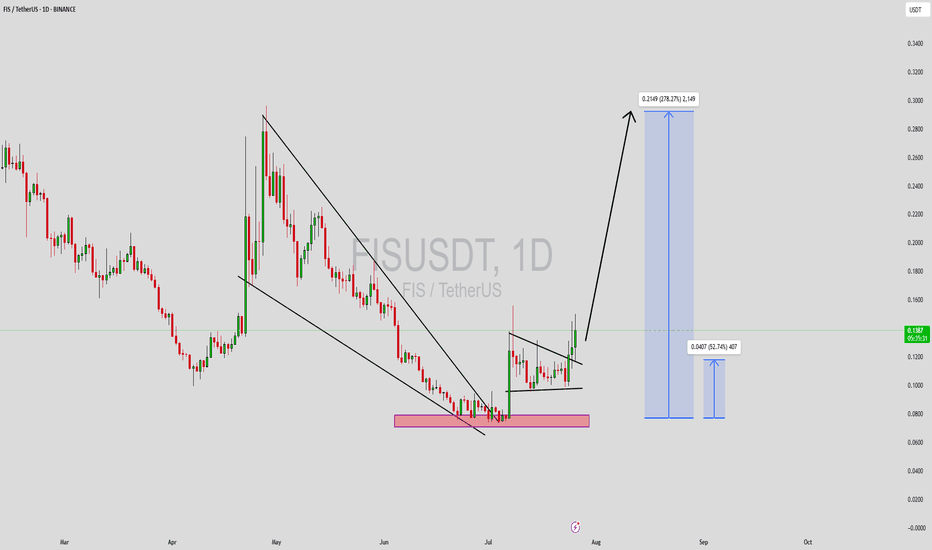

FISUSDT Forming Falling WedgeFISUSDT is forming a textbook falling wedge pattern on the daily timeframe, a well-known bullish reversal signal that often precedes explosive upside breakouts. After an extended corrective phase marked by declining price and compressed volatility, the asset appears to be nearing a breakout zone. The narrowing structure of the wedge, paired with a gradual increase in volume, is a promising setup that signals growing buyer accumulation and a potential shift in market sentiment.

The falling wedge is one of the most reliable bullish continuation and reversal patterns in technical analysis, especially when backed by solid volume, as we’re now observing with FISUSDT. Once the price decisively breaks above the wedge’s resistance line, momentum could accelerate rapidly, triggering a sharp move to the upside. Based on current market conditions and historical price behavior, a target of 240%–250% gain is not out of the question as FIS reclaims previous support levels turned resistance.

Increased investor interest in this project is another key factor to monitor. Social metrics and on-chain activity suggest renewed enthusiasm in the ecosystem, which often precedes strong price performance. Coupled with favorable technicals and a bullish overall structure, FISUSDT offers a compelling opportunity for traders and long-term investors looking for high-risk, high-reward setups.

As always, patience is crucial when trading patterns like the falling wedge. But with technicals aligning and volume confirming accumulation, FISUSDT may soon begin its breakout phase and enter a powerful uptrend.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

FISUSDT trade ideas

FISUSDT.P 15m – Bearish Rejection at Fib Zone | Short SetupPrice faced strong rejection at the 0.13280 high, forming a double top and now pulling back. Current move aligns with Fibonacci retracement zones, with price reacting near the 50–61.8% zone. MACD histogram is weakening, signaling bearish momentum.

