Fartcoin Tests Major Support Zone: Will a Reversal Emerge?Fartcoin has reached a critical support zone that may serve as the foundation for a potential reversal. Traders are closely watching this level for signs of a bottoming structure before confirming a trade.

Price action is now testing the $1.05 region—a key technical support level with multiple overlapping indicators. This zone is not just a psychological round number, but also aligns with the point of control (POC), the VWAP-based support-resistance (VWAPSR), the value area low, and the 0.618 Fibonacci retracement. This confluence makes it a prime candidate for a potential bullish reaction if buyers step in and form a structural base.

Key Technical Points:

- Support at $1.05: Aligns with the POC, VWAPSR, value area low, and 0.618 Fibonacci

- Reversal Watch: A bottoming structure needs to form on the daily timeframe for confirmation

- Key Level for Trade Setup: Current price region offers a technical point of interest, but confirmation is still required

The current zone at $1.05 has become a focal point for market participants due to its technical significance. It represents a major area of price memory and historical volume interaction, making it an ideal level to monitor for a shift in trend. However, while price has arrived at this zone, it has not yet shown clear signs of reversal or structural confirmation.

A reversal from this level would require the formation of a bottoming pattern—such as a double bottom, bullish divergence, or a higher low structure—on the daily timeframe. Without such a structure in place, any bounce should be treated with caution. The current environment presents potential, but a well-defined entry model needs to materialize before considering an actionable trade.

From a broader market structure perspective, the $1.05 region stands out as a potential inflection point. The fact that it aligns with so many technical metrics—POC, VWAPSR, value area low, and the 0.618 Fib—adds credibility to the level as a valid support zone. If a bullish setup forms and volume begins to build from here, the probability of a reversal increases, potentially initiating a new leg toward recent highs.

What to Expect in the Coming Price Action

Fartcoin is trading at a high-confluence support level where a reversal could begin forming. Traders should closely monitor for structural confirmation and volume influx to validate a long setup. Without a bottoming structure, further downside remains possible, but the current level offers an attractive technical area for a potential reversal to develop.

FARTCOINUSDT trade ideas

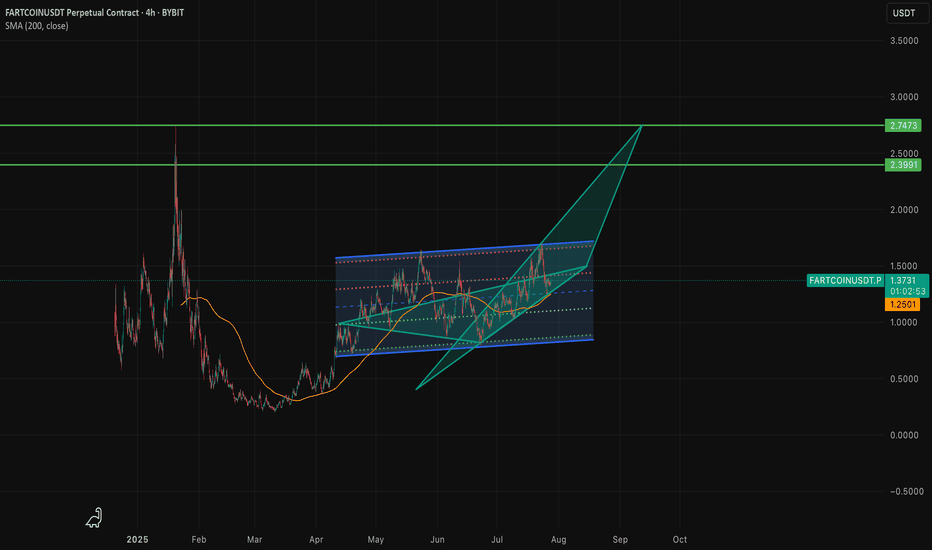

FARTCOIN | #3D — Swing Long from SupportFARTCOIN just tapped into a key 3D support zone after a sweep below prior range lows. The rejection from 1.65–1.45 weekly resistance has set up a fresh entry at demand, with risk well-defined.

Step-by-Step Price Scenario:

Support Confirmation: Price swept the range lows and rebounded from 1.12–1.22 demand. This area is now critical for bulls to hold.

