A POTENTIAL TREND REVERSAL Hello Traders 👋

What are your thoughts on EURUSD

Looking at the daily timeframe we can see that price action didn't take out the liquidity which is located with a blue rectangle which is also acting as the all-time high for EURUSD.

I'm seeing price retracing to reach the liquidity around that blue rectangle and then after start falling downwards.

Let's look at the fundamentals of EURUSD

Trump announced the conclusion of a trade agreement with the EU:

The EU will invest $600 billion more in the US than before

15% tariff on EU goods, including cars

All EU countries will open their markets to the US

EU to purchase hundreds of billions of dollars worth of military equipment

EU to purchase $750 billion worth of energy from the US. Energy is a key part of the agreement.

PS:

It is worth monitoring the market reaction from the opening. Pay attention to the market reaction during different sessions.

Markets may react ambiguously, but against the general backdrop, the following reaction should be expected:

USD → sharp rise (dollar strengthening due to capital inflows and growth in energy exports).

EUR → down, as the EU will bear the costs of tariffs and rising imports from the US.

Gold → down (correction or decline due to the strengthening of the dollar and reduced demand for hedging).

BTC → neutral or slight decline (due to USD strength):

If the agreement stimulates the economy and liquidity, this could be a bullish factor for BTC.

………………………………………….

