EURUSD trade ideas

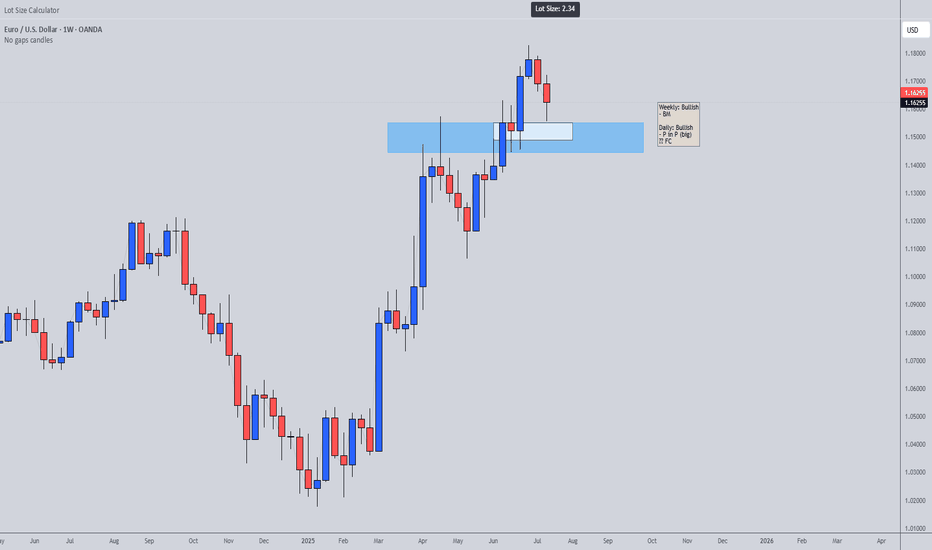

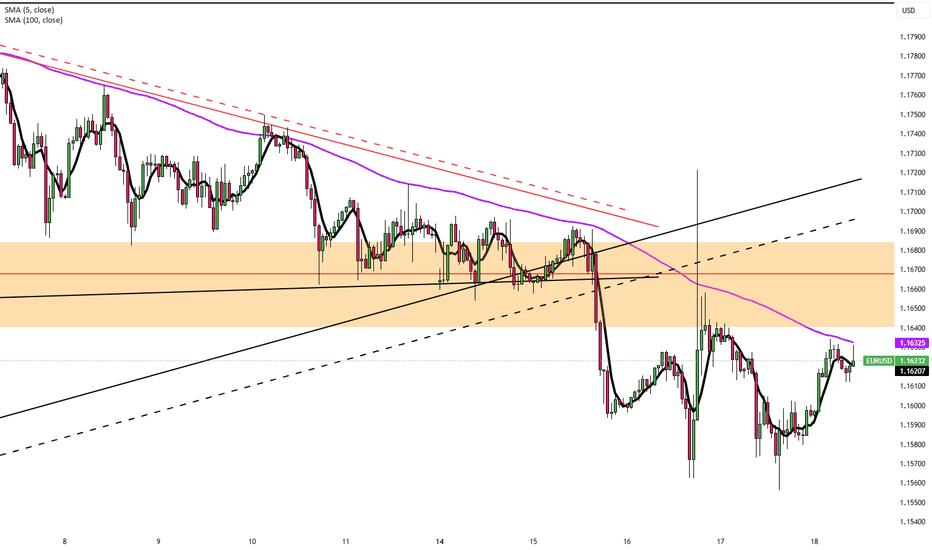

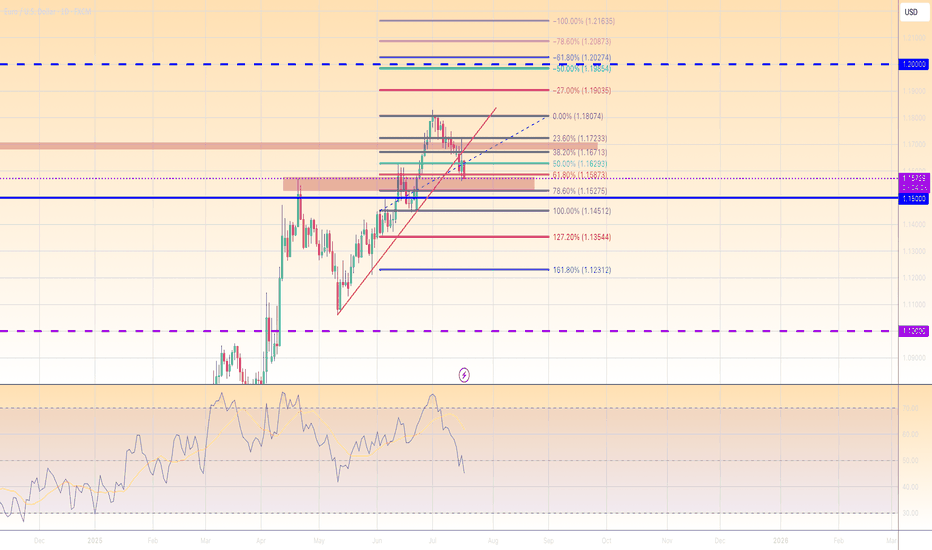

EURUSD potential being range recently story background:

