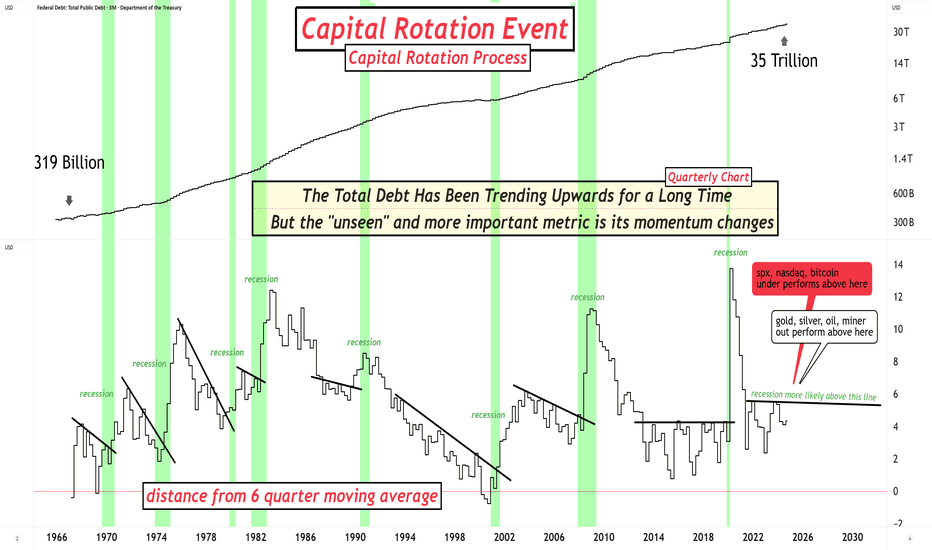

It is not the absolute values in debt that matter.It is not the absolute values in debt that matter.

It is the accelerations and decelerations that create capital rotation events (or are seen at capital rotation events).

Right now, the rate of change is nothing out of the ordinary, ready for its next acceleration.

GFDEBTN trade ideas

The US national debt is approximately $32.6 trillion.I did the math we're all phucked..

The current population of the US is about 335 million people.

By my formulating and calculating and asking ChatGPT=

Debt per person≈97,313.43

The last time the US turned a profit was 2001

The total federal spending for the fiscal year 2023 was approximately $6.3 trillion

Mandatory Spending: $3.85 trillion

Discretionary Spending: $1.79 trillion

Interest on Debt: $663 billion

FEDERAL DEBT priced in the DOW JONES is too HIGH!Those dollars that the US government owes must be inflated away!

As paying back 33 Trillion dollars is not feasible in today's version of dollars.

So they must be paid in even more worthless dollar currency units.

If the US government stops spending they will send the US economy into a recession.

They must continue to pump money into the economy and the stock market.

The con job that inflation is under control is a lie.. and we will continue to see higher prices the rest of the decade albeit at a slower rate.

BUT even 2% annual inflation compounded will erode purchasing power quickly as we have seen in the past. And I have charted before.

I believe we will continue to see the stock market ramp up the next two quarters before taking a summer break.

The underlying hidden to most, inflation trend, will continue to inflate revenues and earnings for most stocks going forward.

The bottom line is that Inflation is a FRAUD perpetuated on the people by the Government.

They print and spend the money first, and then the workers get it after beingTAXED and after prices have gone up.

Then they TAX you on the gain in asset prices! :)

So if u can invest in assets that are in wrapped up Tax free vehicles --- seek those out.

#Crypto can be a way to supercharge your returns for periods of time,

but come with inherent, built in volatility ---

most people walk away with, what could have been stories -- rather than life changing returns

How High will Gold Rally Reach?How high will gold prices reach? They will rise in proportion to the U.S. debt.

Today, we will study the relationship between U.S. debt and gold prices during these periods. We will also explore how high gold prices might go and how soon they could reach these levels.

