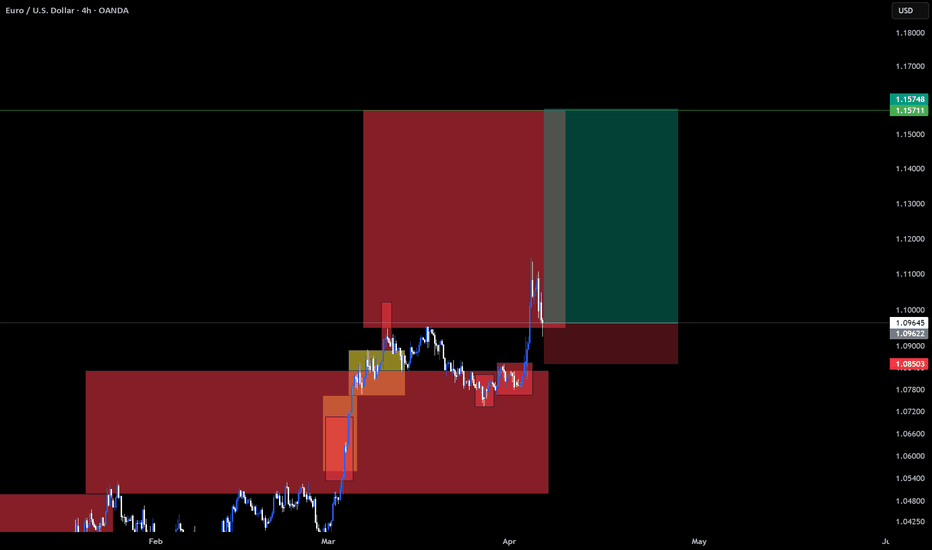

Elliott Wave Insight Into EUR/USD’s Recent MovesThe EUR/USD chart has delivered a clean Elliott Wave sequence, which helps us forecast what may come next.

Wave Count Overview

The structure leading up to the high shows a clear five-wave impulsive rally, ending at Wave 3 in yellow.

This was followed by a corrective A-B-C zigzag, with:

A sharp Wave A down

A shallow Wave B bounce

A clean Wave C drop, matching Wave A in length, bottoming at the 100% Fibonacci projection around 1.10711.

Why This Matters

Elliott Wave theory tells us that a completed zigzag correction—especially when followed by a consolidation like a triangle—often leads to a continuation in the direction of the larger trend. If this consolidation is indeed a Wave 4 triangle, Wave 5 may soon emerge with strength.

What to Watch For:

Breakout from the current flag/triangle pattern.

Confirmation via price closing above the Wave B high.

Strong bullish momentum and rising volume as signs Wave 5 is kicking off.

Conclusion

EUR/USD may be gearing up for a Wave 5 breakout, following a classic zigzag correction and potential triangle consolidation. If this pattern breaks to the upside, it could offer a great trend continuation trade opportunity.

EURUSD_W trade ideas

EUR-USD Bullish Rebound! Buy!

Hello,Traders!

EUR-USD made a retest of

The falling support line

While trading in a local

Uptrend and we are already

Seeing a bullish reaction

So we are locally bullish

Biased and we will be

Expecting a further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Bullish bounce off pullback support?The Fiber (EUR/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 1.1367

1st Support: 1.1278

1st Resistance: 1.1475

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURUSD Sell SetupEURUSD – Institutional Short Setup 🔻

Timeframe: 1H

Date: June 3, 2025

Strategy: OdinVerse HP – Bank Entry Trap + Supply Stack Breakdown

🧠 Smart Money Logic

🔍 Key Zone Details

🔴 Upper Bank Sell Entry (1.14539 – 1.14337) Final liquidity sweep into major HTF supply – fakeout push before drop.

🔴 Lower Bank Sell Entry (1.14210 – 1.14127) True institutional entry zone. Price retested this zone before rejection.

🔻 Current Reaction Zone Price is rejecting the lower zone with bearish follow-through and structure shift.

🔑 Key Confluences

Fakeout Above Trendline → Trap breakouts at the top of rising wedge.

Double Bank Sell Zones → Clear signs of institutional order stacking.

Market Structure Shift → Clean BOS (break of structure) after retest of lower zone.

Mitigation Complete → Last bullish OB fully mitigated, turning supply active.

Daily EQM Sweep → Targeting imbalance & unfilled FVGs below (1.1285 to 1.1200).

🎯 Targets

🎯 TP Levels Zone/Logic

1.13884 Prior demand base / FVG top

1.12854 Major imbalance completion

1.12545 – 1.1200 Liquidity grab + OB tap zone

⚔️ Execution Plan

In Position? Hold – structure confirms clean sell trap.

