Nas100 is Still Correcting Nasdaq is Correcting

Long Term we are still Bullish

Remember that markets hunt liquidity

The short term trend is Lower Highs and Lower Lows

Price is still in Premium For Sells

Looking for a retest of previous short term high and my TP would be around 22580

The only way I would get into a buy trade if price would retest the current support and hold with very bullish price action. No little candles etc.

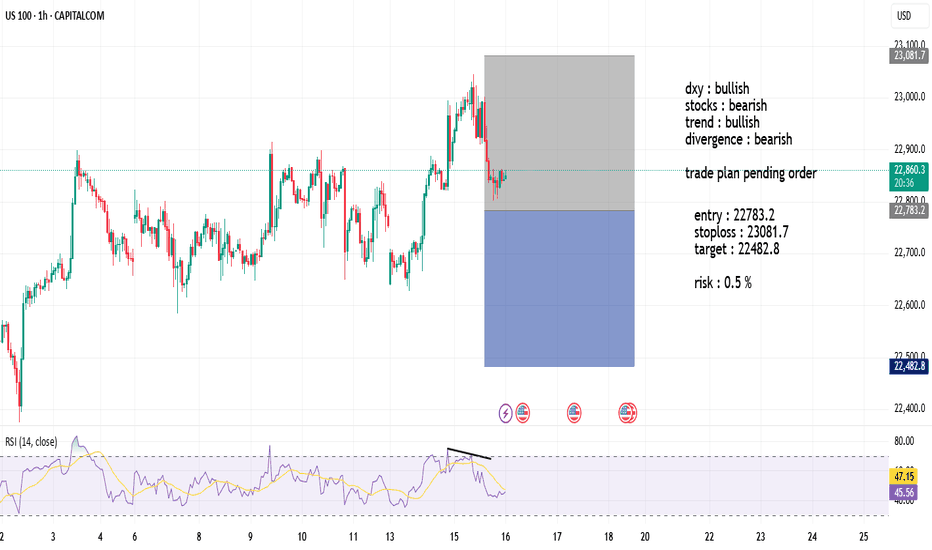

NDQ100 trade ideas

Long position idea on Nasdaq Simple and precise idea of Nasdaq. Bullish momentum in full swing. Nasdaq recently broke out of the previous High/Resistance and shows that the bulls are still in power. Take profit is at 25.000.00 because Nasdaq usually moves around 10.000 pips after a market crash so when doing my calculations from previous Low of 16300, my estimation is around 25000 which equals to 9,000 - 10,000 pips.

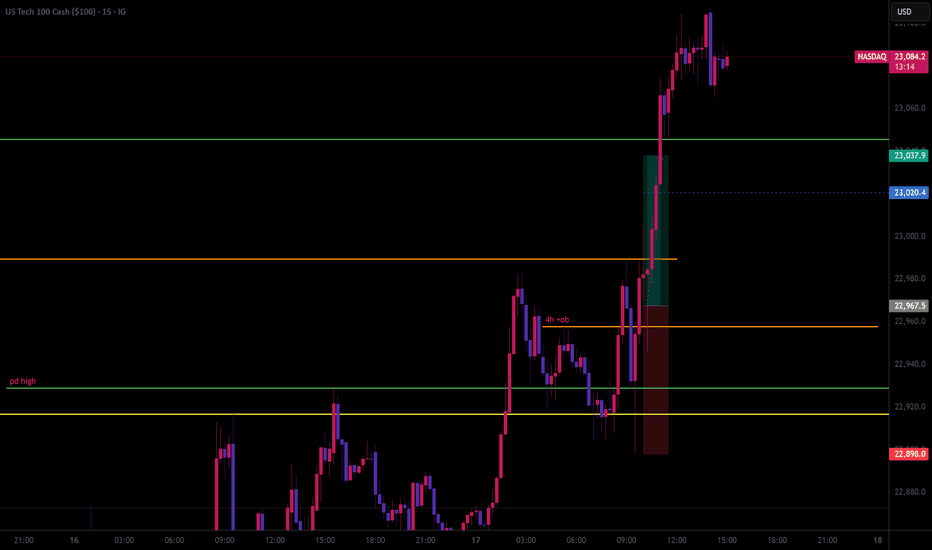

NASDAQ 🔍 Market Overview:

Instrument: US Tech 100 (NASDAQ 100)

Timeframe: 15 Minutes

Current Trend: Short-term downtrend, indicated by the descending trendline connecting recent lower highs.

