DAX/GER - PREPARE TO SHORT on DAX market opening Team,

We all know that the European Union and the United States agreed on Sunday to a broad trade deal that sets a 15 per cent tariff on most E.U. goods, including cars and pharmaceuticals.

The 27-nation bloc also agreed to increase its investment in the United States by more than $600 billion abov

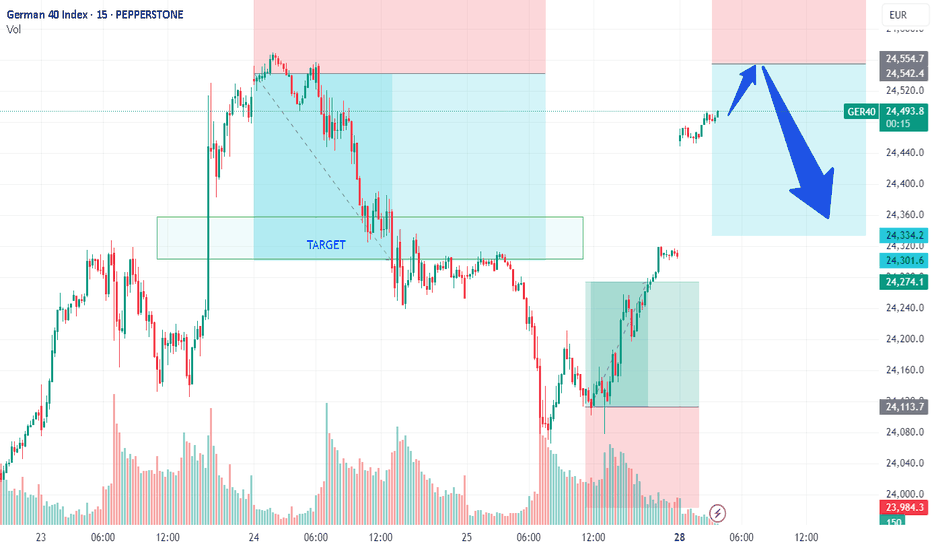

DAX / GER - ANOTHER ROUND OF ENTRY LONGTeam, we have successfully short DAX.GER earlier today with more than 300 points. both target hit