1. a strong bullish momentum appear 23Jun - 1Jul

2. potential range of price level between 1.17176 and 1.15625

position enter criteria

1. if the price reach the key support lv 1.15451 and rebound with strong bullish momentum >>> the first entry point would be around 1.15693

2. if the price breakout the key resistance lv of 1.17183, i will wait for the price retest to around 1.16350 to long again

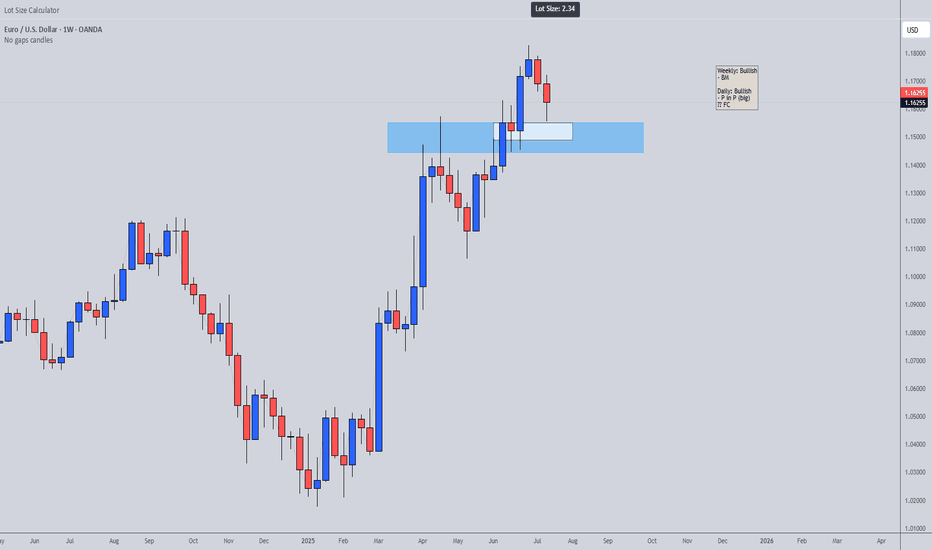

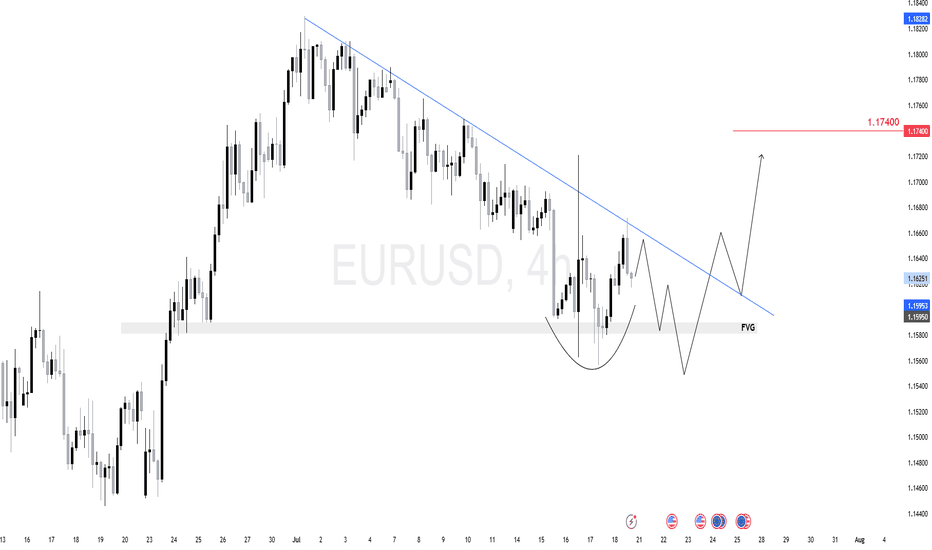

