Dow Jones: Explosive US30 Trade Setup – Entry,Trap & Exit Mapped💎 Dow Jones Robbery Blueprint: The US30 Vault Crack Plan 💎

(Maximized for reach — within TradingView title limit)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Robbers & Money Movers 🕵️♂️💰🚨

This ain't your average analysis — it’s a Thief Trader-style 🔥tactical mission🔥 aimed at the mighty "US30/DJI" (Dow Jones Industrial Average). We're talkin' about a precision heist with a full blueprint: entry zones, trap setups, and escape exits. Read carefully — this ain’t for the faint-hearted traders! 🧠🦾

🧠 Entry Zones (The Break-In) 📈

🛠 ENTRY 1: Candle wick near 44200.0 – that’s the resistance gate. Wait for confirmation.

🎯 ENTRY 2: Sneak in at the Market Makers’ Trap around 43200.00 – a dirty zone where retailers get baited. Perfect time to strike long!

🧱 DCA/Layering strategy recommended. Stack those buy orders like a thief layering explosives on a safe. 💣💸

🛑 Risk Levels (Escape Routes/Stop Loss)

🔊 "Listen up, vault raiders! Never drop your SL until breakout is confirmed. If you jump early, you might land in a bear trap! 🪤"

🔐 Stop Zones (Based on Strategy):

🔐 Max Risk SL (5H TF): If you're deep, your last stand is at 43000.0

☝️ SL depends on your position sizing, number of entries, and risk appetite. Trade like a thief, not a gambler.

🎯 Heist Target (Profit Exit)

🏁 Escape Point: 46000.0 — or exit before heat rises! Don’t be greedy. Rob and vanish. 💨💰

🔥 Market Mood: Why the Heist Is On

"US30/DJI" is bullish AF — thanks to:

📊 Macro-Economic Wind at Our Back

📈 Institutional momentum

📰 Strong sentiment and intermarket flows

Check your chart radar: Fundamentals + technicals aligning = green light for robbery! 🟢

⚠️ Tactical Reminder: News Can Jam the Plan

📵 Avoid new entries during major economic releases

🛡 Use trailing SLs to protect running trades

Stay alert, stay alive. 💡

❤️ Support the Robbery Crew

Hit that 💥BOOST💥 — your love fuels our next mission.