EURUSD trade ideas

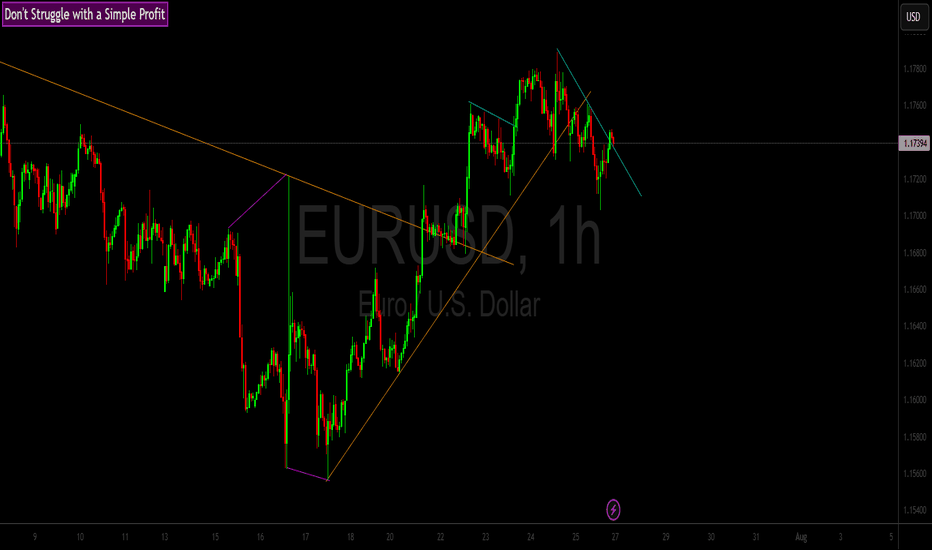

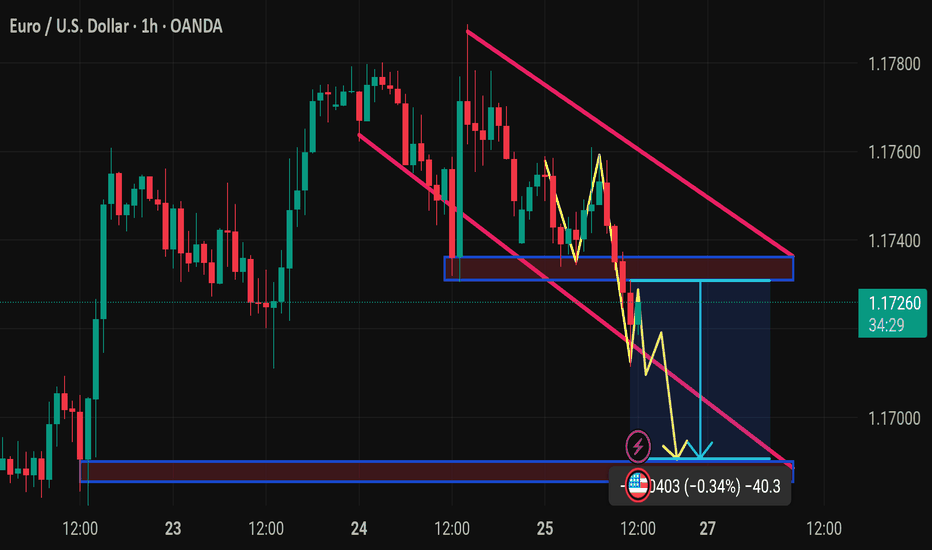

EURUSD – Channel Forming at Trend Top?EURUSD remains bullish but is showing signs of topping out, possibly forming a downward channel. We’re eyeing a mid-channel entry near a weekly gap, looking for one more push higher before a potential reversal. Key levels could form a double top – a breakout or rejection here will be telling.

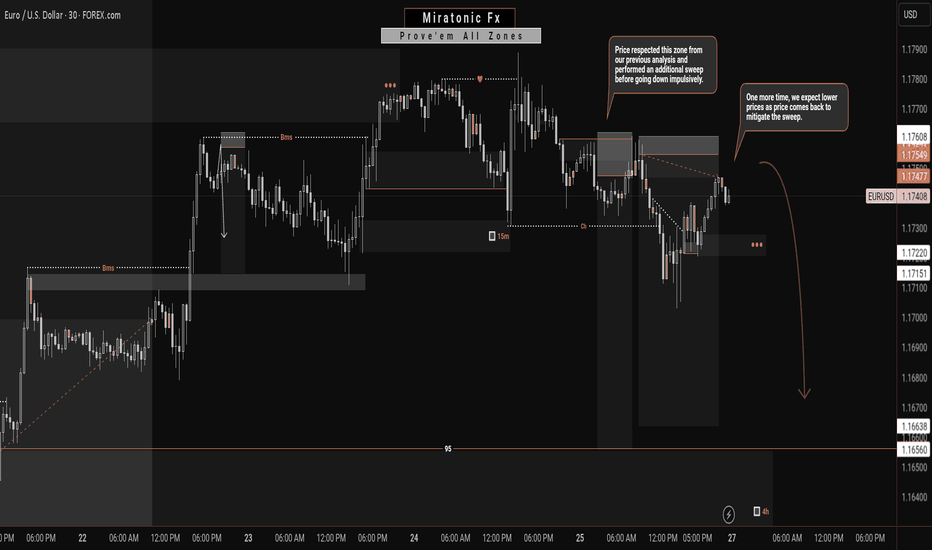

EURUSD: A Bearish Continuation?From my previous analysis, we anticipated a short-term decline on the EURUSD for a Daily bearish pullback. Price respected our zone and made a even stronger sweep before plummeting as forecasted.

Currently, price has returned to mitigate that liquidity sweep. Given the prior impulsive bearish move—which this current bullish correction stems from—we expect another drop, targeting the weak structure below for a potential liquidity grab or continuation.

We'll continue to monitor how price behaves around the current levels, but unless there's a significant shift in momentum, our bearish outlook remains valid. ✅

Follow us for more updates. 🔔

See you on the next one. 🫡

EURUSD is Ready for a Bullish MoveHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

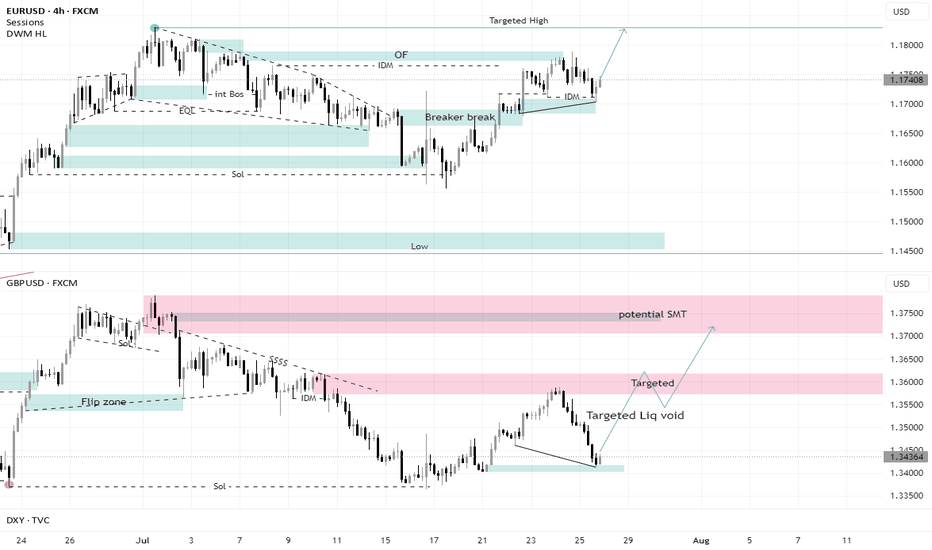

SMT in EU and GU + Targeting Liquidity voidI did not expect the GBPUSD to fall with all this force, but the EURUSD’s refusal to fall with it all these points indicates the strength of the current Low from which it rebounded, and it is expected that this bottom will hold

