1SI trade ideas

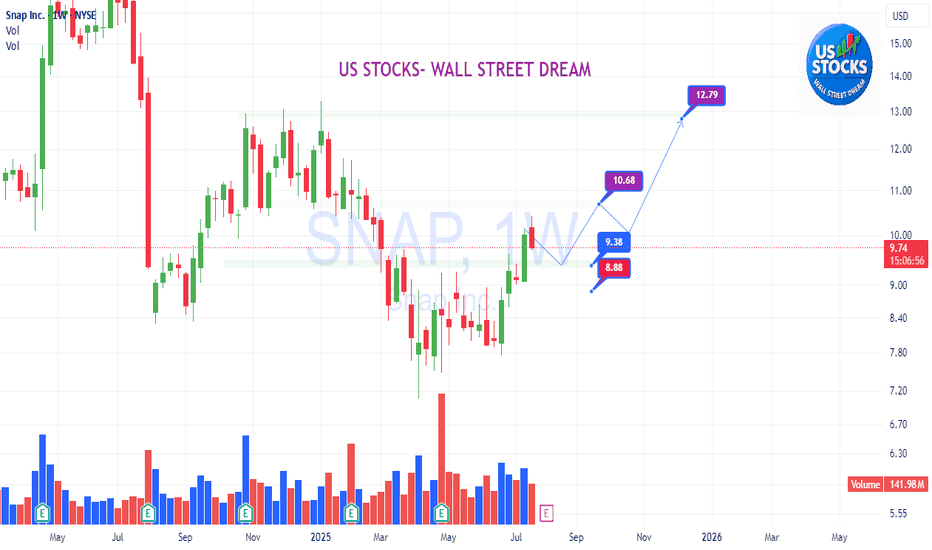

SNAP is in the Wyckoff Accumulation phaseThis Week (July 8 - 12):

Support: The 20-week moving average around $9.00 is now the immediate floor. Below that, the recent support shelf is at $8.00.

Resistance: The first hurdle is the recent high around $10.40. Above that, the path opens up towards $12.00.

Next Month (July/August):

Support: The absolute low of the Selling Climax at $7.10 is the line in the sand that must hold.

Resistance: A major zone of contention will be around $14.00, which was a significant support/resistance area in the past.

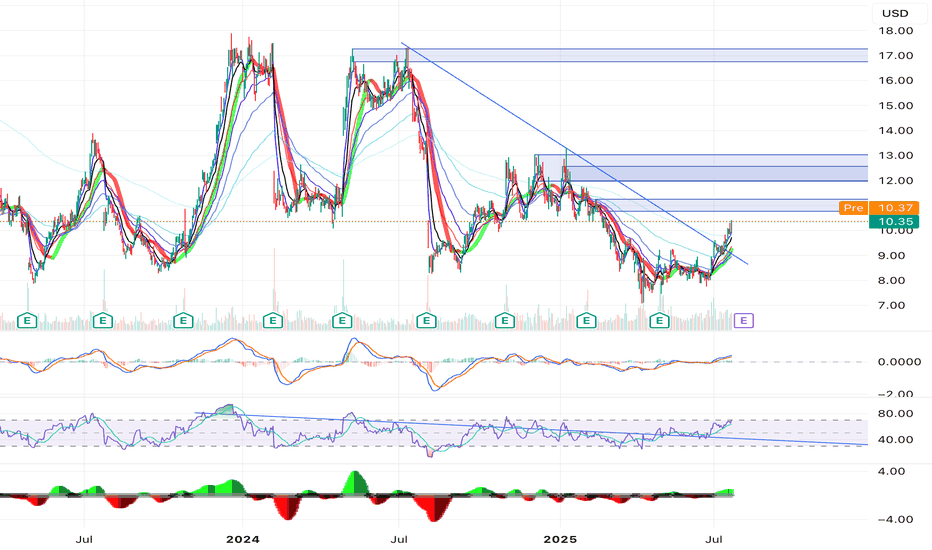

$SNAP -- accumulation $8 into $9. big move brewing into earningsHello, extensive chart here: Daily and Weekly. Looking at this name I like the setup here. The Daily and Weekly chart shows strength in this area, $8 to $9 with heavy accumulation and support. The Weekly chart shows about 13 weeks of this bottoming area with tons of buying from previous years as well. NYSE:SNAP has earnings July 25th and I will be looking to enter $10 calls with a date of 8/15. The premiums could spike just into earnings since it is a popular name to play around that time and it has plenty of daily volume. The SMA and EMA on the weekly honestly is my target -- it is a big sell zone. We are in the liquidity area and have been. Will be starting a position on these contracts this coming week. This name should see $10 with relative strength but my first target is mid $12 before earnings. I would like to shed some contracts into the earnings date and see if we can make an extra buck or two on profited contracts so when earnings comes it can be a risk free stress free play.