📉 Trade Setup (Short Position):

Entry Point: 22,700

Price has broken below the trendline and a horizontal resistance zone around 22,750–22,770, confirming bearish pressure.

Stop Loss: 22,770

Placed just above the previous resistance and trendline. A break above this level would invalidate the downtrend structure.

Target: 22,070

This level aligns with a previously tested demand/support zone, offering a logical take-profit area.

📊 Risk/Reward Analysis:

Risk: ~100 points

Reward: ~640 points

Risk-to-Reward Ratio: 1:6, which is excellent and indicates a high potential reward relative to the risk.

📌 Technical Observations:

Trendline: Clearly established downtrend with lower highs.

Breakout Confirmation: Price rejected from trendline + horizontal resistance = confluence zone.

Volume & Momentum (not shown but advisable to check): Traders should confirm the breakout with increased selling volume or bearish momentum indicators (e.g., RSI dropping below 50 or MACD crossing down).

✅ Conclusion:

This is a well-structured short (sell) setup with:

Clear trendline rejection,

Defined entry, stop loss, and target,

A favorable risk-to-reward ratio.

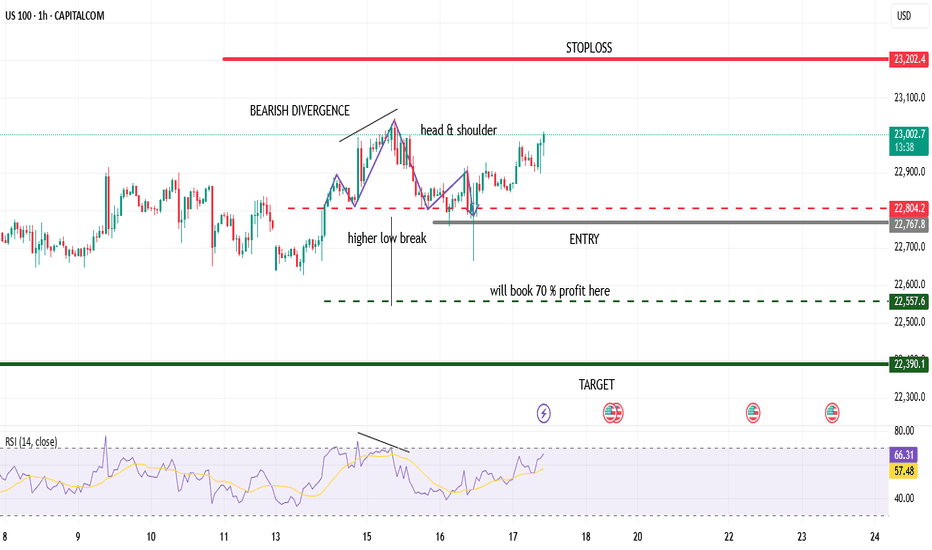

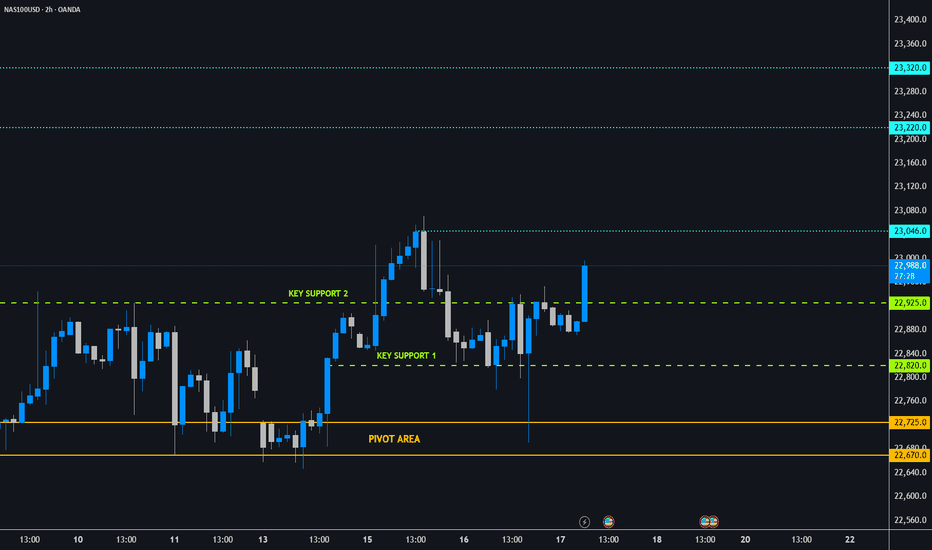

NASDAQ Bulls Defend Pivot – Can 23,000 Break Next?USNAS100

The Nasdaq 100 is currently holding above the pivotal 22,720 level, supported by market optimism amid recent tariff-related developments from the White House.

Bullish Scenario:

Sustained price action above 22,720 keeps bullish momentum intact. A break and 1H close above 22,815 would confirm strength, opening the path toward the psychological milestone and potential all-time high at 23,000.

Bearish Breakdown:

A 1H or 4H close below 22,720 would invalidate the bullish bias and strengthen downside pressure, with initial support seen at 22,615 and deeper correction likely toward 22,420.

Key Technical Levels:

• Resistance: 22,815 · 23,000

• Support: 22,615 · 22,420

Pullback before next leg up

NASDAQ’s looking weak short term. We’ve seen multiple rejections from the highs, an M pattern forming on the daily, and RSI divergence creeping in on the daily — momentum is clearly fading. I already took profit around 21980. And a few small swings between the range since 3rd of June.