Join us and ride daily heist plans with Thief Trading Style 🏴☠️🚀💰

US30 trade ideas

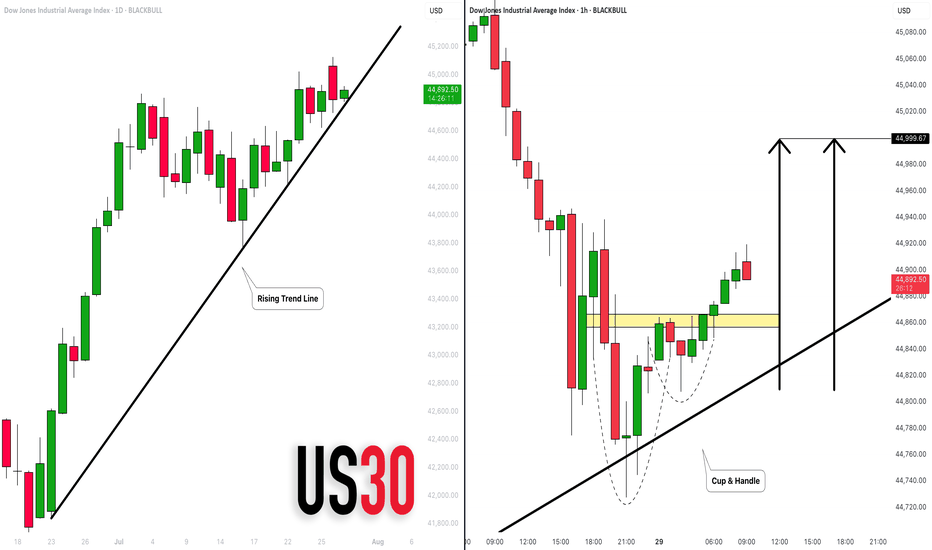

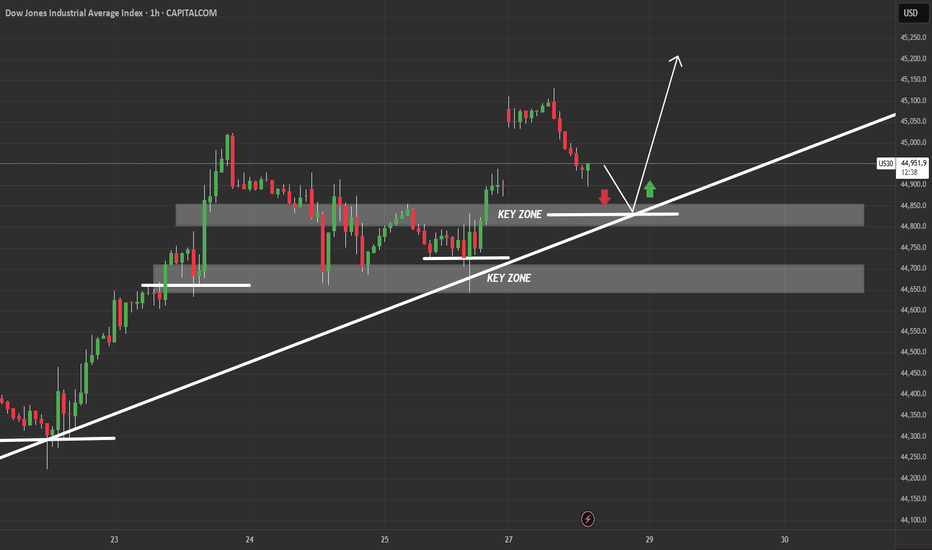

DOW JONES INDEX (US30): Bullish Move From Trend Line

There is a high probability that US30 will continue rising today,

following a test of a solid rising trend line on a daily.

As a confirmation, I see a cup & handle on that after its test

on an hourly time frame.

Goal - 45000

❤️Please, support my work with like, thank you!❤️

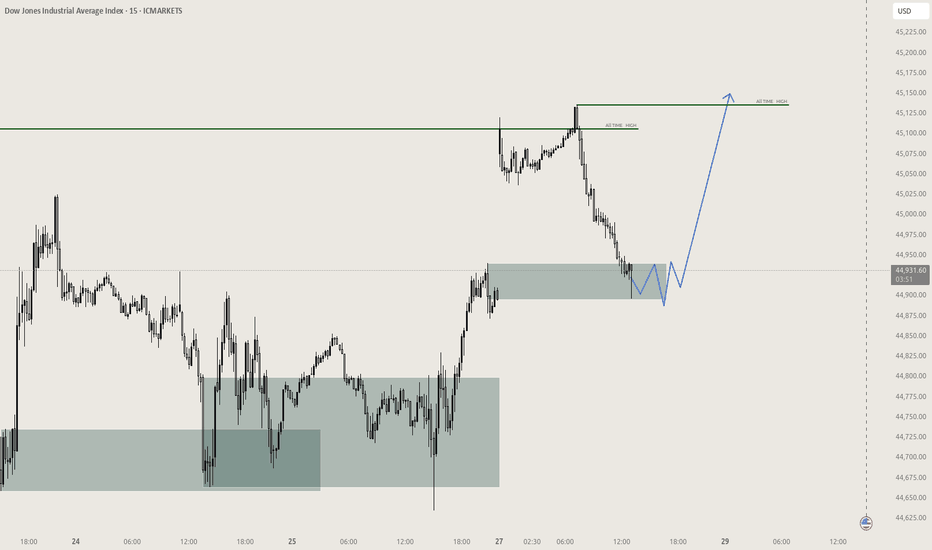

Safe Entry DJIObvious Movement I Guess.

P.High(Previous High) Act As good Support for price to Respect.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

Will the Dow Jones continue its correction?

Hi everyone

The indicator may continue to correct itself by breaking the condition written in the figure (with an orange line). There is a blue box on the figure that shows the place where orders are collected. It is possible that buy orders will be placed in this area and then the downward trend will begin.

What percentage of the probability do you think there is of reaching the specified targets?

Be sure to follow me because you can make good profits from the market.

US30 H4 IdeaThe Federal Reserve meets next week and is widely expected to leave rates unchanged at 4.25%–4.50%. Still, market participants will watch for commentary on inflation and rate-cut prospects, especially after recent criticism of Fed Chair Powell by President Trump.

