EURUSD: Bulls Will Push

Balance of buyers and sellers on the EURUSD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD trade ideas

follow EURUSD LION & PLANE BUY SETUPTHE PRICE has moved as I explained in the last two posts

but we have some update to go along the way

the price could break failing channel

and withdrawal liquidity and filled imbalance

hence reflect from demand zone with zero reflection as i explained in last post with rock and plane

and it will go up to take liquidity in failing channel or downtrend

EUR USD longit can be a viable setup , as last week we got trumped the uncertainty about dollar can continue...

one thing about how i trade . the last method I'm using is using a secondary analyzer app that can detect the lines and patterns , in mass numbers . i would put my favorite asset beside then ill open trades with a proper risk to reward ratio ( 1/ 1.5 usually) , i have fixed hour for job its 5 hours of monitoring the market. after that i wont open trades as it enters new york session . in whole day i would close my trades as i reach my daily goal, then i go do my daily life ...

so you may think i copy these ideas . that's not the case, its true for my real account im using a fish catcher but i know some day i dont have this and i should be able to catch the fishes with my hand. so im sharing these ideas based on my experience and yet i have to work on them ...

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

EURUSD – WEEKLY FORECAST Q3 | W30 | Y25📊 EURUSD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

What's Next On EURUSDPrice currently leans toward a bearish pullback after a series of impulsive bullish moves. So far, we haven’t seen any significant retracement since the rally began. As we anticipate a potential correction, could this be the awaited moment for the bears to step in—especially with only weaker structures left behind and bearish pressure building?

Regardless, every market scenario demands discipline and proper risk management.

Thinking of taking this outlook? Be sure to wait for strong confirmation before jumping in.

Good luck, traders, as we watch price unfold.

👉 Follow for more updates. See you in the next one 😉.