Entry Logic: Accumulation within the blue box is favored for a swing long. Stop loss placed below $1.00 (invalidating the idea if broken).

First Objective: Look for price to reclaim 1.22, with a move toward the weekly S/R at 1.45 as first resistance.

Main Target: If momentum follows through, next key target is 1.65 (D3 SFP), with a possible extension to $2.74 (measured move).

Risk: Breakdown below $1.00 negates the idea and opens the door to much deeper downside (next demand block $0.60–0.80).

Why:

The setup offers a high R:R, with clear invalidation. Reclaiming 1.22 after a sweep typically triggers fast mean reversion, especially on volatile alts. Watch for signs of strength — strong candle closes above 1.22 or a quick retest.

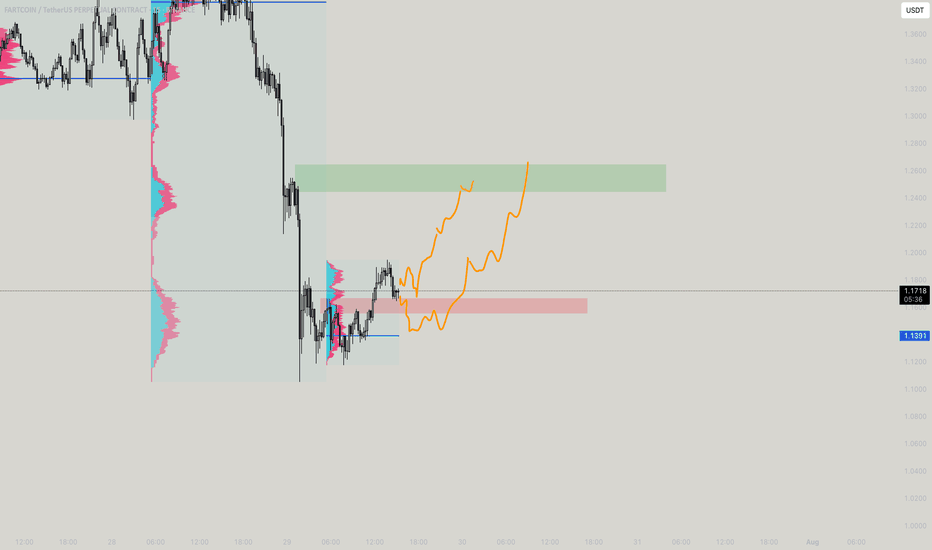

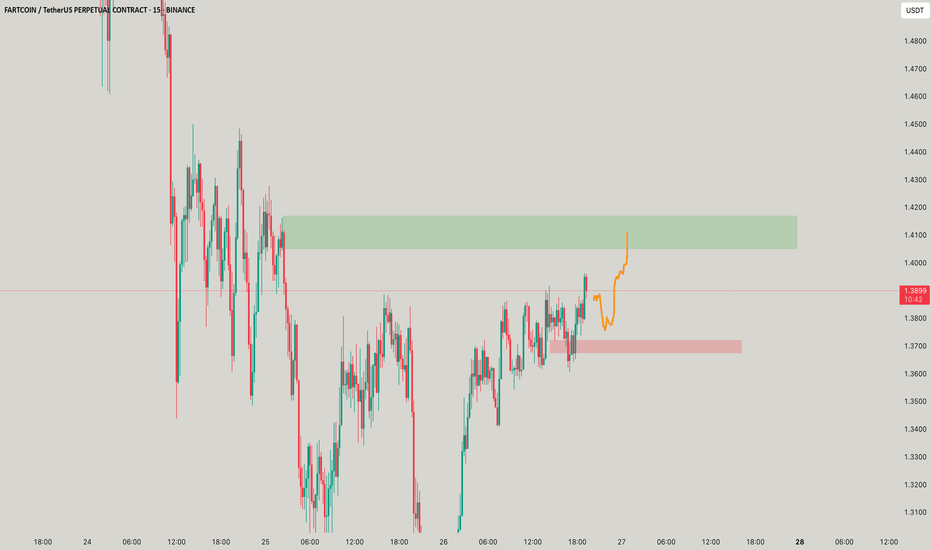

Fartcoin Hello Traders,

After major Pullback, Fartcoin gives a Chance to Enter for the Long Setup in illustrated Price Level.

