About US 100 Cash CFD

The NASDAQ-100 is an index that is constituted by 100 of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world only after the New York Stock Exchange by market capitalization. The companies that are listed in this index range from a variety of industries like Technology, Telecommunications, Biotechnology, Media, and Services. The NASDAQ-100 was first calculated in January 31 of 1985 by NASDAQ and it is a modified capitalization-weighted index. This index has been of good reference to investors that want to know how the stock market is performing without financial services companies, this given that the index excludes financial companies.

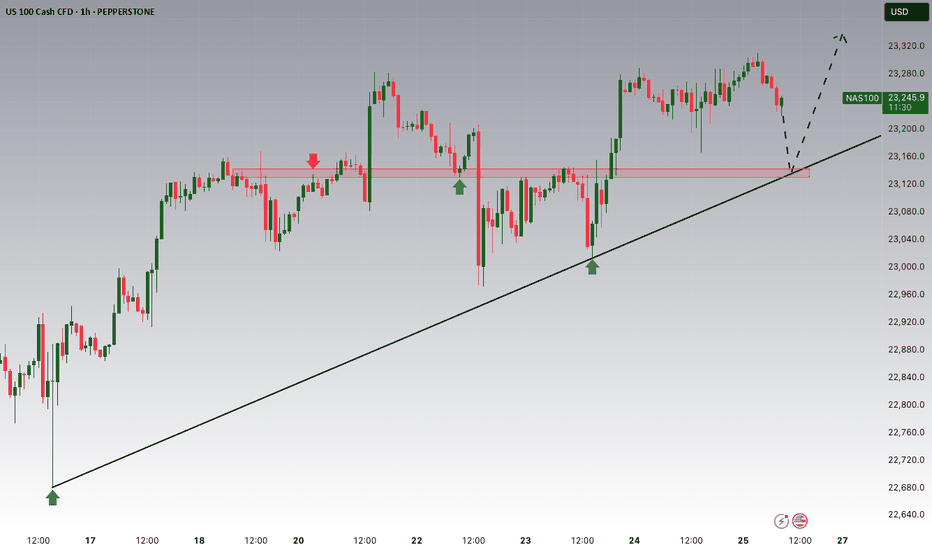

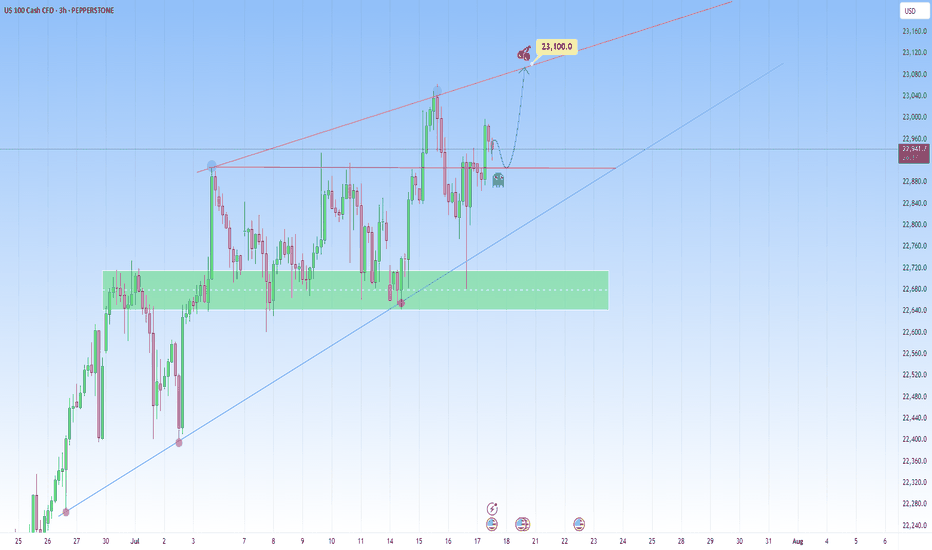

NAS100 steadies at high levels, pay attention nextThe most recent move on NAS100 saw a sharp drop that briefly recovered, likely triggering stops before aggressively reversing from the lower boundary of the newly projected channel. This isn't a cause for concern, on the contrary, it's another opportunity to get involved.