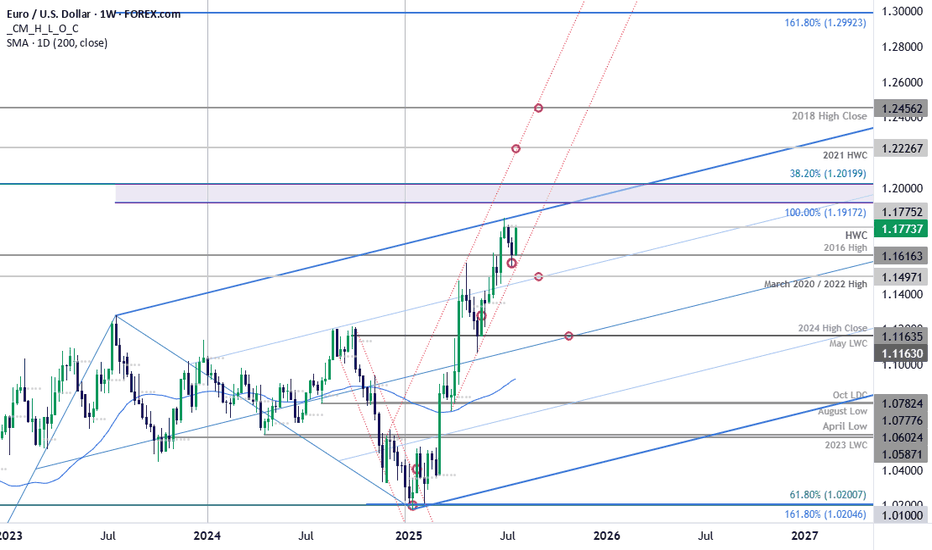

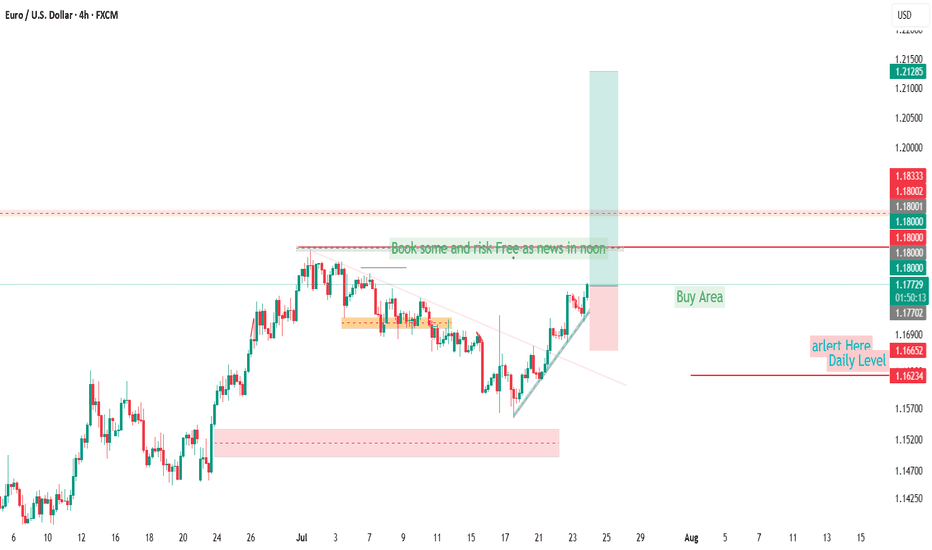

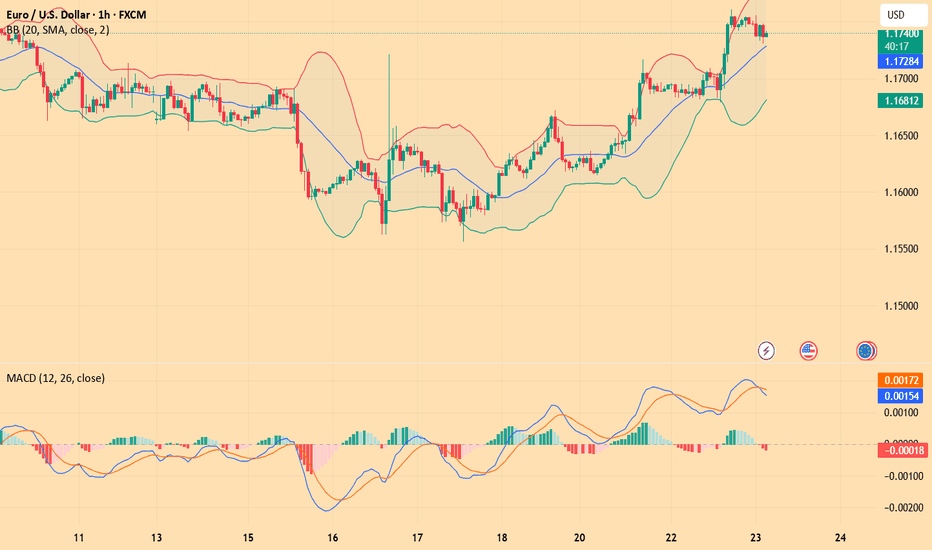

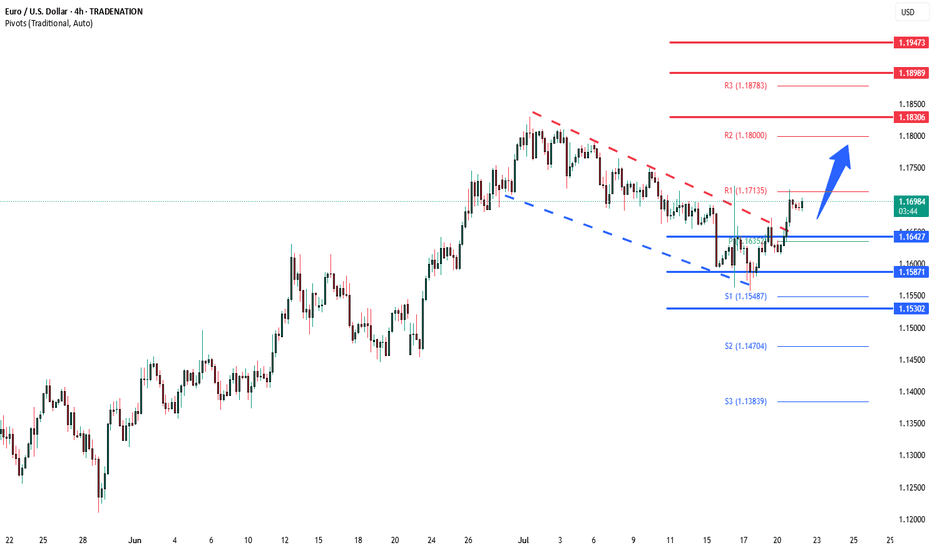

EUR/USD Surges into Resistance Ahead of ECBEuro is poised to snap a two-week losing streak with EUR/USD up more than 1.2% since the Sunday open. The advance takes price back into weekly resistance ahead of tomorrow’s European Central Bank rate decision and the focus now shifts to the weekly close for guidance.

Euro plunged more than 2.3% off the June high with price briefly registering an intraweek low at 1.1557 before rebounding. The rally takes EUR/USD into resistance at the objective high-week close (HWC) / high-close at 1.1775- looking for a reaction off this mark with a weekly close above needed to keep the immediate advance viable into the close of the month.

Initial weekly support remains with the 2016 swing high at 1.1616 with the medium-term outlook still constructive while above the March trendline (red). Ultimately, a break below the 2020 / 2022 highs at 1.1497 would be needed to suggest a more significant high is in place / a larger correction is underway with subsequent support seen at the 2024 high close / May low-week close (LWC) at 1.1164.

A breach / close above this pivot zone exposes the upper parallel (blue), currently near 1.1840s, with the next major technical consideration eyed at 1.1917-1.2020- a region defined by the 100% extension of the 2022 advance and the 38.2% retracement of the 2008 decline (area of interest for possible top-side exhaustion / price inflection IF reached). Subsequent resistance objectives eyed at the 2021 HWC at 1.2227 and the 2018 high-close at 1.2456.

Bottom line: Euro rebounded just ahead of the March uptrend with the rally now testing the yearly high-close ahead of the ECB- watch the Friday close with respect to 1.1775. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops- losses would need to be limited to this week’s low IF price is heading higher on this stretch with a close above the upper parallel still needed to fuel the next major leg of the advance.

