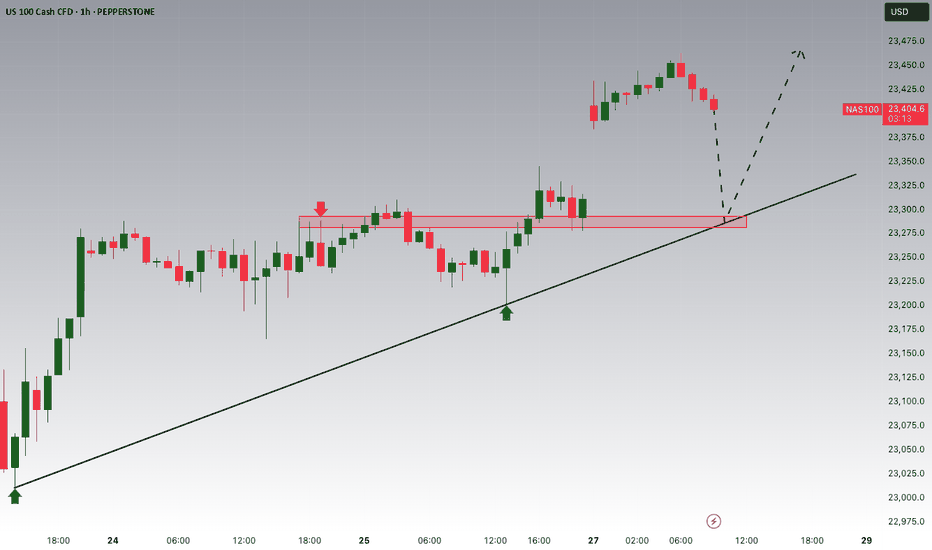

NASDAQ INDEX (US100): Another Gap For Today?I anticipate another gap up opening on the 📉US100 Index, which I believe will be filled today.

The formation of an intraday bearish change of character(CHOCH) on the hourly chart

This indicates a strong likelihood of continued bearish movement, with a target of 23319.

About US 100 Cash CFD

The NASDAQ-100 is an index that is constituted by 100 of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world only after the New York Stock Exchange by market capitalization. The companies that are listed in this index range from a variety of industries like Technology, Telecommunications, Biotechnology, Media, and Services. The NASDAQ-100 was first calculated in January 31 of 1985 by NASDAQ and it is a modified capitalization-weighted index. This index has been of good reference to investors that want to know how the stock market is performing without financial services companies, this given that the index excludes financial companies.

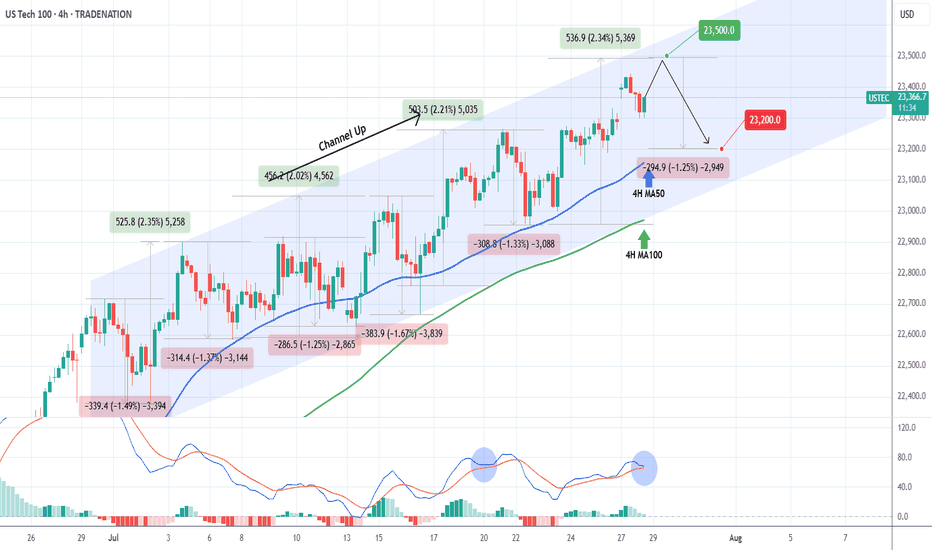

NASDAQ Channel Up to be rejected soon.Nasdaq (NDX) has been trading within a Channel Up since the start of the month. The primary Support level has been the 4H MA50 (blue trend-line), which hasn't closed a 4H candle below it since July 14.

Right now the index is on its latest Bullish Leg, which can technically extend by +2.35% (max suc

NAS100 - Update Dear Friends in Trading,

How I see it,

I will be waiting for a clear and decisive break below the PIVOT.

Keynote:

I am not trading NASDAQ at all...just monitoring patiently!!

I will keep you in the loop as the stock market progress...

I sincerely hope my point of view offers a valued insight

Th

NASDAQ price dropAfter the Nasdaq price reaches around 23642.2, a historic drop will occur and the target is to drop to 16308.

Whatever happens at the highest price, the final destination is towards 16308.

I have identified the price levels in the middle of this expected drop that can cause the price to correct.

I

NAS - LET'S MAKE MILLIONS Team, last night NAS I was expect the FALL BACK as I predicted rate un-change will get NASTY on both DOW AND NAS.

So I have a set up entry LONG, i didnt expect the NAS flying to the moon.

both target hit so fast in 15 minutes

However, today is another opportunity to SHORT NAS on the current market

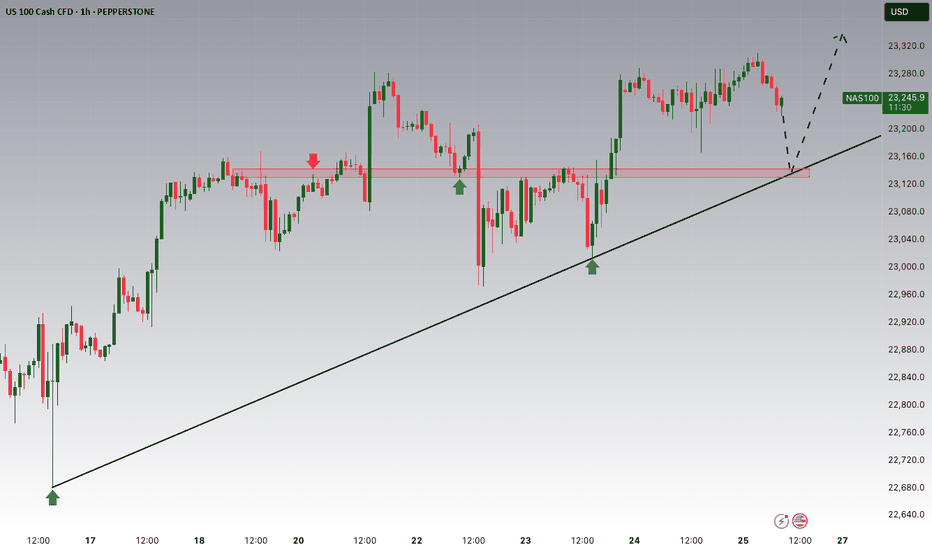

USNAS100 Correction in Play – Watching 23390 & 23440USNAS100

The price is undergoing a bearish correction while trading below 23440, with downside targets at 23300 and 23295, especially if a 1H candle closes below 23390.

A bullish scenario will be activated if price closes 1H above 23440, opening the path toward 23530 and potentially 23700.

At t

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.