That is because this drop a

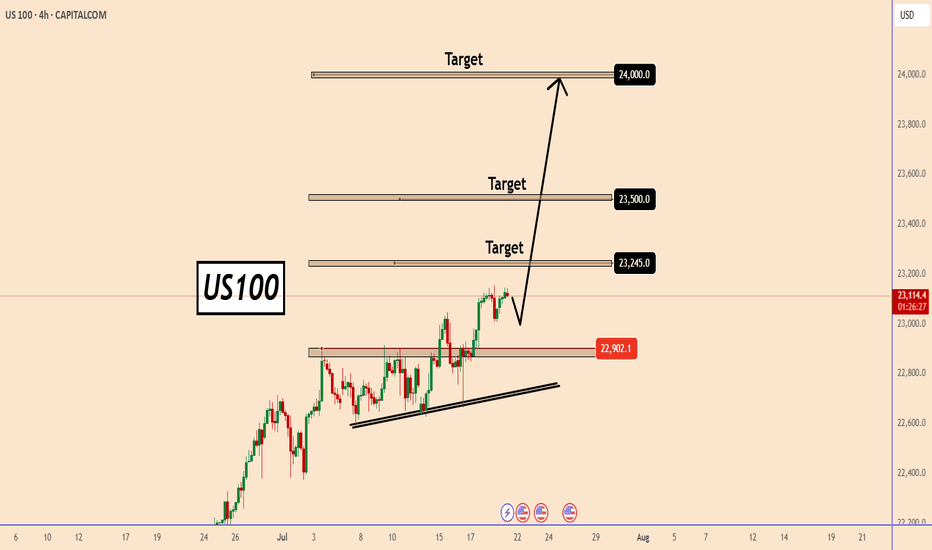

US100 continues to be in a clear uptrend.US100 continues to be in a clear uptrend.

After the price managed to break above 22900, we can see a strong bullish price action. The price increased by almost 2% in just 3 days and the volume still looks high.

There is a high possibility that even if US100 makes a small correction, it could rise

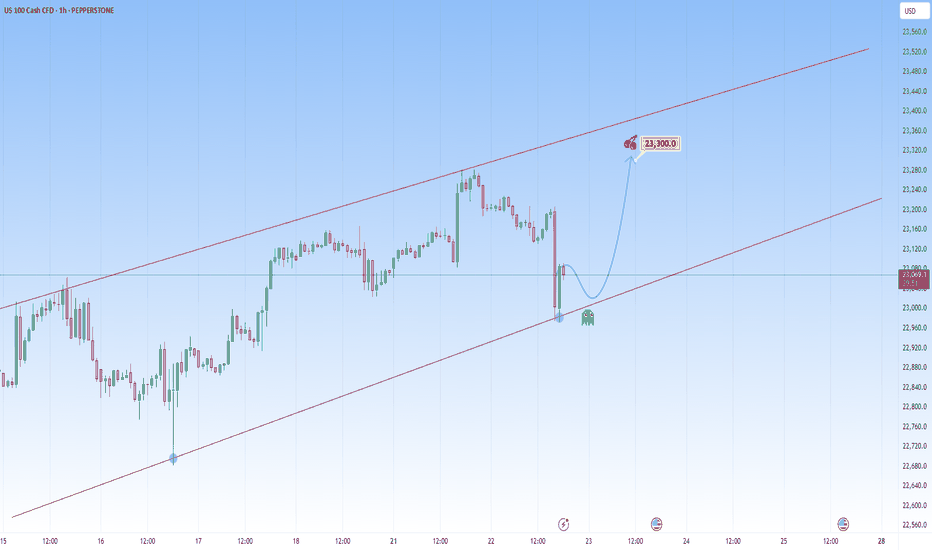

NASDAQ INDEX (US100): Another Gap For Today?I anticipate another gap up opening on the 📉US100 Index, which I believe will be filled today.

The formation of an intraday bearish change of character(CHOCH) on the hourly chart

This indicates a strong likelihood of continued bearish movement, with a target of 23319.