It is clear that GBPUSD was looking for more liquidity and that is why it dropped all these points. With this drop, it created a liquidity void that allowed it to rise and take all these pips back.

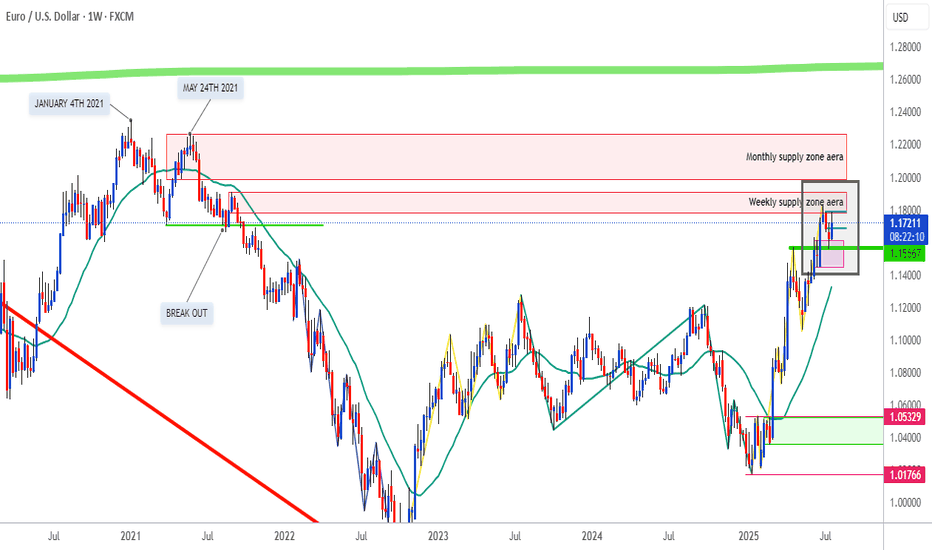

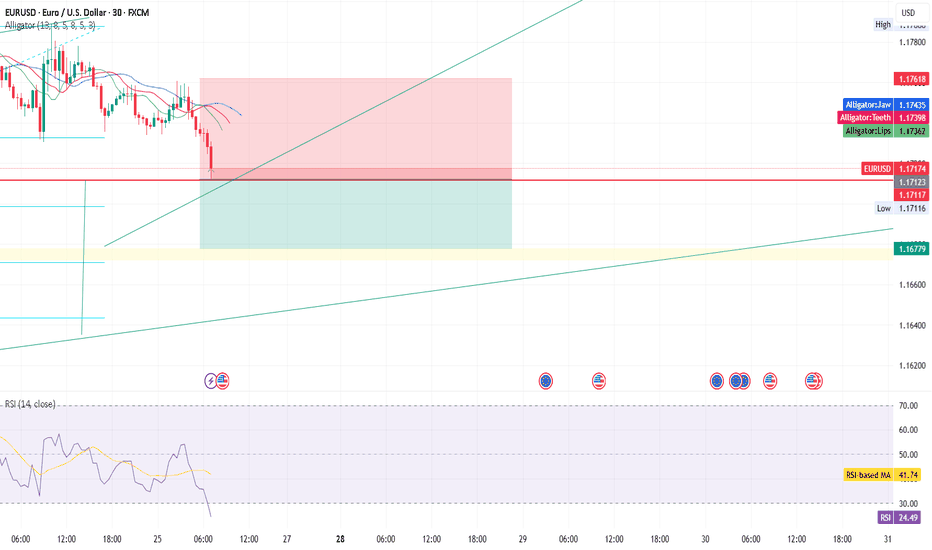

EURUSD: FOMC, PCE, NFP, JOLTs - busy week guaranteedThe ECB meeting was one of the major events during the previous week, when it comes to macro data. As it was widely expected, the ECB left rates unchanged, amid uncertainties related to trade tariffs with the U.S.. The ECB maintains its previous macro outlook, viewing the Euro Zone economy as resilient but facing downside risks. President Lagarde highlighted global trade tensions, geopolitical instability and negative shifts in market sentiment as key risks to further growth. At the same time, Lagarde dismissed concerns about the stronger euro, reiterating that the ECB does not target the exchange rate directly. With the inflation level of 2% and deposit rate of 2%, the ECB is in the position to take a wait-and-see stance on further rate cuts, although some analysts are mentioning the possibility of another 25bps cut in September.

