EURUSD trade ideas

EURUSD LIVE TRADE 65PIPS 5K PROFITEUR/USD stays defensive below 1.1800 ahead of ECB decision

EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

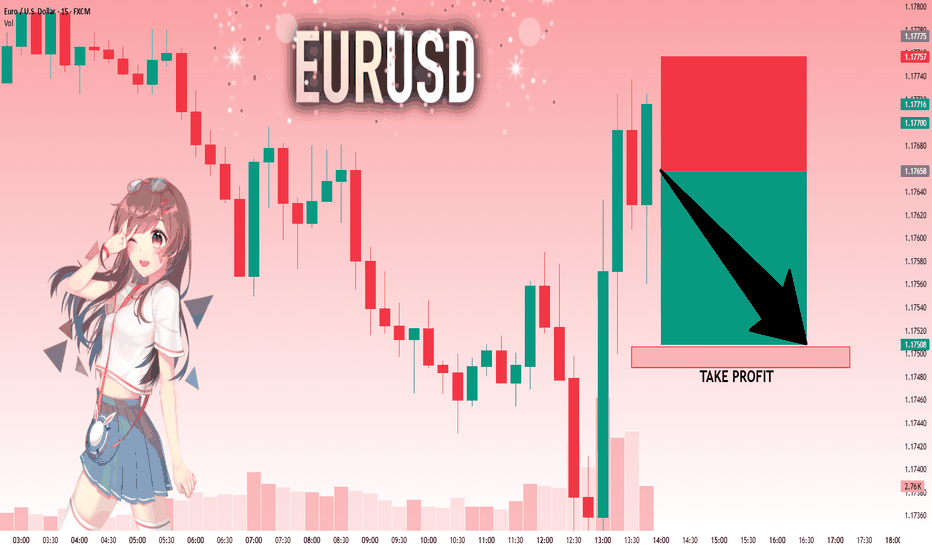

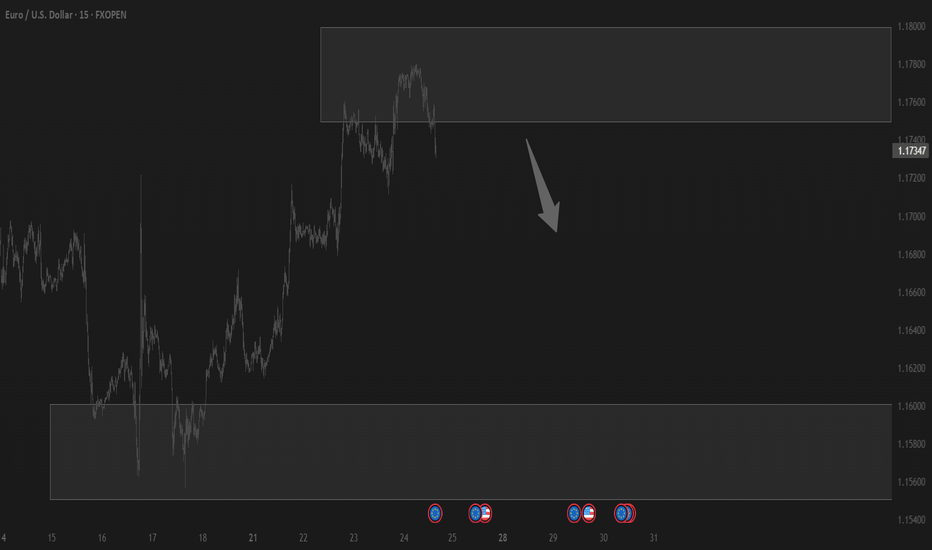

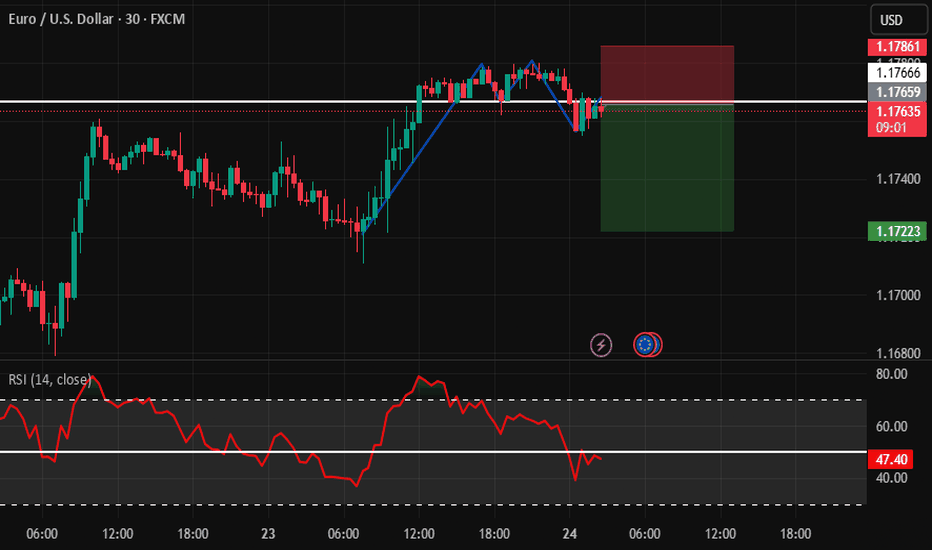

EURUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.17658 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 1.17506..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