-MB

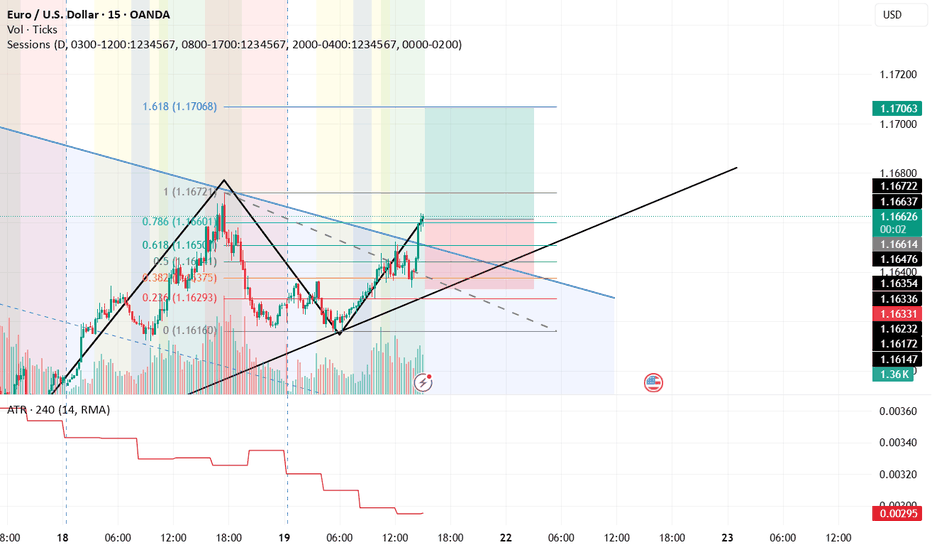

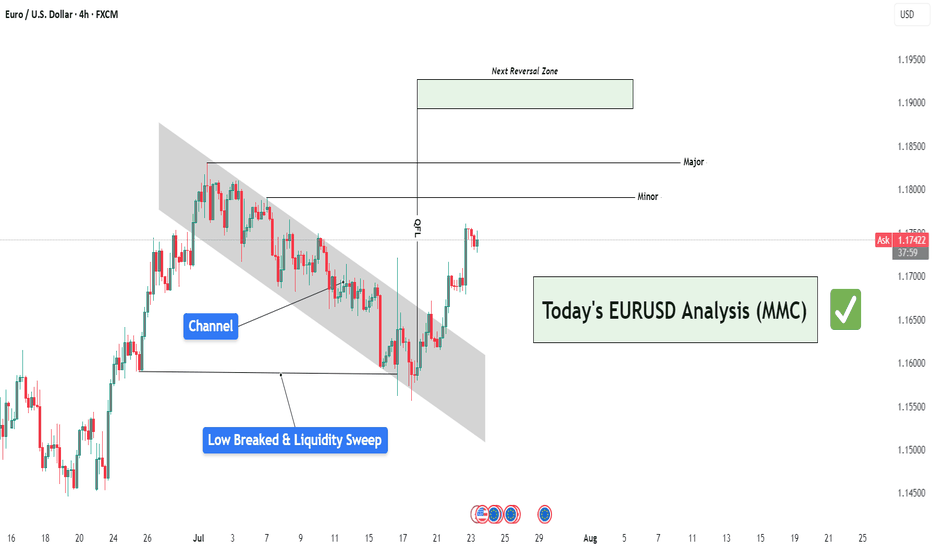

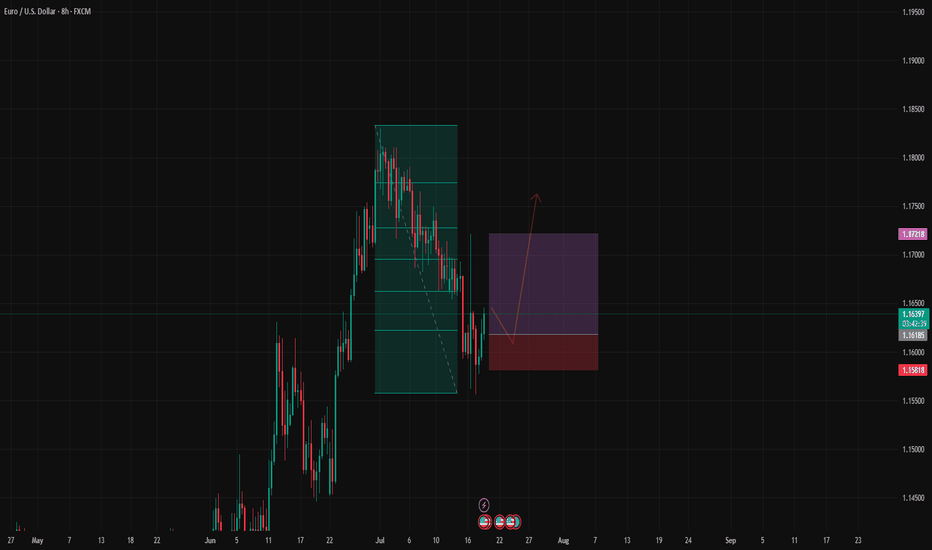

EURUSD Analysis : Liquidity Sweep – EURUSD Targets TO Reversal🧠 Institutional Context & Big Picture

EURUSD has been in a tightly controlled descending channel for several weeks—a classic sign of a market being engineered for liquidity collection. Rather than a naturally trending bearish market, this price action reflects stealth accumulation and market maker manipulation.

The channel structure was used to:

Establish a visible bearish trend (to trap sellers)

Trigger emotional bias for continued shorting

Build up stop orders below swing lows

This phase was about building energy, not continuation.

🔍 Detailed Breakdown of the Chart Elements

📌 1. Descending Channel – Controlled Manipulation

The pair moved within a well-defined bearish channel for multiple weeks.

Each touch respected the top and bottom perfectly—not random, but institutional structure.

It fostered retail confidence in the downtrend while market makers prepared for a reversal.

💥 2. Liquidity Sweep & Trap (Low Breaked & Liquidity Grabbed)

Price spiked below the previous low, clearly sweeping liquidity on July 21.

This is the "engineered breakdown", meant to trigger breakout sellers and stop out early longs.

Immediately after the sweep, the price violently reversed—clear evidence of a liquidity trap.

This is classic MMC logic: induce, trap, reverse.

🟩 3. QFL Base Formed – Bullish Engine Ignited

At the point of reversal, the chart shows the formation of a QFL (Qualified Liquidation Failure) zone.

This QFL base is the core of smart money accumulation—price broke below a base, then quickly reclaimed it.

It's not just support—it’s the true origin of the reversal and an optimal entry point.

📈 4. Breakout from the Channel – Structure Shift Confirmed

Price broke out of the descending channel with strong momentum, confirming:

Structure shift from lower lows → higher highs

Momentum shift in favor of bulls

Entry confirmation for MMC-based long setups

This breakout invalidates the bearish trend and signals a fresh leg up, likely toward unmitigated supply zones.

🟨 5. Current Price Action – Healthy Bullish Consolidation

After the breakout, price is consolidating just above the broken channel, forming a mini-flag or base.

This indicates:

Smart money is accumulating more

No significant selling pressure

Likely continuation toward next supply

🎯 6. Next Targets – Reversal Zones

Minor Resistance: ~1.1800

Major Resistance: ~1.1850 – 1.1880

Next Reversal Zone: 1.1900–1.1950

This zone is highlighted as a potential sell-off area where institutions may offload positions or create new traps.

Watch for signs of exhaustion or redistribution here.

📌 Trade Plan Based on MMC Structure

✅ Bullish Scenario (Currently Active)

Entry Area: Ideally at QFL base or breakout retest (~1.1700–1.1720 zone)

Confirmation: Bullish price action (engulfing, flag break, or liquidity wick)

Targets:

🎯 TP1: 1.1800

🎯 TP2: 1.1850

🎯 TP3: 1.1950 (Reversal Supply Zone)

❌ Invalidation:

A break below the QFL base (~1.1670) with bearish volume would invalidate the bullish MMC structure.

🧠 Smart Money Insight & Logic Recap

This entire move reflects a classic Market Maker Strategy:

Build a trend (descending channel) to shape trader bias

Trigger liquidity events (false breakdown)

Accumulate at the lows via QFL logic

Shift structure (channel breakout)

Target unfilled institutional supply (1.1850–1.1950)

This isn’t random—it’s engineered movement. Your job as a trader is to identify footprints, not follow the crowd.

