Combined with Netflix’s data-driven content production model, this places the company in a highly competitive position compared to its industry peers.

Fundamental Analysis: Sustainable Growth and Competitive Edge

From a fundamental standpoint, Netflix is in a strong position with clear growth drivers:

• Revenue and earnings expansion: In the first half of 2025, the company reported over 15% year-on-year revenue growth and nearly 27% net income growth.

• Free cash flow on the rise: Both internal and external projections indicate that free cash flow (FCF) could double within five years, providing room for further content investment without increasing debt.

• Data-driven competitive advantage: Advanced analytics allow Netflix to optimize original content production based on viewing patterns, generating shows and films with higher success potential.

• Scalable model with increasing margins: The rising ARPU (average revenue per user) in the ad-supported tier suggests Netflix could boost margins without significantly raising operating costs.

• Low debt levels: With manageable net debt and healthy leverage ratios, the company retains financial flexibility for continued organic growth or share buybacks.

Analyst Ratings

According to TipRanks, 38 analysts currently cover Netflix stock. Of those, 29 rate it a Buy and 9 a Hold, with an average price target of $1,255.76.

• Highest price target: $1,600 – Jeffrey Wlodarczak (Pivotal Research)

• Lowest price target: $950

• JPMorgan rating: Hold, with a target of $1,220 – Doug Anmuth

These figures reflect solid market confidence in Netflix’s upward trajectory, though they also suggest that some of the optimism is already priced in.

Technical Analysis: Signs of Strength

Netflix closed Tuesday at $1,278.59, staying above key medium- and long-term resistance levels. The 50-period moving average has remained below the price since mid-April, reinforcing the bullish trend. The RSI is in overbought territory (71.62%), and although the MACD is no longer positive, momentum remains strong in the short term.

This is further supported by a Point of Control (POC) around the $985 level, which served as the support base for the previous upward leg. These mixed signals suggest that a consolidation phase could occur before the stock resumes a stronger upward movement.

The current upward channel has remained intact, pushing prices toward the upper bound, where a retest of limits is likely. A sideways phase between $1,282.57 and $1,400 may precede a new breakout attempt.

Conclusion

Netflix has shown exceptional adaptability in capitalizing on shifts in digital consumer behavior. With a solid financial foundation, sustainable growth, and unique competitive advantages in data and content, the company has a real shot at reaching a one-trillion-dollar valuation. Time and execution will ultimately decide whether that goal is achieved—but the groundwork is already in place.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

NFLX gains the momentumNFLX is gaining strength.

Fundamentals: Netflix reported a 12.5% year-over-year increase in Q1 revenue, reaching $10.54 billion and surpassing expectations. Adjusted EPS rose by ~25% YoY to $6.61, coming in 16% above consensus estimates.

The company also issued bullish Q2 guidance, forecasting 15.4% revenue growth, supported by solid momentum in both subscriber growth and advertising revenue, further boosting investor confidence.

This overall situation puts NFLX in the list of momentum stocks.

From a technical standpoint, it consolidates in the widening chart formation, and may bounce off its bottom, which also corresponds to the area between 20-day moving average and lower band of the Bollinger Bands (20).

NFLX She got away #3Ahh yes the 3rd stock/idea/position I sold out of in order to go all in on $TSLA. I will stay the course with my plan, but when it hits I'm going to Diversify. You should only make mistakes once, if you repeat them you should cut your left nut. IDK, just have a real consequence so you don't F up again.

Currently it's overextended and needs a correction to 1100-1000....but what happens if they announce a stock split? oh yeah, this could moon..... again. fml

The Classic 3 Step Rocket Booster StrategyThe rocket booster strategy is a classic.

This time around Netflix is on hot fire.

Netflix has outperformed Nvidia, Meta, And Apple.

-

No one is talking about Netflix and how its dominating

the stock market.

-

Am guessing that the reason being online entertainment

is on the rise.I remember about a year ago.

Hollywood writers went on strike.

-

This has destroyed the momentum of hollywood movies.

Today its no longer "cool" to watch the latest hollywood movie.

I never thought i would see this day come.

-

Today the "cool " crowd is on Netflix NASDAQ:NFLX

-

Now i want to show you how

to find this stock to trade.

-

First you need to understand the Rocket booster

strategy.

-

The 3 Step Rocket Booster Strategy

-

1-The price has to be above the 50 EMA

2-The price has to be above the 200 EMA

3-The price should gap up

-

That last step is very important so lets digest it using

the Stochastic RSI.

-

at the bottom you will see two lines.

-

That blue line crossed above the orange line.

This "gap" shows you momentum.

-

You can do this on the new tradingview screener

if you want a demonstration rocket boost this content

-

Rocket boost this content to learn more.

-

Disclaimer:Trading is risky please do not use margin.

Also use a simulation trading account first before you trade with real money

Also i want you to learn risk management and profit taking strategies

just in case you decide to use margin

no matter how small or large.

MAG7 - Jun 23, 2025 Institutional Swing Analysis – Jun 21, 2025

📈 AAPL

Trend: Reversal attempt in downtrend

Buy Zones (CALLs): 196 (accumulation)

Sell Zones (PUTs): 199 (distribution)

Support Block: —

Resistance: 201 → 204 → 206

Scenario: Above 200 = continuation to 204–206. Below 198 = back to 195–194.

📈 NVDA

Trend: Consolidating at resistance

Buy Zones: 142.5

Gap Support: 133.57 → 130.27

Support Block: 133.57

Resistance Block: 145.60

Scenario: Above 145.6 = breakout. Below 133.5 = gap fill toward 130.

📈 MSFT

Trend: Strong uptrend

Buy Zones: 466 (accumulation)

Gap Support: 458.8 → 450

Support Block: 458.80

Resistance Block: 480.50

Scenario: Holds 470 = test 485+. Below 458 = fill gap to 450.

📈 AMZN

Trend: Sideways in a wide range

Buy Zones: 212 (accumulation)

Sell Zones: 204, 200

Gap Support: 202.5 → 198

Support Block: 202.51

Resistance Block: 217.60

Scenario: Holding 210 = move to 217+. Below 202 = fill gap to 198–195.

📈 GOOGL

Trend: Bearish

Buy Zones: 175

Sell Zones: 172

Gap Support: 166.7 → 165.4

Support Block: 165.47

Resistance Block: 179.65

Scenario: Below 172 = gap test. Under 165 = risk to 160. Above 179.6 = reversal begins.

📈 META

Trend: Bullish but retracing

Buy Zones: 684

Sell Zones: 708

Gap Support: 683.8 → 649

Support Block: 649.38

Resistance Block: 703.84

Scenario: Holding 683 = move to 700+. Below 683 = gap fill to 649.

📈 NFLX

Trend: Sideways

Buy Zones: 1224

Sell Zones: 1178, 1200

Support Block: 1178.46

Resistance Block: 1257.31

Scenario: Over 1257 = breakout. Below 1220 = retest 1190.

📈 TSLA

Trend: Compressing sideways

Buy Zones: 313 (accumulation)

Sell Zones: 336, 319

Support Block: 284.57

Resistance Block: 367.46

Scenario: Above 336 = move to 355. Below 313 = test 300 → 284.