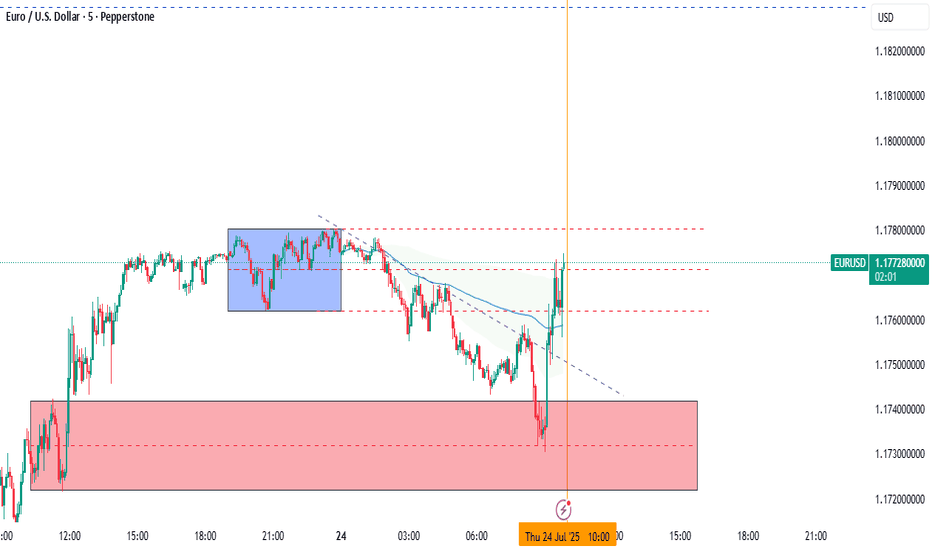

EURUSD SELLEUR/USD stays defensive below 1.1800 ahead of ECB decision

EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

The EUR/USD pair retreated from a fresh two-week peak at 1.1781 posted during Asian trading hours, hovering around 1.1750 ahead of the European Central Bank (ECB) monetary policy announcement. The US Dollar (USD) edged lower on the back of risk appetite, amid headlines indicating a trade deal between Japan and the United States (US).

US President Donald Trump announced in a post on social media a trade deal with Japan that sets "reciprocal" tariffs at 15% on Tuesday, while Japanese Prime Minister Shigeru Ishiba acknowledged the trade agreement on Wednesday, saying it would benefit both sides. Trump shifted his attention to the European Union (EU), noting that if the Union agrees to open up to US businesses, he will then charge lower levies.

Meanwhile, the Hamburg Commercial Bank (HCOB) published the preliminary estimates of the July Purchasing Managers’ Indexes (PMIs). European growth stands at its highest in almost a year according to the surveys, as the Composite PMI rose to 51.0 in July from 50.6 in Jun,e while beating expectations of 50.8.

As for the ECB, the central bank announced its decision to keep the benchmark rates on hold, as widely anticipated. The interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility stood at 2.15%, 2.4% and 2%, respectively. The headline had no impact on EUR/USD, which kept trading at around 1.1750.

Right afterwards, the US released Initial Jobless Claims for the week ended July 19, which improved to 217K from the 221K previously posted and the 227K anticipated. Coming up next is ECB President Christine Lagarde's press conference, and the US S&P Global preliminary July PMIs.

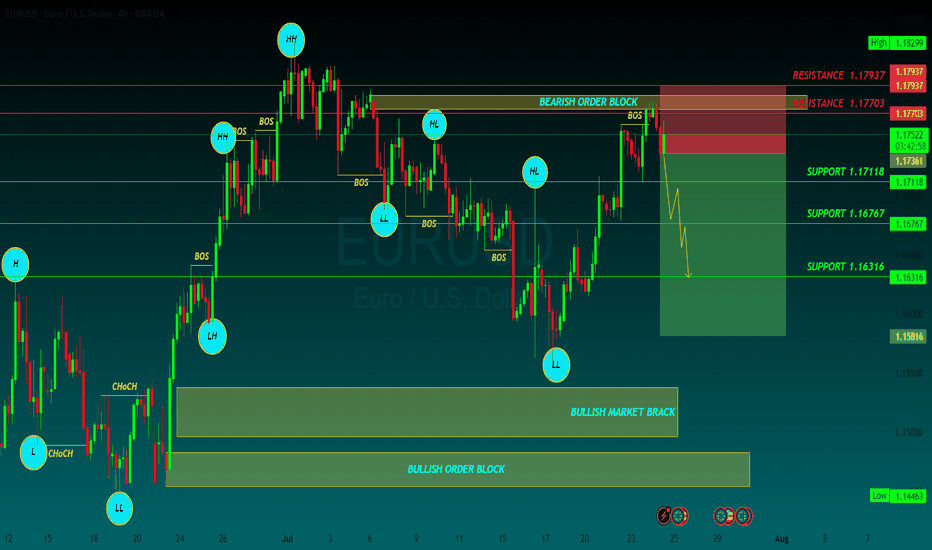

SUPPORT 1.17118

SUPPORT 1.16767

SUPPORT 1.16316

RESISTANCE 1.17937

RESISTANCE 1.17703

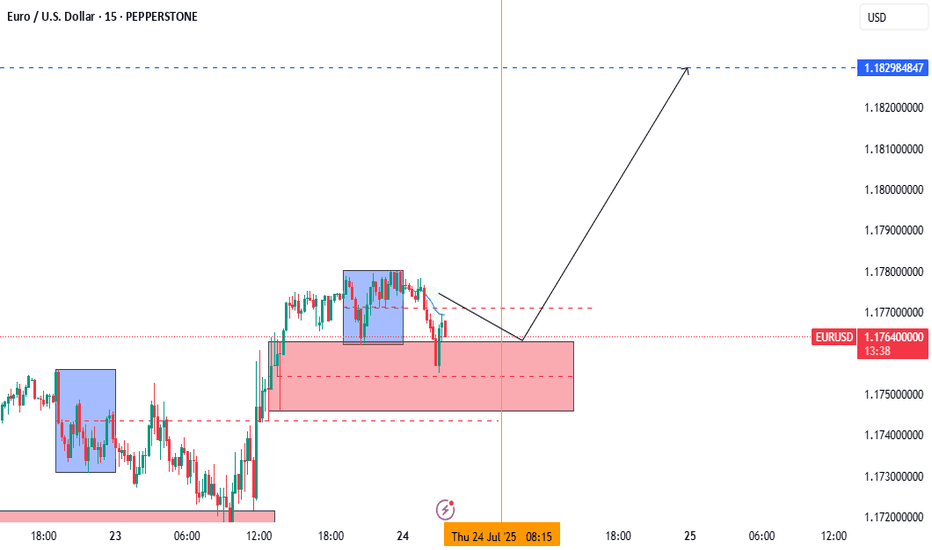

Short or Long-Market is at has broken resistance level but has not tested.

-Market may be rejected by resistance to form a double top (M shape)

-If 14:15 interest rates news are positive on the Euro, we will have to take a long position, to which it may come to retest the new support after some time, confirming the long position.

-If the markets for a double bottom, it means we have tested the resistance level at a second rejection. We would then have to short that position.

