WFC · Daily — Rising-Channel Breakout Idea Toward $89-90Why This Setup Caught My Eye

Multi-year rising channel: Since late 2022 price has respected a neat parallel channel; we’re now testing the upper rail.

Fresh bull-flag breakout: The June pullback carved a tight triangular flag. Last week’s high-volume close above $83 confirmed the breakout.

Measure

Key facts today

Wells Fargo will report Q2 earnings on Tuesday, with expectations of higher profit and revenue compared to last year, despite concerns over valuations and the economic climate.

Wells Fargo's stock is currently trading at $82.36, with a consensus price target of $86.68, suggesting a 5% upside potential based on 12-month price targets.

Wells Fargo, alongside Morgan Stanley and Goldman Sachs, is involved in a proposed $120 million settlement over allegations of concealed conflicts of interest during ViacomCBS share sales.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.21 EUR

19.05 B EUR

121.98 B EUR

3.25 B

About Wells Fargo & Company

Sector

Industry

CEO

Charles William Scharf

Website

Headquarters

San Francisco

Founded

1852

FIGI

BBG00KGFV3F7

Wells Fargo & Co. is a diversified and community-based financial services company, which engages in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. It operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. The Consumer Banking and Lending segment offers consumer and small business banking, home lending, credit cards, auto, and personal lending. The Commercial Banking segment provides banking and credit products across industry sectors and municipalities, secured lending and lease products, and treasury management. The Corporate and Investment Banking segment is composed of corporate banking, investment banking, treasury management, commercial real estate lending and servicing, and equity and fixed income solutions, as well as sales, trading, and research capabilities. The Wealth and Investment Management segment refers to personalized wealth management, brokerage, financial planning, lending, private banking, trust, and fiduciary products and services. The company was founded by Henry Wells and William G. Fargo on March 18, 1852 and is headquartered in San Francisco, CA.

Related stocks

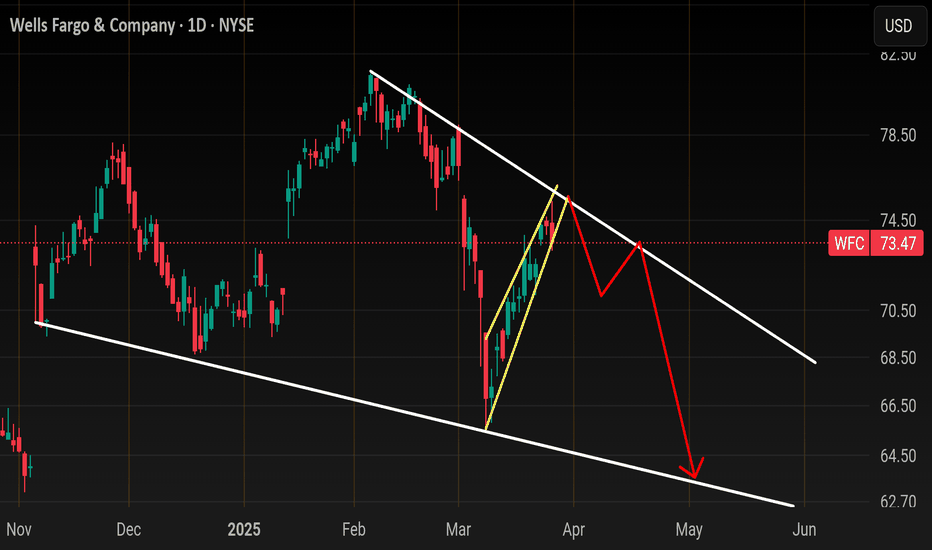

Shorting WFC for short-term correction NYSE:WFC is looking at near-term weakness after a strong bearish counter attack candle was seen rejecting the 123.6% Fibonacci extension of the range (71.82-76.50) and the 88.6% deep retracement level of the larger swing low to high (50.20-80.70).

23-period ROC is looking at a bearish divergence

WFC eyes on $74: Major Resistance going into FED rate decision WFC testing a Major Resistance zone going into FED day.

Looking for a Rejection or a Break-and-Retest for next move.

Financials in general are doing well but due for a little dip.

$73.56-74.11 is the key zone of interest.

$68.91-69.60 is first good support below.

==================================

WFC Trade LevelsEither or set-up while in this range.

For day trades, expect price to move between 64.86-66.30 where there is a daily gap down.

For now, the gap is acting as resistance.

When trading gaps, it depends on your objective. Scalpers might be interested in playing off the H/L of the gap.

While intraday

WFC - Faster Up PhaseAs price transitions through fib circle acceleration of price upwards is allowed

Price has been going through an upward movement however slowly, I expect price to move up faster

This is similar to Tesla's moves upward. Kind of moving up in chunks or in big waves

Weekly timeframe

WFC is moving ahead of the market for better or worse?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many deca

Wells Fargo $WFC at a turning point📌 09.03.2025 Analysis:

✅ 1. Bearish Divergence:

Price Action: Higher high from Nov 26, 2024 → Feb 6, 2025.