Other macro data for the Euro Zone and Germany include the HCOB Manufacturing PMI Flash for July, which stood at 49,8 for the Euro Zone and 49,2 for Germany. Both indicators were standing in line with market expectations. The Ifo business Climate in Germany in July reached 88,6, in line with market forecast.

The previous week was relatively weak when it comes to currently important macro data for the U.S. economy. Posted data include Existing Home Sales in June, which reached 3,93M and were a bit lower from forecasted 4,0M. The indicator dropped by 2,7% compared to the previous month. The S&P Global Manufacturing PMI flash for July reached 49,5 a bit lower from market forecast of 52,6. At the same time the S&P Global Services PMI flash for July beat market expectation with the level of 55,2. The durable Goods Orders in June dropped by -9,3% compared to the previous month, which was a bit lower from -10,8% expected by the market.

The ECB meeting left its mark on the parity of eurusd currency pair during the previous week. The euro strengthened till the level of 1,1786, but eased as of the end of the week, closing it at 1,1742. The currency pair was testing the 1,17 support line on Friday's trading session. The RSI continues to move at levels above the 50 line, ending the week modestly below the level of 60. The MA50 continues to diverge from MA200, without an indication of a potential cross in the near term period.

The week ahead is an important one from the perspective of macro data. A bunch of currently closely watched data for the U.S. will be posted, including PCE, NFP, JOLTs, Unemployment rate in July. In addition to data, the FOMC meeting will be held on Wednesday, July 30th, where the Fed will decide on interest rates. Current market expectation is that the Fed will leave rates unchanged at this meeting. However, the final decision is with the Fed, in which case, any surprises might significantly move the currency pair toward one side. Also, in case of surprises with any of the above mentioned macro data the market reaction could bring higher volatility. Precaution in trading with eurusd in the week ahead is highly advisable. As per current charts, there is a high probability that the currency pair will move to the downside to test the 1,17 support level for one more time. Levels around the 1,1650 might also be shortly tested. In case that the market decides for a higher ground, there is some probability for the level of 1,18, as the next resistance level to be tested shortly.

Important news to watch during the week ahead are:

EUR: GDP Growth Rate for Q2 for both Germany and the Euro Zone, Unemployment rate in Germany in July, Inflation rate in Germany and the Euro Zone preliminary for July,

USD: JOLTs Job Openings in June, GDP Growth Rate for Q2, Pending Home Sales in June, the FOMC meeting and Fed interest rate decision will be held on Wednesday, July 30th, PCE Price Index for June will be posted on Thursday, July 31st, Non-farm Payrolls for July, Unemployment rate in July, ISM Manufacturing PMI in July, University of Michigan Consumer Sentiment final for July.

EURUSD 1HConsidering that the one-hour timeframe trend for the EURUSD symbol has turned bullish and liquidity has been collected at the last low, after a price correction in lower timeframes and observing a suitable candlestick setup, one can enter a buy trade and follow the price at least up to 1.18310.