The rally off the tariff drop was sharp, but it feels mechanical. Bulls look tired here. You can see price is stalling — pushing into the same highs but getting nowhere. Classic signs of distribution.

That said, this isn’t the start of a full-blown bear market. The long-term trend remains bullish. AI investment is still piling into the U.S., tech’s still leading globally, and structurally we haven’t broken down yet. Some weakness is starting to show though.

But short term, I think we see a pullback. The Fed’s still sitting on the fence with rate cuts, which is creating uncertainty. Add that to the current geopolitical tensions, and there’s enough on the table to justify a temporary risk-off move.

If price breaks and closes above 21,860, I’ll reassess and potentially shift back to a bullish bias. Until then, I’m leaning short and letting price action do the talking.

My key downside levels:

TP1: 21,483 — scale out and protect.

TP2: 21,322 — potential bounce from this area.

TP3: 21,145 — structure starts to weaken.

TP4: 20,894 — bears starting to control and a deeper flush, I’ll reassess bias at this level.

SL @ 21850 on my second entry short

Short term: pullback likely.

Big picture: still bullish — but bulls need to reset before any next leg up.

Nasdaq 100: Bearish Signals Near the All-Time HighNasdaq 100: Bearish Signals Near the All-Time High

As the 4-hour chart of the Nasdaq 100 (US Tech 100 mini on FXOpen) shows, the index reached a new all-time high last week. However, the price action suggests that the current pace of growth may not last.

Last week’s strong labour market data triggered a significant bullish impulse. However, the upward momentum has been entirely retraced (as indicated by the arrows).

The tax cut bill signed on Friday, 4 July, by Trump — which is expected to lead to a significant increase in US government debt — contributed to a modest bullish gap at today’s market open. Yet, as trading progressed during the Asian session, the index declined.

This suggests that fundamental news, which could have served as bullish catalysts, are failing to generate sustainable upward movement — a bearish sign.

Further grounds for doubt regarding the index's continued growth are provided by technical analysis of the Nasdaq 100 (US Tech 100 mini on FXOpen) chart, specifically:

→ a bearish divergence on the RSI indicator;

→ price proximity to the upper boundary of the ascending channel, which is considered resistance.

