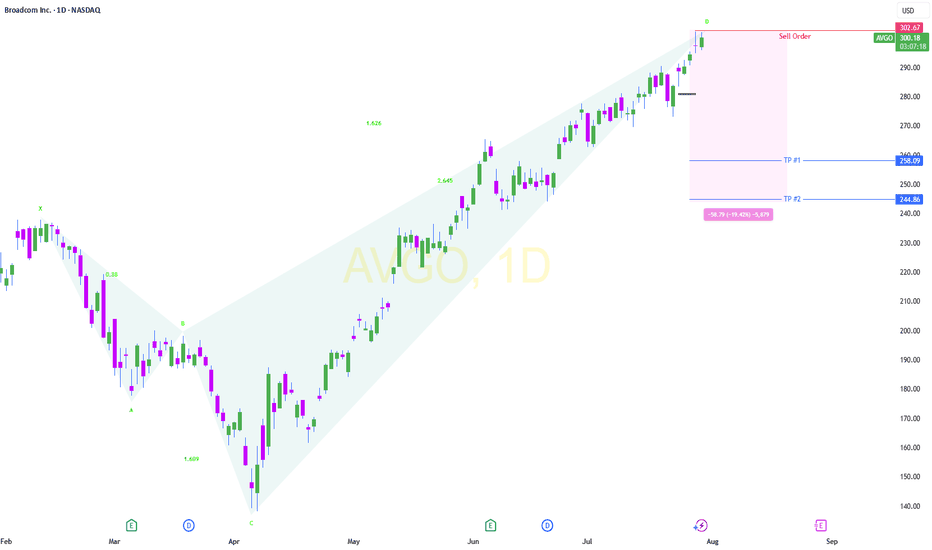

Broadcom (AVGO): Is This the Dip You've Been Waiting For?Broadcom (AVGO) has been demonstrating a remarkably strong bullish trend since early April, carving out a clear path of higher highs and higher lows. This robust upward momentum is well-defined by a series of ascending channels.

Trend and Channel Dynamics:

Initially, we observed price action mov

Key facts today

Broadcom (AVGO) shares fell over 3% amid market pressures on chip stocks, driven by new tariff concerns and weaker US job growth, with an additional drop of over 1% on Friday.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.45 EUR

5.42 B EUR

47.39 B EUR

4.61 B

About Broadcom Inc.

Sector

Industry

CEO

Hock E. Tan

Website

Headquarters

Palo Alto

Founded

1961

FIGI

BBG00KJLNPZ9

Broadcom Inc. is a global technology company, which designs, develops, and supplies semiconductors and infrastructure software solutions. It operates through the Semiconductor Solutions and Infrastructure Software segments. The Semiconductor Solutions segment refers to product lines and intellectual property licensing. The Infrastructure Software segment relates to mainframe, distributed and cyber security solutions, and the FC SAN business. The company was founded in 1961 and is headquartered in Palo Alto, CA.

