Overweight $XYZ ; Raising Price Target to $140+- BOATS:XYZ has been included to S&P 500 . It's a big news for BOATS:XYZ , this was one of the undervalued stock, treated like a dog but this company is always innovating and has strong talented employees.

- On top of that now BOATS:XYZ will get passive funds which is massive and bullish for

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.91 EUR

2.80 B EUR

23.30 B EUR

536.09 M

About Block, Inc.

Sector

CEO

Jack Patrick Dorsey

Website

Headquarters

Oakland

Founded

2021

FIGI

BBG00NWC0GT0

Block, Inc. engages in creating ecosystems for distinct customer audiences. It operates through the Square and Cash App segments. The Square segment provides payment services, software solutions, hardware, and financial services to sellers. The Cash App segment includes the financial tools available to individuals within the mobile Cash App, including peer-to-peer payments, bitcoin and stock investments. It also includes Cash App Card, which is linked to customer stored balances that customers can use to pay for purchases or withdraw funds from an ATM. The company was founded by Jack Patrick Dorsey and James Morgan McKelvey in February 2009 and is headquartered in Oakland, CA.

Related stocks

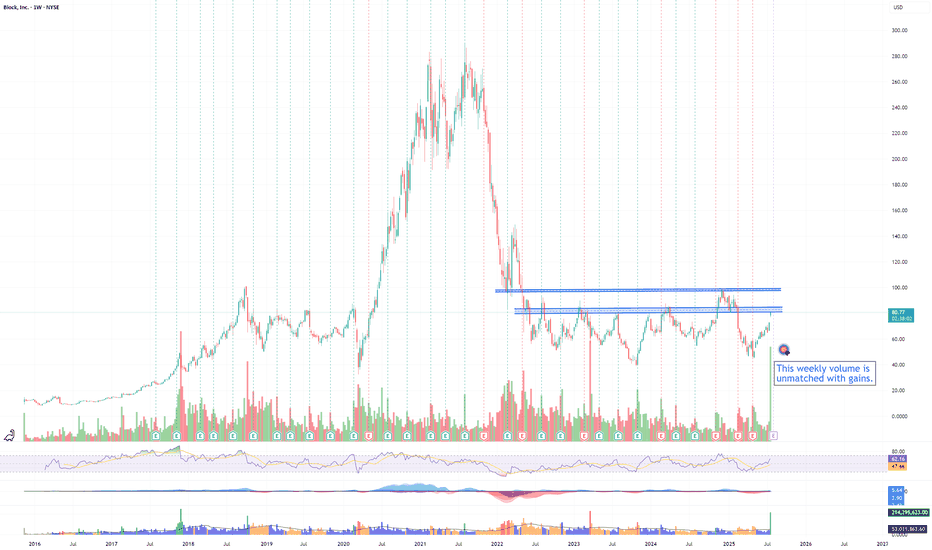

Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout🧠 Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout 📈

WaverVanir VolanX Protocol | Long-Term Thesis | Smart Money Structure

🗓️ Chart as of July 19, 2025 | 1D Timeframe | DSS Score: High Conviction Long

📍 Technical Analysis – VolanX SMC Layer

Block Inc (SQ) is forming a macro reversal bas

Block | XYZ | Long at $64.84Block's NYSE:XYZ revenue is anticipated to grow from $24 billion in FY2024 to $32 billion in FY2027. With a current price-to-earnings ratio of 13.8x, debt-to-equity ratio of 0.36x, and rising cash flow in the billions, it's a decent value stock at its current price. Understandably, there is some h

A BNPL Bubble Is Actually Why I'm Bullish, For NowBNPL is growing and inflating at an increasing rate. From concert tickets to burritos, everyone is using buy now pay later. The global market is projected to hit 560 billion dollars in 2025, up from around 492 billion in 2024, and climb to 912 billion by 2030 at a compounding growth rate of 10.2%. J