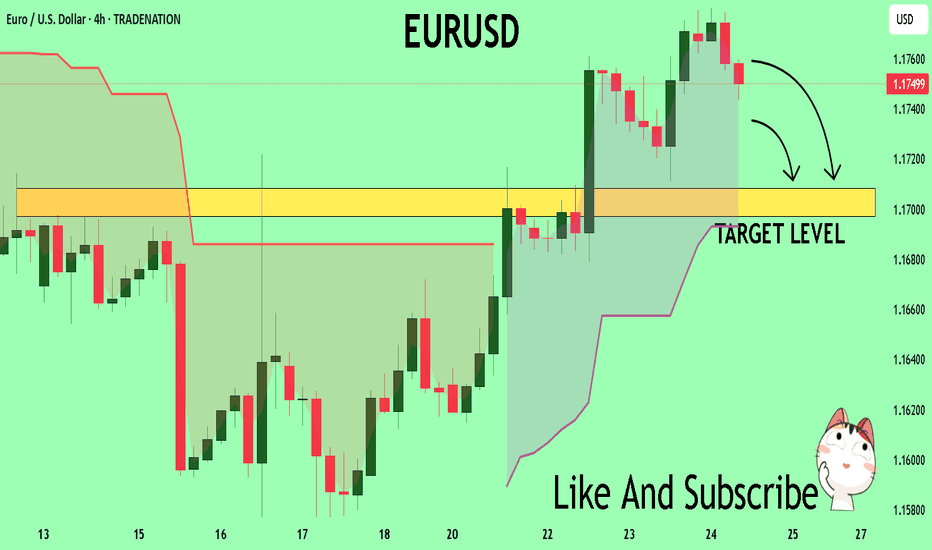

EURUSD A Fall Expected! SELL!

My dear friends,

Please, find my technical outlook for EURUSD below:

The instrument tests an important psychological level 1.1751

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1708

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

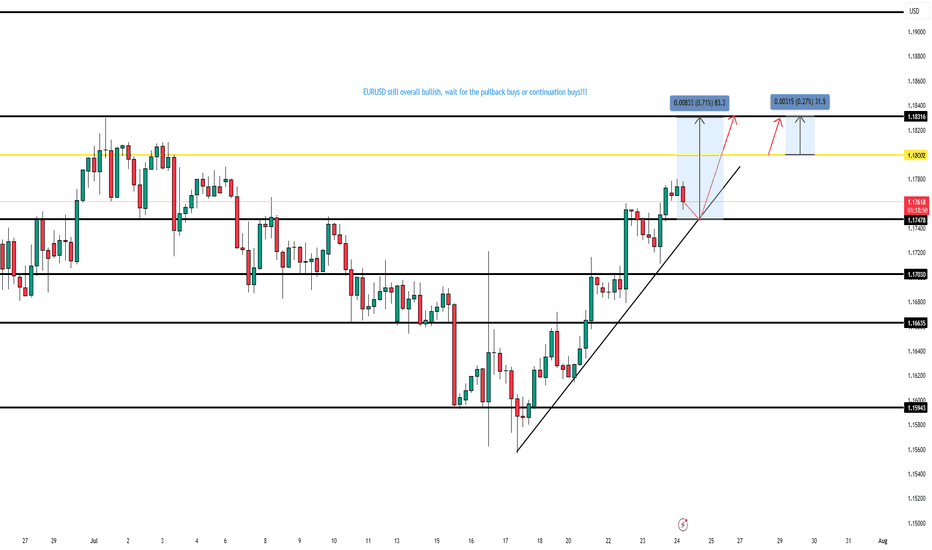

EUR/USD Analysis:🔹 Performance Overview:

The short-term trend is bullish, and price is likely to continue rising toward a key liquidity zone at 1.1829 USD.

1️⃣ Holding above 1.1780 could push the price toward testing the 1.1829 level.

2️⃣ However, a break below the 1.1715 support and stability beneath it may lead to a retest of 1.1680, followed by 1.1640.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