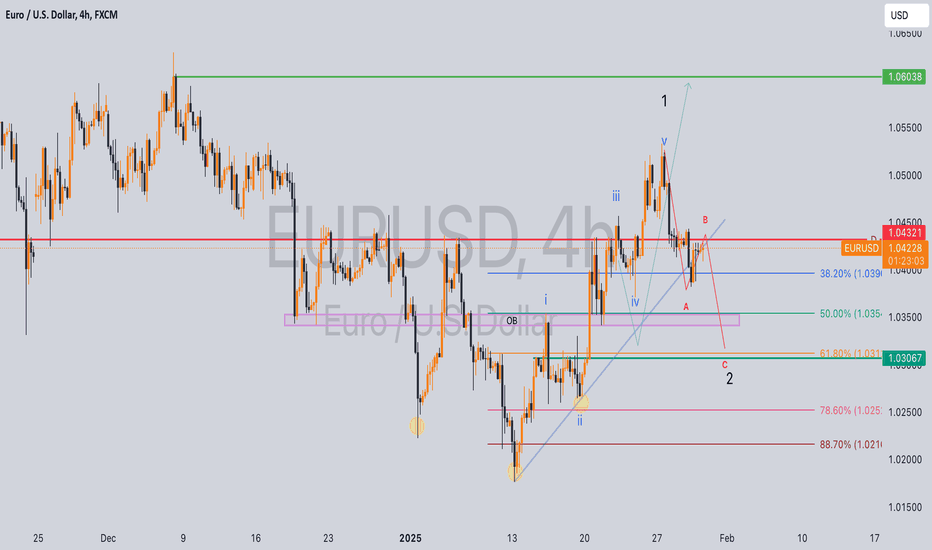

EU possible buy idea?7 days ago, I shared a bullish idea that remains valid despite price failing to hold above 1.04321.

Current Market Analysis:

Price appears to be forming an Elliot Wave 2 (a-b-c) correction.

Key Levels to Watch:

- 38.2% Fibonacci retracement level (minimum required for Wave 2)

- 88.7% Fibonacci retracement level (maximum allowed for Wave 2 to maintain bullish bias)

Trade Plan:

With my initial position at break-even, I'll employ dollar-cost averaging for additional buys targeting 1.065 :

1. 50% Fibonacci retracement level

2. 61.8% Fibonacci retracement level

3. 78.6% Fibonacci retracement level

Stop Loss: 1.017

This is not a financial advice but if you must take the trade, apply proper risk and money management while scaling into the trade.

There are more entries and ways….🧠 Smart Traders Don’t Chase… They Wait for Confluence.

On EUR/USD, price dipped hard — but my system didn’t panic.

It waited — and when the conditions aligned, it fired the BUY.

✅ RSI + Reversion Signal printed right at the low

✅ RSI formed a classic bullish divergence

✅ Price reversed within 2 candles

✅ Textbook bounce — no guesswork

⸻

🔍 What Created the Signal?

1. Price made a lower low

2. RSI made a higher low (momentum shift)

3. Signal confirmed with an “UP” tag from ELFIEDT

4. Candle closed above reversion band = ENTRY

5. SL = just below the signal candle’s low

6. Target = 2R minimum (easily achieved)

⸻

This is what confluence looks like.

📉 Momentum shift +

📈 Reversion overshoot +

🟢 System confirmation = High-Conviction Trade

⸻

💬 DM “DIVERGENCE” if you want this tool

📲 Follow for more setups with real edge

Let the indicators do the thinking — you focus on execution.