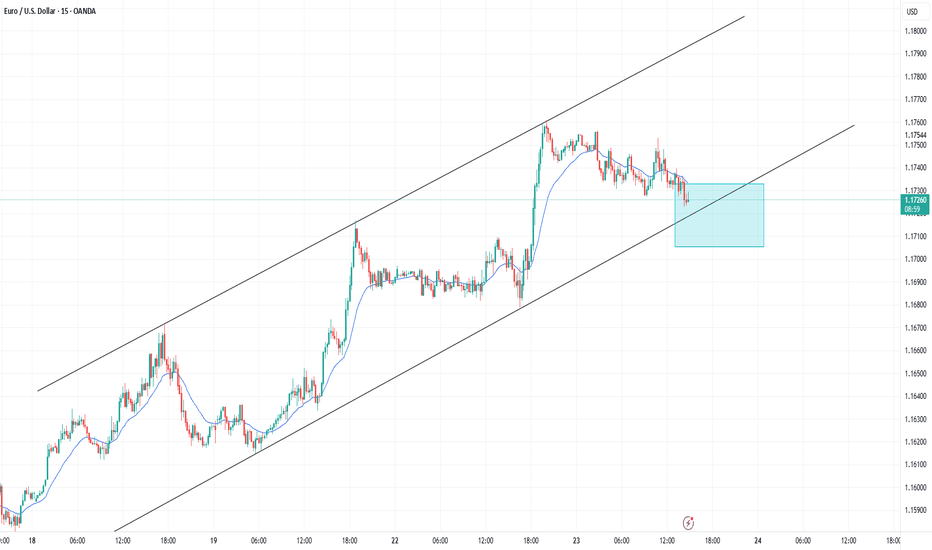

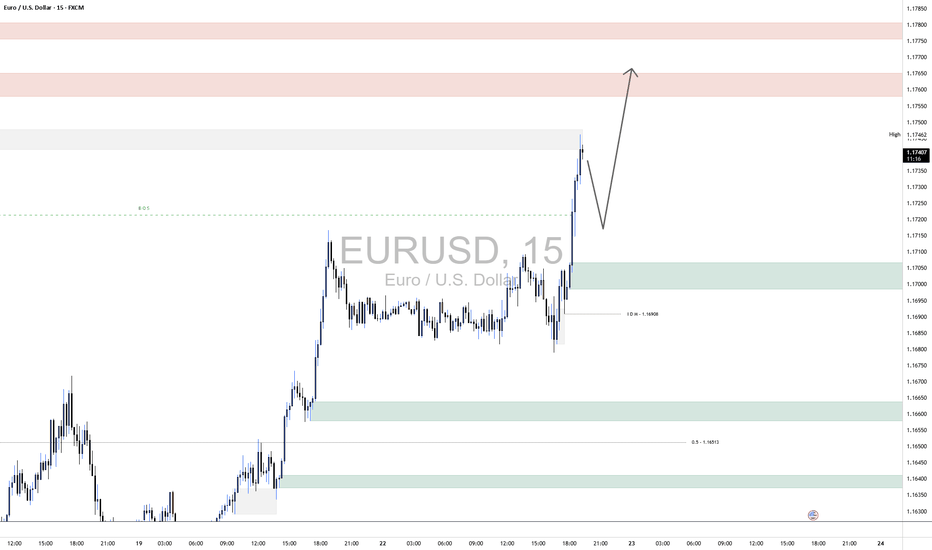

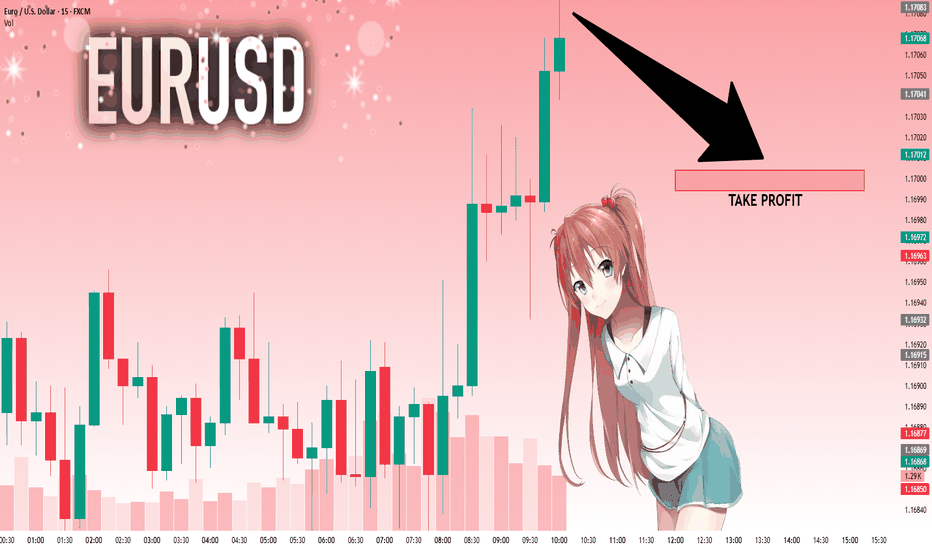

EURUSD LongEURUSD 15-Minute Technical Analysis

EURUSD has broken through a key intraday structure level with strong bullish momentum, indicating continued institutional interest on the buy side. The market is now approaching a higher-timeframe supply region while leaving behind a well-defined demand zone that could serve as a launchpad for further upside.

🔍 Market Structure & Momentum:

Break of Structure (BOS) was confirmed after the recent surge above the previous high, validating the current bullish trend.

Price has rallied aggressively from the IDM low at 1.16908, sweeping short-term liquidity and suggesting smart money involvement.

We are now trading inside a minor supply zone and approaching a broader liquidity cluster between 1.17550 – 1.17800.

🟩 Key Demand Zone

Level: 1.16980 – 1.17100

This zone marks a significant accumulation area where the market built up momentum before the breakout. It's also in line with the IDM (Internal Drawdown Marker), serving as a technical retracement level.