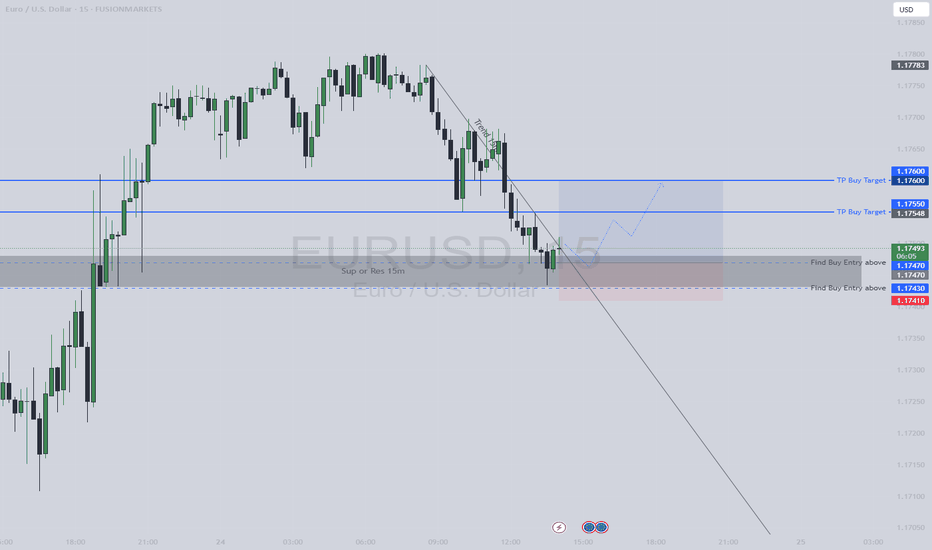

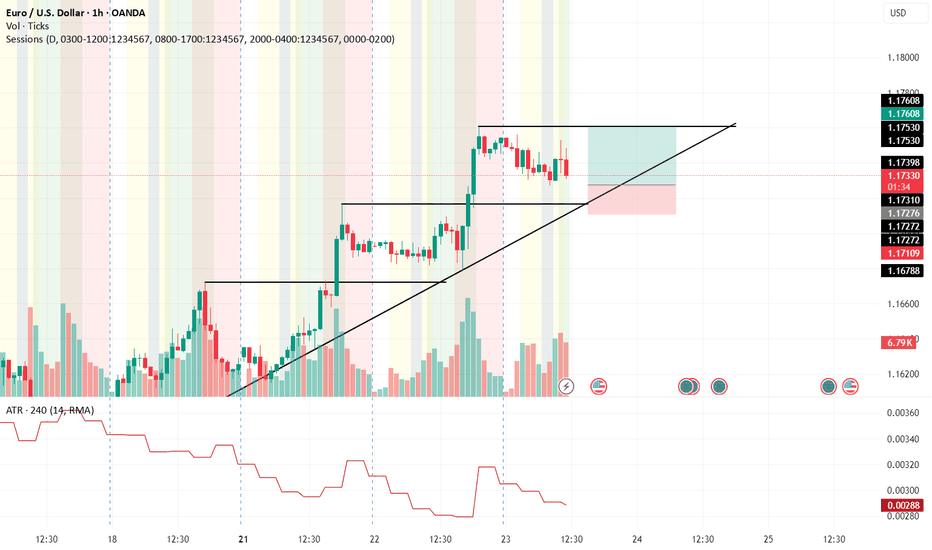

Buy Entry EURUSD🎯 Suggested Trade Setup — Bullish Bias Scalping Opportunity

✅ Buy Entry (Aggressive Intra-Day Play)

📍 Entry Zone: Between 1.17430 and 1.17470 (just above SSL and EQL zones)

🎯 Target: 1.17550 (Day High / minor resistance), with potential extension to 1.17600

🛡️ Stop Loss: Below 1.17410 or the lowest OB (~10-15 pips risk)

🔁 Risk-to-Reward Ratio: Aim for at least 1:2 to 1:3

💡 Why this works: You're buying near liquidity pools with minimal downside. If the breaker block holds and momentum picks up, this could be a swift move.

ECB Interest Rate Decision: What to Expect and How Could React📊 ECB Interest Rate Decision: What to Expect and How EURUSD Could React

This week’s spotlight is on the European Central Bank (ECB) Interest Rate Decision — a key market driver that could shape the near-term direction of the euro and broader European markets. Here's what to expect. 👇

🔔 Key Event to Watch

📅 ECB Interest Rate Decision

🕐 Date: July 24

⏰ Time: 12:15 p.m. UTC

📉 Forecast: Hold at 2.15%

📌 Economic Context

The European Central Bank is expected to hold interest rates steady on Thursday, likely marking the end of its current easing cycle after eight consecutive cuts that brought borrowing costs to their lowest levels since November 2022.

🔒 Main refinancing rate: 2.15%

💰 Deposit facility rate: 2.00%

Policymakers are likely to adopt a wait-and-see approach as they monitor the impact of persistent trade uncertaintyand potential U.S. tariffs on economic growth and inflation.

Adding to the cautious stance, inflation finally reached the ECB’s 2% target in June, and is now forecast to dip belowthat level later this year. This drop is expected to be sustained over the next 18 months, driven by:

A strong euro 💶

Falling energy prices 🛢️

Cheaper imports from China 🇨🇳

Markets are currently pricing in just one more rate cut by December, with around a 50% probability of that happening in September, before a possible tightening cycle resumes in late 2026.

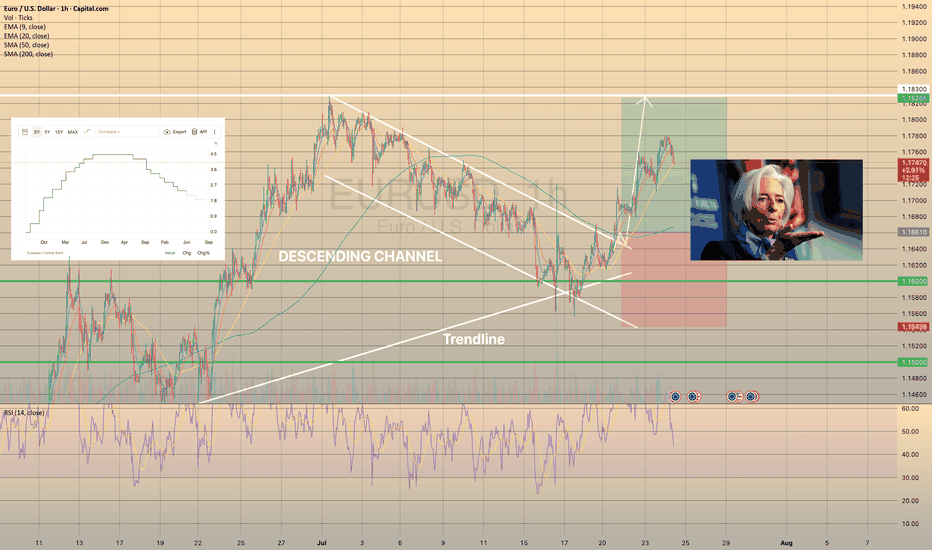

📈 EURUSD Technical Outlook

EURUSD has been trading within a descending channel since early July. However, it recently rebounded from trendline support, backed by bullish RSI divergence. The pair is approaching a breakout above the 1-hour SMA200, signaling a potential continuation of the uptrend. 🔼

A minor pullback is possible before a stronger move

Bullish momentum may continue if resistance is cleared

🎯 Target range: 1.18250 – 1.18300

🧩 Summary

The ECB is likely to keep rates unchanged at 2.15%, adopting a cautious tone amid easing inflation and global trade risks. This outcome could support the euro, particularly if U.S. rate expectations soften.

With technical indicators aligning with fundamental stability, EURUSD may be setting up for a bullish continuationin the coming sessions. 📊💶