Missed Entry? Wait for M5–M15 OB retest or mitigation around 1.1415.

Reversal Risk? Only invalid if 1.1454 breaks with close above.

🔥 OdinVerse Grade: A+ Setup

✔ HTF Supply Confluence

✔ Dual Bank Entry Zones

✔ Structure Shift

✔ Clean Downside Liquidity Targets

My Thoughts #013The pair is still quite bullish...

I would look for sells

if we get to the supply zone and get a choch I would sell then for now I just think it will push up to the supply zone before we get that drop.

As you can see it's the buy before the sell that Choch so that is why I think it will mitigate the Zone before dropping...

Yet I am not. Saying it might not sell from the point it's at but it's just my perspective

Use Proper risk management

Let's do the most

EURUSD - AB=CD harmonic Pattern | BULLISH TREND continuationThis analysis is done on 4H time frame, as it can be seen that market is making series of HH and HL which is our Bullish Trend. however, market took a deep correction and broke the HL which seems trend reversal. Since there is no divergence before correction therefore it is more weighted toward continuation pattern. Having said that, Market took a deep correction till FIB level of 0.618 which forms a AB=CD Harmonic Pattern.

The point D is our Potential Reverse Zone, and it also coincides with the 4H good resistance level (Perfect confluence of PRZ). Therefore we can project our market to reach there.

Entry Points : IN our case we shall plan safe entry on Break-of-Neckline, however the neckline is already broken, therefore we can instant enter into the market OR wait to break again the Market with Good Bullish candle (with good momentum / body).

Our 1st TP will be with R:R of 1:1 and 2nd TP would be 1:2 R:R , As usual SL would be placed below HL as market in the chart.

Regards,

Euro will rise to seller zone and then drop to support lineHello traders, I want share with you my opinion about Euro. At first, price was moving inside a downward channel, forming lower highs and lower lows. Each rejection from the resistance line pushed the price lower, and the structure remained bearish until the price reached the buyer zone near 1.1210 - 1.1185 points. A strong rebound from this area triggered a breakout from the channel, signaling a shift in market dynamics. After this breakout, the trend reversed and price started forming an upward channel, with clean impulses and structured corrections. Bulls began stepping in from higher support levels, and the market started respecting the new rising support and resistance lines. Now the price is approaching the seller zone at 1.1435 - 1.1460 points and has already shown signs of rejection from that area. Given this setup, I believe EURUSD may start to decline and fall back toward the support line of the upward channel. That’s why I’ve placed my TP at 1.1325 points, which aligns with the channel's support structure. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

EURO - Price can boucne up of pennant, breaking resistance levelHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some time ago, price entered to pennant pattern, where it at once bounced up from support line and reached $1.0850 level.

Next, it broke this level and continued to grow to resistance level, and when Euro reached it, price broke it.

But, after price reached resistance line of pennant, it started to decline and soon broke $1.1380 level one more time.

Price fell to support line of pennant and then turned around and, in a short time rose to resistance area.

After this, price fell to support line of pennant, but recently started to grow and now trades near resistance level.

I believe Euro can correct slightly and then launch upward toward $1.1600, breaking resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

EURUSD - LONGLooking at the EURUSD most recent BOS

MAIN Entry

- There was a manipulation on the lower TF in which the FVG (fair value gap) was caused.

- it is also the origin of where price cause the price the break previous structure.

Secondary ENTRY

- Secondary entry will be down at the grey box.

- Will cover this if the first position fails

EURUSD HTF IOF continuationEURUSD is currently in the sell side of the SMR model as price swept the Previous Month High , and a classic example of SMR has taken place.

Draw on liquidity is the deeply discounted H4 Unmitigated Bullish OB found at the 70.5% fib .

I Believe that Price will either reach the D.O.L through NFP news release , or price will continue retracing to the POI prior to news release

I believe L.O.M should be set here , followed by a continued bulls rally following HTF IOF.

What is the TACO trade in forex trading? The “TACO trade” – short for “Trump Always Chickens Out” – originated in equity markets but is equally relevant in forex. The pattern is simple: Trump signals aggressive tariffs, markets react and then reverse when the threat is walked back.

One example: In May 2025, the U.S. dollar weakened sharply after Trump announced a 50% tariff on EU imports. EUR/USD rallied to 1.1440 as traders priced in slower U.S. growth. But just days later, the Trump delayed the tariffs to July, and the dollar quickly regained ground.