Related stocks

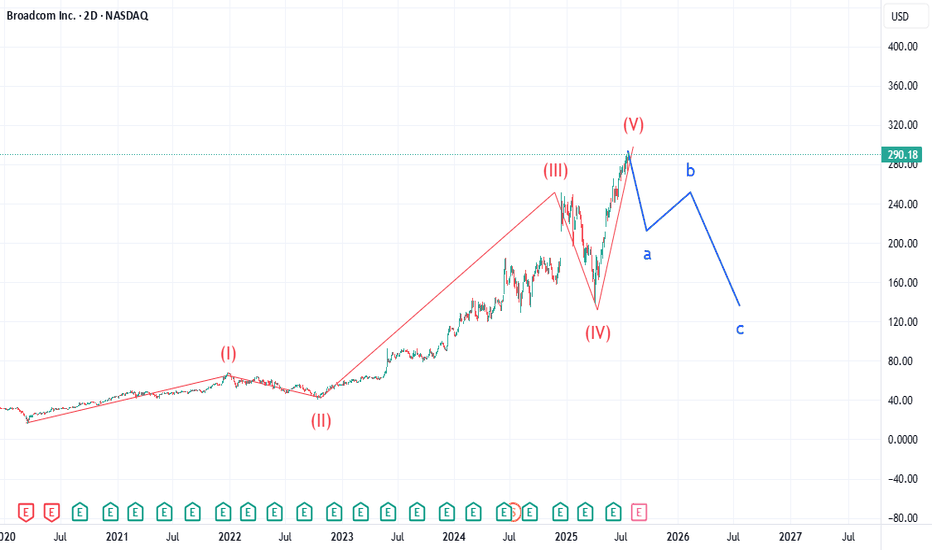

AVGO: Too Many Similarities Market WideLike my chart on BKNG, AVGO is showing an uncanny similarity to Booking.com's chart. Many indices are showing the end of 5 waves in a super cycle dating back to the drop of March 2020. AVGO pt1 is 211. Expecting selling to increase over the next 90 days. Not certain what the catalyst will be, but lo

AVGO Bullish Impulse Wave Structure in ProgressAVGO continues its macro advance with a clear 5-wave impulse structure unfolding. The current price action marks the completion of subwave (i) of wave ⑤, setting the stage for a corrective pullback into subwave (ii).

We expect this corrective leg to reach into the 38.2%–50% Fibonacci retracement zo

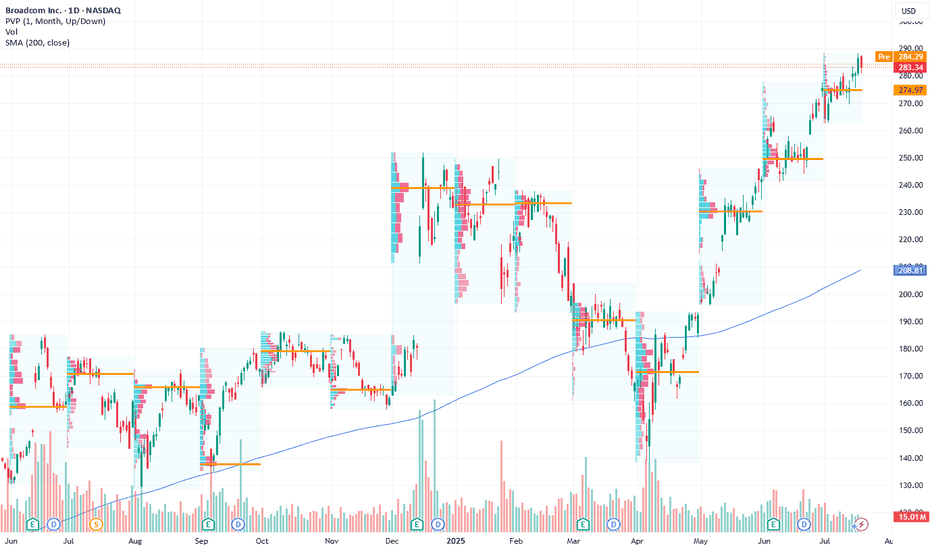

AVGO ( Broadcom.Inc ) NASDAQ:AVGO - Continuation of movement within the ascending channel + potential for a breakout to new historical highs. 🔍 Rationale:

• After a strong correction in the first quarter of 2025, the price formed a reversal and has been moving in a clear ascending channel since the beginning of May.

• T

Broadcom: Positioned for Long-Term Growth in AI and EnterprisesCurrent Price: $283.34

Direction: LONG

Targets:

- T1 = $292.00

- T2 = $305.00

Stop Levels:

- S1 = $280.00

- S2 = $275.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

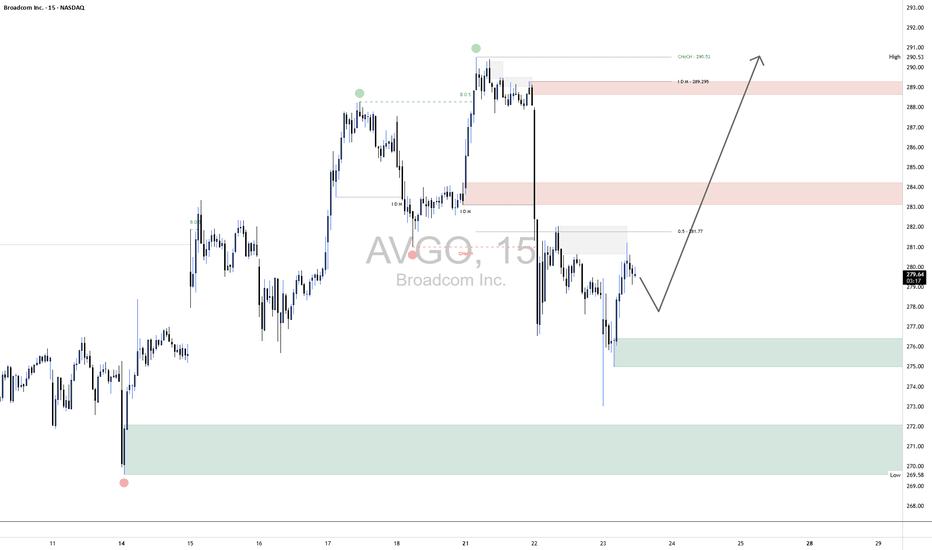

AVGO Long1. Broader Market Structure

1.1 Change of Character (CHoCH)

A clear Change of Character occurred at $290.53, where price broke below a prior higher low. This was a key early signal of a potential bearish reversal, as bullish momentum began to weaken and sellers stepped in with conviction.

1.2 Break

AVGO - LONG Swing Entry Plan NASDAQ:AVGO - LONG Swing Entry Plan

Entry Zone 1: $280.80 – $277.00

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $265.50 – $261.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

A

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 1YD is featured.

Frequently Asked Questions

The current price of 1YD is 249.35 EUR — it has decreased by −2.36% in the past 24 hours. Watch BROADCOM INC. DL-,001 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange BROADCOM INC. DL-,001 stocks are traded under the ticker 1YD.

1YD stock has risen by 2.19% compared to the previous week, the month change is a 10.35% rise, over the last year BROADCOM INC. DL-,001 has showed a 65.13% increase.

We've gathered analysts' opinions on BROADCOM INC. DL-,001 future price: according to them, 1YD price has a max estimate of 350.38 EUR and a min estimate of 183.95 EUR. Watch 1YD chart and read a more detailed BROADCOM INC. DL-,001 stock forecast: see what analysts think of BROADCOM INC. DL-,001 and suggest that you do with its stocks.

1YD stock is 4.64% volatile and has beta coefficient of 2.36. Track BROADCOM INC. DL-,001 stock price on the chart and check out the list of the most volatile stocks — is BROADCOM INC. DL-,001 there?

Today BROADCOM INC. DL-,001 has the market capitalization of 1.19 T, it has increased by 2.56% over the last week.

Yes, you can track BROADCOM INC. DL-,001 financials in yearly and quarterly reports right on TradingView.

BROADCOM INC. DL-,001 is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

1YD earnings for the last quarter are 1.40 EUR per share, whereas the estimation was 1.39 EUR resulting in a 0.69% surprise. The estimated earnings for the next quarter are 1.45 EUR per share. See more details about BROADCOM INC. DL-,001 earnings.

BROADCOM INC. DL-,001 revenue for the last quarter amounts to 13.25 B EUR, despite the estimated figure of 13.21 B EUR. In the next quarter, revenue is expected to reach 13.86 B EUR.

1YD net income for the last quarter is 4.38 B EUR, while the quarter before that showed 5.31 B EUR of net income which accounts for −17.48% change. Track more BROADCOM INC. DL-,001 financial stats to get the full picture.

Yes, 1YD dividends are paid quarterly. The last dividend per share was 0.51 EUR. As of today, Dividend Yield (TTM)% is 0.80%. Tracking BROADCOM INC. DL-,001 dividends might help you take more informed decisions.

BROADCOM INC. DL-,001 dividend yield was 1.25% in 2024, and payout ratio reached 170.61%. The year before the numbers were 2.19% and 55.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 37 K employees. See our rating of the largest employees — is BROADCOM INC. DL-,001 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BROADCOM INC. DL-,001 EBITDA is 27.46 B EUR, and current EBITDA margin is 48.98%. See more stats in BROADCOM INC. DL-,001 financial statements.

Like other stocks, 1YD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BROADCOM INC. DL-,001 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BROADCOM INC. DL-,001 technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BROADCOM INC. DL-,001 stock shows the buy signal. See more of BROADCOM INC. DL-,001 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.