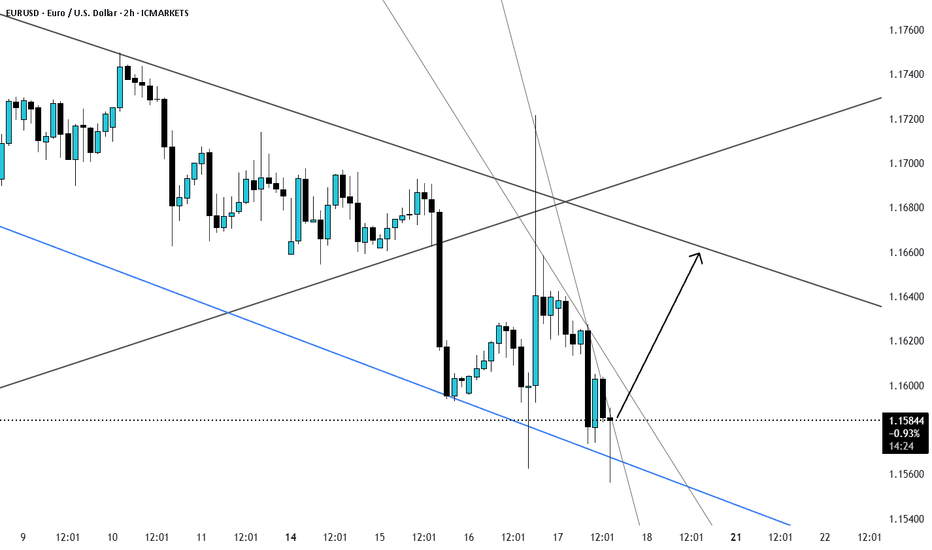

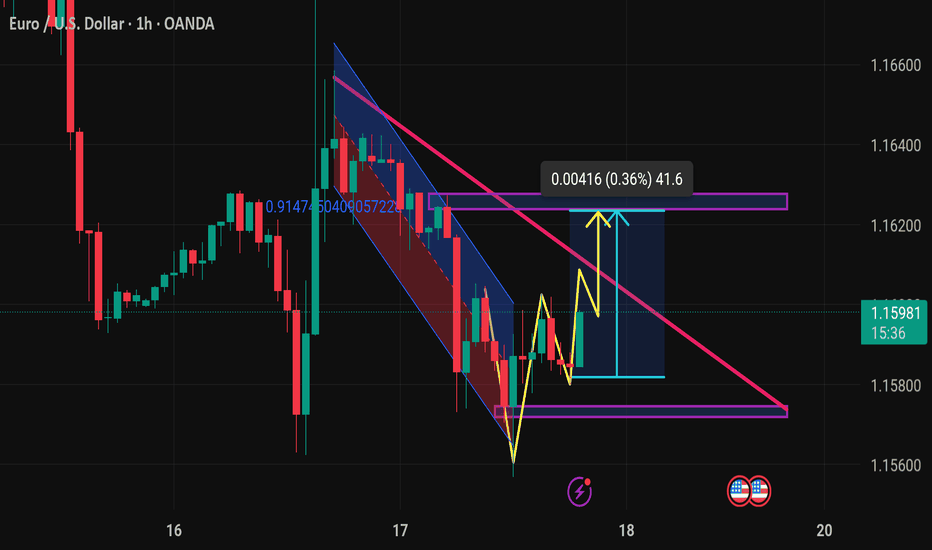

$EU (EURUSD) 4HEURUSD is forming a potential inverse head-and-shoulders just above a 4H fair value gap (FVG).

We expect one more dip toward the 1.1580–1.1595 zone to complete the right shoulder and tap demand.

From there, a breakout above the descending trendline can target 1.1740 next.

The key here is watching the reaction after the FVG test — if buyers step in strong, we ride it up.