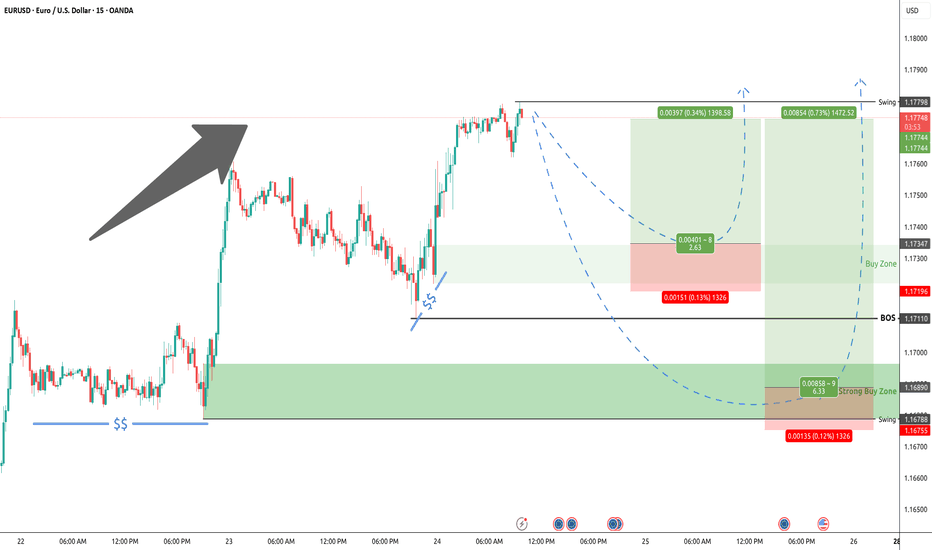

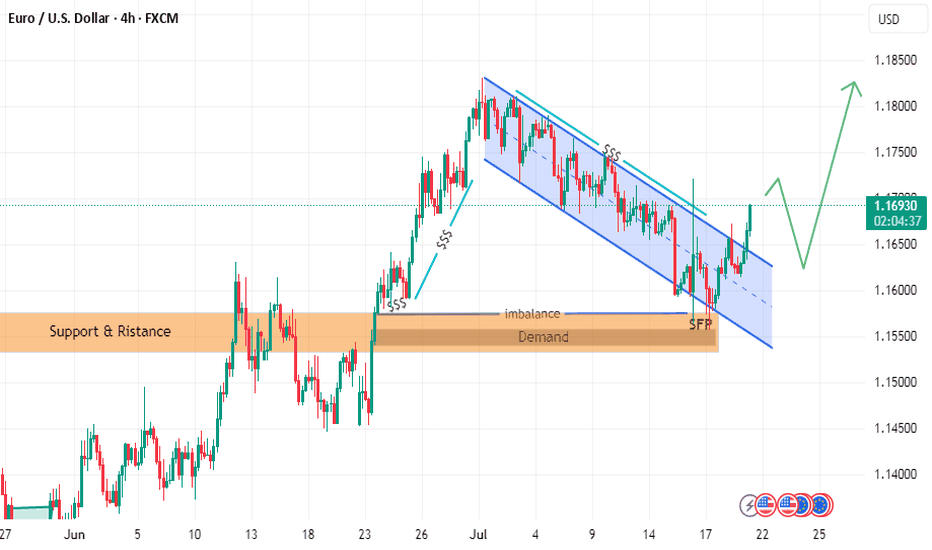

follow EURUSD LION & PLANE BUY SETUPTHE PRICE has moved as I explained in the last two posts

but we have some update to go along the way

the price could break failing channel

and withdrawal liquidity and filled imbalance

hence reflect from demand zone with zero reflection as i explained in last post with rock and plane

and it will go up to take liquidity in failing channel or downtrend

EUR/USD Rises to 2.5-Week High Ahead of ECB MeetingEUR/USD Rises to 2.5-Week High Ahead of ECB Meeting

Today at 15:15 GMT+3, the European Central Bank (ECB) will announce its interest rate decision, followed by a press conference at 15:45 GMT+3. According to Forex Factory, the main refinancing rate is expected to remain unchanged at 2.15% after seven consecutive cuts.

In anticipation of these events, the EUR/USD exchange rate has risen above the 1.1770 level for the first time since 7 July. Bullish sentiment is also being supported by expectations of a potential trade agreement between the United States and the European Union. According to Reuters, both sides are reportedly moving towards a deal that may include a 15% base tariff on EU goods entering the US, with certain exemptions.

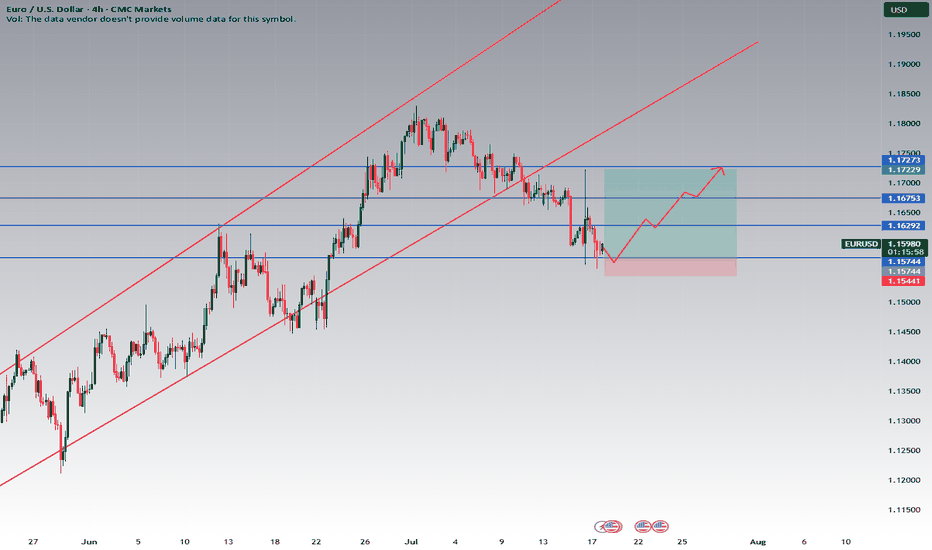

Technical Analysis of the EUR/USD Chart

From a technical perspective, the EUR/USD pair has shown bullish momentum since June, resulting in the formation of an ascending channel (marked in blue).

Within this channel, the price has rebounded from the lower boundary (highlighted in purple), although the midline of the blue channel appears to be acting as resistance (as indicated by the arrow), slowing further upward movement.

It is reasonable to assume that EUR/USD may attempt to stabilise around the midline—where demand and supply typically reach equilibrium. However, today’s market is unlikely to remain calm. In addition to the ECB’s statements, volatility could be heightened by news surrounding Donald Trump’s unexpected visit to the Federal Reserve.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD – Watch for Bullish Reaction Near 1.15744Description:

EURUSD is approaching a major support zone at 1.15744, as shown on the 4H chart. This level lines up with prior structure and could act as a springboard for a bullish move if buyers step in.

Trade Plan:

Do NOT enter immediately at 1.15744.

Wait for clear bullish confirmation at or just above 1.15744 (examples: bullish engulfing, strong pin bar, multiple rejections, or your trusted indicator).