WSL.

SNAP - Bullish Reversal in Playhi traders,

* Reclaimed Support Zone

Price has successfully reclaimed a key historical support around the $8.06–$8.72 range, which previously acted as a base before major rallies. This suggests growing buyer interest at this level.

* RSI Breakout

On the RSI, we’ve seen a clean breakout from a long-term descending trendline, which has capped momentum since late 2023. This momentum shift increases the probability of a bullish continuation.

* Reward/Risk Outlook

This setup shows two potential targets:

🎯 Target 1: $12.80 (mid-range resistance)

🎯 Target 2: $17.34 (multi-year resistance level)

Stop-loss is strategically placed below the reclaimed support zone at around $7.76–$7.79, offering a favorable risk/reward profile.

The confluence of technical signals—price reclaiming support and momentum confirmation via RSI breakout—indicates a possible trend reversal. Bulls could be regaining control, making this an attractive swing opportunity.

A BULLISH SNAPCHAT ANALYSIS SNAPCHAT has a neat chart setup long term. Here is a bullish look. I use a metric called NJT which analyzes total user hours available.

From a technical standpoint, there are gaps up to $70, and it could soar much higher. Think longer term investment, with short term jump potential.

Here is my summarized view with a little help from Grok (X).

"Overview of Snap Inc.'s Assets and Valuation

Snap Inc., the parent company of Snapchat, is a publicly traded technology company listed on the NYSE under the ticker SNAP. Founded in 2011 by Evan Spiegel, Bobby Murphy, and Reggie Brown, it focuses on multimedia messaging, augmented reality (AR), and related products. Below, I outline Snap Inc.'s key assets, estimate their valuation based on available data, and apply the NJT (Net Joint Time) metric to contextualize its user engagement in the competitive landscape of 2025-2026. The NJT metric, defined as monthly active users (MAUs) × average time spent per user per month, is used to assess user hours, with the global pool estimated at 285.6 billion user hours per month (9.52 billion hours/day × 30 days).

Key Assets of Snap Inc.

Snap Inc. owns several products and services, with Snapchat being the flagship. Here’s a breakdown of its primary assets as of June 2025:

Snapchat (Core Multimedia Messaging App)

Description: Snapchat is a visual messaging app allowing users to send ephemeral photos and videos, with features like Stories, Snap Map, Discover, and AR Lenses. It generates most of Snap’s revenue through advertising, particularly AR ads and Snap Ads.

User Metrics: Approximately 900 million MAUs and 453 million daily active users (DAUs) as of Q4 2024, with users spending an estimated 30 minutes daily (15 hours/month).

NJT Calculation:

MAUs: 900 million

Average time spent: 15 hours/month

NJT = 900 million × 15 = 13.5 billion user hours/month

Valuation Estimate: Snapchat accounts for ~98% of Snap’s revenue ($5.26 billion of $5.36 billion in 2024). Assuming the company’s current market cap of $14.18 billion (June 2025) is primarily driven by Snapchat, we allocate ~98% of the market cap to this asset:

Value: $13.9 billion

Spectacles (AR Smart Glasses)

Description: Wearable sunglasses that capture Snaps and integrate with Snapchat, featuring GPS-powered AR lenses and hand-tracking capabilities. Launched in 2016, Spectacles have not gained widespread popularity but remain part of Snap’s AR vision.

User Metrics: Limited user data; estimated <1 million users with minimal time spent (assumed 1 hour/month for valuation purposes).

NJT Calculation:

MAUs: ~1 million (conservative estimate)

Average time spent: 1 hour/month

NJT = 1 million × 1 = 1 million user hours/month

Valuation Estimate: Spectacles contribute ~2% of revenue ($100 million in 2024). Using the same revenue-to-market-cap ratio as Snapchat, we estimate:

Value: $0.28 billion ($280 million)

Bitmoji (Personalized Avatar Platform)

Description: Acquired in 2016 for ~$64 million, Bitmoji allows users to create personalized avatars integrated into Snapchat and other platforms. It enhances user engagement but is not a direct revenue driver.