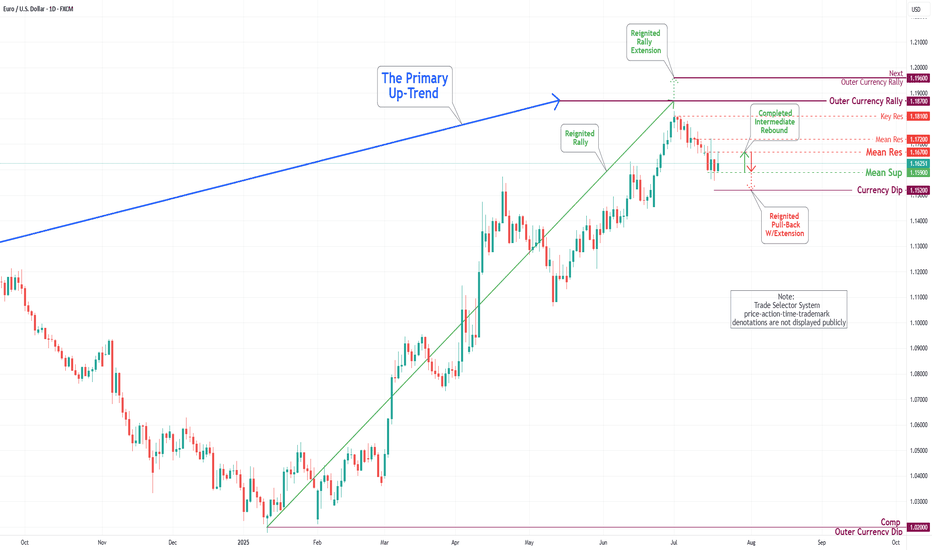

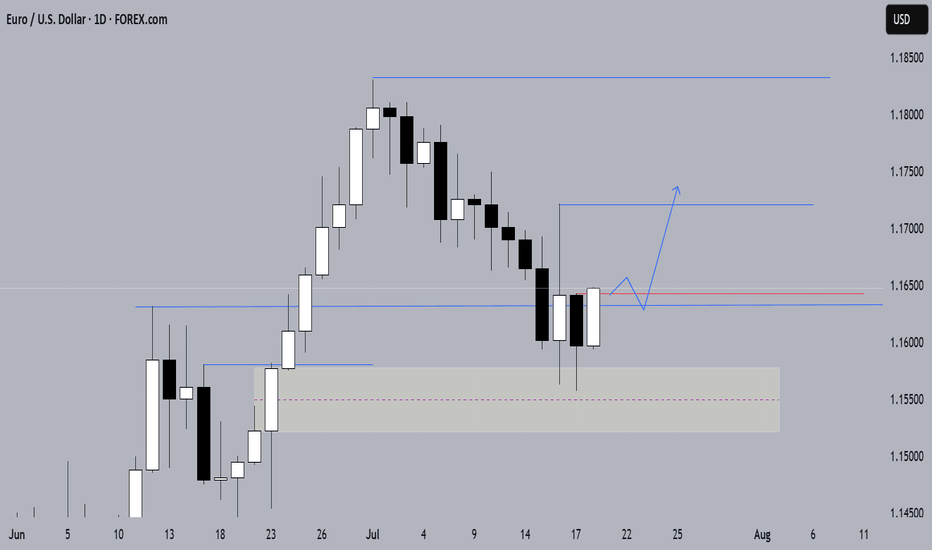

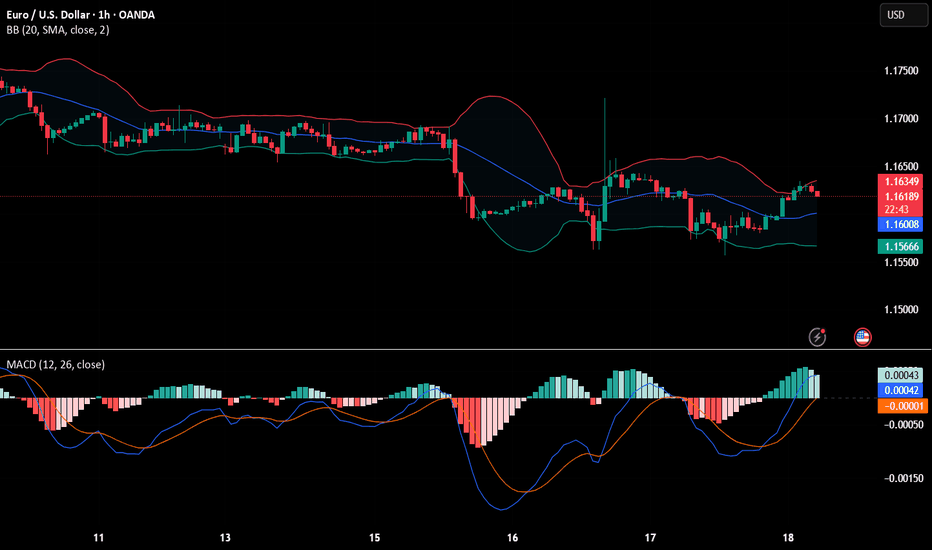

EUR/USD Daily Chart Analysis For Week of July 18, 2025Technical Analysis and Outlook:

In the current trading session, the Euro has continued its decline, completing our Mean Support level of 1.160. Recent analyses indicate that the Euro is likely to experience a sustained downward trend, with an anticipated retest at the Mean Support level of 1.159 and a possible further decline to reach a Currency Dip of 1.152. Nevertheless, it is crucial to consider the potential for a dead-cat bounce toward the Mean Resistance level of 1.167, which could trigger a significant reversal of the downtrend and target a Currency Dip of 1.152.