What Should Traders Watch?

With the major indexes on track for weekly gains, next week’s developments could test the market’s resilience.

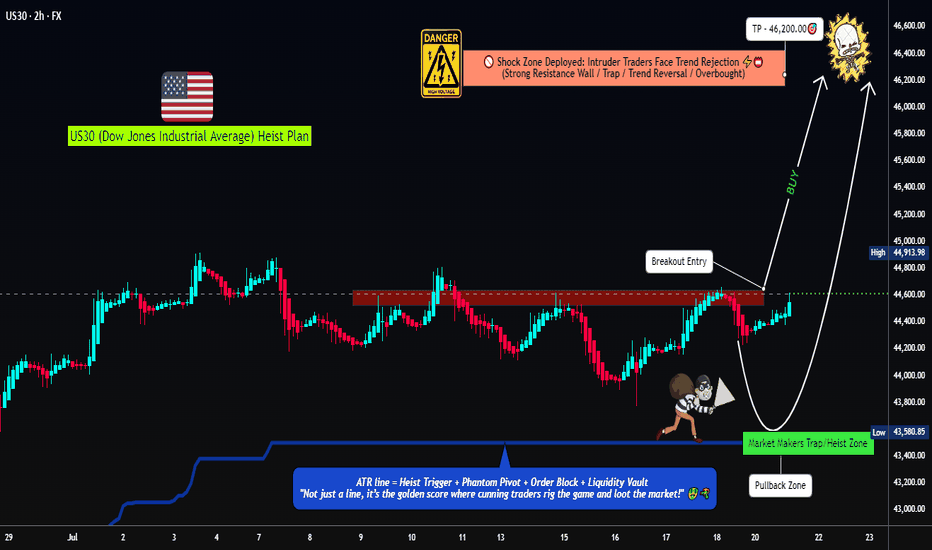

US30 Robbery Blueprint: Breakout, Pullback, Escape Setup💎 Dow Jones Robbery Blueprint: The US30 Vault Crack Plan 💎

(Maximized for reach — within TradingView title limit)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Robbers & Money Movers 🕵️♂️💰🚨

This ain't your average analysis — it’s a Thief Trader-style 🔥tactical mission🔥 aimed at the mighty "US30/DJI" (Dow Jones Industrial Average). We're talkin' about a precision heist with a full blueprint: entry zones, trap setups, and escape exits. Read carefully — this ain’t for the faint-hearted traders! 🧠🦾

🧠 Entry Zones (The Break-In) 📈

🛠 ENTRY 1: Crack the wall near 44700.00 – that’s the resistance gate. Wait for confirmation.

🎯 ENTRY 2: Sneak in at the Market Makers’ Trap around 43500.00 – a dirty zone where retailers get baited. Perfect time to strike long!

🧱 DCA/Layering strategy recommended. Stack those buy orders like a thief layering explosives on a safe. 💣💸

🛑 Risk Levels (Escape Routes/Stop Loss)

🔊 "Listen up, vault raiders! Never drop your SL until breakout is confirmed. If you jump early, you might land in a bear trap! 🪤"

🔐 Stop Zones (Based on Strategy):

📌 Swing Buy SL (2H TF): Place at 44100.00 for the stealth buy.

🏦 Institutional SL (Swing Zone): Drop it around 43000.00

🔐 Max Risk SL (3H TF): If you're deep, your last stand is at 39200.00

☝️ SL depends on your position sizing, number of entries, and risk appetite. Trade like a thief, not a gambler.

🎯 Heist Target (Profit Exit)

🏁 Escape Point: 46200.00 — or exit before heat rises! Don’t be greedy. Rob and vanish. 💨💰

🔥 Market Mood: Why the Heist Is On

"US30/DJI" is bullish AF — thanks to:

📊 Macro-Economic Wind at Our Back

📈 Institutional momentum

📰 Strong sentiment and intermarket flows

Check your chart radar: Fundamentals + technicals aligning = green light for robbery! 🟢

⚠️ Tactical Reminder: News Can Jam the Plan

📵 Avoid new entries during major economic releases

🛡 Use trailing SLs to protect running trades

Stay alert, stay alive. 💡

❤️ Support the Robbery Crew

Hit that 💥BOOST💥 — your love fuels our next mission.