Take Profit will be at Swing High of the Order block. You can also take partially TP in minor swing highs.

Disclaimer

This trading setup is provided for educational purposes only and does not constitute financial advice. Trading involves significant risk, and past performance is not indicative of future results. Users should conduct their own research and consult with a qualified financial advisor before making any investment decisions. xAI and its affiliates are not liable for any losses incurred from using this information.

Ascending Channel Bounce – Long SetupAscending Channel Support Test – Potential Reversal Setup 📈

Price has just tested the lower boundary of the ascending channel and reacted strongly, signaling potential buying interest at this level.

RSI is hovering near the oversold zone, adding confluence to a possible bullish reversal scenario.

Trade Idea:

Entry: 0.89

Target 1: 1.178

Target 2: Previous swing high at 1.69

Stop-loss: Below the channel support breakout

A break and hold above 1.178 could pave the way for a continuation toward the previous high. Watching for volume and bullish candlestick confirmation before adding to the position.

#TechnicalAnalysis #AscendingChannel #RSI #CryptoTrading #ChartPatterns #PriceAction #TradingSetup #BullishScenario #SupportAndResistance #SwingTrade #CryptoSignals

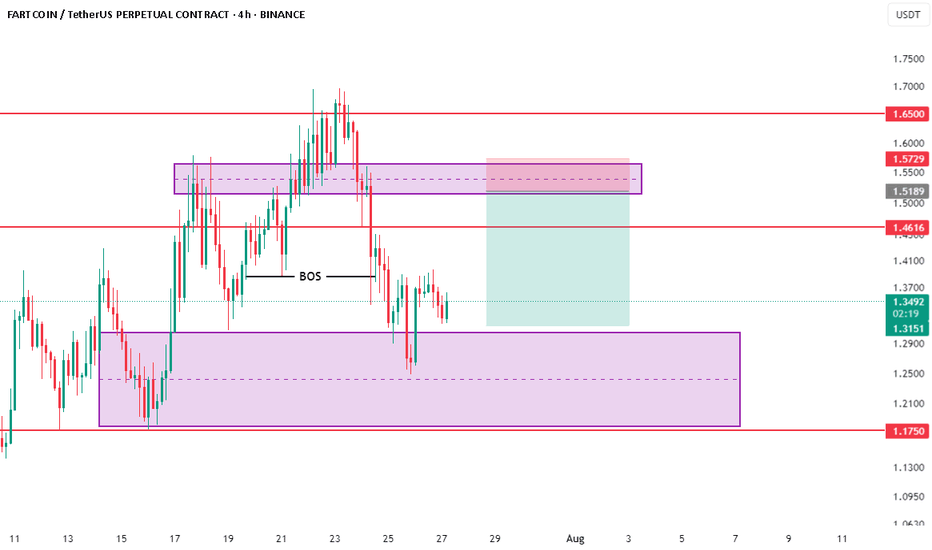

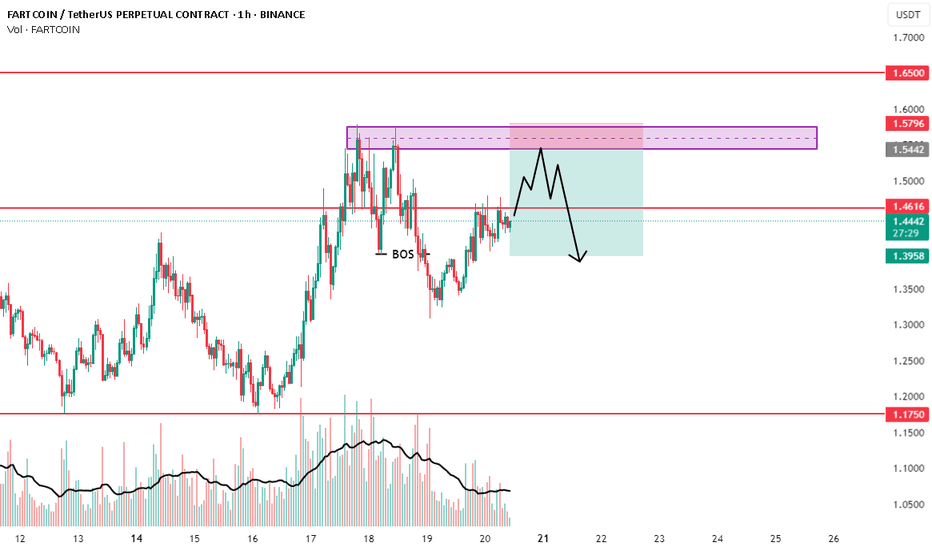

$FARTCOIN/USDT – 4H(Not Financial Advice)

🔍 Key Technical Insights:

BOS (Break of Structure)

A clear BOS is marked near the 1.46 level, confirming a bearish market structure.