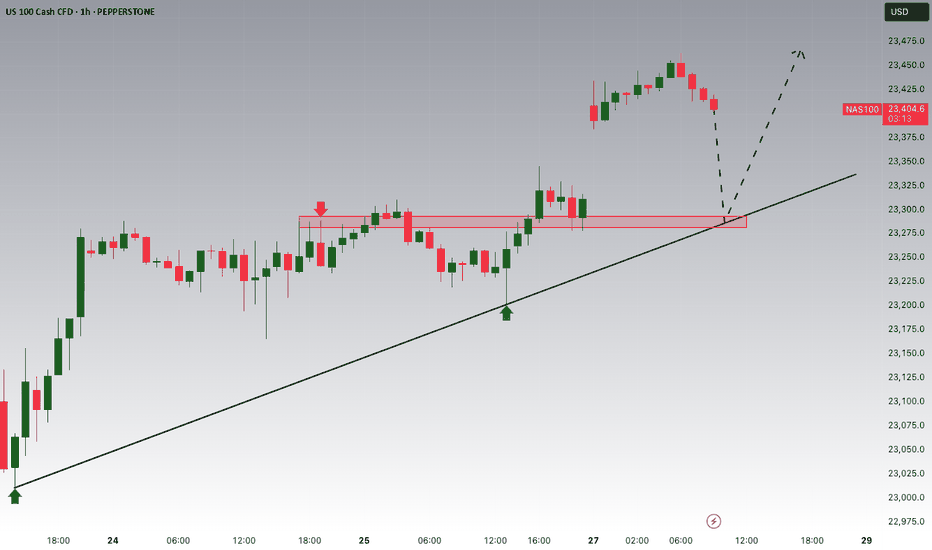

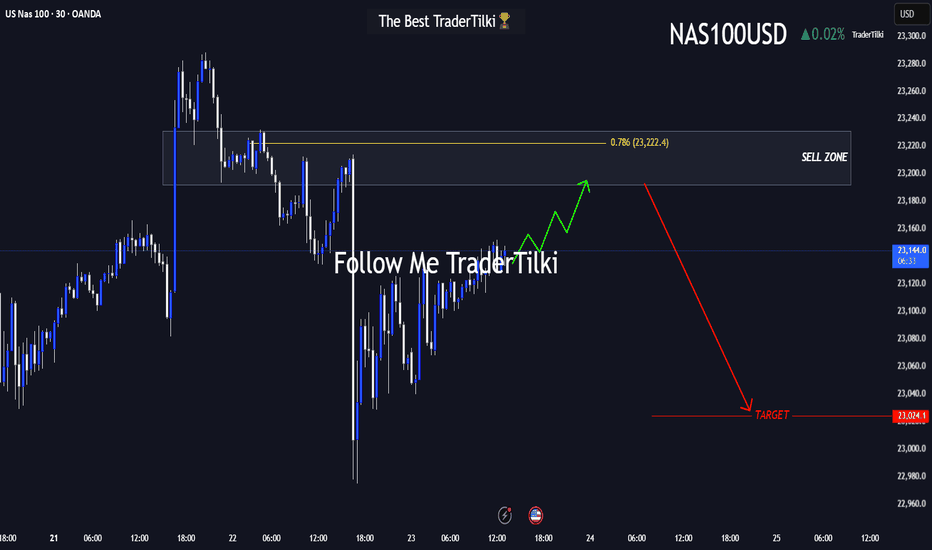

The US100-Nasdaq Playbook: Prime Sell Zone Approaching!Hey friends 👋

I’ve prepared a fresh US100-NASDAQ analysis for you all. Nothing makes me happier than seeing us grow and profit together.

📌 Once price reaches the 23,192 – 23,231 zone, I plan to enter a **Sell** trade from that area.

🔐 Feel free to set your stop-loss based on your personal margin

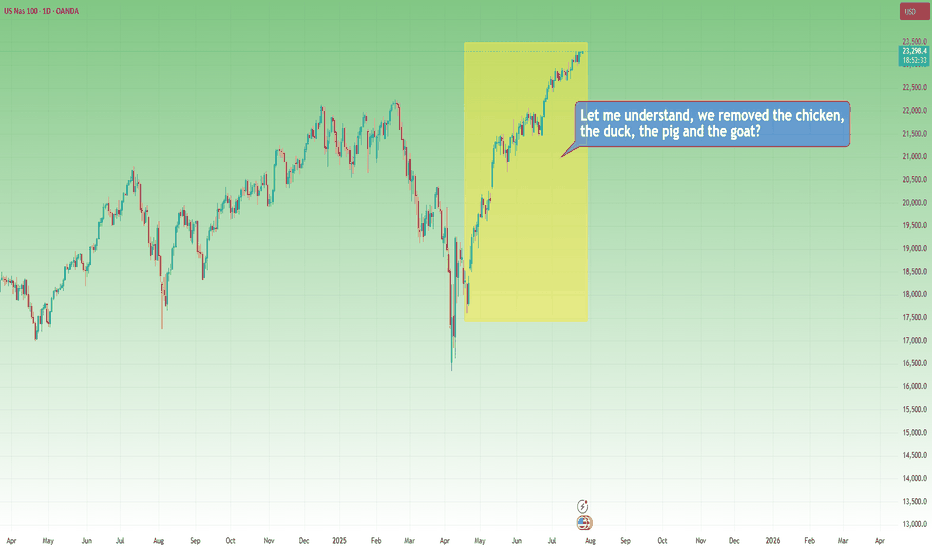

The Markets, the Rabbi and the Goat...It’s funny how sometimes markets react like people in old jokes…

They scream when things get bad, then cheer wildly when things return to how they were — as if something amazing just happened.

