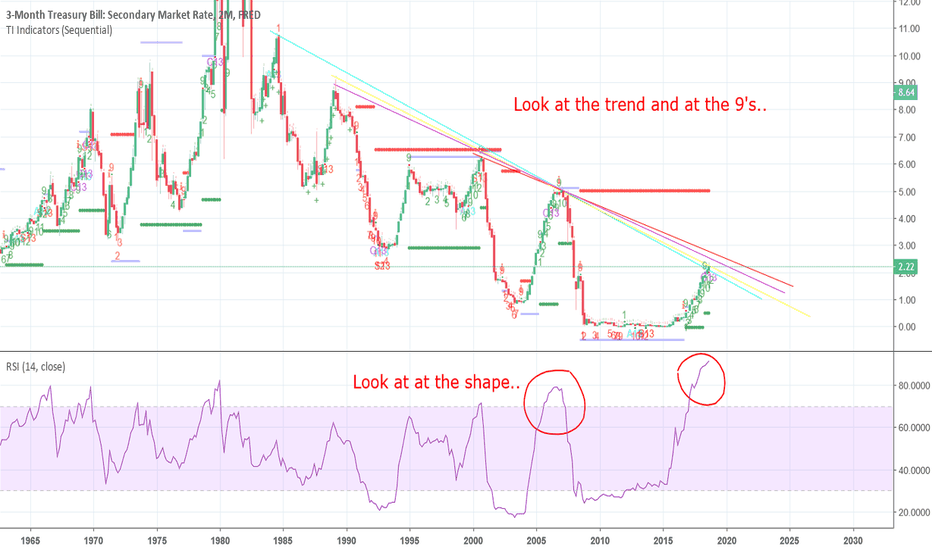

Downtrend sell short SP500 NASDAQTraders, both the 3-month Treasury Bill rates and the S&P 500 are showing signs of a correlated downtrend, similar to patterns observed in previous market downturns like 2002 and 2008. Treasury rates appear to have peaked and are now starting to drop, which historically signals a shift to a risk-off