NL25 trade ideas

AEX: collect the troops for an outbreakHello everyone,

We start the year with a sideways movement (see rectangle) this is a continuation pattern, it is waiting for an outbreak.

The MA20 was able to compensate for the decline yesterday, see that the bottom of the rising trend channel roughly coincides with the MA50. This is an important support, if it breaks, a correction will follow.

The signals are still green with an expectation that an outbreak will emerge.

Regards,

TT

AEX : long term view (MA50 RULES)Hello everybody,

I'm going to start the new year and decade with a long-term analysis based on the monthly chart. What is striking is that in the years 2000 - 2010 there was always a crash after a breakthrough of the MA50. (2001 - 2008) See that in 2010 - 2020 the MA50 offered support twice and a crash (2016 and 2018) has been subtly avoided.

What does 2020 -2030 bring? In the first place a continuation of the long-term upward movement since 2009 within a trend channel the top is currently around 640. Recently there has been a reversed SHS pattern abyss with a course target of around 680 but since space is limited upwards, I do not expect this goal until the end of this year / next year.

The MA50 (currently 520) is particularly important at the bottom, see that it has been flush with the bottom of the channel for several years. It may be clear if this can no longer offer support, a following crash will take place!

It will be an exciting time, good luck all!

Regards,

TT

Warning! AEX shows topping formation Hi everyone,

Today I want to warn you that the AEX-index shows double top formation.

At first, AEX looked quite strong: breaking out of the rising wedge, but now it broke back into the wedge and formed a bearish formation.

Trade safe and take some profits I would say.

AEX : gradually coming to an end: cheers!Hello everybody,

The year is slowly coming to an end, see that after the successful back test of the bottom of the channel we are now back at the top, there is still a small space to reach the 618/620 zone. At the bottom there are 600 and 595 support points, it is important that the trend channel remains intact in the coming weeks so there is no short signal. I wish you all a Merry Christmas and a Happy New Year. Hopefully you will appreciate my analysis and you will continue to follow me in 2020! Thnx

Regards,

TT

AEX : ready to rally Hello everybody,

The index has done a successful back test in zone 585 in recent days, see also that the MA50 (purple line) has provided the necessary support, and the upward trend channel. At the top there is now more room towards 610, a start for a nice end-of-the-year rally.

Regards,

TT

AEX : Who catches the bull ? 605Hello everybody,

Following the outbreak of 5 November, consolidation is currently underway with a narrow range of 5 points between 595 and 600 (see green horizontal lines). The maximum is 605 for the short term. The blue resistance line is provisionally a game breaker for a big move up. The RSI is also lagging behind course. A retest of the 586 outbreak would be a healthy development. The credo therefore remains buy the dips!

Regards ,

TT

AEX : bulls jump over the fence Hello everybody,

It finally happened, a breakthrough by the long-term resistance at 586. The intention now is to stay above it;). First resistance is now around 591 then psychological 600 see also blue previous resistance line in the graph. If the lock can close well above 586 on a weekly basis, a long-term reverse SHS pattern has been completed. We shall see ....

Regards,

TT

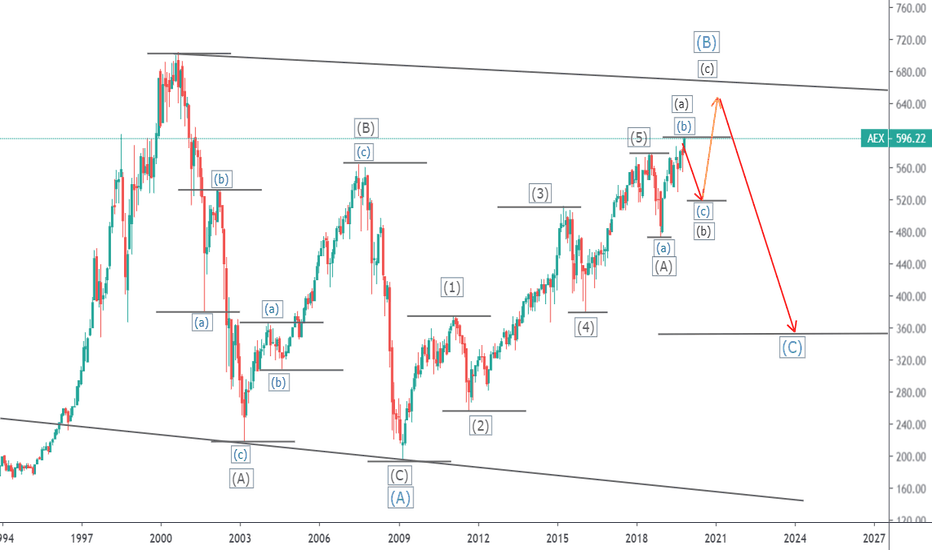

AEX - gloomy European equityFor me, a fundamental problem with Elliott Wave is that in my case my mood can shape my count. Gloomy mood equals bearish count, cheerful mood equals bullish count. This count suggests a top in Dutch equities with a decent correction to follow. I am expecting to be wrong........but you never know.