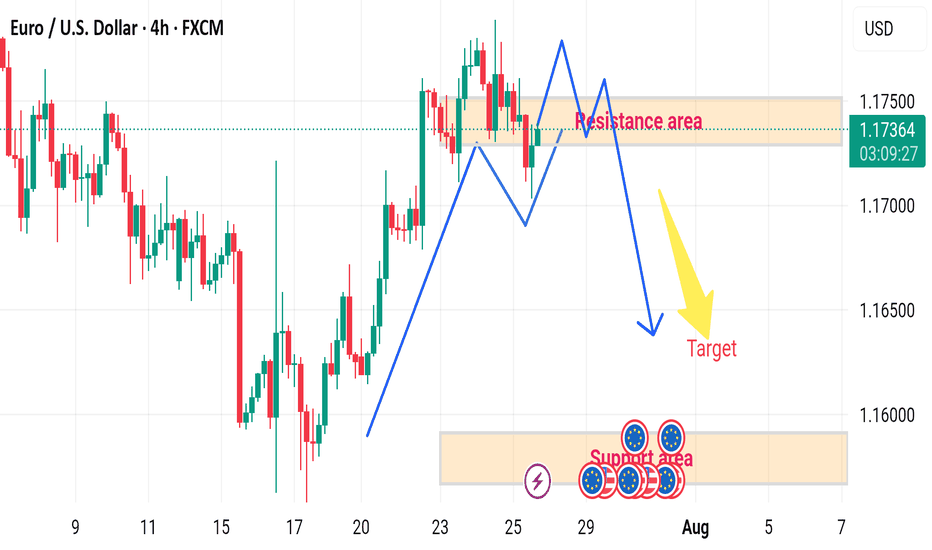

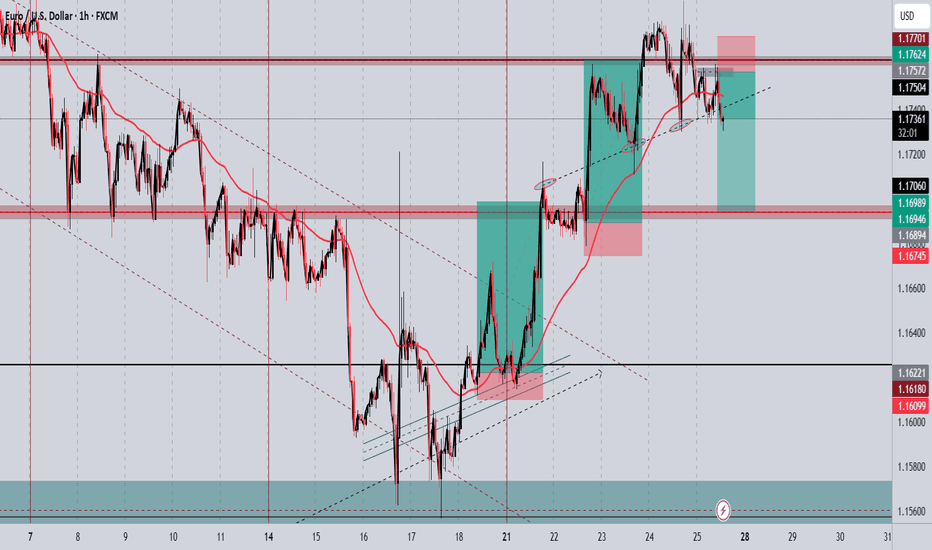

EUR/USD H4 DOWNWARD 🔄 Disrupted EUR/USD 4H Analysis

🟢 Current Context:

Price is currently at 1.17375, slightly below the resistance area (1.17400–1.17500).

Market shows a recent bullish impulse, followed by consolidation within the marked resistance zone.

Projection in the image suggests a double-top pattern forming at resistance, followed by a bearish reversal toward the target demand area (~1.15800–1.16000).

---

⚠️ Disruption Points:

1️⃣ Failed Double Top Scenario

Disruption Hypothesis: Instead of forming a clean double top and reversing, price may break above the resistance zone at 1.17500.

Reasoning: Strong bullish momentum and recent higher highs indicate potential for bullish continuation, invalidating the bearish target.

Disrupted Path: Price could break out → retest the resistance as new support → continue toward 1.18000–1.18300 zone.

2️⃣ Mid-Range Liquidity Trap

The current range may act as a liquidity trap:

Smart money could push the price slightly below support (fake breakdown), attract sellers, then reverse sharply upwards.

This would trap retail sellers targeting the 1.15800 zone.

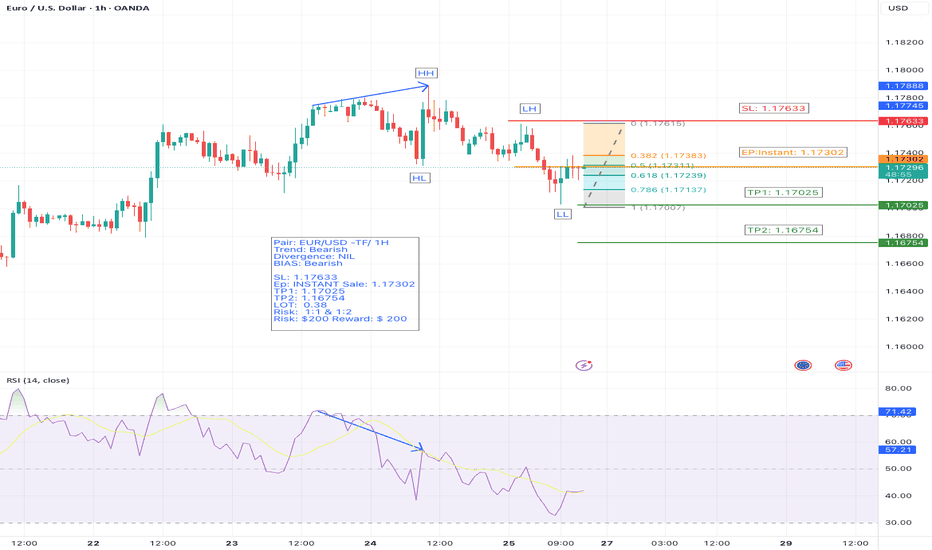

EUR/USD – 1H Timeframe – Bearish Setup- Fibonacci levelsWe’re closely monitoring EUR/USD on the 1-hour chart.