Price broke below the higher low, suggesting lower highs and lower lows in progress.

Supply Zone (Entry Region)

1.5189 – 1.5729 USDT is the defined supply zone where price is expected to react.

Current price is below this zone, indicating potential pullback entry for shorts.

Entry Strategy

Ideal short entry is upon rejection within supply, targeting previous demand zones.

Entry would be around 1.56 – 1.57 (red box top), stop just above 1.5729.

Targets

TP Zone (Demand): 1.3151

Mid-level TP: 1.4616 (prior support turned resistance)

Full TP: At the lower purple box between 1.21 – 1.31

Risk-to-Reward (RRR):

Visually, the trade setup shows an RRR > 2:1, making it favorable if rejection occurs.

🔧 Confluence & Bias

✅ BOS confirms trend shift

✅ Price rejected from premium zone

✅ Bearish candles confirming weakness

❌ No bullish market structure yet

❗ Watch for fakeouts in thin liquidity weekend

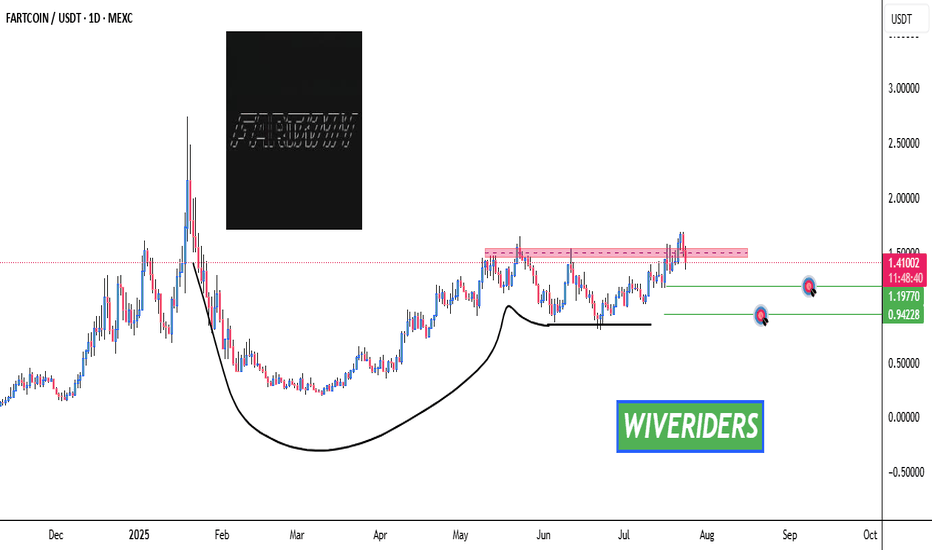

What’s Next? 🚨 $FARTCOIN Cup & Handle Pattern Forming – What’s Next? 📈

$FARTCOIN has formed a bullish Cup & Handle pattern — but is it over?

❌ Not yet. $FARTCOIN hasn’t shown any strong bearish signals for now.

🔍 We’re watching two key green line levels below.

📉 If the price drops toward these zones, we may see buyers step back in — creating a potential entry, but only with confirmation.

✅ Stay patient — no rush to jump in without a setup. Let the chart guide us.