However the market has exceeding the dropping. We decide to go LONG

at the price range 23964-23945

With STOP LOSS at 23865-82

Once the trade hit above 21030-45 - BRING STOP LOSS TO BE

Target 1 at 2108

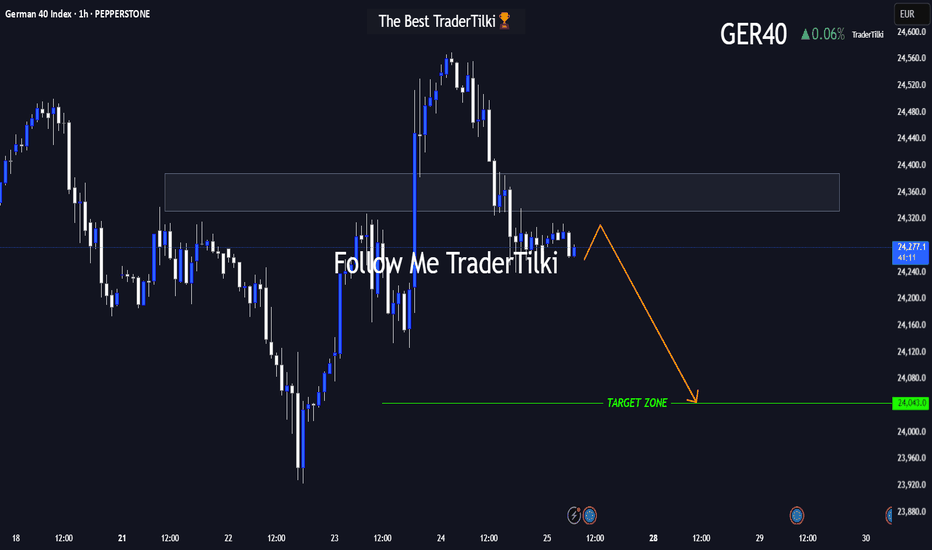

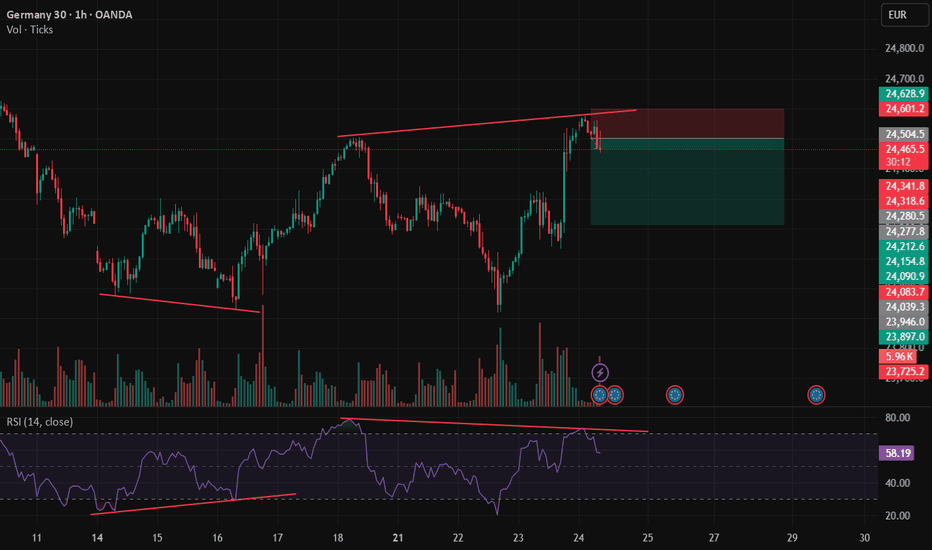

GER40 in Motion: This Setup Speaks Volumes 🌅 Good morning, my friends,

I’ve put together a fresh GER40 analysis just for you. Even if the 1-hour timeframe shows some upward momentum, I fully expect the price to reach my target level of **24,050**.

I'm holding firm until that level is hit.

Every single like from you is a massive source of

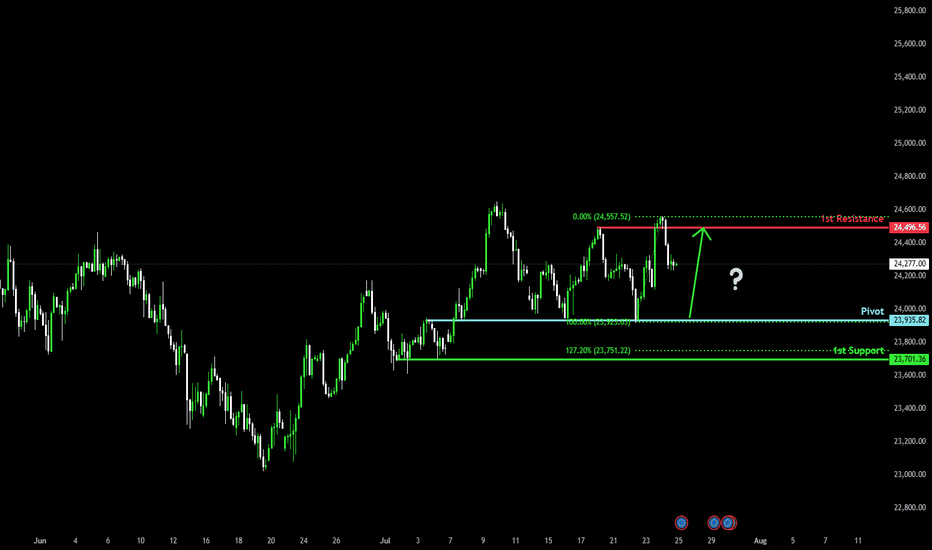

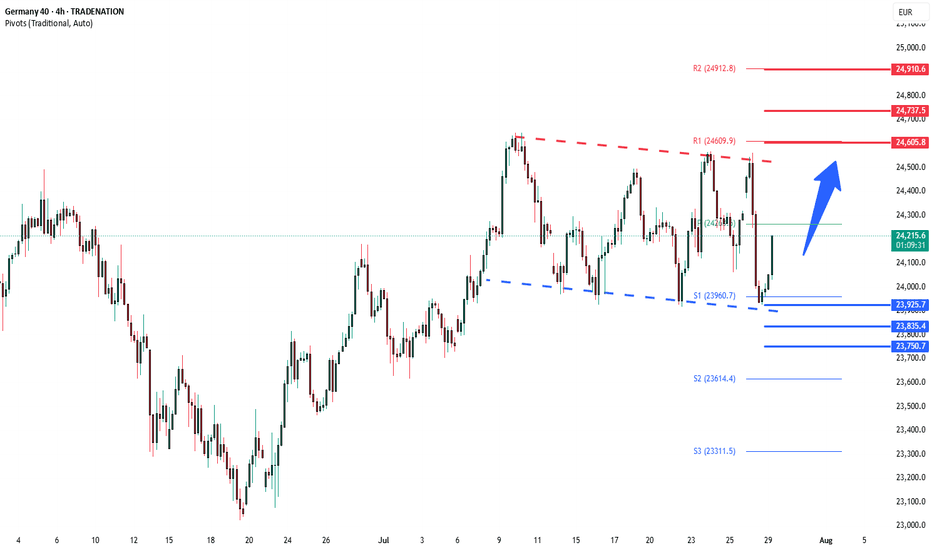

Bullish bounce off major support?DAX40 (DE40) is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 23,935.82