If confirmation is seen, consider a long trade targeting the next resistance levels at 1.16292, 1.16753, and 1.17229.

Place your stop-loss slightly below the swing low (around 1.15441 or according to your risk).

Why Wait for Confirmation?

1.15744 is an area to monitor, not a trigger!

Price may slice through the level or fake out before reversing—waiting for confirmation increases your edge and reduces risk.

Levels to Watch:

Support (monitor for entry): 1.15744

Stop Loss: Below 1.15441

Targets: 1.16292, 1.16753, 1.17229

Extra Tips:

Ignore the entry level if price shows no bullish reaction or momentum.

Watch for news/events that could create volatility and invalidate this setup.

Summary:

Wait for the market to show its hand at 1.15744. Only enter on solid bullish evidence!

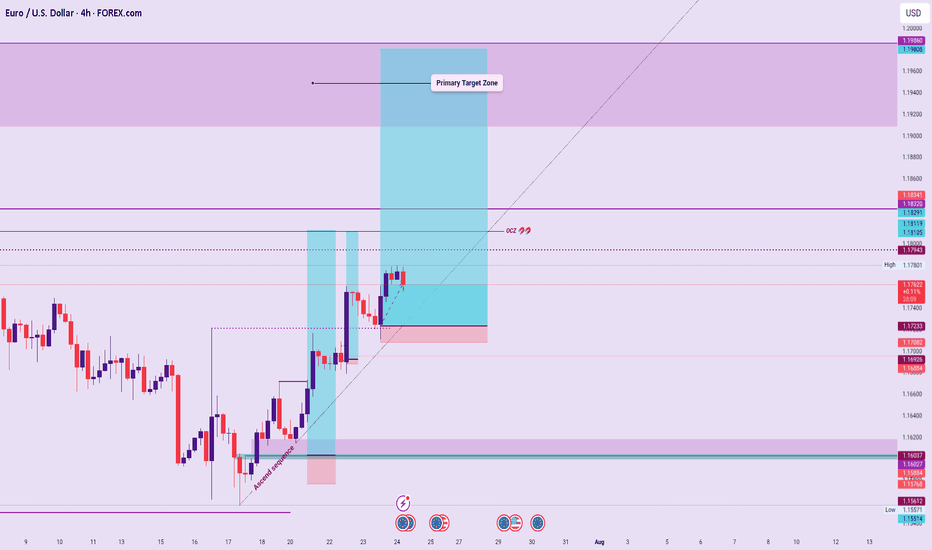

EURUSD – Trade Continuation Outlook: Technical BiasSequence Expectation:

If the current Ascend Sequence structure holds, I anticipate price extending toward or above the target zone, aligned with the directional flow.

Liquidity Magnet:

The OCZ remains a strong attraction point for buy-side flows, given its repeated gravitational pull on price.

Invalidation Criteria:

A structural breach of the Sequence Line would invalidate the bullish outlook, exposing price to the mid-range of the Ascend Sequence or potentially deeper pullbacks below.

Caution Note:

Upcoming U.S. data releases may inject volatility, likely acting as a directional driver.

Wait for clear confirmations before engaging. Trade setups must align with structure and show decisive intent.

Summary Tactical Lean:

Bullish bias stands as long as the Sequence remains intact. OCZ remains in sight. Trade cautiously, adapt to new data flow, and validate every trigger.

🔒 Disclaimer:

This content is for educational and strategic insights only. It is not financial advice. Always confirm with your personal trading plan and manage risk appropriately.

Trading Divergences With Wedges in ForexTrading Divergences With Wedges in Forex

Divergence trading in forex is a powerful technique for analysing market movements, as is observing rising and falling wedges. This article explores the synergy between divergence trading and wedges in forex, offering insights into how traders can leverage these signals. From the basics to advanced strategies, learn how you could utilise this approach effectively, potentially enhancing your trading skills in the dynamic forex market.

Understanding Divergences

In forex trading, the concept of divergence plays a pivotal role in identifying potential market shifts. A divergence in forex, meaning a situation where price action and a technical indicator like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) move in opposite directions, often signals a weakening trend. This discrepancy is a valuable tool in divergence chart trading, as it may indicate a possible reversal or continuation of the current trend.

There are two primary types of divergence in forex—regular and hidden. Regular divergence occurs when the price makes higher highs or lower lows while the indicator does the opposite, often signalling a reversal. Hidden divergence, on the other hand, happens when the price makes lower highs or higher lows while the indicator shows higher highs or lower lows, typically suggesting a continuation of the current trend.

Trading Rising and Falling Wedges

Rising and falling wedges are significant patterns in forex trading, often signalling potential trend reversals. A rising wedge, formed by converging upward trendlines, often indicates a bearish reversal if it appears in an uptrend. Conversely, a falling wedge, characterised by converging downward trendlines, typically reflects a bullish reversal if it occurs in a downtrend.

Traders often look for a breakout from these patterns as a signal to enter trades. For rising wedges, a downward breakout can be seen as a sell signal, while an upward breakout from a falling wedge is often interpreted as a buy signal. When combined with divergences, this chart pattern can add confirmation and precede strong movements.

Best Practices for Trading Divergences

Trading divergence patterns in forex requires a keen eye for detail and a disciplined, holistic approach. Here are key practices for effective trading:

- Comprehensive Analysis: Before trading on divergence and wedges, be sure to analyse overall market conditions.

- Selecting the Right Indicator: Choose a forex divergence indicator that suits your trading style. Common choices include RSI, MACD, and Stochastic.

- Confirmation Is Key: It’s best to watch for additional confirmation from price action or other technical tools before entering a trade.

- Risk Management: Traders always set stop-loss orders to manage risk effectively. Divergence trading isn't foolproof; protecting your capital is crucial.

- Patience in Entry and Exit: Be patient as the divergence develops and confirm with your chosen indicators before entering or exiting a trade.

Strategy 1: RSI and Wedge Divergence

Traders focus on regular divergence patterns when the RSI is above 70 (overbought) or below 30 (oversold), combined with a rising or falling wedge pattern. The strategy hinges on identifying highs or lows within these RSI extremes. It's not crucial if the RSI remains consistently overbought or oversold, or if it fluctuates in and out of these zones.

Entry

- Traders may observe a regular divergence where both the price highs/lows and RSI readings are above 70 or below 30.