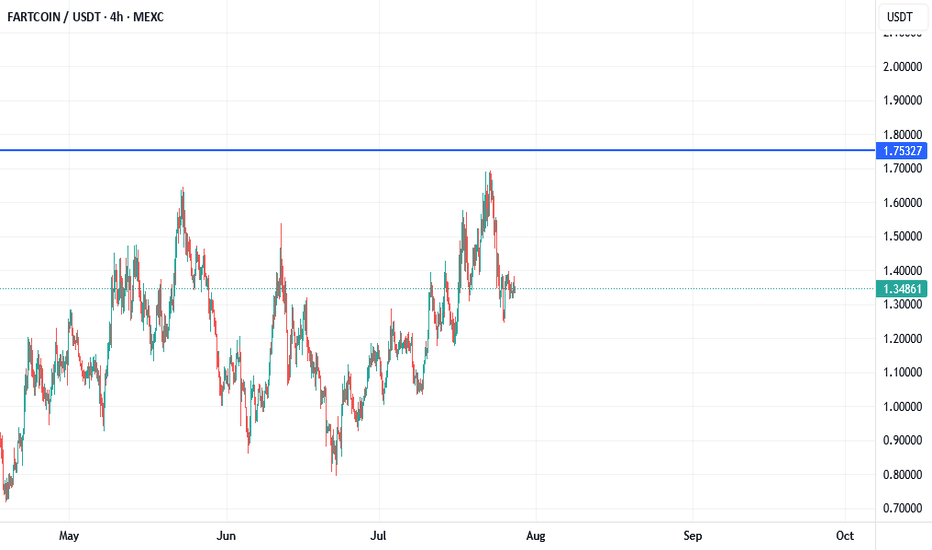

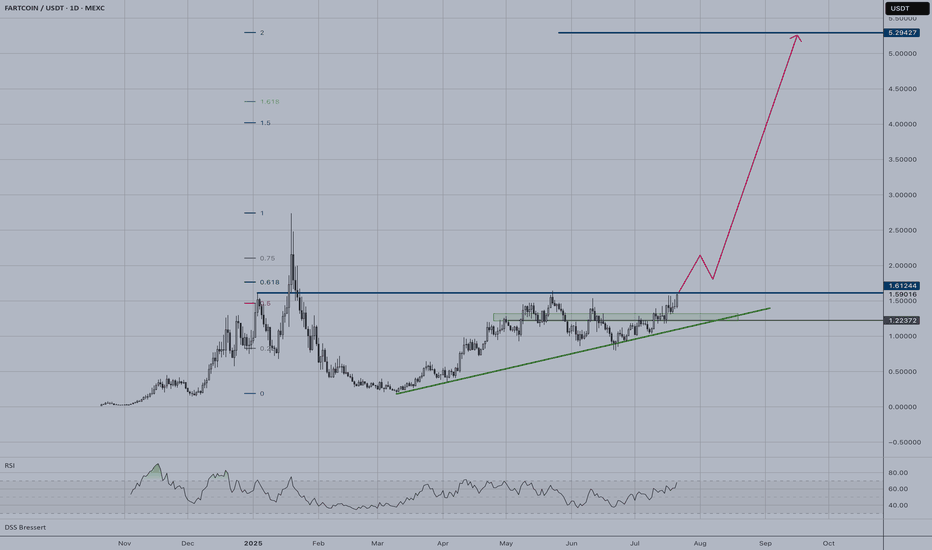

FARTCOIN | Long-Term Resistance Break?FARTCOIN is showing strong bullish momentum as it approaches a critical breakout above long-term resistance around $1.61.

Key Technical Signals:

• Price trading near multi-month resistance after sustained uptrend

• Rising trend line support holding firm since March lows

• RSI in healthy bullish territory without extreme overbought conditions

• Clean breakout setup with minimal overhead resistance

Trade Setup:

• Entry: Current levels around $1.59 or pullback to trend line support

• Initial Target: $2.00 psychological level

• Extended Target: $5.29 based on projected path

• Stop Loss: Below trend line around $1.20

Risk Considerations:

The meme coin nature brings high volatility risk. A failed breakout could see price retreat to trend line support. However, the technical structure suggests bulls are in control, and a decisive break above $1.61 resistance could trigger significant upside momentum toward the marked targets.

Fart Ichimoku Breakout Test📈 Checking bullish signals on the chart

✅ Positive signs:

- The price is stable above the cloud and the candles show the strength of buyers.

- Indicators such as RSI and trading volume are in a good position.