Micro Fold Futures

Ticker: MGC

Minimum fluctuation:

0.10 per troy ounce = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

US Govt Real Debt is Down Last 3 YearsThe "real value of the US Gov't Debt" is a different way of looking at our situation through rose-colored glasses, but it is a fair analysis.

If we "adjust the debt level for inflation" as measured by the CPI Index (All Urban Consumers Index) from the beginning of the series back in 1966, you will have a line that is grinding SIDEWAYS since October 2020 at a reading of $105.9 Billion. The latest number was the July reading at $105.1 Billion which is a slight decline.

All of this sounds like "hocus-pocus" but it is a fact that inflation makes it easier for the Gov't to pay off its debt in the new "cheaper valued" dollars. The dollar is the same, only there are far more of them floating around in the system so each of them is worth less.

If we analyze how the US debt has increased relative to other countries' debt, we could also see how we are doing. The financial market's are open for analysts to find discrepancies between the value of various currencies and over time, the market adjusts for the amount of currency being created in an economy.

We can look at the TVC:DXY or US Dollar Index to see how the US economy has fared versus its trading partners. The Dollar Index is weighted for the amount of trading between the various currencies.

I can follow up on that analysis in the next chart.

For now, we can at least see an optimistic chart about the actual "REAL" amount of debt that the US Gov't (which is US, the taxpayers) has over the last 3 years. Covid spending and lockdown payments to keep the economy afloat certainly launched us up into the stratosphere FIRST but since 2020 that debt has been in a sideways pattern.

[STUDY] Spread between National Debt and Real GDPWas curious to see the spread between the US National Debt and Real GDP. As we can see, the National Debt was sustainable prior to 2016 as productivity was greater, but this has since changed. How long can we continue this, especially with a looming recession aka reduced productivity in spite of continued deficit spending?

U.S. National Debt U.S. default

A topic that has been stirring people's minds in recent months is the U.S. debt ceiling. The general public is asking the question:

"Will the national debt ceiling be raised or will the U.S. default?"

The national debt is the result of the government's financial borrowing to cover the budget deficit. And, as you might have guessed, these borrowings must be paid for.

For the last ~100 years, the U.S. has existed on borrowed capital by placing Treasury bonds. And there is a purely nominal borrowing limit, which in fact America has raised 45 times in the last 40 years so that it can borrow more and more and more. And if they don't, the Treasury will no longer be able to issue debt securities and will only have to cover their expenses with cash balances from their balance sheet.

Spoiler: no money to pay off your own debt

💡Logical conclusion.

The national debt ceiling will be raised anyway, and all the current discussions have only political overtones and have nothing to do with the real economic model of the states. Consequently, no teeth-grinding default and collapse of the global financial system should be expected

How will the increase in state debt affect the cryptocurrency market?

-If you're interested, put +

www.usdebtclock.org

Best regards EXCAVO

USA $31.4T Debt: How will this affect BTC and Stocks?❗ WARNING ❗ You're about to read an unpopular opinion...

Over the past few days, we've seen bullish price action across nearly all markets. Infact, this is the first time since 2013 that Bitcoin has closed so many green dailies consecutively. This entire market reversal seemed a bit sudden, and many claimed "bull trap". (I'm a believer in the Macro, so when it comes to pure charting without fundamentals, longing was the way to go over the past few days, no argument on this).

However, another interesting this happened today - the U.S. government hit its $31.4 trillion borrowing limit TODAY, amid a standoff between the Republican-controlled House of Representatives and President Joe Biden's Democrats on lifting the ceiling (which could lead to a major economic crisis in a few months). Suddenly, I thought to myself, the entire reversal seems even more suspicious. Now here's my unpopular opinion : What if this is part of an elaborate plan to eliminate some of the debt? The world is dependent on the dollar, if the US financial system is in trouble, so is most of the world. Everything is just too interconnected at this point. Across the giants of investment world, there are rising concerns about unsettling markets and risking a recession. Senate Republican leader Mitch McConnell predicted that the debt ceiling would be lifted sometime in the first half of 2023 under conditions negotiated by Congress and the White House.