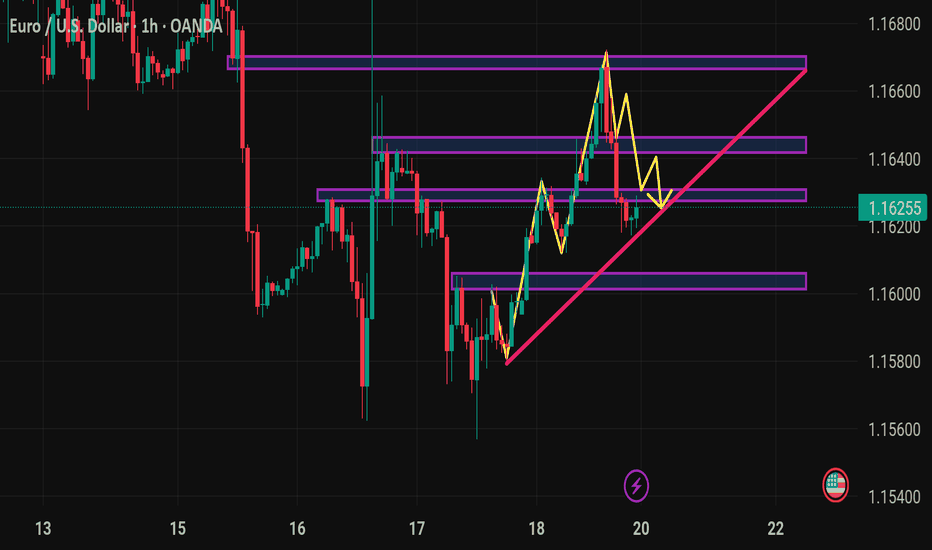

EURUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.16557 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.16419..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

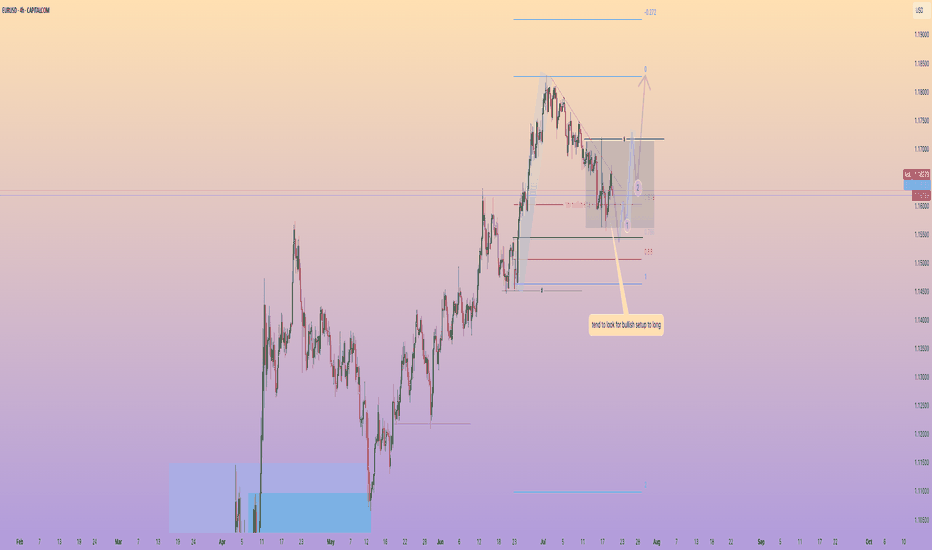

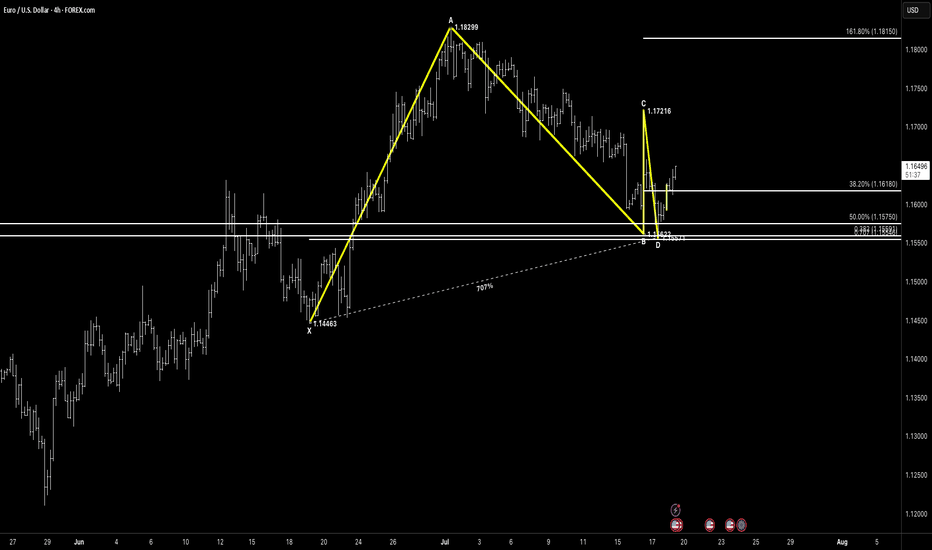

EURUSD / Euro – U.S. Dollar (4H) – ABC Bullish Structure EURUSD / Euro – U.S. Dollar (4H) – ABC Bullish Structure with Double Bottom Base

Pattern Overview:

Pattern Type: ABC Bullish + Corrective Double Bottom

Asset: EURUSD

Timeframe: 4H

Trade Type: Bullish Bias – Monitoring for continuation after rejection from cluster support

🔎 Key Levels

XA: 1.14663 → 1.18299

AB: 1.18299 → 1.16292

BC: 1.16292 → 1.17216

CD: Completion just under 1.15621 cluster

Major Fib Cluster: 0.707% XA, 0.886 AB, 50% CD, Prior Horizontal Support Zone

📐 Fibonacci Extensions & Key Ratios

38.2% retracement: 1.16180

50.0% retracement: 1.15750

161.8% extension: 1.18150

💡 Price Action & Setup

Price has completed an ABC corrective leg, forming a clean double bottom at the D point, hovering over the fib-rich support cluster.

The rejection candle shows buyer interest, and the recent higher low structure implies potential for continuation, especially if price reclaims and holds above 1.1650 short-term structure.

🧠 Market Sentiment

DXY easing slightly after strong dollar dominance

EUR macro calendar quiet – technicals may dominate next moves

Strong base = smart money accumulation likely underway

📊 Next Potential Movement

Break above 1.1675 opens path toward 1.1720, then possibly 1.1815

If 1.1575 cluster fails → risk of full XA retracement

🛡 Risk Management

Aggressive long entries already in play

Conservative entries should wait for higher low confirmation above 1.1650

Protective stop: under 1.1550 zone

📌 Conclusion

This is a bullish structure with a corrective double bottom base sitting right inside a dense confluence zone. Price is compressing between key fibs – expect a directional move next week. Keep your eye on the 1.1675 breakout or 1.1570 loss for next major decision.

“In the densest zones of indecision, patterns and confluence provide the clearest map.”

EUR/USD Drops to $1.16 Amid Strong U.S. DataThe euro declined to $1.16 on Thursday, reaching its lowest level in almost a month as the U.S. dollar regained strength. The dollar’s rise followed solid U.S. inflation data and President Trump’s comments suggesting he will keep Fed Chair Jerome Powell in place, reducing expectations for near-term Fed rate cuts. Meanwhile, markets continued to monitor U.S.-EU trade negotiations ahead of the August 1 deadline.

Resistance for the pair is at 1.1670, while support is at 1.1580.

EURUSD(20250718) Today's AnalysisMarket news:

① Kugler: It is appropriate to keep the interest rate policy stable for "a while".

② Daly: Whether to cut interest rates in July or September is not the most critical.

③ Bostic: It may be difficult to cut interest rates in the short term.

Technical analysis:

Today's buying and selling boundaries:

1.1597

Support and resistance levels:

1.1683

1.1651

1.1630

1.1565

1.1544

1.1512

Trading strategy:

If the price breaks through 1.1630, consider buying in, the first target price is 1.1651

If the price breaks through 1.1597, consider selling in, the first target price is 1.1565

