Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.0994 EUR

−2.03 B EUR

607.42 M EUR

1.07 B

About Plug Power, Inc.

Sector

Industry

CEO

Andrew J. Marsh

Website

Headquarters

Slingerlands

Founded

1997

FIGI

BBG00Q79KXK8

Plug Power, Inc. provides alternative energy technology, which focuses on the design, development, commercialization, and manufacture of hydrogen and fuel cell systems used primarily for the material handling and stationary power markets. Its fuel cell system solution is designed to replace lead-acid batteries in electric material handling vehicles and industrial trucks for some distribution and manufacturing businesses. The company was founded by George C. McNamee and Larry G. Garberding on June 27, 1997, and is headquartered in Slingerlands, NY.

Related stocks

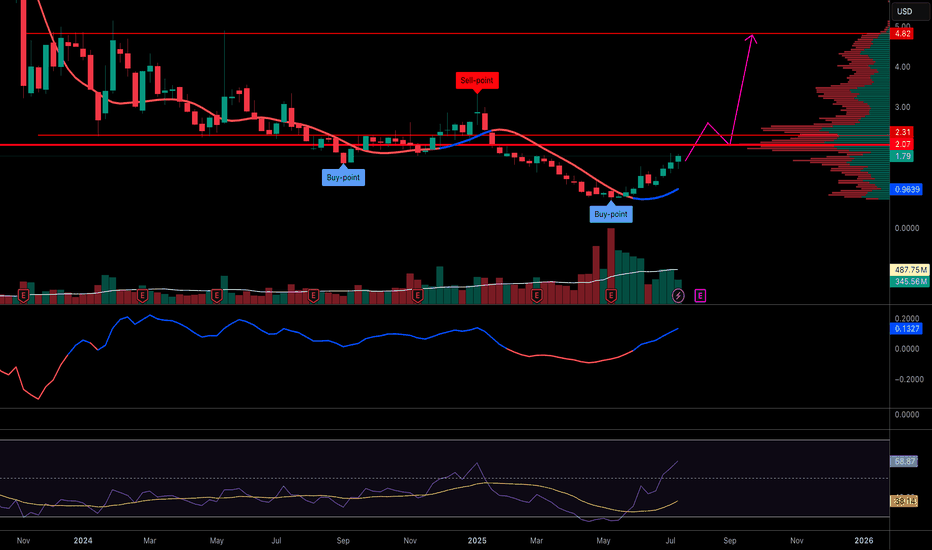

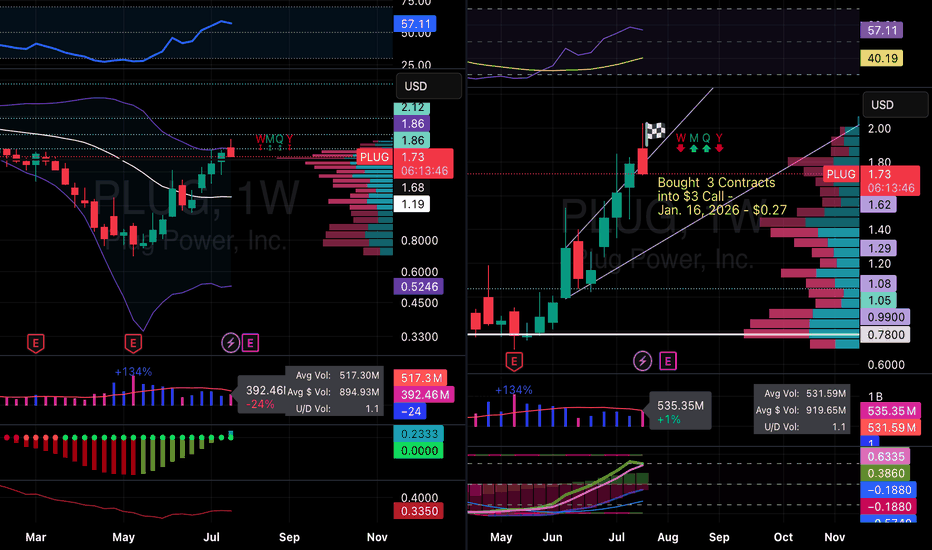

Plugged InIn looking at the money flow for NASDAQ:PLUG , I see the EMAs 8 day and 21 day crossing into a new uptrend. The RSI is still below the overbought territory. The weekly is down with volume pouring in to get ready for the next leg. Sellers are slowing with the MACD. Looking ahead the money in the pas