SMI: Lower high from Nov 26, 2024 → Feb 19, 2025.

Interpretation: This confirms a bearish divergence—institutions were not supporting the price move despite a new high.

📌 Notes:

Look at how

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

WFC5760754

Wells Fargo & Company 0.0% 28-FEB-2039Yield to maturity

8.85%

Maturity date

Feb 28, 2039

94CY

WELLS FARGO & COMPANY 2.5% SNR EMTN 02/05/29Yield to maturity

7.50%

Maturity date

May 2, 2029

WFC.MS

Wachovia Corporation 6.605% 01-OCT-2025Yield to maturity

6.99%

Maturity date

Oct 1, 2025

WFC5679614

Wells Fargo & Company 6.75% 06-NOV-2033Yield to maturity

6.71%

Maturity date

Nov 6, 2033

US94974BGT1

WELLS FARGO 2046 MTNYield to maturity

6.65%

Maturity date

Jun 14, 2046

WFC5673508

Wells Fargo & Company 6.65% 26-OCT-2033Yield to maturity

6.63%

Maturity date

Oct 26, 2033

WFC4776290

Wells Fargo & Company 4.661373% 06-DEC-2028Yield to maturity

6.62%

Maturity date

Dec 6, 2028

US94974BGE4

WELLS FARGO 2044 MTNYield to maturity

6.51%

Maturity date

Nov 4, 2044

NWTP

WELLS FARGO 15/45 MTNYield to maturity

6.50%

Maturity date

Nov 17, 2045

US94974BGK0

WELLS FARGO 2045 MTNYield to maturity

6.49%

Maturity date

May 1, 2045

US94974BGU8

WELLS FARGO 2046 MTNYield to maturity

6.46%

Maturity date

Dec 7, 2046

See all 4WFC bonds

Curated watchlists where 4WFC is featured.

Frequently Asked Questions

The current price of 4WFC is 70.97 EUR — it has decreased by −0.03% in the past 24 hours. Watch WELLS FARGO & CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange WELLS FARGO & CO stocks are traded under the ticker 4WFC.

4WFC stock has risen by 0.07% compared to the previous week, the month change is a 7.58% rise, over the last year WELLS FARGO & CO has showed a 38.18% increase.

We've gathered analysts' opinions on WELLS FARGO & CO future price: according to them, 4WFC price has a max estimate of 81.91 EUR and a min estimate of 60.58 EUR. Watch 4WFC chart and read a more detailed WELLS FARGO & CO stock forecast: see what analysts think of WELLS FARGO & CO and suggest that you do with its stocks.

4WFC reached its all-time high on Feb 7, 2025 with the price of 78.02 EUR, and its all-time low was 17.94 EUR and was reached on Oct 29, 2020. View more price dynamics on 4WFC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4WFC stock is 0.86% volatile and has beta coefficient of 1.27. Track WELLS FARGO & CO stock price on the chart and check out the list of the most volatile stocks — is WELLS FARGO & CO there?

Today WELLS FARGO & CO has the market capitalization of 229.85 B, it has decreased by −0.33% over the last week.

Yes, you can track WELLS FARGO & CO financials in yearly and quarterly reports right on TradingView.

WELLS FARGO & CO is going to release the next earnings report on Jul 15, 2025. Keep track of upcoming events with our Earnings Calendar.

4WFC earnings for the last quarter are 1.28 EUR per share, whereas the estimation was 1.13 EUR resulting in a 13.42% surprise. The estimated earnings for the next quarter are 1.20 EUR per share. See more details about WELLS FARGO & CO earnings.

WELLS FARGO & CO revenue for the last quarter amounts to 18.62 B EUR, despite the estimated figure of 19.15 B EUR. In the next quarter, revenue is expected to reach 17.61 B EUR.

4WFC net income for the last quarter is 4.52 B EUR, while the quarter before that showed 4.91 B EUR of net income which accounts for −7.80% change. Track more WELLS FARGO & CO financial stats to get the full picture.

Yes, 4WFC dividends are paid quarterly. The last dividend per share was 0.36 EUR. As of today, Dividend Yield (TTM)% is 1.94%. Tracking WELLS FARGO & CO dividends might help you take more informed decisions.

WELLS FARGO & CO dividend yield was 2.14% in 2024, and payout ratio reached 27.96%. The year before the numbers were 2.64% and 26.90% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 14, 2025, the company has 217 K employees. See our rating of the largest employees — is WELLS FARGO & CO on this list?

Like other stocks, 4WFC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade WELLS FARGO & CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So WELLS FARGO & CO technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating WELLS FARGO & CO stock shows the strong buy signal. See more of WELLS FARGO & CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.