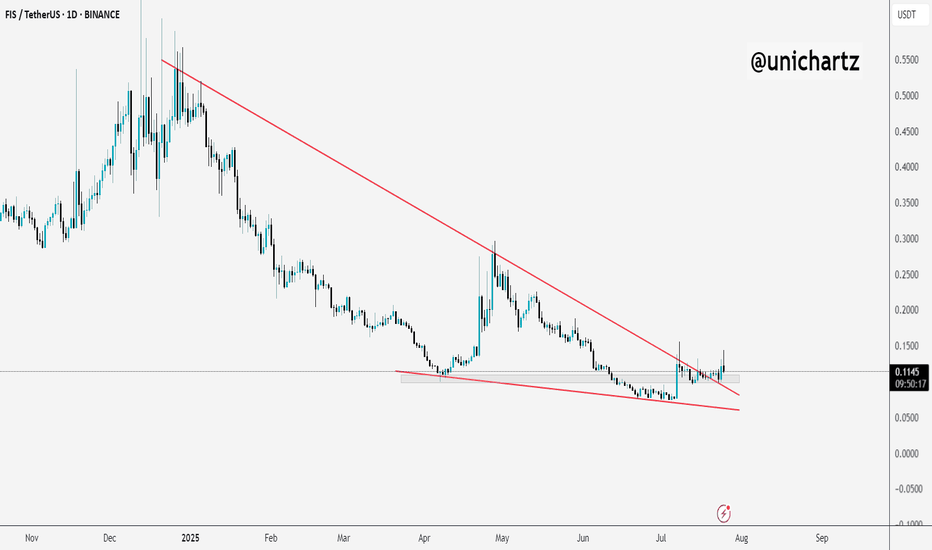

FIS Breaks Out of Falling Wedge – Reversal in Play?$FIS/USDT has finally broken out of a long-term falling wedge pattern, a structure that often signals reversal.

Price is now holding above the breakout zone, showing signs of strength.

As long as it stays above the wedge, we might see further upside in the coming days.

DYOR, NFA

FISUSDT Forming Bullish WaveFISUSDT is currently showing an interesting bullish setup, capturing the attention of crypto traders who are watching for fresh altcoin opportunities. The formation of a bullish wave pattern, supported by steady volume, suggests that FIS could be primed for a strong breakout in the near term. Technical analysts are forecasting a potential price surge of 40% to 50%+ if the bullish momentum sustains and key resistance levels are cleared with conviction.

The sentiment around FIS is improving as more investors recognize its utility and real-world use cases within decentralized finance and staking solutions. The network’s continuous development and strategic partnerships are adding to its long-term growth narrative. This has helped FIS build a loyal community and attract new capital inflows, which is crucial for maintaining positive price action.

From a technical perspective, traders should look for confirmation of this bullish wave pattern by tracking the breakout above trendline resistance and keeping an eye on volume spikes. If the breakout is supported by strong buying interest, the coin could deliver impressive returns in the coming weeks. The crypto market’s overall uptrend could further support this move, making FISUSDT one to watch closely for swing trading setups.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

FIS/USDT – Long-Term Outlook (4H Chart)FIS has broken out of a steep downtrend with a strong bullish candle and sharp RSI spike, showing early signs of a potential long-term trend reversal.

Key Observations:

Downtrend resistance broken with volume

RSI exploded above 80, showing strong momentum

Price is currently retracing to the breakout zone for a potential retest

Setup Plan:

Entry: On successful retest of the breakout trendline (~0.105–0.115 zone)

Stop Loss: Below 0.105 (invalidates the breakout)

Targets (Long-Term):

TP1: 0.121 (interim resistance)

TP2: 0.174

TP3: 0.219

TP4: 0.258

If price confirms the breakout and holds above the trendline support, a longer-term uptrend could follow. Patience is key — retest is critical.

DYOR. Not financial advice

#FIS #CryptoTrading #Breakout

FISUSDT Forming Bullish WaveFISUSDT is currently presenting an exciting opportunity for traders and investors who are tracking projects with strong breakout potential. The chart is showcasing a clear bullish wave pattern, a formation that often indicates an upcoming strong upward trend. This setup suggests that FIS could be gearing up for a significant move, and with the volume looking healthy, the momentum is likely to support this bullish scenario. Traders should closely watch key levels for a decisive breakout confirmation in the coming sessions.

What makes FISUSDT even more interesting is its fundamental backdrop. StaFi (FIS) is a well-known liquid staking protocol that continues to attract investors interested in maximizing yield while maintaining liquidity — a narrative that is regaining strength in the DeFi sector. As more market participants look for ways to unlock value from their staked assets, coins like FIS are well-positioned to benefit from renewed demand, which adds confidence to the projected 190% to 200% upside potential.

From a technical perspective, the recent higher lows and consistent wave structure show that buyers are stepping in at key support zones. A strong breakout above the current resistance area could trigger a new bullish impulse wave, accelerating gains and potentially drawing in fresh capital from traders seeking undervalued gems. Keeping an eye on daily closing candles and volume spikes will be key for confirming the breakout strength.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

FISUSDT UPDATE

Pattern: Falling Wedge Breakout

Current Price: \$0.0811

Target Price: \$0.1416

Target % Gain: 75.47%

Technical Analysis: FIS has broken out of a falling wedge pattern on the 12H chart, with a strong bullish candle and increasing volume indicating a potential trend reversal. A breakout confirmation suggests momentum toward the projected upside.