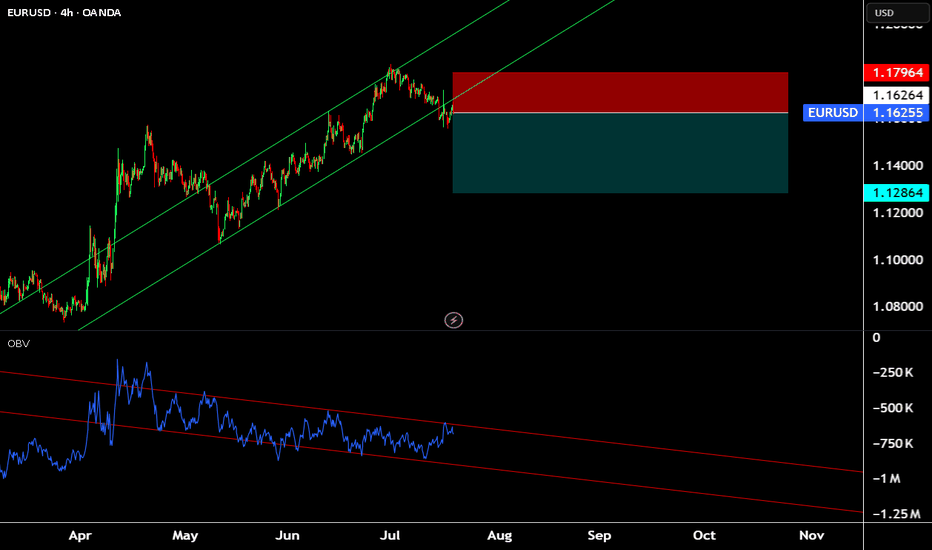

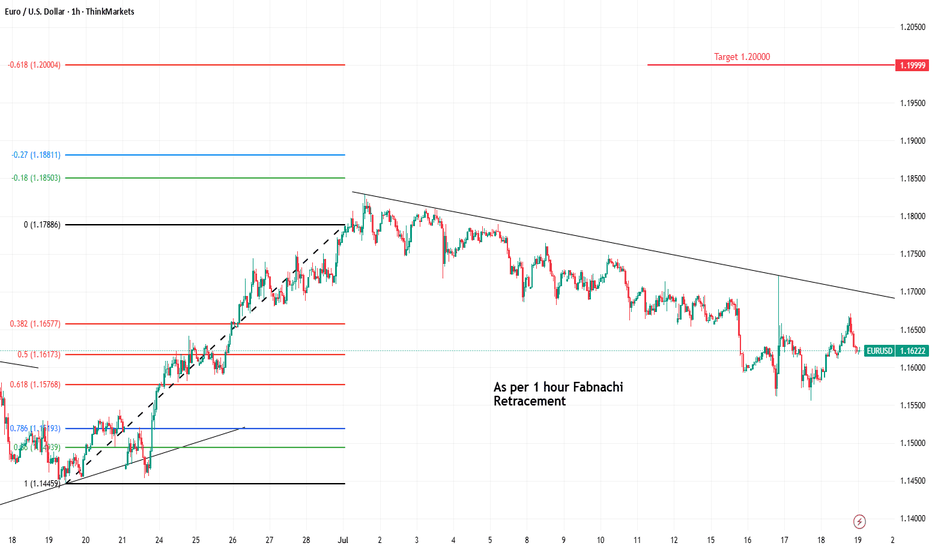

LONG for EURUSD?LONG EURUSD

What is going on with EURUSD

We see how beautiful the market went up from the beginning of the trend line constatly with pullbacks that means a steady uptrend not really the urge that the market want to go back.

We used the fib as always to indicate 61.8% perfect pullback on that and as we see on the resistance that has to be tested.

There will be a fake break out of 100-150 pips.

If we go back on the RSI we see divergence momentum is back to average.

We call this hidden divergence price goes up and indicator goes down.

What indicates us that we also have new space for a higher high.

Targets we have in mind 1.19035 with high momentum what I expect it will hit the 1.20274 , important to have in mind 1.20000 is a key level price wants to go there as a magnet.

Reverse of the analyses:

If it breaks the 61.8% it will retest the market structure and goes to the 1.13544 with high momentum just to test price and set us offside because that is what the market want hit as many stop losses because that’s where the liquidity is build up, takes out and will continue the uptrend.

Follow my journey I try to post daily.

Markets I analyse XAUUSD, EURUSD, USDMXN, XTIUSD, XRPUSD, BTCUSD.

Will start more forex and Crypto soon.

Euro Slips, Brussels Stalls RetaliationEUR/USD is pulling back toward 1.1620 in Thursday’s Asian session as markets await Eurozone HICP data, with eyes on US June retail sales later in the day. The dollar stays firm on expectations that the Fed will hold rates at 4.25%-4.50% in July amid tariff-driven uncertainty.

President Trump announced plans to notify over 150 countries of a 10% tariff, possibly rising to 15-20%, targeting those with minimal U.S. trade ties. He criticized Fed Chair Powell but admitted removing him might destabilize markets, while floating possible trade deals with Europe and India.

Strong June CPI has reignited concerns about prolonged high rates. Dallas Fed’s Lorie Logan and New York Fed’s John Williams both warned that tariffs may keep inflation elevated, reinforcing the case for keeping rates steady.

Resistance for the pair is at 1.1670, while support is at 1.1580.