According to Reuters, the White House is refusing to negotiate with Republicans on raising the debt ceiling because it believes that the majority of them will eventually back off their demands, as a growing group of investors, business groups and moderate conservatives warn of the dangers of edging towards a default. The high-stakes deadlock is widely expected to last for months, and could come down to the last minute as each side tests the other ahead of June when the U.S. government might be forced to default on paying its debt. A default means being unable to pay. Because U.S. debt is considered the bedrock of the global financial system, due in part to its stability, a default could shake economies across the world. Americans could also face a recession, including higher unemployment, and the stock and bond markets would likely plunge. Today, a government that defaults may be widely excluded from further credit; some of its overseas assets may be seized; and it may face political pressure from its own domestic bondholders to pay back its debt.

Today on Twitter, Elon Musk said openly that even if the government taxes every billionaire by 100%, it wouldn't even make a notable dent. According to him, the only way to make a notable dent in this debt is to tax the citizens even more. But what about the markets, the whales, the insider trading between banks, governments and large corporations ?? Trading markets is a multi trillion dollar industry. To make it more practical, the total value of global equity trading alone was 41.8 trillion U.S. dollars in the third quarter of 2021. We know that the Total cryptocurrency market is currently standing just under 1T. I'm unable to find data on the total worldwide value of the commodity market, if you do please comment below with your source. It is estimated that the total amount of money in the world is a couple of quadrillion. Whatever that means. Suddenly, 30 Trillion seems pale in comparison.

Furthermore, investment options go far beyond just stocks, cryptocurrency and commodities. Some of the other less frequently discussed options include:

1. High-yield savings accounts

2. Certificates of deposit (CDs)

3. Money market funds

4. Government bonds

5. Corporate bonds

6. Mutual funds

7. Index funds

8. Exchange-traded funds (ETFs)

9. Dividend stocks

10. Real estate

Now imagine, scooping off a bit of cream from the top?? You wouldn't need to necessarily wipe out an entire market, but a good 20% to 30% drop across markets and Bob's your uncle ! The money machine carries on until next time it's overspent. Hike interest rates. Increases taxes. Inflation. Liquidate markets. Repeat cycle.

So the point that I'm trying to get at is this - remember tot take profits. Nothing wrong with taking a hedge to manage your risk during these uncertain economic times. I personally won't be surprised if there's some major "news event" that sends the markets into a overnight flashcrash soon. I could be totally wrong, in fact I would prefer to be wrong in this case.

What are your thoughts on this?

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

Current vs Future debt payments as percent of incomeThere appears to be a 2-3 year delay between the current debt rates (US) and actually debt payment increases. It seems very likely that debt payments as a percent of tax receipts will go up to 28% similar to 2019 and 2020. What happens after that. It seems unlikely to me that GDP will continue to feed increases in federal tax receipts. 30% and above is next.

A Decade of DebtIt felt like yesterday that Obama Care was the biggest concern on everyones minds.

After 1.4 Trillion in healthcare spendings in 2021 and COVID pounding on weaker baby boomer populations has driven total debt into a parabolic upwards trend.

War is festering in Ukraine, Wars get expensive.

EU is on the brink of an Energy Crisis unlike anyone has seen before.

Battery and Solar are incredible expensive and low margins.

Practical thinking would suggest this is not sustainable.

Inflation will continue, debtors gain from inflation because they are repaid with dollars that are worth less.

If you think this past weeks Bear Market rally marks the end of inflation fears and rising interest rates, think again.

This easing of market conditions can therefore only be temporary and only serve to provide fuel for a second leg down.

