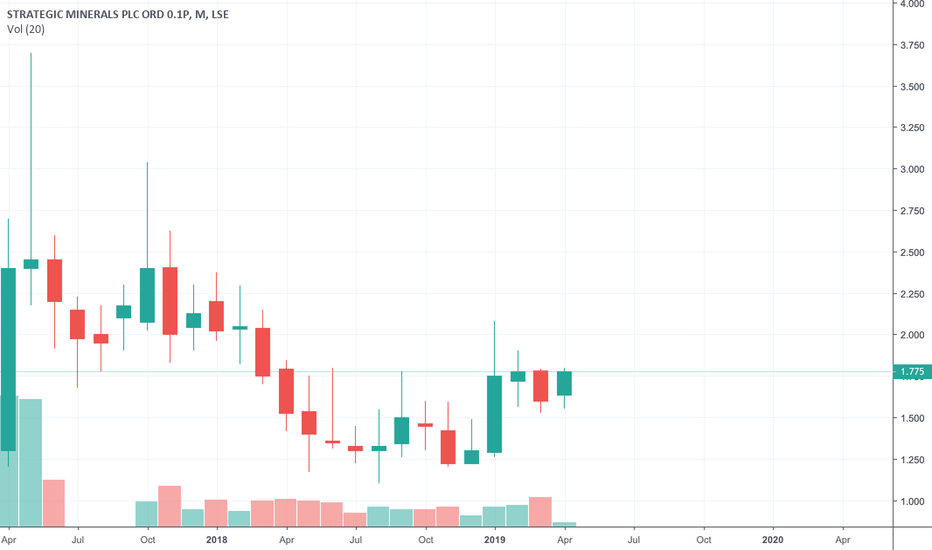

#STRATEGICMINERALS - Weekly falling wedge breakoutA lengthy downtrend may well be broken in SML, if this wedge breakout is confirmed in the next few weeks. But there's a thick Kumo (cloud) on the weekly to overcome to meet the typical wedge target - and that could take some time...

Fundamentally the company is relatively asset-rich (1 producing, 1 not far off producing, 1 medium term), cash poor, but stable & managing costs. Once they ride out the wider economic storm they should be in great shape for the future.

24S trade ideas

#SML #StrategicMinerals - Sentiment Returning?Falling wedge break (coinciding with a 78.6% Fib bounce), strong indicators on the weekly - what's not to like?

Wedge target shown (from initial height) coincides nicely with a fib line from each of the retracement and extension plots.

All it's lacking now is some extra volume...

1st target 2.31p once 50% fibs are broken - 20ma bounce todayIf we hold above trend line and above 61.8% fibs my 1st target is 2.31p once we break above 50% fibs at 1.88p

3.71p and a retest of ATH is quite possible to be hit later on this year if you hold after 1st target but profits will be taken at different stages on chart.

I believe there is a LSE conference that John Peters will be apeaking at, that might give further momentum for the rise.

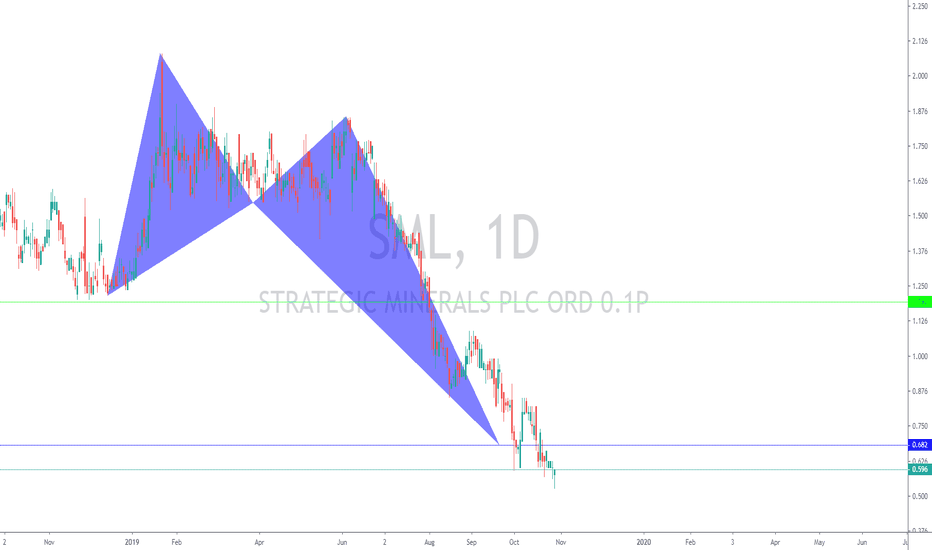

#SML - Possible Head-and-ShouldersWhile Strategic Minerals would appear to be a great medium-to-long-term investment choice based on fundamentals alone; shorter-term the chart is forming something very closely resembling a head-and-shoulders pattern. If this completes by dropping below the neckline then it is likely to continue to be bearish in the immediate future to target up to another 1p lower (the delta between the shoulder height and the head height).