Time Frame: 12H

FISUSDT Forming Falling WedgeFISUSDT is currently displaying a classic falling wedge pattern, which is widely regarded as one of the most reliable bullish reversal signals in technical analysis. This pattern suggests that sellers are gradually losing their grip, while buying pressure is steadily building up inside this narrowing range. With volume starting to align positively with this structure, the setup is gaining momentum for a potential breakout that could yield an impressive 190% to 200%+ upside move if confirmed.

StaFi (FIS) is an innovative project that focuses on unlocking liquidity for staked assets — an area gaining increasing traction within the DeFi ecosystem. As investors look for opportunities to maximize yield without compromising on network security, interest in projects like StaFi is expected to grow. This increasing attention could act as a strong fundamental catalyst, complementing the promising technical setup and fueling sustained buying interest in FISUSDT.

For traders watching this pair, it’s crucial to monitor the breakout zone above the descending trendline. A decisive close above this resistance, backed by strong volume, could trigger a significant rally towards key psychological price levels. Historically, falling wedge breakouts can deliver explosive moves as sidelined investors jump in to catch the momentum. This makes FISUSDT a compelling chart for both swing traders and position traders seeking high-risk, high-reward opportunities.

Keep an eye on the broader crypto market sentiment as well, since a supportive macro trend can further amplify this breakout. With the perfect blend of technical strength, solid fundamentals, and growing investor interest, FISUSDT could be set to surprise many market participants with its next major move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$FIS Falling Wedge Reversal Setup:

FIS is trading inside a falling wedge — a bullish reversal pattern. Current price action near the lower trendline indicates potential for a breakout to the upside.

🔸 Upside Target: 0.2500 – 0.3000

If the price breaks above the wedge (~0.1650), a move toward 0.20 and higher targets is likely, with 0.25 and 0.30 as key resistance zones.

🔸 Risk Level at 0.1380:

A breakdown below this level would invalidate the bullish setup and suggest further downside.

🔸 Outlook:

Monitor closely for a breakout above the wedge resistance. Consider entry on breakout or near support with tight stop loss.

FIS/USDT Long Signal – Breakout Setup✅ Entry: 0.2437 USDT

🎯 Targets:

First Target: 0.2600 USDT

Second Target: 0.2750 USDT

Third Target: 0.2850 USDT

❌ Stop Loss: 0.2291 USDT

🧠 Analysis Explanation:

The price is consolidating within a symmetrical triangle and currently testing the breakout zone near dynamic support.

An upward breakout could trigger a strong bullish move, in line with the ascending trendline support.

RSI is recovering from oversold levels, indicating potential momentum shift.

The setup offers a favorable risk/reward ratio, with the stop loss just below key support.

⚡️ Note: Wait for confirmation of breakout before entry. Use appropriate risk management based on your trading plan.

Stafi Long-Term PREMIUM Full Trade-Numbers (PP: 2063%)Stafi is now trading at bottom prices after hitting a new All-Time Low and this is a great place to enter. This is the perfect chart setup for spot traders.

Here I will share the full trade-numbers for this pair, FISUSDT, and share some of the chart technicals with you that reveal the upcoming change of trend.

Let us start with how to predict a bottom based on the chart structure and the candles.

Notice the "bearish wave" on the left side of the chart. Notice the size of the wave, the length, strength and duration. A "bear market." Simply a long-term correction.

Now, notice the "bottom wave" on the right side of the chart (orange). Notice the size, the length and duration. It is very steep. It goes very fast and it is small thus short-lived.

» The first one is a market phase/cycle while the second one is a market reaction.

» The first one led to a sideways market while the second one will lead to a change of trend.

There are two sets of numbers. Here I am only using one for the trade below but I would still like to explain this method that I use in case you want to learn to do your own numbers by looking at charts.

The first set of numbers uses the All-Time High and the bear market bottom. In this case this would be the peak price 01-March 2021 and the low set 09-May 2022. The low is the zero and the peak the one using the Fibonacci extension tool. The 1.618 is the standard ATH projection. If you are feeling confident, the market is producing strong higher lows, the pair is good, there is strong volume, etc. You can also consider the 2.618 level which is not shown on this chart. Of course, if you move the chart up a little bit you can easily see it.

The second set uses the current market bottom, in this case the low 7-April 2025 and the previous high, 09-Dec 2024. This will give you a set of numbers that you can use to extract also some short-term targets. The first set would only have long-term targets.

When a trading pair produces new All-Time Lows we say that a new All-Time High is not likely but this isn't necessarily true, this is a technical assumption. The truth is that anything is possible and not even the insiders and exchanges who control the bots that control the price of a chart know how far up a pair can really go. When the euphoria phase of a bull market starts it is hard to maintain control.