A retracement into this demand zone would align with a classic bullish continuation pattern, offering a potential re-entry area for long positions.

The imbalance left behind further supports this zone’s potential to hold.

🟥 Overhead Supply Zones (Resistance Clusters):

First Zone: 1.17550 – 1.17700

Second Zone (Stronger): 1.17750 – 1.17900

These zones represent unmitigated supply levels from previous sell-offs and may act as profit-taking or short-term reversal points for intraday traders. These areas are where we expect higher levels of volatility and potential bearish reaction before continuation or reversal.

📈 Expectations & Trade Setup:

Anticipation of a retracement into the 1.16980–1.17100 demand zone for price to establish a higher low before pushing toward unfilled liquidity above 1.17550.

If demand holds, a bullish continuation could aim for 1.17750–1.17900, where confluence with past supply suggests caution.

Should price fail to hold the demand, bearish momentum could pull price back toward the lower demand block at 1.16500 (aligned with the 0.5 fib level of the prior impulse).

EUR USD short setupwe had lower low so i say it may go further down , consider its Friday we may see ranging market so waiting for over price can be logical ...

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

EUR USD longcan be a short term possibility and maybe not let see , today market is so unstructured from yesterday news lets experience ...

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

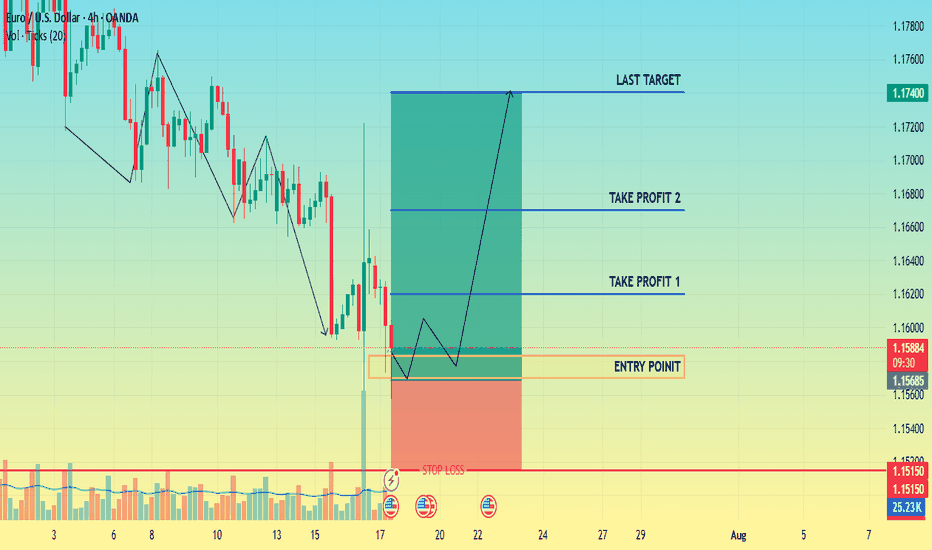

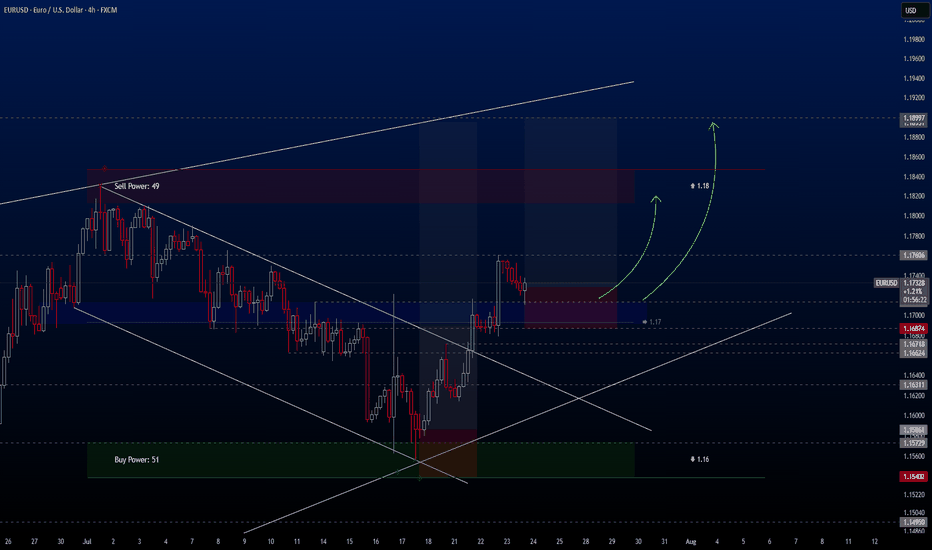

EURUSDHello traders,

I've been closely monitoring the **EURUSD** pair for a while, and it’s now offering an ideal entry opportunity. It has presented several great setups for swing trading, and I’d like to share one of them with you today.

🔍 **Trade Details**

✔️ **Timeframe**: H4/D

✔️ **Risk-to-Reward Ratio**: 1:4.22

✔️ **Trade Direction**: Buy

✔️ **Entry Price**: 1.17281

✔️ **Take Profit**: 1.18997

✔️ **Stop Loss**: 1.16874

🔔 **Disclaimer**: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

EURUSD(20250723) Today's AnalysisMarket news:

White House officials plan to visit the Federal Reserve headquarters on Thursday local time.