It is reasonable to suggest that the market may be overheated and that bullish momentum is waning. Consequently, a correction may be forming — potentially involving a test of the 22,100 level. This level acted as resistance from late 2024 until it was broken by strong bullish momentum in late June.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NASDAQ Potential Bearish Reversal Analysis NASDAQ Potential Bearish Reversal Analysis 🧠🔻

The chart illustrates a potential bearish setup forming after a recent uptrend in NASDAQ. Let's break it down professionally:

🔍 Technical Overview:

Ascending Trendline Break ✅

Price had been respecting a steady ascending trendline.

A break below this trendline indicates a possible momentum shift from bullish to bearish.

Bearish Pattern Formation 🔷

A bearish flag/pennant-like formation can be observed after the sharp rise.

This consolidation followed by a breakdown could be a continuation pattern, hinting at further downside.

Resistance Rejection 🔴

A red arrow marks a clear rejection from the resistance zone near 22,800 USD.

Strong wick rejections and bearish candles suggest selling pressure at that level.

Support Turned Resistance (SUPPOT 🛑)

The previously broken support zone is now acting as resistance (note: "SUPPOT" appears misspelled—should be "SUPPORT").

Bearish Target Zone 🎯

The chart marks a "TAEGET" zone (should be "TARGET") near the 21,900 – 22,000 USD range.

This aligns with prior consolidation and demand zones, making it a likely area for price to retrace.

📌 Key Zones:

Resistance (Rejection Area): 22,800 USD

Current Price: 22,739.7 USD

Bearish Target Zone: 21,900 – 22,000 USD

⚠️ Conclusion:

The market shows signs of a bearish reversal with a confirmed trendline break, resistance rejection, and bearish pattern formation. If the price fails to reclaim the 22,800 level, there’s a high probability of downward continuation toward the 22,000 target.

NAS100 CAUTION - Realistic Perspective!!Dear Friends in Trading,

How I see it,

This rising channel represents severe overbought greed territory.

A very big correction might be around the corner or in the near future.

Daily and Weekly RSI Divergence could be forced to re-balance at any time.

Keynote:

This is not a contradiction of my previous NASDAQ post.

Short-Term strong bullish price action can still prevail.

But please keep this big picture in mind from here on end.

Feel free to ask questions if anything is unclear.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time to study my analysis.

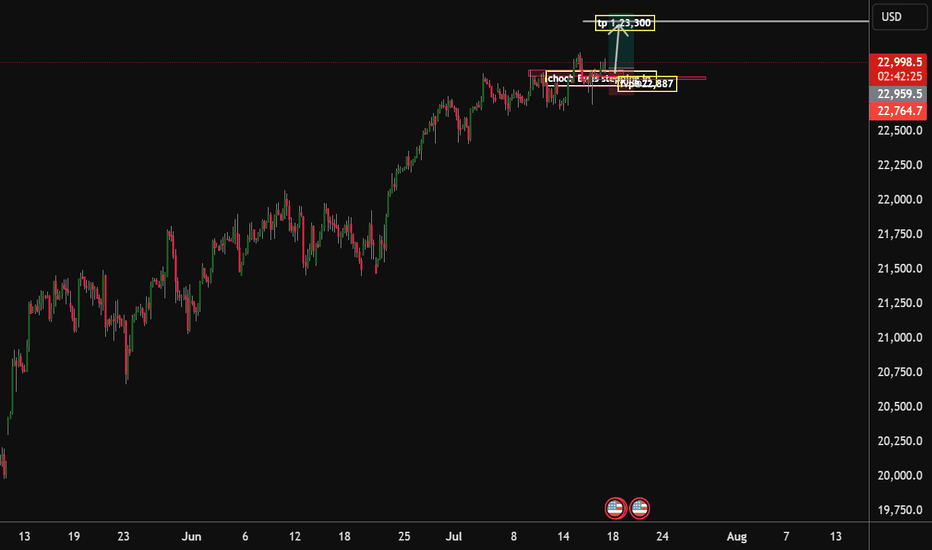

Nas Long to clear HH liquidity before correctionHTF Context – Monthly / Weekly / Daily

• Big Beautiful Bill (Trump Tax + Spending Bill)

o Passed July 4th, acting as a stimulus.

o Markets historically rally on fiscal stimulus expectations (tax cuts + spending packages).

o This fuels bullish sentiment short-term, but long-term raises debt, inflation risk, and rate hike concerns.