Join us and ride daily heist plans with Thief Trading Style 🏴☠️🚀💰

Potential bearish drop?Dow Jones (DJ30) has reacted off the resistance level which is an overlap resitance and could drop from this levle ot our takeprofit.

Entry: 44,643.47

Why we like it:

There is an overlap resistance levle.

Stop loss: 45,133.50

Why we like it:

There is a swing high resistance.

Take profit: 43,954.50

Why we like it:

There is a multi swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

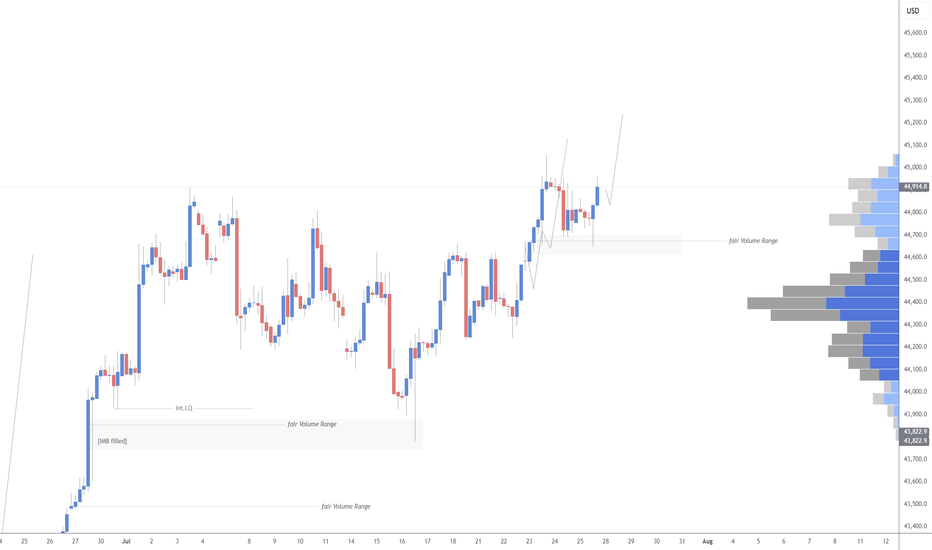

Dow Jones US30 Trend Analysis and Trade Plan Breakdown📈 US30 (Dow Jones) is currently in a strong bullish trend 🔥. This is clearly visible on the 4H chart, where we’re seeing a consistent pattern of higher highs and higher lows 🔼🔼.

👀 I’m watching for a potential long opportunity, especially since the higher timeframes remain firmly bullish 🟢.

🎥 In the video, we break it down:

A quick overview of the 4-hour structure

Then dive into a potential trade setup on the 30-minute chart ⏱️🔍

🧠 This is for educational purposes only and not financial advice ⚠️📚

Long Position on Dow Jones Industrial Average

Initiating a long position at 44,456, supported by robust economic data and stronger-than-expected corporate earnings. These indicators point to continued resilience in the U.S. economy, potentially allowing the Federal Reserve to consider rate cuts sooner than previously anticipated — a positive catalyst for equities.

📌 Entry: 44,456

🛑 Stop Loss: 44,207

🎯 Take Profit: 44,900

Monitoring price action closely as market sentiment continues to shift in response to macroeconomic developments.

DowJones breakout retest supported at 44390Key Support and Resistance Levels

Resistance Level 1: 45197

Resistance Level 2: 45500

Resistance Level 3: 46000

Support Level 1: 44390

Support Level 2: 43900

Support Level 3: 43590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30 Technical Breakdown – 07/31/2025📍 US30 Technical Breakdown – 07/31/2025

US30 is currently trading at 44,624, showing signs of weakness after failing to hold gains near 45,100. The index has broken down from its recent consolidation range and is hovering just above mid-range support at 44,600.

Momentum has shifted slightly bearish, and price action remains choppy within the broader 44,700–45,000 range. Bulls must defend the 44,600 level to avoid a deeper move into the demand zone below.