For forex traders, the TACO trade strategy is about timing: entering on initial panic and exiting on the rollback.

That said, it’s not without risk. If tariffs are actually enforced, the dollar’s decline may be more prolonged. And with markets increasingly aware of this pattern, reactions may become less predictable.

EURUSD Back to 8H Support ZoneFollowing the bullish breakout of the trendline on the 4-hour timeframe and the subsequent pullback to the mentioned level, along with confirmations on lower timeframes, we expect the price to retrace toward the 8-hour support zone to gather momentum for a potential continuation of the upward trend.

While a precise touch of the support level is not guaranteed, based on the current setup, it remains a likely scenario.

A possible entry zone could be around the highlighted orange area. Based on this setup, I anticipate a potential drop of approximately 4% in EUR/USD, targeting the 1.095 level.

Disclaimer: You are responsible for your own trades. Do not risk more than 2% of your account on a single setup.

EURUSD: Move Up Expected! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.13812 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 1.14059.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

Has EUR/USD entered a medium-term correction?The EUR/USD has experienced a corrective pullback in a range-bound manner, touching the 1.14 level during the European session, approaching the Bollinger Band Midline support at 1.129. Earlier, the exchange rate retreated after encountering resistance near the 1.1450 key resistance level. Influenced by Euro-U.S. economic data divergences, the broader European market weakened, exerting downward pressure on the euro. Ahead of this week's ECB monetary policy meeting, the pair is likely to remain range-bound between the 1.1350 support and 1.1500 resistance levels.

If the ECB signals further monetary easing, the exchange rate may decline to test the 1.1350 support zone, with a potential extension of the downward move targeting the Bollinger Band Midline at 1.1292. Conversely, if the market deems the rate-cut expectations to be fully priced in and the ECB delivers a neutral policy stance, this could prompt the EUR/USD to retest the 1.1500 resistance level.

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.

Trading Strategy:

buy@1.13500-1.13600

TP:1.13800-1.13900

Bearish Momentum Builds on Hourly EUR/USD ChartThe EUR/USD pair is showing signs of a short-term trend reversal, with technical indicators turning decisively bearish on the H1 timeframe. After a sustained uptrend, the pair has broken below a key ascending trendline around the 1.04060 area.

As of 11:00 AM 6/3/2025, EUR/USD is trading around 1.1391, down from recent highs near 1.1450. The breakdown comes amid weakening momentum, as confirmed by multiple technical tools.

Indicators Confirm Bearish Shift

The MACD (12,26,9) and MACD (19,39,9) indicators have both printed bearish crossovers, with expanding negative histograms, suggesting downward momentum is strengthening.

Meanwhile, the Momentum (50) indicator hovers just above the neutral 100 level, offering a potential clue of ongoing weakness unless a sharp rebound occurs.

Bearish Trading Setup

My EUR/USD position is currently short with initial downside soft targets at 1.1350, followed by 1.1280 if bearish pressure accelerates. A break above 1.1445 would invalidate bearish setups and shift focus back to the upside.

Technical Summary:

Bias: Bearish (Short-Term)

Opened 6/3/2025 5:03 am USA Eastern at 1.14060 (MT4)

Trade Invalidation: 1.1445

Soft Targets: 1.1350, then 1.1280

Hard Target: None. Holding until MACD (19,39,9) reversal.

The technical landscape suggests traders should remain cautious on long positions unless the pair reclaims the 1.1445 resistance zone. Until then, the bears appear to be in control.

--------------------

The above is an analysis of what I see using my own technical setup and is not investment advice.

EURUSD - OPPORTUNITY HAS ARRIVEDTeam,

I hardly trade EURUSD but the last time, we went long EURUSD when it was 1.03-1.04 - properly 2 months ago.

Now we decide to short, please follow the strategy given out in the chart.

Today, we have successfully hit target on SHORTING GOLD, you can check it yourself yesterday post. We do LIVE trading SHORT UK hit both target, Yesterday we went LONG USDCHF- you can check my post, target hit today as well.

and 15 minutes ago, we do LIVE trading and our soft target for EURUSD hit again.\

Now, we are reshort the EURUSD, please make sure follow the chart accordingly.

Once it hits the 1st target, bring stop loss to BE.

REMEMBER always care about how much you are taking the risk on each of your trade.

EURUSD: Rise Ahead! 🇪🇺🇺🇸

EURUSD successfully violated a significant horizontal supply area yesterday.

The broken structure and a rising trend line compose a contracting demand zone now.

It will be the area from where I will expect a rise to higher level.

The next strong resistance is 1.151

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.