User Metrics: Assumed to align with Snapchat’s user base (900 million MAUs) but with lower engagement (estimated 2 hours/month).

NJT Calculation:

MAUs: 900 million

Average time spent: 2 hours/month

NJT = 900 million × 2 = 1.8 billion user hours/month

Valuation Estimate: As a feature enhancing Snapchat’s ecosystem, we estimate its value based on acquisition cost adjusted for inflation and integration (5% annual growth since 2016):

Value: ~$100 million

Snap Camera (Desktop Application)

Description: Launched in 2018, Snap Camera allows users to apply Snapchat filters during video calls on platforms like Zoom. It has niche usage, primarily for streaming and virtual meetings.

User Metrics: Limited data; estimated 10 million MAUs with 1 hour/month usage.

NJT Calculation:

MAUs: 10 million

Average time spent: 1 hour/month

NJT = 10 million × 1 = 10 million user hours/month

Valuation Estimate: Minimal direct revenue; valued as a brand enhancer at ~1% of Snapchat’s value:

Value: $140 million

Zenly (Location-Sharing App, Discontinued)

Description: Acquired in 2017 for an undisclosed amount (estimated $200-$300 million), Zenly was shut down in 2023, but its location-sharing features were integrated into Snap Map.

User Metrics: No independent users post-shutdown; value absorbed into Snapchat.

NJT Calculation: Not applicable (integrated into Snapchat’s NJT).

Valuation Estimate: Residual value in Snap Map enhancements, estimated at acquisition cost:

Value: ~$250 million

Other Assets (Content Partnerships, Snapchat+, R&D)

Description: Includes partnerships with NBCUniversal, Disney, and others for Snapchat Originals, the Snapchat+ subscription service (7 million subscribers in March 2024), and ongoing AR R&D. Snapchat-Az These contribute to revenue and engagement but are not separately quantified.

User Metrics: Snapchat+ has ~7 million users; other assets are part of Snapchat’s ecosystem.

NJT Calculation: Included in Snapchat’s NJT (13.5 billion hours/month).

Valuation Estimate: Snapchat+ and content partnerships generate ~$100 million annually (estimated); R&D is a cost center. Valued at ~2% of market cap:

Value: $280 million

Total NJT and Market Cap Projection

Total NJT:

Snapchat: 13.5 billion hours/month

Bitmoji: 1.8 billion hours/month

Snap Camera: 10 million hours/month

Spectacles: 1 million hours/month

Total: ~15.311 billion hours/month

Market Share: 15.311 ÷ 285.6 ≈ 5.36% of the global pool (285.6 billion hours/month).

Current Market Cap (June 2025): $14.18 billion

Projected Market Cap Using NJT: Assuming the total market cap of 45 companies (~$10 trillion) is distributed proportionally to NJT shares (as in prior conversations), Snap’s 5.36% share yields:

Projected Market Cap: $536 billion

Comparison: Significantly higher than the current $14.18 billion, suggesting Snap is undervalued based on user engagement.

Breakdown of Valuation by Asset

Asset

NJT (Billion Hours/Month)

Estimated Value ($B)

% of Total Value

Snapchat

13.5

13.9

98.0%

Spectacles

0.001

0.28

2.0%

Bitmoji

1.8

0.10

0.7%

Snap Camera

0.01

0.14

1.0%

Zenly (integrated)

-

0.25

1.8%

Other (Snapchat+, R&D)

-

0.28

2.0%

Total

15.311

14.18

100%

Key Insights

Snapchat Dominance: Snapchat accounts for 98% of Snap’s value and 88% of its NJT, driven by its 900 million MAUs and strong engagement among younger users.

Undervaluation: The projected market cap of $536 billion (based on NJT share) is significantly higher than the current $14.18 billion, suggesting Snap’s user engagement is not fully reflected in its stock price, possibly due to ongoing losses ($1.4 billion in 2022).

AR and Innovation: Investments in AR (Spectacles, Lenses) and Snapchat+ position Snap for growth in 2025-2026, particularly as AR advertising and immersive experiences gain traction.

Challenges: Competition from TikTok and Instagram Reels, privacy changes (e.g., Apple’s iOS updates), and macroeconomic swings in ad spending could limit growth.