📊 Current Market Behavior:

🔄 Choppy consolidation near the lower end of the range

📉 Repeated rejection at 45,100

🧱 Support currently holding around 44,600

⚠️ Downside pressure increasing – caution warranted

📌 Key Levels:

🔹 Resistance Zones:

44,745–44,800 → Immediate intraday ceiling

45,000 → Psychological resistance

45,100 → Previous swing high / heavy rejection area

🔹 Support Zones:

44,600 → Immediate support (currently testing)

44,326 → Strong historical support

44,171–43,929 → Broader demand zone

🧠 Bias:

🔽 Slightly Bearish Intraday

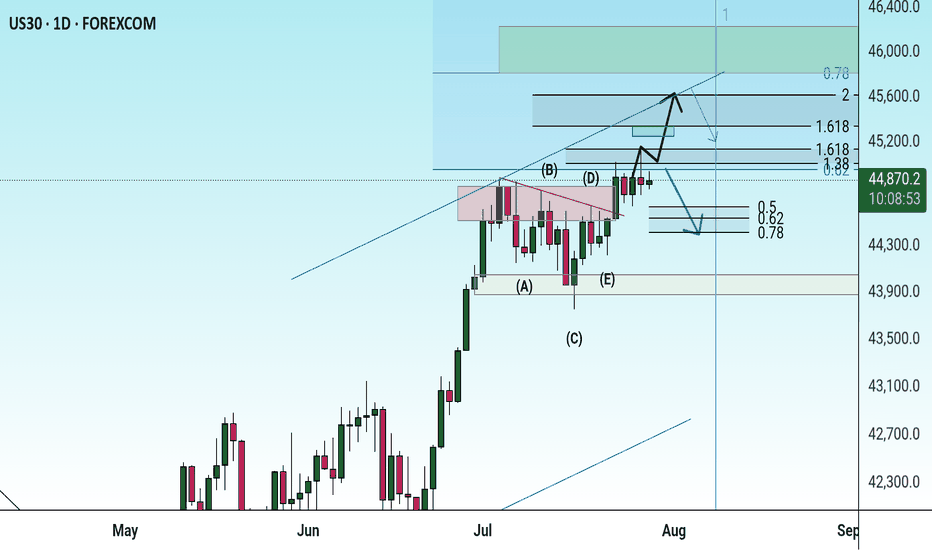

Dow Jones Wave Analysis – 29 July 2025

- Dow Jones reversed from the long-term resistance level 45000.00

- Likely fall to support level 44000.00

Dow Jones index recently reversed down from the resistance zone between the long-term resistance level 45000.00 (which has been reversing the price from the end of 2024) and the upper daily Bollinger Band.

The downward reversal from this resistance zone created the daily Japanese candlesticks reversal pattern, Bearish Engulfing.

Given the strength of the resistance level 45000.00 and the bearish divergence on the daily Stochastic, Dow Jones index can be expected to fall to the next support level 44000.00 (which reversed the price earlier in July).

DowJones bullish breakout support at 44390Key Support and Resistance Levels

Resistance Level 1: 45197

Resistance Level 2: 45507

Resistance Level 3: 46000

Support Level 1: 44390

Support Level 2: 43900

Support Level 3: 43590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30 07/29 Sell Trade I don't like sells because I consider myself an optimistic person but the red candle that I mark in red gave me all I needed to know to enter sell and get my target profit filled. So. I know there is variation in this trade but we were on a downtrend and going against the trend is only acceptable when the trend is over( meaning a reversal) . So when I see a big candle break the support of my variation I entered

DJ30/US30 LONG Reason for trade:

1. Expanding flat in play

2. Equal highs (LIQUIDITY)

3. Currently at the order block area (Ready)

Entry: 43647

Stop Loss: 43386

Take Profit: 45246

Strategy: Wait for a 30 minute engulfing candle closure.

Once in profit of 1:1 R, place the trade at BE

Blessings, in CHRIST.