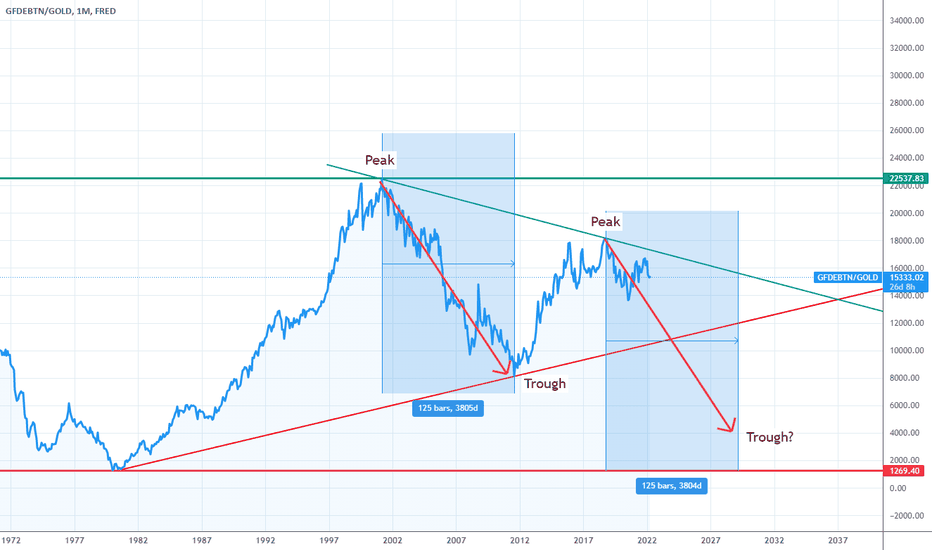

US Debt divided by Gold The US debt to Gold ratio looks to be topping.

The lower this ratio, the more US debt is covered by gold and generally means a rally in the price of gold.

When this ratio breaks the minor diagonal support line, the major support line will be the next target and gold will see gains not seen since the late 1970's.

Fed Funds Rate Limited Due to Debt/GDP & 10Y TreasuryUntil U.S. debt loads get to more normalized levels (below 80%) and the 10Y treasury yield has a far enough spread from the short-end of the curve, the Federal Reserve's hand is almost forced in what they can do from a rate tightening perspective.

Stimmy for Jimmy - NyetManchin plays Foosball again.

$2 Trillion in Stimmy is a solid "Sorry, but no."

_____________________________________________________________

WASHINGTON (AP) — Democratic Sen. Joe Manchin said Sunday he cannot

back his party’s signature $2 trillion social and environment bill, seemingly

dealing a fatal blow to President Joe Biden’s leading domestic initiative heading

into an election year when Democrats’ narrow hold on Congress was already in peril.

Manchin told “Fox News Sunday” that he always has made clear he had reservations

about the bill and that now, after five-and-half months of discussions and negotiations,

“I cannot vote to continue with this piece of legislation.”

The White House had no immediate comment. Biden was spending the weekend in

Wilmington, Delaware.

The legislation’s apparent collapse is sure to deepen the bitter ideological divisions

within the Democratic Party between progressives and moderates. That would call into

question whether Democrats will be able to join together behind any substantial legislation

before the November congressional elections. And it adds a note of chaos just as Democrats

need to demonstrate accomplishments and show a united front before the fall campaign.

________________________________________________________________

Lumps of Coal - Yellen the Fellon won't be squeaking about Defcits unless

she prefers pitchforks and Biden is now the Zombie President - 110%.

The Raven and his Ilk are, as most are all Central Banks around the Globe

being instructed to withdraw Liquidity at an increasing rate.

__________________________________________________________________

Political unrest, Social unrest - assured by Mid - 2022

Real National Debt - Not as high as we think?When you take the total public US Federal debt divided by gold you get this chart.

Interestingly it shows we are in the middle of several year range. Maybe our current debt isn't as bad as we thought?

Note that I call this our "Real" National Debt because gold helps take out all the money printing and serves as a better store of value and/or currency.

2018 shows the highest ever 'real' debt according to this data which was under President Trump.