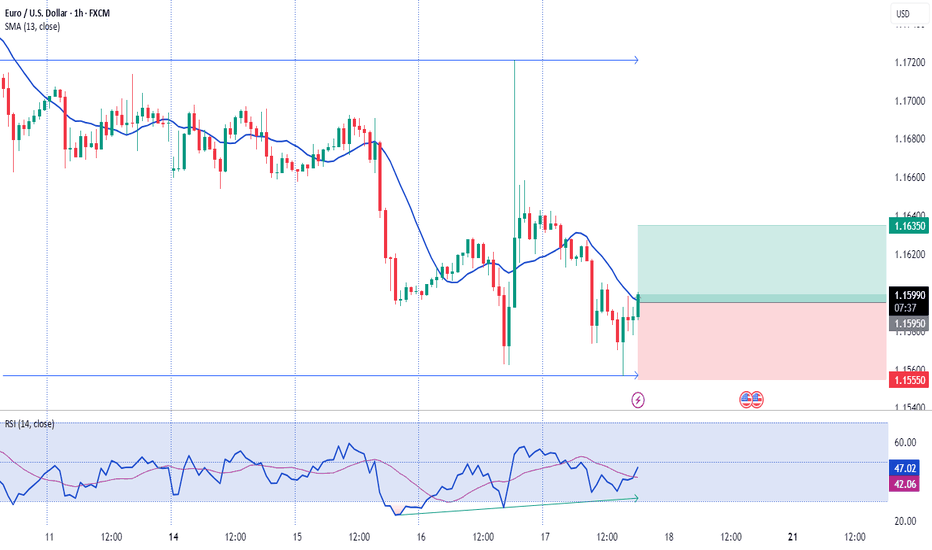

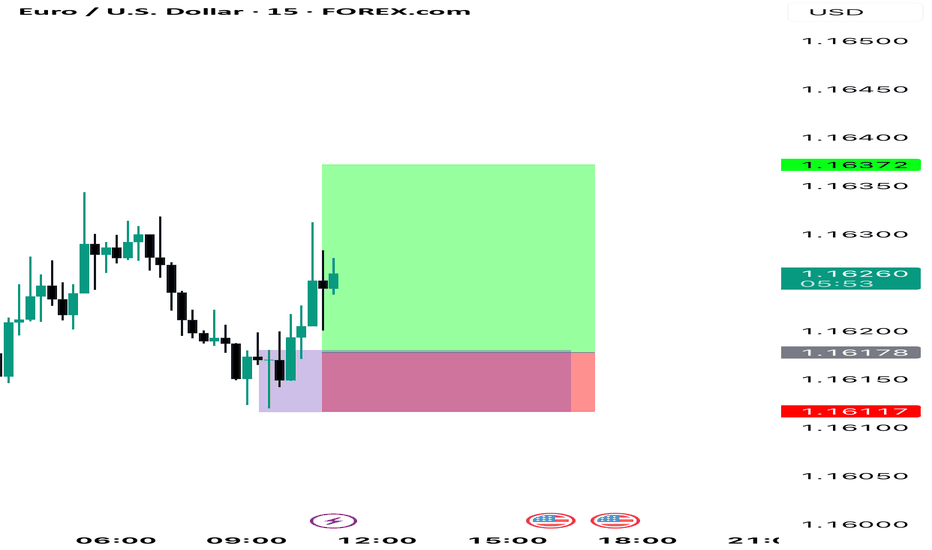

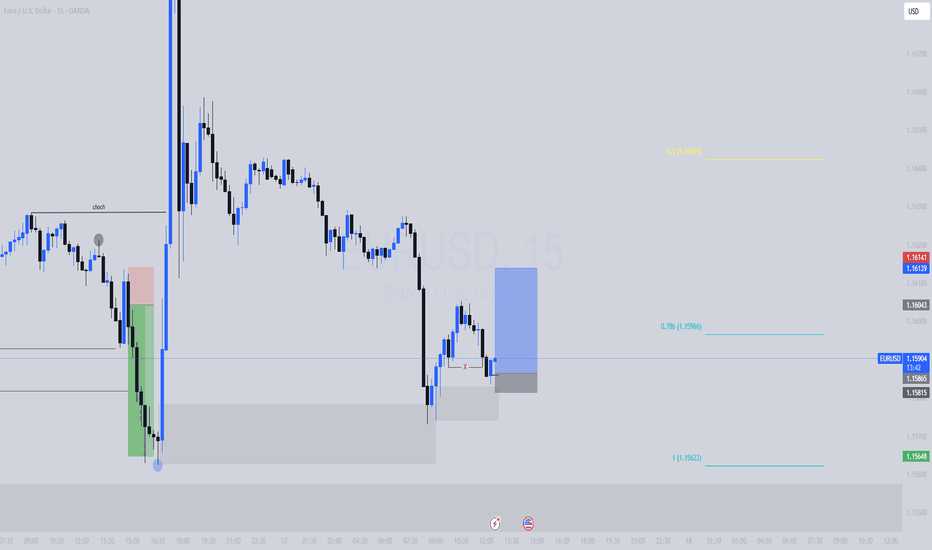

Trade Setup: EUR/USD 15min | OB Mitigation Play⚙️ Type: Countertrend (Risk-managed Buy)

Direction: Long

Entry Zone: 1.15850–1.15886 (Refined OB)

Entry Type: Buy Limit

Stop Loss: Below the OB low → 1.15790

Take Profit Targets:

TP1: 1.16043 (minor imbalance fill)

TP2: 1.16140 (supply zone re-test / 50% fib)

Risk to Reward: ~1:3 minimum (depending on fill and management)

🎯 Why This Setup Works

Price swept sell-side liquidity into a refined OB from the CPI move.

Confluence with 0.786 retracement, suggesting algo entry interest.

Strong momentum imbalance above gives room for retracement pullback.

DXY showing signs of short-term exhaustion at intraday highs.

🔒 Invalidation Criteria

15m candle close below 1.15790

Clean break and hold of OB low → Flip bias bearish