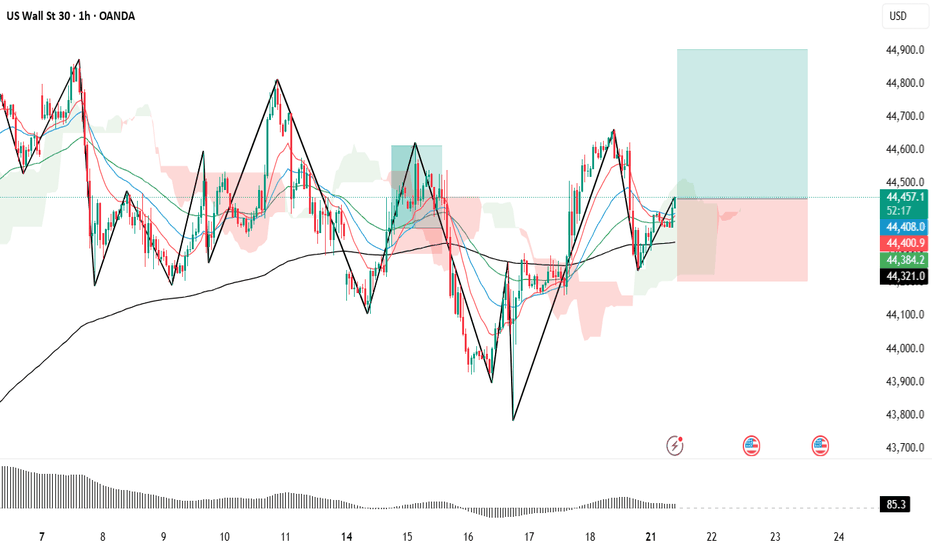

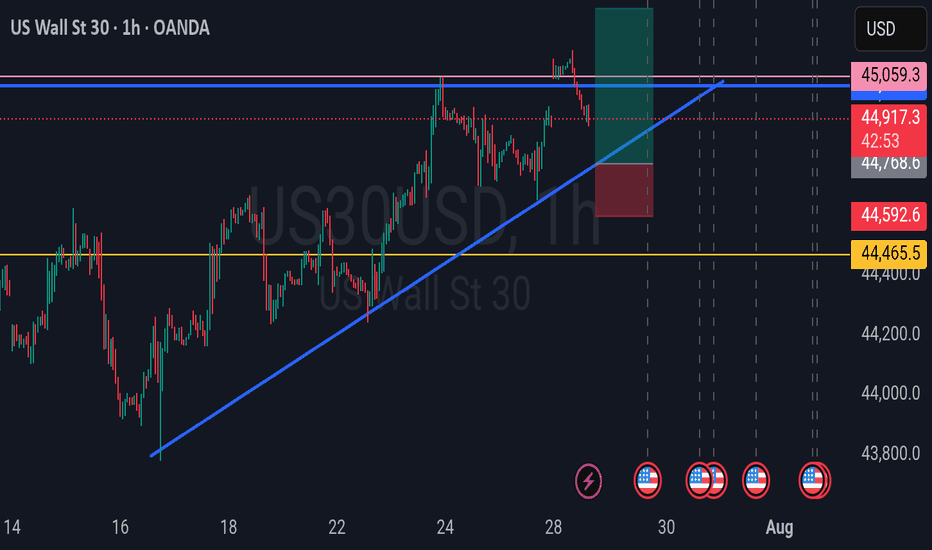

US30 Weekly Forecast – Bullish Bounce or Breakdown?Hope everyone had a great weekend!

This chart outlines a critical US30 intraday structure with price currently pulling back into a key confluence zone composed of:

A rising trendline from July 23rd

Two stacked demand zones, the upper around 44,850 and lower near 44,700

Bullish Scenario (Preferred Bias):

If price respects the trendline and upper key zone, we may see a bullish continuation targeting the 45,150–45,250 range.

The clean bounce zone, marked by the green arrow, suggests smart money might defend this level.

Watch for bullish engulfing or low-volume traps near 44,850–44,880 to confirm entry.

Bearish Scenario (Alternate Play):

If price fails to hold the trendline, and breaks below the 44,850 key zone with momentum, expect a drop into the lower zone (44,650–44,700).

A breakdown below this lower demand could shift the bias entirely, opening the door for a deeper correction back into the mid-44,000s.

Weekly Playbook:

Early week: Monitor the reaction at the upper key zone for sniper long opportunities with tight stops.

Mid to late week: If structure fails, flip bias and look for supply rejections on retests for shorts.

Risk: Account for FOMC/major U.S. news events that may introduce volatility traps around these zones.

Verdict: Stay patient. Let price dictate bias at the trendline. If it holds, this could be a textbook bounce continuation setup.