- The cloud broke with the body

First profit limit 1/451

Second profit limit 1/551

Limit of loss 1/320

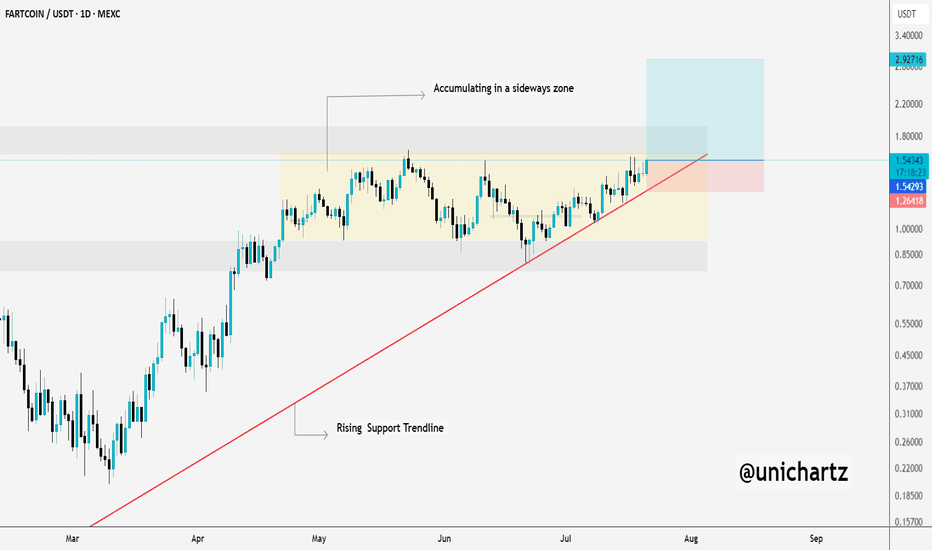

Fartcoin Coiling Up for a Parabolic Move$FARTCOIN is bouncing perfectly from the rising trendline and continuing to accumulate within the sideways range.

If it manages to break above the marked resistance zone, we could see a parabolic move ahead.

The structure looks strong, and momentum is building, keep a close watch on this one, things could get explosive soon.