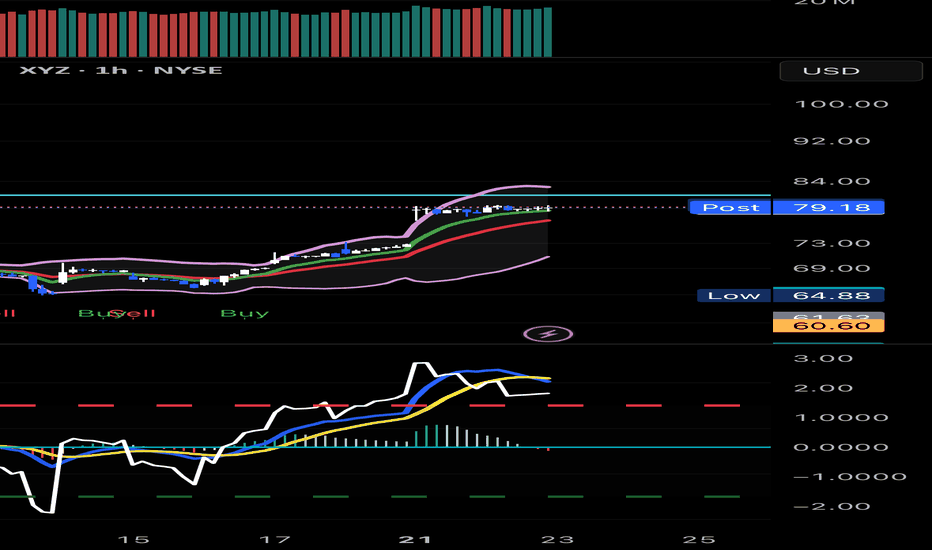

XYZ momentum is buildingXYZ positive weekly volume this week is a first in its history! Even though it has never had this much 'green' volume in its weekly history, there is plenty of resistance to be overcome for this stock

$81-85 will be challenging as sellers all the way from 2022 will begin dumping shares, especially

"Breakout Eagle: Soaring Past Resistance XYZ!"Breakout Eagle: Soaring Past Resistance!"

📝 Trade Breakdown:

🚀 Setup:

XYZ just blasted past a key resistance zone with strong bullish momentum. The breakout is confirmed with a clean retest on both the trendline and horizontal support — a textbook long setup!

📍 Entry: $65.84 (on breakout retest)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SQ5307444

Block, Inc. 0.0% 01-MAY-2026Yield to maturity

5.79%

Maturity date

May 1, 2026

SQ5449300

Block, Inc. 3.5% 01-JUN-2031Yield to maturity

5.29%

Maturity date

Jun 1, 2031

SQ5307445

Block, Inc. 0.25% 01-NOV-2027Yield to maturity

5.17%

Maturity date

Nov 1, 2027

SQ5449301

Block, Inc. 2.75% 01-JUN-2026Yield to maturity

5.05%

Maturity date

Jun 1, 2026

See all 4SQ bonds

Frequently Asked Questions

The current price of 4SQ is 68.56 EUR — it has increased by 1.14% in the past 24 hours. Watch BLOCK stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange BLOCK stocks are traded under the ticker 4SQ.

4SQ stock has risen by 11.32% compared to the previous week, the month change is a 23.09% rise, over the last year BLOCK has showed a 11.68% increase.

We've gathered analysts' opinions on BLOCK future price: according to them, 4SQ price has a max estimate of 81.26 EUR and a min estimate of 29.94 EUR. Watch 4SQ chart and read a more detailed BLOCK stock forecast: see what analysts think of BLOCK and suggest that you do with its stocks.

4SQ stock is 1.12% volatile and has beta coefficient of 1.36. Track BLOCK stock price on the chart and check out the list of the most volatile stocks — is BLOCK there?

Today BLOCK has the market capitalization of 42.27 B, it has increased by 0.98% over the last week.

Yes, you can track BLOCK financials in yearly and quarterly reports right on TradingView.

BLOCK is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

4SQ earnings for the last quarter are 0.52 EUR per share, whereas the estimation was 0.90 EUR resulting in a −42.53% surprise. The estimated earnings for the next quarter are 0.57 EUR per share. See more details about BLOCK earnings.

BLOCK revenue for the last quarter amounts to 5.34 B EUR, despite the estimated figure of 5.72 B EUR. In the next quarter, revenue is expected to reach 5.34 B EUR.

4SQ net income for the last quarter is 175.51 M EUR, while the quarter before that showed 1.88 B EUR of net income which accounts for −90.66% change. Track more BLOCK financial stats to get the full picture.

No, 4SQ doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 11.37 K employees. See our rating of the largest employees — is BLOCK on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BLOCK EBITDA is 2.20 B EUR, and current EBITDA margin is 10.01%. See more stats in BLOCK financial statements.

Like other stocks, 4SQ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BLOCK stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BLOCK technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BLOCK stock shows the buy signal. See more of BLOCK technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.