Technical analysis:

Today's buying and selling boundaries:

1.1730

Support and resistance levels:

1.1811

1.1781

1.1761

1.1699

1.1679

1.1649

Trading strategy:

If the price breaks through 1.1761, consider buying, the first target price is 1.1781

If the price breaks through 1.1730, consider selling, the first target price is 1.1699

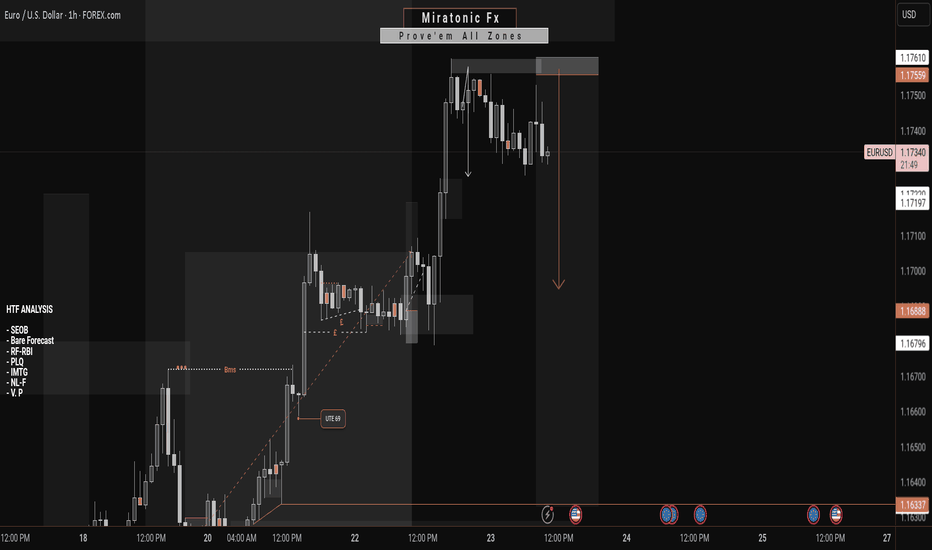

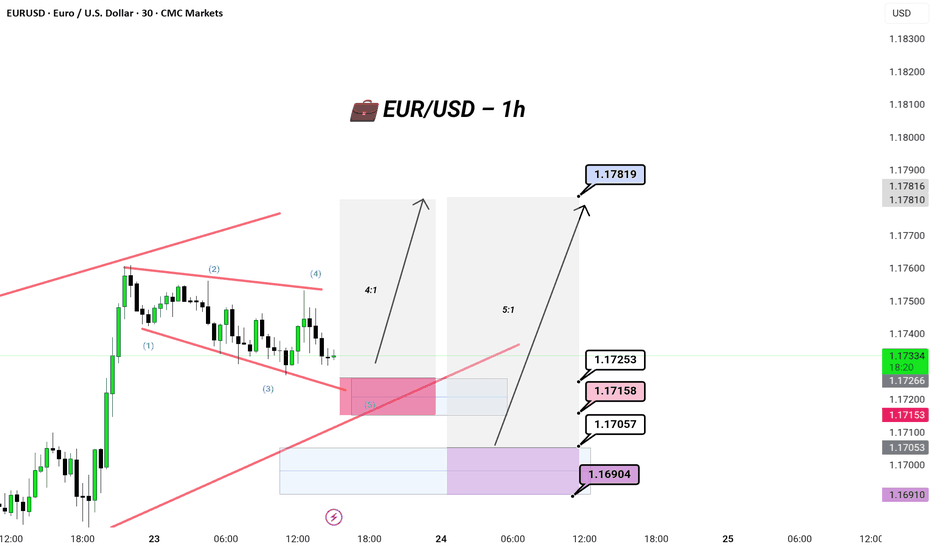

EUR/USD || Correction || 1hr

💼 EUR/USD –🔻 Market Move

Timeframe: 30M | Broker: CMC | Brand: GreenFireForex™

Chart Type: Clean. Tactical. Smart Money meets Waves.

---

🔻 Correction Almost Done (Wave 5)

Classic Elliott 5-wave drop inside a bullish falling wedge.

The boys might be setting up a liquidity sweep before lift-off.

📉 Current Range: Grinding between 1.17334 – 1.17153

🕳️ Liquidity Below:

🩷 1.17158 (Mid OB)

🩶 1.17057 (Deep OB)

💜 1.16904 (Max Draw, SL sweep zone)

---

🚀 Upside Projections

🎯 TP1: 1.17253 (Quick scalp)

🧠 TP2: 1.17819 (Institutional Magnet)

---

🔫 Setup Mood:

🎯 Buy the Dip, don’t chase the breakout.

🧊 Let retail short the wedge, we buy into their fear.

🏎️ Risk-managed, sniper mode.

---

👑

"Liquidity funds lifestyle. Waves fund legacy."

---

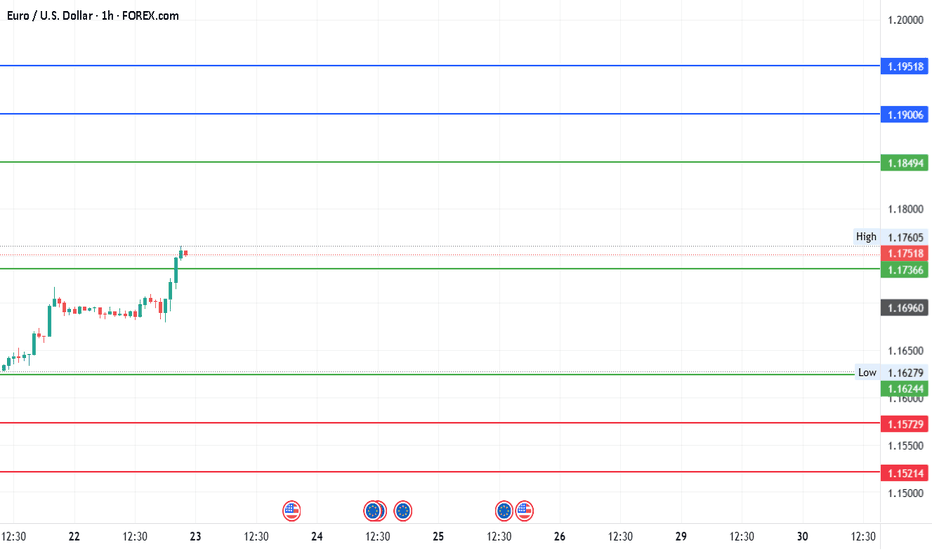

#EURUSD - Pivot Point is 1.174Date: 22-07-2025

#EURUSD - Current Price: 1.175

Pivot Point: 1.174 Support: 1.162 Resistance: 1.185

Upside Targets:

Target 1: 1.190

Target 2: 1.195

Target 3: 1.203

Target 4: 1.211

Downside Targets:

Target 1: 1.157

Target 2: 1.152

Target 3: 1.144

Target 4: 1.136

#TradingView #Forex #Currency #StockMarket #Investing #Trading #EURUSD

#TechnicalAnalysis #SotockCharts #Finance

#PivotPoints #SupportResistance

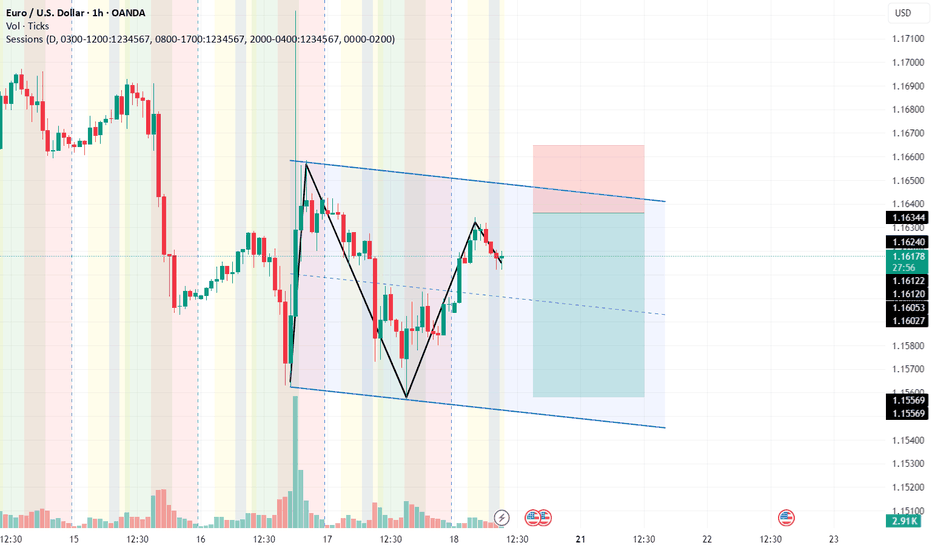

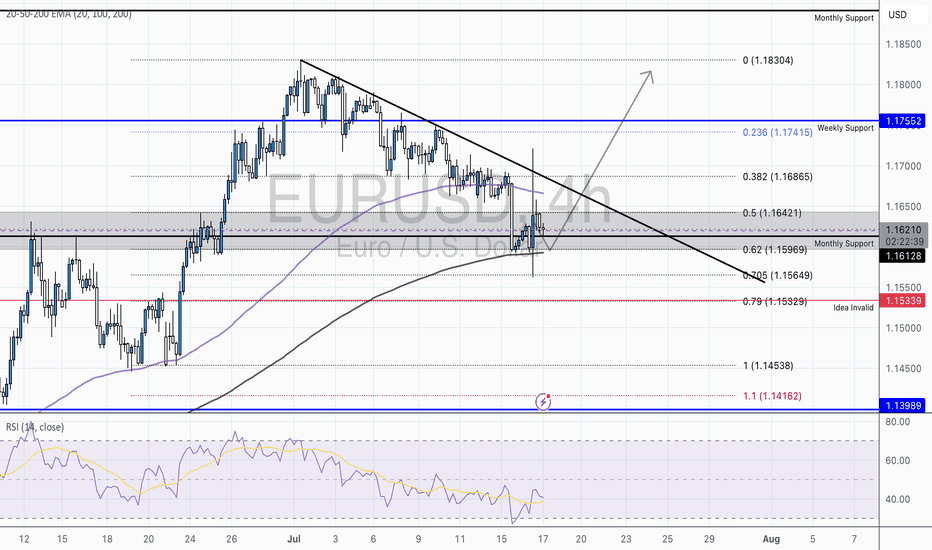

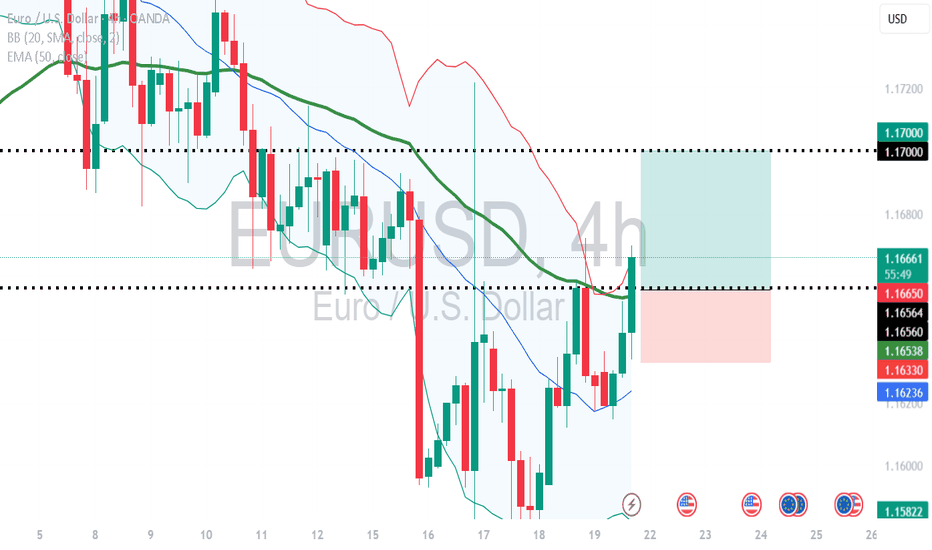

EUR/USD – Falling Wedge at Major Fibonacci Zone | Bullish ReversAfter a strong mid-June rally, EUR/USD has pulled back into a key fib cluster, showing early signs of reversal from a classic falling wedge pattern — often a precursor to bullish breakouts.

Technical Breakdown:

📉 Descending Trendline

🔍 Fibonacci Confluence:

Price is reacting from the 0.5-0.618 – 0.705 zone (1.16421-1.15969), aligning perfectly with historical demand and the golden zone of the fib retracement.

Just below sits the 0.79 fib (1.15339), which also marks our invalidity level for this idea — a deep but powerful retracement if tested.

💡 RSI:

While still below 50, it has created a hidden bullish divergence between July 12–17, hinting that momentum is flipping back to bulls.

🧠 Educational Insight:

This setup combines Trendlines, Fibonacci retracement theory, and EMA dynamics to build a multi-layered trade thesis — the type of confluence we look for at Wright Way Investments.

Price doesn’t just reverse because it hits a fib level. But when structure, EMAs, and RSI align — the odds increase significantly.