1st Support: 23,701.36

1st Resistance: 24,496.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should on

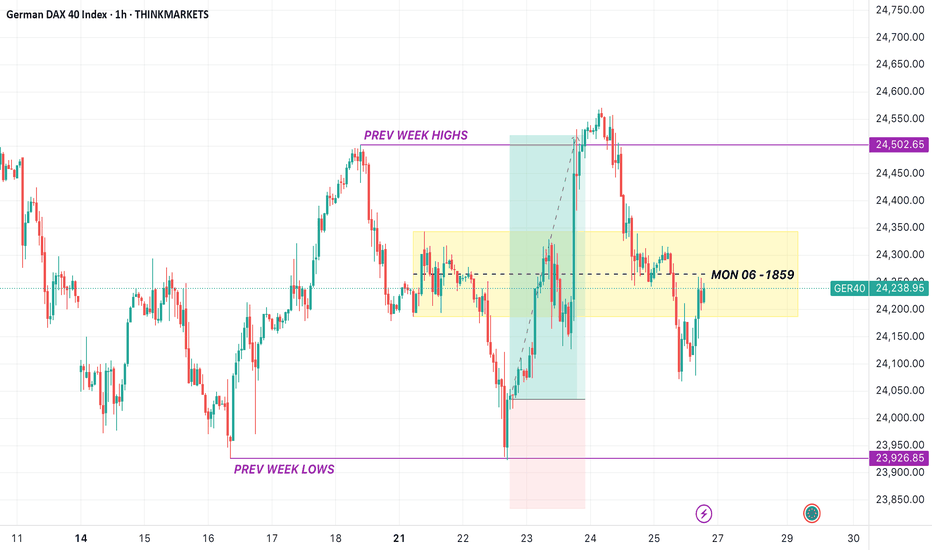

DAX: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 24,252.78 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmati

The DAX Index Is Losing Its Bullish MomentumThe DAX Index Is Losing Its Bullish Momentum

At the end of May, we noted that the German stock index DAX 40 was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed,

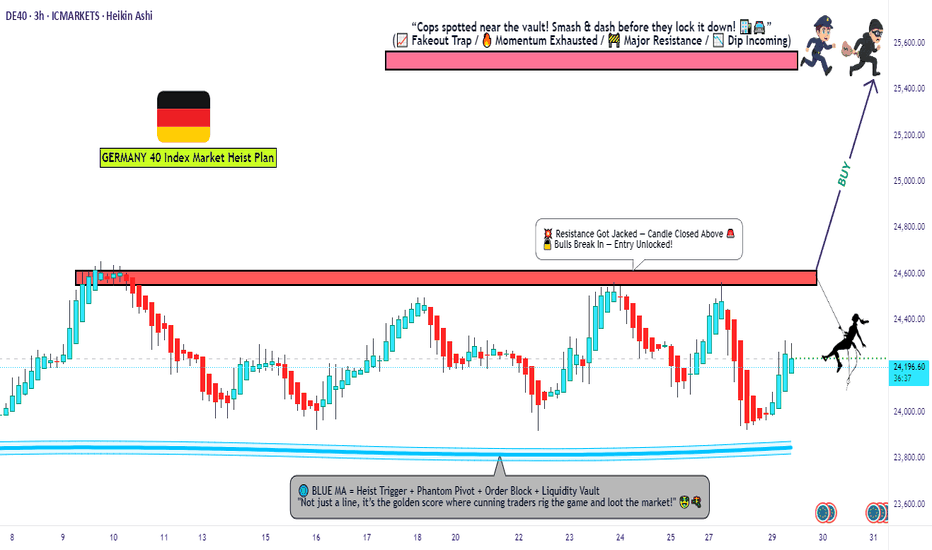

DE40 Breakout Robbery – Bullish Setup Revealed!💣 DE40 / GER40 INDEX BREAKOUT RAID 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Robbers, Money Makers, and Chart Bandits 🕶️💰💣,

We’re rollin' out our latest Thief Trader Heist Plan based on laser-sharp technical + fundamental recon 🧠💼 on the Germany DE40 / GER40 Index. It’s time to ge

DAX oversold rally support at 23925The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 23925 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 23925 would confirm ongoing up

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

German 40 Index Cash reached its highest quote on Jul 10, 2025 — 24,652.55 EUR. See more data on the German 40 Index Cash chart.

The lowest ever quote of German 40 Index Cash is 7,965.30 EUR. It was reached on Mar 18, 2020. See more data on the German 40 Index Cash chart.

German 40 Index Cash is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy German 40 Index Cash futures or funds or invest in its components.