Conclusion

Snap Inc.’s primary asset, Snapchat, drives its value and user engagement, with a projected market cap of $536 billion based on NJT, far exceeding its current $14.18 billion. This suggests significant undervaluation, driven by its strong user base and AR innovations, despite profitability challenges. Spectacles, Bitmoji, and other assets play smaller roles but enhance Snap’s ecosystem, positioning it as a top contender for 2025-2026.

Key Citations

Snap Inc. - Wikipedia

Who Owns Snapchat? - Famoid

Snapchat Revenue and Usage Statistics (2025) - Business of Apps

Snap (SNAP) - Market Capitalization - CompaniesMarketCap

Snapchat - Wikipedia

SNAP Intrinsic Valuation and Fundamental Analysis - Alpha Spread

Snap Inc. Announces Fourth Quarter and Full Year 2024 Financial Results - Snap Inc."

- GROK

Snapchat Long?Technical Analysis:

- NYSE:SNAP has been very close to a very strong support zone on its Daily chart, offering a potentially good trade in my opinion.

Fundamental Analysis:

-In 2024, Snap reported an annual revenue of $5.36 billion, marking a 16% increase from the previous year. However, the company still posted a net loss of $698 million, an improvement from the $1.32 billion loss in 2023 . Adjusted EBITDA improved to $509 million in 2024, up from $162 million in 2023, indicating better operational efficiency.

-Quarterly results showed similar trends. For instance, in Q2 2024, revenue increased by 16% year-over-year to $1.24 billion, but the company still incurred a net loss of $249 million . In Q4 2024, Snap achieved a net income of $9 million, compared to a net loss of $248 million in the same quarter of the previous year .

Challenges:

-Snap faces intense competition in the digital advertising space from larger rivals like Meta Platforms (Facebook and Instagram) and TikTok. These competitors have more extensive user bases and more advanced ad-targeting capabilities, making it challenging for Snap to attract and retain advertisers .

Disclaimer:

This is just my personal opinion and not professional financial advice. Any investment decisions you make are entirely your responsibility. I am not a licensed financial advisor, and I do not guarantee the accuracy or completeness of the information provided. The figures mentioned may be inaccurate, outdated, or subject to change — so please do your own research and due diligence before making any financial decisions. Investing involves risk, and any losses incurred are at your own risk.

4/30/25 - $snap - I'm in for a small 1% sub $84/30/25 :: VROCKSTAR :: NYSE:SNAP

I'm in for a small 1% sub $8

- the metric that matters most to me is growing DAU and at this stage, there's visibility to 1 bn DAUs. very few co's nevermind of this size, have that scale

- we know openAI wants to build social. we know Google desperately needs social. etc. etc. and let's look a the metric that's perhaps the only one that puts this all into perspective: value per DAU. pre-mkt sub $8/shr implies nearly $16/DAU.

- yes. i get the massive SBC. it's what's alway made me hold my nose. yes i get the Evan votes my shares discount. but let's get real here, they're not *actually* burning cash. revenue growth is there b/c it follows DAUs. and mgns only continue to improve given the nature of this data-intensive product. oh - and in a world where AI eats everything digital, the only survivors (IMVHO) are ones with some form of human network effect. imagine trying to re-create this size/ scale product with this many users. possible. but for $16/DAU and technically profitable on a cash basis? good f'n luck.

- at this stage, i think we've entered extreme value. i'd love to own a lot more if/as we take out recent range lows in the low $7s, ideally mid $6s. but i'm not going to be overly greedy here and like the reflexivity option to the upside vs. extreme downside case all-in.

lmk if i've missed anything.

V

SNAP is going down Market Context NYSE:SNAP

Current Price: $9.165

1-Month Move: +5.6% (from $8.68)

1-Year Move: -39.1% (from $15.05)

Year High/Low: $9.96/$7.16

Technicals:

RSI ~69.8 (near overbought)

Above 20-day MA, below 50/200-day MAs (short-term pop in a longer downtrend)

Options Data:

IV Rank: 75th percentile (high premiums)

Put/Call Ratio: 1.25 (bearish skew)

Max Pain: $8.00

High OI: $9.00 puts, $10.00 calls

Historical & Model Insights

Historical Move: SNAP averages 13.5% post-earnings, with a slight bearish bias (6/12 quarters down).

IV Crush: Expect 30–40% IV drop post-print, so time your exit carefully.