📈 Trade Setup (Idea-Based, Not Financial Advice):

Long Entry Zone: Current area (1.159–1.161), with confirmation above 1.1626

Invalidation: Clean break & close below 1.15339

Target Zones:

🎯 TP1 – 1.1642 (50 fib & retest zone)

🎯 TP2 – 1.1686 (38.2 fib)

🎯 TP3 – 1.1755 (Weekly Resistance)

📌 Summary:

EUR/USD is forming a textbook reversal setup, supported by fib precision and EMA alignment. Patience is key — but the ingredients are here for a strong bullish continuation.

EURUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.17083 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.17004..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

EURUSD bullish breakout supported at 1.1640The EURUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend.

Key Technical Level: 1.1640

This level marks the prior consolidation range and now acts as pivotal support. A corrective pullback toward 1.1640 followed by a bullish rejection would reinforce the bullish trend, targeting the next resistance levels at:

1.1830 – Near-term resistance

1.1900 – Minor swing high

1.1940 – Longer-term bullish objective

On the other hand, a decisive daily close below 1.1640 would invalidate the bullish setup, shifting the outlook to bearish in the short term. This could trigger a deeper retracement toward:

1.1590 – Initial support

1.1530 – Key downside target

Conclusion:

As long as 1.1640 holds as support, the technical outlook remains bullish, favoring long positions on dips. A confirmed break below this level would signal a shift in sentiment and open the door to a corrective pullback phase.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

#012: LONG Investment Opportunity on EUR/USD

In this scenario, I placed a passive long order on EUR/USD at a key zone that has shown signs of accumulation and institutional defense in recent days.

The price showed bearish manipulation followed by a sharp rebound with a V-shaped pattern, often indicative of stop-loss hunting. In these phases, a direct entry is less effective than a passive strategy aimed at intercepting a possible technical pullback in the zone where abnormal volumes and algorithmic defenses have manifested.

The order was designed to be activated only if the market were to temporarily return to the previously absorbed zone, thus avoiding chasing the price after a directional candlestick.

The stop-loss placement was carefully chosen to avoid both typical retail hunting zones and areas visible to algorithms. It is positioned to ensure operational invisibility, but also consistency with the logic of institutional defense: if reached, the trade will be automatically invalidated.

The target is aligned with the superior technical structure and the normal range of movement that develops when this dynamic is respected.

This operation is designed to be left to operate completely autonomously, without the need for adjustments or active management. Either in or out. The sole objective is to align with institutional flows, with controlled risk and a favorable management structure.

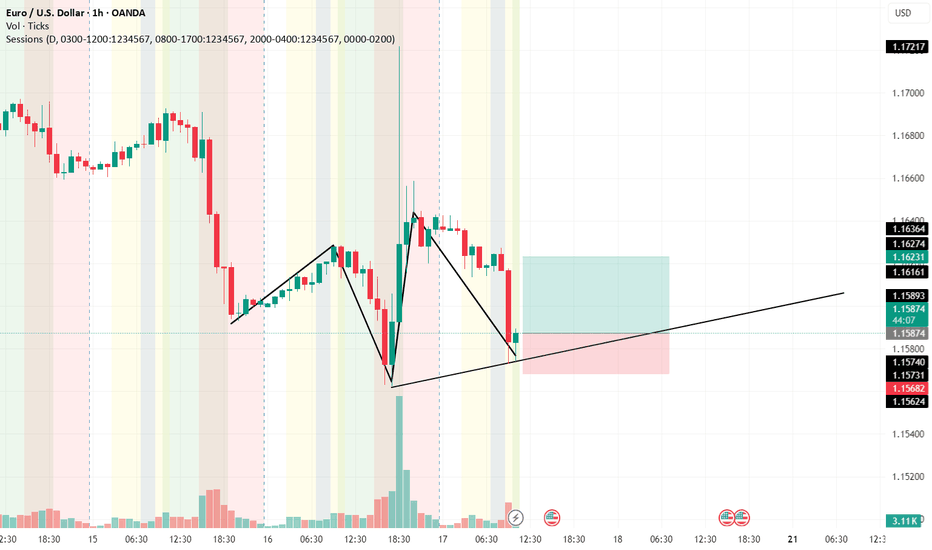

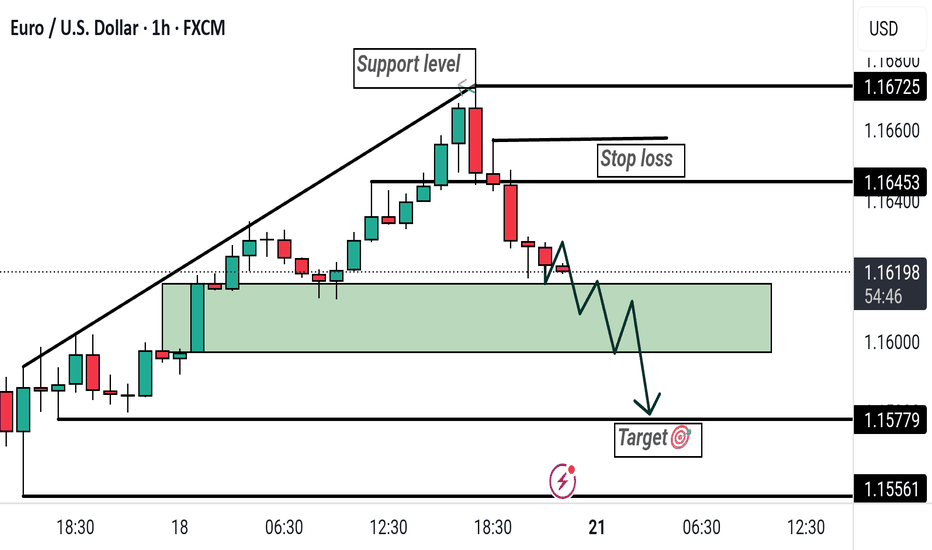

Bearish Breakdown on EUR/USD: Support Flip and Short SetupThis EUR/USD 1-hour chart shows a bearish setup after price breaks below a rising support trendline. A potential short trade is indicated, with a stop loss at 1.16453 and a target at 1.15779. The highlighted green zone marks a key support-turned-resistance area.