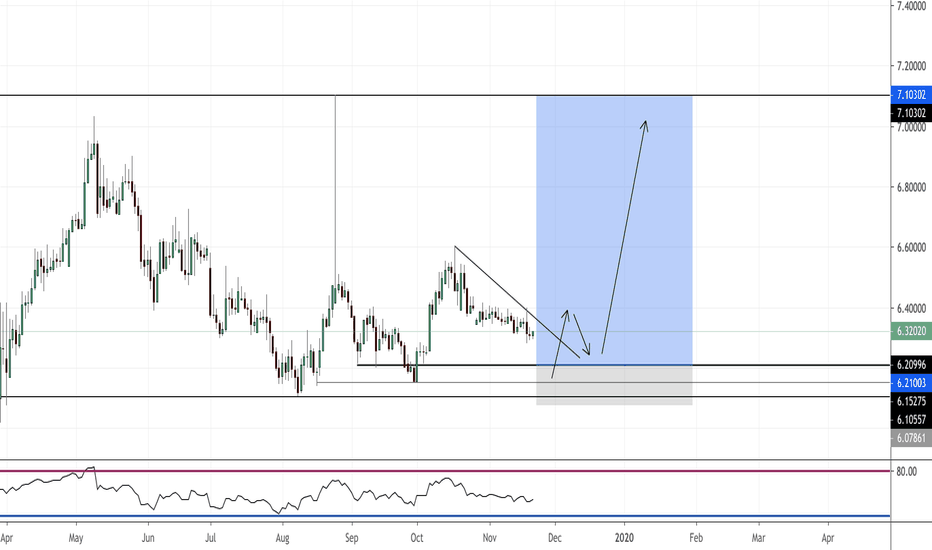

Long on clear break above triangle pattern.

In these articles we post intraday possible outcomes of pairs based on naked trading setup only .. We do not take into account fundamental news which may move pair significantly in any direction , follow your trading plan .

Follow us for more updates and trade ideas.

EURTRY trade ideas

Bullish breakout for EUR/TRY.Hi traders,

wanted to share with you my chart Analysis. The whole first week of February saw EUR/TRY in a down trend, creating a triangle where at the base we have an area of confluence with the trendline formed in the begining of the year (9th of Jan). Week wise and day wise pair is in a long uptrend.

At the beginning of a Friday session (Europe) we saw tweezers bottom/chopsticks candle pattern (on 30min chart) at the area of confluence giving a clear signal of a change in direction of the trend,eating all the shorts on the way - resulting in catapulting of the price up with a text book example of a bullish breakout.

Perfectly following the description of a bullish breakout out of a triangle, price ascended the same amount as the height of the triangle. Price then pulled back to the broken trendline that became the support.

I closed my longs on top of the chart, and will initiate longs for the following weeks, with a good entry. In my opinion we have a begining of a longer term uptrend.

Thank you for reading.

Lukas

Analysis on EURTRY 22.01.2020The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero lines.

The oscillator Force Index is above the zero lines.

If the level of resistance is broken, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 6.6000

• Take Profit Level: 6.6500 (500 pips)

If the price rebound from resistance level, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 6.5500

• Take Profit Level: 6.5200 (300 pips)

EURTRY - 240 - A bit of room for some downsideQuick idea.

EURTRY is near its key support, which if breaks, it may clear the path towards the medium-term tentative upside support line. We will consider the downside only if we see a drop below roughly the 6.5057 level.

For now we remain neutral and continue observing the price action.

Please see the chart for levels and targets.

Don't forget your stop-loss.

Watch for downside consolidation breakout in EURTRY and USDTRYThere is a potential to trade a downside breakout of the consolidation (lira continues to increase) into wedge/triangle support.

The price target is the rising trendline on both the USD/TRY (near 5.75) and EUR/TRY (just above 6.4). A stop loss goes above the consolidation.

The reward:risk is 1.25:1 to 1.5:1, but over a week or two the rollover would add to the potential profit.

The Turkish lira interest rate is 11.25%. The US rate is 1.75% and the EUR rate is 0%. The short trade picks up the interest rate differential. A long trade pays the interest rate differential. I am not interested in the long, only the short, if it materializes.

EUR/TRY trend turning upwardSuddenly, the Turkish lira is experiencing accelerating weakness. EUR/TRY, for example, has been spinning higher lows and higher highs include this week's fresh breakout. These runs usually continue until some dramatic flourish with the Turkish lira losing a LOT within minutes. I won't be surprised to see a 10%+ move in the coming weeks. Note that those climactic moves are often fadeable.