🔻 Trend: Bearish

📉 Price action is clearly forming a series of Lower Highs (LH) and Lower Lows (LL) — a textbook downtrend.

🔎 Divergence: None observed, confirming trend strength.

📊 Current Action: Market is in a retracement phase.

We’ve used Fibonacci retracement, and price has now reached the 38.2% level, a key reversal zone. Based on this, we’ve entered a market sell position.

📌 Trade Setup:

🔹 Entry: Instant Sell @ 1.17302

🔹 Stop Loss: 1.17633

🔹 Take Profit 1: 1.17025

🔹 Take Profit 2: 1.16754

🔹 Risk/Reward: 1:1 and 1:2

🔹 Lot Size: 0.38

🔹 Risk: $200

🔹 Reward: $200 (TP1), $400 (TP2)

⚠️ Bias: Bearish

📍 This trade setup follows strict risk management principles and is based on solid technical confluence.

📈 Let’s see how the price reacts at the key Fib level. Always trade responsibly.

#EURUSD #ForexTrading #BearishSetup #FibonacciTrading #RiskManagement #PriceAction #TradingViewIdeas

EURUSD pullback short- 25/7/25Price failed to break through the supply zone above that was identified on the higher 4hr and 1hr TF.

The last unmitigated zone is highlighted in green and looking to take a short from there to the next low.

There is equal level liquidity below that will draw price there.

In addition the HH is just a wick giving me more confidence that there is weakness in the EUR.

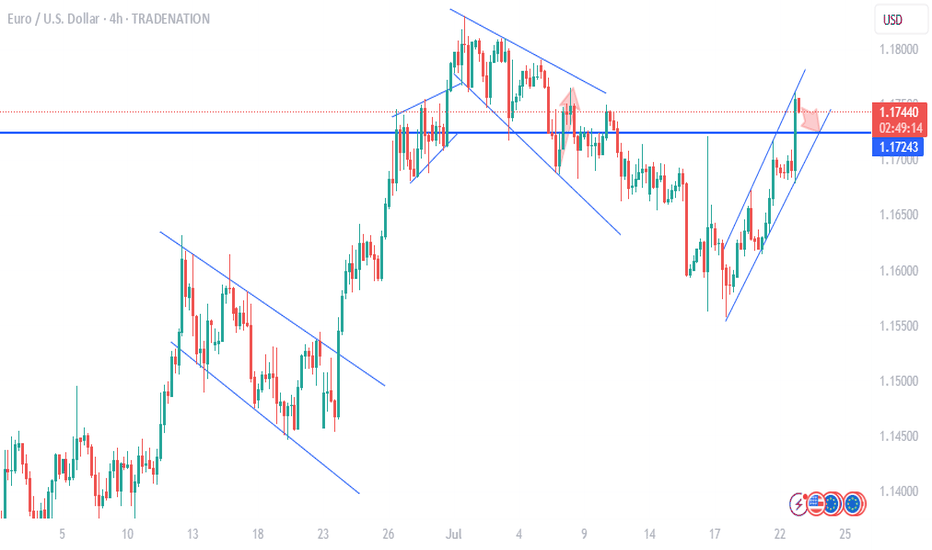

NZDUSD - EURUSDHi TRADERS, while we are looking to trade NZDUSD mkt wave to the upside on the 4h chart let's not think that "it may" be the same as to EURUSD, because the DOUBLE TOP PATTERN that was formed from January 4th through May 21st 2021 and then breaks to the downside have just came to retest supply zone aera on JUNE 30th 2025, and sell off a little. And this week JULY 21st 2025, buyers push price to that same W/D supply zone that also can be called SOPPRT RESISTANCE PIVOT POINT AERAS after a long period of FOUR YEARS, for the first time . My humble opinion

EUR/USD Short Setup – Bearish Reversal OpportunityPrice has rejected near resistance, forming lower highs.

Potential bearish divergence on momentum indicators (RSI/MACD).

Market sentiment suggests euro strength may be cooling after recent ECB hold.

Dollar shows signs of stabilization, adding downward pressure to the pair.