A bullish wave can be neutralized with massive selling pressure. This is done all of the time. If any trading pair starts to grow organically for whatever reason on any exchange, the bots owned by the exchange immediately start selling and balance thing out, they just don't like things moving in ways that they do not control.

Anyway, let's continue; Full trade-numbers below:

_____

FISUSDT (PP: 2063%)

CURRENT PRICE: $0.1263

ENTRY:

1) $0.1420

2) $0.1150

3) $0.0999

TARGETS:

TP1: $0.1852

TP2: $0.2361

TP3: $0.3206

TP4: $0.3889

TP5: $0.4571

TP6: $0.5543

TP7: $0.6781

TP8: $0.8888

TP9: $1.0356

TP10: $1.2566

TP11: $1.4140

TP12: $1.6141

TP13: $2.1926

TP14: $2.7711

STOP: Close monthly below $0.0990

_____

No stop-loss. When trading spot you should be ready to wait for years. That's the mindset. If you are not ready to wait for years, well, you can do whatever you want of course but with this mindset you can never go wrong. There are many ways to approach a trading pair but sometimes we are ready to wait 3 months for a bullish wave and yet it takes 6 months for the wave to develop. Next time we are ready to wait 6 months to see prices go up but the wave starts in 12 months and so on. So always be ready to wait 4-5 times longer than what you initially think is the necessary time for the market to change course. Never place a stop-loss in an exchange because that is just bad for the market, the bots will sell just to active your stop.

Stop-loss orders should be avoided at all cost if you are a beginner or a spot trader. Simply buy and hold.

You can use a stop-loss trading short-term and in many different systems but I am talking about reality here, it is not the same.

Never close a trade out of a whim. Either you do it or yo don't. Either you plan or you don't trade.

If you plan you will be successful and you will achieve success. If you don't plan, you can make money but you will be gambling and this gambling will end up in negative results in the long-term. So, if you are not ready to plan/prepare then just wait, the market is not going away. When you are ready, enter with a plan and you will win for sure.

The plan is easy, what to do when the market moves in a certain way. If it rises, will I sell or hold? If it drops, will I sell or hold? If you decide the answer is to hold then, for how long? If you decide the answer is to sell, how much? Just prepare for all scenarios. You don't have to do anything really other than buy low (now) and sell high (later), but doing the mental exercise will save you from stupid mistakes when excitement (or anxiety) grows.

Just practice.

Success is yours.

Thanks a lot for your continued support.

If you enjoy the content, just follow.

Namaste.

FISUSDT (Do OR Die Condition)If you are really interested in buying this coin and also want to add a stoploss, just buy if its closing daily candles above 0.22 and sell if closes daily candles below 0.22 and so on, if closing above wait for the targets and if closing below sell, and wait for again reclaim 0.22 and buy again

StaFi is the first DeFi protocol unlocking liquidity of staked assets. Users can stake PoS tokens through StaFi and receive rTokens in return, which are available for trading, while still earning staking rewards.

FIS - Triple Bottom Formation with Massive Targets |1H- 1W VIEWTECHNICAL ANALYSIS: 🎯

Pattern Structure:

- Price: $0.4667 (-2.24%)

- Timeframe: Weekly (1W)

- Clear triple bottom formation (2022-2024)

- Strong horizontal support: $0.42

Major Price Targets:

TP1: $1.2867 (344.08% potential)

TP2: $2.3459 (501.44% potential)

Technical Insights:

- Triple bottom pattern confirmed with three tests of $0.42 support

- Multiple touches of resistance at $0.90-1.00 zone

- Clear bullish divergence on weekly timeframe

- Moving averages showing potential golden cross setup

THIS 1H CHART VIEW

Key Levels:

▪️ Major Support: $0.42 (Must Hold)

▪️ Immediate Resistance: $0.90

▪️ Breakout Level: $1.00

Risk Management:

- Entry Zone: $0.45-0.48

- Stop Loss: Below $0.40 (Weekly close)

- Risk:Reward ratio

• To TP1: 1:15

• To TP2: 1:25

Timeframe: Weekly

Bias: Strong Bullish on Break

Pattern: Triple Bottom / Accumulation

Note: Such high targets require patience and proper position sizing. This is a long-term setup. Not financial advice.

#FIS #Crypto #TechnicalAnalysis #Binance

Key Observation: Pattern suggests massive accumulation phase since 2022, with potential for significant upside movement on volume confirmation.