Model Consensus (Grok, Claude, Gemini, DeepSeek): Moderately Bearish

Why? Overextended rally, high IV, Max Pain at $8.00, and “sell the news” risk.

Outlier: One model (Llama/Meta) sees bullish momentum from call activity, but it’s drowned out by bearish signals.

Trade Setup

Strategy: Single-leg, naked put (bearish, defined risk)

Instrument: SNAP

Direction: Put

Strike: $8.50 (premium $0.52, fits $0.30–$0.60 target band)

Expiry: 2025-05-02 (first weekly post-earnings)

Entry Price: $0.52

Entry Timing: Pre-earnings close (2025-04-29)

Profit Target: $0.78 (~50% gain)

Stop Loss: $0.26 (50% loss)

Confidence: 65%

Expected Move: ±$1.24 (~13.5%)

Key Risks:

Positive earnings surprise (strong ad revenue or user growth).

Severe IV crush killing put value.

Broad market/tech rally lifting SNAP.

Upbeat guidance sparking a squeeze.

LONG SNAP: Ooohhh SNAP Buy @ $8.35 set target for 40% With the exlcusion of double bottoms and minor noise in the trend, snap has risen 5 times from $8.35 to +40% gains with the highest at 114%. It just dropped below $8.35. Buy of it rises above $8.35, set your target at 40% or move up your stops using higher highs/higher lows.

2/4/25 - $snap - r/r +ve, this one's always volatile2/4/25 :: VROCKSTAR :: NYSE:SNAP

r/r +ve, this one's always volatile

- every EPS season i like to see a week or two of pitches and then it's clear what the "theme is". it's a game i like to play

- while so many names have yet to report, anything that's pure software, somewhat consumer exposed and not a total loser (as in... it's a decent cap, still has engagement, generates cash etc. etc.) has tended to do pretty well

- admittedly i've always rated zuck more as a leader, but evan's still at the helm and now cheaper inference could be the unlock to these margins and/or offer something interesting for mgmt to chat about

- while it's not "pure" FCF (some SBC to be aware), 5% isn't bad for a name that's growing DD+ and is highly volatile. it's also a reasonably scarce internet property as it's sticky messaging vs. feed-only. i do think they have still to define the ultimate mission, which keeps me watching, always... for seemingly years (since 2017 i've followed this Q by Q)

- anyway

- this is bound to be up or down at least 10% in this tape, maybe more. calls offer better risk/reward given tape likes software per above, ad trends +ve should be a spray and pray benefit to most stonks (partially why i'm nibbling googl as well into results - go read that)

- a loss here will be a paper cut, but i think the setup at 6/10 is good enough for a small punt (5 bps into print for weeklies)

whatchu think anon? am i getting a lil too cray cray ahead of uber results tmr AM which is my bigger fish?

V

SnapChat | SNAP | Long at $11.55NYSE:SNAP - all depends on growth...

While I view this stock as risky into earnings (price gaps on the daily down to the $6.00 range...), SnapChat is still a highly relevant application among youth and is targeting older groups. The valuable data this company has must be staggering. NYSE:SNAP went from revenues of $1.7 billion in fiscal year 2019 to $5.1 through Q3 of 2024. While it is currently operating at a loss per share of -$0.58, the company is expected to return a positive EPS by 2027. Insider selling is currently high, however, and I truly would not be surprised if the stock dipped to fill the gaps (at least into the $8 zone). Regardless, my historical simple moving average lines are starting to flatten out and a change in course for 2025-2026 may be in its future - just stay cautious if the price dips to shake out weak hands.

At $11.55, NYSE:SNAP is in a personal buy zone with room for additional entries if weakness is ahead after earnings.

Targets:

$14.30

$17.00

$21.00

SNAP is range-bound and at support - I'll bite at 10.46The title kind of said it all here. Since I'm underexposed in this area and everything else that's decent and on sale today is in areas I already have exposure to, I'm taking a quick flip shot here.

It's already pulled back 16% from its most recent high, so I like my odds here. Historically, the algo I use for buy signals is 251-4 on SNAP with an average gain on this type of trade being .14% per day held, or about 4x the average daily return of SPY.

Earnings are soon and I hate trading near earnings, so this is designed to be a quick in and out trade. Per my usual strategy, I'll add to my position at the close on any day it still rates as a “buy” and I will use FPC (first profitable close) to exit any lot on the day it closes at any profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Lots currently held:

Lot 1: 10.46