Let me tell you one of those jokes.

It’s about a house, a rabbi… and a goat.

A man goes to the Rabbi:

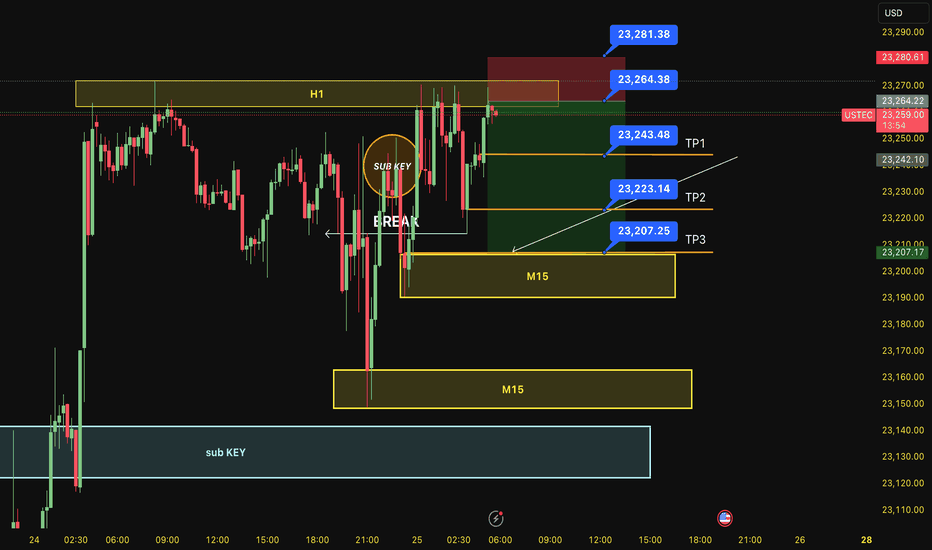

SELL USTEC 25.7.2025Reversal trade order: SELL at H1~M15 (all-time high - ATH)

Type of entry: Limit order

Reason:

- The price breakout the sub key of M15, confirming it will hit the main key M15.

- There is a key H1 support at the entry point.

Note:

- Management of money carefully at the price of bottom of M15 (23,343)

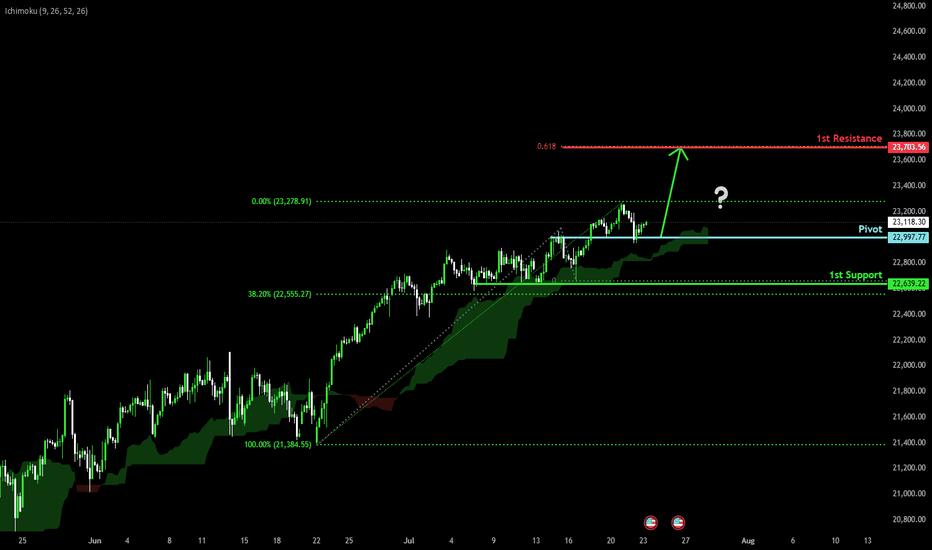

Bullish continuation?USTEC has bounced off the pivot, which has been identified as an overlap support, and could rise to the 1st resistance.

Pivot: 22,997.77

1st Support: 22,639.22

1st Resistance: 23,703.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade wi

NAS100 Bigger Picture. Uptrend to be resumedLooking at the current structure through the lens of a trend trading approach, what we saw on NAS100 is more than a simple price bounce, it’s a trend continuation trading within a high-volatility environment. As price is approaching a key resistance level, how price is behaving around this dynamic t

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.