• Seasonality

o July is typically strong for equities, especially tech, with mid-July often marking local tops before August pullbacks.

• Monthly structure

o Strong bullish monthly candles.

o Next major fib retracements if rejected: 38.2% ~20,398, 50% ~19,625, 61.8% ~18,852.

• Weekly / Daily structure

o HH-HL sequence continues.

o Price in premium zone, approaching major supply block 23,200–23,300.

o Daily BOS not broken downwards yet.

________________________________________

Key Levels

• Major supply / liquidity magnet: 23,200–23,300 (sell-side OB in futures, uncollected liquidity above HH)

• Recent swing high: 22,900

• Daily pivot: 22,470

• Intraday demand zone: 22,450–22,350 (4H wedge base + VWAP)

• Weekly support shelf: 22,100–22,200 (if lost, major trend shift bearish)

________________________________________

My View – Most Likely Path

1. Price is likely to sweep the liquidity above recent highs into the 23,200–23,300 supply zone.

o Why? Market rarely leaves liquidity uncollected. This move traps breakout buyers and hits stops above HHs.

o Big Beautiful Bill fuels the final squeeze higher as algorithms price in fiscal stimulus.

2. After liquidity sweep above 23,200–23,300:

o Expect strong rejection from that zone.

o Institutions offload positions into trapped retail longs.

o Price pulls back towards daily and weekly support zones for reaccumulation.

3. Alternate scenario (less likely)

o Immediate sell-off from current levels without sweeping HH.

o Weak move; would still expect a revisit higher later to clear liquidity before a proper downtrend.

________________________________________

Trade Setups – Intraday & Swing

Intraday Long (Most Likely)

• Bias: Bullish continuation

• Entry Zone: 22,450–22,350 (4H demand + VWAP)

• Trigger: 5m/15m BOS up

• Stop: Below 22,300.

• Targets: First at 22,615, next at 22,845, final at 23,200–23,300.

________________________________________

Intraday Short (Countertrend / Liquidity Sweep Reversal)

• Bias: Short from supply after liquidity grab

• Entry Zone: 23,200–23,300

• Trigger: Sweep of HH with rejection wick or bearish engulfing candle

• Stop: Above 23,350 (structure invalidation).

• Targets: First at 22,845, then 22,600, extend to 22,450 if momentum accelerates.

________________________________________

Swing Long (Continuation)

• Bias: Bullish trend intact

• Entry: After retest of daily pivot (22,470) or 4H demand (22,350–22,450) with 4H CHoCH + BOS up.

• Stop: Below 22,200 (weekly support break invalidates).

• Targets: 22,845 then 23,200–23,300. Blue sky if above.

________________________________________

Swing Short (Only if structure breaks)

• Trigger: Daily close below 22,200

• Bias: Bearish trend shift

• Targets: 21,800 first, then 21,000 major fib cluster and weekly MA.

________________________________________

Summary – My Final Opinion

Price is in a strong uptrend fuelled by fiscal stimulus, rate cuts and tarrif hopes . I think it will sweep the liquidity above 23,200–23,300 before any deeper pullback or trend reversal. Any rejection from that supply zone will be the cue to short for a structural retracement. Until then, I’ll keep buying dips aligned with the HTF bullish structure.

NASDAQ Key Levels July 7 2025If NY fails to reclaim 22,755–780 early in the week, expect a grind back toward 22,644 → 22,600, with 22,520 in play only if volume confirms. Reclaiming and holding above 22,800+ would invalidate this bearish setup.

Watch for trap volume, delta reversals, and volume imbalances at all key zones before entering.

22,880 – 🔻 Weekly wick top

➤ Major rejection zone with a stop cluster sitting above.

22,800–820 – 🧱 Possible NY trap zone

➤ Trap absorption detected here on footprint — watch New York for rejection or breakout.