🔹 Trade Details:

Entry: 1.17572

Take Profit: 1.16946

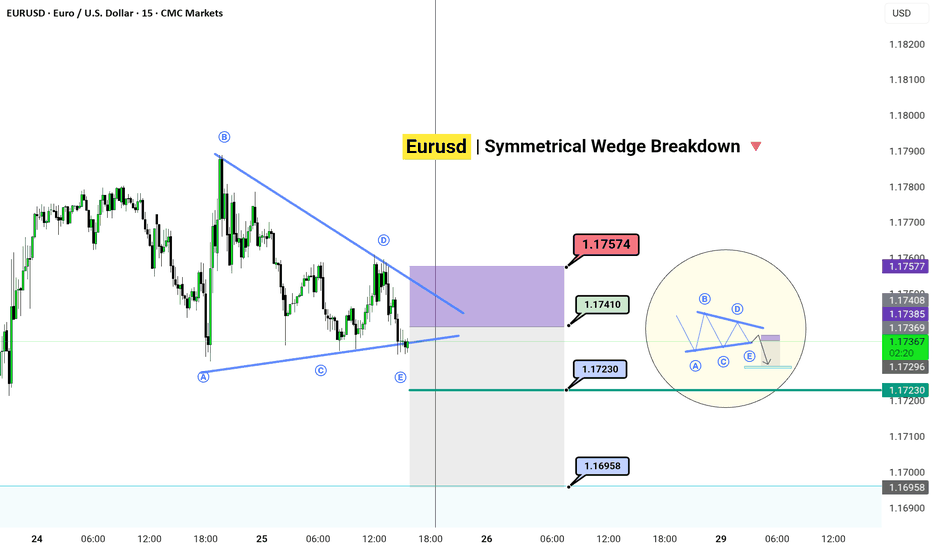

EURUSD | Symmetrical Wedge Breakdown

TF: 15m |

🎯 Setup Insight:

The market doesn’t move in straight lines — it coils.

What you're seeing is an ABCDE corrective wedge, playing out its final phase.

Wave E completed, and liquidity is built right above.

We expect a trap in the purple premium zone (1.1740–1.1757) — then a drop toward 1.1695.

---

🧠 Strategy:

Sell Zone: 1.17410 – 1.17574

Target: 1.16958

Invalidation Above: 1.17600

Wedge ✅

Liquidity ✅

Confluence ✅

Only one move left — the snap.

---

🗝️ Notes:

The market may spike into the OB zone to trap late buyers before the real move unfolds.

The mini-diagram on the right explains it all: "Trap them high, exit them low.✓

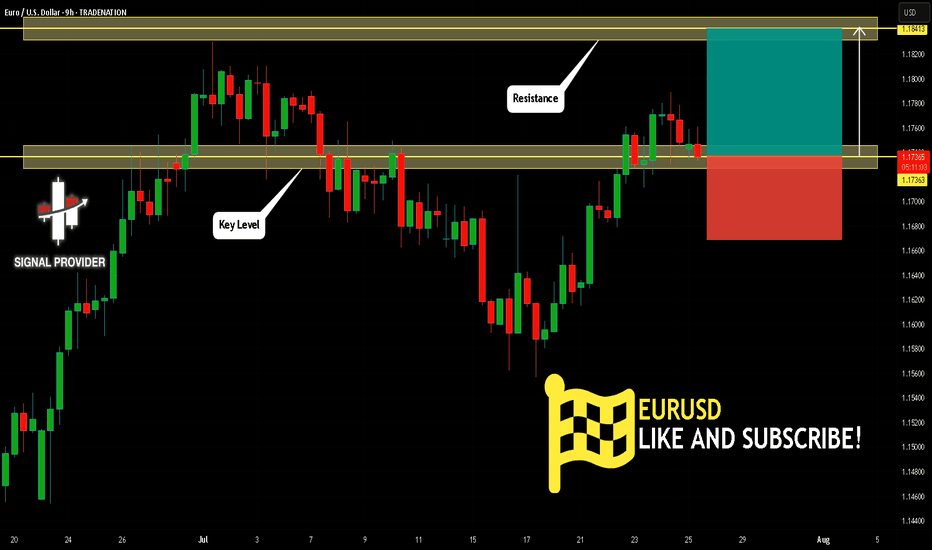

EURUSD Is Bullish! Long!

Take a look at our analysis for EURUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.173.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.184 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!