Get Ready to BUY SPOT FISUSDT on D1 Cycle

🌟 Capture the Momentum with FISUSDT! 🌟

🌍 Market Overview:

FISUSDT is showing strong bullish potential on the D1 timeframe, offering a great opportunity to capitalize on its momentum.

📊 Trade Plan:

📌 Entry: $0.45 - $0.51 – Ideal accumulation range before the breakout.

🎯 Target: x1.5 – Aiming for a 50% profit gain in the short term.

⏳ Hold Time: 1-2 weeks – Strategic short-term hold aligned with the D1 cycle.

🔍 Strategy Insights:

My custom tool RainBow MG3 highlights a high probability of upward movement.

Market trends suggest a strong setup with favorable risk-to-reward ratios.

🚀 Next Steps:

💬 Reach out if you need further support or detailed strategies!

💡 Note: This is not financial advice. Always DYOR before trading.

🔥 FISUSDT is primed for an exciting move – Are you ready to take action? 🔥

FISUSDT Is With Good VolumeFIS is a cryptocurrency token that powers StaFi, a protocol for trading staked assets as derivatives. StaFi operates on the Ethereum platform and uses a DAO structure to decentralize control and distribute security responsibility across multiple stakeholders

Currently buyers are Taking interest in this Strong Project. Expecting 200 % + Gain in this Move.

Overall Market is taking breath but FIS is still getting good volume.

FISUSDT: This Key Metric Could Define the Future - Stafi◳◱ On the BINANCE:FISUSDT chart, the Bband Breakout Super-Trend pattern suggests an upcoming trend shift. Traders might observe resistance around 0.4346 | 0.4671 | 0.5427 and support near 0.359 | 0.3159 | 0.2403. Entering trades at 0.5039 could be strategic, aiming for the next resistance level.

◰◲ General Information :

▣ Name: Stafi

▣ Rank: 714

▣ Exchanges: Binance, Huobipro, Gateio, Mexc

▣ Category / Sector: Financial - Derivatives

▣ Overview: None

◰◲ Technical Metrics :

▣ Current Price: 0.5039 ₮

▣ 24H Volume: 1,992,676.241 ₮

▣ 24H Change: 5.463%

▣ Weekly Change: 24.00%%

▣ Monthly Change: 53.27%%

▣ Quarterly Change: 69.61%%

◲◰ Pivot Points :

▣ Resistance Level: 0.4346 | 0.4671 | 0.5427

▣ Support Level: 0.359 | 0.3159 | 0.2403

◱◳ Indicator Recommendations :

▣ Oscillators: BUY

▣ Moving Averages: STRONG_BUY

◰◲ Summary of Technical Indicators : STRONG_BUY

◲◰ Sharpe Ratios :

▣ Last 30 Days: 4.56

▣ Last 90 Days: 2.55

▣ Last Year: 0.73

▣ Last 3 Years: 0.25

◲◰ Volatility Analysis :

▣ Last 30 Days: 1.16

▣ Last 90 Days: 0.88

▣ Last Year: 1.15

▣ Last 3 Years: 1.20

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:FISUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

#FIS: Unlocking Decentralized Financial ServicesDescription:

This trading idea focuses on FIS (Stafi), a decentralized finance (DeFi) protocol designed to unlock liquidity for staked assets. By utilizing its unique rToken system, FIS allows users to stake their digital assets and receive tradable tokens in return, enabling liquidity without sacrificing staking rewards. This innovation positions FIS as a pivotal player in the DeFi space, addressing a critical limitation in traditional staking. With the growing adoption of staking in blockchain ecosystems, FIS has significant potential to attract users seeking flexible and liquid staking solutions.

It’s important to note that the cryptocurrency market is highly volatile and influenced by various factors such as regulatory changes, technological advancements, and market sentiment. As a result, trading or investing in FIS involves substantial risks and requires proper risk management strategies.

Disclaimer:

This trading idea is provided for educational purposes only and does not constitute financial advice. Trading cryptocurrencies like FIS carries significant risk, including the potential for total capital loss. Always perform thorough research, assess your financial circumstances, and consult a professional financial advisor before making investment decisions. Past performance is not indicative of future results.

FISUSDT Long IdeaFIS has retraced the liquidity left behind with the huge 4hr candle from Monday's trading. It has so far seen $34.2m in USDT volume in the last 24hrs, so there's liquidity activity on the pair. No fair value gap was left at the base, showing the intent of the market maker to keep price action as neat as possible. Price nestled on the 4hr 50ema and has bounced. An entry on the retest, to go fill the 50% of the 4hr wick at the top, would return a decent 10.5RR with invalidation below 4%.