Plug Power Inc. ( PLUG)The Stock formation between Cup and Handle pattern & Inverted Head and Shoulders pattern at the bottom of Handle side.

Any moment can trigger to 1.53$ , by breaking up this Level, the Target price on Chart.

Any positive news Any moment, will trigger UP.

Highly recommended for Buying.

Plug Power Inc. ( PLUG) .Eve-Adam Double Bottom Pattern

This pattern consists of a U-shaped bottom followed by a V-shaped bottom. It ranks third among four patterns according to Bulkowski, with an average gain of 37% after the breakout and before a correction of 20% or more.

Bulkowski Expected Target Price = 103$ in the m

PLUG BUYBUY PLUG at .87 to .47, riding it back up to 3.20 to 13.00 as Profit Targets, Stop Loss is at .20!

If anyone likes mumbo jumbo long useless analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from here and from t

Plug Power: A Mirage or a Miracle?Plug Power (NASDAQ: PLUG), a key innovator in hydrogen energy solutions, recently experienced a significant surge in its stock value. This upturn is largely attributed to a strong vote of confidence from within the company: Chief Financial Officer Paul Middleton substantially increased his stake by

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 4PLUG is featured.

Frequently Asked Questions

The current price of 4PLUG is 1.5296 EUR — it has decreased by −0.93% in the past 24 hours. Watch PLUG POWER stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange PLUG POWER stocks are traded under the ticker 4PLUG.

4PLUG stock has risen by 7.72% compared to the previous week, the month change is a 55.92% rise, over the last year PLUG POWER has showed a −31.42% decrease.

We've gathered analysts' opinions on PLUG POWER future price: according to them, 4PLUG price has a max estimate of 2.98 EUR and a min estimate of 0.47 EUR. Watch 4PLUG chart and read a more detailed PLUG POWER stock forecast: see what analysts think of PLUG POWER and suggest that you do with its stocks.

4PLUG reached its all-time high on Jan 27, 2021 with the price of 59.8000 EUR, and its all-time low was 0.6302 EUR and was reached on May 16, 2025. View more price dynamics on 4PLUG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4PLUG stock is 1.14% volatile and has beta coefficient of 0.77. Track PLUG POWER stock price on the chart and check out the list of the most volatile stocks — is PLUG POWER there?

Today PLUG POWER has the market capitalization of 1.80 B, it has decreased by −8.99% over the last week.

Yes, you can track PLUG POWER financials in yearly and quarterly reports right on TradingView.

PLUG POWER is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

4PLUG earnings for the last quarter are −0.19 EUR per share, whereas the estimation was −0.18 EUR resulting in a −10.13% surprise. The estimated earnings for the next quarter are −0.13 EUR per share. See more details about PLUG POWER earnings.

PLUG POWER revenue for the last quarter amounts to 123.56 M EUR, despite the estimated figure of 122.24 M EUR. In the next quarter, revenue is expected to reach 134.16 M EUR.

4PLUG net income for the last quarter is −181.78 M EUR, while the quarter before that showed −1.29 B EUR of net income which accounts for 85.91% change. Track more PLUG POWER financial stats to get the full picture.

No, 4PLUG doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 3.22 K employees. See our rating of the largest employees — is PLUG POWER on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PLUG POWER EBITDA is −837.15 M EUR, and current EBITDA margin is −158.02%. See more stats in PLUG POWER financial statements.

Like other stocks, 4PLUG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PLUG POWER stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PLUG POWER technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PLUG POWER stock shows the sell signal. See more of PLUG POWER technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.