22,755–22,780 – 🔁 Retest zone

➤ Multiple trap wicks with low delta on 1H/15M. Likely to bait breakout traders before fading.

22,700 – ⚠️ Structural demand / pivot point

➤ A clean break + hold below = bearish market shift.

22,644 – ✅ Session low / Take Profit 1

➤ If 22,700 breaks, this is the first clean downside target.

22,600 – 🎯 Daily value zone

➤ High-probability liquidity target if selling extends below 22,644.

22,520 – 🧨 Final sweep target

➤ Only likely if New York session sells off hard mid-to-late week.

US100 SELLERS WILL DOMINATE THE MARKET|SHORT

US100 SIGNAL

Trade Direction: short

Entry Level: 22,684.7

Target Level: 22,082.0

Stop Loss: 23,085.2

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 10h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NASDAQ | - Structure Refined | Bullish Intent Into Next WeekPair: NAS100

Bias: Bullish

Timeframes: 4H, 2H, LTFs

• 4H broke structure to the upside with a new HH — clear sign of bullish intent stepping in.

• 2H gives clarity on the move — beginning of the week was messy, but price cleaned up nicely and gave us refined structure to work with.

• Now we wait for mitigation into the OB zone to see if price respects and gives us the setup.

🔹 Entry: After price mitigates OB and confirms with CHoCH on LTFs

🔹 Entry Zone: Marked OB zone — wait for confirmation

🔹 Target: Near structure highs — continuation if bulls step in

Mindset: Messy beginnings don’t mean bad outcomes. Structure eventually reveals the truth — just stay patient and ready.

Bless Trading!

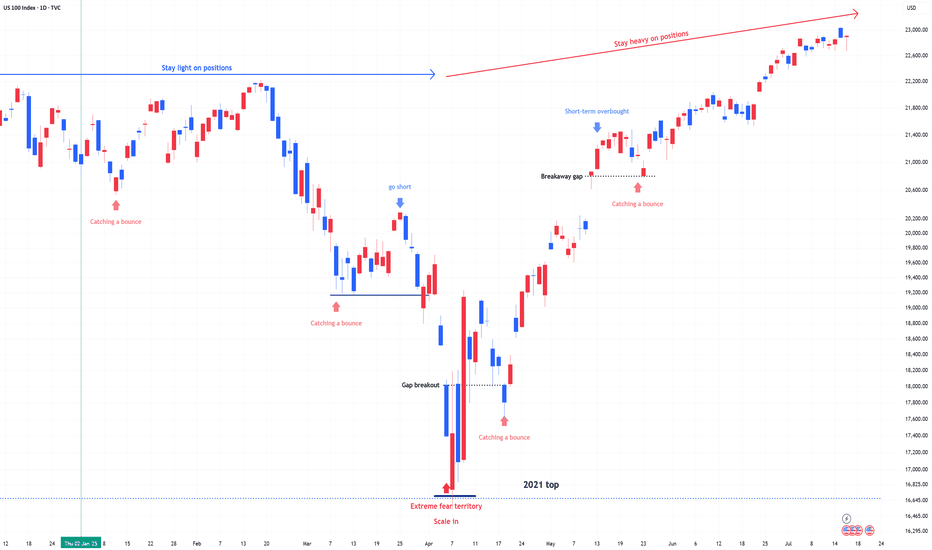

US 100 (NDQ) : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

2) Current Market State: No More Fear, but Watching

Since then, the market has stabilized.

The fear has disappeared, but we are still in a wait-and-see mode as traders assess the next move.

Momentum is holding, but participation remains cautious.

3) Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

Nasdaq100 Bulls ready to drive the price to 23,300 handle With the choch on the market structure and with Key data released on Thursday, reflected strength in the U.S. economy. Stocks rose this Thursday, buoyed by fresh economic data reports and a slew of corporate earnings releases. The tech-heavy Nasdaq Composite has advanced 0.4%, and quarterly earnings reports released this week have exceeded Wall Street’s expectations, fueling investor confidence. I am expecting that by the end of this week or the beginning of next week will see the bulls drive the market to our 23,300 handle. I am with the bulls on this one

Tp1.23,300.