- After the formation of a lower high (in an overbought zone) or a higher low (in an oversold zone) in the RSI, traders typically watch as the RSI crosses back below 70 or above 30. This is accompanied by a breakout from a rising or falling wedge, acting as a potential signal to enter.

Stop Loss

- Stop losses might be set just beyond the high or low of the wedge.

Take Profit

- Profit targets may be established at suitable support/resistance levels.

- Another potential approach is to exit when the RSI crosses back into the opposite overbought/oversold territory.

Strategy 2: MACD and Wedge Divergence

Regarded as one of the best divergence trading strategies, MACD divergence focuses on the discrepancy between price action and the MACD histogram. The strategy is particularly potent when combined with a rising or falling wedge pattern in price.

Entry

- Traders typically observe for the MACD histogram to diverge from the price. This divergence manifests as the price reaching new highs or lows while the MACD histogram fails to do the same.

- The strategy involves waiting for the MACD signal line to cross over the MACD line in the direction of the anticipated reversal. This crossover should coincide with a breakout from the rising or falling wedge.

- After these conditions are met, traders may consider entering a trade in anticipation of a trend reversal.

Stop Loss

- Stop losses may be set beyond the high or low of the wedge, which may help traders manage risk by identifying a clear exit point if the anticipated reversal does not materialise.

Take Profit

- Profit targets might be established at nearby support or resistance levels, allowing traders to capitalise on the expected move while managing potential downside.

Strategy 3: Stochastic and Wedge Divergence

Stochastic divergence is a key technique for divergence day trading in forex, especially useful for identifying potential trend reversals. This strategy typically employs the Stochastic Oscillator with settings of 14, 3, 3.

Entry

- Traders may look for divergence scenarios where the Stochastic readings are above 80 or below 20, mirroring the RSI approach.

- This divergence is observed in conjunction with price action, forming a rising or falling wedge.

- Entry may be considered following a breakout from the wedge, which signals a potential shift in market direction.

Stop Loss

- Setting stop losses just beyond the high or low of the wedge might be an effective approach.

Take Profit

- Profit targets may be set at key support/resistance levels.

The Bottom Line

Divergence trading, coupled with the analysis of rising and falling wedges, offers a comprehensive approach to navigating the forex market. By integrating the discussed strategies with sound risk management and market analysis, traders may potentially enhance their ability to make informed decisions in the dynamic world of forex.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

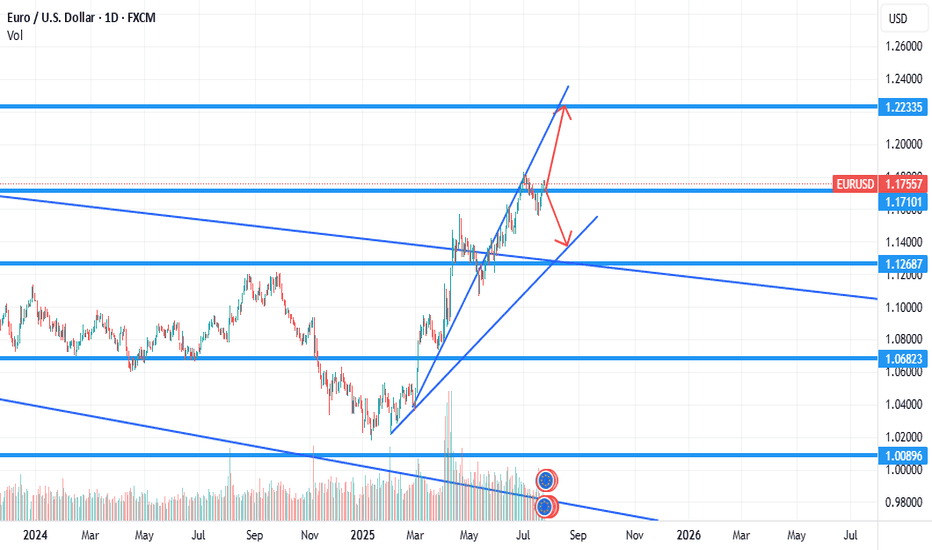

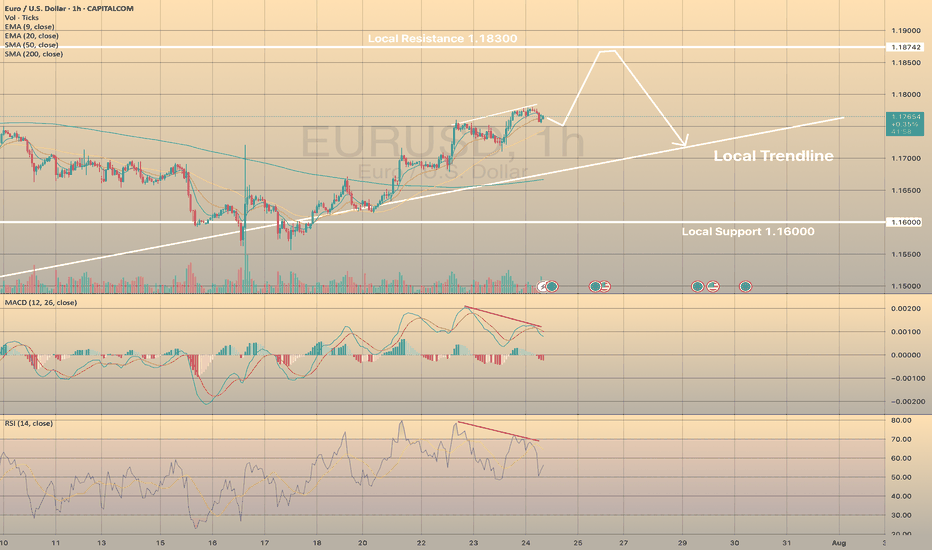

EURUSD IS ON ITS WAY TO LOCAL HIGHSEURUSD IS ON ITS WAY TO LOCAL HIGHS

EURUSD successfully rebounded from local support of 1.16000 and since then continues to rise towards local resistance of 1.18300. Recently the price has started to show the bearish divergence on RSI and Macd indicators. MACD went into the red zone.

What is the bearish divergence?