DYOR, NFA

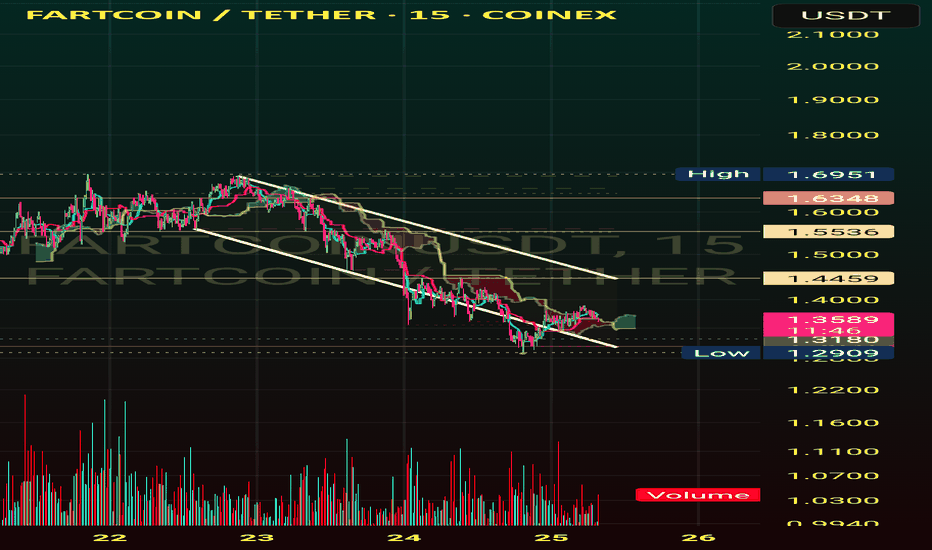

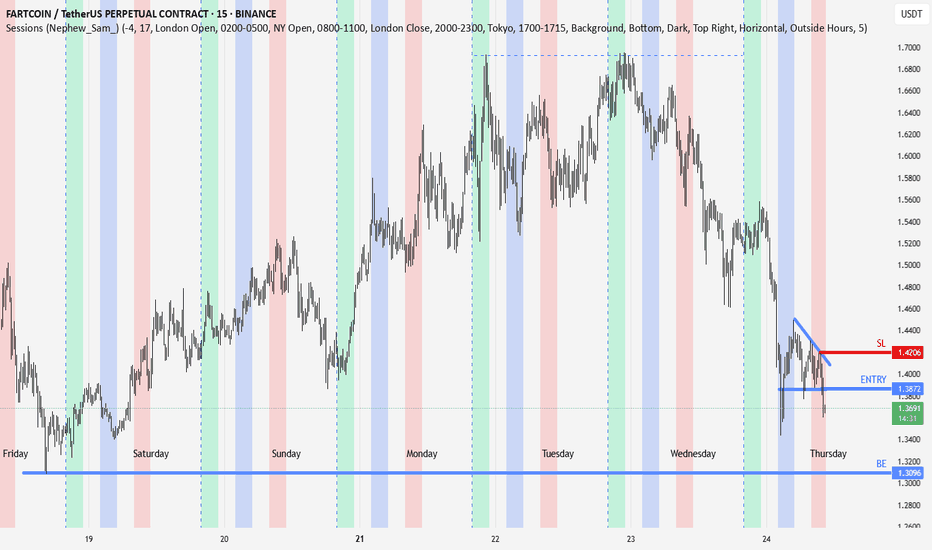

FARTCOIN/USDT Short Setup – 1H Chart🧠 FARTCOIN/USDT Short Setup – 1H Chart

The market recently showed a Break of Structure (BOS) to the downside, confirming bearish pressure. Price has now retraced back into a major supply zone between 1.5442 – 1.5796, where multiple rejections have already formed — suggesting potential distribution.

You're looking to short around 1.4355, aiming for a drop back toward the 1.3958 demand level.

The stop-loss is placed above the supply zone at 1.5796, which, if breached, would invalidate the setup completely and flip bias to bullish. The take-profit sits at 1.3958, a clean target just above previous support.

🎯 Trade Details

Entry: ~1.4355

Stop-loss: 1.5796

Target: 1.3958

Risk/Reward: ~3.6R

❌ Invalidation :

This setup gets invalidated if price breaks and holds above 1.5796, showing strong bullish momentum and reclaiming the supply area. A 1H candle closing above that zone would be your exit signal.

✅ Conclusion

FARTCOIN/USDT is showing a clear bearish setup after a break of structure, with price reacting strongly from a key supply zone. A short position around 1.4355 targeting 1.3958 offers a solid 3.6R risk-to-reward. Invalidation is cleanly defined above 1.5796. As long as price stays below the supply, the bearish bias remains valid.

📉 Clean setup based on structure + supply

🧠 Trade at your own risk | NFA

📲 Follow @Ali15349323 for more setups

FARTCOIN like a Fartphoenix rising from the ashesNo one believed in it when it first appeared. Everyone sold it at $1. At $2, the funding was already negative. Everyone laughed at it when it fell to $0.2.

🔥 But it's back again to prove to us that this isn't the end. Or is this the final chord? Let's take a closer look:

In fact, FARTCOIN has been one of my favorite tokens for trading over the past two months. People are used to shorting memes and other junk when they grow so much, and that's why they continue to grow.

➡️ However, FARTCOIN has been experiencing a divergence in purchase volumes since the beginning of June. Fewer and fewer people are willing to buy at this price.

➡️ There is also a divergence in Money Flow in liquidity inflows. Positions continue to close, although new liquidity also continues to come in. The indicator is currently in the neutral zone.

➡️ Yesterday's drop formed a GAP at $1.63 - $1.41. And as we know, 99% of GAPs close sooner or later.

➡️ What about liquidity? Right now, there is more of it at the top, as always. With every correction, everyone starts shorting memes first. Therefore, liquidity accumulates quickly at the top.

➡️ However, the price moves from liquidity to liquidity, which is why FARTCOIN continues to grow. But in the current momentum, it was one of the first to start moving, and I think it's time for it to cool down a bit.

📌 Conclusion:

Technically, everything points to a correction. Logically, too. We can close the GAP at the top and start to decline, or it will remain hanging for some time if Bitcoin pulls the market down again today.

However, I am currently only considering shorts in FARTCOIN. It has been growing too long and too strongly, and it is time for it to cool down and gather strength for the next momentum in October (if there is one).

Subscribe to stay up to date with the latest market ideas! ⚡️