NAS100 - Follow Progress 3Dear Friends in Trading,

How I see it,

Remember:

"NASDAQ IS IN EXTREME GREED/OVERBOUGHT TERRITORY"

1) NASDAQ formed new key support/demand levels post CPI + PPI

2) Price needs to stabilize above 23046 next.

3) As long as both key support levels hold, the potential for more

bull runs remains high.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time to study my analysis.

NAS100 Forecast 24HAs of Tuesday, July 15, 2025, 2:03:11 AM UTC+4 the forecast for US100 (Nasdaq 100) in the next 24 hours presents a mixed outlook, with underlying bullish sentiment but caution due to ongoing market dynamics and potential for short-term pullbacks.

Factors Contributing to a Bullish Bias:

Underlying Strength and Breakout Behavior: Despite some short-term bearish technical signals, the Nasdaq is described as being in "breakout mode," decisively overriding key levels. This suggests underlying bullish momentum.

AI as a Growth Driver: Artificial intelligence (AI) remains a primary growth driver for the US economy and the technology sector, which heavily influences the Nasdaq 100. Confidence in secular tailwinds like cloud computing and semiconductor demand also persists .

Temporary US Dollar Weakness: The US Dollar Index (DXY) is currently in a retracement phase, pulling back after strength. A weaker dollar can provide a relief rally for risk assets like the Nasdaq, making US tech stocks more attractive to international investors.

Potential for Federal Reserve Rate Cuts: While no rate cuts are expected over the summer, a rate cut is considered likely in September. Historically, phases of moderate interest rate cuts in the absence of a recession have been positive for the US stock market.

"Buy on Dip" Mentality: Some analyses suggest that any short-term declines could be viewed as buying opportunities, indicating an underlying positive sentiment among investors.

Strong Earnings Expectations (for some tech): Despite general market concerns, some technology companies associated with AI innovation are expected to perform well, contributing positively to the index.

Factors Suggesting Caution and Potential for Bearish Movement/Volatility:

Escalating Trade Tensions (Trump's Tariffs): President Trump's continued aggressive protectionist stance and new tariff threats (e.g., against Canada) are a significant risk. These can create uncertainty, weigh on corporate profits, and lead to market volatility. This is frequently cited as the main risk for US indices.

Short-Term Technical Bearishness: Some technical analyses indicate a high chance of bearish candle closures across various timeframes (1H, 4H, Daily, Weekly, Monthly) , and some traders are eyeing selling opportunities from specific resistance zones (e.g., around 22,800-22,869).

Overvalued Growth Stocks: Following a recent rally, US stocks, particularly growth stocks, are trading at a premium to fair value. This can limit upside potential and make the market more susceptible to corrections if tariff negotiations falter or earnings guidance disappoints.

Market Seasonality: As we move into the latter half of July, market seasonality can shift from bullish to a more bearish stance.

Earnings Season and "Sell on the News" : While major financial institutions are kicking off Q2 earnings season, there's a potential for a "sell on the news" response, even if earnings aren't particularly bad, given the strong rally stocks have already staged.

Mixed Global Signals: European markets showing mixed performance and pressure from US futures suggest cautious global risk sentiment, which could cap upside for the Nasdaq.

Unfilled Stock Imbalances: Some technical analysis points to an unfilled stock imbalance around 22,300, which could act as a reaction point if the price pulls back.

Key Levels to Watch (Approximate):

Support: 22,600, 22,300 (unfilled imbalance), 21,611 (resistance-turned-support), 20,673 (Fibonacci extension and prior high).

Resistance: 22,800, 22,869, 23,000-23,100 (potential re-entry targets for rally continuation), 25,000-25,100 (approximate imbalance level to be filled).

In conclusion, for the next 24 hours, the US100 is likely to face a battle between underlying bullish momentum driven by AI and potential Fed policy, and the immediate headwinds of escalating trade tensions and some short-term technical bearishness. Traders should be prepared for volatility and quick shifts in sentiment based on news flow, particularly regarding trade and upcoming earnings reports.

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.