Bearish divergence is a technical analysis pattern where the price makes higher highs in an uptrend, but a momentum indicator (e.g., RSI, MACD) forms lower highs, signaling weakening bullish momentum and a potential downward reversal. To trade, identify the divergence in a clear uptrend with the indicator showing lower highs (e.g., RSI above 70). Sell or short when the price confirms a reversal (e.g., breaks below a support level or trendline) with increased volume. Set a stop-loss above the recent high. Target the next support level.

Generally speaking, it doesn't necessarily mean that EURUSD will drop immediately, the price may even grow a bit. However, it highlights some short opportunities.

EURUSD LONG AND EDUCATIONAL BREAKDOWN ECB INTRESTRATE RELEASE The European Central Bank is expected to hold key rates for the first time in over a year on Thursday.

The Eurozone inflation rate has hit the ECB’s 2% target as the US-EU trade deal uncertainty lingers.

The EUR/USD pair could experience intense volatility following the ECB policy announcements.

The European Central Bank (ECB) is on track to leave its key interest rates unchanged after its July policy meeting, after having reduced rates at each of its last seven meetings. The decision will be announced on Thursday at 12:15 GMT.

The interest rate decision will be followed by ECB President Christine Lagarde’s press conference at 12:45 GMT.

EURUSD SHORT IDEAFrom my POV theres a high probability for EUR/USD for short as we can look there is market structre shifted already on M30 and H1 which is our confluence for this setup . Our risk to reward is 1 to 4 so its very good for intraday and swing trading . Trade calm , trade safe stick to your plan !

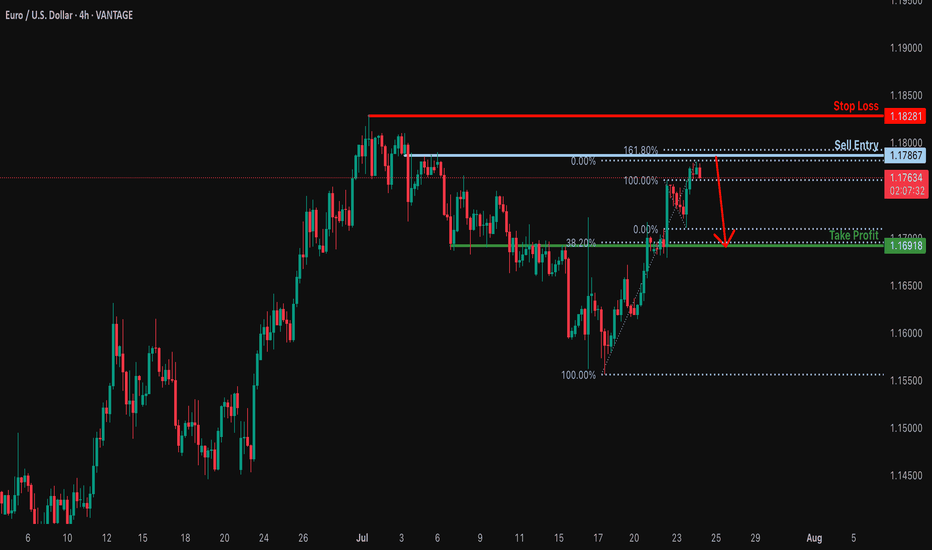

Bearish reversal off 161.8% Fibonacci resistance?EUR/USD is rising towards the resistance level which is a pullback resitance that lines up with the 161.8% Fibonacci rretracement and could drop from this level to our take profit.

Entry: 1.1786

Why we like it:

There is a pullback resistance level that lines up with the 161.8% Fibonacci extension.

Stop loss: 1.1828

Why we like it:

There is a swing high resistance.

Take profit: 1.1691

Why we like it:

There is an overlap support that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

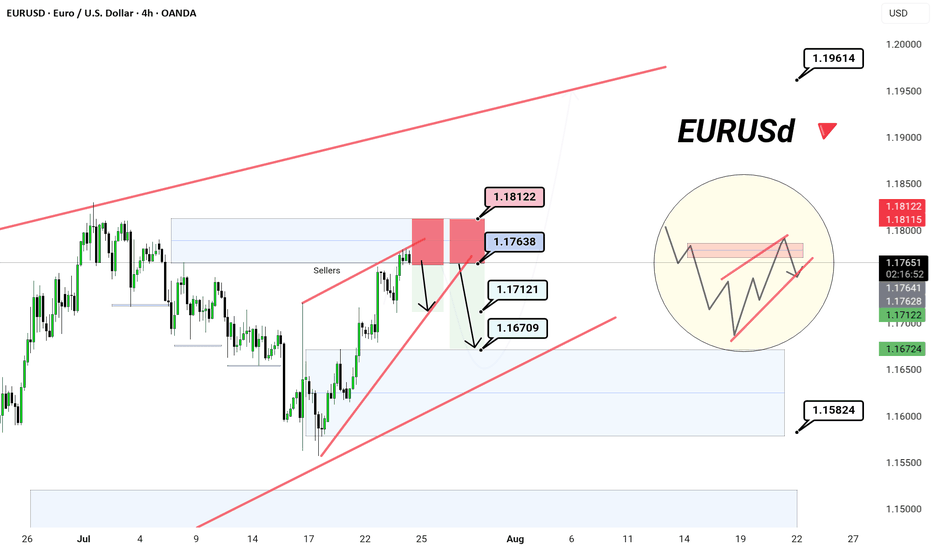

EURUSD | 4H Chart | New York Session Sellers in Play 📉 EURUSD | 4H Chart | New York Session Sellers in Play 🇺🇸

🟥 Red Zone Rejection – clarity

As the New York session unfolds, sellers are stepping in at a premium supply zone — classic reaction near 1.1763–1.1812.

🔻 Current Structure:

Rising wedge formation tapped into prior supply zone

Price kissed the upper wedge and reacted — sellers triggering from the red zone

NY session = high liquidity = aggressive positioning by institutions

🎯 Potential Bearish Targets:

1️⃣ 1.1712 – Minor structure support

2️⃣ 1.1670 – Trendline + liquidity sweep

3️⃣ 1.1582 – Major bullish invalidation (optional swing target)

🧠 Smart Money Note:

This is where liquidity is grabbed before reversal

Risk-to-reward favors downside short-term as long as price stays below 1.1812

📌 Bias: Tactical Short

🎯 Reaction + Rejection = Execution

🎩

EUR USD longlong-term trend is bullish yet we may have a correction or a change in trend but always trade the trends the chance of reversal is always lower then the chance of continuation ...

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !